Mediacom Communications Bundle

How Does Mediacom Navigate the Cutthroat Telecom Arena?

In today's fast-paced digital world, understanding the Mediacom Communications SWOT Analysis is crucial for anyone navigating the telecom sector. Mediacom, a key player in the cable and communications industry, faces constant pressure to innovate and expand its offerings. This analysis dives deep into the competitive environment, exploring how Mediacom secures its position in the market.

This exploration of the Mediacom competitive landscape will identify its key competitors and evaluate its market share within the telecom industry. We'll dissect Mediacom's services, from cable internet providers to business solutions, offering a comprehensive telecom industry analysis. Furthermore, we'll examine factors influencing Mediacom's performance, including Mediacom internet speed comparison, pricing, and customer satisfaction, to provide a clear picture of its standing in the market.

Where Does Mediacom Communications’ Stand in the Current Market?

Mediacom Communications carves out its market position primarily in smaller cities and towns across 22 states in the U.S. It distinguishes itself by focusing on markets often underserved by larger competitors. This strategic focus helps define the Mediacom competitive landscape, allowing it to build a strong presence in specific regional areas.

As the fifth-largest cable television company in the U.S. by video subscribers, Mediacom is also a leading broadband provider in its service areas. Its core offerings include high-speed internet, digital television, and voice services for both residential and business customers. This comprehensive suite of services is a key aspect of its value proposition.

The company's commitment to network infrastructure is evident through its continuous investment in upgrading to gigabit speeds across its footprint. This has been crucial in maintaining its competitive edge in broadband services. For more insights, you can explore the Target Market of Mediacom Communications.

Mediacom holds a significant position in its service areas, particularly in the Midwest and Southeast. While specific market share data for 2024-2025 is not readily available, the company is a major player in the cable internet providers sector. This regional focus helps Mediacom compete effectively against larger national providers.

Mediacom's services include high-speed internet, digital television, and voice services. It has invested heavily in its network to offer gigabit speeds, which is a key differentiator. The company focuses on providing reliable and fast broadband, catering to the increasing demand for high-speed internet.

For the fiscal year 2023, Mediacom reported total revenues of $2.27 billion. Despite a slight decrease from the previous year, this indicates a stable operational scale compared to industry averages for regional providers. This financial performance reflects the company's capacity to maintain its market position.

Mediacom emphasizes its high-speed internet offerings, recognizing the growing demand for fast and reliable broadband. The company's strategy leverages its strong regional presence to serve as the dominant wireline provider in many areas. This focus on digital transformation is evident in its symmetrical speeds and advanced Wi-Fi solutions.

Mediacom's competitive edge comes from its focus on underserved markets and its investment in high-speed internet infrastructure. This allows it to offer competitive services compared to other Mediacom competitors. The company’s strategy focuses on providing value to its customers through reliable services.

- Gigabit internet speeds across its footprint.

- Strong regional presence in the Midwest and Southeast.

- Emphasis on symmetrical speeds and advanced Wi-Fi solutions.

- Focus on customer service and local market expertise.

