Kodak Bundle

Who Really Owns the Kodak Company Today?

Ever wondered who steers the ship at Eastman Kodak Company, the iconic name synonymous with photography for over a century? Understanding the Kodak ownership structure is key to grasping its strategic pivots and future potential. From its groundbreaking beginnings to its current focus on print and advanced materials, the company's journey is a fascinating case study in market adaptation.

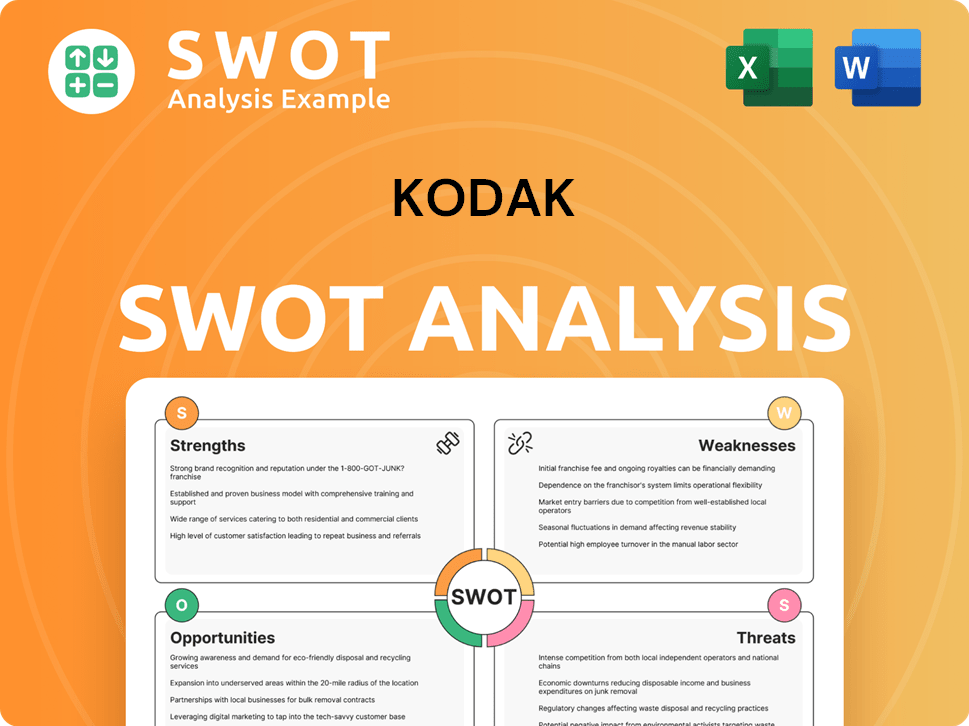

Delving into the Kodak SWOT Analysis reveals how ownership changes have shaped its response to technological shifts. The Kodak company has navigated significant challenges, including bankruptcy, and its current ownership reflects a dynamic evolution. Exploring the Kodak ownership structure provides valuable insights into the Kodak brand's resilience and its ongoing transformation in a competitive landscape. Understanding who owns Kodak today is crucial for anyone interested in the Kodak stock, its history, and its future.

Who Founded Kodak?

The genesis of the Eastman Dry Plate and Film Company, later known as the Eastman Kodak Company, is inextricably linked to George Eastman. His vision and financial backing were pivotal in establishing the company. Eastman's innovations in photography, particularly the roll film system patented in 1884, laid the groundwork for the company's future.

In 1888, the Eastman Dry Plate and Film Company was officially founded, and the name was changed to Eastman Kodak Company in 1892. Initially, Eastman held a significant portion of the company's shares, allowing him to steer the company's direction and growth. This concentrated ownership reflected his crucial role as the inventor and primary financier.

Early ownership of the Kodak company was largely consolidated in Eastman's hands. This structure facilitated swift decision-making and rapid innovation, contributing to the early success of the company in the photographic industry. The company's focus on making photography accessible was directly reflected in Eastman's control.

George Eastman was the primary founder of the Eastman Kodak Company. He invented the roll film system and provided the initial financial backing. His vision was instrumental in the company's early success.

Eastman held the majority of shares in the early days of the company. This structure allowed for centralized control and quick decision-making. Other early investors played a role, but their stakes were less significant.

Early investments were crucial for funding research, development, and manufacturing. These investments helped the company grow and expand its operations. The focus was on making photography accessible to the masses.

There were no significant early ownership disputes that altered the company's trajectory. Eastman's strong leadership and vision helped avoid major conflicts. The company's focus remained on innovation and growth.

