Keurig Dr Pepper Bundle

How Does Keurig Dr Pepper Navigate the Beverage Battleground?

Keurig Dr Pepper (KDP) is a major player in the North American beverage industry, constantly adapting to shifting consumer tastes and intense competition. Recent strategic moves, like the acquisition of a majority stake in GHOST Energy in December 2024, demonstrate its commitment to growth. Formed in 2018 through a merger, KDP boasts a diverse portfolio of both hot and cold beverages.

With impressive Q1 2025 results and a strong 2024 performance, understanding the Keurig Dr Pepper SWOT Analysis and its position within the competitive landscape is critical. This analysis will delve into KDP's key rivals, competitive advantages, and the market trends shaping its future. We'll explore the beverage industry competition, including a detailed Dr Pepper market analysis and its impact on KDP's strategic direction.

Where Does Keurig Dr Pepper’ Stand in the Current Market?

Keurig Dr Pepper (KDP) holds a strong position in the North American beverage industry. Its diverse portfolio includes over 125 brands across several categories, such as soft drinks, coffee, and water. KDP utilizes direct sales and a network of partners for distribution.

In the first quarter of 2025, KDP reported net sales of $3.64 billion, marking a 4.8% increase year-over-year. The U.S. Refreshment Beverages segment saw an 11.0% rise in net sales, driven by volume/mix and favorable pricing. However, the U.S. Coffee segment experienced a 3.7% decline, partly due to pricing adjustments.

KDP's international markets, particularly Mexico and Canada, have shown strong performance. The company's full-year 2024 net sales were $15.4 billion, with a 3.6% year-over-year growth. Adjusted diluted EPS for 2024 grew by 7.8% to $1.92. KDP's free cash flow surged 82% in 2024 to $1.7 billion, enabling reinvestment and shareholder returns, including a 7% dividend hike in Q3 2024. The acquisition of a 60% stake in GHOST Energy by December 2024 for approximately $990 million further diversifies its product portfolio.

KDP has a significant market presence in North America, with a wide range of beverage products. The company's strong distribution network and diverse portfolio contribute to its competitive advantage. KDP's strategic moves, such as the GHOST Energy acquisition, reflect its efforts to stay competitive in the evolving beverage industry.

KDP demonstrated solid financial performance in 2024, with revenue growth and increased free cash flow. The company's adjusted diluted EPS also saw an increase. These financial results enable KDP to invest in growth initiatives and provide returns to shareholders. For more insights, check out the Marketing Strategy of Keurig Dr Pepper.

The competitive landscape of KDP includes major players in the beverage industry. KDP competes with companies such as Coca-Cola and PepsiCo. KDP's strategy involves a mix of organic growth, strategic acquisitions, and efficient distribution to maintain and enhance its market position. The company's focus on innovation and portfolio diversification is key.

KDP faces challenges such as fluctuating green coffee costs and changing consumer preferences. However, opportunities exist in expanding its product portfolio and growing in international markets. The company’s ability to adapt to market trends and leverage its distribution network will be crucial.

KDP's strong market position is supported by a diverse portfolio and robust financial performance. The company's ability to adapt to market changes and leverage its distribution network is key to its success. Strategic acquisitions and international expansion are crucial for future growth.

- Diverse portfolio of over 125 brands.

- Strong performance in U.S. Refreshment Beverages.

- Strategic acquisitions to diversify product offerings.

- Focus on international market growth.

