Learning Technologies Group Bundle

How Does Learning Technologies Group Stack Up in the EdTech Arena?

The corporate training industry is undergoing a massive transformation, fueled by technological innovation and the need for upskilled workforces. Learning Technologies Group (LTG) has become a key player in this dynamic environment, but how does it fare against its rivals? This analysis dives into the competitive landscape, providing a comprehensive overview of LTG's position and its strategic moves.

Founded in 2007, Learning Technologies Group SWOT Analysis is a leader in the Training Industry. This report examines the Competitive Landscape of Learning Technologies Group, evaluating its LTG market share analysis and the LTG competitive advantage. We'll explore Learning Technologies Group's key competitors and assess its LTG growth strategy within the ever-evolving EdTech sector.

Where Does Learning Technologies Group’ Stand in the Current Market?

In the dynamic realm of the EdTech and corporate training sectors, Learning Technologies Group (LTG) has carved out a significant market position. LTG's operations are centered around providing comprehensive digital learning and talent management solutions. This includes a broad spectrum of services, from learning platforms to custom content development and strategic consulting, all designed to enhance employee performance.

The company's value proposition lies in its ability to offer integrated, end-to-end talent management solutions. This approach covers various aspects of the employee lifecycle, such as onboarding, compliance, sales enablement, leadership development, and talent acquisition. This comprehensive approach positions LTG as a key player in the competitive landscape of the training industry.

LTG's strategic acquisitions, particularly the 2021 acquisition of GP Strategies, have significantly bolstered its standing. While specific market share figures for 2024-2025 are still emerging, the acquisition solidified LTG's position as one of the largest global providers in the learning and talent technology space. This growth trajectory underscores the company's ambition and capability to adapt to market demands.

LTG offers a diverse suite of learning platforms, including LEO Learning, Gomo, and PeopleFluent. These platforms are complemented by custom content development services. Strategic consulting services are also provided to improve employee performance.

LTG serves a broad range of customers, from large enterprises to mid-sized businesses. The company's solutions are applicable across various sectors. These sectors include finance, healthcare, retail, and manufacturing, showcasing its versatility.

LTG has a strong presence in North America and Europe. The company is actively expanding its operations in other regions. This global reach reflects its commitment to serving a diversified client base worldwide.

For the fiscal year ending December 31, 2023, LTG reported revenues of £564.9 million. The company also had an adjusted EBIT of £104.9 million. This financial performance highlights LTG's scale and stability in the market.

LTG's financial health and strategic positioning underscore its competitive advantage in the corporate learning and development sector. The company's integrated offerings provide a significant edge. For more insights into LTG's approach, consider exploring the Marketing Strategy of Learning Technologies Group.

LTG's robust financial performance and strategic acquisitions have solidified its position. The company continues to expand its global footprint, serving diverse customer segments. LTG's integrated solutions offer a competitive advantage in the market.

- Strong revenue growth in 2023, reaching £564.9 million.

- Adjusted EBIT of £104.9 million, demonstrating profitability and scale.

- A focus on end-to-end talent management solutions.

- Global presence with a significant footprint in North America and Europe.

Learning Technologies Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Learning Technologies Group?

The digital learning and talent management market, where Learning Technologies Group (LTG) operates, is fiercely competitive. This landscape includes direct and indirect rivals, all vying for market share in the burgeoning EdTech and corporate training sectors. Understanding the competitive dynamics is crucial for assessing LTG's position and future prospects.

LTG faces a diverse set of competitors, ranging from established enterprise software giants to specialized learning platform providers and agile content development agencies. The competitive pressures are amplified by the rapid evolution of technology and the ongoing consolidation within the training industry. This dynamic environment requires continuous adaptation and strategic innovation.

Key direct competitors include large enterprise software companies that offer integrated HR and learning modules. These companies often bundle learning management systems (LMS) and content within their broader HR solutions. Specialized learning platform providers also pose a significant challenge, focusing specifically on delivering advanced learning technologies. Bespoke content development agencies, both small and large, compete with LTG in the custom learning solutions space.

Cornerstone OnDemand is a major competitor, providing cloud-based talent management software, including LMS and content. Its strength lies in its extensive client base and integrated HR solutions. In 2023, Cornerstone OnDemand reported revenues of approximately $683 million, demonstrating its significant presence in the market.