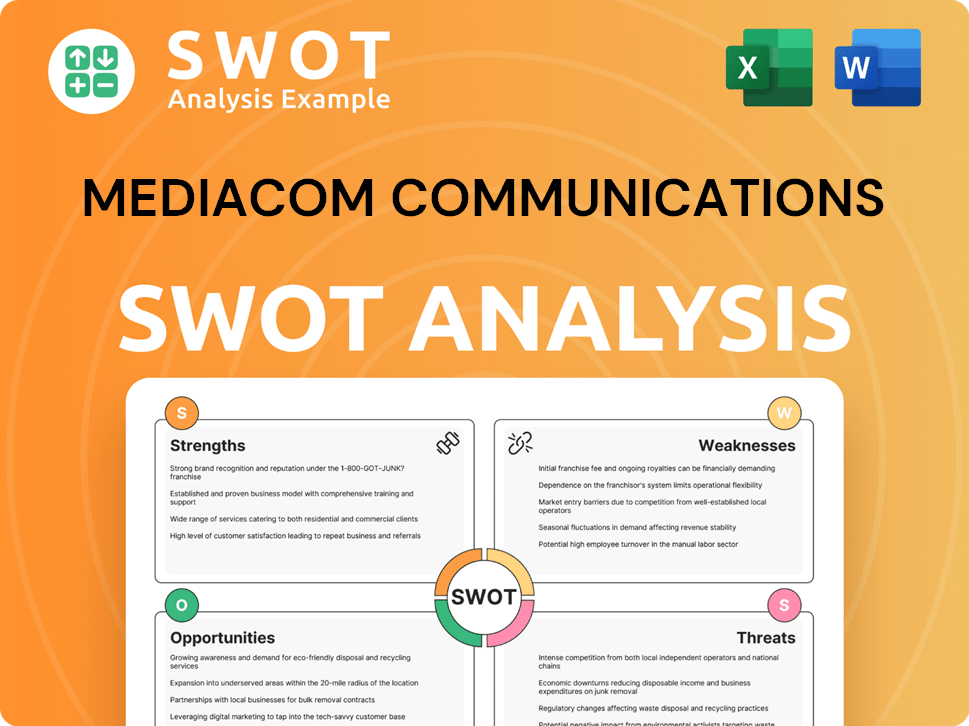

Mediacom Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mediacom Communications?

In the competitive landscape of the telecommunications sector, Mediacom Communications faces a diverse range of rivals. Its primary competitors include cable multiple system operators (MSOs), national telecommunication companies, and fixed wireless access (FWA) providers. Understanding the dynamics of these competitors is crucial for assessing Mediacom's market position and strategic challenges.

The company's success depends on its ability to differentiate its services and maintain a competitive edge in a market characterized by rapid technological advancements and evolving consumer preferences. This analysis will explore Mediacom's key competitors, their strengths, and the challenges they pose, providing insights into the factors shaping the telecom industry.

Mediacom's competitive landscape is significantly influenced by the presence of other major players. These rivals compete for market share by offering various services, including internet, television, and phone services. Understanding the strategies and market positions of these competitors is essential for evaluating Mediacom's performance and future prospects. For more information on Mediacom's business model, see Revenue Streams & Business Model of Mediacom Communications.

Charter Communications (Spectrum), Comcast (Xfinity), and Cox Communications are direct competitors. These companies often have greater economies of scale and broader brand recognition. They compete directly with Mediacom in overlapping service areas, particularly in the edges of their footprints.

AT&T and Verizon are significant competitors, especially with their fiber optic deployments and FWA services. Verizon's expansion of 5G Home Internet directly competes with Mediacom's broadband offerings. These companies invest heavily in infrastructure and technology.

Verizon and T-Mobile are expanding their 5G Home Internet services, leveraging their mobile networks to enter the home internet market. These providers offer an alternative to traditional cable and DSL, often with competitive pricing and faster deployment. FWA is becoming a prominent competitor.

DISH Network and DirecTV compete for video subscribers, although the cord-cutting trend has shifted focus to broadband. These providers are adapting to the market by offering bundled services and focusing on internet offerings to retain customers. They are a significant factor in the overall telecom industry.

Smaller, localized fiber providers are disrupting the traditional competitive landscape by offering alternative high-speed internet options. These companies often focus on specific geographic areas and provide high-speed internet services. They are a growing segment of the market.

Strategic alliances and mergers, such as T-Mobile's expansion of its 5G Home Internet service, influence the competitive dynamics. These partnerships and acquisitions allow companies to expand their reach and offer new services. They are a key factor in the industry's evolution.

The competitive landscape for Mediacom is shaped by several key factors that influence its market share and customer satisfaction. These factors include pricing strategies, service availability, and technological advancements. Understanding these elements is essential for evaluating Mediacom's position in the telecom industry.

- Pricing and Bundling: Competitors often offer aggressive pricing and bundled services to attract customers. Mediacom must remain competitive in this area. For example, in 2024, bundled packages including internet, TV, and phone services were a significant driver of customer acquisition for many providers.

- Service Availability: The geographic reach of services is crucial. Mediacom's availability by zip code and its ability to expand its network influence its competitive position. In 2024, the expansion of fiber optic internet options was a key focus for many providers.

