Kodak Bundle

Can Kodak Thrive in Today's Competitive Market?

Kodak, once a titan of the photography world, faced an unprecedented challenge with the rise of digital technology. This iconic brand, born in 1888, has since navigated a complex journey of transformation. Today, the company operates in a vastly different Kodak SWOT Analysis landscape, making it crucial to understand its current position.

Understanding the Kodak competitive landscape requires a deep dive into its current operations and Kodak market analysis. This article will explore the Kodak competitors and the strategic shifts that have reshaped the company's Kodak business model. We'll also examine the Kodak industry dynamics, the Kodak challenges faced, and the strategies Kodak employs to compete in today's market.

Where Does Kodak’ Stand in the Current Market?

The current Kodak competitive landscape is focused on commercial print, packaging, and advanced materials & chemicals. The company strategically emphasizes its strength in digital plate technology and workflow software. Kodak's market analysis reveals a shift from consumer products to business-to-business (B2B) operations, focusing on industrial applications.

Kodak's business model involves providing solutions for offset printing, with plates and computer-to-plate (CTP) solutions. In packaging, the Flexcel NX System is a key offering. The company's geographical presence spans across North America, Europe, and Asia.

Kodak's challenges include adapting to market changes and maintaining profitability. The company has divested non-core assets to invest in core technologies. For fiscal year 2024, Kodak reported an operational EBITDA of $35 million, demonstrating improved financial health.

Kodak's core operations focus on commercial print, packaging, and advanced materials & chemicals. It provides digital plate technology and workflow software for commercial printing. The company is a key player in the offset printing market, offering plates and CTP solutions.

The value proposition of Kodak lies in providing high-quality solutions for the printing and packaging industries. Its Flexcel NX System is recognized for quality and efficiency. This focus allows Kodak to serve a growing demand for high-quality packaging.

Kodak has a global presence, serving customers across North America, Europe, Asia, and other regions. This broad reach allows it to cater to diverse markets and customer needs worldwide.

The primary customer segments for Kodak include packaging companies, publishing houses, and visual communications businesses. These segments align with its focus on commercial print and packaging solutions.

Kodak has transformed from a consumer-centric brand to a B2B enterprise, focusing on industrial applications. This strategic shift involved divesting non-core assets and investing in technologies that align with its current direction. The company is committed to profitability and strategic growth within its chosen segments. For more insights, see the Growth Strategy of Kodak.

- Focus on commercial print and packaging.

- Emphasis on digital plate technology and workflow software.

- Global presence with a B2B focus.

- Strategic investments in core businesses.

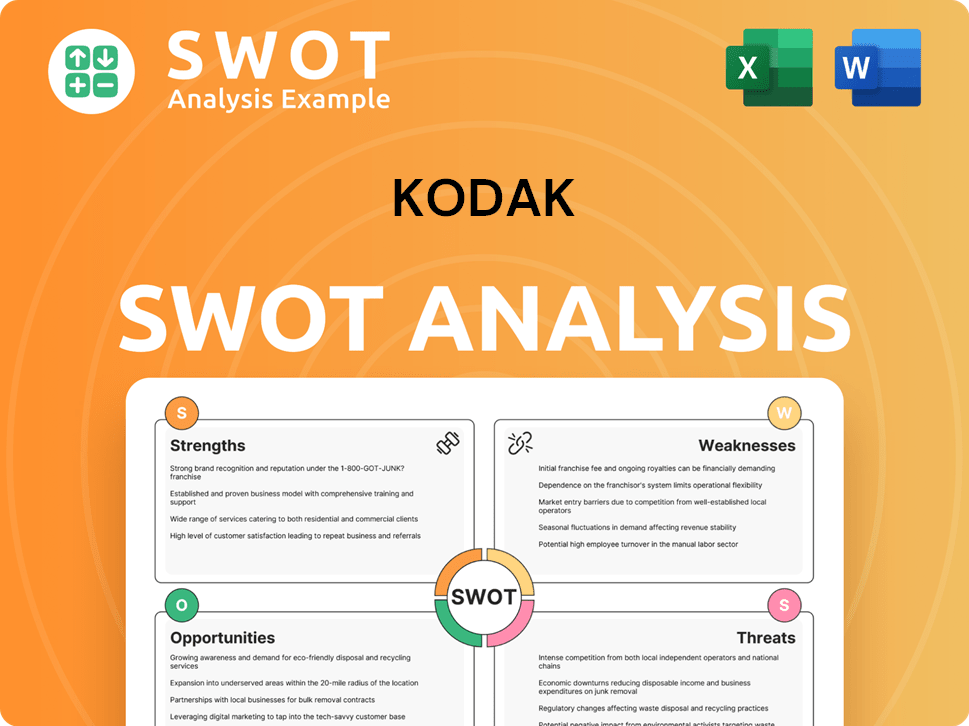

Kodak SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kodak?

