Mediacom Communications Bundle

Unveiling Mediacom: How Does This Communications Giant Operate?

Ever wondered how Mediacom, a major player in the cable and internet industry, connects homes and businesses across the U.S.? From high-speed Mediacom Communications SWOT Analysis to comprehensive entertainment options, Mediacom services are a staple in many communities. This exploration dives deep into Mediacom's business model, revealing how it delivers its offerings and generates revenue.

Understanding Mediacom's operations is crucial for anyone seeking to assess its market position and future prospects. We'll examine the company's Mediacom Communications SWOT Analysis, its approach to Mediacom internet, and the factors influencing its competitive landscape. Whether you're evaluating Mediacom packages or researching Mediacom customer service, this analysis provides valuable insights.

What Are the Key Operations Driving Mediacom Communications’s Success?

Mediacom Communications creates value by providing broadband, video, and voice services to residential and business customers. The company focuses on serving non-urban areas across 22 states, offering essential connectivity where larger providers may have less presence. Their core offerings include high-speed internet, cable TV, and phone services, tailored to meet the needs of communities often underserved by major telecom companies.

The core products offered by Mediacom include Xtream Internet, Mediacom TV, and Mediacom Phone. Xtream Internet offers various speed tiers, with up to 8 Gbps available in select areas. Mediacom TV provides a wide array of channels, and Mediacom Phone offers local and long-distance calling. These services are complemented by business solutions, including high-speed data, voice, and managed services.

Mediacom's operational processes are built around a robust hybrid fiber-coaxial (HFC) network. This infrastructure is continuously upgraded to enhance service quality and reliability. In 2024, Mediacom announced plans to expand its 8 Gig internet service, investing in fiber deeper into neighborhoods and leveraging DOCSIS 4.0 technology. This ensures that Mediacom remains competitive in the market by offering leading-edge internet speeds and services.

Mediacom utilizes a hybrid fiber-coaxial (HFC) network to deliver its services. This network is continuously upgraded to support higher speeds and improved reliability. The company is investing in DOCSIS 4.0 technology to enhance its capabilities.

Mediacom provides a range of services, including Xtream Internet, Mediacom TV, and Mediacom Phone. Xtream Internet offers various speed tiers, with up to 8 Gbps in select areas. Business solutions include high-speed data, voice, and managed services.

Mediacom's sales channels include direct sales, online platforms, and retail locations. Customer service is handled through call centers and online support. The company focuses on providing reliable and accessible customer support.

Mediacom’s value proposition lies in providing high-speed internet and other services in non-urban areas. This focus allows Mediacom to serve communities often underserved by larger providers. This strategic approach helps Mediacom to stand out in the telecommunications market.

Mediacom's operations involve a comprehensive approach to delivering services, from network management to customer support. The company manages its own network, ensuring service quality and reliability. Sales and customer service are handled through multiple channels to provide accessible support.

- Network Management: Mediacom manages its network from headend to customer premise.

- Supply Chain: The company sources network equipment from various vendors.

- Field Operations: A large field operations team handles installation and maintenance.

- Customer Service: Call centers and online support are available for customer assistance.

