Lockheed Martin Bundle

Who Buys from Lockheed Martin?

Delving into the customer demographics and target market of Lockheed Martin is key to understanding the aerospace and defense industry. This analysis offers critical insights for investors, analysts, and strategists. Exploring Lockheed Martin's customer profile reveals a complex landscape of governmental entities and international partners.

From its origins in aviation to its current status as a global defense leader, Lockheed Martin's customer base has dramatically shifted. Understanding the company's Lockheed Martin SWOT Analysis is crucial for assessing its strategic positioning within its target market. Examining its clientele, industry focus, and market analysis provides a comprehensive view of its operations and future prospects. This includes identifying who are Lockheed Martin's primary customers and what countries buy Lockheed Martin products.

Who Are Lockheed Martin’s Main Customers?

Understanding the customer demographics and target market of Lockheed Martin is crucial for analyzing its business strategy. Lockheed Martin primarily operates within the business-to-government (B2G) sector, with its customer base largely consisting of governmental entities. This focus shapes its market approach and influences its product and service offerings. The company's Lockheed Martin customer profile is defined by strategic needs, defense budgets, and technological requirements.

Lockheed Martin's target market is predominantly composed of national governments and their defense, intelligence, and security agencies worldwide. This strategic focus distinguishes it from companies that cater to broader consumer markets. The company's financial success and operational strategies are deeply intertwined with these governmental relationships. As of 2024, the U.S. government accounted for approximately 73.9% of Lockheed Martin's revenue, demonstrating a significant reliance on U.S. government contracts.

Lockheed Martin's market analysis reveals a consistent B2G focus, with the emphasis shifting in response to global threats and technological advancements. The company's ability to adapt to these changes is reflected in its financial performance and its enduring role in the defense and aerospace industries. The company's approach to customer acquisition and retention is tailored to the specific needs of its governmental clients.

The U.S. Department of Defense is Lockheed Martin's largest customer, including the U.S. Air Force, Navy, Army, and Marine Corps. Contracts involve major aircraft programs like the F-35 Joint Strike Fighter, which contributed 26% of total sales in 2024. The DoD's long-term, fixed-price contracts provide stability. The F-35 program had 110 aircraft deliveries in 2024.

This segment includes allied nations seeking to modernize their defense capabilities. Lockheed Martin supplies various systems to countries worldwide, including JASSM systems to Japan, Finland, Poland, and the Netherlands. In 2024, the company delivered 10 S-70i Black Hawk helicopters to the Philippine Department of National Defense. This segment is experiencing growth due to increased global defense expenditures.

This includes agencies like NASA and other intelligence and homeland security entities. Lockheed Martin provides space systems, cybersecurity solutions, and advanced technology services. The company's work with these agencies underscores its role in national security and technological innovation. The company's expertise extends beyond defense to include space exploration and advanced technology services.

Demand is increasing for integrated solutions, cybersecurity, and advanced technologies. The company's record year-end backlog of $176 billion in 2024 demonstrates the enduring global demand. The company's ability to adapt to changing global threats and technological advancements is a key factor in its success. For additional context, you can explore the Competitors Landscape of Lockheed Martin.

Lockheed Martin's customer base is primarily composed of governmental entities, with the U.S. Department of Defense being its largest customer. International governments also represent a significant portion of its clientele, driving growth through defense modernization programs. The company's focus on technological innovation and advanced solutions positions it to meet evolving global security needs.

- U.S. Department of Defense (DoD)

- International Governments

- Other Government Agencies (NASA, intelligence, homeland security)

