KHovnanian Homes Bundle

Can KHovnanian Homes Conquer New Markets and Sustain Growth?

K. Hovnanian Enterprises, Inc. is charting an ambitious course, fueled by a strategic pivot designed to reshape its future in the KHovnanian Homes SWOT Analysis. From its roots in affordable housing to its current position as a major player in the Homebuilding Industry, the company's evolution is a testament to its adaptability. This analysis delves into the company's growth strategy and its potential to capitalize on emerging opportunities.

This exploration examines KHovnanian Homes' Future Prospects, including its expansion plans, especially the recent MOU with Saudi Arabia's NHC, which signals a significant move into international Real Estate Development. We'll dissect the company's Financial Performance, market trends, and strategic initiatives to provide a comprehensive outlook on KHovnanian Homes and the housing market, helping investors and stakeholders understand the company's potential for long-term success and navigate the complexities of the Homebuilding Industry.

How Is KHovnanian Homes Expanding Its Reach?

K. Hovnanian Enterprises is actively pursuing a robust Growth Strategy, focusing on strategic partnerships and increasing its land position and community count. This approach is designed to foster expansion and capitalize on emerging opportunities within the homebuilding industry. The company's initiatives are geared towards enhancing its market presence and driving sustainable growth.

A significant aspect of K. Hovnanian's expansion strategy involves international partnerships. The company is leveraging its extensive experience in the Real Estate Development sector to tap into new markets. This strategic direction is supported by investments in land and community development, positioning the company for sustained delivery growth.

The company's expansion plans are multifaceted, encompassing both domestic and international initiatives. These efforts are designed to bolster its competitive position and capitalize on the evolving dynamics of the homebuilding industry. The company's strategic moves are aimed at enhancing its market share and achieving long-term financial performance.

In May 2025, K. Hovnanian M.E. Investments, the Middle East subsidiary, signed a Memorandum of Understanding (MOU) with NHC, a leading real estate developer in Saudi Arabia. This partnership aims to develop residential communities across Saudi Arabia. The partnership leverages K. Hovnanian's nearly 70 years of experience and over 376,000 homes built in the United States.

As of January 31, 2025, total controlled consolidated lots increased by 28.8% year-over-year to 43,254. This increase reflects a strategic focus on a 'land-light' approach where 84% of lots were optioned. In the second quarter of fiscal 2025, the consolidated community count increased by 14.7% to 125 communities compared to the prior year.

The company reported a 12% year-over-year increase in open communities in Q2 2025. This growth is supported by the increased lot count and community count. K. Hovnanian aims to drive delivery growth in excess of 10% annually over the next few years, supported by these investments in land and community count.

The company's strategic focus on increasing land inventory and community presence positions it for sustained delivery growth. These initiatives are designed to support the company's financial performance. The company's expansion plans are a key part of its Growth Strategy.

K. Hovnanian is focusing on strategic partnerships and increasing its land position and community count to drive growth. The company's focus on increasing its land inventory and community presence positions it for sustained delivery growth. These initiatives are designed to support the company's financial performance.

- Strategic MOU with NHC in Saudi Arabia to develop residential communities.

- Total controlled consolidated lots increased by 28.8% year-over-year to 43,254 as of January 31, 2025.

- Consolidated community count increased by 14.7% in Q2 2025 compared to the prior year, reaching 125 communities.

- The company aims to drive delivery growth in excess of 10% annually over the next few years.

