Johnson Controls International Bundle

Can Johnson Controls International Maintain Its Leading Edge?

Johnson Controls International (JCI) is a powerhouse in the smart building solutions sector, but how does it stack up against the competition? With a history stretching back to 1885, JCI has transformed from a thermostat innovator into a global leader. This Johnson Controls International SWOT Analysis will help you understand its position.

This market analysis will delve into the competitive landscape, examining JCI's industry competitors and their strategies. Understanding the HVAC industry and building automation dynamics is crucial to assessing JCI's market share and competitive advantages. We'll explore its financial performance, recent acquisitions, and business strategy to provide a comprehensive industry analysis report and future outlook, helping you understand how Johnson Controls International navigates market challenges.

Where Does Johnson Controls International’ Stand in the Current Market?

Johnson Controls International (JCI) holds a prominent position in the building technologies sector, ranking among the top three global providers. The company's core operations revolve around offering building solutions, including HVAC equipment, fire and security systems, building automation, and industrial refrigeration. This diverse portfolio allows JCI to serve various customer needs within the HVAC industry and beyond.

The company's value proposition centers on enhancing building efficiency, safety, and sustainability. It achieves this by providing integrated solutions that optimize energy consumption, improve indoor environments, and ensure the security of building occupants. JCI's focus on innovation and customer-centric solutions solidifies its market standing.

JCI's financial performance highlights its strong market position. For the twelve months ending March 31, 2025, revenue reached $23.248 billion, reflecting a substantial year-over-year increase of 14.06%. In fiscal year 2024, the company reported $22.952 billion in revenue, marking a 2.78% increase from the prior year.

JCI is strategically focusing on its core building solutions business. This is demonstrated by the planned divestiture of its Residential & Light Commercial HVAC business to Bosch Group for approximately $8.1 billion, expected to close in Q4 fiscal 2025. This move aims to streamline operations and boost shareholder value.

JCI's global presence is significant, with a strong focus on North America, which is projected to contribute 52% of total revenues in FY2025, with an expected growth of 7% to $12 billion. The company's Building Solutions backlog reached a record $14.0 billion in Q2 fiscal 2025, increasing 12% organically year-over-year, indicating robust future growth prospects.

JCI's profitability metrics are competitive within the industry. As of March 31, 2025, the company's Return on Assets (ROA) was 3.71%, Return on Equity (ROE) was 9.80%, and Return on Invested Capital (ROIC) was 6.24%. These figures underscore the company's efficiency in utilizing assets and generating returns.

The competitive landscape for Johnson Controls International includes both established players and emerging competitors in the HVAC industry and building automation sectors. JCI faces challenges such as fluctuating raw material costs, supply chain disruptions, and the need to continuously innovate to meet evolving customer demands.

- JCI's strategic focus on building solutions and its planned divestiture of the Residential & Light Commercial HVAC business to Bosch Group.

- The company's strong financial performance, including revenue growth and solid profitability metrics.

- The increasing demand for sustainable and energy-efficient building solutions.

- The company's ability to capitalize on the growing market for smart building technologies.

- The company's record backlog of $14.0 billion in Q2 fiscal 2025.

For a deeper dive into JCI's strategic approach, consider reading about the Growth Strategy of Johnson Controls International.