- Internet Speed and Data Caps: Mediacom's internet speed comparison and data cap policies are important. Competitors offer varying speeds and data limits, affecting customer satisfaction. In 2024, the trend was toward higher speeds and more generous data allowances.

- Customer Service: Customer service reviews and ratings significantly impact customer loyalty. Mediacom must focus on improving its customer service to compete effectively. In 2024, customer satisfaction ratings were a key performance indicator for telecom companies.

- Technological Advancements: The adoption of new technologies, such as fiber optic internet options and 5G, is crucial. Mediacom must invest in these technologies to remain competitive. In 2024, the deployment of 5G home internet services was a major trend.

- Business Internet Plans: Mediacom's business internet plans are important for attracting business customers. Competition in this segment is intense, requiring specialized services and support. In 2024, the demand for robust business internet solutions continued to grow.

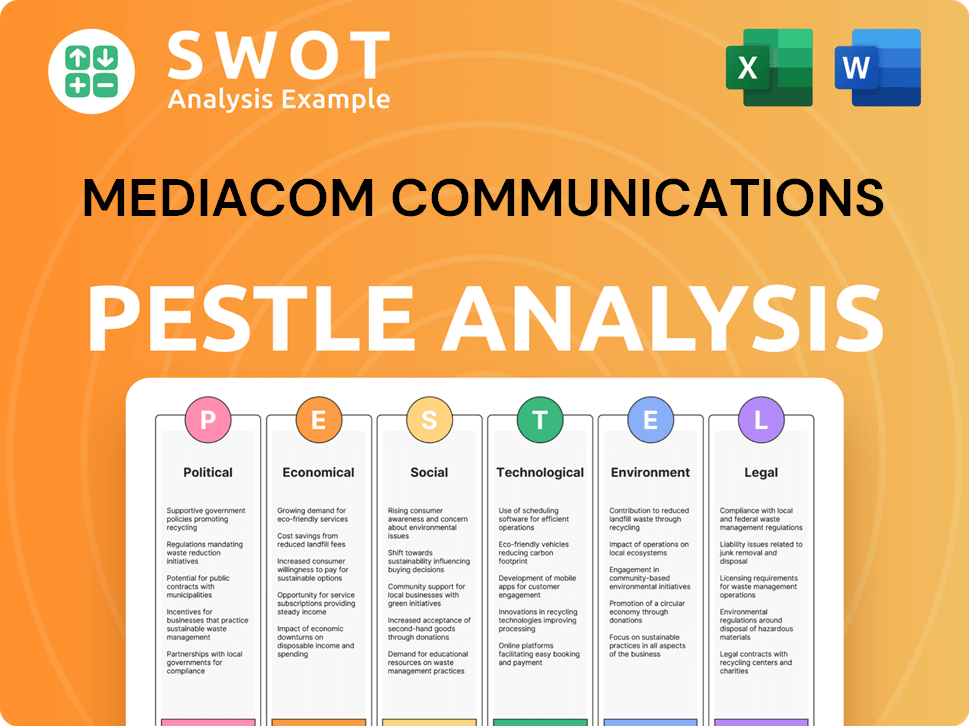

Mediacom Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mediacom Communications a Competitive Edge Over Its Rivals?

Understanding the Mediacom competitive landscape requires a look at its key advantages. The company has carved a niche by focusing on smaller cities and towns, often becoming the primary provider of high-speed internet and cable services in these areas. This strategic focus provides a significant edge over competitors, especially in regions with less dense populations.

Mediacom's commitment to upgrading its broadband network to offer gigabit speeds is crucial for maintaining a strong position in the market. This focus on speed and reliability is vital for customer retention and attracting new subscribers. The ability to bundle services—internet, TV, and phone—adds further value, fostering customer loyalty and offering competitive pricing.

While larger companies may have more brand recognition, Mediacom leverages its localized approach and community engagement to build stronger customer relationships. Operational efficiencies, developed over years of serving specific markets, also contribute to competitive pricing and profitability. This strategy is relatively sustainable due to the high costs of building competing wireline infrastructure, although emerging technologies like Fixed Wireless Access (FWA) and government-funded fiber deployments pose potential threats.

