JOST Bundle

Can JOST Werke SE Maintain Its Dominance in a Crowded Market?

The commercial vehicle sector is a battlefield, and JOST Werke SE is a key player. Understanding the JOST SWOT Analysis is crucial for grasping its position. This report dives deep into the JOST competitive landscape, dissecting its strengths and weaknesses. We'll explore how JOST navigates the challenges and opportunities within the JOST industry.

This analysis will provide a comprehensive JOST market analysis, examining the company's performance against its JOST competitors. We'll uncover JOST's competitive advantages and evaluate its strategic moves. Furthermore, we'll discuss the impact of JOST products on its JOST market share, offering insights for investors and industry professionals alike.

Where Does JOST’ Stand in the Current Market?

JOST Werke SE holds a strong position in the global commercial vehicle sector, especially in safety-critical systems. The company's market share data for 2024-2025 is still emerging, but JOST has historically been a leader in key areas like fifth wheels and landing gears. It serves a wide range of customers, including major original equipment manufacturers (OEMs) and aftermarket clients worldwide.

Its main product lines include fifth wheels, landing gears, axles, and steering systems, all designed to boost safety and efficiency in heavy-duty transportation. JOST's global presence is extensive, with operations and sales across Europe, North America, South America, Asia, and Africa. This allows the company to meet regional demands and maintain strong relationships with its international clients. Over time, JOST has expanded its offerings to include a broader range of components, adapting to industry changes and technological advancements, strengthening its position as a holistic solutions provider.

The company's financial health remains solid, with a reported revenue of €1,248 million in fiscal year 2023, demonstrating its significant scale within the industry. While specific comparisons to industry averages for 2024-2025 are pending, JOST's consistent financial performance and strategic investments indicate a resilient market standing. The company has a particularly strong presence in the European and North American markets, where its established relationships with major OEMs provide a significant competitive advantage. For more insights, check out the Growth Strategy of JOST.

JOST's market position is characterized by its strong presence in key product segments and a diverse customer base. The company's focus on safety-critical systems and its global footprint are key factors in its competitive advantage. The company's strategic expansion into a wider range of components has strengthened its position as a holistic solutions provider, enhancing its market share.

JOST's product offerings include fifth wheels, landing gears, axles, and steering systems, all designed to improve safety and efficiency. These products serve various market segments within the commercial vehicle industry, including heavy-duty trucks, trailers, and buses. The company's ability to provide a wide range of components positions it well to serve diverse customer needs.

The commercial vehicle industry is highly competitive, with JOST facing competition from various players. The competitive landscape includes both large multinational corporations and smaller regional manufacturers. JOST's ability to maintain its market share depends on its innovation, product quality, and global presence.

JOST has a significant global presence, with operations and sales across Europe, North America, South America, Asia, and Africa. This widespread presence allows the company to cater to regional demands and maintain close relationships with its international clientele. This global footprint supports its market share and growth strategies.

JOST's strengths include its strong market position, diverse product portfolio, and global presence. Its weaknesses may include dependence on the commercial vehicle industry's cyclical nature and potential supply chain disruptions. The company's strategic initiatives and financial performance are important for its competitive advantages.

