Kodak Bundle

Can Kodak Reclaim Its Former Glory?

Kodak, a name synonymous with photography, has undergone a dramatic transformation. From its iconic film days to a focus on print and advanced materials, the company's journey is a testament to its resilience. This exploration delves into Kodak's strategic pivot, examining its Kodak SWOT Analysis and the key decisions shaping its future.

The early 2024 sale of its Prosper inkjet business signals a clear commitment to core growth areas. This strategic shift allows us to analyze Kodak's business model and its plans for expansion, innovation, and market share growth within the evolving print and materials sectors. Understanding Kodak's strategic initiatives for growth is crucial for investors and analysts alike, especially considering its recent financial performance and future outlook. This analysis will also cover Kodak's challenges and opportunities in the digital age.

How Is Kodak Expanding Its Reach?

The current expansion initiatives of the company are focused on strengthening its position in commercial print and growing its advanced materials and chemicals segments. These strategies are designed to diversify revenue streams and foster sustainable growth. The company's focus on innovation and strategic investments aims to capitalize on emerging opportunities within specialized markets.

The sale of the Prosper inkjet business, expected to conclude by the end of the first half of 2024, is a critical enabler of this strategy. This transaction will provide capital to invest in core areas, supporting the company's expansion plans. These strategic moves are part of a broader effort to ensure the company's long-term viability and competitiveness.

In commercial print, the company is prioritizing its Sonora process-free plates. These plates continue to gain market share due to their environmental benefits and efficiency. The company is actively pursuing opportunities to expand the adoption of these plates globally, targeting regions with increasing demand for sustainable printing solutions. This focus aligns with the growing trend towards eco-friendly practices in the printing industry.

The company is concentrating on expanding its Sonora process-free plates. These plates offer environmental advantages and operational efficiencies. The company aims to increase their global adoption, particularly in regions with a growing demand for sustainable printing solutions. This initiative supports the company's Kodak marketing strategy by highlighting its commitment to innovation.

The company is exploring new applications for its existing intellectual property and expertise. This includes specialty chemicals for batteries and flexible electronics. Although specific launches haven't been widely publicized, the company intends to leverage its R&D for high-growth opportunities. This diversification strategy is key to the company's future prospects.

The sale of the Prosper inkjet business is a key enabler, providing capital for core investments. This strategic move supports the company's expansion into commercial print and advanced materials. The company aims to reduce its reliance on the mature commercial print market. This aligns with the company's plans for sustainable growth.

The company emphasizes its commitment to innovation within its advanced materials and chemicals segments. This indicates a pipeline of potential new offerings. R&D investments are crucial for identifying and pursuing high-growth opportunities. This focus supports the company's technological advancements and innovations.

The company's growth strategy focuses on commercial print and advanced materials. These areas are expected to drive future revenue and market share. The company's strategic initiatives for growth include expanding its Sonora plates and exploring new applications for its chemical expertise.

- Expansion of Sonora Process-Free Plates: Continued market share growth due to environmental benefits.

- Advanced Materials and Chemicals: Exploring new applications for specialty chemicals.

- Strategic Investments: Capital from the Prosper sale to fund core business areas.

- Innovation: Emphasizing R&D to identify high-growth opportunities.

