Keurig Dr Pepper Bundle

Can Keurig Dr Pepper continue its reign in the beverage world?

From its roots in a Texas drugstore to its current status as a beverage behemoth, Keurig Dr Pepper (KDP) has a compelling story. The 2018 merger that created KDP reshaped the industry, bringing together the innovative single-serve coffee systems of Keurig with the diverse beverage portfolio of Dr Pepper Snapple Group. But what's next for this industry leader?

This comprehensive analysis of KDP will explore its Keurig Dr Pepper SWOT Analysis, dissecting its growth strategy and future prospects within the dynamic beverage industry. We'll delve into KDP's financial performance, market share analysis, and expansion plans, examining how it navigates beverage industry trends and changing consumer preferences. Understanding the KDP company analysis is crucial for investors and strategists alike, as we uncover the drivers behind its revenue growth and assess its long-term growth potential.

How Is Keurig Dr Pepper Expanding Its Reach?

The growth strategy of Keurig Dr Pepper (KDP) is multifaceted, focusing on expansion across various fronts to capitalize on opportunities within the beverage industry. This includes strategic acquisitions, new product launches, and international market penetration. These initiatives are designed to boost revenue, diversify the product portfolio, and strengthen its market position. The company's ability to adapt to changing consumer preferences and beverage industry trends is crucial for its future prospects.

A key component of KDP's expansion strategy involves targeting high-growth sectors. The acquisition of GHOST Energy, finalized on December 31, 2024, exemplifies this approach, aiming to tap into the rapidly expanding energy drinks market. This move is expected to positively influence KDP's financial performance in 2025, contributing to both net sales and adjusted earnings per share (EPS) growth. For investors, understanding these expansion plans is crucial for evaluating the Owners & Shareholders of Keurig Dr Pepper.

In addition to acquisitions, KDP is actively expanding its product offerings and distribution networks. This includes introducing new flavors and beverage options to attract a broader consumer base. The company's focus on international expansion and strategic partnerships also plays a crucial role in its growth trajectory. KDP's commitment to innovation and strategic market moves positions it to maintain a competitive edge in the beverage industry.

The acquisition of GHOST Energy, completed in late 2024, is a strategic move to enter the high-growth energy drink market. This acquisition is expected to boost KDP's net sales and adjusted EPS in 2025. This expansion is a key part of KDP's strategy to diversify its revenue streams.

KDP is expanding its product portfolio with new flavors and beverage options. The introduction of Dr Pepper Blackberry and other new products like Canada Dry Fruit Splash and Mott's Active hydrating juice for kids in 2024 aims to increase consumer engagement. These launches are designed to cater to evolving consumer preferences.

KDP is focusing on international expansion and strengthening its distribution networks. Strategic partnerships with companies like Electrolit, C4, and The Honickman Companies are boosting distribution in key international territories. These collaborations are crucial for accessing new customer bases and increasing market share.

A long-term sales and distribution agreement with Black Rifle Coffee Company for Black Rifle Energy™ drinks, expected to launch nationwide in early 2025, is a key initiative. These agreements are designed to diversify revenue streams and maintain a competitive edge. This move is part of KDP's broader strategy to enhance its market presence.

KDP's expansion strategy involves acquisitions, new product launches, and international growth. The acquisition of GHOST Energy and the introduction of new flavors like Dr Pepper Blackberry are significant moves. Strategic partnerships and distribution agreements are also critical for KDP's growth.

- Acquisition of GHOST Energy to enter the energy drink market.

- New product launches, including Dr Pepper Blackberry and other beverage options.

- International expansion and strategic partnerships to strengthen distribution networks.

- Agreements with companies like Black Rifle Coffee Company to expand product offerings.

