ACS Actividades de Construccion y Servicios Bundle

Can ACS Actividades de Construccion y Servicios Continue Its Ascent?

ACS Actividades de Construccion y Servicios (ACS Group), a titan in the global infrastructure arena, is charting a course for substantial expansion. From its roots in Madrid, Spain, ACS has transformed into a multinational powerhouse, boasting a diverse portfolio spanning civil construction, industrial services, and building services. With 2024 sales hitting €41.63 billion, the company's current scale and market position are undeniable.

This ACS Actividades de Construccion y Servicios SWOT Analysis will delve into the company's strategic initiatives, examining its recent acquisitions like Thiess and Dornan Engineering, which are pivotal to its ACS growth strategy. We'll dissect how ACS is leveraging its robust financial outlook and record order backlog to capitalize on infrastructure projects, ensuring a deep dive into the ACS future prospects and its competitive landscape within the construction company analysis sector. Furthermore, we will explore investment opportunities and the company's sustainability efforts.

How Is ACS Actividades de Construccion y Servicios Expanding Its Reach?

The expansion initiatives of ACS Group are designed to solidify its position in the global construction and services market. The company's strategy focuses on entering new markets, diversifying its service offerings, and leveraging strategic mergers and acquisitions. This multi-faceted approach aims to drive long-term growth and enhance shareholder value, making it a key aspect of the overall Marketing Strategy of ACS Actividades de Construccion y Servicios.

A significant area of focus for ACS Group is the expansion of its digital infrastructure, particularly in data centers. The company is investing heavily in this sector to capitalize on the growing demand for data storage and processing capabilities. This strategic move aligns with the broader trend of technological transformation and positions ACS Group as a key player in the digital economy.

Geographically, ACS Group is strategically strengthening its presence in key regions to capitalize on market opportunities. The company's expansion efforts are concentrated in North America, Europe, and Australia, where it is undertaking significant infrastructure projects. These initiatives are supported by strategic partnerships and acquisitions, enabling ACS Group to enhance its capabilities and market reach.

ACS Group plans to invest an additional €300 million in data centers in 2025. The company aims to develop projects with 2 GW currently in execution and a further 4 GW in view. This investment is part of its strategy to capture market share in technological transformation and expand its digital infrastructure portfolio.

ACS Group intends to bring in a 50% partner for its new Digital & Energy division. This division will encompass data centers and renewable energy projects, reflecting the company's commitment to sustainable and technologically advanced infrastructure. This strategic partnership will help to strengthen its position in the market.

North America remains a leading market for ACS Group, with the United States accounting for 57% of its net sales in Q1 2025. The integration of Dragados North America, completed in January 2025, has created the second-largest civil contractor in the United States. This underscores the importance of the North American market for ACS Group.

Turner, a subsidiary of ACS Group, is expanding its reach into Europe with investment opportunities in high-tech projects. The company expects over €20 billion in potential work in Europe. This expansion highlights the company's strategic focus on high-growth sectors and geographical diversification.

ACS Group's expansion strategy includes significant investments in data centers, renewable energy, and transportation infrastructure. The company is focusing on strengthening its presence in North America, Europe, and Australia. These initiatives are supported by strategic acquisitions and partnerships.

- Data Centers: Investing an additional €300 million in 2025, with projects totaling 6 GW in view.

- North America: Dragados North America integration, creating the second-largest civil contractor in the U.S. with combined sales exceeding $6 billion and a backlog of approximately $16 billion.

- Europe: Turner expanding into high-tech projects, expecting over €20 billion in potential work.

- Sustainable Mobility: Focusing on transportation infrastructure projects in the United States, Spain, and Germany.

