KHovnanian Homes Bundle

How Does KHovnanian Homes Stack Up in Today's Housing Market?

The U.S. homebuilding industry is a battlefield, constantly reshaped by economic forces and consumer demands. KHovnanian Homes SWOT Analysis is a major player, but how does it navigate this competitive arena? Understanding its position requires a deep dive into its rivals, market share, and the strategies that define success in the real estate competition.

This analysis will dissect the competitive landscape, examining KHovnanian Homes' financial performance and market position. We'll explore its geographic footprint, compare it against key competitors like Lennar and D.R. Horton, and assess its construction quality and building practices. By understanding the industry trends and KHovnanian Homes' competitive advantages, you can gain valuable insights for your investment decisions and strategic planning.

Where Does KHovnanian Homes’ Stand in the Current Market?

K. Hovnanian Enterprises holds a strong market position within the U.S. homebuilding industry. It's consistently ranked among the top 10 homebuilders based on both homebuilding revenues and home deliveries. This positioning reflects its significant presence and operational scale in the competitive real estate market.

The company's core operations involve the design, construction, and sale of a diverse range of residential properties. These include single-family detached homes, townhomes, condominiums, and active adult communities. This diverse product portfolio allows the company to cater to a broad customer base, from first-time buyers to luxury buyers, enhancing its market reach.

As of October 31, 2024, K. Hovnanian Homes operated in 147 residential communities. These communities were spread across 13 states, including Arizona, California, and Florida. This wide geographic distribution supports its market share and reduces dependence on any single regional market.

In fiscal 2024, the company reported total revenues of $3.00 billion, a 9.0% increase from the previous year. For the first six months of fiscal 2025, revenues rose by 4.4% to $1.36 billion. This growth indicates positive momentum in its sales and operational efficiency.

The company has strategically expanded its land position by almost 50% since the second quarter of fiscal 2023. As of April 30, 2025, the company's consolidated community count increased by 14.7% to 125 communities. This expansion strategy supports future growth and market share gains.

K. Hovnanian is focused on improving its balance sheet. As of April 30, 2025, total shareholder equity was $820.4 million, with total debt at $1.0 billion. The debt-to-equity ratio stood at 126.4%. This indicates a focus on financial stability and long-term sustainability.

In Q1 2025, K. Hovnanian's market share was approximately 3.37%, calculated based on total revenue. This places the company among the leading homebuilders in the U.S. The company's operational cash flow is currently negative, and the debt is not well covered by this metric, although its interest payments are well covered by EBIT (7.1x coverage).

- The company's focus on reducing debt and increasing equity is a key strategy.

- The expansion of its land portfolio and community count positions it for future growth.

- Despite the negative operational cash flow, the company's interest payments are well covered.

- For more detailed insights into the company's strategic moves, consider reading about the Growth Strategy of KHovnanian Homes.

