Johnson Controls International Bundle

Who Really Owns Johnson Controls International?

Understanding a company's ownership is crucial for investors and stakeholders alike. The Johnson Controls International SWOT Analysis reveals strategic insights, and its ownership structure is key to understanding its direction. The merger with Tyco International in 2016 reshaped the company, transforming it into a global powerhouse. This examination will uncover the key players behind this industry leader.

From its origins in 1885 as the Johnson Electric Service Company, Johnson Controls has evolved significantly. Today, as a publicly traded company, understanding who owns Johnson Controls, the JCI owner, and the Johnson Controls ownership structure is essential. This exploration will delve into the major investors and the dynamic shifts in the company's shareholder base. Knowing the Johnson Controls company's parent company and its key executives provides a comprehensive view of its operations.

Who Founded Johnson Controls International?

The story of Johnson Controls International began in 1885 with Professor Warren S. Johnson, marking the start of its journey in building control innovation. Johnson, who patented the first electric room thermostat in 1883, founded the Johnson Electric Service Company in Milwaukee, Wisconsin. This venture was backed by a group of Milwaukee investors, including William Plankinton, establishing a collaborative ownership structure from the outset.

The company's initial focus was on manufacturing, installing, and servicing automatic temperature regulation systems for buildings. While specific details about the initial share distribution are not readily available, the involvement of multiple investors suggests a shared ownership model. The company's evolution continued with key figures like Harry W. Ellis and Joseph Cutler taking leadership roles.

In 1940, the company, then known as Johnson Service Company, transitioned to a public entity. This move, with an over-the-counter listing on the NASDAQ system, significantly altered its ownership structure, opening it up to a broader base of investors. The early days of Johnson Controls, therefore, reflect a blend of entrepreneurial vision and collaborative financial backing.

Founded in 1885 by Professor Warren S. Johnson.

Backed by a group of Milwaukee investors led by William Plankinton.

Automatic temperature regulation systems for buildings.

Went public in 1940 with an over-the-counter listing on the NASDAQ system.

Harry W. Ellis and Joseph Cutler played significant roles in the company's early development.

Hussein Mohamad Nahfawi is also mentioned as a co-founder in some sources.

The early ownership of Johnson Controls involved a mix of its founder, early investors, and key figures who shaped the company's direction. The transition to a publicly traded company in 1940 marked a significant change in Johnson Controls ownership, opening it up to a wider range of shareholders. Understanding the initial structure provides insight into the company's evolution and the shift from private to public ownership. The current JCI owner structure is primarily institutional, with a significant portion of shares held by institutional investors. As of the latest data, the company continues to be a major player in the building technology and solutions sector, with a global presence.

