JOST Bundle

Who Really Owns JOST Company?

Understanding a company's ownership structure is like deciphering its DNA – it reveals the core drivers behind its decisions and future prospects. For a global leader like JOST Werke SE, the journey from its inception to its current standing is a compelling tale of strategic evolution. Discover how JOST SWOT Analysis can provide deeper insights into the company's strategic position.

This article pulls back the curtain on the JOST Company ownership, exploring the key players and pivotal moments that have shaped the JOST Group. We'll examine the transition from private ownership to the public sphere, identifying the major JOST shareholders and JOST management that steer its course. Uncover the answers to "Who owns JOST" and gain a comprehensive understanding of this industry giant.

Who Founded JOST?

The foundation of the company, now known as JOST Werke SE, was laid in 1952 by Josef Jost. His initial focus was on producing essential components for the commercial vehicle industry, which was rapidly growing in post-war Germany. The early days of the company were marked by a commitment to quality and reliability, setting a strong base for future expansion.

Details about the exact initial equity split or early investors are not widely available. However, the company's early ownership was primarily within the Jost family. Josef Jost's vision was to create robust and dependable systems that would be crucial to commercial transportation. This early commitment to quality and safety was deeply ingrained in the company's operational philosophy from the start, guiding its product development and market strategy.

The early operational structure likely centered around the family's long-term commitment to the business and its growth. As the company expanded, it would have relied on reinvested profits and potentially debt financing to fuel its operations and product development. Any initial ownership disputes or buyouts, if they occurred, would have been managed internally within the private family-owned structure, prior to any public disclosures.

Josef Jost founded the company in 1952, concentrating on components for the commercial vehicle sector.

Initially, ownership was primarily held within the Jost family, with details of early equity splits not widely publicized.

The company likely used reinvested profits and debt financing to support its growth.

A commitment to quality and safety was foundational, influencing product development and market strategy.

Early agreements and the foundational structure likely centered around the family's long-term commitment to the business and its growth.

Any internal ownership matters were handled within the private family-owned structure before any public disclosures.

Understanding the initial ownership structure of JOST provides insight into its long-term strategy and values. The company's early focus on quality and family-based ownership set the stage for its growth. Examining the history of the company, including its early ownership, is vital to understanding the current JOST Company Ownership structure.

- Josef Jost founded the company in 1952.

- Early ownership was primarily held within the Jost family.

- The company prioritized quality and reliability from the beginning.

- Financial strategies included reinvested profits and debt financing.

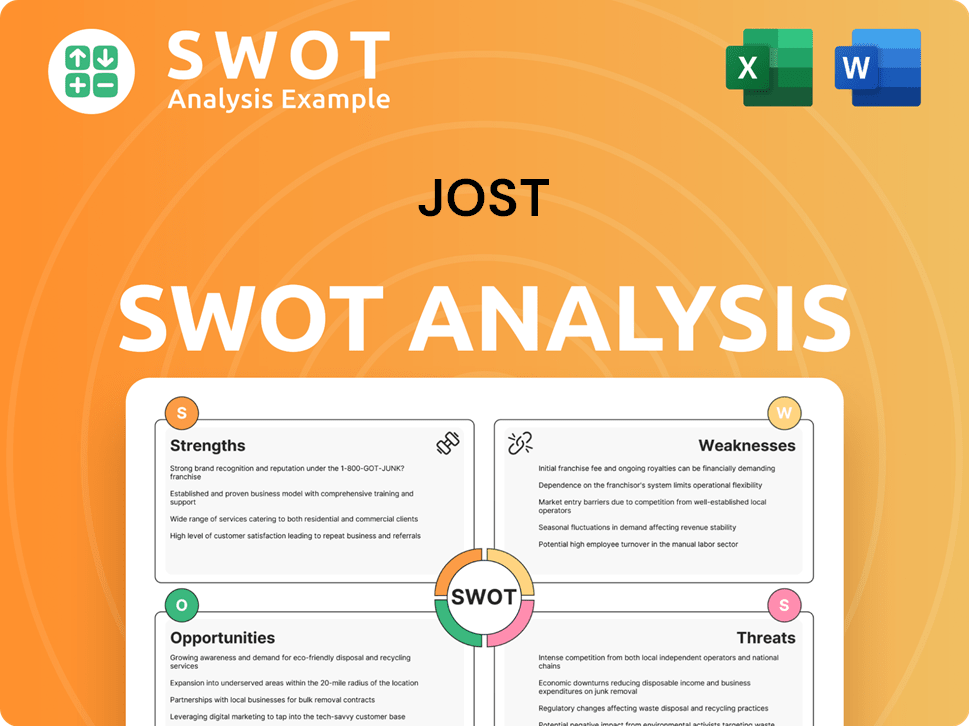

JOST SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has JOST’s Ownership Changed Over Time?