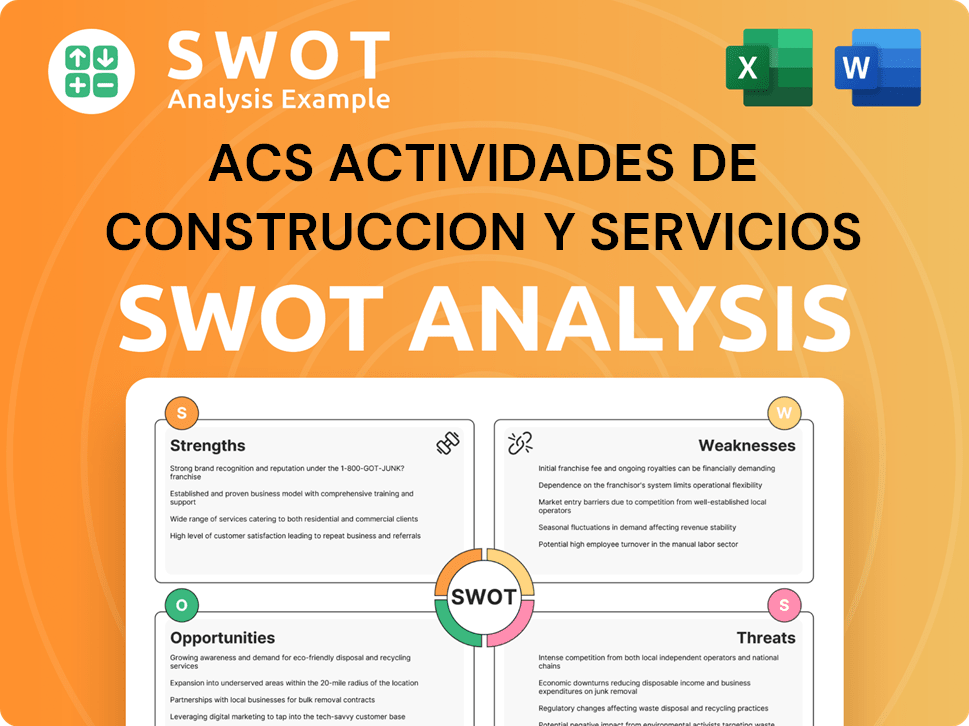

ACS Actividades de Construccion y Servicios SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ACS Actividades de Construccion y Servicios Invest in Innovation?

The ACS growth strategy heavily emphasizes innovation and technology to drive expansion, particularly in high-tech sectors. This strategic pivot is designed to capitalize on emerging opportunities in digital infrastructure, biopharma, and health, positioning the company for sustained growth. This approach is crucial for maintaining a competitive edge in the evolving infrastructure landscape and securing ACS future prospects.

A key element of this strategy involves substantial investment in data centers, with plans to allocate an additional €300 million in 2025. These investments are geared towards supporting the increasing computational demands of AI workloads. Furthermore, the company is expanding its footprint in the semiconductor sector, securing new orders for facilities that support chip lithography machines.

The company is also fostering digital transformation through initiatives like the GEN project, which involves a global network of 2,000 engineers. This project aims to share best practices and expertise across new markets and sectors. Moreover, the company's commitment to innovation is integrated into its sustainability strategy, which includes 26 strategic lines and 38 objectives for 2025, as outlined in its Sustainability Master Plan 2025, demonstrating its dedication to creating shared value and maintaining its leadership in the infrastructure sector.

The strategic plan for 2024-2026 targets increasing the proportion of high-tech infrastructure projects in its backlog to over 40% by 2027. This represents a significant increase from the current 25% share. This shift underscores the company's commitment to sectors like digital infrastructure, biopharma, and health.

Significant investments in data centers are a cornerstone of the innovation strategy. An additional €300 million is slated for investment in 2025. These data centers are designed to meet the increasing computational needs of AI workloads.

The company is expanding its presence in the semiconductor sector. New orders have been secured for assembly and test facilities for chip lithography machines in the U.S. This diversification supports the company's growth strategy.

The GEN project is a key initiative for digital transformation, involving 2,000 engineers globally. This project facilitates the sharing of best practices and expertise across new markets and sectors. This enhances the company's competitive advantage.

The company's sustainability strategy is integrated with its innovation efforts. The Sustainability Master Plan 2025 includes 26 strategic lines and 38 objectives. This demonstrates a commitment to creating shared value and maintaining leadership in the infrastructure sector.

The company's strategic investments are focused on high-growth areas such as data centers and the semiconductor industry. These investments are aimed at securing long-term growth and increasing market share. These investments are crucial for the company's long-term outlook.

The company's approach to innovation and technology is multifaceted, encompassing significant investments in data centers, expansion into the semiconductor sector, and digital transformation initiatives. These strategies are designed to enhance its position in the market and drive future growth. For more details, you can read about it in Competitors Landscape of ACS Actividades de Construccion y Servicios.

