Indo Count Bundle

How Does Indo Count Company Stack Up in the Global Textile Arena?

The home textile industry is booming, with a market value nearing $140 billion in 2024 and projected to keep growing. This dynamic environment, fueled by changing consumer tastes and technological innovation, presents both opportunities and challenges for companies vying for market share. Indo Count SWOT Analysis can help to understand the company's position.

Indo Count Company, a major player in this competitive landscape, has transformed from a yarn spinner to a vertically integrated home textile giant. Understanding the Indo Count Company competitive analysis report is crucial for investors and strategists. This market analysis will delve into the Indo Count Company market position, identifying key competitors and evaluating its competitive advantages within the textile industry.

Where Does Indo Count’ Stand in the Current Market?

Indo Count Industries Limited (ICIL) is a significant player in the global home textile industry, specifically in the bed linen sector. It is recognized as the largest global bed linen company, specializing in bed sheets, fashion bedding, utility bedding, and institutional bedding. This Growth Strategy of Indo Count highlights its robust market position and strategic initiatives.

ICIL's core operations focus on manufacturing and exporting bed linen products. The company's value proposition lies in providing high-quality, value-added products to a global customer base. Its significant market share and strong financial performance reflect its success in the competitive landscape.

ICIL has a leading position in the global home textile market, particularly in bed linen. The company is a major supplier and exporter of bed linen, with a wide global reach. Its focus on bed sheets, fashion bedding, utility bedding, and institutional bedding contributes to its diverse product portfolio.

ICIL's revenue is primarily generated from the US and UK markets. The US market accounts for a substantial portion of its operating income. The company is expanding its presence in the US through acquisitions and new manufacturing facilities. ICIL exports to over 50 countries, aiming to broaden its geographical footprint.

ICIL reported a total operating income of ₹3,580 crore in FY24. Sales volume increased to 968 lakh meters in FY24. Operating margins improved due to a better product mix, with value-added products contributing 50.20% of total revenue.

ICIL is investing in new manufacturing facilities to scale its utility bedding operations. The acquisition of a US-based company manufacturing pillows, comforters, and utility bedding further strengthens its market position. These initiatives support the company's growth strategy and enhance its competitive advantages.

ICIL's financial health is robust, with a comfortable capital structure and strong liquidity. The company's net profit for FY24 reached ₹3,379 million, with net profit margins improving to 9.5%. As of March 31, 2024, ICIL had a net worth of ₹2,089 crore and unencumbered cash and liquid investments of ₹225.23 crore.

- Increased sales volume in FY24.

- Improved operating margins due to a better product mix.

- Healthy net profit and net profit margins.

- Strong liquidity and capital structure.

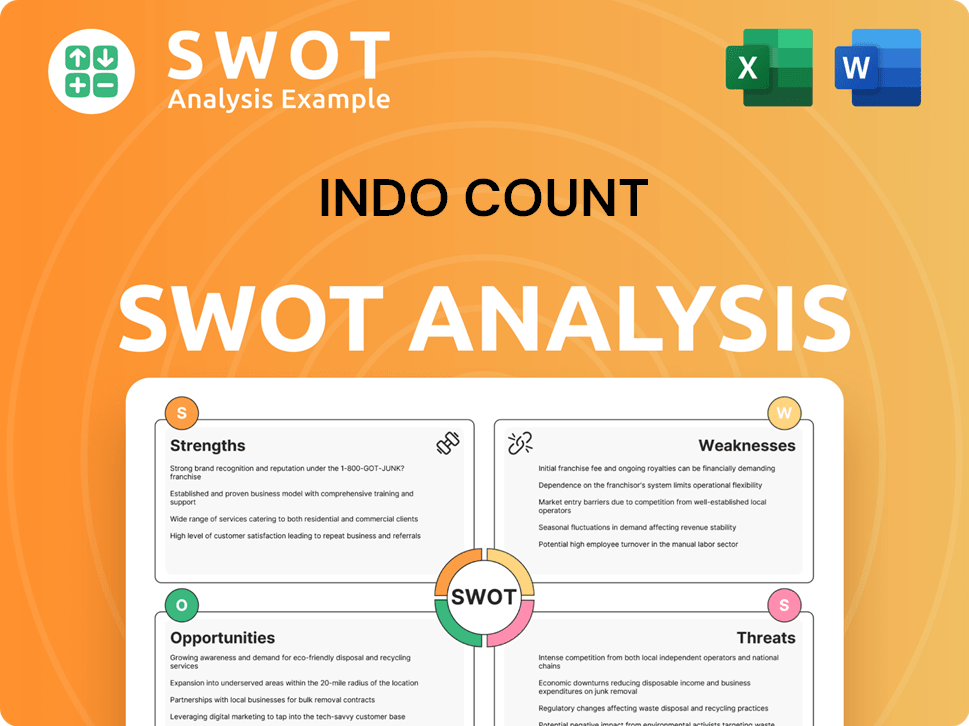

Indo Count SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Indo Count?

