KHovnanian Homes Bundle

How Does KHovnanian Homes Thrive in the Housing Market?

K. Hovnanian Enterprises, Inc., a prominent KHovnanian Homes SWOT Analysis, has been shaping the American housing landscape since 1959. From first-time buyer homes to luxury residences, KHovnanian caters to diverse needs across 13 states. With billions in revenue and a growing net income, understanding KHovnanian's operations is key.

This deep dive explores how KHovnanian Homes generates value, examining its revenue streams and competitive advantages. We'll analyze its current industry position, considering associated risks and future prospects. Whether you're researching new homes or seeking insights into real estate investments, this analysis provides valuable perspective on KHovnanian's journey and its impact on the market, including KHovnanian Homes reviews and KHovnanian Homes locations.

What Are the Key Operations Driving KHovnanian Homes’s Success?

K. Hovnanian Enterprises, often referred to as KHovnanian Homes, focuses on designing, constructing, marketing, and selling residential homes. They offer a variety of home types, including single-family detached homes, townhomes, condominiums, and active adult communities. This approach allows them to cater to a wide range of buyers, from first-time purchasers to those seeking luxury homes.

The company's operational model encompasses the entire home-buying process, from initial design and construction to sales and after-sales services. They also provide mortgage origination and title services to streamline the process for their customers. KHovnanian emphasizes strategic land purchases to ensure good investment returns. In fiscal 2024, the average sales price for a K. Hovnanian home, including options, was $538,000.

KHovnanian Homes is expanding its operations. As of April 30, 2025, the consolidated community count increased by 14.7% to 125 communities. Total controlled consolidated lots also rose by 15.2% to 42,440 lots. The company's strategy includes becoming a significant builder in its selected markets to achieve economies of scale. They also leverage strategic partnerships, such as the joint venture with GTIS Partners, which totals $1 billion in equity across 15 joint ventures.

KHovnanian Homes offers a range of housing options to meet different customer needs. Their portfolio includes single-family homes, townhomes, and active adult communities. This variety enables them to appeal to a broad customer base, from first-time buyers to those seeking luxury homes. The company's ability to adapt to market conditions is a key element of its strategy.

KHovnanian Homes collaborates with strategic partners to expand its operations. A notable partnership is with GTIS Partners, which has a $1 billion equity investment across 15 joint ventures. These partnerships support the company's growth in high-growth markets. These collaborations help KHovnanian Homes in its goal to become a major player in the homebuilder industry.

KHovnanian Homes aims to enhance the home-buying experience through integrated services. They provide mortgage origination and title services to streamline the process. The company also incorporates smart home solutions, such as Wi-Fi thermostats and video doorbells, to provide convenience and security for homeowners. This focus on customer satisfaction is a key aspect of their value proposition.

KHovnanian Homes is focused on adapting to changing market conditions. They offer smart home features to meet current demands. The company's strategy includes increasing its lot count and community count. The company’s ability to adapt to market trends, as explored in Competitors Landscape of KHovnanian Homes, is essential for its success.

KHovnanian Homes' core operations focus on home design, construction, and sales, catering to diverse customer segments. They manage the entire home-buying journey, from design to mortgage services. Strategic land purchases and partnerships are crucial for their growth.

- Diverse product offerings: Single-family homes, townhomes, and active adult communities.

- Strategic land acquisition: Focus on securing land for future developments.

- Smart home integration: Offering features like Wi-Fi thermostats and video doorbells.

- Partnerships: Collaborations to expand market reach and development capabilities.