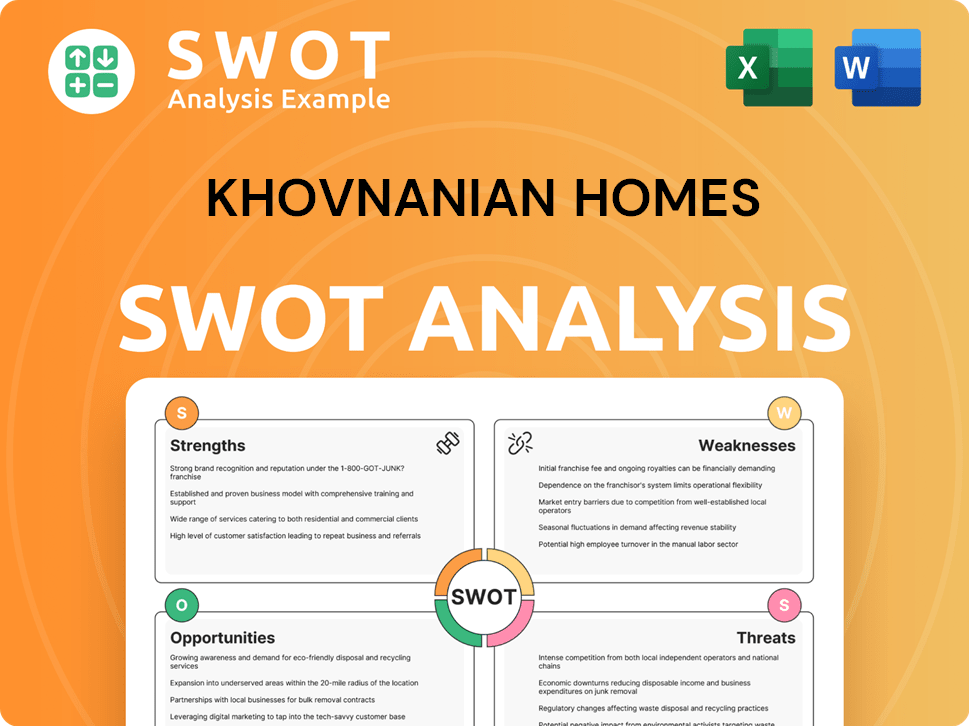

KHovnanian Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does KHovnanian Homes Invest in Innovation?

The strategic approach of KHovnanian Homes focuses on operational efficiency and capital allocation to foster sustained growth, particularly in the current market conditions. While specific details on research and development investments or in-house technology development are not extensively detailed in recent reports, the company's focus includes a commitment to building quality homes and enhancing profitability. This involves a keen eye on optimizing land transactions and adapting to economic challenges.

To navigate the housing market, the company emphasizes 'Quick Move-In homes' (QMIs) and utilizes mortgage rate buy-downs. QMIs help in efficient inventory management and sales. Mortgage rate buy-downs are a direct response to the economic environment, aiming to attract buyers despite high interest rates. This proactive strategy highlights an understanding of customer needs and market dynamics.

KHovnanian Homes reviews land transactions to ensure economic viability, even walking away from land option positions that no longer meet their return hurdles. This disciplined approach to land acquisition and the willingness to adjust the portfolio demonstrate a pragmatic approach to optimizing their portfolio and ensuring long-term financial health. This strategic decision to 'burn through certain less profitable land parcels at lower gross margins' in favor of new opportunities that meet return hurdles highlights a pragmatic approach to optimizing their portfolio.

KHovnanian Homes prioritizes 'Quick Move-In homes' (QMIs) to streamline sales and reduce backlog times. This strategy allows for faster inventory turnover and quicker revenue generation. QMIs are a key component of the company's strategy to adapt to changing market conditions and customer preferences.

The company uses mortgage rate buy-downs to attract buyers in a high-interest-rate environment. This tactic makes homes more affordable and competitive. This approach is a direct response to current economic challenges, aiming to attract buyers despite high interest rates.

KHovnanian Homes demonstrates a disciplined approach to land acquisition by reviewing land transactions to ensure economic viability. They are willing to walk away from land option positions that do not meet their return hurdles. This strategic decision to 'burn through certain less profitable land parcels at lower gross margins' in favor of new opportunities that meet return hurdles highlights a pragmatic approach to optimizing their portfolio.

KHovnanian Enterprises leverages strategic operational approaches to drive sustained growth, particularly in the current challenging market environment. The company emphasizes optimizing capital allocation and improving operational efficiencies. This includes a commitment to building quality homes while enhancing profitability.

KHovnanian Homes is committed to enhancing profitability through various strategic initiatives. These include optimizing capital allocation, improving operational efficiencies, and focusing on building quality homes. The company's financial performance is a key indicator of its success in the homebuilding industry.

The company's strategies are designed to adapt to market changes. This includes the use of mortgage rate buy-downs and a focus on QMIs. These tactics are essential for maintaining sales volume and attracting buyers in a competitive market. KHovnanian Homes is constantly adapting to market trends.