- Data Center Investments: Allocating an additional €300 million in 2025 to expand data center capacity.

- Semiconductor Sector: Securing new orders for facilities supporting chip lithography machines.

- Digital Transformation: Launching the GEN project, involving 2,000 engineers globally.

- Sustainability Integration: Implementing 26 strategic lines and 38 objectives within the Sustainability Master Plan 2025.

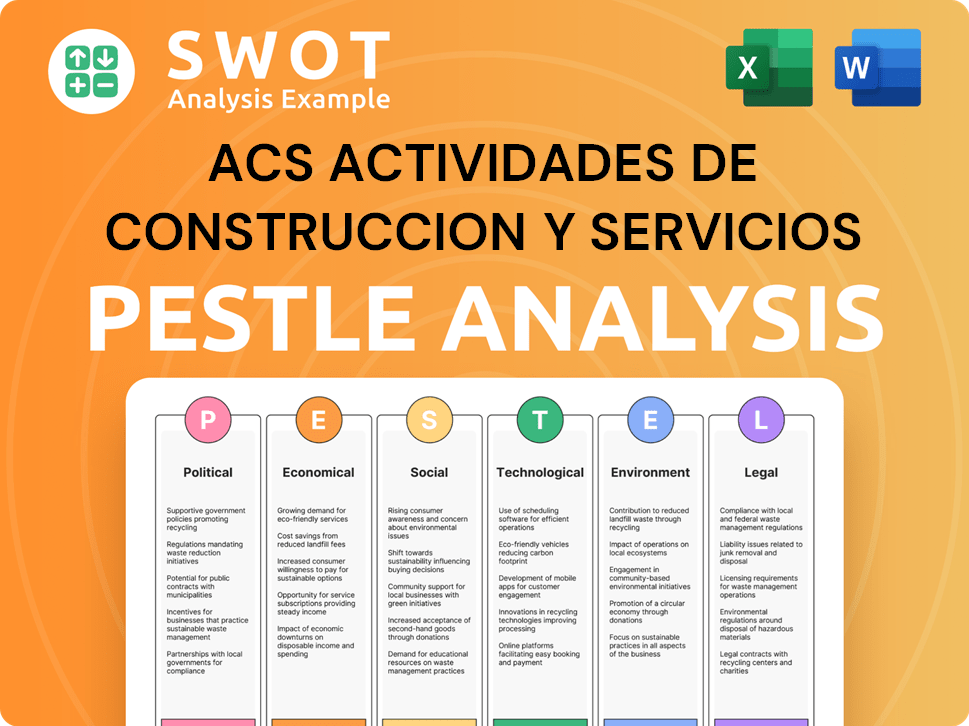

ACS Actividades de Construccion y Servicios PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ACS Actividades de Construccion y Servicios’s Growth Forecast?

The financial outlook for ACS Group is robust, supported by strong performance in early 2025 and ambitious growth targets. The company's strategic initiatives and record order backlog point to continued expansion. An in-depth Revenue Streams & Business Model of ACS Actividades de Construccion y Servicios analysis provides further insights into the company's financial structure and operational strategies.

In Q1 2025, ACS Group demonstrated significant financial growth. This positive trend is expected to continue, driven by strategic acquisitions and a focus on infrastructure projects. This construction company analysis reveals a strong commitment to shareholder value and sustainable growth.

ACS Group is targeting substantial growth in the coming years. The company's strategic plan and financial performance data indicate a strong trajectory. Investment opportunities in ACS Actividades de Construccion y Servicios are supported by a solid financial foundation and a clear growth strategy.

In Q1 2025, ACS Group reported a net profit of €191 million, a 17.2% increase year-on-year. Sales rose by 35.4% to €11.8 billion, and EBITDA surged by 51.7% to €699 million.

ACS Group aims for a 17% growth in ordinary net profit for 2025. The company is focused on achieving these targets through strategic initiatives and efficient project execution.

The 2024-2026 Strategic Plan targets an attributable profit between €850 million and €1 billion by 2026. Revenue growth is projected at 6% to 10% annually during this period.

ACS Group anticipates reaching between €43 billion and €48 billion in revenue by 2026, representing a 35% increase compared to 2023. This growth is supported by a strong order backlog.