The competitive landscape for the Indo Count Company is shaped by its position in the global home textile market. This market is highly competitive, with both domestic and international players vying for market share. Understanding the key competitors is crucial for strategic planning and market analysis.

Indo Count faces competition from a variety of companies, ranging from large, established textile manufacturers to emerging brands. These competitors employ different strategies, including price competition, innovation, and branding, to gain an edge in the market. The company's ability to navigate this competitive environment is essential for its financial performance and future growth.

The Indian home textile export market is dominated by a few major players. These companies compete on various fronts, including product quality, pricing, and distribution networks. The competitive dynamics are also influenced by global trends and economic conditions.

The most significant direct competitors of Indo Count include several large Indian textile companies. These companies compete directly in the home textile export market, offering similar products and services.

A major player in the Indian home textile export market, Welspun Living Limited is a key direct competitor. They compete with Indo Count in terms of market share and product offerings.

Trident Limited is another prominent Indian textile company that competes in the home textile segment. They are a significant player in the market, offering a range of home textile products.

Himatsingka Seide Limited is a significant Indian exporter of home textiles. They compete with Indo Count in the global market, focusing on high-quality products.

GHCL is identified as a top competitor, involved in home textile products. They are a significant player in the home textile market, offering a range of products.

K P R Mill Ltd is a large textile company in India with a substantial market capitalization. They compete with Indo Count in the broader textile market, including home textiles.

In addition to direct competitors, Indo Count also faces competition from indirect and emerging players. These companies may offer different products or target different market segments, but still pose a competitive threat.

- Brooklinen: A brand offering modern and luxurious bedding products.

- Peacock Alley: Known for its premium quality and craftsmanship, focusing on high-end bed and bath linens.

- Standard Fiber: A producer of home bedding products and textiles.

- Ashabi: A manufacturer and supplier of textile products.

- Sisma: A manufacturer of absorbent cotton and derivatives and homecare products.

- ShowTex: A company that manufactures flame retardant fabrics.

- Vinny Overseas, Ishidaya, SleepLabs, Tekla, and Undercover: These companies are also noted as alternatives or competitors, offering various textile and bedding products.

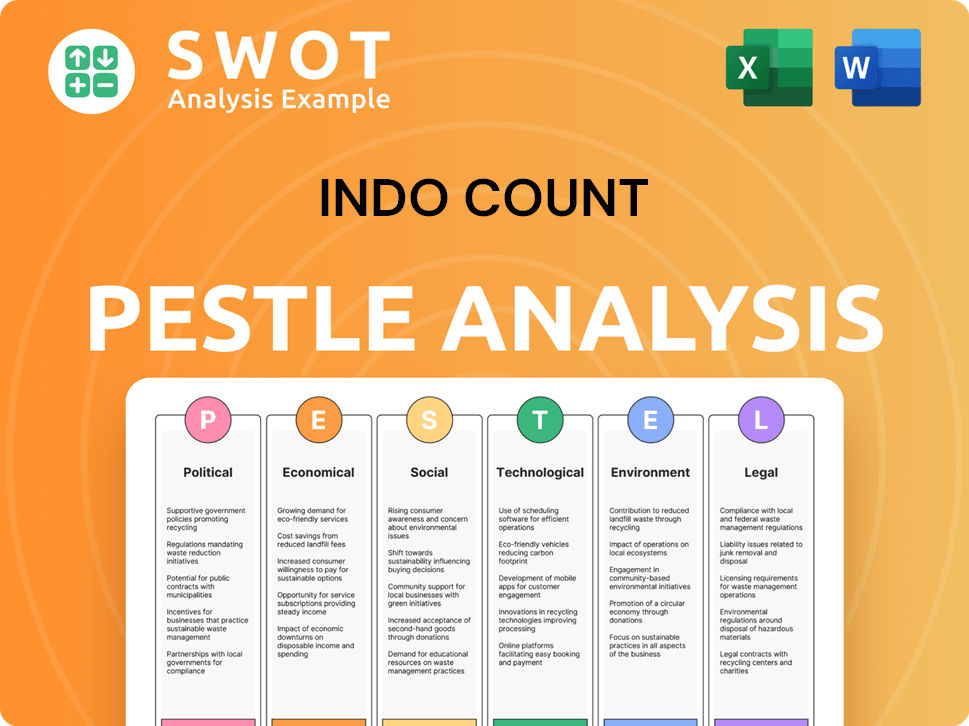

Indo Count PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Indo Count a Competitive Edge Over Its Rivals?