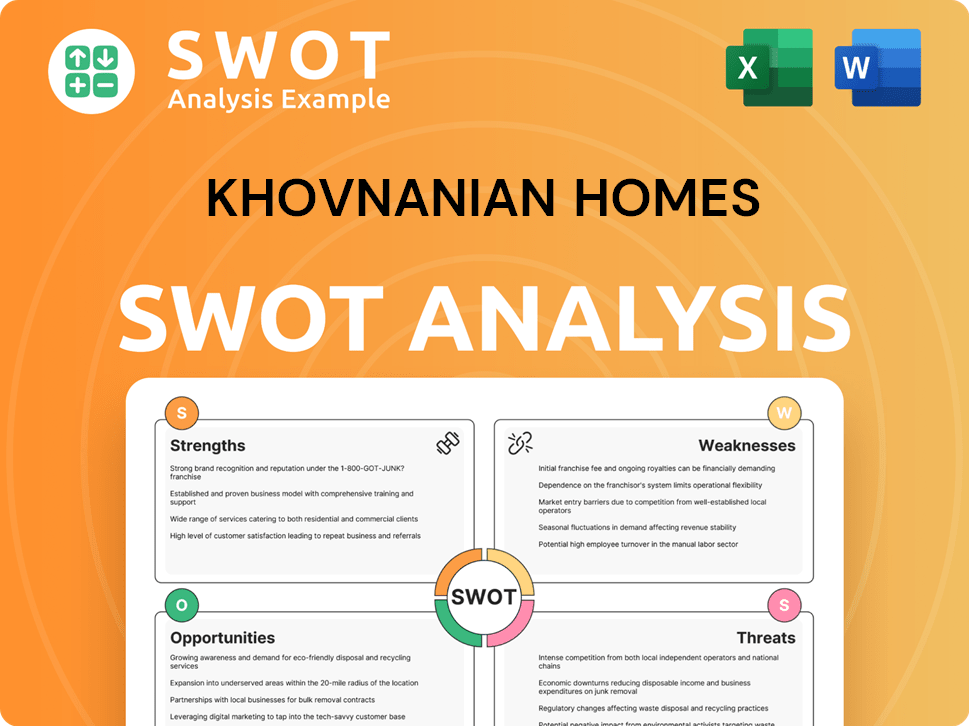

KHovnanian Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging KHovnanian Homes?

The Competitive Landscape for K. Hovnanian Enterprises is shaped by a diverse set of competitors within the homebuilding industry. This analysis examines the key players and the dynamics influencing the company's market position. Understanding these competitive pressures is crucial for assessing the company's performance and future prospects.

The homebuilding sector is intensely competitive, with companies vying for market share through various strategies. These include land acquisition, marketing, and economies of scale. The presence of alternative housing options, such as existing homes and rentals, further intensifies the competition, influencing potential homebuyers' decisions.

K. Hovnanian Enterprises faces direct competition from several major homebuilders. These competitors include D.R. Horton, Lennar, NVR, PulteGroup, Toll Brothers, Beazer Homes USA, Meritage Homes, Cavco Industries, KB Home, and M/I Homes.

Larger national builders often leverage greater sales and financial resources. This enables them to acquire prime land and invest heavily in marketing. Economies of scale also play a significant role, allowing them to offer competitive pricing and product offerings.

The homebuilding market is dynamic, with market share fluctuating among competitors. K. Hovnanian Enterprises' market share in Q1 2025 was approximately 3.37%, indicating the ongoing competition and the need for strategic adjustments.

Competitors like D.R. Horton and Lennar have extensive geographic reach. They often offer diversified product offerings, targeting similar buyer segments as K. Hovnanian. Toll Brothers focuses on the luxury home market.

The availability of previously owned homes and rental housing provides alternative options for potential homebuyers. These options can impact the demand for new homes and influence the competitive landscape.

New or emerging players, particularly those leveraging technology for more efficient construction or sales processes, could also disrupt the traditional competitive landscape. This highlights the need for innovation and adaptation.

Analyzing the Competitive Landscape requires a deep understanding of the strategies employed by each player. For instance, D.R. Horton and Lennar's extensive geographic footprints and diverse product lines pose significant challenges. Toll Brothers' focus on the luxury market requires K. Hovnanian to compete in that segment. For further insights into the target market, consider reading about the Target Market of KHovnanian Homes.

Several factors drive competition in the homebuilding industry. These include financial resources, land acquisition, marketing, and operational efficiency. Understanding these factors is crucial for assessing a company's competitive position.

- Financial Strength: Access to capital for land acquisition and construction.

- Land Acquisition: Securing prime locations for new home communities.

- Marketing and Sales: Effective strategies to attract and convert potential buyers.

- Operational Efficiency: Streamlining construction processes to reduce costs.