- Increasing demand for integrated solutions and cybersecurity

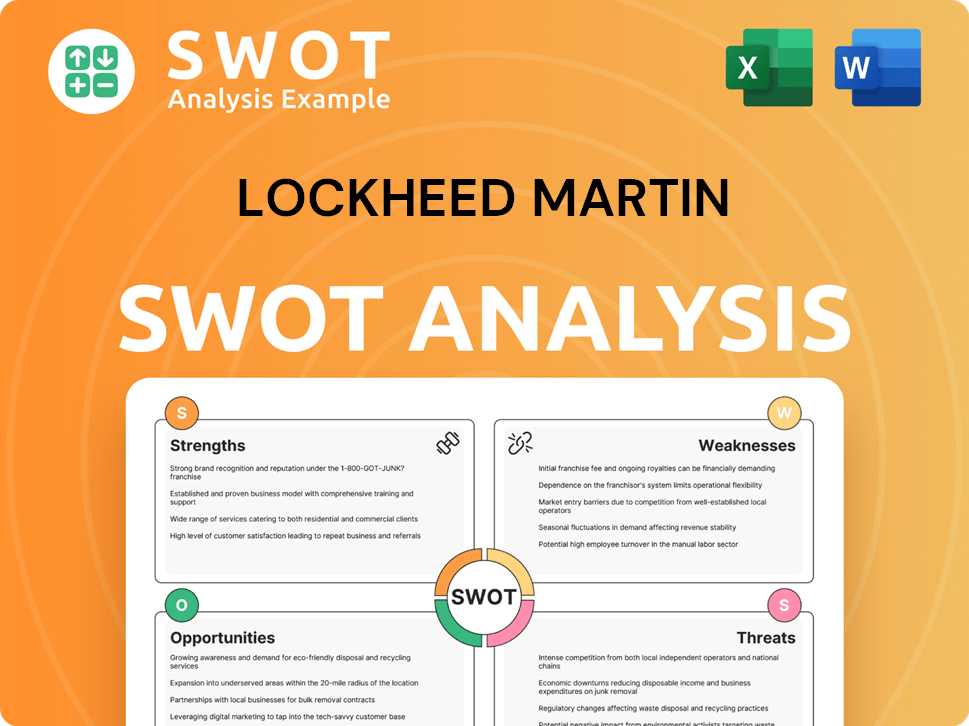

Lockheed Martin SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Lockheed Martin’s Customers Want?

Understanding the customer needs and preferences of Lockheed Martin is crucial for analyzing its market position. The company's primary customers are national governments and their defense agencies, making the analysis of its customer base a key aspect of its market analysis. This customer profile heavily influences the company's strategies and product development.

The company's target market is defined by those seeking advanced defense and aerospace solutions. This includes a focus on technological superiority, operational effectiveness, and long-term strategic planning. Lockheed Martin’s ability to meet these needs determines its success in the defense industry.

The company’s customer demographics are characterized by a focus on national security, technological advancements, and cost-effectiveness. Lockheed Martin's clientele includes entities that prioritize cutting-edge defense technologies and reliable performance. The company's approach to meeting these demands shapes its market share and customer acquisition strategies.

Customers seek cutting-edge technology to maintain a strategic advantage. This includes advanced fighter jets, missile systems, and space-based intelligence. The company invested over $3 billion in research and development and capital investment in 2024 to meet this demand.

Defense systems must be highly reliable and proven. Product usage patterns emphasize readiness, sustainment, and long-term operational support. The F-35 program's sustainment contracts highlight this need.

There's a growing preference for integrated, all-domain solutions. These solutions seamlessly connect across military branches and allied forces. The company is committed to developing digital and interoperable systems.

Customers seek cost-effective solutions and long-term value, especially given budget constraints. This influences decisions around sustainment contracts, upgrades, and production efficiency.

Customers demand secure systems and supply chains, especially in an era of cyber threats. The company's focus on domestic suppliers helps reduce exposure to global trade tensions.

International customers prefer localization of production and technology transfer. This builds domestic defense industrial bases and enhances self-reliance. Strategic alliances are key to meeting these demands.

Lockheed Martin tailors its offerings to meet these needs through market research and direct customer engagement. This approach allows the company to understand specific requirements and customize products and services. The company's continuous investment in areas like hypersonics and artificial intelligence reflects its adaptation to evolving customer demands. To learn more about the financial aspects, consider reading about the Revenue Streams & Business Model of Lockheed Martin.