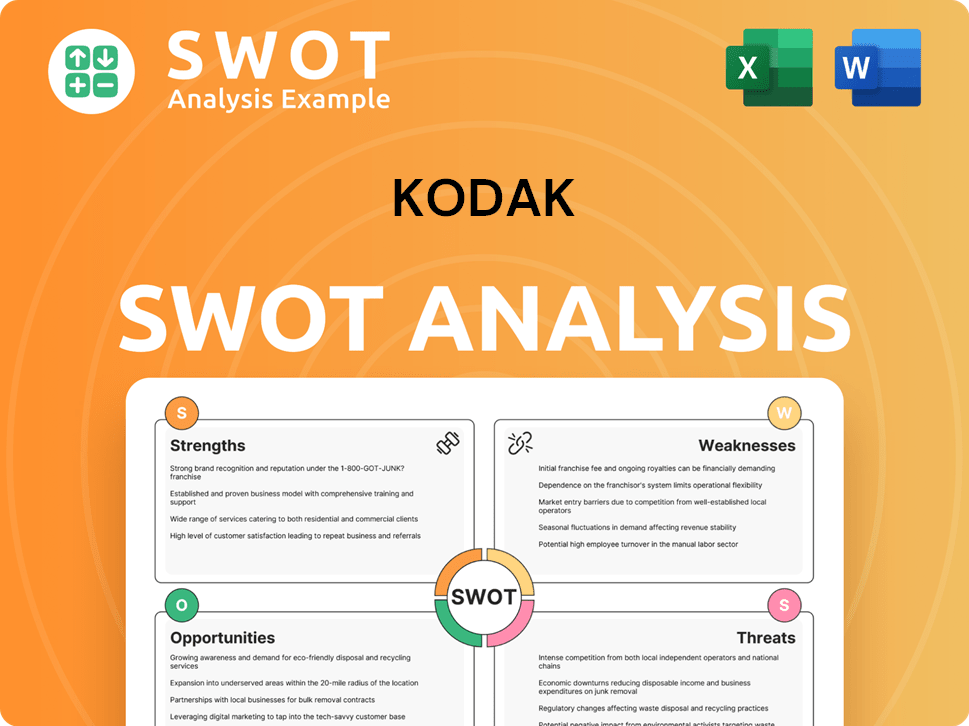

Kodak SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kodak Invest in Innovation?

The innovation and technology strategy of the company centers on its imaging science legacy, now applied to commercial print and advanced materials. A key focus is research and development (R&D) for its Sonora process-free plates. This eliminates chemical processing, supporting both environmental sustainability and operational efficiency for printers. This strategy is crucial for the company's long-term vision and goals.

The company's approach involves continuous improvement and the development of specialized chemical formulations and materials for industrial clients. The company's commitment to innovation is evident in its continued investment in R&D, aiming to create proprietary solutions that address specific market needs and provide a competitive advantage. This strategy is a key part of the company's strategic initiatives for growth.

In the realm of advanced materials and chemicals, the company leverages its extensive patent portfolio and scientific knowledge. The company often highlights its unique manufacturing capabilities and expertise in precision coating and synthesis as key differentiators in its advanced materials segment. This is part of the company's plans for sustainable growth.

The company is heavily invested in R&D for its Sonora process-free plates. This innovation reduces environmental impact and improves operational efficiency for printers. This is a core element of the company's technological advancements and innovations.

The company is developing new applications using its patent portfolio and scientific knowledge. They focus on specialized chemical formulations and materials for industrial clients. This strategy supports the company's expansion into new markets.

The company continues to invest in R&D to create proprietary solutions. These solutions aim to address specific market needs and provide a competitive advantage. This is a key aspect of the company's research and development investments.

The company highlights its unique manufacturing capabilities. Expertise in precision coating and synthesis is a key differentiator. This helps in maintaining a competitive advantage.

The Sonora process-free plates are a prime example of the company's sustainability efforts. This supports environmental goals and enhances operational efficiency. This aligns with the company's plans for sustainable growth.

The company aims to create proprietary solutions through R&D. This approach helps in addressing market needs and gaining a competitive advantage. This is part of the company's competitive advantages and disadvantages.

The company's innovation strategy is centered on specific areas. These include process-free printing plates and the development of advanced materials. The company's Competitors Landscape of Kodak provides additional context on the competitive environment.

- Sonora Plates: Continuous improvement and expansion of compatibility.

- Advanced Materials: Development of specialized chemicals and materials.

- R&D: Investment in proprietary solutions.

- Manufacturing: Leveraging unique capabilities in coating and synthesis.