The company's financial strategy includes robust cash flow generation and significant shareholder remuneration. ACS Actividades de Construccion y Servicios's expansion plans are fueled by a strong financial base and strategic investments. The long-term outlook for ACS Actividades de Construccion y Servicios remains positive, supported by its strategic initiatives and market position.

The record order backlog stood at €90.8 billion in Q1 2025, reflecting a 16.5% year-on-year increase. The book-to-bill ratio was 1.3x, indicating strong future revenue potential.

Cash flow generation reached €1.7 billion in the last twelve months as of March 2025. The company aims to generate between €3.3 billion and €4 billion in net operating cash flow over the next three years.

Net debt increased to €2.8 billion due to strategic acquisitions. This includes the consolidation of Thiess' net debt of €1.2 billion, reflecting the company's investment in growth.

ACS Group plans to allocate at least €2 billion to shareholder remuneration. The annual dividend is expected to be €2 or more per share, demonstrating a commitment to shareholder value.

Analysts forecast a revenue CAGR of 6.3% over FY 2024-2027, reaching €50 billion. EBITDA is expected to grow at an 11.5% CAGR to €3.4 billion, with net income growing at a 6.6% CAGR to €1 billion.

Recent acquisitions, such as the consolidation of Thiess, have strategically positioned the company for future growth. These acquisitions are key to ACS's expansion plans.

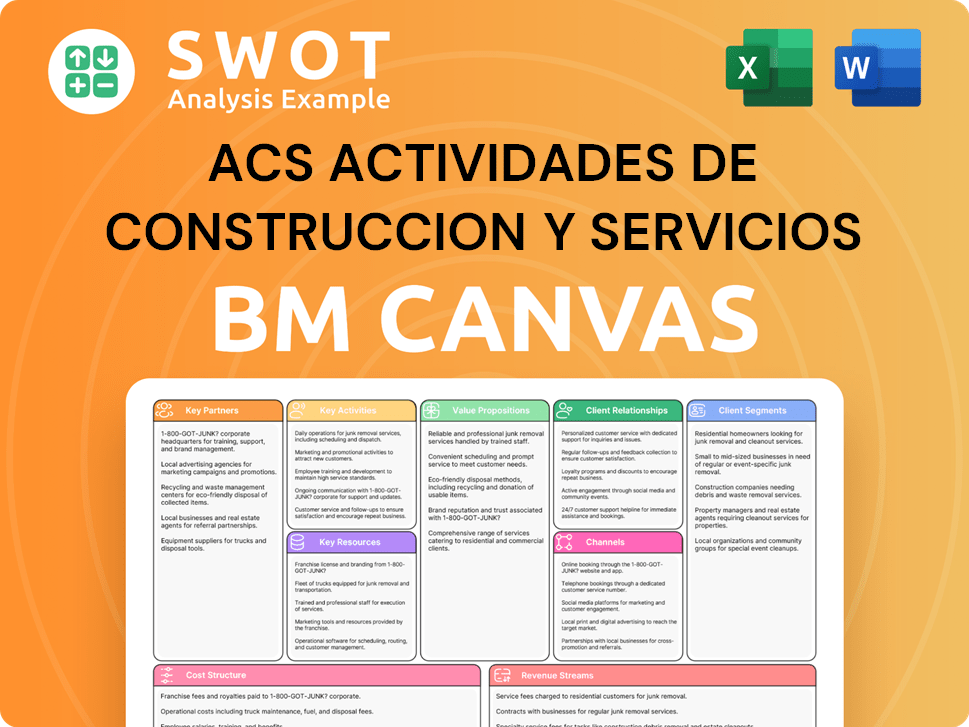

ACS Actividades de Construccion y Servicios Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ACS Actividades de Construccion y Servicios’s Growth?

The ambitious ACS growth strategy faces several potential risks and obstacles. Strategic acquisitions and large-scale projects can increase net debt and strain financial flexibility. Market competition and economic uncertainties in key markets also pose challenges to the company's financial performance and future prospects.

Increased net debt, particularly due to strategic acquisitions, is a significant concern. As of March 2025, the net debt reached €2.8 billion, marking an increase of €1.2 billion since March 2024. The construction industry's low-margin nature and inflation in raw materials, alongside demands for higher wages, add further pressure on profit margins. Economic fluctuations in vital markets could also impact demand for infrastructure projects.