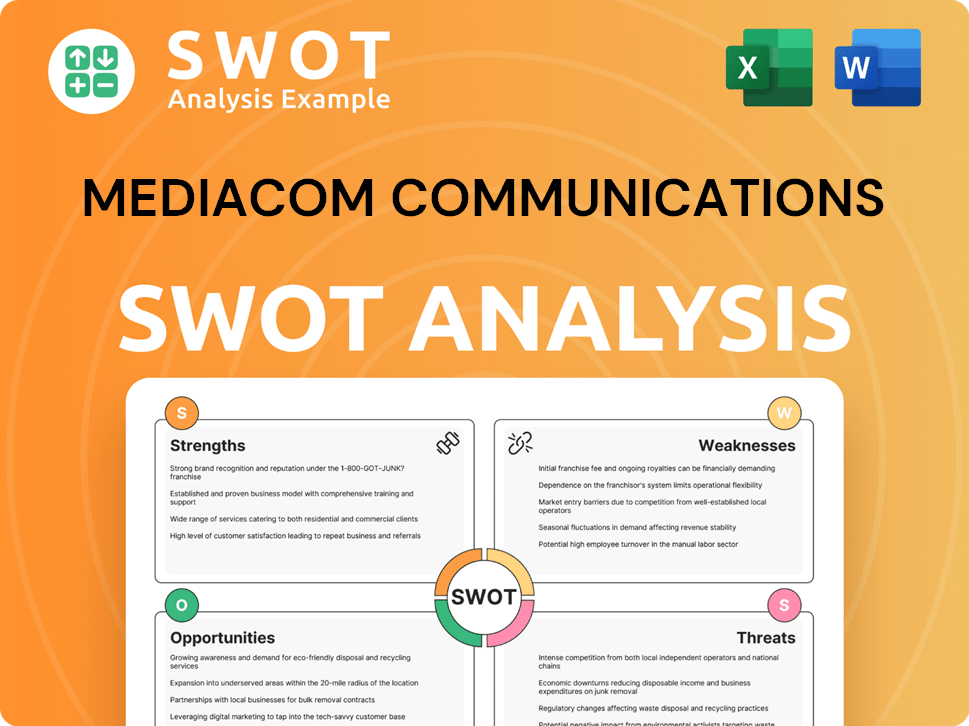

Mediacom Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mediacom Communications Make Money?

Mediacom Communications generates revenue mainly through subscription-based services. These services include internet, video, and phone offerings. While specific financial breakdowns for 2024 or 2025 aren't publicly available, the company's revenue streams are well-defined.

Historically, internet services have become the primary revenue driver for cable operators, surpassing traditional video services. This trend is consistent across the industry. Mediacom's focus has shifted towards its broadband infrastructure, reflecting the industry-wide trend of internet services becoming the primary growth engine and revenue source.

The company's monetization strategies involve tiered pricing for internet speeds. They offer various plans under their Xtream Internet service, ranging from 100 Mbps up to 8 Gbps. Bundling strategies, offering discounts for multiple services (internet, TV, and phone), also play a key role.

Mediacom's internet services are a major revenue source. The company offers various internet speed tiers to cater to different customer needs. The expansion of their 8 Gig internet service underscores their focus on high-speed data.

Video services contribute to revenue, although their importance has decreased compared to internet. Mediacom provides cable TV services, and advertising revenue from its channels is part of the income.

Mediacom also offers phone services as part of its bundled packages. These services add to the overall revenue generated from subscriptions.

Mediacom generates revenue from business services. They provide tailored connectivity and communication solutions to small and medium-sized enterprises.

Bundling services together encourages customer loyalty. Customers who subscribe to multiple services often receive discounts, increasing the average revenue per user.

Advertising revenue from cable TV channels contributes to the overall revenue. However, this is a smaller portion compared to subscription fees.

Mediacom's strategy includes a strong emphasis on Owners & Shareholders of Mediacom Communications, particularly in high-speed internet. The company's focus on upgrading its network and expanding its internet services highlights its commitment to this area. While specific financial figures for 2024 and 2025 are not available, the trend indicates a shift towards internet services as the primary revenue generator.