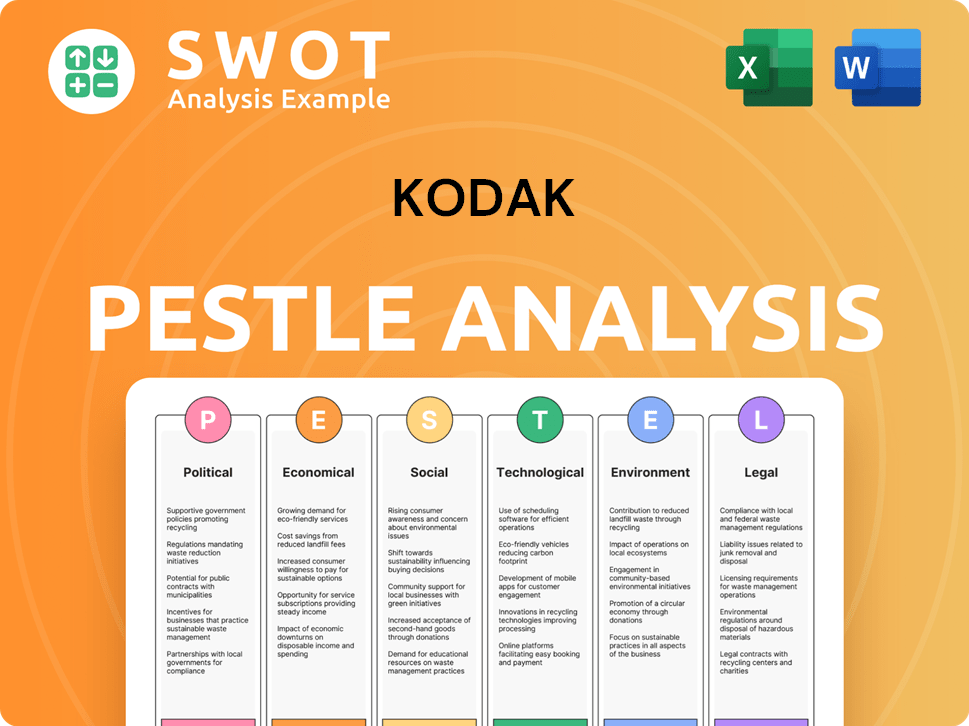

Kodak PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kodak’s Growth Forecast?

The financial outlook for the company in 2024 and beyond centers on strategic repositioning and profitability within its core business segments. A significant financial event was the sale of the Prosper inkjet business for $200 million. This capital is earmarked for debt reduction and investment in growth areas. This approach is a key part of the overall Kodak growth strategy, focusing on sustainable financial health.

For the first quarter of 2024, the company reported revenues of $274 million. This figure reflects a slight decrease compared to the previous year, mainly due to the impact of the Prosper sale and other operational adjustments. However, the company is prioritizing improvements in operational EBITDA and cash flow from operations. This focus is crucial for achieving long-term financial goals and ensuring Kodak's future prospects.

Management is confident in achieving its long-term financial goals. This confidence stems from a focus on profitable segments, particularly traditional print solutions and emerging opportunities in advanced materials. While specific revenue targets for 2025 were not explicitly detailed in recent public releases, the strategy suggests organic growth within core businesses. This growth will be supported by strategic investments and potentially smaller acquisitions. The aim is to maintain healthy profit margins by emphasizing high-value products and services. This financial narrative underpins the company's strategic plans, aiming for sustainable profitability and shareholder value through a more streamlined and focused business model, which is a critical element of a thorough Kodak company analysis.

The company is concentrating on its profitable segments, including traditional print solutions and advanced materials. This focus is designed to drive organic growth and maintain healthy profit margins. The strategy emphasizes high-value products and services to support profitability.

Strategic investments and potential targeted acquisitions are planned to support growth. These investments are aimed at strengthening core businesses and exploring new opportunities. The company is carefully managing its capital to ensure sustainable growth and shareholder value.

Improving operational EBITDA and cash flow from operations is a key priority. This focus is essential for achieving long-term financial goals. The company is streamlining its operations to enhance efficiency and profitability.

