JOST Bundle

Can JOST Werke SE Maintain Its Momentum?

JOST Werke SE, a titan in the commercial vehicle component market, is charting a course for continued expansion. Founded in 1952, the company has evolved into a global force, supplying vital systems for trucks, trailers, and agricultural vehicles. But what are the specific strategies fueling its JOST SWOT Analysis and future growth?

This analysis dives deep into JOST's strategic initiatives, examining its plans for JOST growth strategy and how it intends to capitalize on JOST industry trends. We'll explore the company's JOST future prospects, including its JOST Company analysis and potential JOST Company expansion plans, offering insights into its JOST financial performance and JOST market share in a competitive landscape. Understanding JOST's approach to JOST Company product innovation and JOST Company global market presence is key to assessing its JOST Company long-term goals and JOST Company investment opportunities.

How Is JOST Expanding Its Reach?

The company's growth strategy is multifaceted, focusing on both geographical and product expansion to boost its market share. This approach aims to capitalize on emerging market growth and adapt to evolving industry demands. The company's strategic initiatives are designed to foster long-term sustainability and competitiveness.

A key element of the company's future prospects involves expanding its global market presence, particularly in regions experiencing significant commercial vehicle industry growth. The company's expansion plans include establishing stronger distribution networks and potentially local manufacturing facilities. The goal is to better serve regional customers and reduce logistical costs, contributing to sustained financial performance.

The company's commitment to product innovation is evident in its efforts to develop new offerings, such as lightweight components and advanced coupling solutions. Strategic mergers and acquisitions are also considered to gain access to new technologies and expand its customer base, which supports its business model analysis. These actions are designed to maintain a competitive edge and adapt to industry trends.

The company is actively expanding its global footprint, especially in high-growth markets. This includes strengthening distribution networks and exploring local manufacturing in key regions. The focus is on Asia and North America, recognizing the substantial market opportunities in these areas, which aligns with its long-term goals.

The company is broadening its product range to meet evolving industry needs. This involves developing new products like lightweight components for improved fuel efficiency and advanced coupling solutions for electric vehicles. These efforts are crucial for adapting to industry trends and maintaining a strong market position.

The company considers strategic mergers and acquisitions to gain access to new technologies and expand its customer base. This approach can also help acquire complementary product lines, enhancing its competitive landscape. Recent acquisitions have been part of its expansion plans to strengthen its portfolio.

The company integrates sustainability efforts into its expansion plans. This includes developing products that support fuel efficiency and reduce emissions. These initiatives align with the company's long-term goals and address the growing demand for sustainable solutions, which is a key factor in its future outlook 2024.

The company's expansion strategy includes geographical growth, product diversification, and strategic acquisitions. These initiatives aim to enhance market share and mitigate risks associated with a limited product range. The company's ongoing efforts reflect its commitment to staying ahead of industry changes.

- Geographical expansion in emerging markets.

- Development of new products, including lightweight components.

- Strategic mergers and acquisitions to gain new technologies.

- Focus on sustainability and fuel efficiency.

The company’s strategic initiatives are designed to capitalize on the evolving commercial vehicle market. The company's focus on geographical expansion, particularly in Asia and North America, is driven by the substantial market opportunities in these regions. For a deeper understanding of the company's target market, you can read more in this article: Target Market of JOST.

