Keurig Dr Pepper Bundle

Who Really Controls Keurig Dr Pepper?

Ever wondered who pulls the strings at one of North America's beverage giants? The story of Keurig Dr Pepper SWOT Analysis is a fascinating journey through mergers, acquisitions, and the ever-shifting landscape of corporate ownership. From its roots in iconic brands like Dr Pepper to its modern-day status, understanding the KDP owner is key to grasping its strategic moves.

This exploration into Keurig Dr Pepper ownership will unveil the key players shaping its future. We'll delve into the evolution of its ownership structure, from its initial founders to the influence of major shareholders and the dynamics of its KDP stock. Discover the answers to questions like: Who owns Keurig Dr Pepper, and how does this impact its strategic decisions and market position?

Who Founded Keurig Dr Pepper?

The current structure of the Keurig Dr Pepper (KDP) company is a result of a merger. This means that its ownership is a blend of the original companies: Keurig Green Mountain and Dr Pepper Snapple Group. Understanding the founders and early ownership of these entities provides insight into the current KDP ownership.

Keurig, Inc. was established in 1990 by Peter Dragone and John Sylvan. They were the creators of the single-serve coffee brewing system. Details about their initial equity split and early financial backing are not widely publicized in specific percentage terms. However, their venture was driven by their innovation in the coffee market. Early on, Keurig secured investments from venture capital firms that recognized the potential of their brewing technology.

Dr Pepper's origins date back to 1885, making its founding ownership structure significantly different and more complex. It involved individual entrepreneurs and partnerships over more than a century. The Dr Pepper Snapple Group, before the merger, was spun off from Cadbury Schweppes in 2008. Its 'founding' as an independent public company involved distributing shares to Cadbury Schweppes shareholders.

Peter Dragone and John Sylvan founded Keurig in 1990. They developed the single-serve coffee brewing system.

Dr Pepper's history dates back to 1885. Its ownership structure evolved through individual entrepreneurs and partnerships.

Keurig received early investments from venture capital firms. These firms recognized the potential of its brewing technology.

Dr Pepper Snapple Group was spun off from Cadbury Schweppes in 2008. This resulted in a distribution of shares to Cadbury Schweppes shareholders.

Early agreements for both companies included standard startup provisions. These included vesting schedules and buy-sell clauses.

The founding teams focused on product development and market penetration. This laid the groundwork for their eventual success.

Understanding the history of Keurig Dr Pepper ownership involves looking at the origins of Keurig and Dr Pepper. The early ownership of Keurig was shaped by its founders and venture capital investments. Dr Pepper's ownership evolved over more than a century, starting with individual entrepreneurs. The Dr Pepper Snapple Group's formation involved a spin-off from Cadbury Schweppes. The initial focus of both companies was on product development and market penetration. As of early 2024, the company's stock symbol is KDP, and it is publicly traded.

- The merger created the current Keurig Dr Pepper entity.

- Keurig was founded by Peter Dragone and John Sylvan.

- Dr Pepper's history dates back to 1885.

- The Dr Pepper Snapple Group was spun off in 2008.

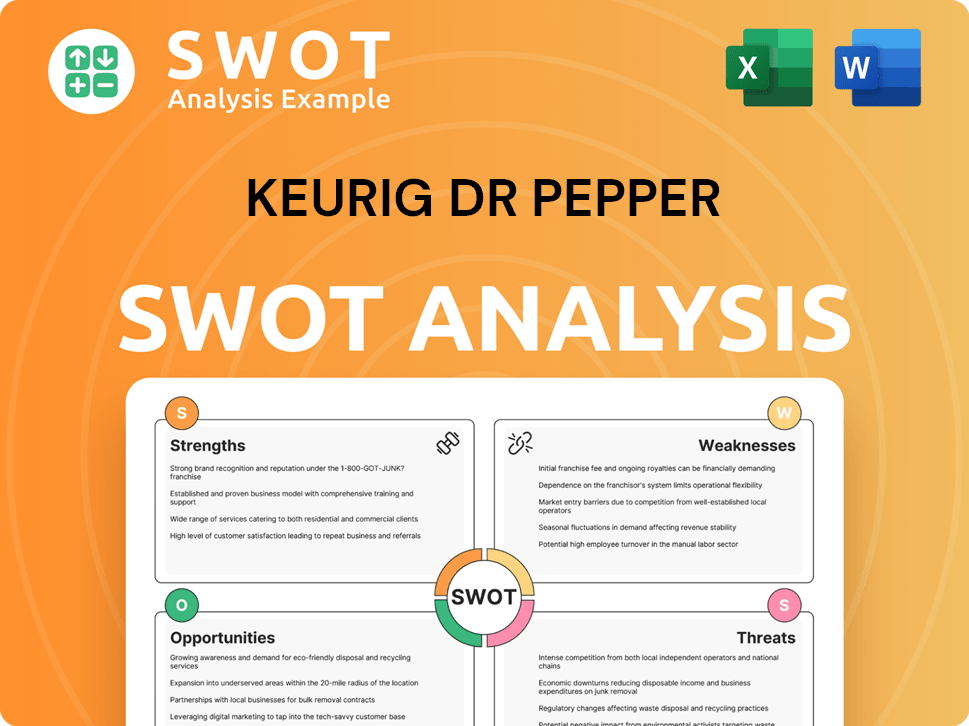

Keurig Dr Pepper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Keurig Dr Pepper’s Ownership Changed Over Time?