The sale of the Prosper inkjet business provided capital for debt reduction. This strategic move strengthens the company's financial position. Reducing debt is a key step in ensuring long-term financial stability.

The company's strategy includes a focus on organic growth within its core businesses, supported by strategic investments and potential acquisitions. This approach aims to ensure sustainable profitability and shareholder value. This is a critical part of the company's plan for Kodak's plans for sustainable growth. For a deeper dive into the company's history and strategies, you can find more information in an article about the evolution of the company.

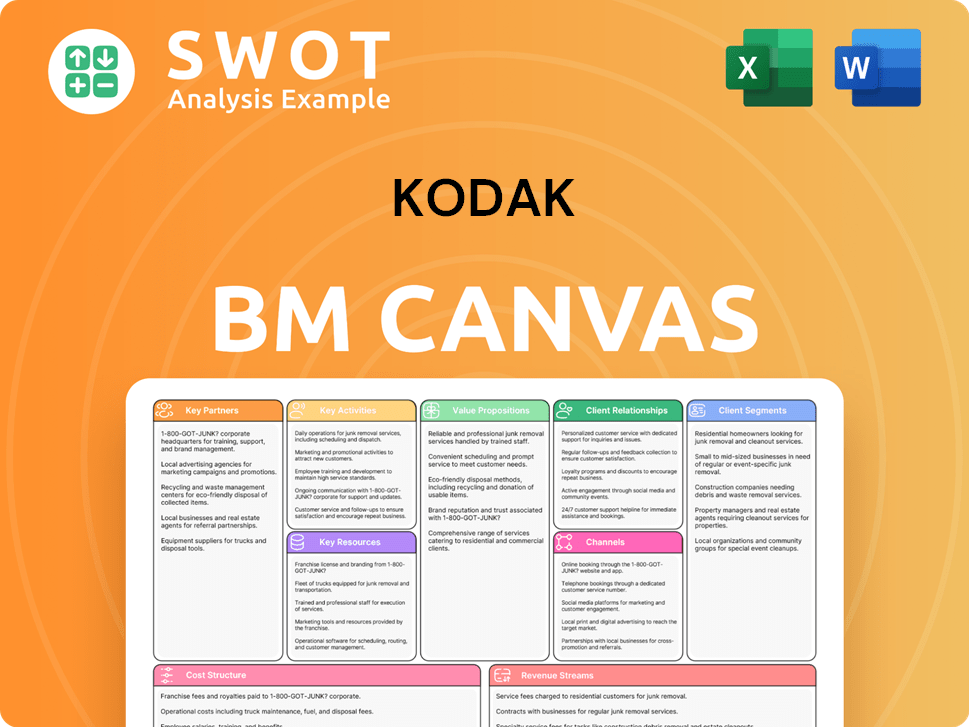

Kodak Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kodak’s Growth?

The path ahead for the company, especially concerning its Kodak growth strategy, is laden with potential risks and obstacles. These challenges span market competition, regulatory changes, supply chain issues, and the rapid pace of technological advancement. Navigating these complexities is crucial for realizing the company's Kodak future prospects.

Market competition within the commercial print industry presents a significant hurdle. Regulatory shifts, such as stricter environmental standards, could necessitate substantial investments. Supply chain vulnerabilities, exacerbated by global events, might disrupt operations and impact profitability, directly influencing the Kodak company analysis.

Technological disruption demands continuous investment in research and development to remain competitive. Internal resource constraints, including access to specialized talent and capital, could also hinder expansion initiatives. The company's management utilizes ongoing market analysis and risk management frameworks to address these challenges. For a deeper understanding of its journey, consider the Brief History of Kodak.

The commercial print industry is highly competitive, with numerous established players and new entrants vying for market share. This intense competition can squeeze profit margins and limit growth potential. The company must continually innovate and differentiate its offerings to stay ahead.