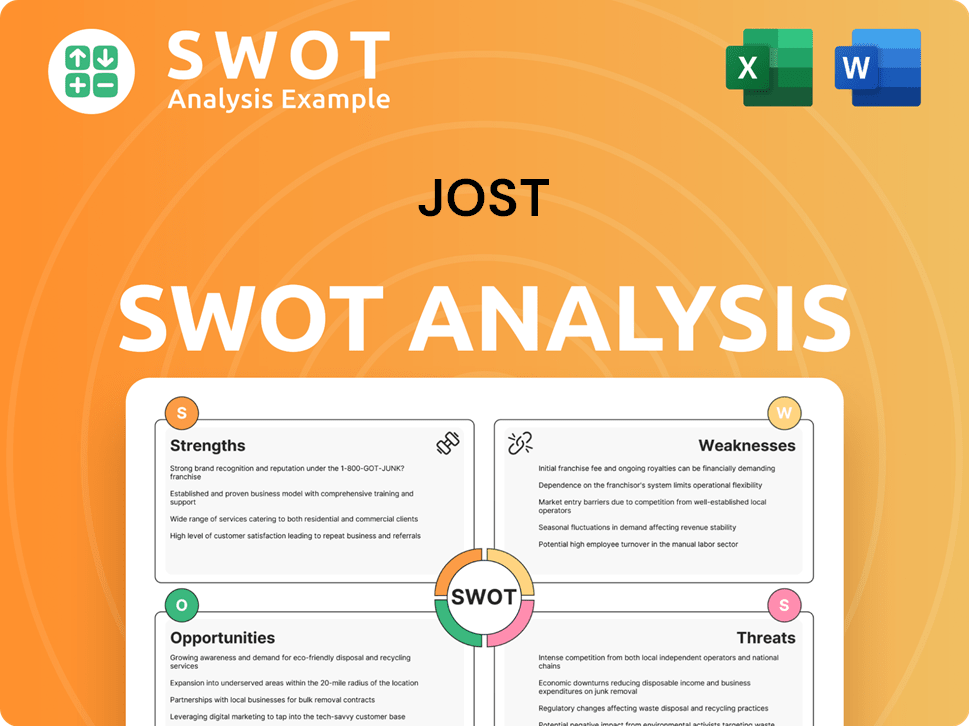

JOST SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JOST Invest in Innovation?

The cornerstone of the company's sustained growth is its unwavering commitment to innovation and technological advancement. This dedication is evident through substantial investments in research and development (R&D), aimed at enhancing existing product lines and pioneering solutions for the future of commercial transportation. This strategic focus not only drives the company's growth objectives but also reinforces its leadership in an industry increasingly prioritizing environmental responsibility and advanced technological solutions.

This approach includes internal development efforts, often complemented by collaborations with external innovators, startups, and academic institutions. These partnerships leverage diverse expertise, accelerating technological breakthroughs and ensuring the company remains at the forefront of industry advancements. The company's strategic initiatives and expansion plans are deeply intertwined with its innovation and technology strategy.

The company's emphasis on digital transformation is clear through its focus on automation within manufacturing processes. It also integrates advanced technologies like the Internet of Things (IoT) and data analytics into its product offerings. These efforts are crucial for maintaining and expanding its market position.

The company's R&D expenditure for 2023 was approximately EUR 32.7 million, representing 2.2% of its sales revenue. This highlights a consistent investment in innovation, crucial for its long-term goals.

The company is developing smart fifth wheels with integrated sensors. These provide real-time data on coupling status, load distribution, and maintenance needs, enhancing safety and operational efficiency.

Sustainability initiatives are a core component of the company's innovation strategy. Efforts are directed towards developing lighter materials and energy-efficient manufacturing processes.

The company develops components that support the transition to electric and hydrogen-powered commercial vehicles. This focus aligns with industry trends and future outlook for 2024 and beyond.

The company focuses on automation within manufacturing processes. It also integrates advanced technologies like the Internet of Things (IoT) and data analytics into its product offerings. This is a key aspect of its business model analysis.

The company collaborates with external innovators, startups, and academic institutions. These partnerships leverage diverse expertise and accelerate technological breakthroughs.

The company’s technological advancements are designed to improve operational efficiency and support sustainability. These innovations are critical drivers for the company's future prospects.

- Smart fifth wheels with integrated sensors for real-time data.

- Development of lighter materials to reduce vehicle weight.

- Energy-efficient manufacturing processes.

- Components supporting electric and hydrogen-powered vehicles.