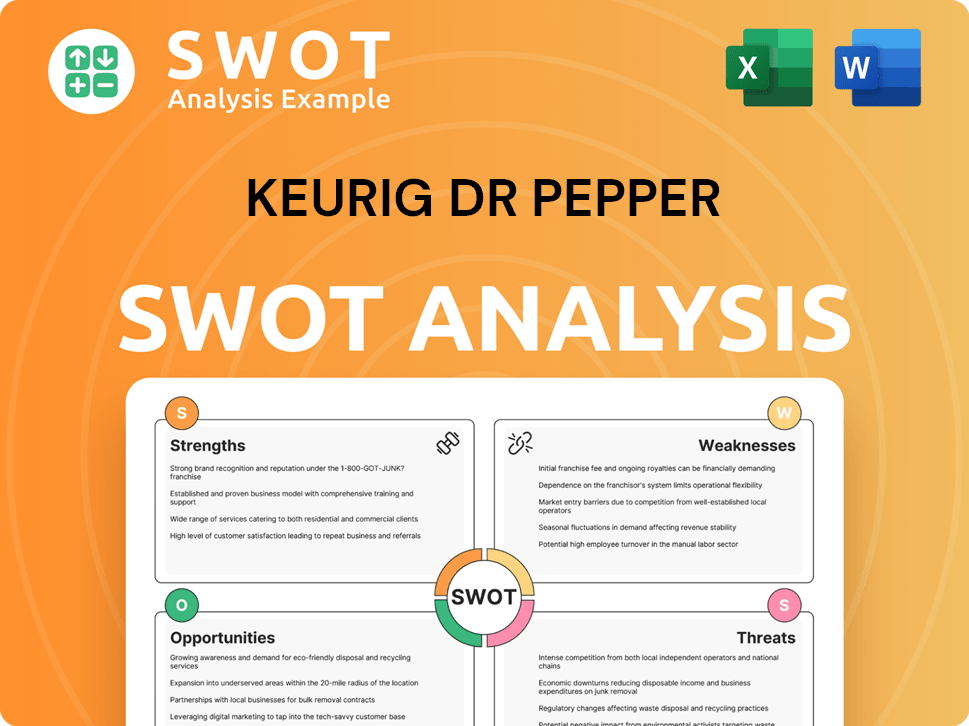

Keurig Dr Pepper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Keurig Dr Pepper?

The Keurig Dr Pepper competitive landscape is shaped by its diverse product portfolio and the broad beverage market it serves. KDP faces significant competition across various segments, from soft drinks to coffee and energy drinks. Understanding the competitive dynamics is crucial for assessing KDP's market position and growth prospects.

The Dr Pepper market analysis reveals a complex interplay of established giants and emerging players. KDP's ability to navigate this competitive environment depends on its strategic initiatives, including innovation, distribution, and partnerships. The company's performance is influenced by its ability to differentiate itself and capture market share.

KDP's competitive strategy involves a mix of organic growth and strategic acquisitions. This approach allows KDP to strengthen its position in existing markets and expand into new categories. The company's success is contingent on its ability to adapt to changing consumer preferences and competitive pressures.

The Coca-Cola Company and PepsiCo are the primary direct competitors in the soft drink segment. These companies have extensive global distribution networks. They also have substantial marketing budgets.

Starbucks is a major competitor in both ready-to-drink coffee and retail coffeehouse segments. Other competitors include traditional coffee brands and direct-to-consumer coffee providers. KDP's coffee systems business faces challenges from various players.

KDP's acquisition of a majority stake in GHOST Energy positions it against Monster Beverage. The energy drink market is highly competitive. This is due to growing consumer demand.

Anheuser-Busch InBev SA/NV, Diageo, and Ambev compete for consumer attention. They also compete for distribution space. These companies have non-alcoholic offerings.

Liquid Death and Niagara Bottling are disrupting the bottled water segment. These companies are gaining market share. They are also changing the competitive landscape.

KDP's partnerships with brands like Electrolit and Nutrabolt (for C4 Energy) expand its footprint. These partnerships enhance distribution capabilities. They also help KDP enter health-conscious beverage categories.

The beverage industry competition is intense, with companies constantly vying for market share. KDP's strategies include innovation, strategic acquisitions, and partnerships. For example, in 2023, KDP saw net sales increase by 3.4% to reach approximately $14.7 billion, demonstrating its ability to compete effectively. Furthermore, the company's focus on both traditional and emerging beverage categories allows it to diversify its revenue streams and mitigate risks associated with changing consumer preferences. To learn more, explore the Growth Strategy of Keurig Dr Pepper.

KDP's competitive advantages include its diverse product portfolio and extensive distribution network. The company's strong brand recognition and strategic partnerships also contribute to its success. These factors enable KDP to compete effectively in the beverage market.

- Diverse Portfolio: KDP offers a wide range of beverages, including soft drinks, coffee, and energy drinks.

- Distribution Network: KDP has a robust distribution network, ensuring product availability.

- Strategic Partnerships: Collaborations with brands like Electrolit and Nutrabolt enhance market reach.