The Marketing Strategy of Indo Count reflects a strong focus on its competitive advantages, including a robust global presence and a vertically integrated business model. This strategic approach has enabled the company to maintain its position as a leading player in the textile industry. A detailed market analysis reveals that Indo Count Company has consistently demonstrated its ability to adapt and grow, even amidst market challenges.

Indo Count's strategic moves, such as the acquisition of the US brand 'Wamsutta' and securing licensing agreements, highlight its commitment to expanding its presence in the premium branded segment. These initiatives are part of a broader business strategy aimed at increasing value-added revenue and strengthening its market share. The company's financial performance is closely tied to its ability to leverage these competitive strengths.

The company's commitment to sustainability, reflected in its Dow Jones Sustainability Index (DJSI) score of 66 in 2024, is another key differentiator. This focus on environmental and social responsibility is increasingly important in the competitive landscape. Furthermore, Indo Count's financial performance and future outlook are positively influenced by these sustainable practices.

Indo Count is a leading home textile supplier and exporter of bed linen. This established position provides a strong foundation for its business strategy. The company benefits from a global reach and long-term relationships with key customers.

The vertically integrated model controls the entire supply chain, from spinning to product design. This integration enhances efficiency and provides value to clients. This is a key factor in the company's strong momentum and healthy growth.

Indo Count's expertise in designing and processing bed linen, including printing and dyeing, is a significant advantage. This allows for a wide range of products and caters to a diverse client base. The company's product portfolio is a key aspect of its competitive advantages.

Indo Count's commitment to sustainability, with a DJSI score of 66 in 2024, is a growing competitive factor. This includes reducing emissions and improving water efficiency. These practices are integrated into its strategic objectives.

Indo Count's competitive advantages include its established market position, vertical integration, product expertise, and sustainability initiatives. These strengths contribute to its ability to maintain a strong market position and achieve sustainable growth. The company's recent acquisitions and focus on value-added products further enhance its competitive edge.

- Established relationships with top global retailers.

- Vertically integrated business model for greater efficiency.

- Focus on value-added products and premium brands.

- Commitment to sustainable manufacturing practices.

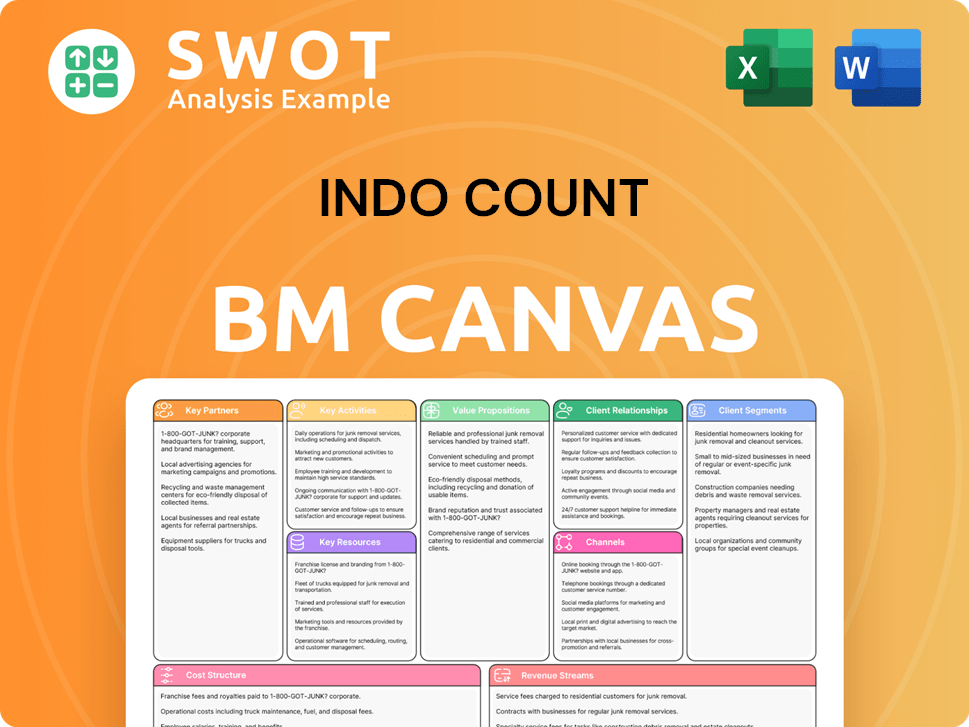

Indo Count Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Indo Count’s Competitive Landscape?