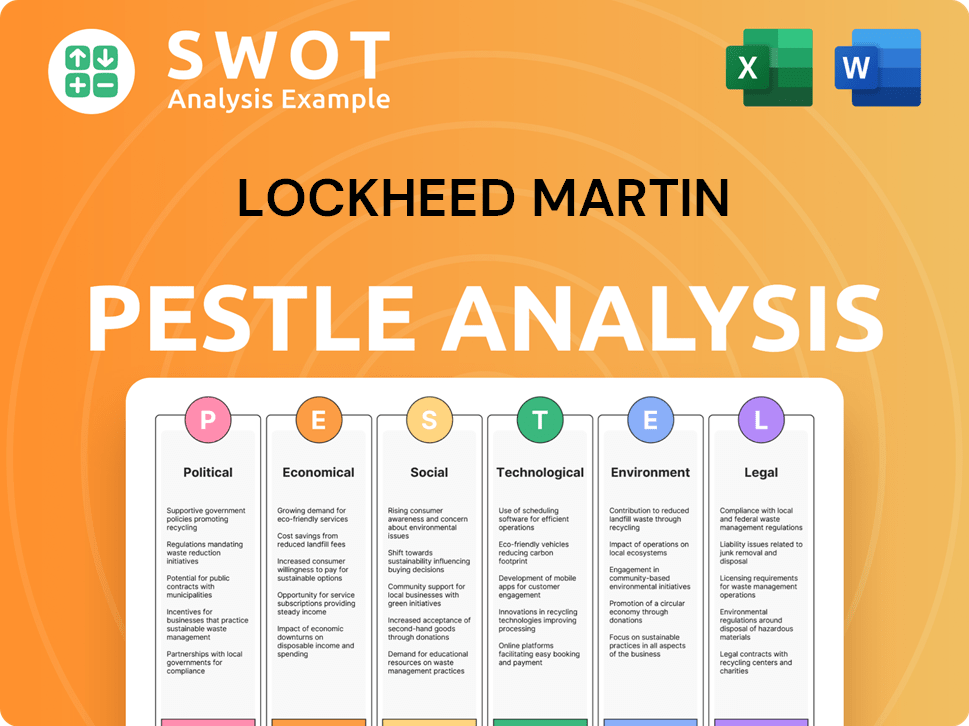

Lockheed Martin PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Lockheed Martin operate?

Lockheed Martin's geographical market presence is extensive, with a strong foundation in the United States, which serves as its primary market. The company's customer base is diverse, spanning across various continents, with a significant portion of its revenue originating from the U.S. government. This global reach is supported by strategic international sales and partnerships, allowing the company to cater to the specific needs of different regions.

In 2024, the U.S. market accounted for approximately 73.9% of Lockheed Martin's total revenue, demonstrating a robust domestic presence. The remaining 26.1% of revenue came from international sales, highlighting the company's global footprint and its ability to secure contracts worldwide. This distribution underscores the importance of both domestic and international markets in Lockheed Martin's overall financial performance.

Lockheed Martin's customer profile includes governments and defense organizations worldwide. The company's ability to adapt its products and services to meet the specific needs of each region is crucial to its success. This approach, along with strategic partnerships, enables Lockheed Martin to maintain a competitive edge in the global defense market and achieve consistent growth. For more insights, check out the Growth Strategy of Lockheed Martin.

European NATO members have increased their defense budgets in recent years, creating a growing market for Lockheed Martin's products. The rise in defense spending, with 32% of budgets allocated to procurement and R&D in 2024, drives demand for fighter jets and missile systems. Lockheed Martin engages in joint development projects with NATO allies to meet regional needs.

The Middle East is a key market, particularly for missile defense systems. Saudi Arabia is a major customer for the THAAD system, and Lockheed Martin is actively involved in localization initiatives. The company aims to support Saudi Vision 2030 by localizing over 50% of defense spending by the end of the decade, fostering local manufacturing capabilities.

Countries like Japan, Finland, Poland, and the Netherlands are recipients of Lockheed Martin's JASSM systems. The company has also delivered S-70i Black Hawk helicopters to the Philippines. These sales demonstrate the company's ability to meet the diverse defense needs of the Asia-Pacific region through tailored solutions.