The ownership of the Keurig Dr Pepper company has evolved significantly over time, marked by key mergers and acquisitions. Before the 2018 merger that created Keurig Dr Pepper, Keurig Green Mountain was taken private in 2016. This acquisition was led by JAB Holding Company, with a deal valued at approximately $13.9 billion. Simultaneously, Dr Pepper Snapple Group operated as a publicly traded entity, having spun off from Cadbury Schweppes in 2008.

The 2018 merger of Keurig Green Mountain and Dr Pepper Snapple Group was a pivotal moment, resulting in the formation of Keurig Dr Pepper. Following this merger, JAB Holding Company became the largest shareholder. This strategic move consolidated the beverage industry, creating a major player with a diverse portfolio of brands. The shifts in ownership have influenced Keurig Dr Pepper's strategic direction, focusing on efficiency, brand integration, and market expansion.

| Event | Date | Impact |

|---|---|---|

| Keurig Green Mountain Acquisition by JAB | 2016 | Took Keurig private; JAB Holding Company became a major stakeholder. |

| Dr Pepper Snapple Group Spinoff | 2008 | Dr Pepper Snapple Group became a publicly traded company. |

| Keurig Green Mountain and Dr Pepper Snapple Group Merger | 2018 | Creation of Keurig Dr Pepper; JAB Holding Company became the largest shareholder. |

As of early 2024, JAB Holding Company remains a significant major stakeholder in Keurig Dr Pepper. Other major shareholders include institutional investors like Vanguard Group Inc. and BlackRock Inc. These institutional holdings represent passive investments on behalf of their clients, but their collective voting power is substantial. The company's market capitalization, as of early June 2025, is approximately $45 billion. If you're interested in learning more about the company's approach, you might find insights in the Marketing Strategy of Keurig Dr Pepper.

The ownership of Keurig Dr Pepper is largely influenced by JAB Holding Company and institutional investors.

- JAB Holding Company is the largest shareholder.

- Institutional investors like Vanguard and BlackRock hold significant shares.

- The merger in 2018 was a pivotal event in the company's history.

- The company's market cap is approximately $45 billion as of early June 2025.

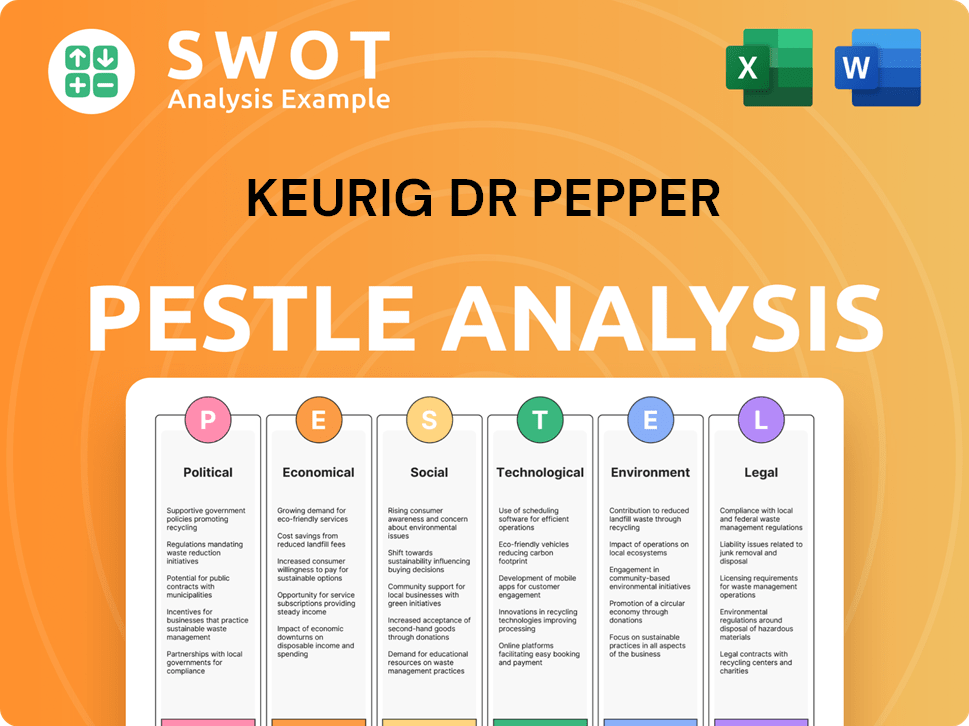

Keurig Dr Pepper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Keurig Dr Pepper’s Board?

