Indo Count Bundle

Who Buys Bedding from Indo Count?

Delving into the world of Indo Count Company, understanding its customer demographics and target market is key to unlocking its success. From luxury bed sheets to decorative fabrics, Indo Count strategically positions itself in the competitive textile industry. The company's evolution, marked by acquisitions like the Wamsutta brand, has dramatically reshaped its consumer profile.

To truly grasp Indo Count's market position, we must analyze its Indo Count SWOT Analysis, which reveals the intricacies of its customer base. This exploration will uncover Indo Count's primary customers, their geographic market focus, and the company's marketing strategies. By examining Indo Count's customer segmentation, we can better understand how it caters to diverse needs and buying behaviors, ensuring sustained growth in the home textile market.

Who Are Indo Count’s Main Customers?

Understanding the customer base of Indo Count Company involves analyzing its market segmentation across both business-to-business (B2B) and business-to-consumer (B2C) channels. The company's strategy includes a significant expansion into the B2C and direct-to-consumer (D2C) markets, particularly in North America. This shift is supported by strategic acquisitions and licensing agreements aimed at reaching end consumers more directly. The company's focus on premium home textiles suggests a target market that values quality and design.

The company's customer demographics are diverse, reflecting its dual approach. The B2B segment primarily serves top global retailers and international brands. The B2C segment, on the other hand, is expanding through acquisitions and licensing, targeting consumers in the US and Canada. This expansion includes brands like Wamsutta, Fieldcrest, and Waverly, catering to consumers seeking luxurious home fashion products. The launch of the Gaiam fitness brand's home segment further indicates a move towards health-conscious and lifestyle-oriented consumers.

Indo Count's revenue is heavily concentrated in the US market, which accounted for nearly 70% of its revenue in FY24. This highlights the importance of the North American consumer in their target segments. Strategic investments and acquisitions, such as the US-based quilt and pillow manufacturer Fluvitex USA and Modern Home Textiles, Inc., along with plans for a greenfield manufacturing facility in North Carolina, USA, are aimed at strengthening its presence in the utility bedding segment and deepening its market presence in the US. These shifts are prompted by market research and the strategic intent to increase revenue and margins through branded goods, which typically command higher margins (22% to 30%).

The B2B segment comprises global retailers and international brands. These customers likely seek high-quality, design-focused home textile products. This segment contributes significantly to the company's revenue, with a focus on providing premium bedding solutions.

The B2C segment includes consumers targeted through brands like Wamsutta, Fieldcrest, and Waverly. The focus is on consumers who appreciate luxury and quality in home fashion. The launch of Gaiam's home segment also targets health-conscious consumers.

The US market is the primary focus, generating nearly 70% of Indo Count's revenue in FY24. Strategic investments and acquisitions in the US, such as Fluvitex USA and Modern Home Textiles, Inc., emphasize this focus. Expansion includes a new manufacturing facility in North Carolina.

The company aims to increase revenue and margins through branded goods, which typically command higher margins (22% to 30%). This strategy includes expanding its presence in the utility bedding segment. The company's approach involves a mix of organic growth, acquisitions, and licensing agreements.

Indo Count's customer demographics are segmented across B2B and B2C channels, with a strong emphasis on the North American market. The shift towards B2C and D2C models reflects a strategic move to capture higher margins and enhance brand presence. The company's focus on premium and luxury bedding products suggests a target market with higher disposable incomes and an appreciation for quality.

- Market Segmentation: B2B (retailers, international brands) and B2C (consumers through various brands).

- Geographic Focus: Primarily the US market, accounting for nearly 70% of revenue.

- Product Strategy: Emphasis on premium bedding and home fashion products to target consumers.

- Customer Profile: Consumers seeking quality, design, and potentially sustainable practices in home textiles.