A strong reliance on the North American market presents a risk to revenue stability, especially if economic or regulatory conditions deteriorate. Strategic acquisitions, while beneficial for long-term growth and business development, bring integration risks and cost challenges that could impact net margins and overall financial efficiency. The company's management actively addresses these risks through its risk management culture.

Strategic acquisitions, such as the consolidation of Thiess, have led to increased net debt, potentially affecting financial flexibility. As of March 2025, net debt stood at €2.8 billion, a rise of €1.2 billion since March 2024. This increase could impact the company's ability to manage upcoming large-scale projects and investments, especially in managed lanes and data centers.

Intense competition in high-tech sectors and the construction industry's generally low margins can pressure profit margins. Inflation in raw materials and demands for higher wages add further strain. Despite a strong track record in cost management, these factors pose ongoing challenges. These pressures could affect the

Economic uncertainties in key markets can affect demand for infrastructure projects. A high dependency on the North American market poses a risk to revenue stability if economic or regulatory conditions worsen. This dependence could influence

Strategic acquisitions, while beneficial for long-term growth, carry integration risks and cost challenges that could impact net margins and overall financial efficiency. The company's management assesses and prepares for these risks through a robust risk management culture. Focusing on collaborative and lower-risk contracts, along with standardizing risk management policies in the bidding phase, are key strategies.

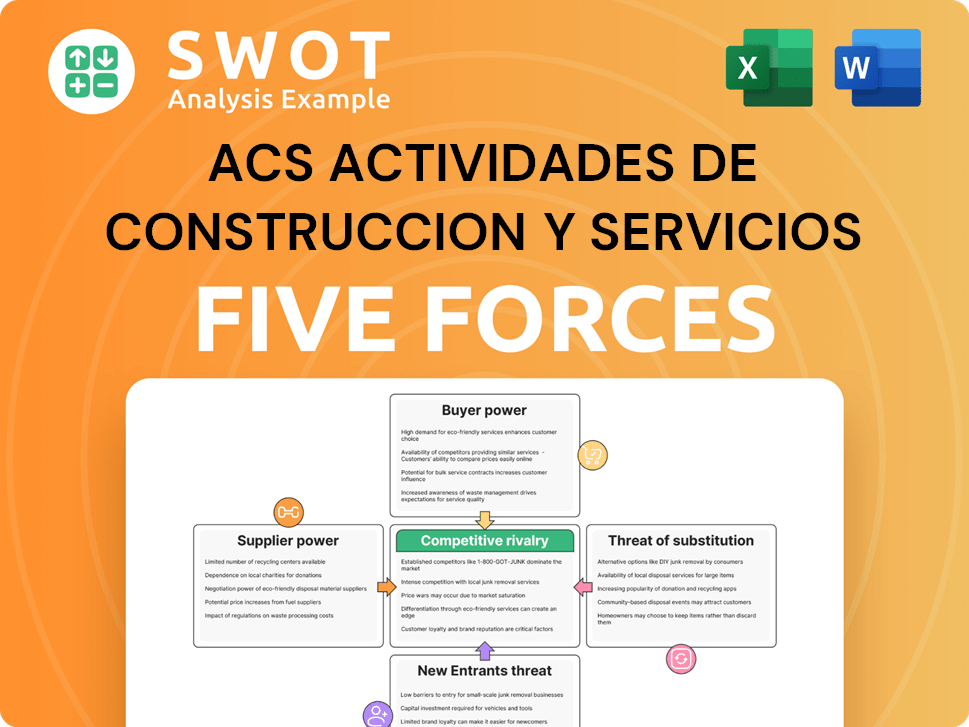

ACS Actividades de Construccion y Servicios Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACS Actividades de Construccion y Servicios Company?

- What is Competitive Landscape of ACS Actividades de Construccion y Servicios Company?

- How Does ACS Actividades de Construccion y Servicios Company Work?

- What is Sales and Marketing Strategy of ACS Actividades de Construccion y Servicios Company?

- What is Brief History of ACS Actividades de Construccion y Servicios Company?

- Who Owns ACS Actividades de Construccion y Servicios Company?

- What is Customer Demographics and Target Market of ACS Actividades de Construccion y Servicios Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.