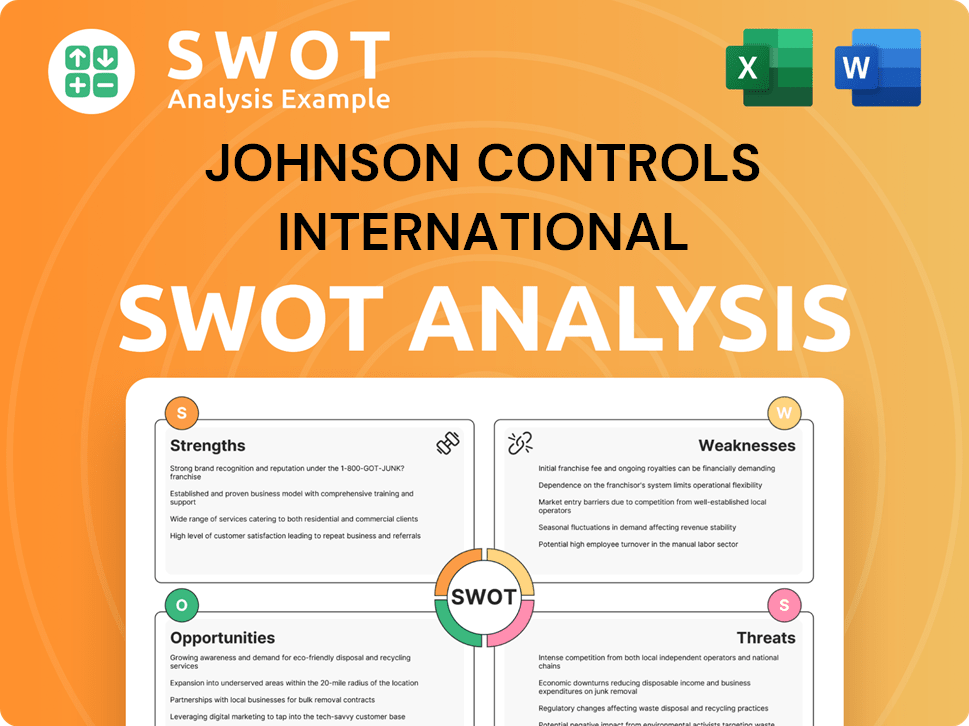

Johnson Controls International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Johnson Controls International?

The competitive landscape for Johnson Controls International within the commercial building automation and HVAC control system sector is intense. The market is dominated by several large, well-established companies that compete on various fronts, including technology, pricing, and distribution. Understanding this competitive environment is crucial for assessing Johnson Controls International's strategic position and future prospects.

Johnson Controls International faces both direct and indirect competition. Direct competitors offer similar products and services, while indirect competitors may provide alternative solutions or target different segments of the market. The dynamics of this competition are constantly evolving, influenced by technological advancements, mergers, and acquisitions, and shifts in customer preferences. A detailed market analysis reveals the key players and their strategies.

The HVAC industry is a significant area of competition. Companies are constantly innovating to improve energy efficiency and integrate smart technologies. This drives the need for continuous adaptation and strategic planning to maintain a competitive edge. The following sections provide a deeper look into the key players and their impact on Johnson Controls International.

Honeywell is a major competitor, offering integrated building management systems and HVAC solutions. They focus on smart building technologies and energy management. Honeywell's financial performance in recent years reflects its strong position in the market.

Siemens provides comprehensive building automation, fire safety, and security systems. They emphasize digital solutions and IoT integration to enhance building efficiency. Siemens has expanded its offerings in energy management.

Schneider Electric focuses on energy management and automation solutions. Their products aim to improve energy efficiency and reduce carbon emissions in buildings. Schneider Electric has a strong global presence.

Carrier is a major player in the HVAC market, offering a wide range of heating, ventilation, and air conditioning systems. They focus on energy-efficient solutions and sustainable building practices. Carrier's market share is significant.

Trane Technologies provides HVAC and building automation solutions. They are known for their innovation in sustainable building technologies. Trane competes directly with Johnson Controls in several markets.

Daikin is a global leader in HVAC equipment and systems. They focus on energy-efficient products and have a strong presence in the residential and commercial markets. Daikin's expansion has increased competition.

The competitive landscape is shaped by various factors, including technological advancements, mergers and acquisitions, and shifts in customer demand. Companies are investing in digital services, SaaS, and IoT to enhance their offerings. Strategic alliances and acquisitions are also common as companies seek to expand their portfolios and global footprints. For more insights, refer to the article about Owners & Shareholders of Johnson Controls International.

- Market Share: The top competitors, including Johnson Controls International, collectively hold a significant portion of the building automation system market.

- Innovation: Companies are investing heavily in R&D to develop smart building solutions, energy-efficient systems, and integrated platforms.

- Digital Transformation: The integration of IoT, AI, and cloud-based services is transforming the industry, creating new opportunities and challenges.