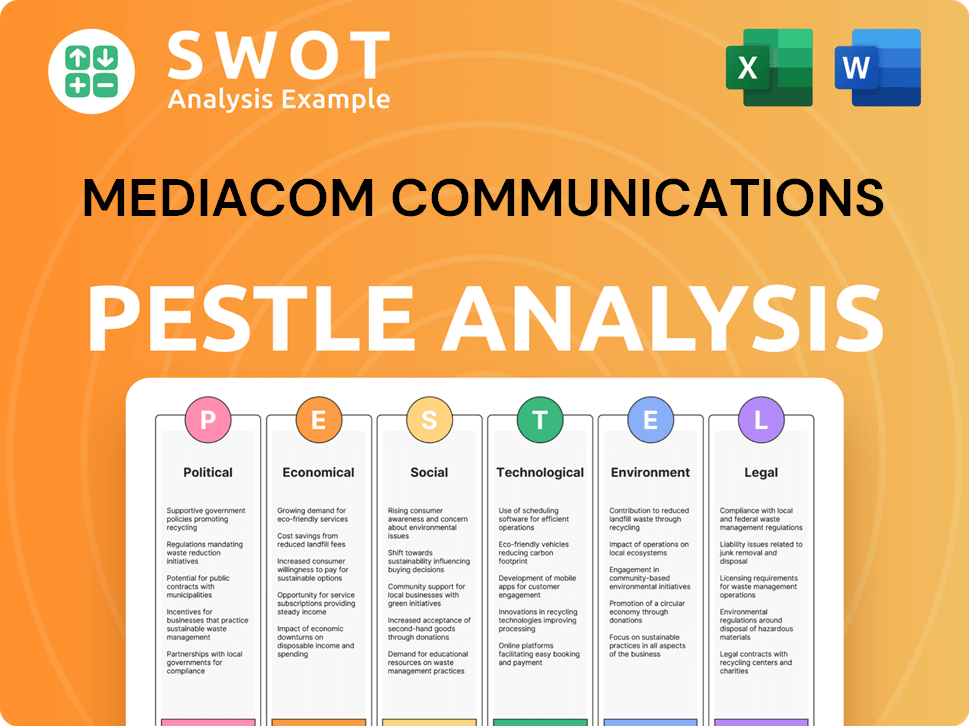

Mediacom Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Mediacom Communications’s Business Model?

The journey of Mediacom has been marked by significant milestones and strategic moves, particularly its consistent investment in network upgrades to deliver higher internet speeds. A key strategic move has been the company's focus on serving smaller cities and towns, a market segment often overlooked by larger telecommunications giants. This niche strategy has allowed Mediacom to establish a strong presence and build customer loyalty in these communities.

A notable recent milestone is Mediacom's ongoing expansion of its 8 Gig internet service, which began rolling out in late 2023 and continues into 2024 and 2025, reaching over 250,000 homes and businesses. This move directly addresses the increasing demand for ultra-fast broadband and positions Mediacom competitively. Operational challenges have included the capital-intensive nature of network upgrades and the ongoing need to manage customer expectations in a rapidly evolving technological landscape.

Mediacom has responded by consistently investing in its infrastructure, deploying technologies like DOCSIS 4.0 to enhance network capacity and speed. The company's competitive advantages stem from its established network infrastructure in its service areas, often being the incumbent provider. Its focus on customer service in smaller markets also contributes to customer retention. Furthermore, Mediacom's commitment to the 10G initiative, aiming to deliver 10-Gigabit speeds and enhanced smart home capabilities, demonstrates its adaptation to new trends and technology shifts, ensuring its business model remains robust against competitive threats from fiber overbuilders and fixed wireless access providers.

Mediacom's rollout of 8 Gig internet service, which began in late 2023, is a significant milestone. This expansion, reaching over 250,000 homes and businesses, showcases its commitment to providing ultra-fast broadband. The company continues to invest in its network, deploying technologies like DOCSIS 4.0.

A key strategic move for Mediacom has been its focus on serving smaller cities and towns. This niche strategy has allowed the company to establish a strong presence and build customer loyalty. Mediacom's commitment to the 10G initiative demonstrates its adaptation to new trends and technology shifts.

Mediacom's competitive advantages stem from its established network infrastructure and focus on customer service in smaller markets. The company is often the incumbent provider in its service areas. This positioning helps with customer retention and market share.

Operational challenges include the capital-intensive nature of network upgrades and managing customer expectations. The company faces competition from fiber overbuilders and fixed wireless access providers. Mediacom addresses these challenges through continuous infrastructure investments.