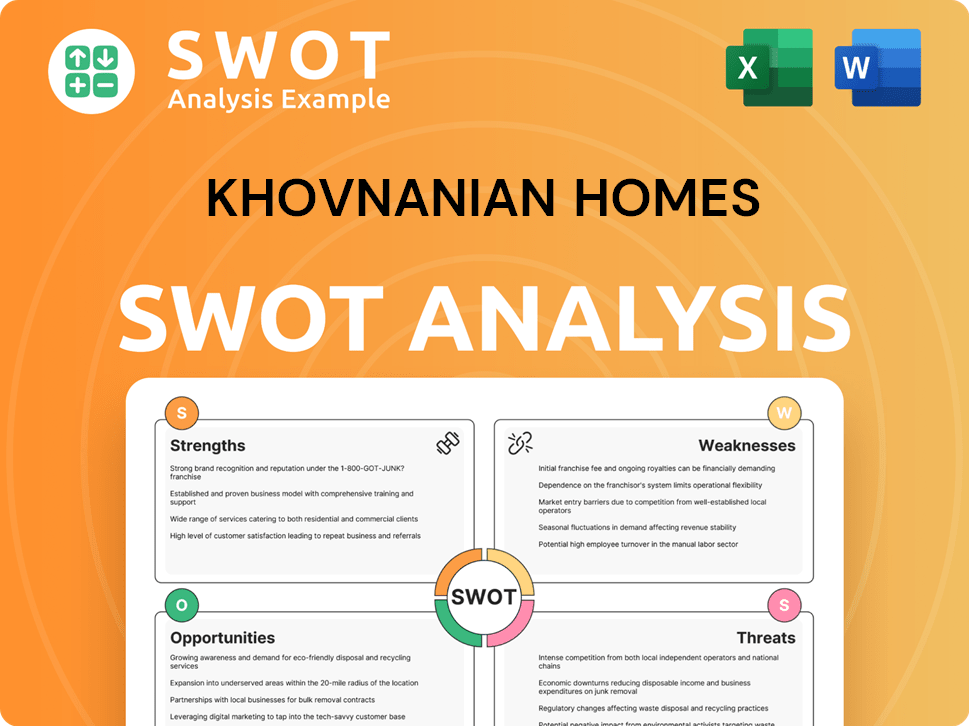

KHovnanian Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does KHovnanian Homes Make Money?

K. Hovnanian Enterprises, commonly known as KHovnanian Homes, primarily generates revenue through its homebuilding operations. This includes the sale of various types of homes, such as single-family detached homes, townhomes, condominiums, and active adult communities. The company's financial performance is closely tied to the housing market and its ability to sell and deliver homes.

The company also has a financial services segment that contributes to its overall revenue. This segment provides mortgage loans and title services to KHovnanian Homes customers. Additionally, the company participates in domestic unconsolidated joint ventures, which also generate home sales revenue.

For decision-makers looking into the strategies of this homebuilder, understanding its revenue streams and monetization tactics is crucial. This knowledge provides insight into how KHovnanian adapts to market changes and maintains its financial health. The company's approach to sales and financing is a key aspect of its business model.

KHovnanian Homes leverages multiple revenue streams and monetization strategies. Home sales are the primary source of income, with financial services and joint ventures providing additional revenue. The company employs various tactics to attract buyers and manage profitability in a fluctuating market. For those interested in the marketing side of this homebuilder, check out the Marketing Strategy of KHovnanian Homes.

- Home Sales: This is the core of KHovnanian's revenue, encompassing various housing types. For fiscal year 2024, home sales revenue reached $2.88 billion, a 9.3% increase from the previous year.

- Financial Services: The financial services segment offers mortgage loans and title services, contributing to the company's overall revenue. In the second quarter of fiscal 2025, this segment generated $21.32 million in revenue.

- Joint Ventures: KHovnanian participates in domestic unconsolidated joint ventures, which generate additional home sales revenue. In the second quarter of fiscal 2025, home sales revenues from these joint ventures increased by 21.4% to $144.5 million. For the first six months of fiscal 2025, these joint ventures contributed $276.3 million in home sales revenues.

- Incentives: To attract buyers, especially in a volatile market, KHovnanian offers incentives. In the fiscal fourth quarter of 2024, incentives represented 8.5% of the average sales price.

- Land Strategy: The company focuses on economically viable land transactions and maintains a 'land light' position. This strategy aims to capitalize on increased demand while managing gross margins.