- Brand Recognition: Strong brand recognition helps maintain customer loyalty.

- Innovation: KDP continuously introduces new products and improves existing ones.

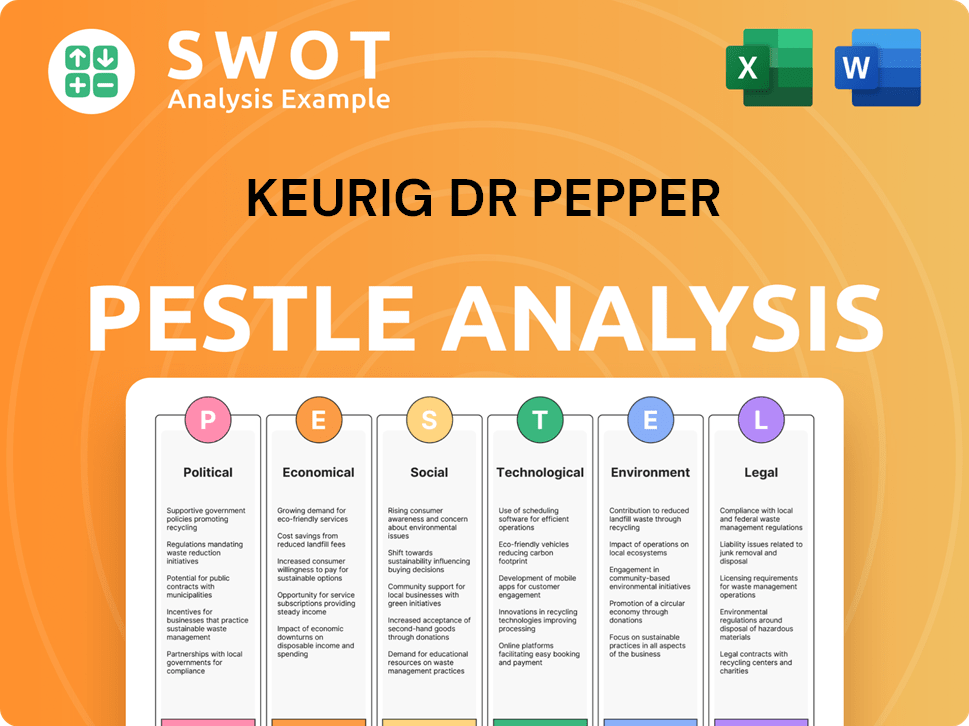

Keurig Dr Pepper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Keurig Dr Pepper a Competitive Edge Over Its Rivals?

The competitive landscape for Keurig Dr Pepper (KDP) is shaped by its diverse product portfolio and strategic market positioning. KDP's ability to compete effectively is influenced by factors like its extensive distribution network, brand equity, and operational efficiency. Understanding these elements is crucial for evaluating KDP's sustained success in the beverage industry.

KDP's key milestones include significant mergers and acquisitions that have broadened its reach and product offerings. Strategic moves, such as partnerships with emerging brands and investments in innovation, have strengthened its competitive edge. These actions are designed to address evolving consumer preferences and maintain market share against established and emerging rivals.

The company's competitive edge is further enhanced by its financial performance, including strong cash flow generation. KDP's ability to maintain and improve margins, despite inflationary pressures, highlights its operational strength. This financial health supports investments in product innovation, marketing, and infrastructure, ensuring its leadership in the beverage sector.

KDP's wide range of beverages, including hot and cold options, allows it to cater to various consumer tastes. This includes iconic brands like Dr Pepper, Canada Dry, and the Keurig single-serve coffee system. This diversification helps KDP capture a larger market share and mitigate risks associated with relying on a single product category.

KDP's distribution network, encompassing direct sales, retailers, and partnerships, gives it a strong retail presence. This extensive route-to-market capability is crucial for scaling partner brands and ensuring product availability across grocery stores, convenience stores, and online platforms. This network is a key factor in its ability to compete effectively.

Brands like Dr Pepper have demonstrated consistent market share growth, indicating strong brand appeal. KDP's ability to innovate and launch successful new products, such as Dr Pepper Creamy Coconut and Canada Dry Fruit Splash Cherry in 2024, reinforces consumer engagement and market share. These innovations help KDP stay ahead of the competition.

