Lockheed Martin Bundle

Can Lockheed Martin Maintain Its Dominance in a Changing World?

In a world defined by escalating geopolitical tensions and rapid technological advancements, the aerospace and defense sector is more critical than ever. Lockheed Martin, a long-standing leader in this domain, continuously shapes the future of defense and security. From its humble beginnings to its current status as a global powerhouse, the company's evolution is a testament to its commitment to innovation and strategic adaptation.

This article provides an in-depth analysis of the Lockheed Martin SWOT Analysis, exploring its competitive landscape and the Lockheed Martin competitors it faces. We'll dissect the Lockheed Martin market analysis, examining its Lockheed Martin industry position, its Lockheed Martin defense strategies, and its Lockheed Martin competitive advantages. Furthermore, we'll explore its Lockheed Martin market share analysis, Lockheed Martin vs Boeing comparison, and other Lockheed Martin key rivals, offering insights into its Lockheed Martin competitive positioning and future prospects.

Where Does Lockheed Martin’ Stand in the Current Market?

Lockheed Martin firmly holds a dominant market position within the global aerospace and defense industry. It consistently ranks as the world's largest defense contractor by revenue. This strong standing is a key aspect of the Lockheed Martin competitive landscape.

In 2023, the company reported net sales of $67.6 billion, highlighting its immense scale and financial strength in the sector. Its market leadership is especially evident in key segments such as fighter aircraft, missile defense systems, and advanced combat ships. The F-35 Lightning II program, for instance, is a cornerstone of its fighter aircraft portfolio, significantly contributing to its revenue through ongoing production and global sales.

The company's primary product lines span Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. Geographically, Lockheed Martin has a significant global presence, serving the U.S. government as its primary customer, alongside a broad international clientele across Europe, Asia, and the Middle East. Over time, Lockheed Martin has strategically shifted its positioning to focus on advanced technology solutions, moving beyond traditional hardware sales to emphasize integrated systems and sustainment services, reflecting a broader industry trend towards digital transformation and lifecycle support. For more insights, explore the Revenue Streams & Business Model of Lockheed Martin.

Lockheed Martin's market share is substantial, particularly in areas like missile defense and advanced aircraft. While specific market share figures are proprietary, analysts consistently place the company at the forefront of critical defense capabilities. The company's financial health, as evidenced by consistent revenue and strong order backlogs, significantly surpasses industry averages, underscoring its robust market standing. This solid financial performance is a key factor in the Lockheed Martin market analysis.

Lockheed Martin has strategically positioned itself to focus on advanced technology solutions and integrated systems. This shift includes a move beyond traditional hardware sales towards emphasizing integrated systems and sustainment services. This strategy reflects a broader industry trend towards digital transformation and lifecycle support, which is vital for understanding Lockheed Martin's competitive positioning.

Lockheed Martin's global presence is significant, with a strong focus on serving the U.S. government and a broad international clientele. The company has a substantial presence across Europe, Asia, and the Middle East. Its global reach is a key element in its Lockheed Martin industry dominance.

Lockheed Martin holds a particularly strong position in areas requiring high-level research and development, such as stealth technology and hypersonics. Its expertise in these advanced areas is unparalleled, contributing to its competitive advantages. This focus on innovation is critical for the Lockheed Martin defense sector.

Lockheed Martin's strengths include its vast revenue base, diverse product portfolio, and strong relationships with governments worldwide. The company's focus on advanced technologies and integrated systems provides a significant competitive edge. These advantages are crucial for its Lockheed Martin competitive landscape.

- Dominant market share in key segments.

- Strong financial performance with consistent revenue.

- Leading provider of missile defense systems.

- Significant investment in research and development.