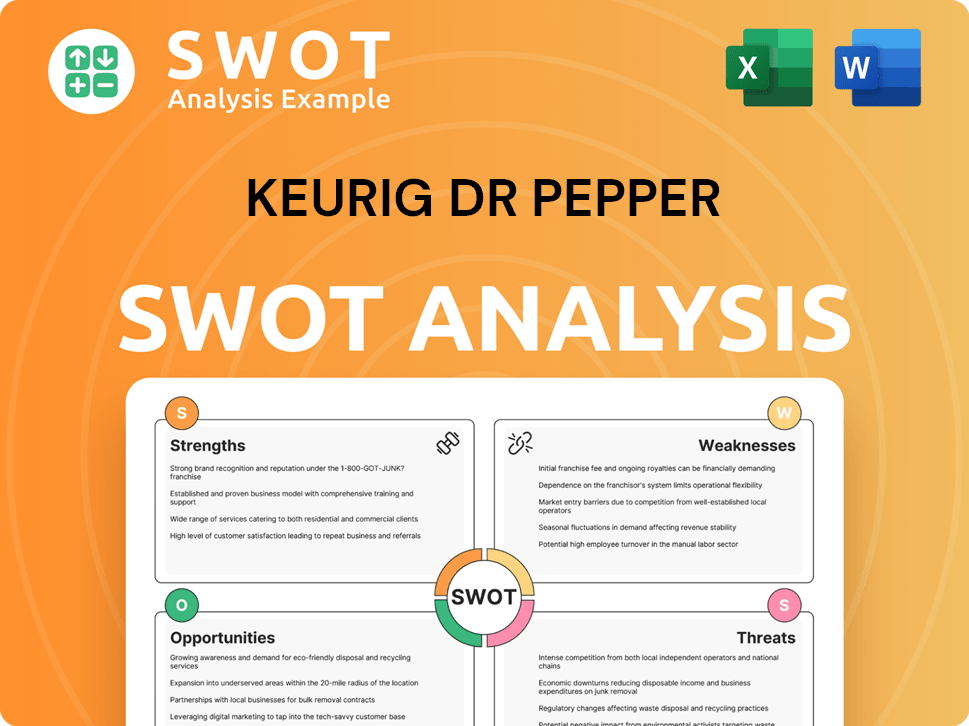

Keurig Dr Pepper SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Keurig Dr Pepper Invest in Innovation?

Keurig Dr Pepper (KDP) utilizes innovation and technology as core components of its Keurig Dr Pepper growth strategy, aiming to maintain its competitive position and drive sustainable expansion. This approach is particularly evident in its brewing systems and coffee pod offerings. The company continuously adapts to changing consumer preferences and beverage industry trends, ensuring its products remain appealing and relevant in the coffee and beverage market.

KDP's focus on innovation extends across its product lines and operational strategies. The company's commitment to sustainability, digital transformation, and strategic partnerships demonstrates a forward-thinking approach to meet evolving consumer demands. These initiatives are essential for driving KDP's future prospects and maintaining its market share in a dynamic industry.

The company's investment in technology and innovation is a key driver for its financial performance. By focusing on these areas, KDP aims to enhance operational efficiency and meet the evolving needs of consumers. This strategic focus supports the company's long-term growth potential and its ability to navigate the challenges facing Keurig Dr Pepper.

In 2024, KDP launched the Keurig K-Brew+Chill brewer, which features Quick Chill Technology for iced beverages. This new brewer caters to the growing demand for convenient and refreshing beverage options. The company also introduced the Keurig Alta brewer, which utilizes K-Rounds, a new pod technology.

The development of K-Rounds represents a significant advancement in sustainability. These pods are made with compacted roasted and ground coffee, protected by a plant-based, compostable coating. Beta-testing for K-Rounds is expected in late 2024, highlighting KDP's commitment to reducing its environmental impact.

To support the scaling of K-Rounds manufacturing, a new production plant is being constructed in Spartanburg, South Carolina. This expansion underscores KDP's investment in its innovative products and its commitment to meeting market demand. The new plant will enhance the company's production capabilities.

KDP invests in digital transformation initiatives to improve operational efficiency and enhance consumer experiences. These efforts are crucial for adapting to changing market dynamics and consumer preferences. Digital strategies support KDP's competitive landscape.

KDP's innovation extends to its brand portfolio, with new product launches like Dr Pepper Creamy Coconut. These new products drive viral engagement and attract new customers. KDP's diverse brand portfolio is a key driver of revenue growth.

KDP's innovative partnership model builds emerging growth platforms in categories such as premium coffee, energy, sports hydration, and ready-to-drink coffee. These partnerships allow KDP to diversify its offerings and enter new markets. This strategy also supports the company's international market strategy.