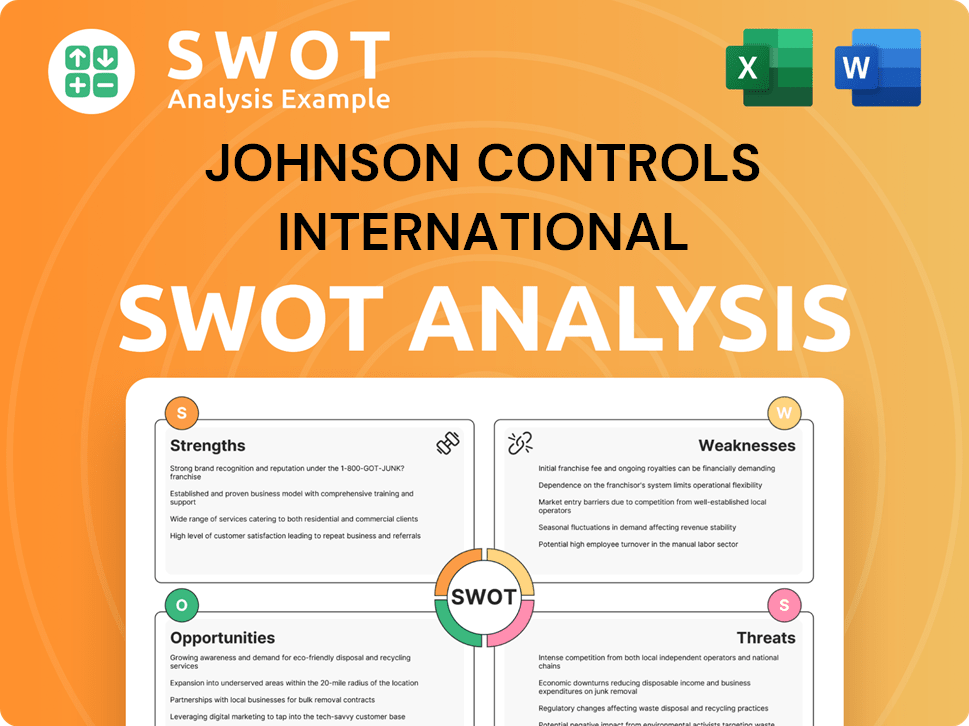

Johnson Controls International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Johnson Controls International’s Ownership Changed Over Time?

The ownership structure of Johnson Controls International plc, a publicly traded company on the New York Stock Exchange (NYSE: JCI), has evolved significantly over time. A key event was the 2016 merger with Tyco International, which resulted in the formation of Johnson Controls International plc, now based in Ireland. This merger reshaped the company's structure and its investor base, setting the stage for its current ownership landscape.

This transformation has allowed for a diverse range of investors, from individual shareholders to large institutional entities, to own a portion of the company. The company's history reflects strategic shifts and adaptations in response to market dynamics and growth opportunities. Understanding these changes is crucial for evaluating the company's long-term prospects and its alignment with shareholder interests.

| Key Dates | Event | Impact on Ownership |

|---|---|---|

| January 25, 2016 | Merger with Tyco International | Formation of Johnson Controls International plc, domiciled in Ireland. |

| June 12, 2025 | Institutional Ownership Data | Institutional owners hold approximately 93.1% of the company's stock. |

| Q1 2025 | Institutional Investment Activity | STRS Ohio and Acadian Asset Management acquired new stakes. |

As of June 12, 2025, Johnson Controls International plc has 2097 institutional owners and shareholders. Institutional ownership is substantial, representing about 93.1% of the company's stock, as of May 2025. Major shareholders include Dodge & Cox (10.73%), Vanguard Group Inc (10.37%), and BlackRock, Inc. (5.745% as of April 23, 2025). These major investors significantly influence company strategy and governance. The company's strong financial performance, with free cash flow reaching $1.087 billion in fiscal 2024, further supports its stability. Learn more about the company’s financial strategies by reading our article on Revenue Streams & Business Model of Johnson Controls International.

Johnson Controls' ownership structure is primarily institutional, reflecting confidence in its long-term strategy. Key stakeholders include major investment firms. The company's financial health and strategic direction are influenced by these significant shareholders.

- Institutional ownership accounts for approximately 93.1% of the company's stock.

- Dodge & Cox, Vanguard Group Inc, and BlackRock, Inc. are among the largest shareholders.

- The company's robust financial performance, including strong free cash flow, supports its stability.

- Insider selling and institutional buying reflect the dynamic nature of the ownership.