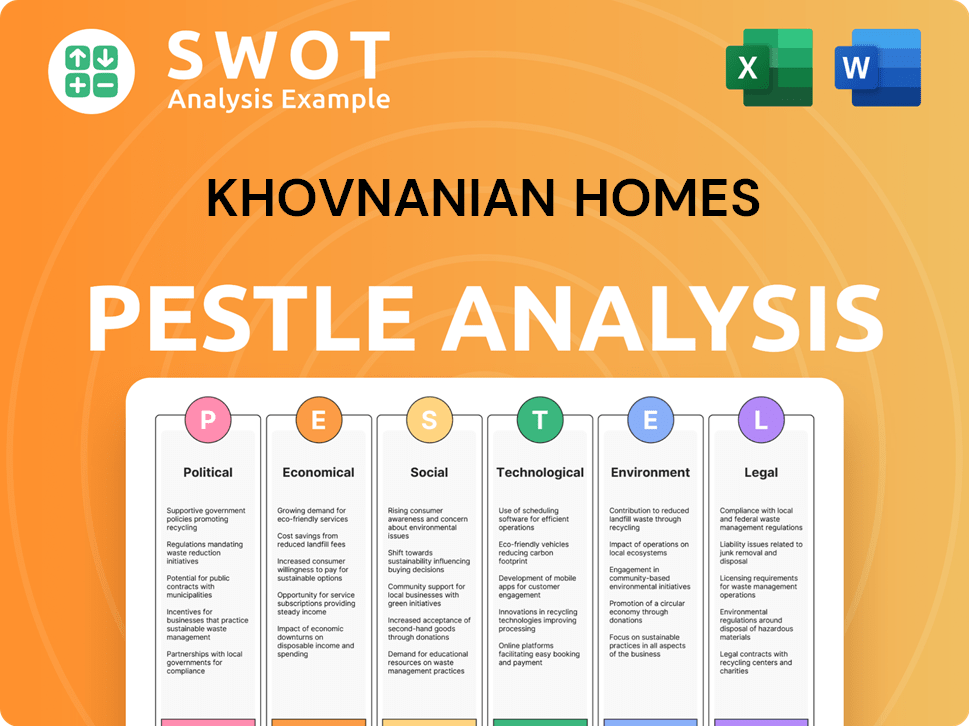

KHovnanian Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives KHovnanian Homes a Competitive Edge Over Its Rivals?

K. Hovnanian Enterprises, a prominent player in the homebuilding sector, has established a strong competitive position through strategic initiatives and a commitment to operational excellence. With a history dating back to 1959, the company has cultivated a solid reputation and brand recognition, crucial in the competitive real estate market. This foundation supports its ability to attract and retain customers, which is essential for sustained growth.

The company's operational strategies, including a 'land-light' approach, are designed to mitigate risks and optimize capital deployment. This focus, combined with a diversified geographic presence and product offerings, enables K. Hovnanian to adapt to changing market dynamics and consumer preferences. Recent financial performance and strategic partnerships further highlight its efforts to enhance its competitive edge.

In a competitive landscape, understanding the competitive advantages of K. Hovnanian Homes is crucial for stakeholders. This analysis provides insights into the company's strengths, strategic moves, and market position. For more detailed information, you can explore Owners & Shareholders of KHovnanian Homes.

K. Hovnanian Homes benefits from its long-standing presence in the homebuilding industry. Founded in 1959, the company has delivered over 376,000 homes in the U.S. This extensive experience contributes to brand equity and customer trust, vital assets in the homebuying process. The well-known trade name, K. Hovnanian® Homes, further enhances its market presence.

The company's 'land-light' approach is a key operational advantage. As of January 31, 2025, 84% of its total controlled consolidated lots were optioned. This approach helps manage risk and capital by reducing the amount of owned land. The total controlled consolidated lots increased by 28.8% to 43,254 as of January 31, 2025, indicating a strong pipeline.

K. Hovnanian operates across 13 states, providing geographic diversification. The company builds various home types, including single-family detached homes, townhomes, and active adult communities. This diversified product offering allows the company to cater to a wide range of buyer segments and adapt to changing market conditions.

K. Hovnanian focuses on improving its financial position, including reducing debt and increasing equity. In fiscal 2024, land and land development spending increased by 47% year-over-year, and lot count grew by 32%. The company reported the second-highest trailing twelve-month Return on Equity (ROE) among midsized homebuilders at 27.0% as of May 20, 2025.