Lockheed Martin employs a comprehensive global expansion and localization strategy, conducting market research to understand local dynamics. The company establishes strategic alliances and partnerships to integrate cutting-edge technologies. An example is the collaboration in Saudi Arabia, where subcontracts are awarded to local companies for THAAD components.

Lockheed Martin's success in diverse markets is driven by a focus on localization and collaboration. This approach allows the company to meet specific local needs, contributing to its overall sales growth. In 2024, sales reached $71.0 billion, a 5% increase from 2023, with a record year-end backlog of $176 billion, reflecting strong market demand and effective customer acquisition strategies.

- Extensive market research to understand local dynamics.

- Strategic alliances and partnerships.

- Tailoring products and services to meet specific local needs.

- Focus on deep market penetration through localization.

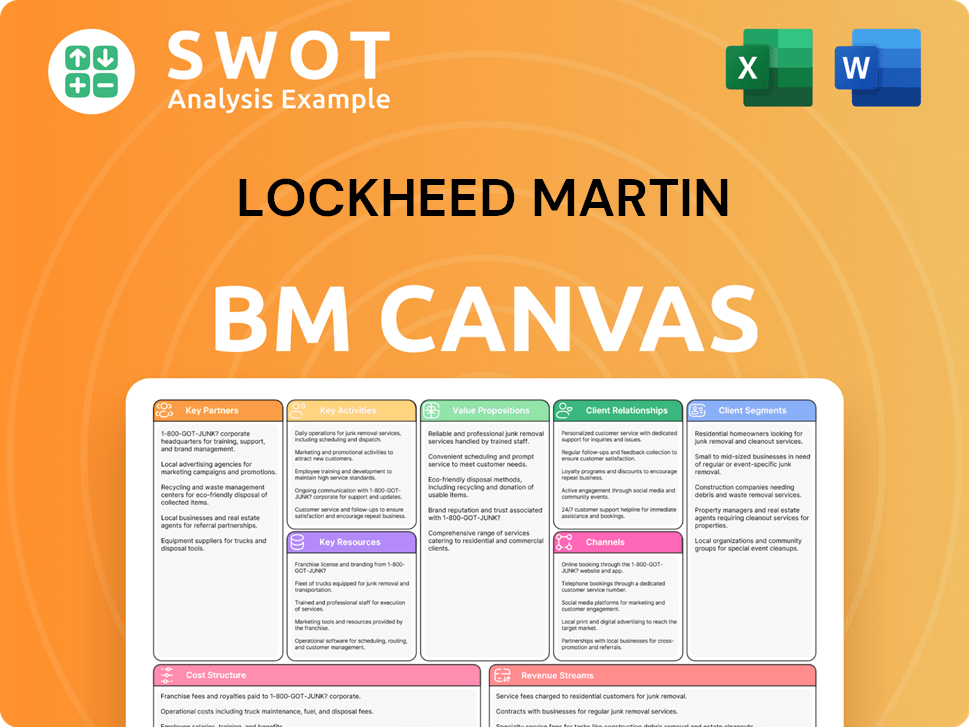

Lockheed Martin Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Lockheed Martin Win & Keep Customers?

The customer acquisition and retention strategies of Lockheed Martin are highly specialized due to its business-to-government (B2G) model. Its approach centers on technological leadership, strategic partnerships, and a thorough understanding of governmental defense needs. This contrasts with typical marketing campaigns, focusing instead on long-term relationships and direct engagement with government entities worldwide.

Lockheed Martin's customer base primarily consists of governmental bodies, making its customer acquisition and retention strategies unique. The company's success is built on its ability to meet the specific needs of its clients, ensuring long-term contracts for the development, production, and sustainment of advanced systems. This approach has contributed to its strong financial performance, as evidenced by the $71.0 billion in sales in 2024.