- Sustainability: There is a growing emphasis on sustainable building practices and solutions that reduce carbon emissions.

- Global Presence: Companies with a strong global presence have a competitive advantage due to their ability to serve diverse markets and customer needs.

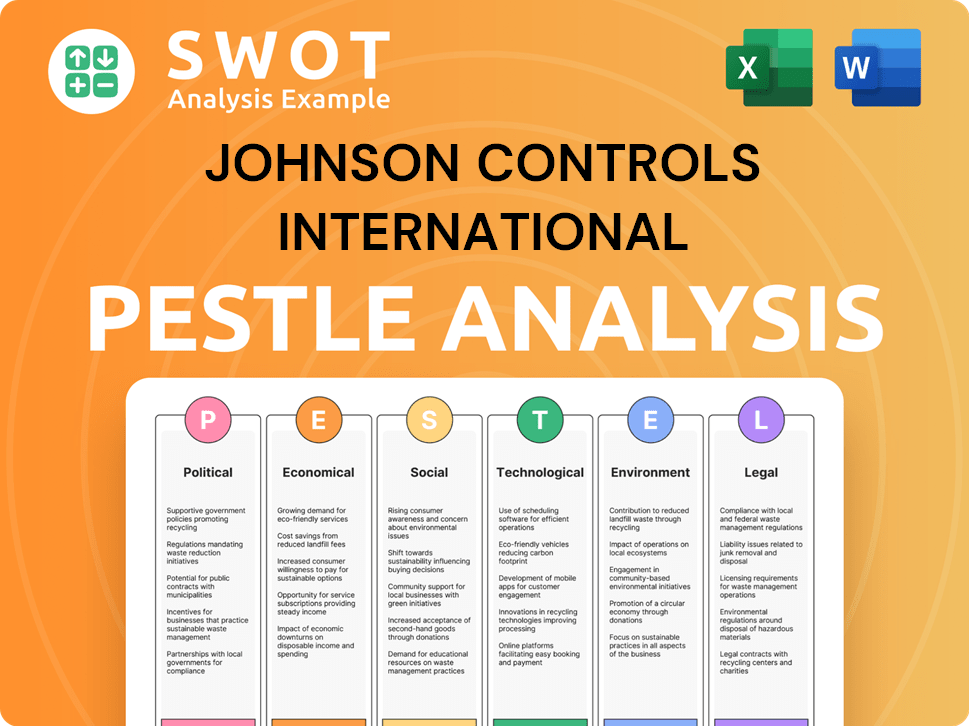

Johnson Controls International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Johnson Controls International a Competitive Edge Over Its Rivals?

The competitive landscape for Johnson Controls International (JCI) is shaped by its strategic focus on smart and sustainable building solutions. Key milestones include the development of the OpenBlue digital platform, which integrates building products and services with cutting-edge technology. Strategic moves involve significant investments in research and development, particularly in areas like energy efficiency and smart building technologies. JCI's competitive edge is defined by its proprietary technologies, strong brand equity, and a global presence that allows it to serve diverse markets effectively.

A deep dive into the Brief History of Johnson Controls International reveals a company built on a foundation of innovation and expansion. JCI's ability to adapt to evolving market demands, especially in the HVAC industry and building automation, is crucial. The company's commitment to sustainability and digital transformation further strengthens its position in the competitive landscape. Recent financial data indicates that JCI's strategies are yielding positive results, with notable growth in key business segments.

The market analysis of JCI highlights its significant role in the HVAC industry, building automation, and energy management solutions. JCI's competitive advantages include its extensive global presence, a diversified portfolio, and a robust R&D program. These factors enable JCI to maintain a strong position against its industry competitors. The company's focus on innovation and customer-centric solutions is essential for long-term success.

The OpenBlue digital software platform is a key differentiator, providing data-driven 'smart building' services. This platform integrates JCI's building products and services with advanced technology and digital capabilities. A recent study in April 2025 found that the OpenBlue platform drives efficiency and cost savings for customers.

