Mediacom Communications Bundle

Can Mediacom Communications Continue to Thrive in the Telecommunications Revolution?

Mediacom Communications, a significant player in the U.S. cable and communications sector, has built its foundation on connecting underserved communities with advanced services. Founded in 1995, the company has grown to become the 5th largest cable operator, serving millions across 22 states. This success story, however, is just the beginning of an even more ambitious journey.

Mediacom's Mediacom Communications SWOT Analysis reveals the company's strategic moves, including its expansion plans and how it tackles the challenges within the broadband market. The company's consistent revenue growth, spanning over 100 quarters as of Q4 2021, highlights its strong financial standing. Now, let's delve into the Mediacom growth strategy and explore the exciting Mediacom future prospects within the dynamic telecommunications industry.

How Is Mediacom Communications Expanding Its Reach?

The primary customer segments for Mediacom Communications include residential and business clients. Mediacom focuses on providing high-speed internet, cable television, and phone services to homes. For businesses, Mediacom offers tailored solutions, including dedicated internet access, data networking, and voice services, aiming to meet the specific needs of various industries.

Mediacom's strategy targets both urban and rural areas, with a strong emphasis on expanding its fiber-optic infrastructure to reach underserved markets. This approach allows the company to capture a broader customer base and enhance its competitive position in the telecommunications industry. The company is also focused on offering bundled services to increase customer loyalty and revenue per customer.

Mediacom's expansion initiatives are primarily focused on extending its high-speed broadband services. A key element of this strategy involves fiber construction projects, often supported by government grants, to bring ultra-high-speed internet to unserved or underserved areas. This is a crucial aspect of the Marketing Strategy of Mediacom Communications, as it enhances the company's reach and competitiveness.

In 2024, Mediacom completed a $5.3 million private investment for a 73-mile fiber network in Lakewood Township, Minnesota, providing access to over 1,100 homes and businesses. This expansion is part of Mediacom's broader strategy to enhance its network infrastructure and reach more customers.

In September 2024, the first phase of a fiber-to-the-home network was completed in St. Louis County, Minnesota, connecting 135 homes in Biwabik Township. The project aims to reach 550 underserved homes upon full completion. Mediacom is also undertaking fiber builds near Hibbing, Minnesota.

Mediacom launched a 10G platform in rural Kentucky in late 2024 and early 2025. This initiative highlights Mediacom's commitment to providing advanced broadband services in underserved areas. The company is also activating a fiber optic broadband network in Baldwin County, Alabama.

In July 2024, Mediacom launched Mediacom Mobile, a wireless phone service in partnership with Verizon. This service offers unlimited and 'By the Gig' plans designed to be bundled with Xtream Internet. This expansion allows Mediacom to offer a more comprehensive communication solution.

Mediacom is committed to bridging the digital divide through initiatives like Xtream Connect, which provides affordable internet access to low-income households. This commitment is a key component of their long-term business model.

- Xtream Connect provides affordable internet access.

- The company is focused on reaching new customer segments.

- Mediacom is adapting to industry changes.

- Mediacom is strengthening its business services division.