KHovnanian Homes' growth strategy involves several key initiatives aimed at navigating the current market conditions and ensuring future prospects. These include a focus on Quick Move-In homes, strategic use of mortgage rate buy-downs, and disciplined land acquisition practices. These actions are crucial for adapting to market changes and maintaining a competitive edge.

- Quick Move-In Homes: These homes are a key part of the strategy to improve inventory turnover.

- Mortgage Rate Buy-Downs: Attract buyers in a high-interest-rate environment.

- Disciplined Land Acquisition: Ensures economic viability and optimizes the portfolio.

- Operational Efficiency: Focus on improving capital allocation and profitability.

- Market Analysis: Competitors Landscape of KHovnanian Homes provides a broader view of the competitive environment.

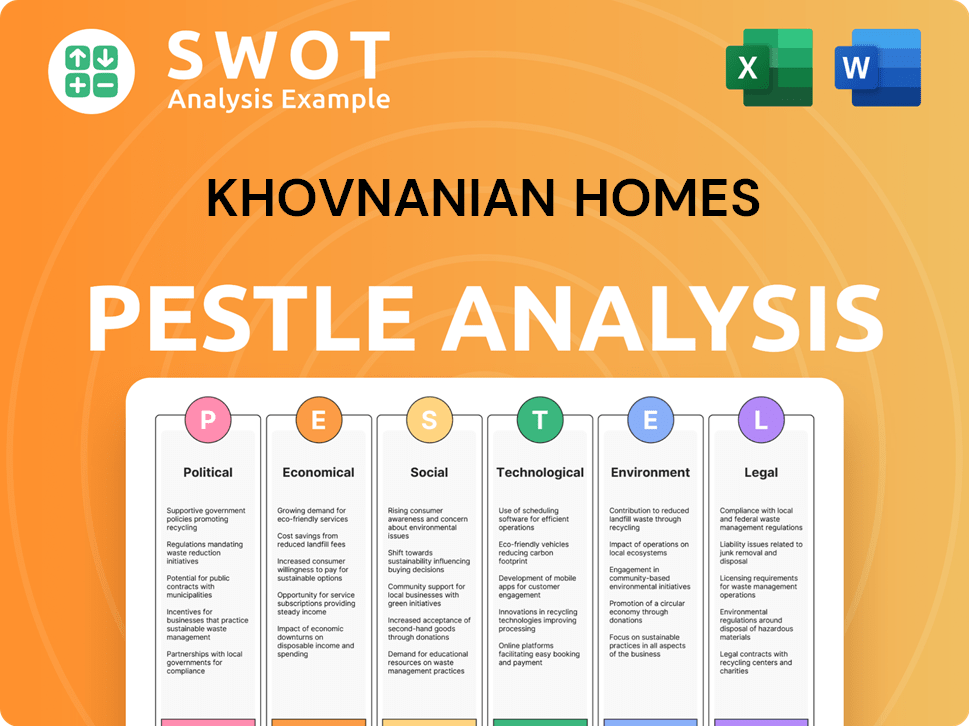

KHovnanian Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is KHovnanian Homes’s Growth Forecast?

K. Hovnanian Enterprises has shown consistent financial growth, which is a key aspect of its Growth Strategy. The company's performance in the homebuilding industry reflects its ability to adapt and succeed. Analyzing its Financial Performance is crucial for understanding its Future Prospects.

In the first quarter of fiscal 2025, the company experienced significant revenue increases. This positive momentum indicates a strong start to the year and suggests potential for continued expansion. The company's strategic initiatives are designed to sustain this growth and improve its market position.

The company's financial outlook for the coming quarters is promising, with projected revenue and EBITDA figures. These projections are based on current market conditions and the company's strategic plans. The company is also focused on managing its capital structure and reducing debt to strengthen its financial position.

Total revenues for the fiscal first quarter of 2025 increased by 13.4% to $673.6 million. Home sales revenues also increased by 12.8%, reaching $646.9 million. This demonstrates the company's ability to generate higher sales volume.

Income before income taxes for Q1 2025 rose by 22.4% to $39.9 million. Net income for the quarter was $28.2 million, or $3.58 per diluted common share. This indicates improved profitability compared to the previous year.

EBITDA for the first quarter of fiscal 2025 was $71.0 million, up from $64.5 million in the prior year's first quarter. This growth in EBITDA reflects the company's operational efficiency and financial health.