The ownership of the JOST Group has evolved significantly, especially after its Initial Public Offering (IPO) on July 20, 2017. Before the IPO, funds advised by Cinven, a major international private equity firm, held a significant stake, having acquired a majority in 2008. The IPO was a strategic move to broaden the ownership base and access public capital markets. The initial market capitalization at the time of the IPO was around €600 million. This transition marked a shift from private equity ownership to a more diversified structure, impacting the company's strategic direction.

Following the IPO, the ownership structure of JOST shifted to include a variety of institutional investors, mutual funds, and index funds, becoming significant JOST shareholders. As of recent disclosures, major stakeholders include prominent institutional investors. For example, BlackRock, Inc. holds a notable stake, with its voting rights crossing certain thresholds in early 2024, indicating a strong institutional presence. The free float of JOST shares after the IPO provided liquidity and diversified the ownership structure. As of May 2025, the share capital of JOST Werke SE is divided into 15,000,000 no-par value ordinary bearer shares. These changes in ownership have allowed JOST to pursue further growth initiatives and acquisitions, such as the strategic acquisition of Ålö Holding AB in 2019.

| Event | Date | Impact on Ownership |

|---|---|---|

| Acquisition of Majority Stake by Cinven | 2008 | Consolidated ownership under private equity firm. |

| Initial Public Offering (IPO) | July 20, 2017 | Broadened ownership base; introduced institutional investors. |

| Strategic Acquisition of Ålö Holding AB | 2019 | Expanded product portfolio; potentially influenced investor confidence. |

The evolution of JOST Company ownership, from private equity to a publicly traded company, has significantly impacted its shareholder base. Knowing who owns JOST now involves understanding the roles of institutional investors and the free float of shares. This shift has enabled JOST to pursue strategic acquisitions and growth initiatives, reflecting a dynamic ownership structure that influences its market position and financial performance. For more insights, consider exploring resources that provide detailed information on JOST's financial performance and strategic direction.

The ownership structure of JOST has transformed significantly since its IPO.

- Cinven initially held a majority stake before the IPO.

- The IPO introduced a diverse range of shareholders, including institutional investors.

- BlackRock, Inc. is a major institutional investor, holding a notable stake.

- The company's share capital includes 15,000,000 no-par value ordinary bearer shares.

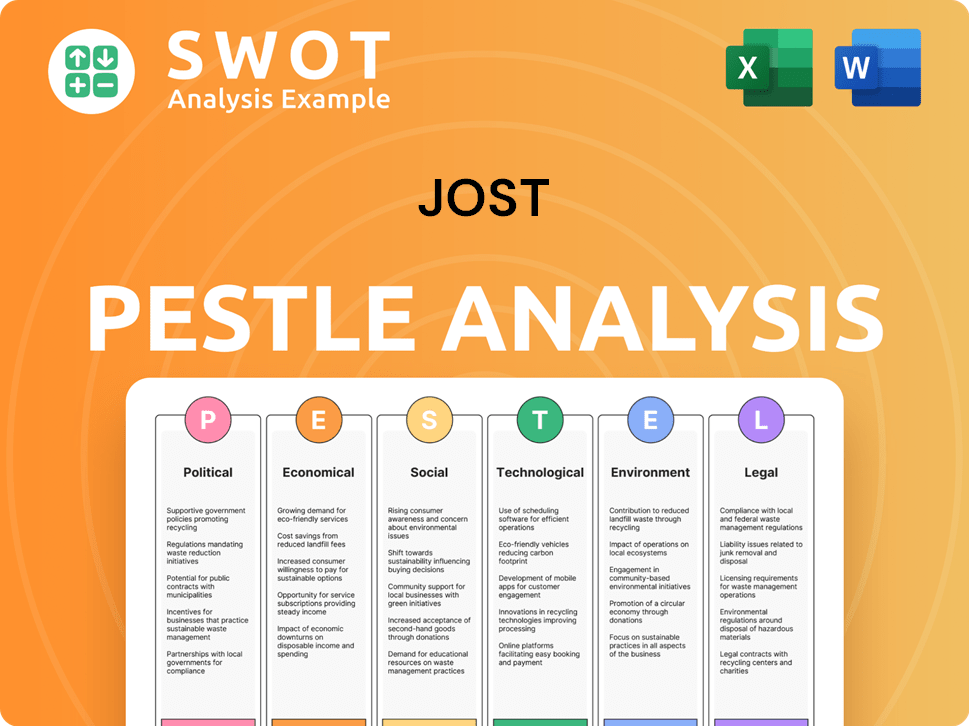

JOST PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on JOST’s Board?