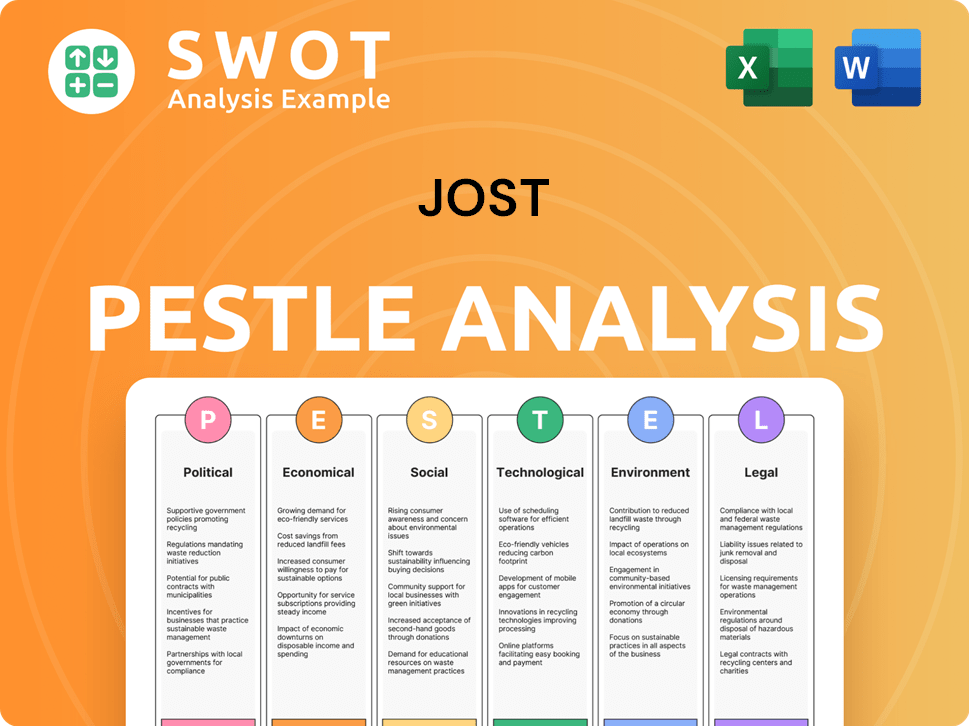

JOST PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is JOST’s Growth Forecast?

The financial outlook for JOST Werke SE is promising, underpinned by strong performance in recent years. The company's JOST growth strategy is clearly reflected in its financial results and future projections. The JOST Company analysis reveals a commitment to sustained expansion and profitability within the global commercial vehicle components market.

In 2023, JOST reported sales of EUR 1,770 million, a 7.2% increase compared to the previous year. This growth is a testament to its effective market strategies and operational efficiency. The adjusted EBIT for the same period was EUR 191 million, resulting in an adjusted EBIT margin of 10.8%. The company's net profit reached EUR 106 million, indicating robust financial health and effective cost management.

Looking ahead, JOST anticipates continued growth. For the fiscal year 2024, the company projects sales between EUR 1.8 billion and EUR 1.9 billion, with an adjusted EBIT margin expected to be between 9.5% and 10.0%. These projections are supported by a solid balance sheet and strategic investments. The company's financial ambitions are aligned with its historical performance, which has consistently shown revenue growth and stable profitability margins. The company's disciplined financial management and clear guidance provide a strong narrative that underpins its strategic plans for future growth in the global commercial vehicle components market. For more insights, check out the Marketing Strategy of JOST.

JOST holds a significant position in the global commercial vehicle components market. The company's JOST market share is supported by its diverse product portfolio and strong customer relationships. Its market position is enhanced by strategic acquisitions and continuous product innovation.

JOST's financial performance is characterized by consistent revenue growth and stable profitability. The company's JOST financial performance in 2023 reflects its ability to navigate market challenges and capitalize on opportunities. Healthy cash flow generation allows for internal investments and potential M&A activities.

The commercial vehicle components market is influenced by various JOST industry trends, including the increasing demand for electric vehicles and autonomous driving technologies. JOST is strategically positioned to benefit from these trends through product innovation and expansion into new markets. The company's focus on sustainability also aligns with evolving industry standards.

JOST's strategic initiatives include expanding production capacities and enhancing technological capabilities. These initiatives are aimed at strengthening the company's competitive position and driving future growth. The company's strategic focus includes both organic growth and potential acquisitions.

JOST Company revenue growth drivers include increased demand for commercial vehicles, expansion into emerging markets, and the introduction of innovative products. The company's focus on customer satisfaction and operational excellence also contributes to revenue growth. Strategic partnerships and collaborations further support revenue generation.

JOST Company expansion plans involve increasing its global market presence and expanding its product portfolio. The company is exploring opportunities in high-growth regions and investing in research and development to stay ahead of market trends. Expansion is supported by a strong financial foundation and strategic partnerships.