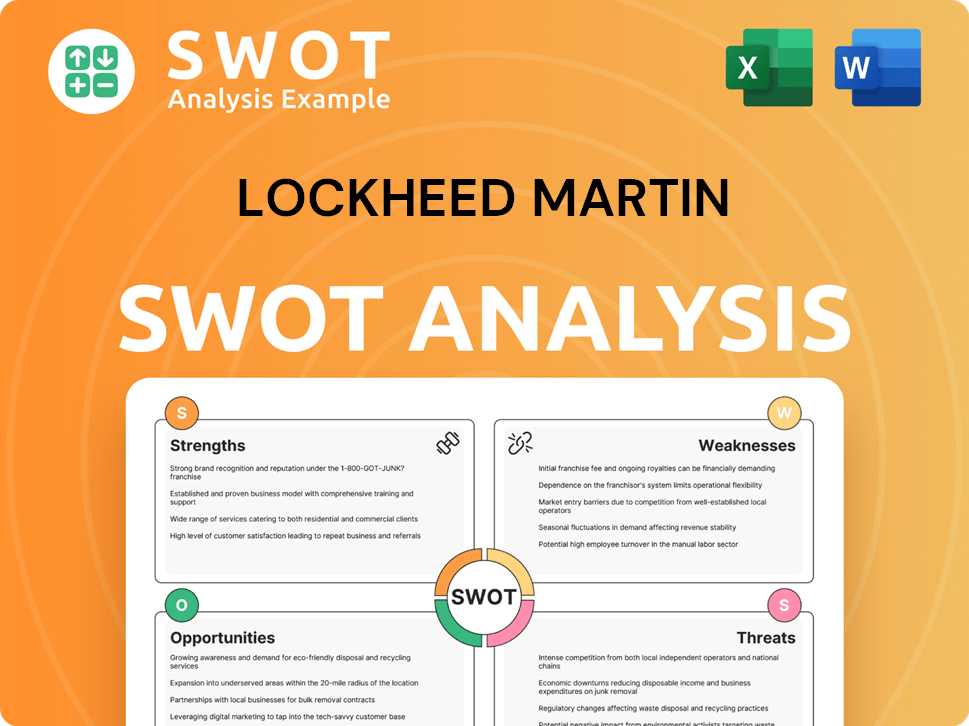

Lockheed Martin SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Lockheed Martin?

The Lockheed Martin competitive landscape is dominated by a few key players in the global aerospace and defense market. Understanding the Lockheed Martin competitors is crucial for any market analysis. This landscape is shaped by technological advancements, geopolitical factors, and government spending on defense.

The Lockheed Martin industry faces constant challenges and opportunities, with companies vying for lucrative defense contracts and market share. The competitive dynamics are complex, involving direct rivals, emerging technologies, and strategic alliances that reshape the industry. A detailed look at these competitors provides insights into the Lockheed Martin defense strategies.

The primary direct competitors of Lockheed Martin include The Boeing Company, Raytheon Technologies (RTX Corporation), Northrop Grumman Corporation, and BAE Systems. These companies compete across various segments, including military aircraft, missiles, and electronic systems. The competition often revolves around technological innovation, pricing strategies, and securing major defense contracts. The Lockheed Martin market analysis reveals the impact of these competitors on its financial performance.

Boeing is a major competitor, particularly in military aircraft. Its F-15 and F/A-18 programs compete with Lockheed Martin's offerings. Boeing's extensive manufacturing capabilities and established platforms give it a strong position in the market.

RTX Corporation, formed from the merger of Raytheon and United Technologies, competes in missiles, air defense systems, and electronic systems. It directly challenges Lockheed Martin's Missile and Fire Control (MFC) and Rotary and Mission Systems (RMS) segments. RTX often focuses on technological innovation.

Northrop Grumman is a key rival in stealth aircraft, unmanned systems, and missile defense. It frequently competes for high-value contracts, and its B-21 Raider program is a significant competitor. Northrop Grumman's focus is on advanced technology and system integration.

BAE Systems, a UK-based multinational, competes across a broad spectrum, including combat vehicles, naval ships, and electronic systems. It has a strong presence in international markets. BAE Systems offers a diverse portfolio of products and services.

Emerging players and specialized technology firms are disrupting the landscape, especially in areas like cybersecurity, AI, and satellite technology. These companies bring new competition to the market. The increasing focus on commercial space ventures also introduces new competitors.

Mergers and alliances, such as the Raytheon-UTC merger, reshape competitive dynamics, creating larger, more diversified entities. These larger entities offer broader portfolios of products and services, intensifying pressure on Lockheed Martin to innovate and adapt. Strategic alliances are becoming more common.

The competition among these companies involves various strategies. Lockheed Martin's competitive advantages are often challenged by rivals' technological advancements and pricing strategies. The competition is particularly fierce during major defense procurement cycles. The Lockheed Martin market share analysis reveals how these dynamics impact its position.

- Technological Innovation: RTX and Northrop Grumman often compete on this front.