The Board of Directors at JOST Werke SE is integral to the company's governance and strategic direction. As of early 2025, the Supervisory Board includes individuals representing various stakeholder interests. Dr. Manuel Cubero serves as Chairman, with Dr. Christian Terlinde as Deputy Chairman. Other members include Dr. Birgit Behrendt and Dr. Jörg Kaltenbrunner, among others, some of whom represent employee interests. This structure aims to balance shareholder representation with independent oversight, aligning with good corporate governance practices. Understanding the Growth Strategy of JOST can also shed light on the board's strategic decisions.

The composition of the board reflects a commitment to diverse expertise and perspectives, which is crucial for navigating the complexities of the global transportation industry. The board's role includes overseeing the management board and ensuring that the company operates in the best interests of its shareholders. The board's decisions are critical to the company's financial performance and long-term sustainability, influencing everything from strategic investments to operational efficiencies. The board's structure is designed to promote accountability and transparency in all of its operations.

| Board Member | Position | Notes |

|---|---|---|

| Dr. Manuel Cubero | Chairman of the Supervisory Board | Oversees the management board. |

| Dr. Christian Terlinde | Deputy Chairman | Supports the Chairman in his duties. |

| Dr. Birgit Behrendt | Member of the Supervisory Board | Contributes to strategic oversight. |

| Dr. Jörg Kaltenbrunner | Member of the Supervisory Board | Offers expertise and guidance. |

The voting structure at JOST Werke SE generally follows a one-share-one-vote principle for its ordinary shares. There are no publicly disclosed dual-class shares, special voting rights, or golden shares that would grant outsized control to specific individuals or entities beyond their proportional shareholding. Major institutional investors, such as BlackRock, hold significant voting rights due to their substantial shareholdings, but their influence is proportional to their ownership stake. No recent proxy battles or activist investor campaigns have significantly altered the company's decision-making processes. The focus remains on ensuring a balance of shareholder representation and independent oversight, which are fundamental to maintaining good corporate governance.

The Supervisory Board at JOST oversees the management board, ensuring strategic direction and governance.

- The board includes diverse members, including employee representatives.

- Voting rights are primarily based on a one-share-one-vote system.

- Major institutional investors have proportional influence based on their shareholdings.

- The company focuses on maintaining good corporate governance practices.

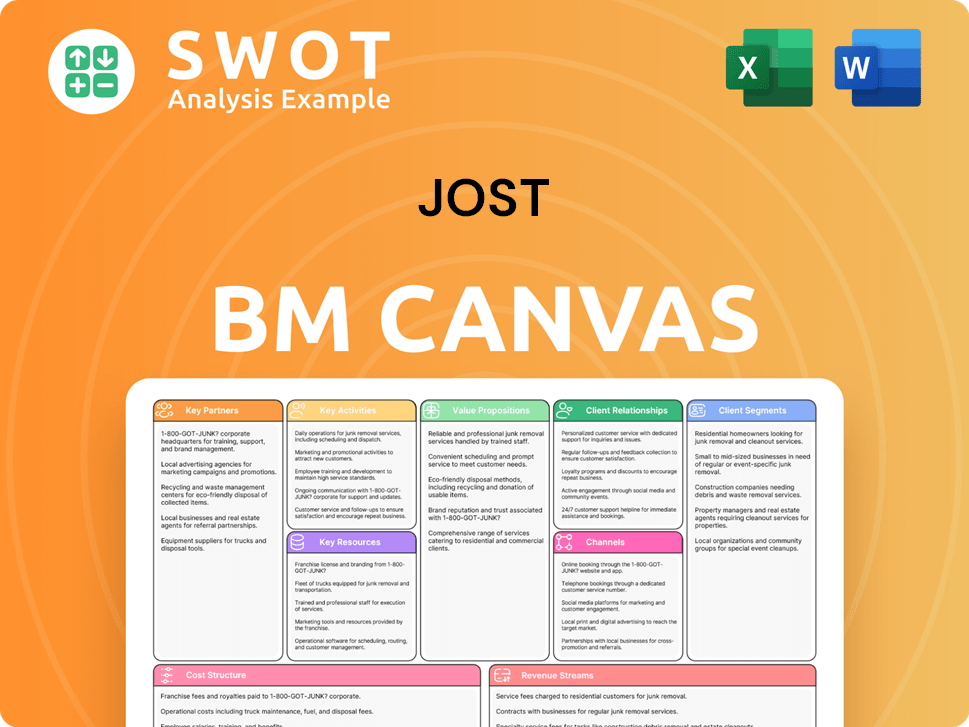

JOST Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped JOST’s Ownership Landscape?