KDP's operational efficiencies and financial health support its competitive edge. Record productivity improvements in 2024 helped offset inflationary costs and maintain margins. Strong operating cash flow and free cash flow generation, with free cash flow surging 82% to $1.7 billion in 2024, support value-enhancing investments and shareholder returns.

KDP's competitive advantages include a diversified product portfolio, a robust distribution network, strong brand equity, and operational efficiencies. These factors enable KDP to compete effectively in the beverage industry. For more insights, consider reading about the Growth Strategy of Keurig Dr Pepper.

- Diversified product offerings to cater to a wide range of consumer preferences.

- Extensive distribution network ensuring product availability across various retail channels.

- Strong brand equity and customer loyalty, particularly with iconic brands like Dr Pepper.

- Operational efficiencies and financial health, supporting investments and shareholder returns.

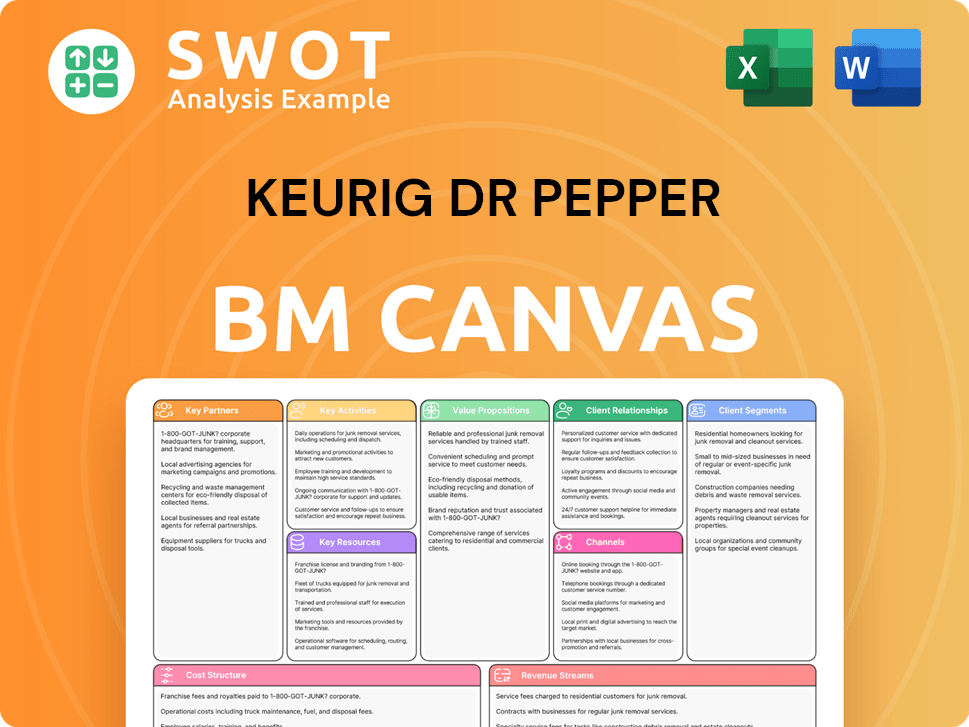

Keurig Dr Pepper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Keurig Dr Pepper’s Competitive Landscape?

The beverage industry is currently undergoing significant shifts, driven by evolving consumer preferences, technological advancements, and the rise of e-commerce. This dynamic environment presents both challenges and opportunities for companies like Keurig Dr Pepper. Understanding the Keurig Dr Pepper competitive landscape requires a close look at these trends and how the company is positioning itself to succeed.

The company faces risks from fluctuating raw material costs and intense competition from established and emerging players. Despite these challenges, KDP has several growth opportunities, including strategic acquisitions, international expansion, and product innovation. KDP's strategies are focused on achieving balanced growth and reinforcing its market position in the evolving beverage sector, as highlighted in the Brief History of Keurig Dr Pepper.

Consumers are increasingly drawn to healthier and functional beverages. Technological advancements are reshaping product development and distribution. E-commerce is growing in importance, enabling wider customer reach and enhanced product positioning. KDP is responding to these trends with new flavors and functional beverage offerings.