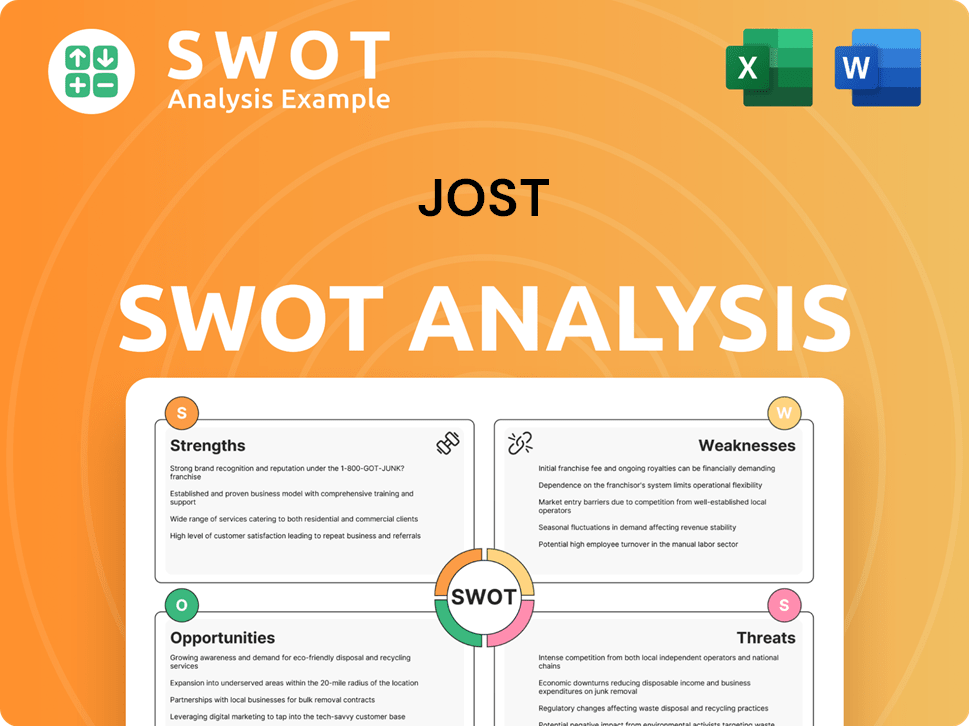

- Strengths: Strong market position, diverse product portfolio, global presence, and established relationships with OEMs.

- Weaknesses: Dependence on the cyclical commercial vehicle industry, potential supply chain disruptions, and competition from rivals.

- Opportunities: Expansion into emerging markets, product innovation, and strategic partnerships.

- Threats: Economic downturns, changing regulations, and increasing competition.

JOST SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging JOST?

The JOST competitive landscape is shaped by a mix of well-established global players and specialized regional manufacturers. These companies compete in the commercial vehicle components sector, with the battleground often centered on securing Original Equipment Manufacturer (OEM) contracts. Factors like competitive pricing, technological superiority, and robust supply chain capabilities are crucial for success in this environment.

JOST market analysis reveals a dynamic environment where mergers, acquisitions, and technological advancements constantly reshape the competitive dynamics. The rise of electric vehicles (EVs) in the commercial vehicle space introduces new challenges and opportunities, pushing all competitors to innovate and adapt to changing market demands. Understanding the strengths and weaknesses of key rivals is essential for JOST to maintain and grow its market position.

JOST's strategic positioning requires a deep understanding of its key competitors and their market strategies. This includes analyzing product offerings, pricing strategies, and global market presence. The goal is to assess how JOST can leverage its strengths to gain a competitive edge and achieve sustainable growth in the industry.

Direct competitors are those that offer similar products and services, directly vying for the same customers. These companies often have a significant market share and a broad product portfolio that overlaps with JOST's offerings. Understanding their strategies is crucial for JOST to maintain its competitive edge.

Indirect competitors may not offer identical products but can still impact JOST's market position. This can include companies in related industries or those focusing on emerging technologies. These competitors can indirectly challenge JOST by shifting industry priorities or introducing innovative solutions.

JOST's competitive advantages are the unique strengths that set it apart from its rivals. These can include technological expertise, strong brand recognition, efficient supply chains, and a focus on customer service. Identifying and leveraging these advantages is key to JOST's long-term success.

Market share analysis involves assessing JOST's position relative to its competitors. This includes evaluating sales figures, market penetration, and customer acquisition rates. Understanding market share dynamics helps JOST identify areas for growth and develop effective strategies to increase its market presence.

Strategic partnerships and alliances can provide JOST with access to new markets, technologies, and resources. Collaborations with other companies can help JOST expand its product offerings and increase its competitiveness. These partnerships can also facilitate innovation and accelerate growth.

Competitive pricing strategies are essential for attracting customers and maintaining profitability. JOST must carefully consider its pricing in relation to its competitors, taking into account factors like production costs, market demand, and value proposition. Effective pricing helps JOST remain competitive and sustain its market position.

JOST's primary competitors include SAF-HOLLAND and Meritor (now part of Cummins). SAF-HOLLAND is a significant global player, offering a wide range of products that directly compete with JOST. Meritor, particularly before its acquisition, was a major competitor in axles and braking systems. Indirect competition also comes from diversified industrial conglomerates and smaller, specialized companies. For instance, companies focusing on advanced telematics or electrification components for commercial vehicles could indirectly challenge JOST. The competitive landscape is further shaped by mergers and acquisitions, such as Cummins' acquisition of Meritor, which consolidates market power. The rise of EV commercial vehicles introduces new competitors focused on lightweight materials or integrated e-axle solutions, pushing established players to innovate. For a deeper dive into the company's performance, you can read more about its financial strategies here.