- Pricing Strategies: Especially for large government contracts, pricing is a key battleground.

- Defense Procurement Cycles: High-profile competitions occur during these cycles.

- Mergers and Acquisitions: These reshape the competitive landscape, creating larger entities.

- Emerging Technologies: Cybersecurity, AI, and satellite technology are areas of disruption.

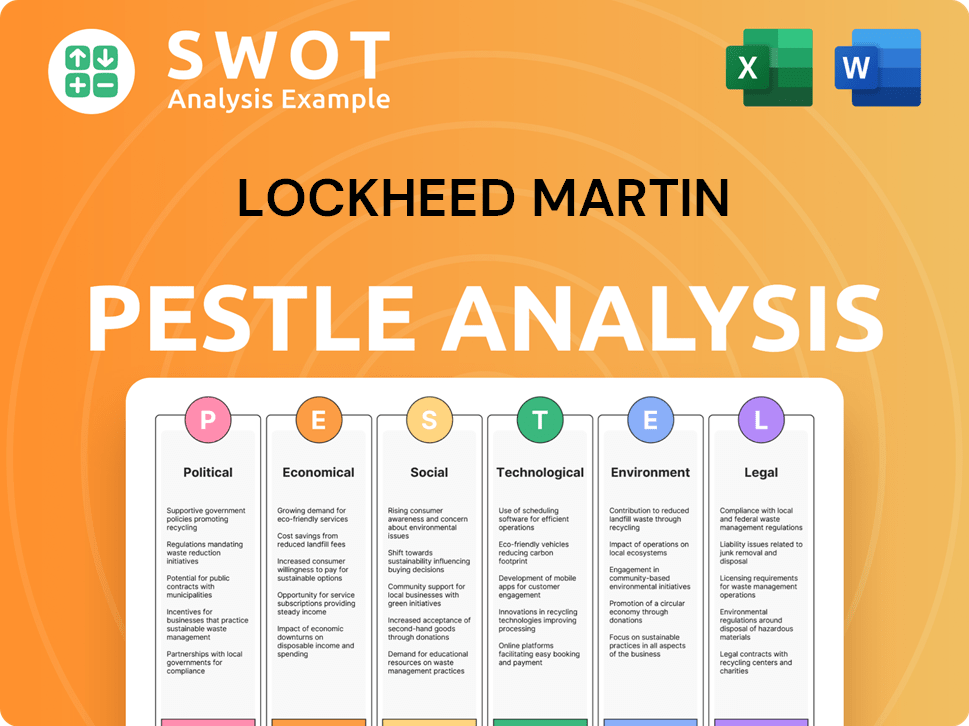

Lockheed Martin PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Lockheed Martin a Competitive Edge Over Its Rivals?

The competitive landscape for Lockheed Martin is shaped by its significant technological prowess and deep-rooted relationships within the defense sector. The company's ability to innovate and integrate complex systems, particularly in areas like advanced aeronautics and stealth technology, sets it apart. Its strategic focus on research and development, with investments totaling $1.4 billion in 2023, fuels its competitive edge. This focus allows it to consistently deliver cutting-edge solutions to its customers.

Lockheed Martin's market position is further solidified by its strong brand equity and long-standing partnerships, especially with the U.S. Department of Defense. These relationships, built on trust and reliability, provide a stable foundation for securing major defense contracts. The company's global presence and comprehensive lifecycle support for its products also enhance its value proposition, making it a preferred choice for critical national security programs. The company's vast global distribution networks and sustainment capabilities further enhance its value proposition, offering comprehensive lifecycle support for its products.

The company faces challenges from imitation and shifts in industry trends. The defense industry is dynamic, with new technologies and market demands constantly emerging. Navigating these changes requires continuous adaptation and strategic foresight to maintain its competitive advantage. For a deeper understanding of the company's origins and evolution, consider reading the Brief History of Lockheed Martin.

Lockheed Martin's competitive advantages include its advanced technological capabilities, particularly in stealth technology and complex systems integration. The F-35 Lightning II, a fifth-generation fighter jet, exemplifies this, showcasing advanced sensor fusion and networked warfare capabilities. The company's substantial investment in research and development, with R&D expenses totaling $1.4 billion in 2023, ensures a pipeline of future defense solutions, driving its market analysis.