KDP is committed to reducing its environmental impact through various sustainability initiatives. These efforts include reducing virgin plastic use. In 2022, the company achieved an 11% reduction in virgin plastic use. The company's focus on sustainability is a key aspect of its long term growth potential.

- KDP's investment in sustainable practices aligns with consumer demand for eco-friendly products.

- The development of K-Rounds is a significant step toward reducing waste in the single-serve coffee market.

- These initiatives demonstrate KDP's commitment to environmental responsibility and enhance its brand image.

- The company's sustainability efforts are crucial for navigating the challenges facing Keurig Dr Pepper.

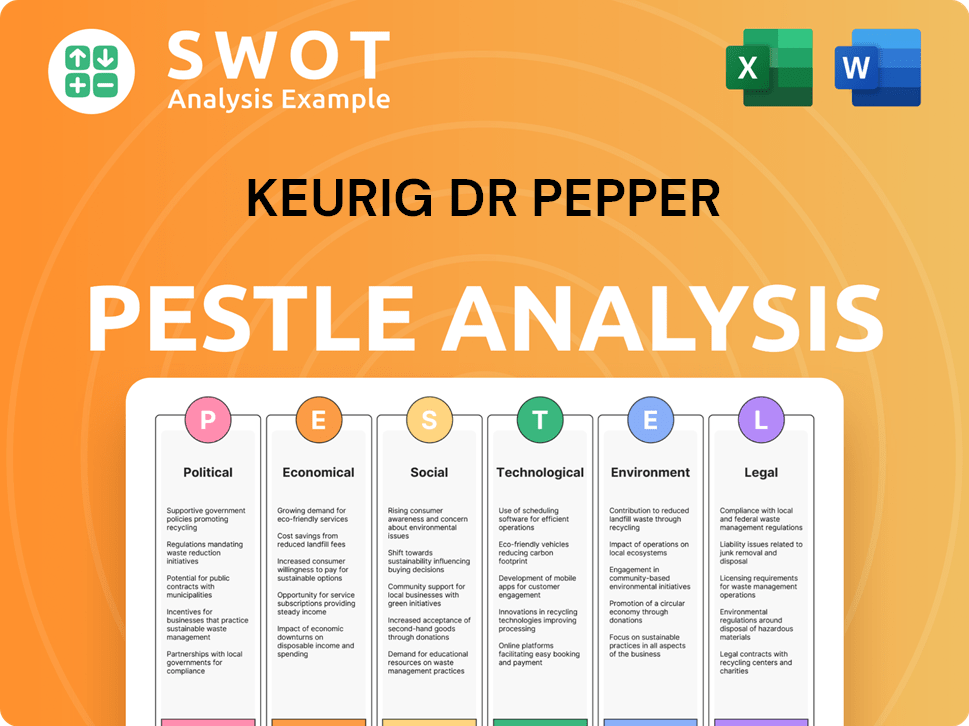

Keurig Dr Pepper PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Keurig Dr Pepper’s Growth Forecast?

The financial outlook for Keurig Dr Pepper (KDP) is robust, reflecting strong performance in 2024 and promising projections for 2025. The company's strategic initiatives and market positioning have contributed to its financial health, leading to increased investor confidence. This positive trajectory is supported by solid revenue growth, effective cost management, and strategic acquisitions.

For the fiscal year ending December 31, 2024, KDP reported impressive financial results. Net sales reached $15.35 billion, marking a 3.6% increase compared to the previous year. The constant currency net sales growth was even stronger at 3.9%. These figures highlight the company's ability to expand its market presence and drive sales, even amidst changing beverage industry trends. The growth demonstrates the effectiveness of KDP's strategies in a competitive market.

KDP's financial performance in 2024 included significant improvements in profitability and cash flow. Adjusted diluted earnings per share (EPS) grew by 8%, marking the second consecutive year of sequential acceleration. Operating cash flow surged by 67% to $2.2 billion, and free cash flow saw an 82% increase, reaching $1.7 billion. These financial achievements underscore the company's operational efficiency and its capacity to generate substantial cash, which supports future investments and shareholder returns.

KDP is targeting mid-single-digit net sales growth and high-single-digit adjusted EPS growth in constant currency for 2025. This guidance incorporates the expected contributions from the recent GHOST acquisition. This outlook reflects the company's confidence in its ability to sustain growth and capitalize on market opportunities.