A detailed JOST vs. major competitors analysis reveals the strengths and weaknesses of each player, helping JOST formulate effective strategies. This includes an assessment of product offerings, market share, and financial performance. The analysis also considers the impact of recent mergers and acquisitions on the competitive landscape.

- SAF-HOLLAND: A major global competitor with a broad product portfolio.

- Meritor (Cummins): Competes in axles and braking systems, now part of Cummins.

- Emerging EV Component Manufacturers: New entrants focused on e-axles and lightweight materials.

- Diversified Industrial Conglomerates: Companies with divisions producing similar components.

- Specialized Niche Players: Smaller companies focusing on specific product areas or technologies.

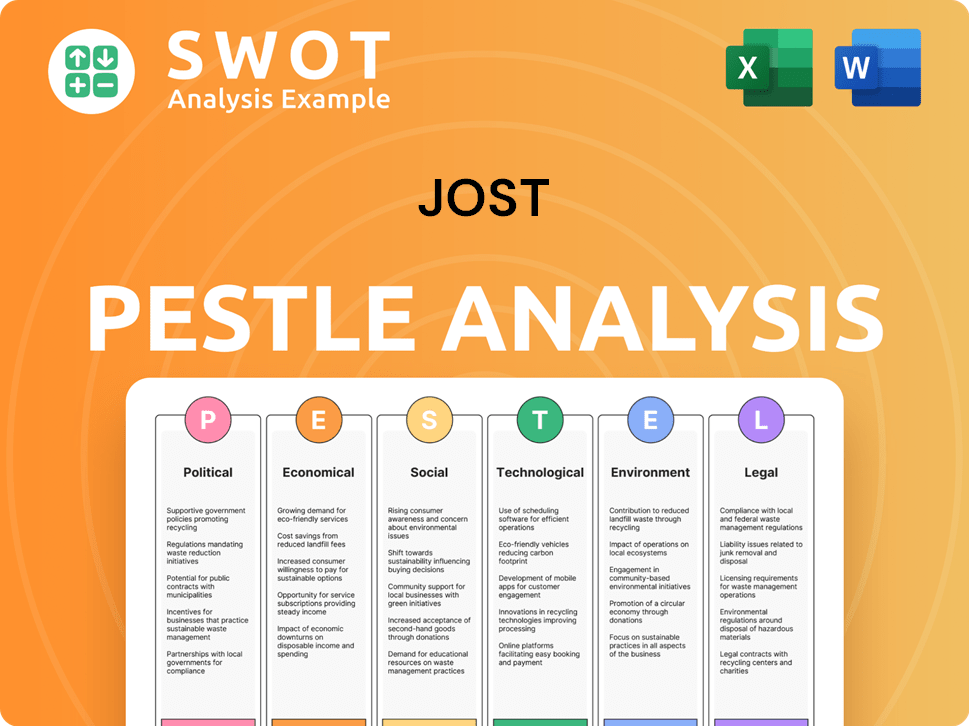

JOST PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives JOST a Competitive Edge Over Its Rivals?

Understanding the JOST competitive landscape involves recognizing its key strengths. The company has built a strong brand reputation over decades, known for quality and reliability in the commercial vehicle components industry. This reputation is a significant advantage, fostering customer loyalty among both original equipment manufacturers (OEMs) and aftermarket clients. Furthermore, JOST's market analysis reveals a global presence, enabling efficient delivery and service worldwide.

JOST's strategic moves include leveraging economies of scale in manufacturing and procurement, giving it a cost advantage. Its global distribution network is another critical asset, allowing efficient delivery and service to customers across continents. The company continuously invests in research and development to maintain its competitive edge, especially in the face of industry changes towards electrification and autonomous driving.

A crucial element of JOST's competitive edge is its proprietary technology and intellectual property. This includes patented designs for essential components like fifth wheels and landing gears. These innovations provide superior performance and durability. Strong relationships with major global OEMs, often through long-standing partnerships, also create a barrier to entry for new JOST competitors. These partnerships ensure that JOST's products are integrated into new vehicle designs from the outset.