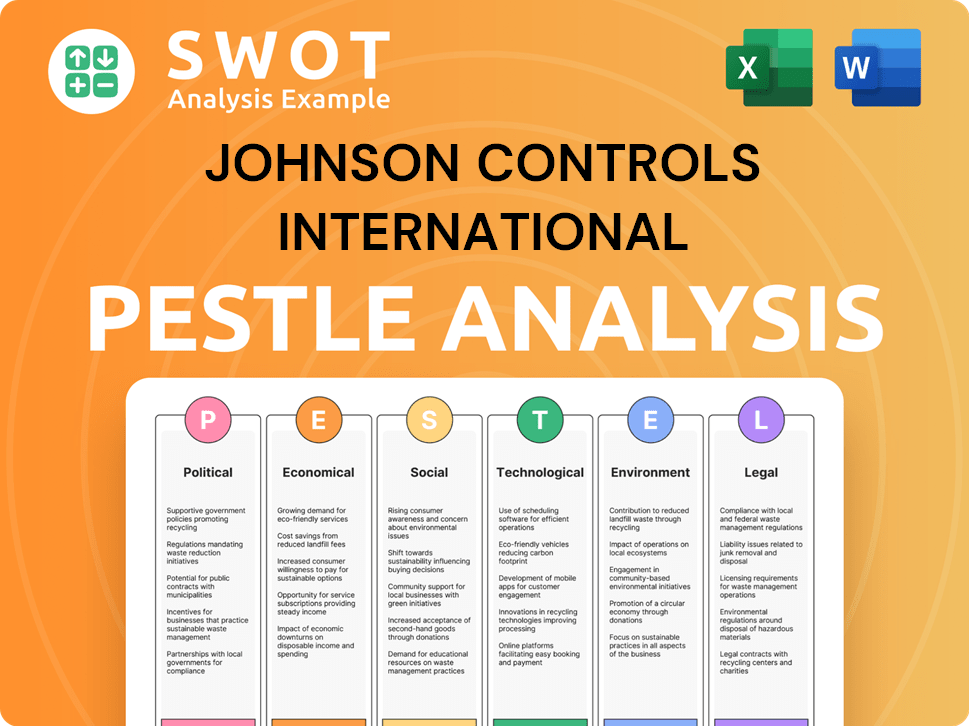

Johnson Controls International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Johnson Controls International’s Board?

The current Board of Directors of Johnson Controls International plc plays a crucial role in the company's governance. At the Annual General Meeting (AGM) on March 12, 2025, shareholders voted on the election of each board member. Joakim Weidemanis succeeded George Oliver as Chief Executive Officer and principal executive officer immediately following the conclusion of the AGM on March 12, 2025, as previously disclosed on February 5, 2025. The board's composition and leadership transitions are key aspects of understanding the company's strategic direction.

George Oliver was re-elected as a director at the AGM and will serve as Non-Executive Chairman of the Board until July 31, 2025, after which Mark P. Vergnano will succeed him. Oliver will continue in an advisory role until December 31, 2025. This transition plan highlights the company's approach to leadership succession and the continuity of experience within the board. Understanding the board's makeup is essential when considering the Johnson Controls company's strategic planning and oversight.

| Board Member | Title | Notes |

|---|---|---|

| Joakim Weidemanis | Chief Executive Officer | Succeeded George Oliver on March 12, 2025 |

| George Oliver | Non-Executive Chairman | Will serve until July 31, 2025, then advisory role until December 31, 2025 |

| Mark P. Vergnano | Non-Executive Chairman (from July 31, 2025) | Will succeed George Oliver |

The voting structure of Johnson Controls is generally based on a one-share-one-vote principle. At the March 12, 2025 AGM, the holders of 599,942,445 ordinary shares were represented, constituting a quorum. Shareholders approved management proposals regarding the re-allotment of treasury shares and the Board's authority to allot shares up to approximately 20% of the issued ordinary share capital, along with the waiver of statutory pre-emption rights for such issuances. This demonstrates the direct link between shareholder voting and the Board's authority and corporate actions. For more details on the company's past, you can read the Brief History of Johnson Controls International.

Shareholders' voting rights are crucial in shaping Johnson Controls ownership and strategic decisions.

- Ordinary shares have standard voting rights, with no known dual-class shares.

- Shareholders approved key proposals at the March 12, 2025 AGM.

- Quorum at the AGM was represented by holders of 599,942,445 ordinary shares.

- The Board has authority to allot shares up to approximately 20% of the issued ordinary share capital.