K. Hovnanian has expanded its international reach, signing a strategic Memorandum of Understanding (MOU) with Saudi Arabia's leading real estate developer NHC in May 2025. This partnership builds on an existing joint venture that has delivered over 2,450 homes in Saudi Arabia since 2013. This expansion aligns with Saudi Arabia's Vision 2030.

- Leveraging expertise in a growing international market.

- Diversifying revenue streams and market exposure.

- Capitalizing on opportunities presented by Vision 2030.

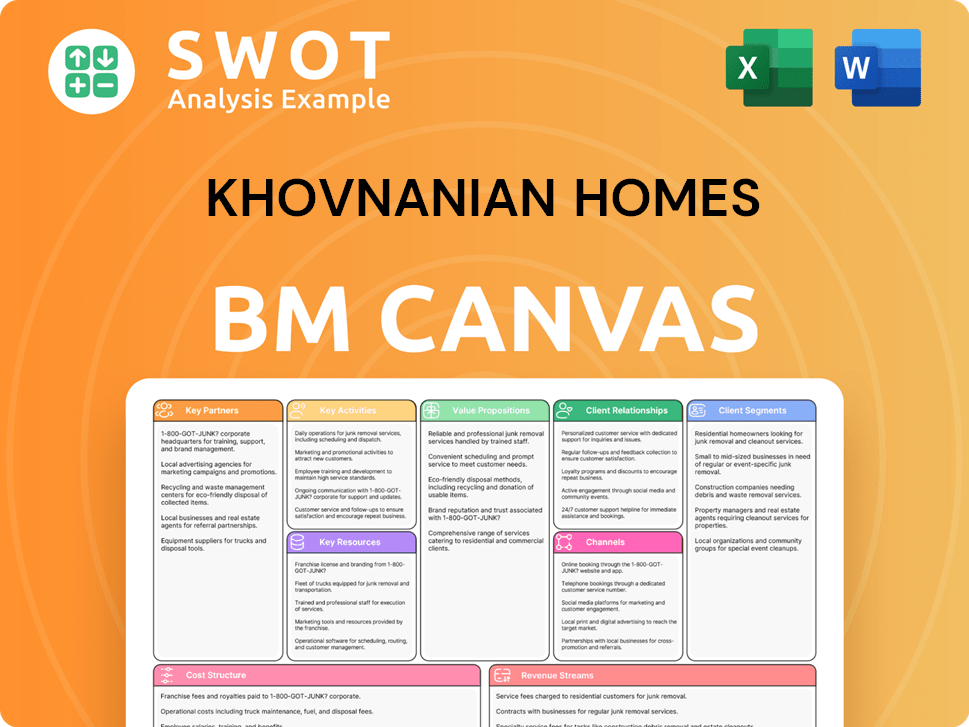

KHovnanian Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping KHovnanian Homes’s Competitive Landscape?

The homebuilding industry, including companies like K. Hovnanian Homes, is currently navigating a dynamic landscape shaped by various economic and market forces. Despite ongoing challenges, such as fluctuating mortgage rates and economic uncertainties, the demand for housing remains strong, driven by a persistent housing shortage across the U.S. This environment presents both opportunities and risks for homebuilders, influencing their strategies and financial performance.

K. Hovnanian Homes, like other players in the Competitive Landscape, must adapt to evolving consumer preferences, technological advancements, and regulatory changes. The company's ability to manage costs, secure land, and respond to market shifts will be crucial in determining its success in the coming years. The Brief History of KHovnanian Homes provides context for understanding the company's evolution and its position within the industry.

Key trends in the homebuilding sector include sustained consumer demand, despite economic pressures, and the increasing importance of technological integration in sales and customer engagement. Regulatory changes, particularly regarding land use and environmental considerations, also impact development timelines and costs. Consumer preferences are shifting towards energy-efficient homes and communities with specific amenities.

Challenges include managing gross margins amid mortgage rate impacts and navigating constraints related to utilities for new communities. A decrease in consolidated contracts, as seen with a 7.5% drop in Q2 2025, and a 12.5% decrease in the dollar value of the consolidated contract backlog, highlight the current market pressures. Adapting to changing consumer demands and regulatory landscapes also presents ongoing challenges.