Managing raw material cost volatility, especially green coffee bean prices, is a key challenge. Increased regulatory scrutiny and competition from established giants like Coca-Cola and PepsiCo, and emerging players, also pose risks. Foreign exchange rates are anticipated to create a headwind to KDP's full-year top- and bottom-line growth in 2025.

The acquisition of GHOST Energy positions KDP in the expanding energy drink market. International expansion, particularly in markets like Mexico and Canada, offers growth potential. Product innovation, especially in healthier options and functional beverages, remains a key strategy to meet evolving consumer demands. The company's focus on balanced growth and market position is key.

KDP targets mid-single-digit net sales growth and high-single-digit adjusted EPS growth in constant currency for 2025. The company is committed to consumer-focused brand building and dynamic capital allocation. These strategies are designed to navigate the demanding operating landscape and maintain resilience in the evolving beverage sector.

KDP is implementing pricing adjustments to mitigate raw material cost pressures, particularly in the U.S. Coffee segment, which saw a 3.7% decline in net sales in Q1 2025. The company is investing up to $250 million, starting in mid-2025, to integrate GHOST into its direct store delivery network. Foreign exchange rates are expected to create a one to two percentage point headwind to KDP's full-year top- and bottom-line growth in 2025.

- KDP's acquisition of a 60% stake in GHOST Energy in December 2024

- Targeted growth: mid-single-digit net sales growth and high-single-digit adjusted EPS growth in constant currency for 2025

- Focus on consumer-obsessed brand building and route-to-market advantage

- Strategic focus on international expansion, including Mexico and Canada

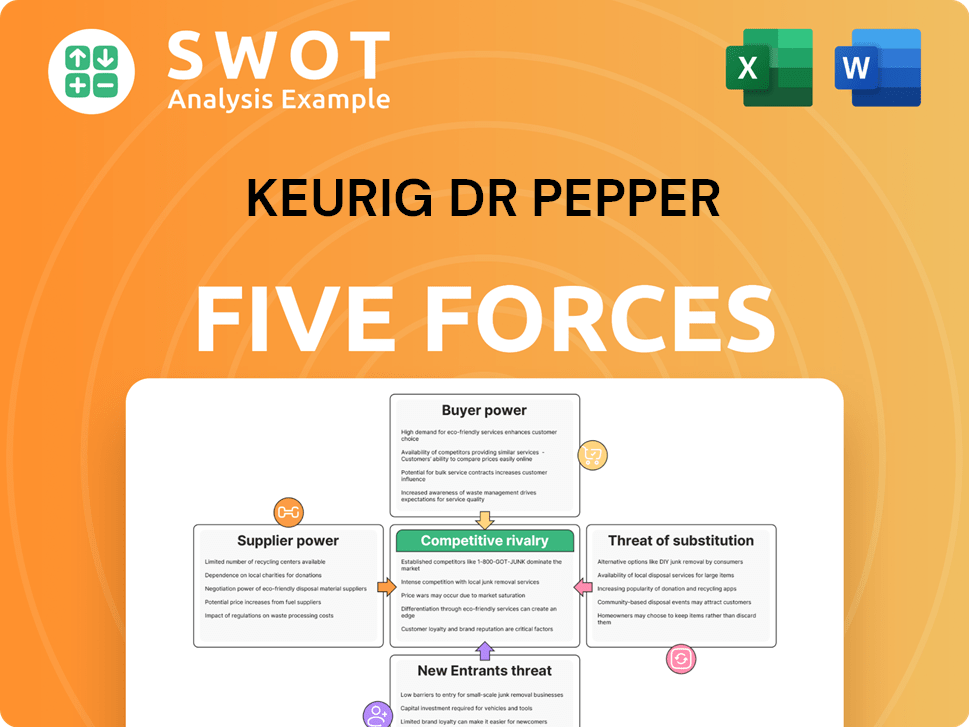

Keurig Dr Pepper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Keurig Dr Pepper Company?

- What is Growth Strategy and Future Prospects of Keurig Dr Pepper Company?

- How Does Keurig Dr Pepper Company Work?

- What is Sales and Marketing Strategy of Keurig Dr Pepper Company?

- What is Brief History of Keurig Dr Pepper Company?

- Who Owns Keurig Dr Pepper Company?

- What is Customer Demographics and Target Market of Keurig Dr Pepper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.