Skillsoft offers a broad range of digital learning content, platforms, and services, often competing with LTG on content breadth and platform capabilities. Skillsoft's revenue in 2023 was around $550 million, highlighting its substantial market share.

Numerous smaller agencies and larger consultancies compete with LTG in the custom content development space. These firms offer bespoke learning solutions tailored to specific client needs. The market is highly fragmented, with varying levels of specialization and geographic focus.

Professional services firms like Deloitte and Accenture provide HR and learning consulting services. These firms often leverage their broader consulting engagements to offer learning technology solutions. Their extensive client networks and consulting expertise provide a competitive edge.

Workday, primarily an HR and finance suite, increasingly integrates learning functionalities. This expansion into learning capabilities poses a growing competitive threat. Workday's revenue in 2023 was approximately $7.45 billion, reflecting its strong position in the enterprise software market.

Degreed focuses on skill-based learning and talent mobility, offering a specialized approach to corporate training. Degreed's focus on skills development and career pathways differentiates it in the market. The company has raised over $200 million in funding, indicating investor confidence in its growth potential.

Indirect competition also arises from professional services firms and specialized providers. The competitive landscape is further shaped by emerging players leveraging AI and adaptive learning technologies. Mergers and acquisitions continue to reshape the industry, creating larger, more integrated competitors. For instance, the acquisition of EdCast by Cornerstone OnDemand illustrates the ongoing consolidation. For a deeper understanding of the target market, consider reading about the Target Market of Learning Technologies Group.

Several factors influence the competitive dynamics within the Learning Technologies Group (LTG) market. These include the breadth and depth of content offerings, the sophistication of learning platforms, pricing models, and the ability to integrate with existing HR systems.

- Content Library: The size and quality of content libraries are critical. Competitors with extensive and up-to-date content have a significant advantage.

- Platform Capabilities: User-friendly and feature-rich learning platforms are essential. This includes mobile learning, analytics, and integration capabilities.

- Pricing and Value: Competitive pricing and the ability to demonstrate value are crucial for attracting and retaining clients.

- Integration: Seamless integration with existing HR systems and other enterprise software is a key requirement for many clients.

Learning Technologies Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Learning Technologies Group a Competitive Edge Over Its Rivals?

The competitive landscape for Learning Technologies Group (LTG) is shaped by its strategic moves and key milestones. LTG has expanded its presence in the EdTech and corporate training sectors through acquisitions and organic growth. The company's ability to integrate diverse learning and talent management solutions has been a key differentiator, allowing it to capture a significant share of the training industry.

LTG's competitive edge comes from its comprehensive suite of services, proprietary technologies, and strong customer relationships. These advantages support its position in a dynamic market. Continuous investment in research and development, alongside strategic partnerships, further strengthens its competitive position.

The company's focus on data-driven insights and analytics in its learning platforms helps clients demonstrate ROI, a crucial differentiator in today's performance-oriented learning environment. The acquisition of GP Strategies significantly bolstered LTG's consulting capabilities and global delivery network, providing a substantial human capital advantage in strategic learning and development services.

LTG offers end-to-end solutions, covering learning platforms, content development, and talent management. This integrated approach simplifies vendor management for clients. This comprehensive offering is a key differentiator in the competitive landscape.

Products like Gomo and PeopleFluent provide unique features. These technologies are difficult for competitors to replicate quickly. This proprietary advantage contributes to LTG's market position.

LTG has strategically acquired companies to expand its capabilities. The acquisition of GP Strategies enhanced consulting services and global reach. These acquisitions have strengthened LTG's position in the market.

Years of successful client engagements have built strong brand equity. This brand recognition fosters customer loyalty and trust. This strong brand reputation supports LTG's competitive advantage.

LTG's competitive advantages include a comprehensive solution offering, proprietary technologies, and a strong brand. These factors contribute to its success in the EdTech and corporate training markets. Owners & Shareholders of Learning Technologies Group benefit from these strengths.

- End-to-end learning and talent solutions.

- Proprietary technologies like Gomo and PeopleFluent.

- Strategic acquisitions enhancing capabilities.

- Strong brand equity and customer loyalty.

Learning Technologies Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Learning Technologies Group’s Competitive Landscape?

The digital learning and talent management sector is experiencing significant shifts, creating both opportunities and challenges for companies like Learning Technologies Group (LTG). The increasing use of Artificial Intelligence (AI) and Machine Learning (ML) in learning platforms, along with the rising demand for skills-based learning, are key trends. Conversely, data privacy concerns and economic uncertainties pose risks, demanding strategic adaptation.