Analyzing the Kodak competitive landscape reveals a complex environment shaped by technological shifts and industry consolidation. The company faces a diverse array of rivals across its various business segments, from commercial print to advanced materials. Understanding these competitors is crucial for assessing Kodak's market analysis and strategic positioning.

The evolution of the photography industry and the rise of digital technologies have significantly altered the competitive dynamics. Kodak's challenges include adapting to these changes while competing with established players and emerging innovators. A deeper look into Kodak's business model and its ability to navigate this landscape is essential for understanding its future prospects.

For a comprehensive understanding of Kodak's strategic direction, consider reading about the Growth Strategy of Kodak, which provides additional insights into the company's plans and initiatives.

In the commercial print and packaging sectors, Kodak competes directly with major players offering similar solutions. These competitors provide a wide range of products and services, challenging Kodak on multiple fronts.

Fujifilm is a key competitor, providing graphic arts solutions such as plates, presses, and workflow software. Fujifilm has a strong presence in the printing industry, competing directly with Kodak on technology and market share. Fujifilm reported revenue of approximately $22.7 billion in fiscal year 2023.

Agfa-Gevaert offers a range of printing solutions, particularly in offset and inkjet segments. Agfa-Gevaert competes with Kodak in the printing sector, focusing on technology and market share. Agfa-Gevaert generated revenue of about $2.5 billion in 2023.

Konica Minolta is a significant player in the digital printing space, offering diverse solutions for commercial and industrial printing. Konica Minolta competes with Kodak in digital printing, providing a wide range of products and services. Konica Minolta's revenue in fiscal year 2023 was approximately $6.9 billion.

In the advanced materials and chemicals space, Kodak competes with numerous chemical companies and material science firms. These companies often have larger product portfolios and broader market reach. The competition is intense due to the specialized nature of the market.

The rise of digital printing technologies introduces competition from companies specializing in inkjet and toner-based solutions. These companies often offer more integrated digital ecosystems, challenging Kodak's position in the market. This segment is experiencing rapid innovation and growth.

Kodak's competitive environment is shaped by several factors. These include the rise of digital technologies, industry consolidation, and the emergence of sustainable printing solutions. Understanding these dynamics is crucial for Kodak's strategic planning.

- Market Share: Assessing Kodak's market share compared to competitors like Canon and Nikon is essential.

- Strategic Decisions: Analyzing the key strategic decisions of Kodak's competitors provides insights into their successes and failures.

- Financial Performance: Comparing Kodak's financial performance with its rivals offers a benchmark for its operational efficiency.

- Innovation: Kodak's innovation and product development efforts are critical for maintaining a competitive edge.

- Challenges: Addressing Kodak's challenges in adapting to digital technologies and changing consumer preferences is vital.

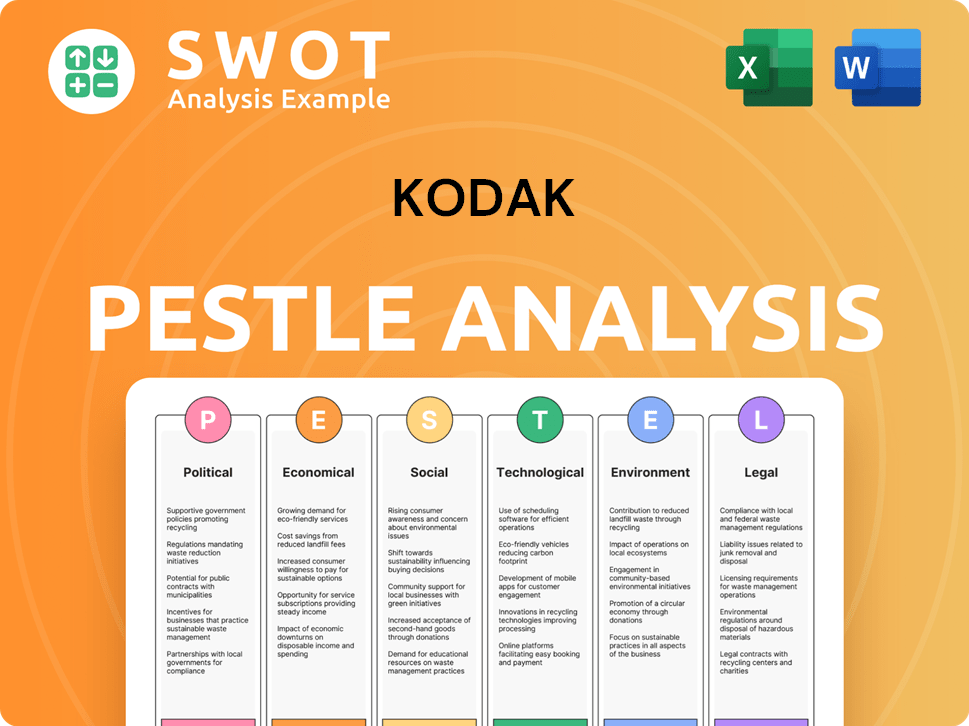

Kodak PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kodak a Competitive Edge Over Its Rivals?