The current board of directors of the Keurig Dr Pepper company plays a vital role in its governance, reflecting the interests of its major shareholders. As of early 2025, the board typically includes representatives from JAB Holding Company, given their substantial ownership stake, alongside independent directors and potentially members of the executive management team. For example, Olivier Goudet, a partner at JAB Holding Company, serves as Chairman of the Board, indicating JAB's strong influence. Other board members often include individuals with extensive experience in the consumer goods and beverage industries, some of whom may represent other significant institutional investors or bring independent expertise.

The composition of the board is crucial for understanding who controls Keurig Dr Pepper. The board's decisions influence the company's strategic direction, financial performance, and overall value. The specific individuals on the board and their affiliations provide insights into the power dynamics and priorities of the company. The board's role is particularly significant given that the company is a publicly traded entity, making its governance structure subject to scrutiny from investors and stakeholders. Understanding the board's composition is essential for anyone looking to understand the Keurig Dr Pepper ownership structure.

| Board Member | Title | Affiliation |

|---|---|---|

| Olivier Goudet | Chairman of the Board | JAB Holding Company |

| Independent Directors | Various | Independent |

| Executive Management | Various | Keurig Dr Pepper |

Keurig Dr Pepper operates under a one-share-one-vote structure for its common shares, which is typical for many publicly traded companies. However, the concentration of ownership with JAB Holding Company means they exert significant control over voting matters, effectively having outsized influence due to the sheer volume of shares they hold. While there are no publicly disclosed special voting rights or golden shares for specific entities, JAB's majority or significant minority ownership translates into de facto control over major corporate decisions, including board appointments, strategic initiatives, and mergers or acquisitions. There have been no widely reported recent proxy battles or activist investor campaigns that have significantly challenged the current governance structure or JAB's influence, suggesting a relatively stable ownership and control environment as of early 2025. For more insights into the company's strategic moves, consider reading about the Growth Strategy of Keurig Dr Pepper.

Understanding the board of directors and voting power is crucial for grasping Keurig Dr Pepper ownership.

- JAB Holding Company has significant influence due to its ownership stake.

- The board's composition reflects the interests of major shareholders.

- The one-share-one-vote structure gives JAB effective control.

- No significant challenges to the current governance structure have been reported recently.

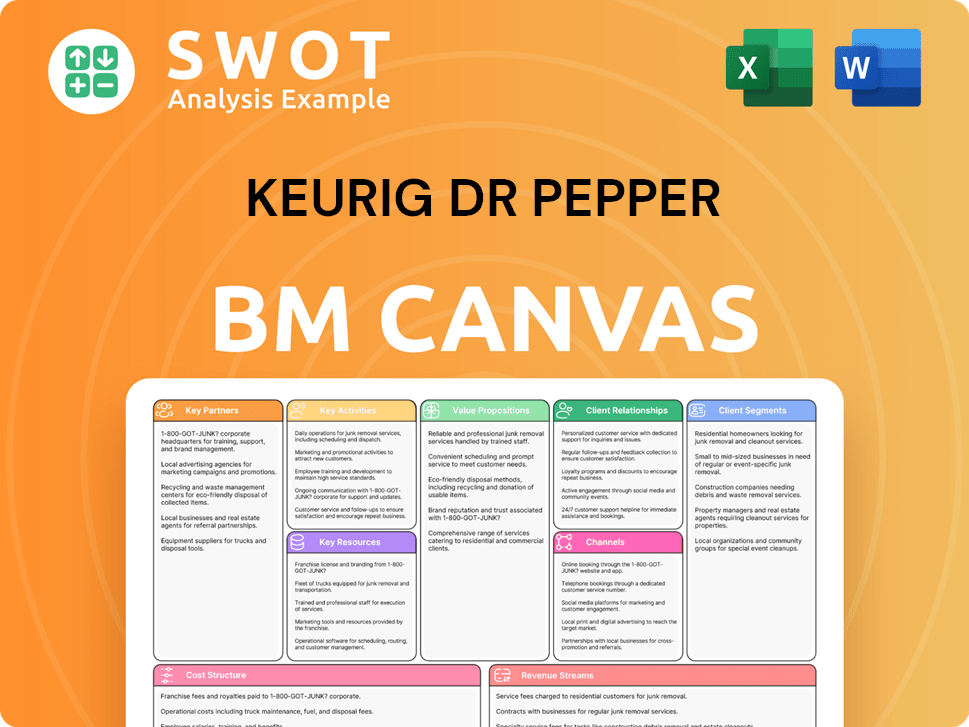

Keurig Dr Pepper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Keurig Dr Pepper’s Ownership Landscape?