The company benefits from strong brand equity and deep-rooted customer loyalty, especially with the U.S. Department of Defense. Lockheed Martin has cultivated decades-long relationships built on trust and performance. This positions the company favorably for securing critical national security programs and maintaining its competitive positioning within the Lockheed Martin defense sector.

Lockheed Martin leverages economies of scale through massive production capabilities and a global supply chain. This allows for cost efficiencies in manufacturing, such as with the C-130 Hercules transport aircraft. The company's extensive global distribution networks and sustainment capabilities further enhance its value proposition, offering comprehensive lifecycle support for its products, impacting the Lockheed Martin industry outlook.

A critical advantage is Lockheed Martin's highly skilled talent pool of engineers, scientists, and program managers. This expertise enables the development and execution of complex projects. This human capital advantage supports innovation and maintains a competitive edge in the Lockheed Martin competitive landscape.

Lockheed Martin's competitive advantages are multifaceted, encompassing technological leadership, strong customer relationships, and efficient operations. These advantages are crucial for maintaining its market share analysis and navigating the challenges within the defense industry.

- Technological Innovation: Continuous investment in R&D, particularly in areas like hypersonics and artificial intelligence.

- Customer Relationships: Strong ties with the U.S. Department of Defense and other global partners.

- Operational Efficiency: Economies of scale in production and a robust global supply chain.

- Talent and Expertise: A highly skilled workforce driving innovation and project execution.

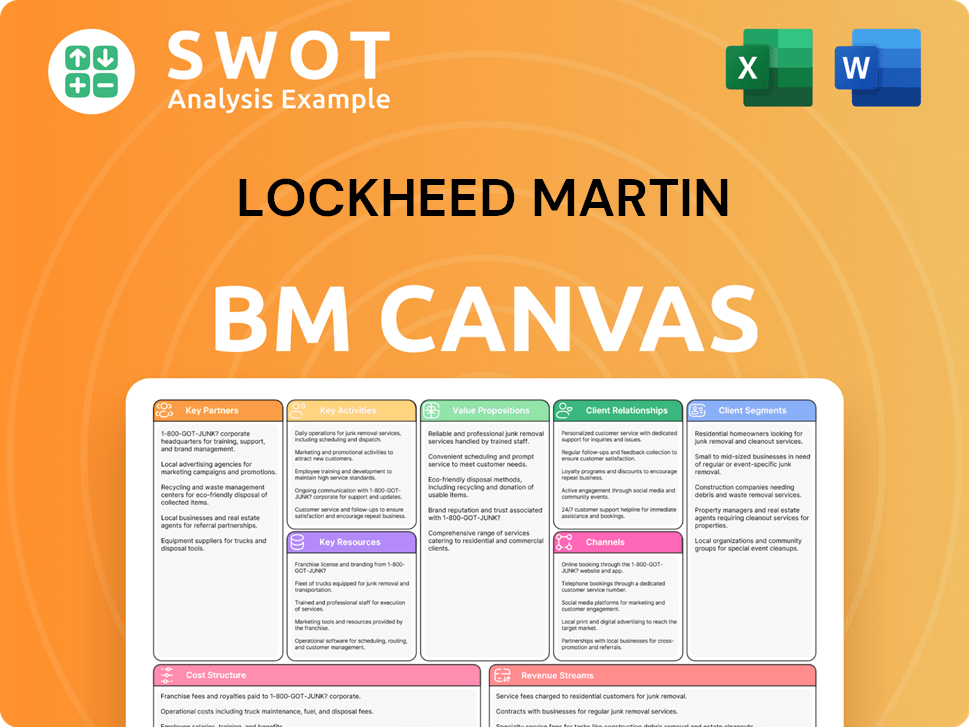

Lockheed Martin Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Lockheed Martin’s Competitive Landscape?

The aerospace and defense industry is experiencing significant shifts, influencing the Target Market of Lockheed Martin. Technological advancements, geopolitical tensions, and evolving defense spending priorities are key drivers. Understanding the current landscape is crucial for assessing Lockheed Martin's competitive position and future prospects. The company faces both challenges and opportunities as it navigates these dynamic market conditions.

Lockheed Martin's competitive landscape is shaped by rapid technological advancements, particularly in areas like artificial intelligence, hypersonics, and cyber warfare. The increasing emphasis on multi-domain operations and integrated battle management systems demands greater interoperability. Regulatory changes, driven by geopolitical tensions and defense spending, also impact demand and contract awards.

