loanDepot Bundle

How Does loanDepot Stack Up in the Mortgage Wars?

The mortgage industry is a battlefield, constantly reshaped by interest rate fluctuations, technological leaps, and shifting consumer demands. loanDepot, a major player in the retail mortgage sector, has strategically positioned itself to navigate these turbulent waters. Founded in 2010, the company aimed to revolutionize lending by merging technology with a personalized customer experience.

loanDepot's journey from a California startup to a leading non-bank lender is a testament to its adaptability and strategic vision. Understanding the loanDepot SWOT Analysis is crucial for grasping its market position. This analysis will dissect the loanDepot competitive landscape, examining its key competitors and the factors driving its success in the financial services sector. We'll explore loanDepot's market share and delve into the intricacies of its business model to provide a comprehensive loanDepot market analysis.

Where Does loanDepot’ Stand in the Current Market?

loanDepot holds a significant position in the U.S. mortgage lending sector, recognized as one of the largest non-bank retail mortgage originators. The company's market presence is substantial, consistently ranking among the top lenders in the industry. Understanding the loanDepot competitive landscape is crucial for assessing its performance and strategic direction.

The company offers a range of mortgage products, including conventional, FHA, VA, and jumbo loans, along with refinance options and home equity lines of credit (HELOCs). Its operations span across the United States, utilizing both an online platform and retail branches to serve a diverse customer base. The loanDepot market analysis reveals a focus on a hybrid approach, blending digital efficiency with personalized service.

In early 2024, loanDepot demonstrated resilience. The company reported total loan originations of $4.8 billion in the first quarter of 2024, indicating a recovery in lending activity. This performance suggests a strong position within the mortgage industry, particularly in the retail segment. For more insights into the company's ownership structure, you can read about the Owners & Shareholders of loanDepot.

loanDepot consistently ranks among the top mortgage lenders in the U.S. In 2023, it was the second-largest retail mortgage originator. The company's market share fluctuates but remains substantial within the financial services sector.

loanDepot provides a comprehensive suite of mortgage products, including conventional, FHA, VA, and jumbo loans. They also offer refinance options and HELOCs. This diversified product line caters to a broad range of borrowers.

loanDepot has a widespread presence across the United States. Its operations are supported by a network of retail branches and a robust online platform. This dual approach allows the company to serve customers nationwide.

loanDepot's financial performance in early 2024 showed signs of recovery, with $4.8 billion in loan originations in Q1 2024. While the mortgage industry faced headwinds in 2023, loanDepot's results indicate resilience. This highlights the importance of loanDepot financial performance review.

loanDepot's strengths include a strong technological infrastructure, brand recognition, and a hybrid business model. The company's strategy focuses on combining digital efficiency with personalized service. This approach aims to capture a wider customer base. Analyzing loanDepot competitive advantages is crucial for understanding its market position.

- Hybrid Business Model: Blends online and retail presence.

- Technological Infrastructure: Supports efficient loan processing.

- Brand Recognition: Enhances customer trust and acquisition.

- Product Diversification: Offers a wide range of mortgage products.

loanDepot SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging loanDepot?

The loanDepot competitive landscape is intensely competitive, encompassing both traditional financial institutions and innovative non-bank lenders. This dynamic environment requires constant adaptation and strategic positioning to maintain and grow market share. Understanding the key players and their strategies is crucial for assessing loanDepot's market position and future prospects.

loanDepot faces significant challenges from well-established competitors and emerging fintech companies. The mortgage industry is subject to rapid changes due to technological advancements and shifting consumer preferences. This necessitates a keen understanding of the competitive environment to navigate and capitalize on market opportunities.

loanDepot operates within a highly competitive mortgage lending landscape, facing challenges from both traditional banks and other non-bank lenders. Its most significant direct competitors include well-established players such as Rocket Mortgage (formerly Quicken Loans), United Wholesale Mortgage (UWM), and Wells Fargo. Rocket Mortgage, a dominant force in the online lending space, challenges loanDepot through its strong brand recognition, extensive digital platform, and aggressive marketing campaigns, often engaging in high-profile battles for market share in the direct-to-consumer segment. UWM, on the other hand, primarily focuses on the wholesale channel, supporting independent mortgage brokers, which indirectly impacts loanDepot by increasing competition for broker-referred business. Traditional banks like Wells Fargo leverage their vast customer bases, extensive branch networks, and diverse financial product offerings to compete for mortgage originations.