Mediacom's strategy centers on serving smaller markets, differentiating it from larger competitors. This approach has allowed it to build a strong customer base and establish a solid market presence. The company's investment in advanced technologies like DOCSIS 4.0 and the 10G initiative underscores its commitment to staying competitive.

- Market Focus: Targeting smaller cities and towns.

- Technology Investments: Deploying DOCSIS 4.0 and the 10G initiative.

- Competitive Advantage: Established network infrastructure and customer service focus.

- Service Offerings: Expanding 8 Gig internet service.

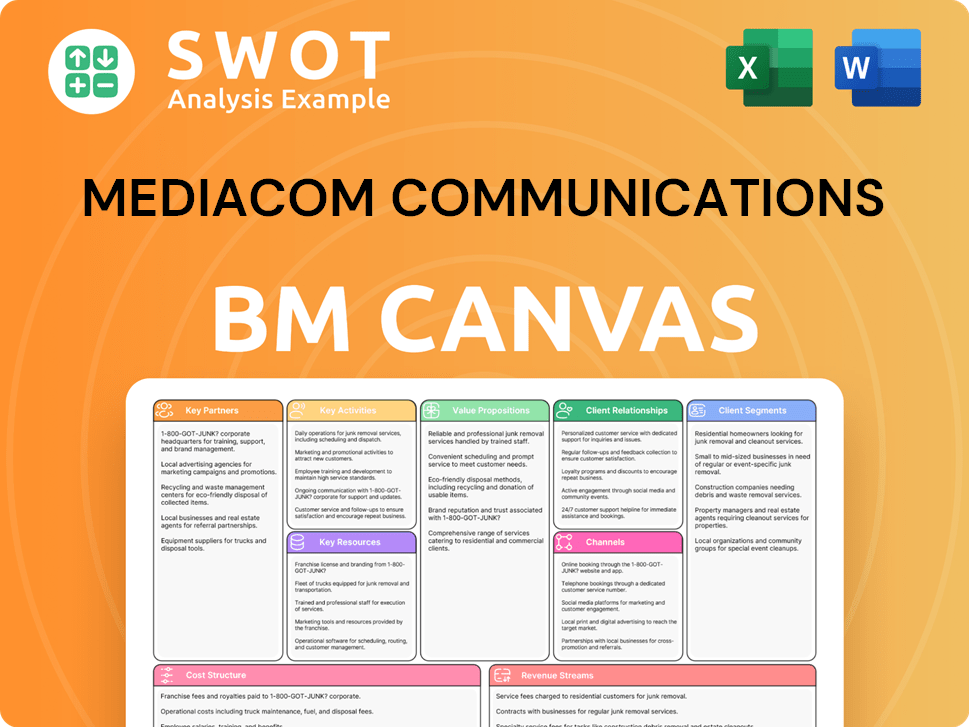

Mediacom Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Mediacom Communications Positioning Itself for Continued Success?

Mediacom Communications maintains a strong industry position as a leading cable and broadband provider, particularly in the smaller cities and towns across the 22 states it serves. Although specific market share data for 2024-2025 is not publicly available for this privately held company, its extensive network footprint and consistent investment in speed upgrades indicate a significant presence in its operational areas. Customer loyalty is often driven by the reliability and speed of its internet services, especially in regions where competition might be less intense compared to major metropolitan areas.

Key risks and headwinds for Mediacom include the ongoing threat from fiber-to-the-home (FTTH) overbuilders and the increasing adoption of fixed wireless access (FWA) services from mobile carriers. Regulatory changes, particularly concerning net neutrality and broadband infrastructure funding, could also impact operations and investment strategies. Changing consumer preferences, such as cord-cutting in video services, continue to necessitate a strong focus on broadband as the primary revenue driver. For more information about the company, check out the Growth Strategy of Mediacom Communications.

Mediacom holds a significant market position in the cable and broadband sector, especially in smaller markets. Its focus on reliable internet services helps maintain customer loyalty, particularly in areas with less competition. The company's investment in network upgrades and expansion of 8 Gig internet service are key to maintaining its competitive edge.