In Q1 2025, KDP reported net sales of $3.64 billion, a 4.8% increase year-over-year. GAAP net income increased by 13.9% to $517 million, or $0.38 per diluted share. This positive start to the year indicates continued momentum and the effectiveness of KDP's strategic initiatives.

KDP repurchased $1.11 billion of its common stock during 2024, demonstrating its commitment to returning value to shareholders. The company also declared total dividends of $0.89 per share for 2024, increasing its quarterly dividend by 7% to $0.92 per share in Q1 2025. These actions reflect KDP's financial strength and its focus on shareholder value.

Despite some challenges in the coffee segment, KDP's overall financial performance and projections highlight its confidence in its strategic plans. The company continues to adapt to changing consumer preferences and market dynamics. For more details on KDP's business model, explore Revenue Streams & Business Model of Keurig Dr Pepper.

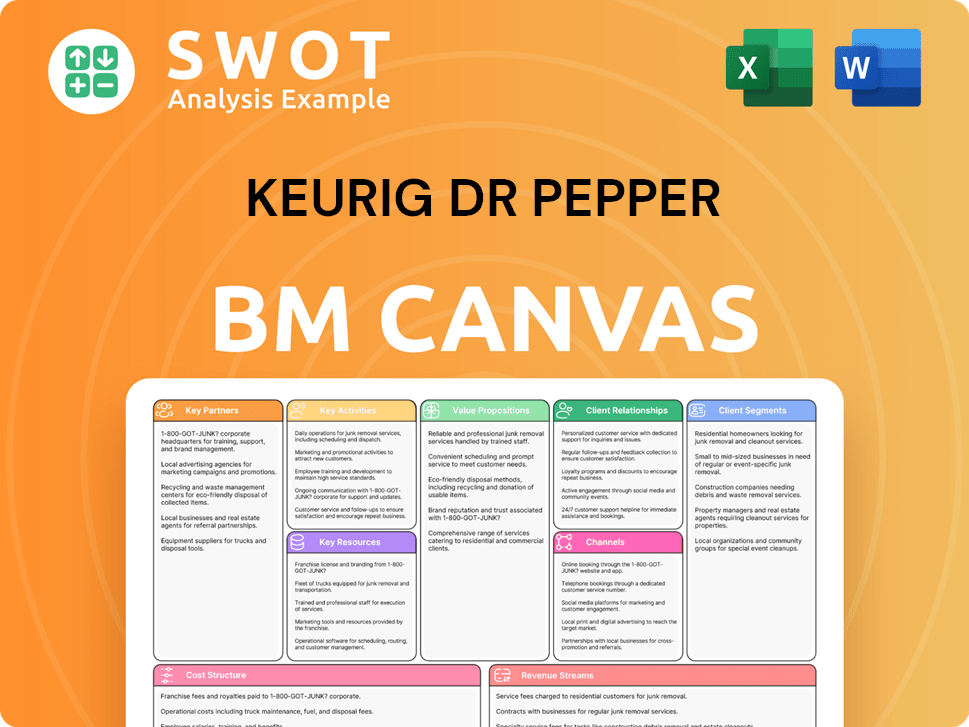

Keurig Dr Pepper Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Keurig Dr Pepper’s Growth?

The growth strategy of Keurig Dr Pepper (KDP) faces several risks that could hinder its expansion and financial performance. The company must navigate a competitive landscape, evolving consumer preferences, and regulatory changes. Understanding these challenges is vital for assessing KDP's long-term growth potential and making informed investment decisions.

KDP's operations are susceptible to supply chain disruptions, fluctuating commodity prices, and cybersecurity threats. These factors can impact profitability and market share. KDP's ability to mitigate these risks will be crucial for sustaining its revenue growth and maintaining investor confidence.

The company's strategic initiatives, including digital transformation and sustainability efforts, are designed to address these challenges. However, the effectiveness of these initiatives and their impact on KDP's financial performance remain to be seen. A thorough KDP company analysis is essential to understand the complexities of its business environment.

KDP competes with major multinational corporations and smaller, agile companies in the beverage industry. This intense competition requires continuous innovation and adaptation. To stay competitive, KDP must effectively manage its brand portfolio and respond to the latest beverage industry trends.

