Indo Count Bundle

Can Indo Count Company Continue Its Ascent in the Textile Industry?

Indo Count Industries, a leader in home textiles, is undergoing a significant transformation in fiscal year 2025, marked by strategic acquisitions and U.S. manufacturing expansions, including the launch of the Beautyrest brand. This strategic pivot is designed to navigate economic headwinds and unlock new revenue streams, especially with the support of the India-UK Free Trade Agreement. Founded in 1988, the company has evolved from a textile processor to a global supplier, now boasting a market capitalization of $746 million as of May 27, 2025.

This article offers a comprehensive Indo Count SWOT Analysis, examining its growth strategy, expansion plans, and financial performance. We'll explore Indo Count Company's future prospects, including its strategic initiatives to enhance its product portfolio and leverage technological advancements within the Textile Industry. Investors and analysts alike will gain valuable insights into the company's competitive landscape and potential investment opportunities, making this a crucial read for anyone interested in Business Development and market trends.

How Is Indo Count Expanding Its Reach?

The Indo Count Company is actively pursuing a robust growth strategy, focusing on expanding its market presence and product offerings. This involves strategic acquisitions, greenfield projects, and brand development to strengthen its position in the Textile Industry. The company's approach is designed to enhance its revenue streams and solidify its market share in the global home textile market.

A key element of Indo Count Company's expansion strategy is its focus on the US market. This is evident through a series of acquisitions and investments aimed at building a strong presence in North America. These initiatives are supported by both organic growth and inorganic strategies to ensure sustainable business development and capitalize on emerging market trends.

The company's future prospects are closely tied to its ability to execute these expansion plans effectively. The following sections provide a detailed look at the specific initiatives and their potential impact on the company's performance.

In September 2024, Indo Count acquired an 81% stake in a US-based company, marking a significant move to enter the utility bedding segment. This acquisition was followed by the purchase of Modern Home Textiles Inc. in Phoenix, Arizona. These acquisitions aim to enhance the company's product offerings and expand its customer base in the US market.

Indo Count is investing $15 million in a new manufacturing facility in North Carolina, USA, through its subsidiary, Indo Count Global East, Inc. This project is expected to generate approximately $175 million in revenue and significantly increase the company's annual capacity. The facility is expected to gradually build revenue from September 2025.

The company is expanding its branded offerings, notably with the Beautyrest brand, and acquired the global home fashion brand Wamsutta in April 2024 for $10.2 million. Indo Count has also partnered with licensed brands such as Fieldcrest and Waverly to broaden its branded product segment. These initiatives are designed to strengthen the company's brand portfolio and market reach.

Domestically, the company's brands, Boutique Living and Layers, are driving growth through omnichannel expansion and influencer marketing. The recently announced India-UK Free Trade Agreement presents an opportunity to accelerate growth and strengthen the company's presence in the UK market. These strategies are geared towards increasing Indo Count Company's global presence.

Indo Count's expansion strategy includes a mix of acquisitions, greenfield projects, and brand development. These initiatives are designed to drive revenue growth and enhance its market position. The company's focus on the US market and its strategic partnerships are key to its long-term success. To learn more about the company's financial performance, consider reading this detailed Indo Count Company growth strategy analysis.

- Acquisition of US-based companies to expand product offerings and customer base.

- Investment in a new manufacturing facility in North Carolina to increase capacity.

- Expansion of branded products through acquisitions and partnerships.

- Leveraging the India-UK Free Trade Agreement to strengthen its presence in the UK.