Mediacom strategically focuses on underserved, less densely populated areas. This approach minimizes direct competition from larger providers. Their extensive network footprint in these areas provides a solid foundation for service delivery.

Mediacom invests in its broadband network, offering gigabit speeds across its footprint. This commitment to advanced technology ensures competitive internet services. Bundling services (internet, TV, and phone) provides convenience and potential cost savings.

Mediacom's localized approach and community engagement help build strong customer relationships. This is particularly effective in the specific service areas they target. They often have an advantage over larger competitors in this regard.

Operational efficiencies, honed through years of serving specific markets, enable competitive pricing. This helps Mediacom maintain profitability and attract customers. They can often offer attractive bundles and discounts.

Mediacom benefits from its established infrastructure and network footprint in smaller cities and towns. This regional focus reduces direct competition. They also excel in providing high-speed internet and bundled services.

- Focus on underserved markets.

- Investment in advanced broadband technology.

- Strong customer relationships through localized approach.

- Efficient operations leading to competitive pricing.

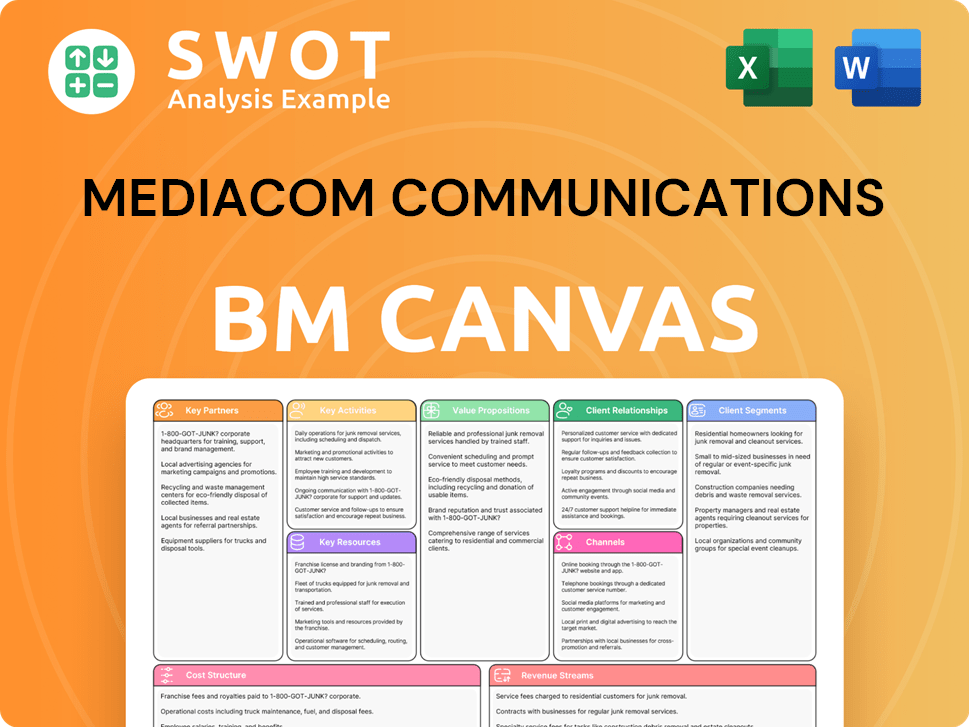

Mediacom Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mediacom Communications’s Competitive Landscape?

The telecommunications industry is experiencing rapid transformation, significantly impacting the Mediacom competitive landscape. Increased demand for high-speed internet and evolving consumer preferences for content consumption are key drivers. This dynamic environment necessitates strategic adaptation to maintain and grow Mediacom market share amidst intensifying competition from various providers.

Telecom industry analysis reveals that regulatory changes and technological advancements are reshaping the competitive dynamics. Mediacom's ability to navigate these challenges and capitalize on emerging opportunities will determine its future success. The company’s strategic focus on broadband services and potential diversification into digital services will be essential for long-term resilience in a competitive market.

The demand for faster internet speeds and lower latency continues to grow due to streaming services, remote work, and smart home devices. Regulatory changes, particularly concerning broadband infrastructure funding and net neutrality, could impact Mediacom's operational costs. Competition is increasing from fixed wireless access (FWA) providers and the expansion of fiber-to-the-home (FTTH) networks.