The Indo Count Company operates within a dynamic textile industry, navigating a complex competitive landscape. Understanding the market analysis is crucial for assessing its market share and future prospects. This involves evaluating industry trends, identifying potential risks, and recognizing opportunities for strategic growth. This article, along with a Brief History of Indo Count, provides a comprehensive overview of the company’s position.

The company faces challenges such as geographical concentration and exposure to currency fluctuations, which can impact its financial performance. However, strategic initiatives and a focus on value-added products aim to mitigate these risks and capitalize on emerging opportunities. The company's growth strategy is closely tied to its ability to adapt to these market dynamics and maintain a competitive edge.

The home textile industry is witnessing a surge in demand for sustainable and eco-friendly products. Technological advancements, including smart textiles and digital printing, are also reshaping the sector. Furthermore, there is a growing emphasis on customization and personalization to meet consumer preferences.

The industry is characterized by intense competition due to a low concentration of major players. The company's reliance on the US market and a few key customers presents a significant risk. Currency fluctuations also pose a threat to profit margins.

The growing home textile market, projected to reach nearly USD 209.53 billion by 2032, offers significant growth potential. Expanding branded offerings, particularly through acquisitions like Wamsutta, and entering the US manufacturing sector, are key strategies. The India-UK Free Trade Agreement presents further growth prospects.

The company aims to reduce emissions by 15% through renewable energy sources by 2025 and increase the share of sustainably procured materials to 60% by 2030. Expanding its B2C footprint and focusing on value-added products are also key strategies.

The Indo Count Company is strategically positioned to capitalize on industry trends while mitigating risks. Its commitment to sustainability and expansion plans are crucial for future growth. The company's ability to navigate the competitive environment will determine its long-term success.

- Sustainability initiatives, including a DJSI score of 66 in 2024, are a key competitive advantage.

- The company is expanding its branded offerings, including the Wamsutta brand, and entering US manufacturing.

- The global home textile market is projected to grow at a CAGR of 5.6% from 2025, presenting significant opportunities.

- Strategic focus on value-added products and B2C expansion is essential for sustained growth.

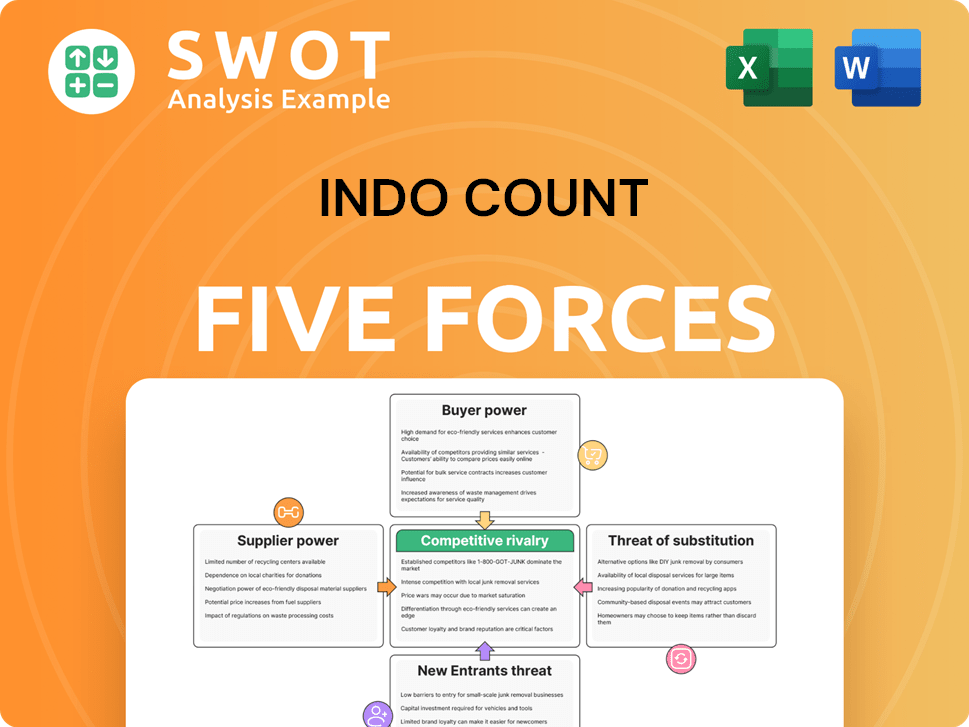

Indo Count Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Indo Count Company?

- What is Growth Strategy and Future Prospects of Indo Count Company?

- How Does Indo Count Company Work?

- What is Sales and Marketing Strategy of Indo Count Company?

- What is Brief History of Indo Count Company?

- Who Owns Indo Count Company?

- What is Customer Demographics and Target Market of Indo Count Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.