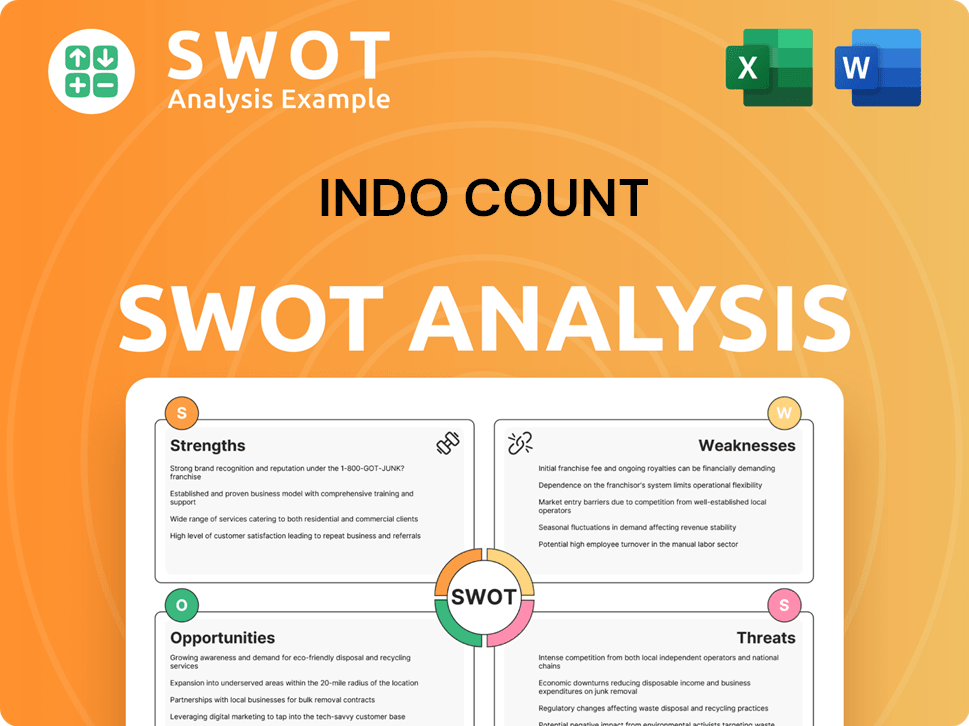

Indo Count SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Indo Count’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any company. For Indo Count Company, a deep dive into customer demographics and the target market reveals key insights that drive product development and marketing strategies. The company's focus on innovation, design, and sustainability directly addresses the evolving demands of its clientele, particularly in the premium home textile segment.

Indo Count's customers are driven by a combination of practical, aesthetic, and aspirational needs. They value superior materials, craftsmanship, and designs that enhance their living spaces. The company's approach to sourcing sustainable cotton and its commitment to eco-friendly practices resonate with environmentally conscious consumers, a growing segment in the textile industry.

The company's strategic moves, such as acquiring brands and entering licensing agreements, are aimed at addressing the holistic needs of customers. This expansion includes offering a broader product portfolio and tailoring marketing efforts to specific segments, which is essential for transforming prospects into profits. This approach is crucial for navigating the competitive landscape and maintaining a strong market position.

Customers prioritize high-quality materials and superior craftsmanship. This focus ensures product longevity and enhances the overall user experience. This is a core value that Indo Count Company emphasizes in its product offerings.

Aesthetic appeal and innovative designs are essential. Customers seek products that complement their home décor and reflect their personal style. The company invests in design to meet these evolving preferences.

Comfort and practicality are key considerations. Products must offer a comfortable user experience and meet functional needs. Indo Count ensures its products provide both comfort and utility.

Growing demand for sustainable and ethically sourced products. Consumers are increasingly conscious of environmental impact and ethical production practices. Indo Count addresses this through sustainable sourcing.

Customers trust established brands with a strong reputation. Brand recognition and reliability influence purchasing decisions. The company's acquisitions and licensing agreements support this need.

Consumers appreciate a wide product range and convenient shopping experiences. Offering a diverse portfolio and accessible channels enhances customer satisfaction. The company expands its offerings to meet these needs.