JOST benefits from a strong brand reputation in the commercial vehicle sector, fostering customer loyalty. This reputation is built on decades of delivering quality and reliable products. This loyalty is crucial for maintaining market share and attracting new customers in a competitive environment.

JOST's extensive global distribution network is a key competitive advantage. This network allows for efficient delivery and service to customers across continents. This ensures that products are readily available and supported worldwide, enhancing customer satisfaction.

JOST invests heavily in proprietary technologies and a robust intellectual property portfolio. This includes patented designs and innovations in areas like lightweighting and sensor integration. These innovations ensure that JOST remains at the forefront of technological advancements.

Strong relationships with major global OEMs provide JOST with a significant advantage. These partnerships ensure that JOST's products are integrated into new vehicle designs from the start. These collaborations often involve co-development projects, creating a barrier to entry for new competitors.

JOST leverages several competitive advantages to maintain its market position. These include a strong brand reputation, a global distribution network, and proprietary technology. The company's strategic partnerships with OEMs further solidify its position in the market.

- Strong Brand Equity: Decades of quality and reliability have built significant customer loyalty.

- Economies of Scale: Manufacturing and procurement efficiencies allow for cost advantages.

- Global Distribution: An extensive network ensures efficient delivery and service worldwide.

- Proprietary Technologies: Patented designs and innovations offer superior performance.

- OEM Partnerships: Long-standing relationships ensure product integration in new vehicle designs.

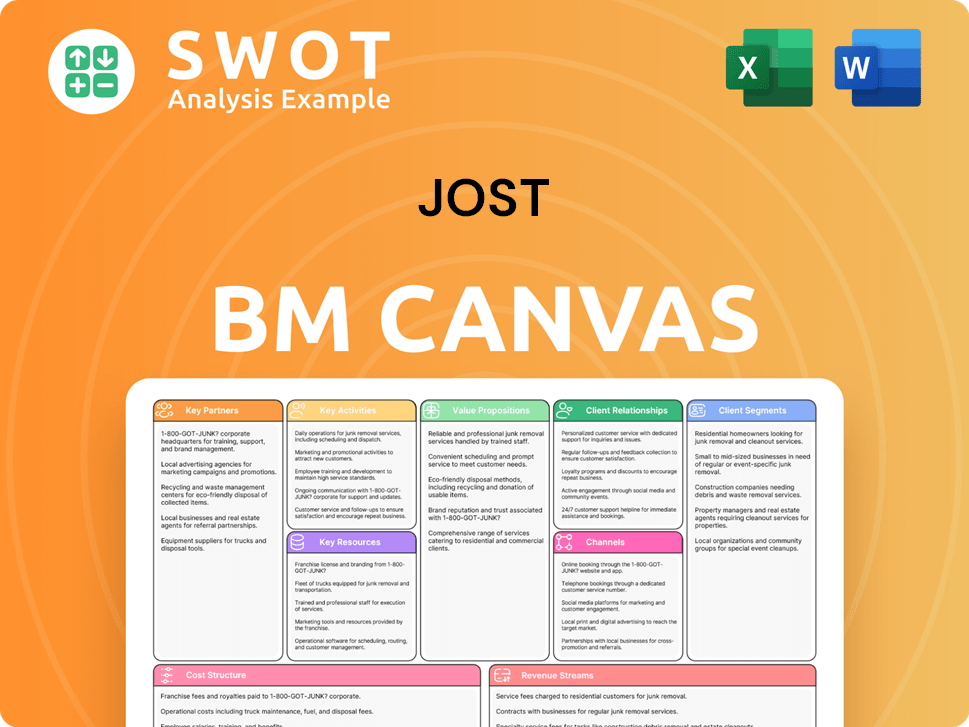

JOST Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping JOST’s Competitive Landscape?

The commercial vehicle industry is undergoing a period of significant transformation. This is mainly driven by technological advancements, evolving regulations, and shifting market demands. These factors are reshaping the competitive landscape for companies like JOST Werke SE. Understanding these trends is crucial for assessing JOST's market position, identifying potential risks, and evaluating future opportunities.

For Owners & Shareholders of JOST, the evolving industry presents both challenges and chances. The need to adapt to new technologies and the emergence of new competitors require strategic agility. Simultaneously, the expansion of commercial vehicle fleets in emerging markets and the development of innovative products offer significant growth potential. The company's strategic decisions will be critical in navigating these dynamics and maintaining its competitive edge.