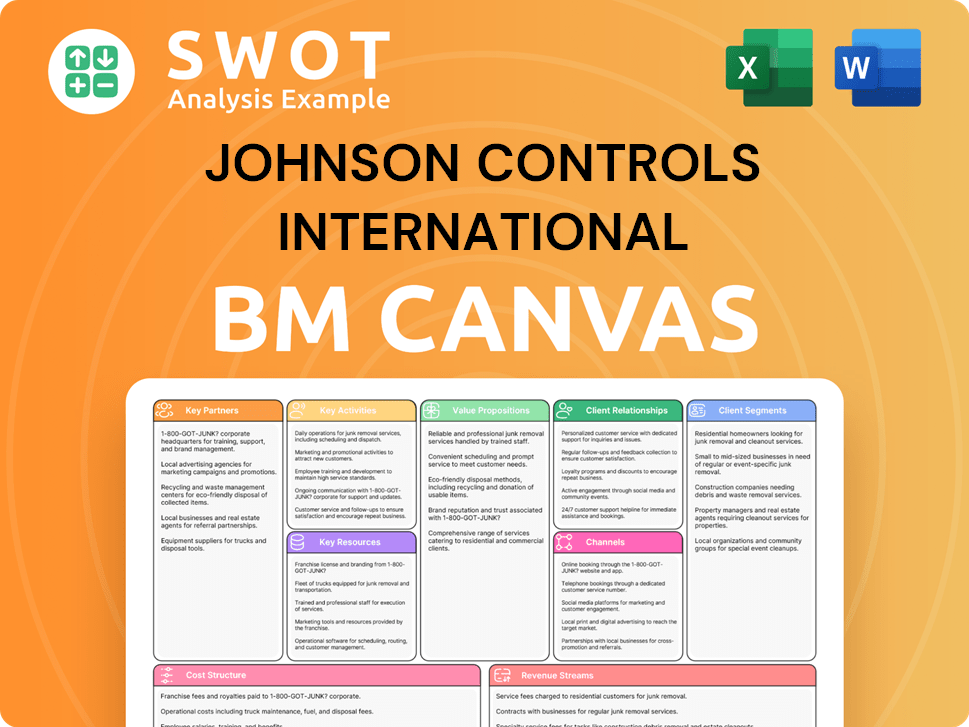

Johnson Controls International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Johnson Controls International’s Ownership Landscape?

Over the past few years, Johnson Controls International has experienced significant shifts in its ownership structure and operational strategies. A key development was the transition in leadership, with Joakim Weidemanis taking over as CEO on March 12, 2025. This change, along with other executive team adjustments in early 2025, is aimed at streamlining operations and driving growth. The company also announced a realignment of its organizational structure on April 1, 2025, moving from four to three reporting segments to simplify operations and accelerate growth.

In terms of shareholder returns, the company has been actively involved in share buyback programs. In June 2025, the board approved a $9 billion share repurchase authorization, adding to the remaining amount from a 2021 authorization. In Q4 2024, JCI returned $370 million to shareholders through buybacks, and another $330 million in Q1 2025, bringing year-to-date buybacks to $660 million as of Q2 2025. For fiscal year 2024, the company returned over $1.3 billion to shareholders, including $795 million in dividends and $535 million in buybacks.

| Metric | Details | Data |

|---|---|---|

| Institutional Ownership | Percentage of stock held by institutional investors | 90.05% (as of 2025) |

| Share Repurchase Authorization | Value of the share repurchase program authorized | $9 billion (approved June 13, 2025) |

| Share Buybacks (Q4 2024) | Amount returned to shareholders via buybacks | $370 million |

| Share Buybacks (Q1 2025) | Amount returned to shareholders via buybacks | $330 million |

| Year-to-Date Buybacks (as of Q2 2025) | Total buybacks for the year | $660 million (8.2 million shares) |

| Total Returns to Shareholders (Fiscal Year 2024) | Combined dividends and buybacks | Over $1.3 billion |

| Dividends (Fiscal Year 2024) | Amount returned to shareholders via dividends | $795 million |

| Buybacks (Fiscal Year 2024) | Amount returned to shareholders via buybacks | $535 million |

| Quarterly Dividend (January 17, 2025) | Dividend per share | $0.37 |

The ownership profile of Johnson Controls reflects a strong presence of institutional investors, with 90.05% of the stock owned by them as of 2025. Despite some insider selling, institutional investors such as STRS Ohio and Acadian Asset Management have increased their stakes, indicating confidence in the company's future, particularly in the areas of smart building technology and sustainability solutions. The company's consistent dividend payments since 1887 also highlight its commitment to shareholder returns.

Joakim Weidemanis became CEO on March 12, 2025, following George R. Oliver's retirement. This change is part of a broader strategy to streamline operations and promote growth within the company.

The company has been active in share buyback programs, with a $9 billion authorization approved in June 2025. In fiscal year 2024, over $1.3 billion was returned to shareholders through dividends and buybacks.

Institutional investors hold a significant portion of the company's stock, at 90.05% as of 2025. This indicates strong confidence in the company's strategic direction and long-term value.

As of April 1, 2025, the company realigned its structure, transitioning from four to three reporting segments. This change aims to simplify operations and accelerate growth.

Johnson Controls International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Johnson Controls International Company?

- What is Competitive Landscape of Johnson Controls International Company?

- What is Growth Strategy and Future Prospects of Johnson Controls International Company?

- How Does Johnson Controls International Company Work?

- What is Sales and Marketing Strategy of Johnson Controls International Company?

- What is Brief History of Johnson Controls International Company?

- What is Customer Demographics and Target Market of Johnson Controls International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.