The competitive landscape necessitates a focus on innovation and strategic partnerships. The future outlook for LTG involves expanding its global reach and capitalizing on the sustained demand for online learning solutions. Understanding the competitive landscape is critical for stakeholders and investors interested in the Revenue Streams & Business Model of Learning Technologies Group.

The EdTech and corporate training industry is seeing a surge in AI-driven solutions. There's a growing emphasis on skills-based learning to meet evolving workforce needs. Data security and regulatory compliance remain critical concerns for companies like LTG.

Intense competition from both established players and agile startups is a major hurdle. Economic downturns could impact corporate training budgets. Rapid technological advancements require continuous innovation to stay relevant in the Training Industry.

Emerging markets offer significant growth potential for digital learning solutions. The shift towards hybrid and remote work models fuels demand for scalable online learning platforms. Strategic partnerships and AI integration can boost LTG's market position.

LTG is likely to focus on becoming an integrated AI-powered talent experience platform. This involves leveraging its comprehensive offerings and global presence. The goal is to capture new market share and remain resilient.

LTG should prioritize investments in AI and adaptive learning technologies. Expanding its global footprint, particularly in high-growth regions, is crucial. Forming strategic partnerships to enhance its ecosystem will be key to success.

- AI Integration: Enhance platforms with AI-driven personalization and automation.

- Global Expansion: Target emerging markets with tailored learning solutions.

- Strategic Partnerships: Collaborate with tech and content providers.

- Data Security: Strengthen data privacy and compliance measures.

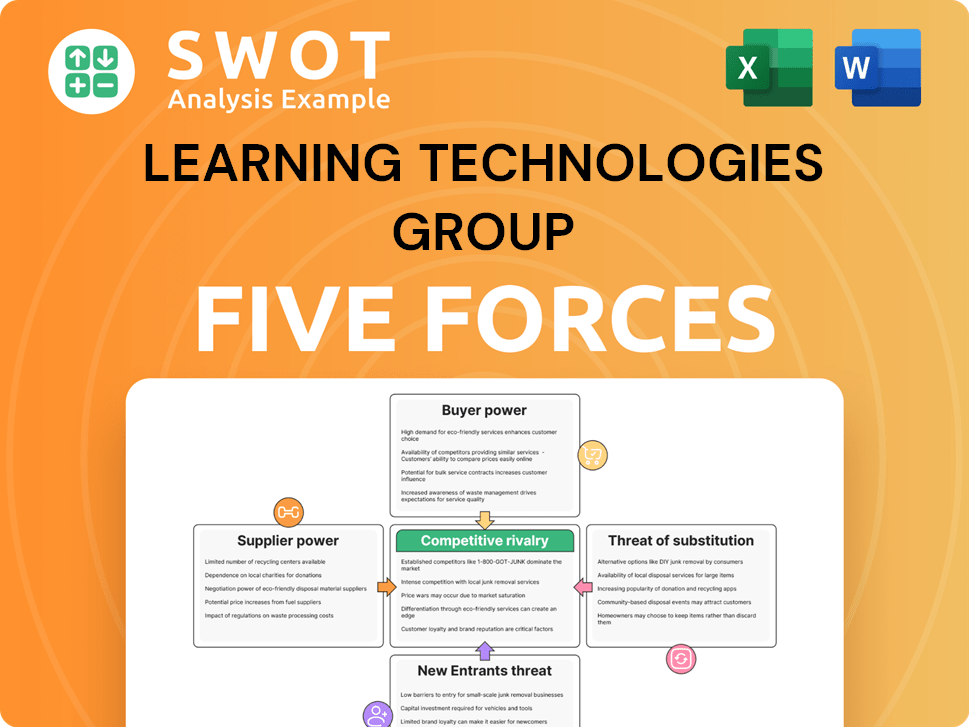

Learning Technologies Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Learning Technologies Group Company?

- What is Growth Strategy and Future Prospects of Learning Technologies Group Company?

- How Does Learning Technologies Group Company Work?

- What is Sales and Marketing Strategy of Learning Technologies Group Company?

- What is Brief History of Learning Technologies Group Company?

- Who Owns Learning Technologies Group Company?

- What is Customer Demographics and Target Market of Learning Technologies Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.