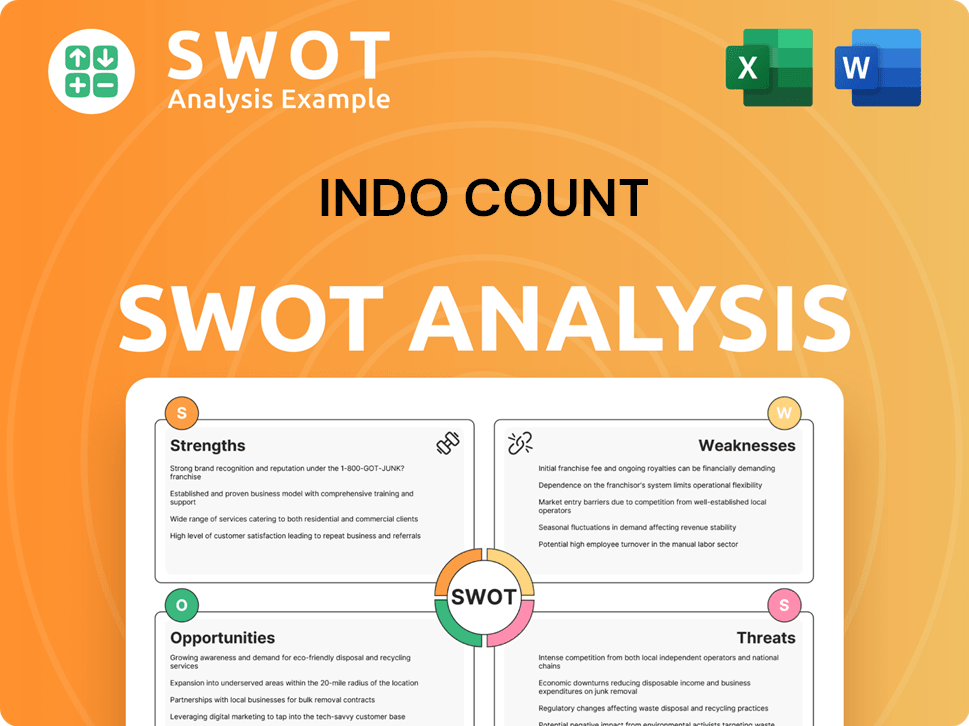

Indo Count SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Indo Count Invest in Innovation?

Indo Count Industries is actively employing innovation and technology to drive its growth strategy within the dynamic textile industry. The company's commitment to research and development (R&D) and in-house development is central to its approach, fueling the creation of new products and the enhancement of existing ones. This focus is reflected in its value-added product segment, which is a key driver of its financial performance.

The company's strategic initiatives also include a strong emphasis on digital transformation and sustainability. These efforts are designed to improve operational efficiency, reduce environmental impact, and meet evolving consumer demands. By integrating technology and sustainable practices, Indo Count aims to maintain a competitive edge and ensure long-term value creation.

Indo Count's strategic investments in technology and innovation are geared towards enhancing its market position and achieving sustainable growth. These initiatives are critical for adapting to changing market dynamics and consumer preferences, ensuring the company's continued success in the global textile market.

Indo Count prioritizes research and development (R&D) to foster product innovation. Value-added products significantly contribute to revenue, with a contribution of 50.20% of total revenue in FY24, up from 45.50% the previous year. The company anticipates further improvements in sales from this segment from FY26 onwards, which will support operating margins.

The company has embarked on a digital transformation journey in partnership with Accenture, announced in March 2024. This initiative aims to improve operational efficiency and enhance its competitive advantage in the Textile Industry. Digital transformation is a key component of Indo Count's business development strategy.

Indo Count is deeply invested in sustainability and circular economy practices. The company's commitment to sustainability is evident in its improved Dow Jones Sustainability Index (DJSI) score of 66 in 2024, a significant increase from 45 in 2023. This places Indo Count among the top 10% of global companies in the Textile, Apparel, and Luxury Goods sector.

The company aims to reduce emissions by 15% through renewable energy sources by 2025. In FY24, emissions were reduced by 6.2% (Kg CO2/Kg of production) compared to FY23. Indo Count launched a solar power generation unit in Gujarat in May 2024, supporting its long-term sustainability goals.

Indo Count plans to increase the share of sustainably procured materials to 60% by 2030. The company is also working towards water neutrality, improving water efficiency to 39 KL/MT in FY24 from 45.4 KL/MT in FY23. These efforts are crucial for the company's sustainable practices.

Indo Count has received recognition for its sustainability efforts, including the 'Excellence in Waste Reduction and Circular Innovation Leadership Award' and the 'CITI-BSL Best Sustainable Retail Practices Award' at the CITI Sustainability Awards 2024-25. The company's strong performance on the Carbon Disclosure Project (CDP) with a 'B' rating further highlights its commitment to a greener future.