The company's strategies are designed to maintain and expand its customer base within the defense and aerospace sectors. This involves continuous innovation, strategic alliances, and a focus on delivering high-performance, reliable systems. The company's commitment to after-sales service and its expertise in government contracting are key to retaining its customers and securing its position in the market. For more insights, explore the Marketing Strategy of Lockheed Martin.

Lockheed Martin builds enduring relationships with government entities. This involves direct engagement with defense ministries, military branches, and procurement agencies. Anticipating customer needs is crucial for securing long-term contracts for advanced systems.

Continuous innovation is a core acquisition strategy. The company invests heavily in R&D to develop cutting-edge technologies. In 2024, Lockheed Martin invested over $3 billion in R&D and capital investment to advance national security through innovation.

The company forms strategic alliances with other defense contractors and technology companies. These partnerships facilitate technology transfer and co-production. Collaborations in Saudi Arabia to localize THAAD missile components exemplify this strategy.

Demonstrating superior performance and reliability is paramount. The F-35 program, despite past delays, continues to be a major contributor to sales. Lockheed Martin focuses on operational excellence to ensure timely and efficient execution.

Long-term sustainment and upgrade contracts are crucial for retention. The company provides extensive after-sales support, including logistics and training. F-35 sustainment contracts are a prime example of this.

Lockheed Martin has deep expertise in navigating complex government procurement processes. Its reliance on long-term, fixed-price U.S. government contracts provides a stable revenue base. The company's record year-end backlog of $176 billion reflects the success of these strategies.

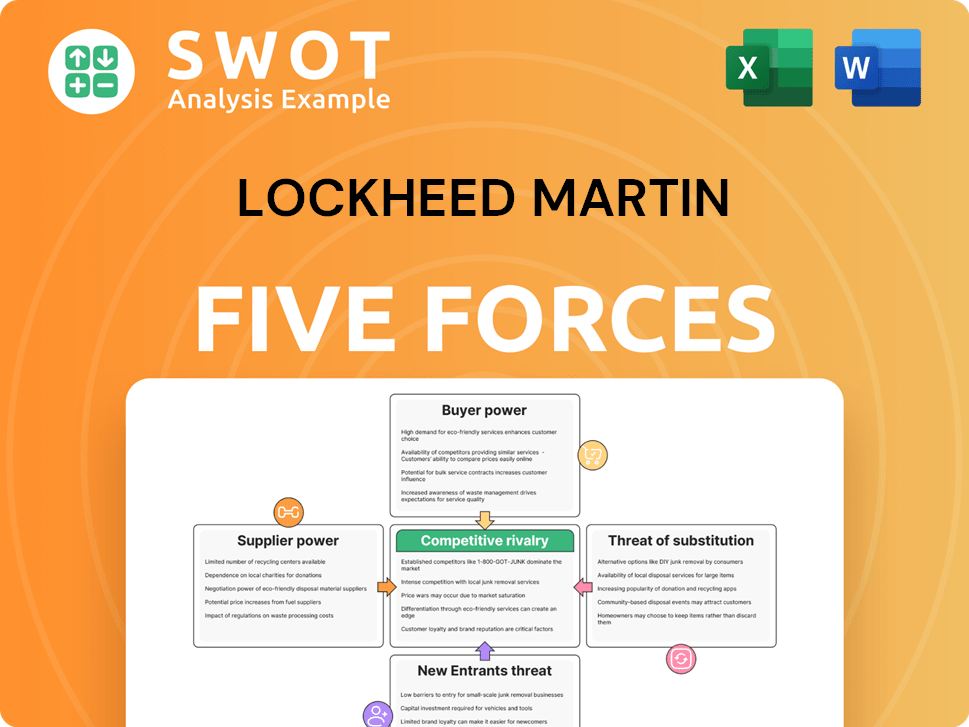

Lockheed Martin Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lockheed Martin Company?

- What is Competitive Landscape of Lockheed Martin Company?

- What is Growth Strategy and Future Prospects of Lockheed Martin Company?

- How Does Lockheed Martin Company Work?

- What is Sales and Marketing Strategy of Lockheed Martin Company?

- What is Brief History of Lockheed Martin Company?

- Who Owns Lockheed Martin Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.