JCI holds a leading position in cooling solutions for data centers, especially with its YORK Chiller platform. Orders for these solutions more than doubled sales in fiscal 2024. This growth highlights JCI's ability to meet the increasing demand for efficient data center cooling.

JCI benefits from significant brand equity, built over its long history since 1885. Strong customer loyalty is a key advantage, contributing to stable revenue streams. This loyalty is fostered through reliable products and services.

JCI has an extensive global presence, operating in over 150 countries with a workforce exceeding 100,000 employees. This global footprint supports economies of scale and a vast distribution network. This wide reach allows JCI to serve a diverse customer base worldwide.

JCI's commitment to research and development (R&D) is another crucial advantage, with an annual investment of $1.2 billion focused on sustainable and smart building technologies. Approximately one-third of the company's revenue comes from services, with half of that being recurring, providing stable and resilient cash flow.

- Smart building technologies: $480 million investment.

- Energy efficiency solutions: $350 million investment.

- Sustainability innovations: $370 million investment.

- Recurring revenue contributes to financial stability.

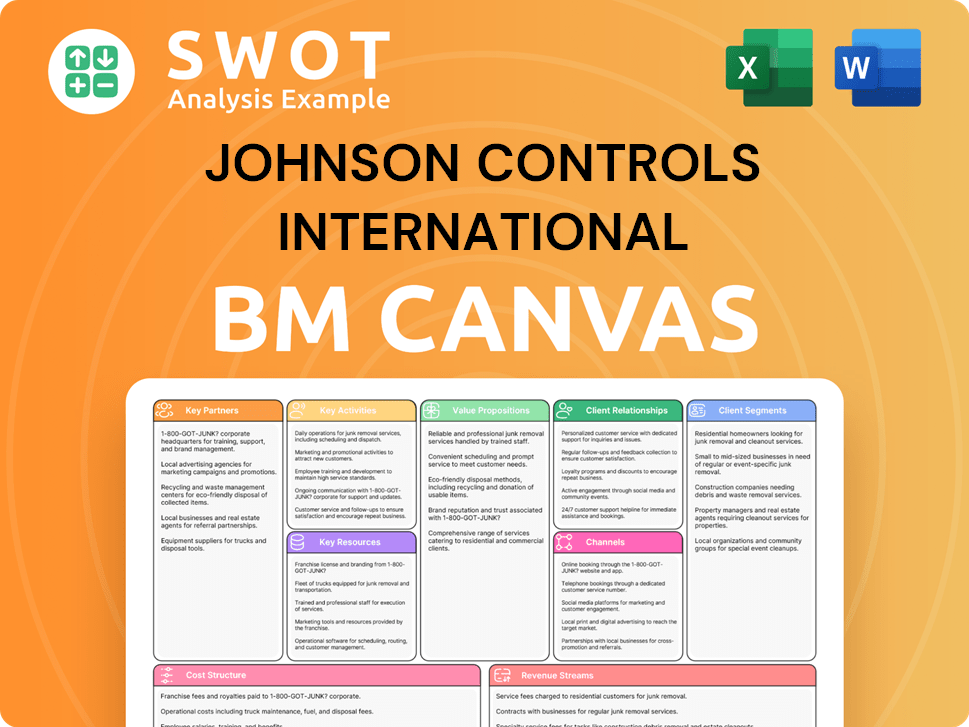

Johnson Controls International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Johnson Controls International’s Competitive Landscape?

The building technologies sector is experiencing significant shifts, driven by technological advancements, regulatory changes, and sustainability demands. This dynamic environment presents both challenges and opportunities for companies like Johnson Controls International. Understanding the Marketing Strategy of Johnson Controls International is crucial for navigating this evolving landscape.

The competitive landscape for Johnson Controls is shaped by the HVAC industry, building automation, and the broader construction market. Key factors include technological innovation, economic conditions, and the push for sustainable building practices. The company's future outlook depends on its ability to adapt to these trends and capitalize on emerging opportunities while mitigating potential risks.