Over the past few years, the Keurig Dr Pepper ownership structure has remained relatively stable. JAB Holding Company continues to hold a significant stake, demonstrating a long-term commitment to the Dr Pepper brand and the wider beverage sector. While there haven't been major shifts in the ownership, the company's strategic moves, such as portfolio optimization and partnerships, have influenced investor sentiment.

Institutional investors, including firms like Vanguard and BlackRock, hold substantial portions of KDP stock, reflecting a broader trend of institutional ownership in large-cap companies. The influence of JAB Holding Company, a private equity-backed entity, presents a different dynamic compared to traditional founder-controlled companies. There have been no recent public announcements regarding significant changes in JAB's strategic ownership or a potential privatization, indicating a continued focus on operational strategies under the current ownership framework. The company's ownership structure provides a solid foundation for its long-term plans as it navigates the evolving beverage market.

| Shareholder | Approximate Ownership | Notes |

|---|---|---|

| JAB Holding Company | Majority | Key private equity-backed entity. |

| Vanguard | Significant | One of the largest institutional holders. |

| BlackRock | Significant | Another major institutional investor. |

The Keurig Dr Pepper company continues to adapt to market changes. To understand more about their consumer base, you can explore the Target Market of Keurig Dr Pepper. This stability in ownership provides a strong base for future strategic initiatives.

JAB Holding Company is the primary owner. Vanguard and BlackRock are among the largest institutional investors. These entities collectively shape the company's ownership landscape.

The ownership structure of KDP owner has shown stability. This stability is a key factor for long-term strategic planning. The focus remains on operational performance and market adaptation.

Institutional investors play a significant role in Keurig Dr Pepper ownership. Their holdings influence investor sentiment and strategic decisions. This highlights the importance of institutional support.

The current ownership structure supports the company's long-term strategy. The company is well-positioned to navigate the evolving beverage market. The focus is on sustained growth and market adaptation.

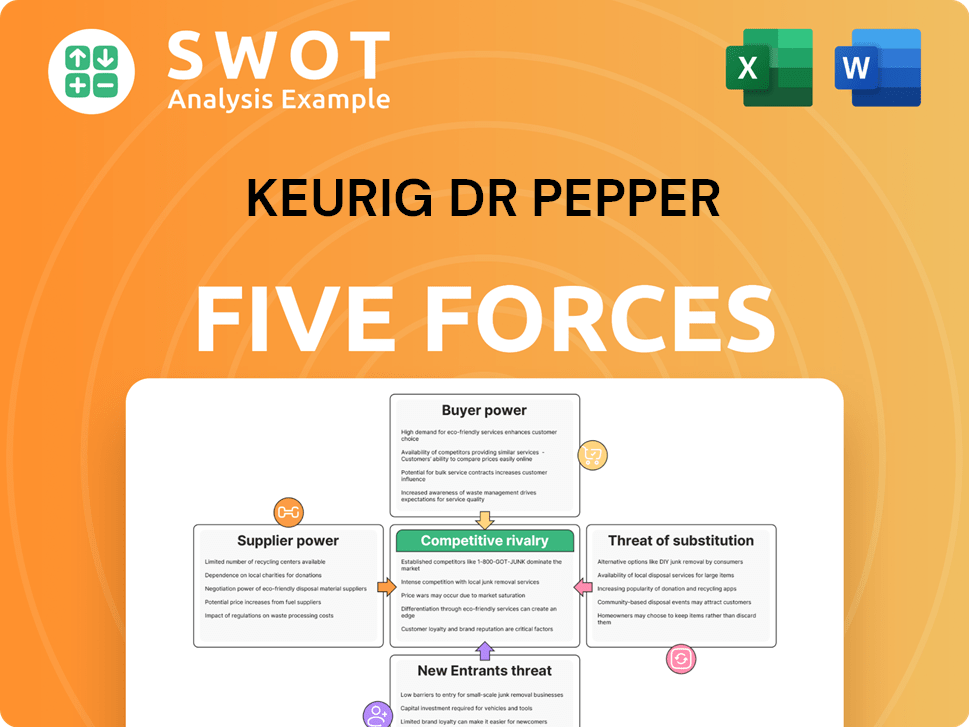

Keurig Dr Pepper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Keurig Dr Pepper Company?

- What is Competitive Landscape of Keurig Dr Pepper Company?

- What is Growth Strategy and Future Prospects of Keurig Dr Pepper Company?

- How Does Keurig Dr Pepper Company Work?

- What is Sales and Marketing Strategy of Keurig Dr Pepper Company?

- What is Brief History of Keurig Dr Pepper Company?

- What is Customer Demographics and Target Market of Keurig Dr Pepper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.