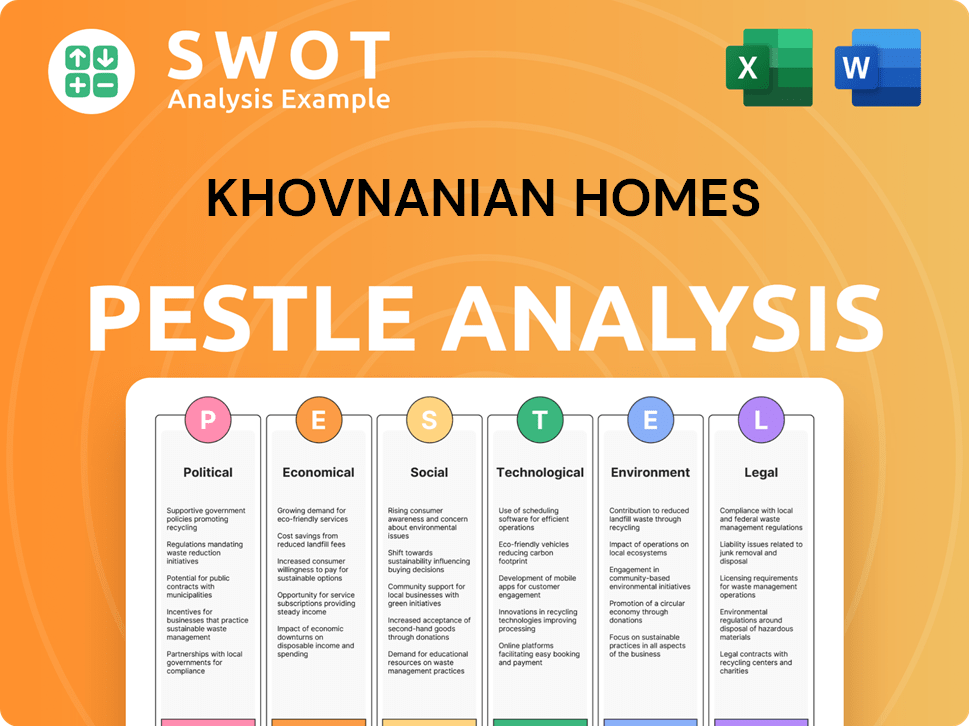

KHovnanian Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped KHovnanian Homes’s Business Model?

K. Hovnanian Enterprises, a prominent homebuilder, has navigated significant milestones, strategic shifts, and competitive advantages throughout its history. Founded in 1959, the company has evolved, adapting to market dynamics and consumer preferences. This evolution is marked by key strategic moves and an enduring commitment to building quality homes.

A pivotal strategic move in fiscal 2024 was the shift from debt reduction to growth. This resulted in increased spending on land and land development, a growing lot count, and an expansion of community count. These actions reflect a proactive approach to capitalize on market opportunities and strengthen its market position. The company's focus on strategic partnerships and innovative offerings further enhances its competitive edge within the real estate sector.

As of April 30, 2025, the consolidated community count increased by 14.7% to 125 communities. Total controlled consolidated lots rose by 15.2% to 42,440 lots, demonstrating the company's commitment to expansion and market penetration. These metrics highlight the company's growth trajectory and its ability to secure and develop land for future homebuilding projects.

Founded in 1959, K. Hovnanian Enterprises has a long-standing history in the homebuilding industry. The company's initial public offering in 1983 marked a significant step in its corporate development. These milestones reflect the company's growth and evolution over several decades.

In fiscal 2024, the company shifted its focus from debt reduction to growth, increasing land and land development spending. The expansion of the joint venture portfolio with GTIS Partners to $1 billion in equity across 15 joint ventures is another key strategic move. In May 2025, a strategic Memorandum of Understanding (MOU) was announced between K. Hovnanian M.E. Investments and Saudi Arabia's NHC.

K. Hovnanian Homes boasts a strong brand and nearly 70 years of experience, having built over 376,000 homes in the United States. The company adapts to market conditions by offering incentives like mortgage rate buydowns. Incorporating smart home solutions enhances customer benefits and market differentiation.