Managing subscriber churn in a competitive market is a significant challenge. Mitigating the impact of cord-cutting on the video subscriber base is crucial. Adapting to evolving consumer preferences for personalized and on-demand content is also essential. Securing and retaining skilled technical talent to manage and expand advanced networks presents another challenge.

Federal and state funding initiatives for broadband expansion, such as the Broadband Equity, Access, and Deployment (BEAD) program, offer avenues for network expansion. The increasing adoption of smart home technologies and the growing need for robust home Wi-Fi solutions provide opportunities for value-added services. Strategic partnerships with content providers or technology companies could enhance service offerings.

Mediacom's competitive position is evolving towards a stronger focus on its core broadband product. Exploring diversification into related digital services is essential. The company aims to remain resilient in a rapidly changing market. The company needs to respond to the challenges and opportunities to maintain its position.

Mediacom must prioritize network upgrades to meet the rising demand for higher broadband speeds. Managing operational costs amidst regulatory changes is crucial for profitability. Adapting to the evolving preferences of consumers and expanding into new markets will be vital for sustainable growth.

- Investment in network infrastructure to support higher speeds and lower latency.

- Strategic partnerships to enhance service offerings and compete effectively.

- Focus on customer retention and satisfaction to reduce churn rates.

- Exploration of value-added services to increase revenue streams.

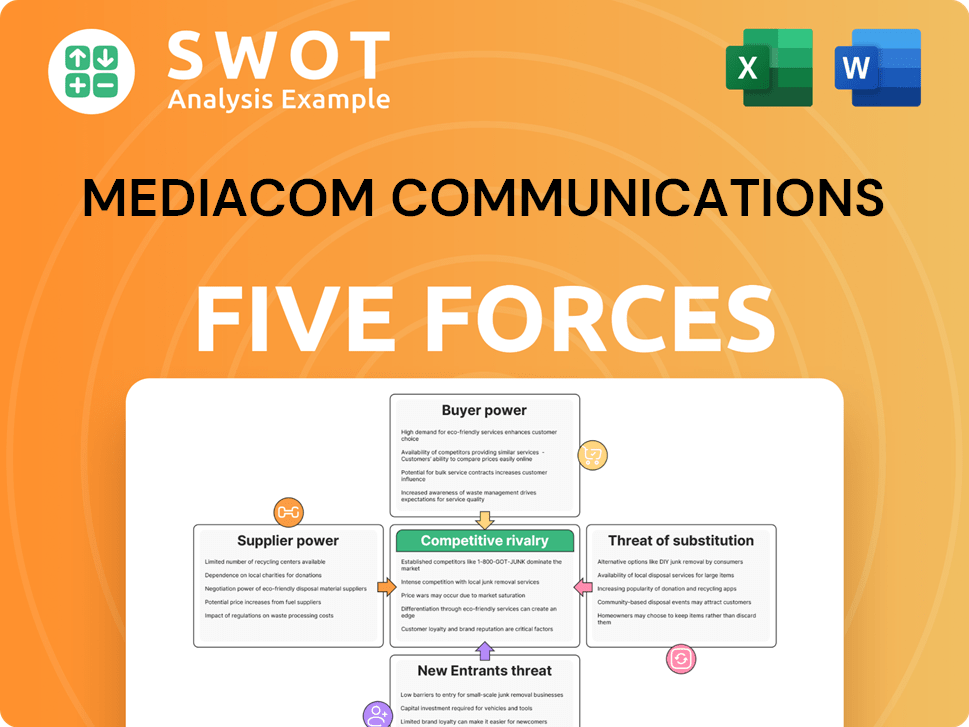

Mediacom Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mediacom Communications Company?

- What is Growth Strategy and Future Prospects of Mediacom Communications Company?

- How Does Mediacom Communications Company Work?

- What is Sales and Marketing Strategy of Mediacom Communications Company?

- What is Brief History of Mediacom Communications Company?

- Who Owns Mediacom Communications Company?

- What is Customer Demographics and Target Market of Mediacom Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.