The early vision was to simplify photography for everyone. This goal influenced how the company was structured and managed. This vision helped shape the Kodak brand.

Eastman's roll film system was a groundbreaking innovation. It made photography easier and more convenient. This innovation set the stage for the company's success.

Early ownership of the Eastman Kodak Company was primarily concentrated with George Eastman, who held the majority of shares. While specific percentages of other early investors are not widely detailed, their contributions were essential for the company's initial capital and operations. The early focus on accessible photography, championed by Eastman, shaped the company's direction. For more information about the company's target market, you can read about the target market of Kodak.

The early ownership structure was essential for the company's growth.

- George Eastman's role was pivotal.

- Early investors provided crucial financial support.

- The company's focus on accessible photography was key.

- The concentrated ownership enabled swift decision-making.

Kodak SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kodak’s Ownership Changed Over Time?

The Eastman Kodak Company, a name synonymous with photography for over a century, has seen its ownership structure evolve dramatically. Initially, after its 1901 IPO, the company was widely held, reflecting its status as a blue-chip stock. The advent of digital photography, however, presented significant challenges, culminating in a Chapter 11 bankruptcy filing in January 2012, which fundamentally reshaped its ownership landscape.

The bankruptcy proceedings led to a significant shift in ownership. Upon emerging from bankruptcy in September 2013, a consortium of lenders and bondholders, including the U.K. Kodak Pension Plan (KPP), converted their debt into equity. KPP became the dominant shareholder, holding approximately 85% of the common stock. Distressed debt investors and hedge funds also gained significant stakes during this restructuring. These events marked a pivotal moment in the Kodak history, altering its strategic direction.

| Key Event | Impact on Ownership | Approximate Date |

|---|---|---|

| Initial Public Offering | Widely held by institutional and individual investors | 1901 |

| Chapter 11 Bankruptcy Filing | Led to a restructuring of debt and equity | January 2012 |

| Emergence from Bankruptcy | KPP and other lenders became major shareholders | September 2013 |

As of early 2025, Kodak ownership is primarily comprised of institutional investors, mutual funds, and individual shareholders. While precise percentages fluctuate, major asset management firms and investment funds hold significant shares. For example, in the first quarter of 2024, institutional ownership accounted for a substantial portion of the outstanding shares. The company’s focus has shifted from consumer imaging to commercial printing, advanced materials, and brand licensing, reflecting the changes in its ownership structure and the broader market dynamics. The Kodak brand continues to be a recognizable name, navigating the evolving landscape of the photography and imaging industries.

The Kodak company has seen major shifts in ownership due to market changes and financial restructuring.

- Initial public offering in 1901 established a broad shareholder base.

- Bankruptcy in 2012 led to a significant restructuring of ownership.

- Emergence from bankruptcy saw lenders and bondholders gain major stakes.

- Today, institutional investors and funds are key stakeholders.