Rocket Mortgage is a major competitor, known for its strong brand and digital platform. It frequently engages in aggressive marketing to capture market share in the direct-to-consumer segment. Rocket Mortgage's focus on technology and customer experience poses a significant challenge to loanDepot.

UWM operates primarily in the wholesale channel, providing services to independent mortgage brokers. While not a direct competitor in the same segment as loanDepot, UWM's presence influences the market. UWM's wholesale focus indirectly impacts loanDepot by increasing competition for broker-referred business.

Wells Fargo leverages its extensive customer base and branch network to compete in the mortgage market. Traditional banks like Wells Fargo offer a wide range of financial products, providing a competitive advantage. Wells Fargo's established market presence and diverse offerings present a significant challenge.

Smaller regional banks and credit unions compete with loanDepot, often focusing on local markets. These institutions may offer competitive rates and personalized service to attract customers. The competition from these entities adds pressure on loanDepot.

Fintech companies leverage technology to offer streamlined digital experiences and competitive rates. These companies pose a disruptive threat due to their agility and lower overhead. Fintech lenders are continuously innovating, putting pressure on established lenders.

New players are using AI and machine learning to optimize the lending process. This innovation puts pressure on established lenders to continuously innovate. This technology-driven competition is reshaping the mortgage industry.

The loanDepot market analysis reveals several key factors influencing the competitive landscape. These factors include brand recognition, digital platform capabilities, pricing strategies, and customer service. Understanding these factors is crucial for loanDepot to maintain its market position and achieve sustainable growth.

- Brand Recognition: Strong brand awareness and reputation are crucial for attracting customers.

- Digital Platform: The efficiency and user-friendliness of online platforms are vital for customer acquisition and retention.

- Pricing: Competitive interest rates and fees are essential to attract borrowers.

- Customer Service: Providing excellent customer service is key to building loyalty and positive reviews.

- Technological Innovation: Leveraging AI and machine learning to optimize the lending process.

loanDepot PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives loanDepot a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of loanDepot is crucial for a comprehensive loanDepot market analysis. The company has carved a niche in the mortgage industry through a blend of technological innovation, a hybrid operational model, and strategic brand building. Analyzing these strengths offers insights into loanDepot's market position analysis and its ability to navigate the challenges within the financial services sector.

loanDepot's approach combines digital and physical channels, setting it apart in the loanDepot competitive landscape. This omnichannel strategy allows it to serve a diverse customer base, from those preferring online convenience to those seeking in-person guidance. This dual approach contributes significantly to its operational efficiency and customer satisfaction, influencing its market share loanDepot.

The company's investments in technology have streamlined the loan process, leading to faster closing times and a better overall customer experience. This technological edge, combined with a strong brand presence, has helped build customer loyalty and drive repeat business. These factors are key in understanding loanDepot's competitive advantages.

loanDepot's hybrid model combines online and retail channels. This allows for a wider reach and caters to diverse customer preferences. This approach enhances customer acquisition strategies and supports loanDepot growth strategies.

The company has invested heavily in its digital infrastructure. This includes streamlining the loan application and approval processes. These improvements lead to faster closing times and improved customer satisfaction.

loanDepot has built a strong brand reputation since its founding. This, along with a focus on customer service, fosters loyalty. This approach supports repeat business and referrals.

loanDepot's scale allows for competitive pricing and a wide range of products. This enhances its appeal to a broad customer base. This is a key factor in its ability to compete effectively.

loanDepot's competitive edge is evident in its operational model and technological advancements. The company's focus on customer service and brand building has solidified its position. These elements are critical when assessing loanDepot's key competitors 2024 and the broader loanDepot and industry trends.

- Hybrid Model: Offers both online and retail services.

- Tech Integration: Streamlines loan processes.

- Brand Recognition: Builds customer loyalty.

- Competitive Pricing: Provides a wide range of products.

loanDepot Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping loanDepot’s Competitive Landscape?

The mortgage industry is currently undergoing significant shifts, impacting the loanDepot competitive landscape. Fluctuating interest rates and the rapid adoption of digital technologies are key drivers. Understanding these trends is crucial for assessing loanDepot's market analysis and future prospects.