Key trends include the rise of AI and autonomous systems, increased focus on multi-domain operations, and growing demand for advanced defense capabilities. The industry is also seeing an increase in cybersecurity threats and the need for advanced data analytics. Furthermore, the commercial space sector is expanding, creating new opportunities and competition.

Challenges include rising R&D costs, the need to adapt to rapidly evolving threats, and competition from new market entrants. Declining demand for legacy systems and increased scrutiny over defense spending pose additional risks. The company must also navigate supply chain disruptions and potential talent shortages.

Opportunities lie in the global demand for advanced defense capabilities, particularly in missile defense and deterrence. Emerging markets offer opportunities to modernize defense forces. Product innovations in areas like directed energy weapons and quantum computing offer avenues for differentiation. Strategic partnerships can also expand capabilities and market reach.

Lockheed Martin is focusing on R&D, portfolio diversification, and international market expansion. The company is also emphasizing systems integration and advanced technology to address complex security challenges. Strategic alliances and investments in emerging technologies are key to maintaining a competitive edge.

In 2024, the global defense market is estimated to be worth over $2.5 trillion, with continued growth expected. Lockheed Martin's revenue for 2024 was approximately $66.5 billion. The company invests heavily in R&D, with spending exceeding $2.6 billion in 2024. The U.S. Department of Defense remains its primary customer, accounting for a significant portion of its revenue.

- Global defense spending is projected to increase by 3-5% annually.

- Lockheed Martin's backlog of orders exceeds $160 billion.

- The company is actively pursuing international contracts to diversify its revenue streams.

- Investments in AI and cyber security are increasing to meet evolving threats.

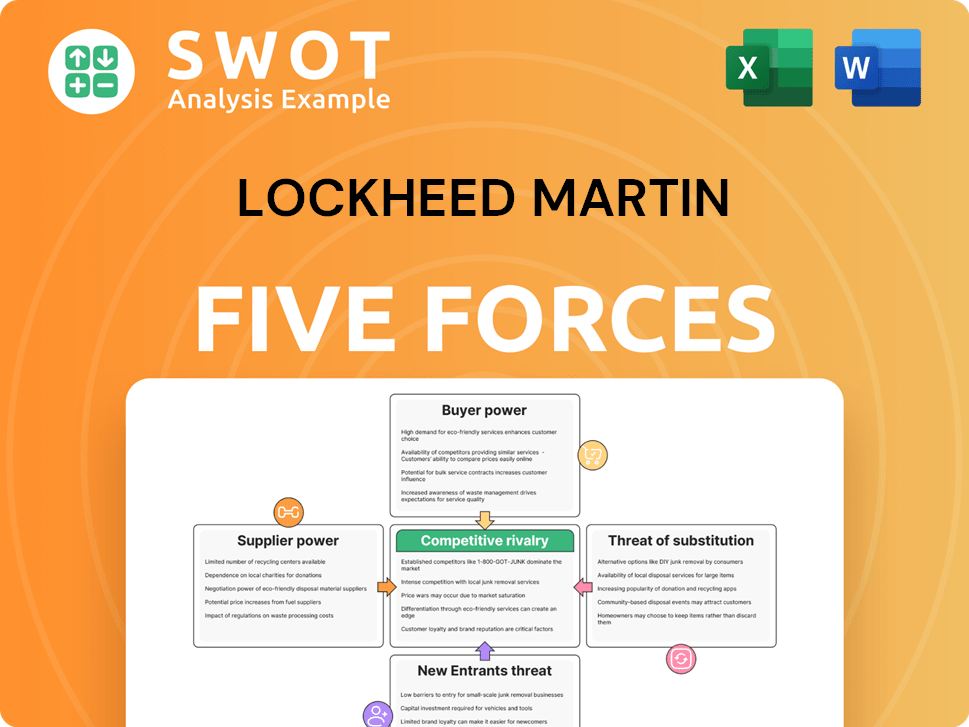

Lockheed Martin Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lockheed Martin Company?

- What is Growth Strategy and Future Prospects of Lockheed Martin Company?

- How Does Lockheed Martin Company Work?

- What is Sales and Marketing Strategy of Lockheed Martin Company?

- What is Brief History of Lockheed Martin Company?

- Who Owns Lockheed Martin Company?

- What is Customer Demographics and Target Market of Lockheed Martin Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.