The company faces operational challenges, including lower contract pace per community and the impact of mortgage rate buydowns on gross margins. Despite these challenges, K. Hovnanian continues to focus on economically viable land transactions and improving its balance sheet. The company is actively working to mitigate these challenges.

The company has expanded its market presence through strategic partnerships and international ventures. The joint venture with GTIS Partners aims to build 12,600 homes valued at $6 billion. The recent MOU with Saudi Arabia's NHC further solidifies its presence in the Middle East, where it has delivered over 2,450 homes since 2013.

- The GTIS Partners joint venture includes eight newly added communities across various states.

- The strategic MOU with NHC in Saudi Arabia builds on existing regional presence.

- These partnerships are crucial for expanding market reach and increasing home deliveries.

- The expansion strategy focuses on both domestic and international markets.

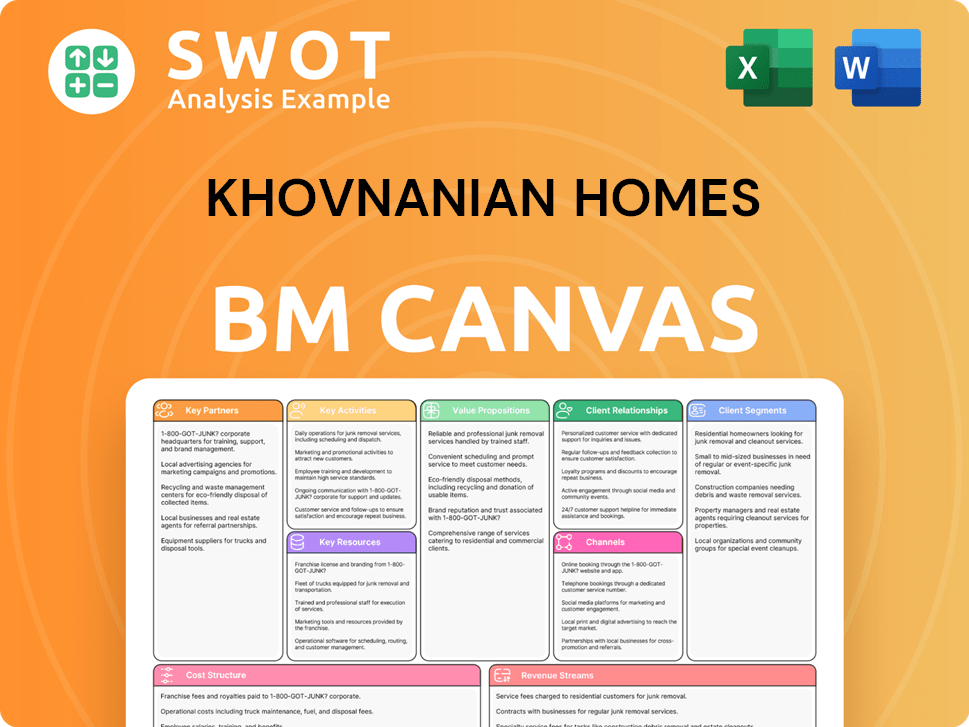

KHovnanian Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is KHovnanian Homes Positioning Itself for Continued Success?

K. Hovnanian Enterprises, operating under the trade name K. Hovnanian® Homes, maintains a strong position in the homebuilding industry, ranking among the largest in the nation. The company is also a major developer of active lifestyle communities under the K. Hovnanian's® Four Seasons brand. K. Hovnanian operates across 13 states and 27 markets, demonstrating a broad geographic footprint.

Despite its market presence, K. Hovnanian faces several risks, including economic uncertainty and high mortgage rates. These factors contribute to a slower contract pace and pressure on gross margins. The company's performance in fiscal 2024 showed positive results, but more recent data indicates challenges in maintaining this momentum.

K. Hovnanian Homes is a significant player in the homebuilder market, operating in numerous states. The company's diverse portfolio includes both standard homes and active adult communities. K. Hovnanian's market position is backed by its extensive operational reach and brand recognition.

High mortgage rates and economic uncertainty pose significant challenges for K. Hovnanian. These factors can lead to decreased contract volume and margin pressures. The company must navigate these headwinds to maintain profitability and growth.