Indo Count's strategic initiatives are designed to ensure its future prospects in the textile industry. The company's focus on innovation, technology, and sustainability positions it well for long-term growth. These initiatives are critical for maintaining a competitive edge and adapting to evolving market trends.

- Continued investment in R&D to develop new products and enhance existing ones.

- Expansion of digital transformation initiatives to improve operational efficiency.

- Further enhancement of sustainability practices, including emission reduction and sustainable sourcing.

- Focus on improving water efficiency and achieving water neutrality.

- Leveraging its strong performance on the CDP to attract environmentally conscious investors.

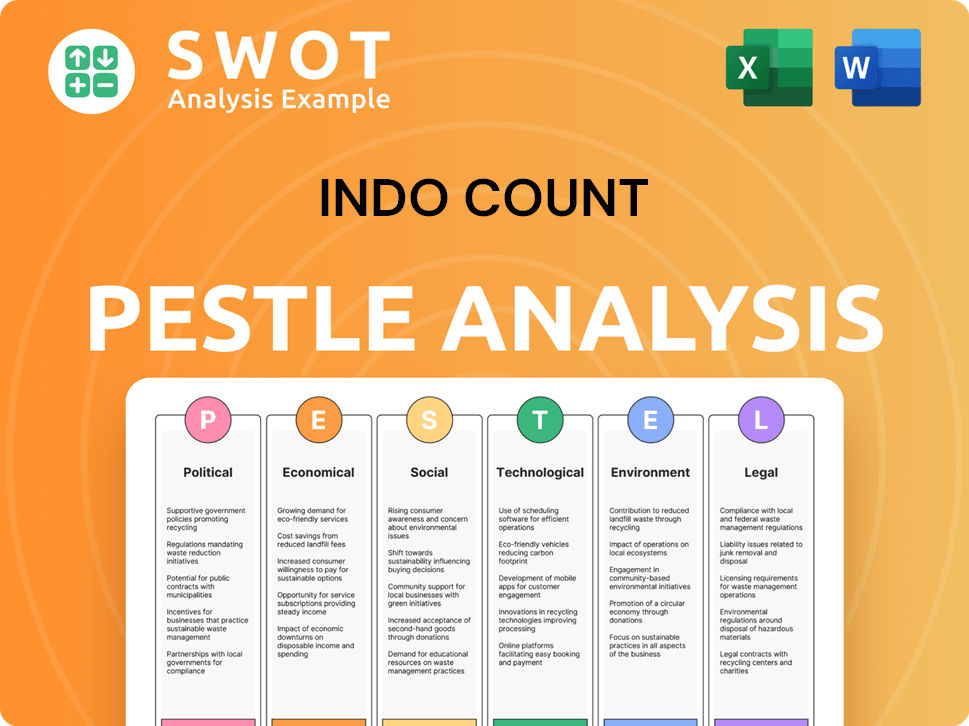

Indo Count PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Indo Count’s Growth Forecast?

The Target Market of Indo Count shows a mixed financial performance for the fiscal year 2025. Revenue increased by 16.71% to ₹4151.39 crore, but net profit decreased by 27.20% to ₹246.00 crore. This indicates growth in sales volume, but challenges in maintaining profitability.

For the quarter ending March 2025, net sales decreased by 6.47%, and net profit significantly declined by 87.82%. Operating profit also saw a substantial decrease, reflecting increased expenses, including branding costs. Despite these short-term setbacks, the company's total operating income saw an increase in FY24, supported by higher sales volume.

The company's financial risk profile remains strong, with a comfortable gearing ratio of 0.46x as of March 31, 2024. The company has unencumbered cash and liquid investments of ₹225.23 crore as of March 31, 2024. The company anticipates achieving the lower end of its sales volume guidance for FY25 and expects EBITDA margins in the range of 15-16%.

Indo Count Company's revenue grew by 16.71% in FY25. This growth was driven by an increase in sales volume, indicating strong demand for its products. The company's strategic initiatives and market presence contributed to this positive performance.

Despite revenue growth, net profit decreased by 27.20% in FY25. This decline was primarily due to higher expenses, including increased branding investments. The company is working on improving its profit margins through various cost-optimization measures.

The March 2025 quarter saw a 6.47% decrease in net sales and an 87.82% decline in net profit. This downturn was influenced by seasonal factors and increased operational costs. The company is focused on strategies to enhance its performance in the coming quarters.