Rising interest rates, a major trend in 2023 and early 2024, have presented challenges to mortgage originations. This environment necessitates strategic adaptation for lenders like loanDepot. Simultaneously, technological advancements offer opportunities for enhanced efficiency and customer experience. The loanDepot competitive landscape also includes evolving regulations, requiring continuous compliance adjustments.

The mortgage industry is influenced by interest rate fluctuations, with rising rates in 2023 and early 2024 impacting loan demand. Digital transformation, including AI and blockchain, is reshaping processes. Regulatory changes constantly require lenders to adapt their compliance frameworks.

Navigating interest rate volatility will be a key challenge for loanDepot competitors. Adapting to evolving consumer behaviors and regulatory changes is crucial. Maintaining profitability in a competitive market requires strategic agility and innovation.

Technological advancements offer opportunities to enhance efficiency and customer experience. Growth in HELOC demand presents a significant opportunity for lenders. Strategic partnerships and product diversification can drive market share gains.

Continued investment in AI and automation can improve operational efficiency. Diversifying product offerings, especially in HELOCs, can boost revenue. Strategic partnerships are essential for expanding market reach and enhancing service capabilities. For more on strategies, see Marketing Strategy of loanDepot.

To maintain a strong loanDepot market position analysis, the company should focus on several key strategies. These include leveraging technology for operational efficiency and customer satisfaction. Further, strategic partnerships and product diversification are critical for sustainable growth.

- Investment in AI and automation to streamline processes.

- Expansion of HELOC offerings to capitalize on market demand.

- Strategic alliances to broaden market reach and enhance service capabilities.

- Continuous adaptation to changing consumer preferences and regulatory landscapes.

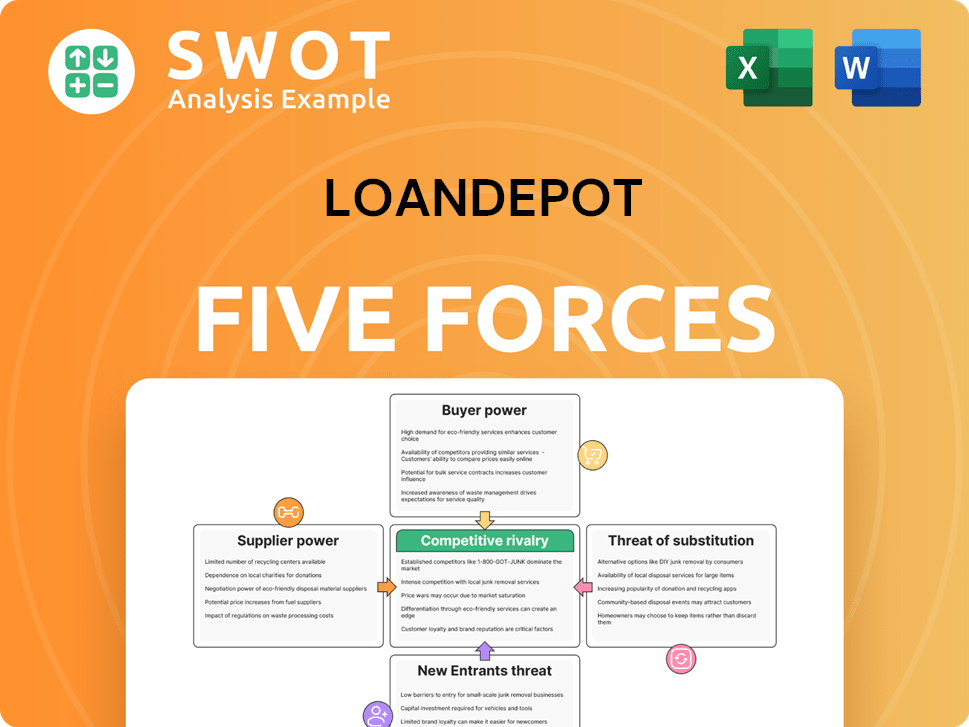

loanDepot Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of loanDepot Company?

- What is Growth Strategy and Future Prospects of loanDepot Company?

- How Does loanDepot Company Work?

- What is Sales and Marketing Strategy of loanDepot Company?

- What is Brief History of loanDepot Company?

- Who Owns loanDepot Company?

- What is Customer Demographics and Target Market of loanDepot Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.