K. Hovnanian reported a 24% year-over-year increase in full-year income before income taxes. Total revenues for the year reached $3.00 billion. The company ended fiscal 2024 with 130 active selling communities.

K. Hovnanian is focused on strategic initiatives to improve its financial position and drive growth. The company aims to increase deliveries by over 10% annually in the coming years. For the third quarter of fiscal 2025, the company anticipates total revenues between $750 million and $850 million.

K. Hovnanian is actively working on several strategic initiatives to address current market challenges and improve its financial standing. These include debt reduction, equity increases, and an expansion of its land holdings. For the third quarter of fiscal 2025, adjusted homebuilding gross margin is projected between 17.0% and 18.0%, with adjusted income before income taxes expected to range from $30 million to $40 million.

- Focus on reducing debt and increasing equity to strengthen the balance sheet.

- Expanding land positions by almost 50% since the second quarter of fiscal 2023.

- Aiming for delivery growth exceeding 10% annually in the next few years.

- In the second quarter of fiscal 2025, consolidated contracts decreased by 7.5%.

- The gross contract cancellation rate for consolidated contracts was 15% for the second quarter ended April 30, 2025.

To learn more about the company's growth strategy, you can read about the Growth Strategy of KHovnanian Homes.

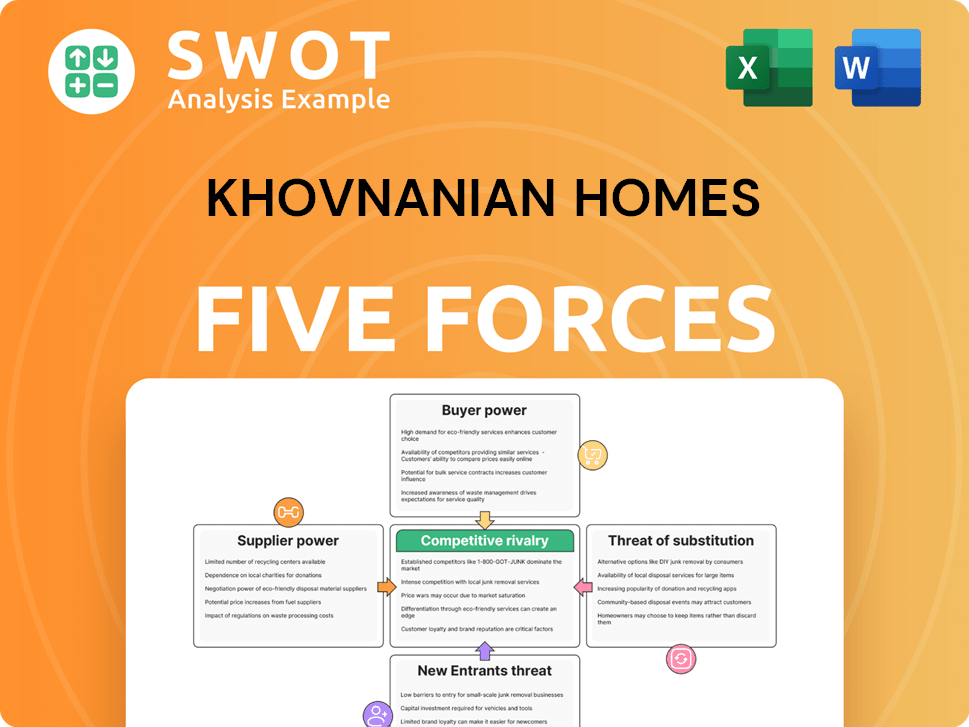

KHovnanian Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of KHovnanian Homes Company?

- What is Competitive Landscape of KHovnanian Homes Company?

- What is Growth Strategy and Future Prospects of KHovnanian Homes Company?

- What is Sales and Marketing Strategy of KHovnanian Homes Company?

- What is Brief History of KHovnanian Homes Company?

- Who Owns KHovnanian Homes Company?

- What is Customer Demographics and Target Market of KHovnanian Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.