For the second quarter of fiscal 2025, total revenues are projected between $675 million and $775 million. Adjusted income before income taxes is expected to be between $20 million and $30 million, and adjusted EBITDA between $50 million and $60 million.

In fiscal year 2024, total revenues increased by 9.0% to $3.00 billion. The company reported a 24.38% increase in earnings, reaching $222.88 million. This demonstrates solid financial growth and effective management.

- The company delivered 6,151 homes in 2024.

- K. Hovnanian repurchased 188,800 shares of Class A common stock for $26.5 million in fiscal 2024.

- Total liquidity as of January 31, 2025, was $222.4 million.

K. Hovnanian is focused on improving operational efficiencies and optimizing capital allocation. The company aims to maintain disciplined cost management to enhance profitability and drive future growth. These initiatives are crucial for long-term success.

The company actively manages its capital structure, including share repurchases. K. Hovnanian plans to redeem the remaining $26.6 million of its 13.5% senior notes maturing in February 2026 before the end of the second quarter of fiscal 2025. This reduces leverage and improves financial flexibility.

Total liquidity as of January 31, 2025, was $222.4 million, within the targeted range of $170 million to $245 million. This strong liquidity position supports the company's operations and strategic investments. The company is well-positioned to navigate market fluctuations.

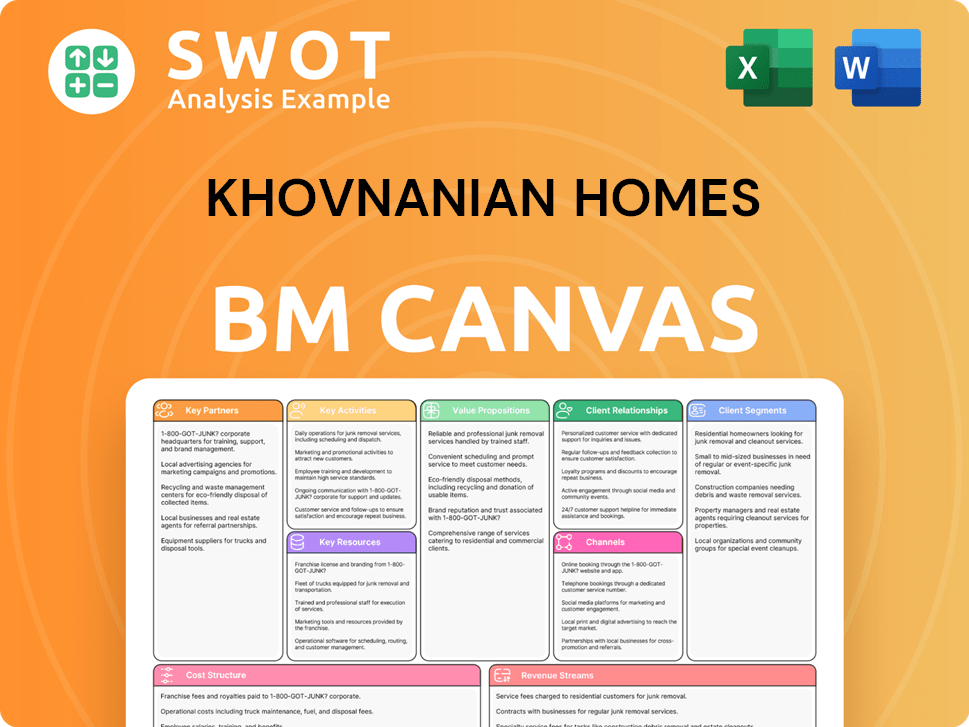

KHovnanian Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow KHovnanian Homes’s Growth?

The path for KHovnanian Homes, a key player in the Homebuilding Industry, is not without its challenges. Several risks and obstacles could influence the company's Growth Strategy and Future Prospects. These include market competition, regulatory shifts, and vulnerabilities within the supply chain, all of which demand careful management.

Construction delays due to material and labor shortages have added complexity. The company has also navigated economic uncertainties and fluctuations in mortgage rates, impacting homebuyer decisions. The company's financial performance can be affected by these factors, requiring strategic adjustments to maintain profitability.