Mediacom faces risks from FTTH overbuilders, who are deploying fiber networks. The increasing adoption of FWA services from mobile carriers presents another challenge. Regulatory changes and evolving consumer preferences, such as cord-cutting, also impact operations.

Mediacom plans to sustain and expand its ability to make money by continuing to enhance its network capabilities. The company is focusing on delivering competitive speeds and reliable service. Exploring new smart home and business solutions built upon its advanced broadband infrastructure will ensure its long-term viability.

Mediacom is expanding its 8 Gig internet service and investing in 10G network upgrades. These upgrades aim to deliver multi-gigabit speeds and low latency. Leadership is committed to providing cutting-edge broadband services to meet future demands.

Mediacom's success hinges on its ability to compete with fiber and FWA offerings. The company must continue to invest in its network and innovate to meet evolving consumer needs. Maintaining strong customer service and competitive pricing plans is crucial for retaining and attracting customers.

- Focus on broadband as the primary revenue driver.

- Continue network upgrades to offer faster speeds.

- Explore new services, such as smart home solutions.

- Adapt to regulatory changes and consumer preferences.

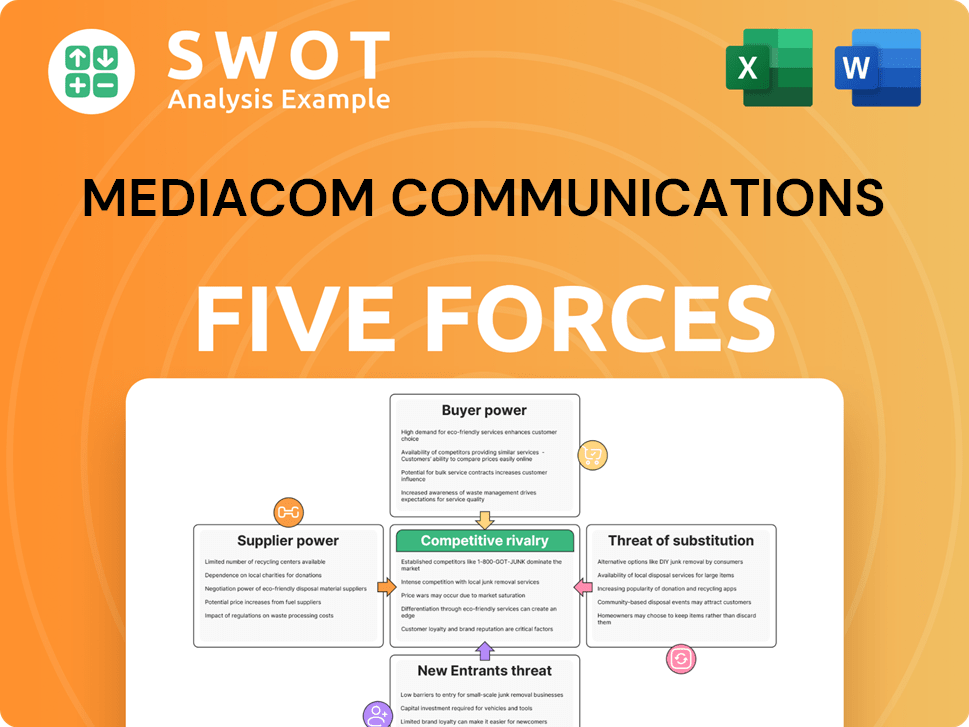

Mediacom Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mediacom Communications Company?

- What is Competitive Landscape of Mediacom Communications Company?

- What is Growth Strategy and Future Prospects of Mediacom Communications Company?

- What is Sales and Marketing Strategy of Mediacom Communications Company?

- What is Brief History of Mediacom Communications Company?

- Who Owns Mediacom Communications Company?

- What is Customer Demographics and Target Market of Mediacom Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.