The competitive landscape for the company has evolved significantly, transitioning from consumer-focused imaging to industrial applications. Key milestones include the shift towards digital technologies and strategic moves into commercial printing and packaging solutions. Understanding the Kodak competitive landscape requires analyzing its core strengths and how it adapts to market changes. The company's ability to repurpose its core competencies for new markets is crucial.

The company's strategic decisions have focused on leveraging its intellectual property and expertise in imaging science. This includes investing in research and development to maintain a competitive edge. The Kodak business model has adapted to the digital age by focusing on B2B relationships and industrial applications. This shift is a direct response to the challenges posed by digital photography and the rise of smartphones.

A deep dive into the Kodak market analysis reveals the importance of its proprietary technologies and global distribution network. The company's historical brand equity provides a foundation for its current operations. The company's long-standing customer relationships in the commercial printing and packaging sectors offer a stable revenue base.

The company's proprietary technologies are a significant competitive advantage. These include digital plates for offset printing, such as the Sonora Process Free Plates, and flexographic solutions like the Flexcel NX System. These technologies offer environmental benefits and enhance print quality, providing a distinct selling proposition.

A substantial portfolio of patents in imaging, materials science, and chemical formulations provides a barrier to entry. This intellectual property is a foundation for future product development. The company continues to invest in new technologies to maintain its competitive edge and adapt to evolving market demands.

The company's brand equity, though transformed, still carries a legacy of quality and reliability. This legacy is leveraged in B2B relationships. Its established global distribution network and long-standing customer relationships provide a stable revenue base and opportunities for upselling and cross-selling.

The company leverages its extensive research and development capabilities. Continuous investment in new technologies is key to maintaining its competitive edge. This focus on innovation is crucial for adapting to evolving market demands and staying ahead of Kodak competitors.

The company's competitive advantages stem from its history of innovation and expertise in imaging science. Its proprietary technologies, such as the Sonora Process Free Plates and Flexcel NX System, offer significant benefits. These advantages are crucial in the current Kodak industry landscape.

- Proprietary Technologies: Digital plates and flexographic solutions.

- Intellectual Property: A strong patent portfolio.

- Brand Equity: Legacy of quality in industrial circles.

- Global Network: Established distribution and customer relationships.

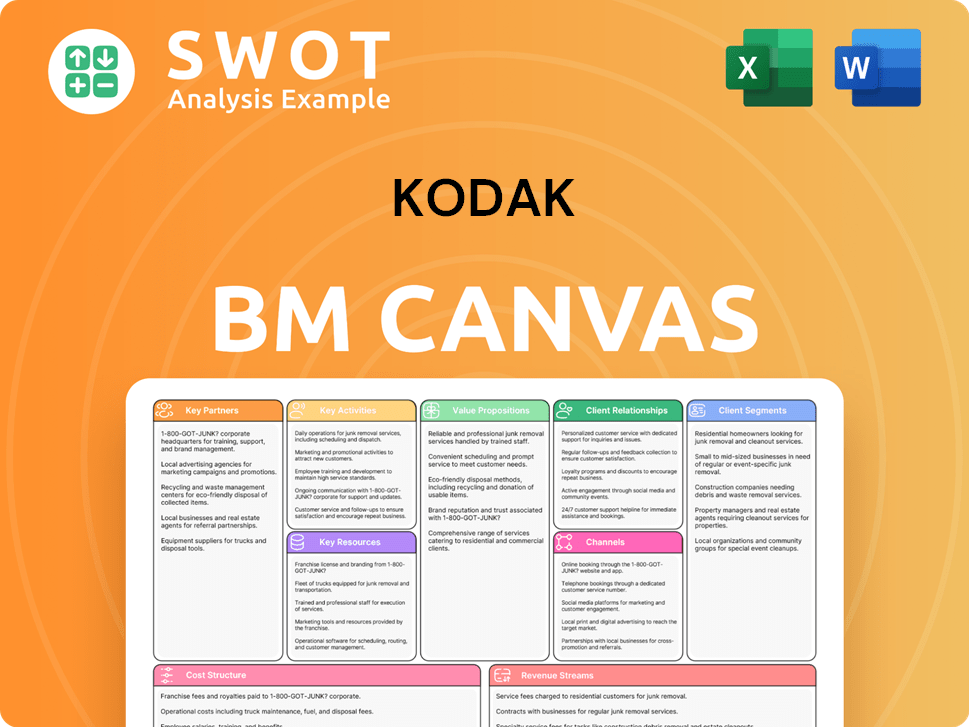

Kodak Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kodak’s Competitive Landscape?