The industry is experiencing rapid technological advancements, particularly in electrification, autonomous driving, and connectivity. Stricter emissions standards and safety regulations are also driving innovation. These trends require companies to adapt their product lines and develop new solutions. The shift towards electric vehicles (EVs) is a major driver of change, impacting demand for traditional components.

Adapting traditional product lines to new propulsion systems poses a significant challenge. The emergence of new market entrants, especially those focused on electric powertrains and digital solutions, intensifies competition. Declining demand in traditional segments due to the shift to EVs and increasing regulation on component materials also pose risks. Companies must manage these challenges to maintain market share.

Significant growth opportunities exist in emerging markets where commercial vehicle fleets are expanding. The development of innovative products tailored for electric and autonomous trucks and trailers also presents opportunities. Strategic investments in research and development for e-mobility solutions and smart systems are crucial. Strategic partnerships can accelerate entry into new technologies.

JOST is strategically deploying resources into research and development for e-mobility solutions and smart systems. The company is exploring strategic partnerships to accelerate its foray into new technologies. These initiatives aim to strengthen its competitive position and capitalize on evolving trends. Adaptability and innovation are key to success in this changing market.

To thrive in the evolving commercial vehicle industry, JOST needs a multi-faceted strategy. This includes focusing on innovation, forging strategic partnerships, and expanding into emerging markets. These actions will help JOST navigate the challenges and seize the opportunities presented by industry trends.

- Innovation in E-Mobility: Investing in R&D for electric vehicle components and smart systems.

- Strategic Partnerships: Collaborating with technology providers and other industry players to accelerate development.

- Market Expansion: Targeting growth in emerging markets where commercial vehicle demand is increasing.

- Product Diversification: Developing new products tailored for electric and autonomous vehicles.

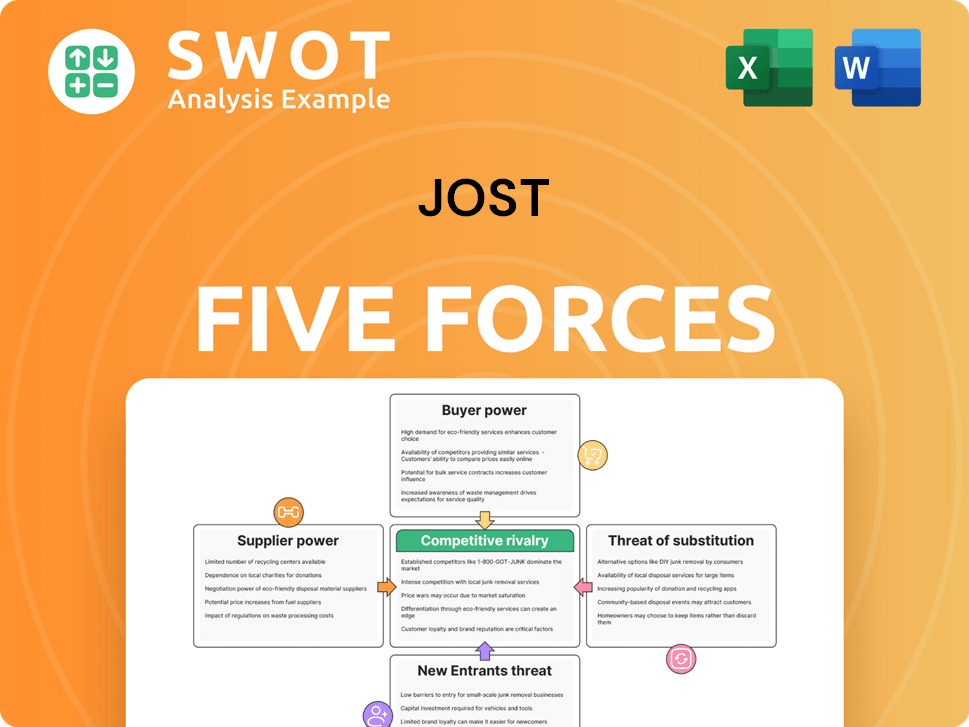

JOST Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JOST Company?

- What is Growth Strategy and Future Prospects of JOST Company?

- How Does JOST Company Work?

- What is Sales and Marketing Strategy of JOST Company?

- What is Brief History of JOST Company?

- Who Owns JOST Company?

- What is Customer Demographics and Target Market of JOST Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.