Opportunities for growth include strategic land acquisitions, expanding community counts, and forming strategic partnerships. K. Hovnanian Homes has increased its land position by almost 50% since Q2 fiscal 2023, with a 15.2% increase in total controlled consolidated lots to 42,440 as of April 30, 2025. The company's move into international markets, such as its recent MOU with Saudi Arabia's NHC, also presents significant growth potential.

For Q3 fiscal 2025, K. Hovnanian Enterprises expects total revenues between $750 million and $850 million, with an adjusted homebuilding gross margin projected between 17.0% and 18.0%. Adjusted income before income taxes is anticipated to range from $30 million to $40 million. These projections reflect the company's focus on maintaining profitability and growth amidst market fluctuations.

K. Hovnanian Homes is implementing several strategic initiatives to address industry trends and future challenges. These include a focus on economically viable land transactions, expanding community counts, and pursuing international expansion through strategic partnerships. The company is also working to improve its balance sheet by reducing debt and increasing equity, further enhancing its long-term resilience.

- Focus on economically viable land transactions.

- Expanding community counts to drive delivery growth.

- Strategic partnerships for international expansion, such as the MOU with NHC in Saudi Arabia.

- Efforts to improve the balance sheet by reducing debt and increasing equity.

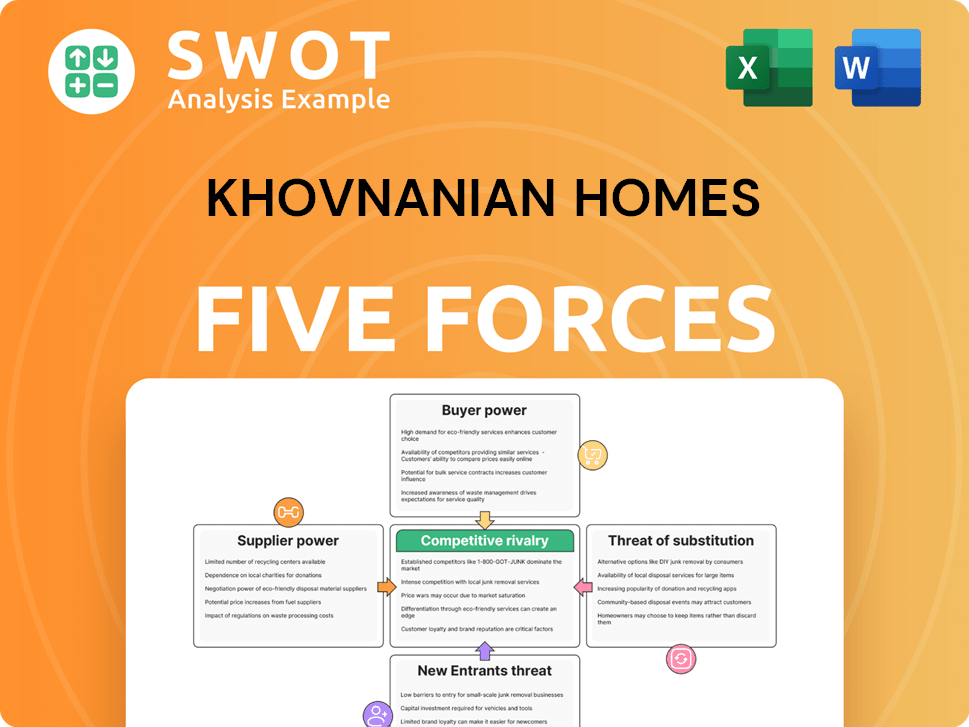

KHovnanian Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of KHovnanian Homes Company?

- What is Growth Strategy and Future Prospects of KHovnanian Homes Company?

- How Does KHovnanian Homes Company Work?

- What is Sales and Marketing Strategy of KHovnanian Homes Company?

- What is Brief History of KHovnanian Homes Company?

- Who Owns KHovnanian Homes Company?

- What is Customer Demographics and Target Market of KHovnanian Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.