Indo Count maintains a strong financial position with a gearing ratio of 0.46x. The company has substantial cash and liquid investments, ensuring financial flexibility. This stability supports its long-term growth strategy and investment opportunities.

The company anticipates achieving its sales volume guidance for FY25. Analysts forecast an average revenue growth of 21% per annum over the next two years. This growth is expected to outpace the 13% growth forecast for the Luxury industry in India. The company's strategic initiatives and market positioning are key to its future prospects.

- Focus on value-added products to improve margins.

- Expansion into new markets and product categories.

- Investment in sustainable practices and product innovation.

- Strategic initiatives to drive revenue growth and market share.

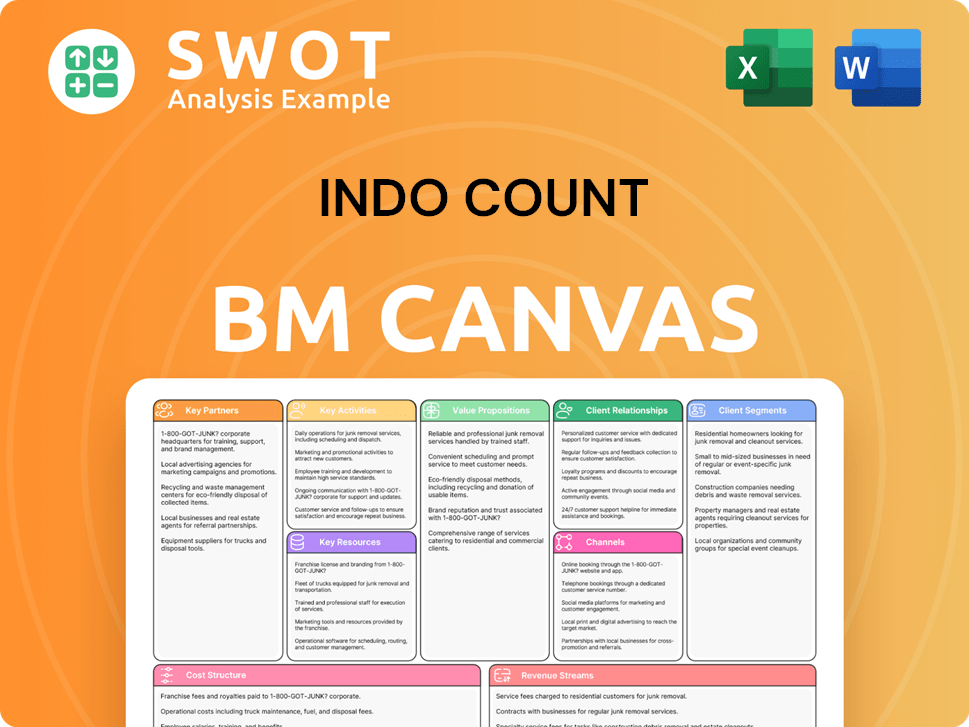

Indo Count Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Indo Count’s Growth?

The Indo Count Company faces various risks that could impact its Growth Strategy and Future Prospects. These challenges range from market dynamics to operational hurdles, requiring strategic management to ensure sustained success. The cyclical nature of the Textile Industry and intense competition demand continuous adaptation and innovation.

Fluctuations in raw material prices, especially cotton, and currency exchange rates pose significant financial risks for Indo Count. These factors can directly affect profitability, as seen in the past when softening raw material prices impacted realization. Supply chain disruptions and geopolitical events, such as the Red Sea Crisis, add further complexity and uncertainty.

Additionally, the company's financial performance has shown signs of strain recently. Declining financial health indicators, including drops in operating profit to interest ratio, Profit Before Tax, and Profit After Tax, alongside rising interest expenses and a drop in net sales, signal potential challenges. These factors require careful monitoring and proactive measures.

The home textile industry is highly competitive, requiring Indo Count to continuously innovate and differentiate its offerings. Intense competition can pressure margins and market share. Understanding the Indo Count Company competitive landscape is crucial for strategic planning and maintaining a competitive edge.

Cotton price fluctuations directly affect production costs and profitability. Efficient hedging strategies and the ability to pass on costs to customers are essential. The average realization per meter was ₹344 in FY24 compared to ₹373 in FY23, highlighting the impact of raw material prices.