Indo Count Company employs several strategies to meet customer needs. These strategies include product innovation, sustainable sourcing, brand expansion, and targeted marketing. These efforts are designed to strengthen the company's position in the textile industry and drive growth. For more insights, consider reading about the Growth Strategy of Indo Count.

- Product Innovation: Continuous development of new designs and features.

- Sustainable Sourcing: Using BCI, organic, and ELS cotton.

- Brand Expansion: Acquiring and licensing brands to broaden the product portfolio.

- Targeted Marketing: Tailoring marketing efforts to specific customer segments.

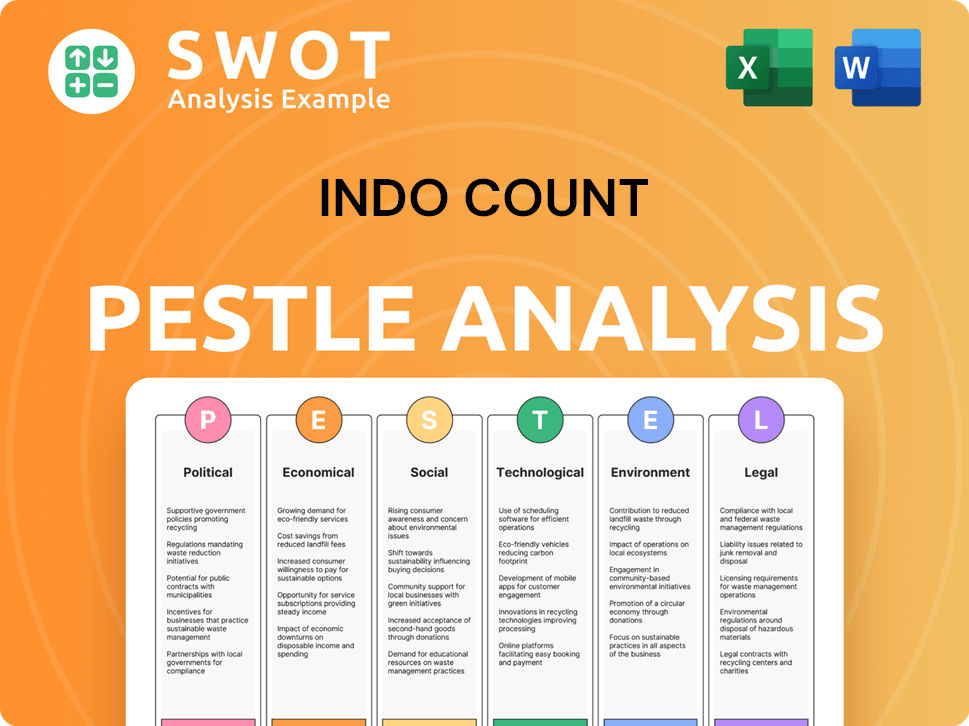

Indo Count PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Indo Count operate?

The geographical market presence of Indo Count Industries Limited is extensive, spanning over 50 countries across five continents. The company strategically targets diverse international markets, adapting its offerings to meet varied customer demographics and preferences. This global approach is a key element of its growth strategy within the textile industry.

The United States is the primary market for Indo Count, contributing nearly 70% of its total sales in FY24. This strong presence makes the company a leading supplier of bed sheets in the US, holding over 20% of the market share in this region. Beyond the US, the company also has a significant presence in Europe, with the UK and Europe together accounting for approximately 12% of total sales in FY24.

Indo Count's expansion strategy includes new markets such as Canada, Australia, Japan, and the UAE. The acquisition of GHCL's home textile business provided access to the Australian market. This expansion is supported by India's Free Trade Agreement with Australia. To support its global operations, the company has established international subsidiaries and a distribution network, including showrooms and design studios in key locations like New York (US), Manchester (UK), and Dubai (UAE), alongside warehouses in the US, UK, Dubai, and India. Understanding the Brief History of Indo Count helps to understand the company's market strategies.