KHovnanian Homes faces a competitive landscape. It must navigate challenges such as supply chain disruptions and economic uncertainty. For instance, the impact of mortgage rate buydowns can compress gross margins. The company's ability to adapt to changing market conditions and maintain customer satisfaction is critical.

The Homebuilding Industry is highly competitive. KHovnanian Homes competes with numerous national and regional builders. This requires constant innovation and efficient operations to maintain market share.

Supply chain disruptions can lead to construction delays and increased costs. Shortages of materials and labor have historically impacted cycle times. The company must secure reliable supply chains to maintain project timelines.

Economic downturns and changes in interest rates can affect housing demand. High mortgage rates can make homes less affordable, potentially impacting sales. KHovnanian Homes needs to adapt to changing economic conditions.

Changes in building codes, zoning regulations, and environmental standards can increase costs. Compliance with new regulations can add to project expenses. The company must stay informed and adapt to regulatory changes.

Negative customer experiences can damage the company's reputation. Complaints related to service or repairs can impact brand image. Addressing customer issues promptly is essential.

Fluctuations in interest rates and land prices can affect profitability. The company must manage financial risks through strategic planning and hedging. Maintaining a strong financial position is crucial.

To mitigate these risks, KHovnanian Homes employs several strategies. These include a 'land-light' approach, careful land acquisition reviews, and optimizing capital allocation. They also use joint ventures and options to manage risks. For more insights, consider reading the Brief History of KHovnanian Homes.

Improving operational efficiencies is a key focus. The company aims to reduce construction cycle times and enhance customer satisfaction. This involves streamlining processes and addressing customer complaints effectively. The goal is to maintain strong returns on equity and investment.

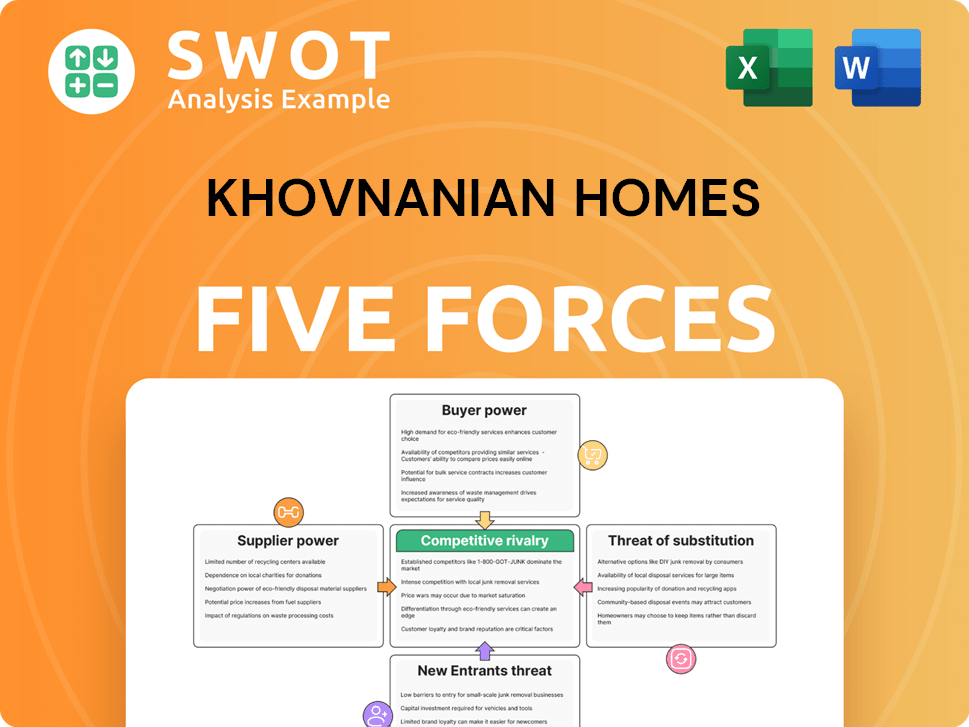

KHovnanian Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of KHovnanian Homes Company?

- What is Competitive Landscape of KHovnanian Homes Company?

- How Does KHovnanian Homes Company Work?

- What is Sales and Marketing Strategy of KHovnanian Homes Company?

- What is Brief History of KHovnanian Homes Company?

- Who Owns KHovnanian Homes Company?

- What is Customer Demographics and Target Market of KHovnanian Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.