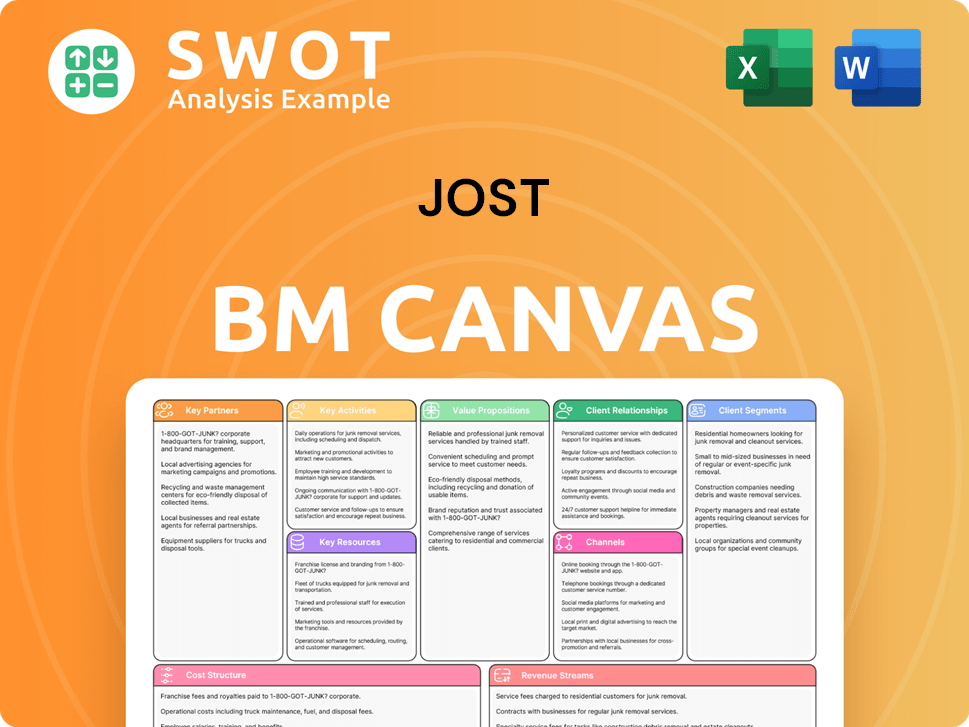

JOST Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow JOST’s Growth?

The path to success for the JOST Company analysis is not without its hurdles. Several factors could potentially hinder the company's ambitious plans, impacting its JOST future prospects. Understanding these risks is crucial for investors and stakeholders evaluating JOST growth strategy.

One primary concern is the competitive landscape. The commercial vehicle components market is highly competitive, with both established firms and emerging innovators vying for JOST market share. This competition may lead to price wars and decreased profitability. Furthermore, regulatory changes, such as stricter emissions standards and evolving vehicle safety regulations, necessitate adjustments to products and manufacturing processes, potentially increasing costs. The shift towards electric and autonomous vehicles also demands considerable investment in research and development, which could strain resources.

Supply chain disruptions represent another significant risk. Dependence on specific raw materials, geopolitical instability, and logistical challenges can disrupt production schedules and inflate costs. To mitigate these risks, the company focuses on diversifying its supplier base, improving inventory management, and establishing strategic partnerships. Technological advancements and alternative technologies also pose potential threats, potentially rendering existing products obsolete. To stay ahead, the company continuously invests in research and development and maintains a flexible product development pipeline.

The commercial vehicle components market is intensely competitive. Major players and innovative startups constantly vie for market share. This competition can lead to pricing pressures and reduced profit margins, impacting the company's financial performance. The company must continually innovate and improve its products to maintain its market position. For more details, you can read about the Owners & Shareholders of JOST.

Regulatory changes, such as stricter emissions standards and safety regulations, require costly product adaptations. The shift towards electric and autonomous vehicles demands substantial R&D investment. Failure to adapt to these changes could lead to a loss of market share. The company's ability to innovate and respond to these market shifts will be critical for its long-term success.

Supply chain disruptions, including geopolitical tensions and logistics issues, can significantly impact production. Dependence on specific raw materials and components increases vulnerability. The company mitigates this risk through supplier diversification and robust inventory management. The company's ability to manage these vulnerabilities will be crucial for maintaining production efficiency and meeting customer demands.

Managing rapid growth while maintaining product quality and operational efficiency can strain resources. Strong risk management frameworks, scenario planning, and a focus on operational excellence are essential. Maintaining a balance between expansion and operational stability is vital for the company's long-term success. The company's ability to adapt to internal and external challenges will determine its future success.

JOST Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JOST Company?

- What is Competitive Landscape of JOST Company?

- How Does JOST Company Work?

- What is Sales and Marketing Strategy of JOST Company?

- What is Brief History of JOST Company?

- Who Owns JOST Company?

- What is Customer Demographics and Target Market of JOST Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.