Over the past few years, JOST Werke SE has steadily refined its ownership structure, focusing on strategic growth initiatives. This includes a blend of organic expansion and targeted acquisitions to strengthen its market position. The integration of Ålö Holding AB in 2019 significantly broadened JOST's product offerings and market reach, particularly in the agricultural sector. While specific large-scale share buybacks or secondary offerings have not been prominently announced, the company's financial performance and strategic investments continue to influence its share price and, consequently, the value held by its shareholders. The company's commitment to its long-term vision remains a priority.

Industry trends such as increasing institutional ownership and the rise of ESG (Environmental, Social, and Governance) investing are also impacting JOST. Institutional investors are increasingly focused on companies' sustainability practices and governance structures. As a public company, founder dilution is a natural occurrence. However, JOST's leadership remains dedicated to its long-term vision. There have been no public announcements regarding privatization plans or significant changes in listing status, indicating a continued focus on its current public ownership structure and strategic growth within the commercial vehicle and agricultural equipment markets. To learn more about the company's financial aspects, consider reading Revenue Streams & Business Model of JOST.

| Aspect | Details | Impact |

|---|---|---|

| Institutional Ownership | Increasing focus on ESG factors. | Influences strategic decisions and market perception. |

| Acquisitions | Integration of Ålö Holding AB in 2019. | Diversified product portfolio and market reach. |

| Shareholder Value | Share price influenced by financial performance and investments. | Impacts the value held by shareholders. |

The ownership structure of JOST Company is primarily influenced by its status as a publicly listed company. This means that a significant portion of the company is owned by various shareholders, including institutional investors, as well as individual investors. The company's management team plays a crucial role in decision-making, but the shareholders ultimately have a significant influence on the company's direction through their voting rights and investment decisions. Key executives at JOST Company, along with the board of directors, are responsible for overseeing the company's operations and ensuring that the interests of the shareholders are represented. The company's financial performance and strategic investments are key factors influencing the ownership structure.

JOST is a publicly listed company, with ownership distributed among various shareholders.

Major investors include institutional investors and individual shareholders.

JOST management is key to operations, but shareholders influence company direction.

Financial performance and strategic investments affect the ownership structure.

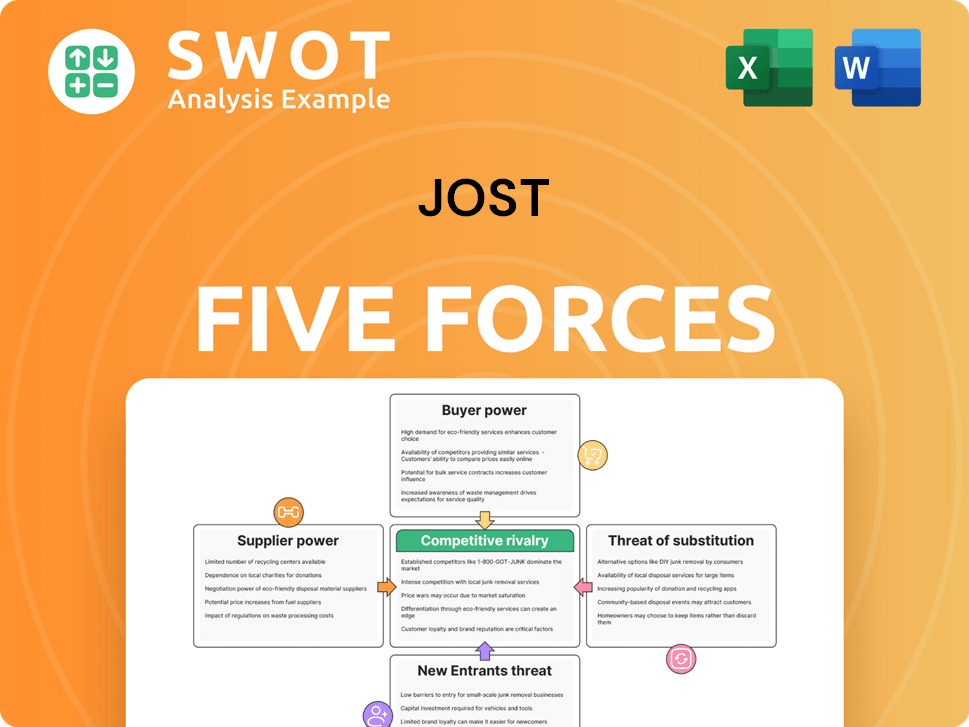

JOST Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JOST Company?

- What is Competitive Landscape of JOST Company?

- What is Growth Strategy and Future Prospects of JOST Company?

- How Does JOST Company Work?

- What is Sales and Marketing Strategy of JOST Company?

- What is Brief History of JOST Company?

- What is Customer Demographics and Target Market of JOST Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.