The Owners & Shareholders of Kodak face a competitive landscape shaped by industry trends, future challenges, and opportunities. The company's position requires strategic adaptation to navigate shifts in technology, consumer preferences, and market dynamics. Understanding the competitive environment is crucial for making informed business decisions.

Kodak's industry position involves a transition from traditional photography to digital printing and advanced materials. Risks include competition from larger firms and the decline in traditional offset printing. The future outlook depends on successfully leveraging its expertise in materials science and adapting to evolving market demands. The company's ability to innovate and capitalize on emerging opportunities is key.

The Kodak competitive landscape is heavily influenced by the ongoing shift toward digital printing. Increasing demand for sustainable solutions and the growth of packaging and functional printing also play a significant role. Technological advancements in inkjet and advanced materials present both challenges and opportunities.

A key challenge is the continued decline in traditional offset printing volumes. Intense competition from larger companies with greater R&D budgets also poses a threat. Maintaining profitability while investing in new technologies and markets remains a critical balancing act for Kodak.

Significant opportunities exist in emerging markets where demand for print and packaging is still growing. Innovations in functional printing, such as printed electronics and biomedical applications, also present avenues for diversification. Kodak's focus on sustainable products aligns with growing industry demand.

Kodak aims to remain resilient and capitalize on evolving market dynamics by leveraging its expertise in materials science. The company is focusing on sustainable products, such as process-free plates, to gain a competitive edge. Strategic partnerships and collaborations are also being explored.

The Kodak market analysis reveals a need to adapt to the digital printing revolution and the impact of smartphones. Kodak's competitors, such as Canon and Fujifilm, have made significant strategic decisions. Kodak's financial performance compared to rivals highlights the need for strategic adjustments.

- The decline in traditional offset printing has forced Kodak to pivot towards digital and specialized applications.

- Competition from larger companies with greater R&D budgets presents a significant challenge.

- Emerging markets and innovations in functional printing offer growth opportunities.

- Kodak's strategic focus on sustainable products provides a competitive advantage.

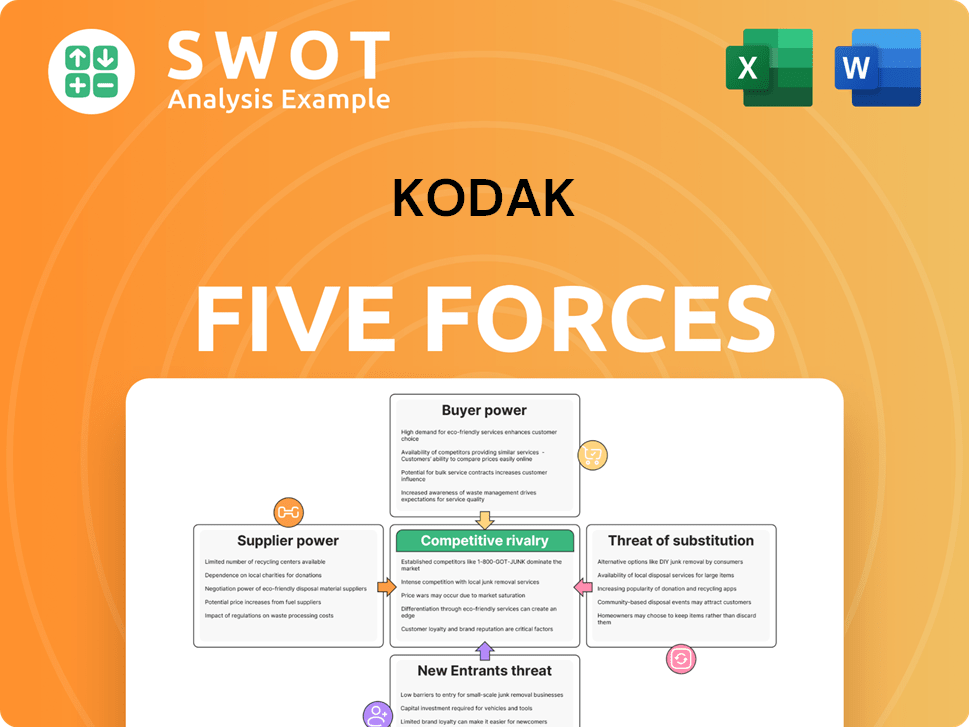

Kodak Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kodak Company?

- What is Growth Strategy and Future Prospects of Kodak Company?

- How Does Kodak Company Work?

- What is Sales and Marketing Strategy of Kodak Company?

- What is Brief History of Kodak Company?

- Who Owns Kodak Company?

- What is Customer Demographics and Target Market of Kodak Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.