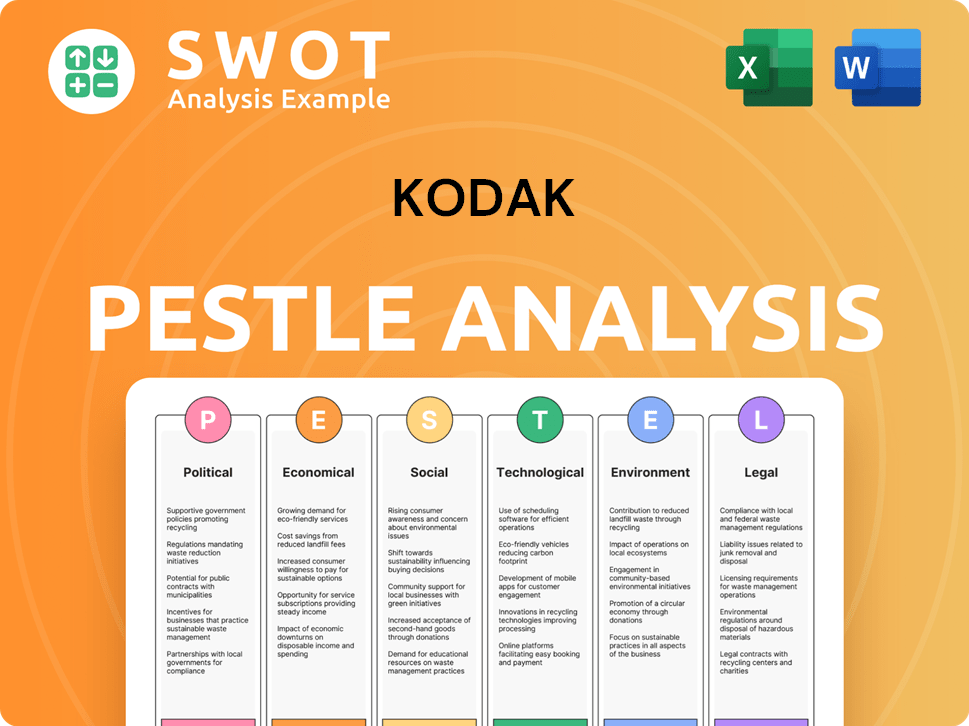

Kodak PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kodak’s Board?

The current Board of Directors of Eastman Kodak Company, as of early 2025, is pivotal in its governance, mirroring its ownership structure. The board includes independent directors and those with expertise relevant to Kodak's focus areas. Individuals with backgrounds in industrial manufacturing or corporate restructuring are often appointed. The composition balances oversight, strategic guidance, and shareholder interests.

The board's decisions are made collectively, representing all shareholders. Independent directors ensure corporate governance best practices. Details on the board's composition and decisions are in annual proxy statements and SEC filings. The board's role is critical in guiding the Kodak company through its ongoing transformation and financial performance.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Richard L. Braddock | Lead Independent Director | Extensive experience in finance and corporate governance. |

| James Continenza | Executive Chairman | Experience in finance and restructuring. |

| David E. Bullwinkle | Director | Expertise in manufacturing and operations. |

The voting structure for Kodak stock is generally based on a one-share, one-vote principle. Major institutional investors, due to their substantial shareholdings, exert significant influence through their voting power. There are no publicly disclosed dual-class share structures or special voting rights. The company has not been subject to high-profile proxy battles or activist investor campaigns recently. For more information, you can read the Revenue Streams & Business Model of Kodak.

The Board of Directors oversees Eastman Kodak Company, ensuring strategic direction and shareholder interests. The voting structure is straightforward, with major investors wielding significant influence. The board's decisions are crucial for the company's ongoing business transformation.

- The board includes independent directors and those with relevant expertise.

- Voting rights are based on a one-share, one-vote principle.

- The board's actions are detailed in annual filings.

- Focus on business transformation and financial performance.

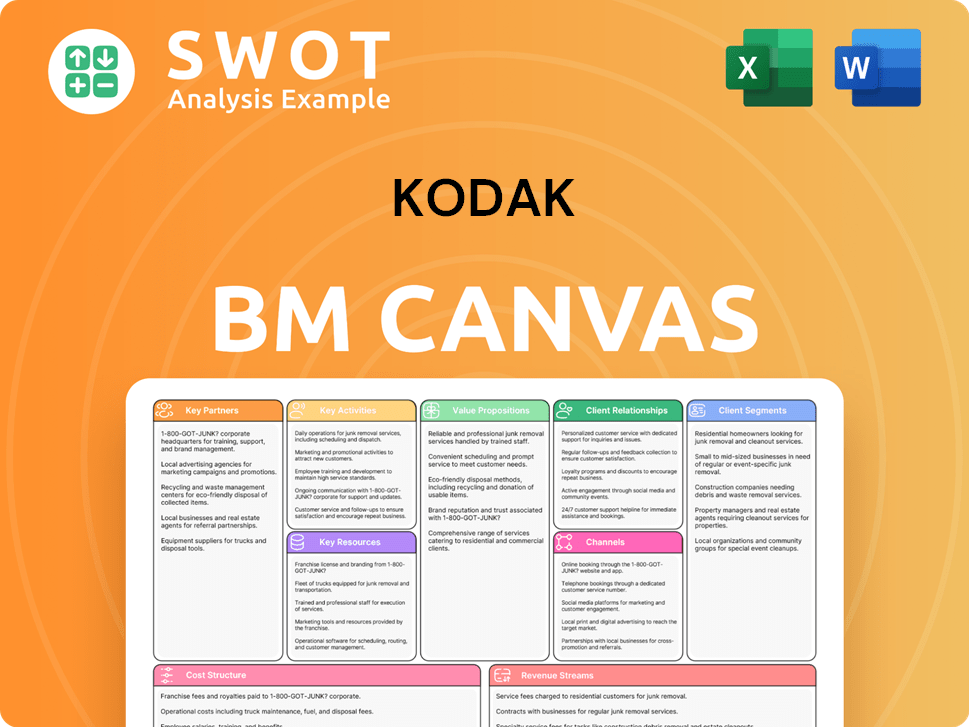

Kodak Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kodak’s Ownership Landscape?