Indo Count addresses varying customer demographics through localized offerings and marketing strategies. This approach allows the company to effectively segment its market and cater to specific consumer profiles.

The acquisition of brands like Wamsutta, Fieldcrest, and Waverly strengthens its B2C footprint in North America, focusing on the specific demands of that market. This helps in defining the Indo Count target market.

In India, the company has established its presence with domestic brands like 'Boutique Living' and 'Layers', demonstrating a localized approach for the Indian consumer. This indicates a focus on Indo Count customer base analysis.

Recent strategic moves include investments in US-based utility bedding manufacturers, such as Fluvitex USA, Inc., and Modern Home Textiles, Inc. These investments aim to strengthen its foothold in the US utility bedding manufacturing sector.

Indo Count is setting up a greenfield manufacturing facility in North Carolina, USA, with an approximate investment of $15 million, targeting a production capacity of 18 million pillows. Revenue buildup is targeted from September 2025, aiming to deepen its market presence, especially on the East Coast of the US.

The company aims to double its revenues by 2028, driven by its core business, utility bedding, and brands. This growth strategy is a key aspect of the company's long-term vision within the textile industry.

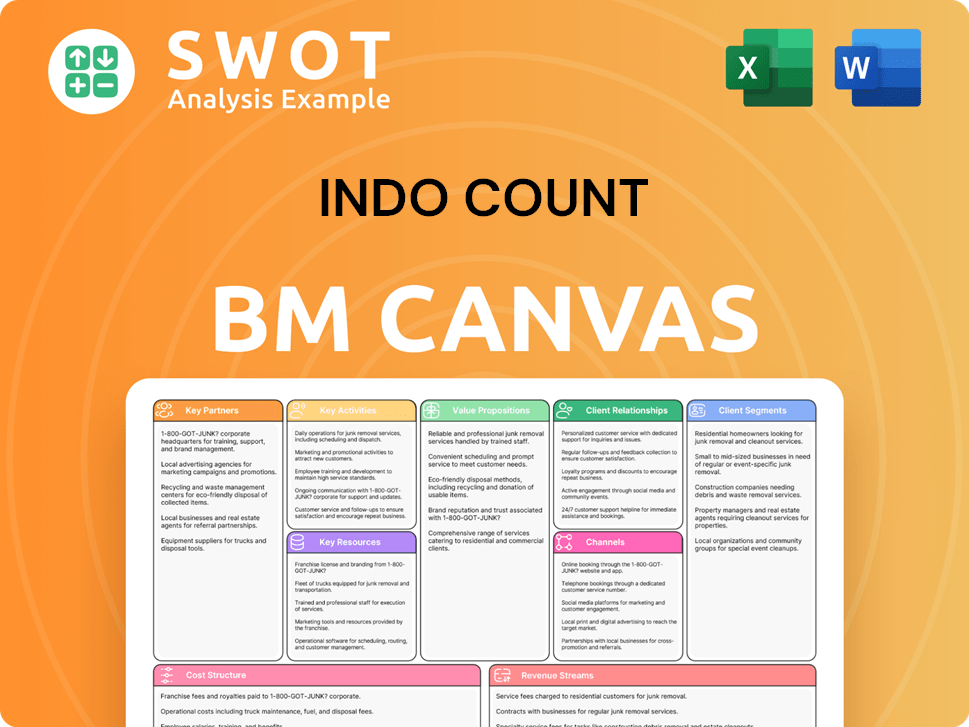

Indo Count Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Indo Count Win & Keep Customers?

Indo Count Industries utilizes a multi-channel approach to attract and retain customers, blending marketing strategies, sales tactics, and customer-focused initiatives. This includes a significant shift towards B2C and D2C (Direct-to-Consumer) channels globally, enhancing direct engagement with consumers.

For customer acquisition, the company leverages its diverse brand portfolio, which includes owned and licensed brands, designing customized marketing strategies around these brands. This approach is designed to transform prospects into profits. For example, the acquisition of Wamsutta is expected to boost revenue and margins significantly, with branded goods typically commanding higher margins.