Changes in environmental standards and other regulations could necessitate significant investments. Compliance costs and potential changes to product formulations can impact the financial performance. The company must proactively adapt to evolving regulatory landscapes.

Global events can disrupt the supply chain, affecting the availability of raw materials and increasing costs. These disruptions can lead to production delays and reduced profitability. Diversifying suppliers and building resilient supply chains is crucial.

The rapid pace of technological advancement requires continuous investment in research and development. Failing to keep pace with innovation can lead to obsolescence and loss of market share. The company must prioritize R&D to stay competitive.

Internal resource constraints, such as access to specialized talent and capital, can hinder expansion initiatives. Securing adequate funding and attracting skilled employees are essential for growth. Strategic partnerships can also help overcome these limitations.

Shifts in global economic conditions can affect industrial demand and the company's overall financial performance. Monitoring economic indicators and adapting strategies accordingly are essential. Economic downturns can particularly impact demand.

The company employs a proactive approach to risk management, including ongoing market analysis and robust risk management frameworks. Scenario planning helps anticipate potential challenges and develop contingency plans. The divestiture of underperforming business units, like the Prosper inkjet business, is a strategic move to streamline operations and focus on core strengths.

Emerging risks include shifts in global economic conditions and the increasing importance of cybersecurity. Protecting intellectual property and operational integrity against cyber threats is crucial. The company must continually assess and adapt its strategies to address these evolving challenges.

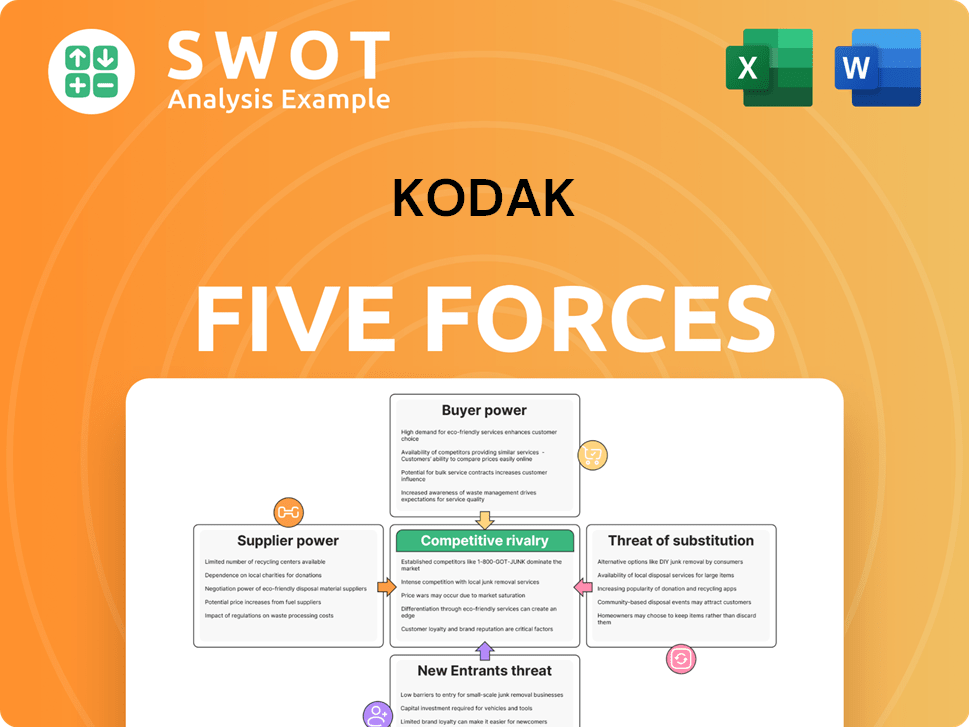

Kodak Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kodak Company?

- What is Competitive Landscape of Kodak Company?

- How Does Kodak Company Work?

- What is Sales and Marketing Strategy of Kodak Company?

- What is Brief History of Kodak Company?

- Who Owns Kodak Company?

- What is Customer Demographics and Target Market of Kodak Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.