Over the past few years, the Eastman Kodak Company has seen its ownership profile evolve within the context of its strategic transformation. While no dramatic shifts have occurred like the post-bankruptcy restructuring, the company has engaged in financial activities that subtly impact its ownership. These include potential share buybacks, which reduce the number of outstanding shares and can increase the proportional ownership of remaining shareholders, and occasional secondary offerings, which can dilute existing ownership but raise capital. Specific details on buyback programs or secondary offerings in 2024-2025 would be available in the company's financial reports.

Industry trends, such as increased institutional ownership and the rise of passive investing through index funds, also influence Kodak ownership. A significant portion of Kodak stock is held by large institutional investors. Given George Eastman's initial dominant stake and the subsequent public offerings and bankruptcy, the current ownership is largely dispersed among a wide range of institutional and individual investors. There have been no public statements by the company or analysts in late 2024 or early 2025 indicating plans for privatization or a significant change in its public listing status. The focus remains on optimizing its current business segments in commercial print, advanced materials, and brand licensing. For more background, you can read a Brief History of Kodak.

Kodak company ownership structure is primarily dispersed among institutional and individual investors. Major institutional holders include investment firms and mutual funds. The company's financial reports provide detailed information on significant shareholders and ownership changes.

Kodak may engage in share buybacks to reduce outstanding shares. Secondary offerings can dilute ownership but raise capital. Details on these activities are found in the company's financial filings and SEC filings.

Increased institutional ownership is a common trend in publicly traded companies. Passive investing through index funds also influences Kodak ownership. These trends shape the Kodak brand's investor base.

There are no current plans for privatization or significant changes in public listing status. The company focuses on its core business segments. Leadership changes and new strategic investors are announced through official channels.

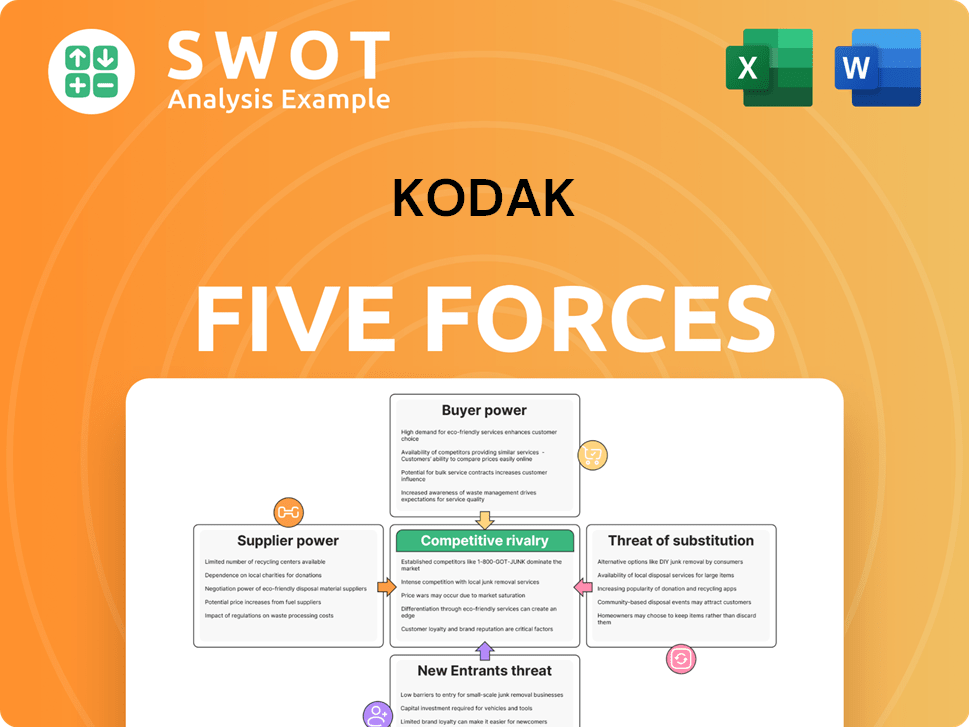

Kodak Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kodak Company?

- What is Competitive Landscape of Kodak Company?

- What is Growth Strategy and Future Prospects of Kodak Company?

- How Does Kodak Company Work?

- What is Sales and Marketing Strategy of Kodak Company?

- What is Brief History of Kodak Company?

- What is Customer Demographics and Target Market of Kodak Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.