Consumer preferences are constantly shifting, with a growing demand for healthier and more sustainable products. KDP needs to adapt its product offerings to meet these changing demands. Brief History of Keurig Dr Pepper provides context on the company's evolution and its response to market trends.

KDP faces regulatory changes related to health, safety, environmental impact, and packaging across various markets. Compliance with these regulations can increase operational costs. These costs can affect the company's profitability and sales figures.

Supply chain vulnerabilities, including increased costs for raw materials, packaging, and transportation, present a significant risk. These factors can lead to higher operational expenses. KDP must implement effective supply chain management strategies to mitigate these risks.

The coffee segment faces challenges due to fluctuating coffee bean prices and competitive pricing. This can lead to lower profit margins. In Q1 2025, the coffee segment experienced a 2.9% decline.

Reliance on information technology makes KDP vulnerable to cybersecurity threats, which could lead to data breaches and system disruptions. Protecting sensitive data is crucial for maintaining customer trust. Cybersecurity incidents can also impact operational efficiency.

Climate change presents physical risks to operations and supply chains, potentially affecting the availability and cost of agricultural commodities. Changes in weather patterns can disrupt crop yields and increase production costs. KDP's sustainability initiatives are designed to address these environmental challenges.

KDP is investing in digital transformation and sustainability initiatives to manage these risks. The company is also focusing on strategic acquisitions and partnerships. Financial instruments are utilized to hedge against market risks, such as commodity price fluctuations. These steps are essential for long term growth potential.

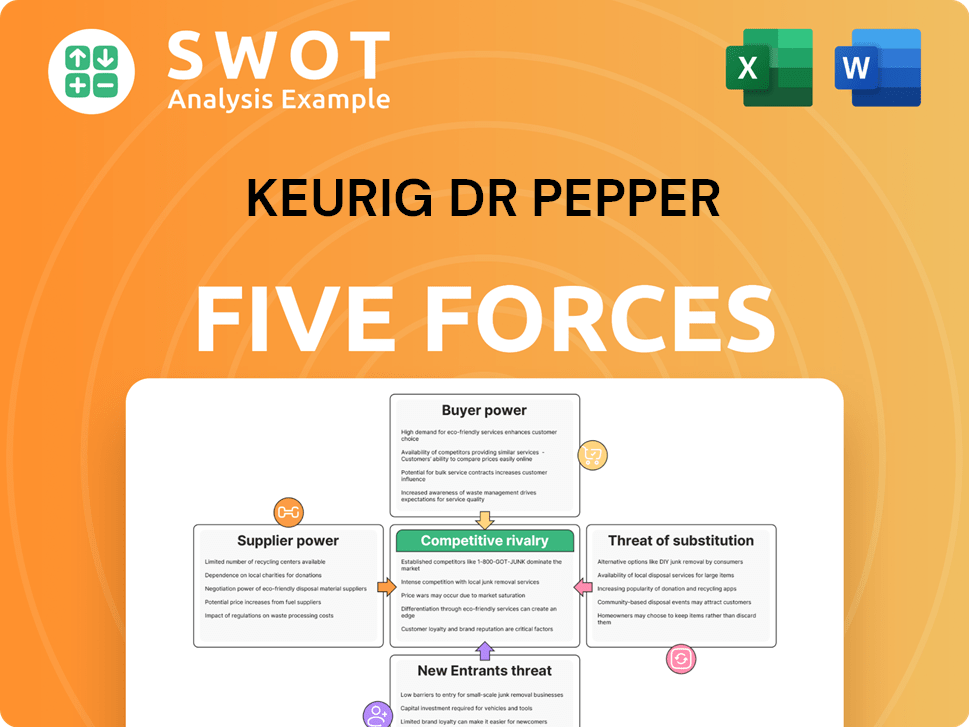

Keurig Dr Pepper Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Keurig Dr Pepper Company?

- What is Competitive Landscape of Keurig Dr Pepper Company?

- How Does Keurig Dr Pepper Company Work?

- What is Sales and Marketing Strategy of Keurig Dr Pepper Company?

- What is Brief History of Keurig Dr Pepper Company?

- Who Owns Keurig Dr Pepper Company?

- What is Customer Demographics and Target Market of Keurig Dr Pepper Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.