Technological advancements are transforming the building industry, with AI, IoT, and digital twins enhancing efficiency. The building automation system market is expected to reach USD 205.55 billion by 2030. Regulatory changes and sustainability efforts, such as the nZEB standards, are also key drivers.

Intense competition in the HVAC industry and potential economic downturns pose challenges. Global economic uncertainty, including tariffs and interest rates, could impact material costs. The industry faces a talent shortage, which could hinder project completion and technology adoption.

Strong demand for smart, energy-efficient building systems presents growth opportunities. The data center market offers significant potential due to the need for efficient cooling. Emerging markets and strategic partnerships also provide avenues for expansion.

The company is simplifying its portfolio, focusing on operational excellence, and leveraging its record backlog of $14.0 billion as of Q2 fiscal 2025. Strategies include increasing customer focus and implementing lean business systems to accelerate momentum.

The building automation market's projected growth, coupled with sustainability initiatives, highlights the industry's potential. Johnson Controls International's ability to adapt to technological changes and economic conditions will be critical. The company's strategic focus on building solutions and operational excellence positions it for future success.

- The building automation system market is projected to grow from USD 117.37 billion in 2025 to USD 205.55 billion by 2030.

- The company's record backlog of $14.0 billion as of Q2 fiscal 2025 provides a strong foundation.

- Focus on sustainable building solutions and the OpenBlue platform supports decarbonization efforts.

- Strategic partnerships and product innovations are key for growth in emerging markets.

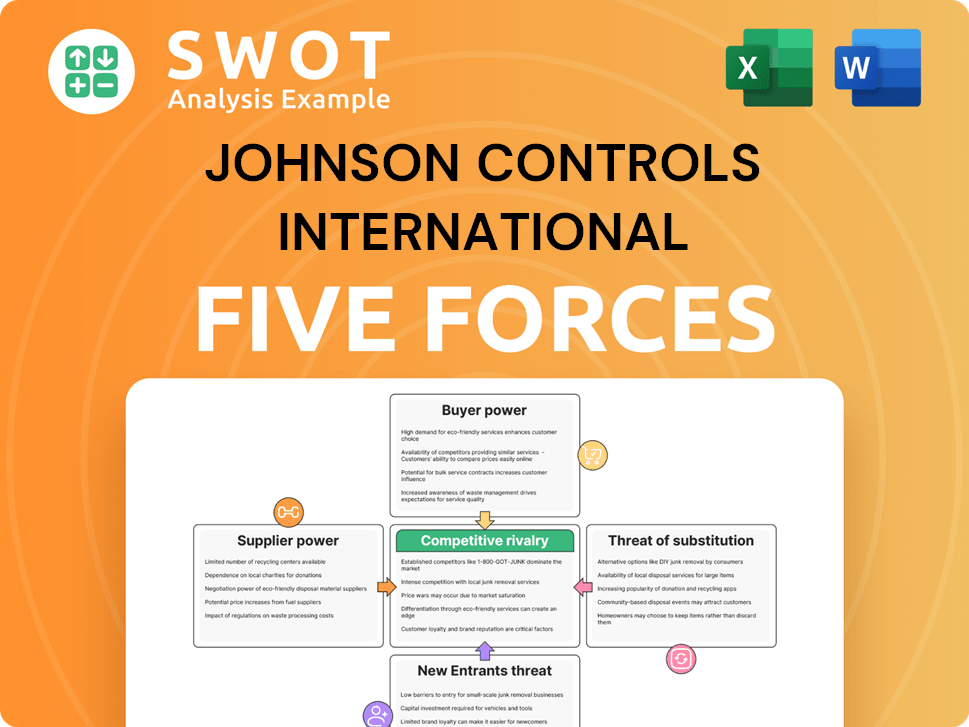

Johnson Controls International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Johnson Controls International Company?

- What is Growth Strategy and Future Prospects of Johnson Controls International Company?

- How Does Johnson Controls International Company Work?

- What is Sales and Marketing Strategy of Johnson Controls International Company?

- What is Brief History of Johnson Controls International Company?

- Who Owns Johnson Controls International Company?

- What is Customer Demographics and Target Market of Johnson Controls International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.