Geopolitical events, such as the Red Sea Crisis, can increase freight costs and disrupt supply chains. These disruptions can affect production schedules and increase operational expenses. The Indo Count Company global presence may be impacted by these events.

Higher interest costs and investments in new facilities can strain profitability. Recent declines in key financial metrics, such as operating profit and net sales, indicate potential pressures. These factors require careful financial management and strategic adjustments. For more information on the Indo Count Company business model, refer to Revenue Streams & Business Model of Indo Count.

Uncertain macroeconomic and geopolitical environments can create near-term challenges. These uncertainties can affect demand, supply chains, and overall business performance. The company must be prepared to adapt to changing market conditions and geopolitical risks.

Concentration in specific products or customer segments can increase risk. Diversification into new product lines, such as utility bedding and branded offerings, is crucial. This helps to reduce product and customer concentration risks, improving the Indo Count Company market share.

Indo Count employs several strategies to mitigate these risks. These include diversifying its product portfolio, efficient working capital management, and maintaining a strong financial risk profile. The focus on Business Development and strategic initiatives is also key to long-term value creation. The company's focus on execution, integration, and expanding its footprint in high-potential categories is also important.

A robust capital structure and strong debt coverage metrics provide a buffer against financial shocks. The company's ability to manage working capital efficiently and adapt to challenging market conditions is a key strength. The company's financial performance should be monitored closely to assess its ability to overcome these obstacles. The Indo Count Company financial performance can be tracked through quarterly and annual reports.

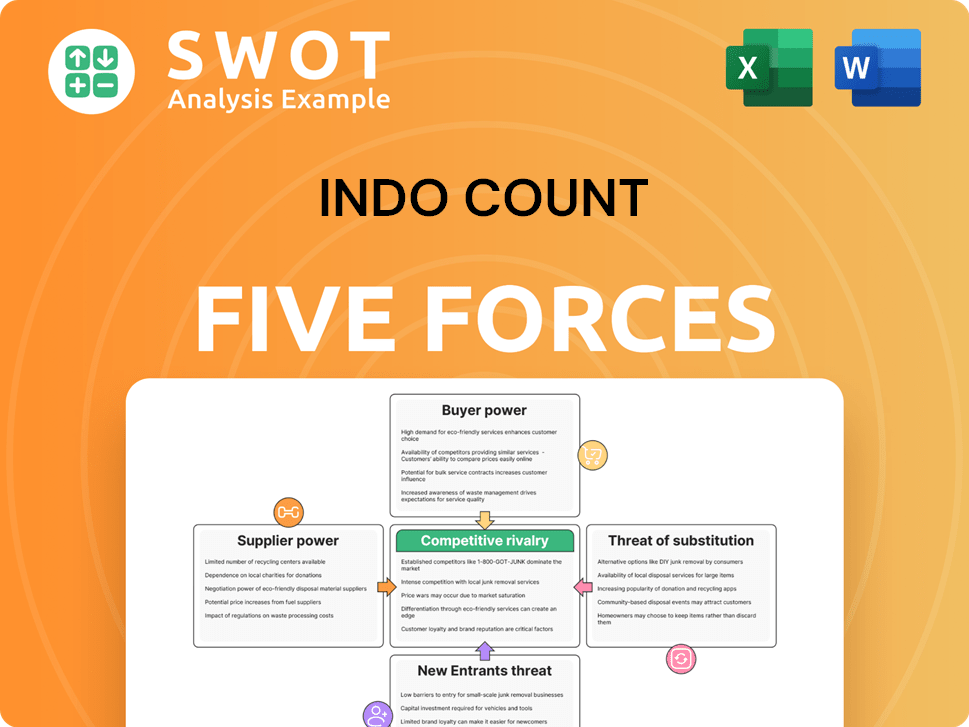

Indo Count Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Indo Count Company?

- What is Competitive Landscape of Indo Count Company?

- How Does Indo Count Company Work?

- What is Sales and Marketing Strategy of Indo Count Company?

- What is Brief History of Indo Count Company?

- Who Owns Indo Count Company?

- What is Customer Demographics and Target Market of Indo Count Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.