Customer retention is supported by a commitment to innovation, quality, and sustainability, key factors for customer loyalty in the home textile market. The company's focus on long-standing relationships with major clients, such as Walmart (contributing over 20% of revenue in FY24), indicates a strong emphasis on maintaining existing business.

The company uses a multi-brand strategy, including owned brands like Pure Earth and licensed brands such as Wamsutta, to attract customers. Customized marketing strategies are developed for each brand. Indo Count also participates in events like New York Market Week to acquire new customers.

With a move towards B2C and D2C, the company is likely increasing its focus on online sales and e-commerce. The ability to build online stores for brands like Wamsutta is a stated objective. E-commerce's share of total retail sales in the US has been on an upward trend.

Customer retention is supported by innovation, quality, and sustainability. Long-standing relationships with major clients like Walmart are maintained. The company focuses on a 'customer-centric' approach and 'ready to market' strategy, with investments in capacity and R&D.

The company is shifting towards a higher value-added product mix. In FY24, value-added products contributed 50.20% of total revenue, up from 45.50% the previous year. This focus on premium products and branded segments is expected to drive volume and margin growth. More information about the Owners & Shareholders of Indo Count can be found here.

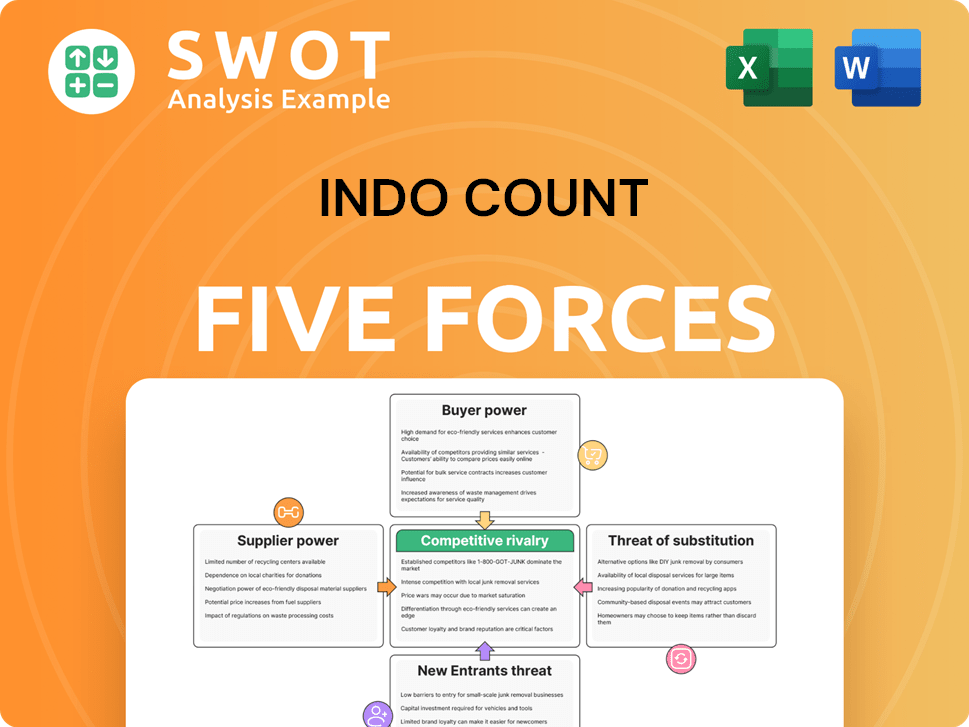

Indo Count Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Indo Count Company?

- What is Competitive Landscape of Indo Count Company?

- What is Growth Strategy and Future Prospects of Indo Count Company?

- How Does Indo Count Company Work?

- What is Sales and Marketing Strategy of Indo Count Company?

- What is Brief History of Indo Count Company?

- Who Owns Indo Count Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.