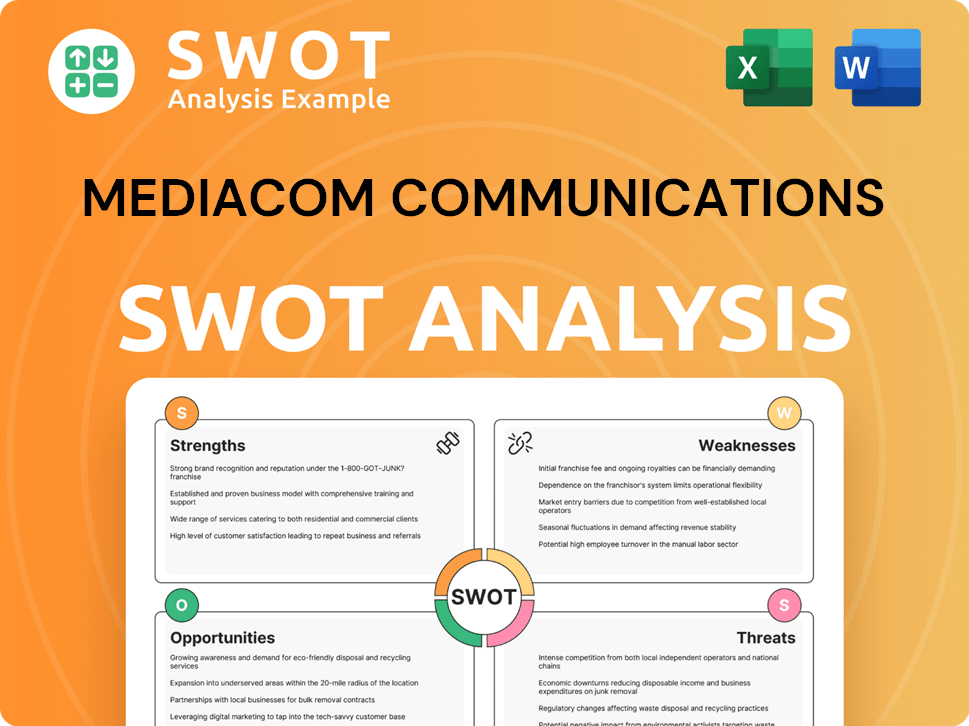

Mediacom Communications SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mediacom Communications Invest in Innovation?

Understanding the innovation and technology strategy of Mediacom Communications is crucial for assessing its growth trajectory and future prospects. This strategy is pivotal in navigating the competitive landscape of the telecommunications industry and ensuring sustained market share. The company's approach to technology and innovation directly influences its ability to meet evolving customer needs and maintain a competitive edge.

Mediacom's strategic investments in technology are designed to enhance service offerings and improve customer experiences. These investments are a key part of the company's plan to stay ahead in the broadband market and adapt to changing consumer preferences. The company's focus on technological advancements is a core component of its long-term business model.

The company is actively upgrading its broadband network to the cable industry's new 10G Platform. This upgrade allows Mediacom to deliver multi-gig and symmetrical speed broadband services. This technological advancement is a key part of Mediacom's strategy to provide high-speed internet to both urban and rural communities.

Mediacom's fiber-rich network infrastructure is a cornerstone of its growth strategy. The company is investing significantly in its network to provide faster and more reliable internet services. This investment is crucial for maintaining a competitive advantage in the broadband market.

The deployment of the 10G Platform enables Mediacom to offer multi-gig and symmetrical speed broadband services. This technology allows for future speeds of 10 gigabits and beyond. The launch in rural Kentucky in December 2024 and expansions in Minnesota in April and June 2025 demonstrate Mediacom's commitment to providing high-speed internet.

Mediacom introduced a groundbreaking WiFi experience with eero 7, launching 'Advanced WiFi' in May 2025. This initiative aims to deliver exceptional internet connectivity throughout the entire home. The implementation of TrueMesh technology and future Wi-Fi 7 capabilities enhances the customer experience.

Mediacom has partnered with CSG to extend their nearly 30-year relationship for another five years. This partnership will enable Mediacom to swiftly bring new innovations to the market. The focus is on growing customer lifetime value through enhanced customer engagement and loyalty.

In October 2024, Mediacom launched new online tools to inform and connect residents in new build markets. These tools track construction progress and provide direct communication channels for grant-funded projects. This demonstrates Mediacom's commitment to transparency and community engagement.

Mediacom's expansion of high-speed internet services in rural communities, such as Wells and Winnebago, Minnesota, and Webster and Elko New Market, Minnesota, highlights its commitment to bridging the digital divide. These expansions show Mediacom's dedication to providing advanced internet solutions in underserved areas.

Mediacom's innovation and technology strategy is multifaceted, encompassing network upgrades, customer experience enhancements, and strategic partnerships. These initiatives are critical for driving the company's growth and ensuring its long-term success. For more insights, you can explore the Brief History of Mediacom Communications.

Mediacom's technological advancements are designed to improve service offerings and customer satisfaction. These advancements are a key part of Mediacom's strategic plan to stay ahead in the competitive telecommunications industry.

- Deploying the 10G Platform for multi-gig and symmetrical speed broadband.

- Launching 'Advanced WiFi' with eero 7 to enhance home internet connectivity.

- Utilizing partnerships to accelerate innovation and improve customer engagement.

- Providing online tools to inform and connect residents in new build markets.

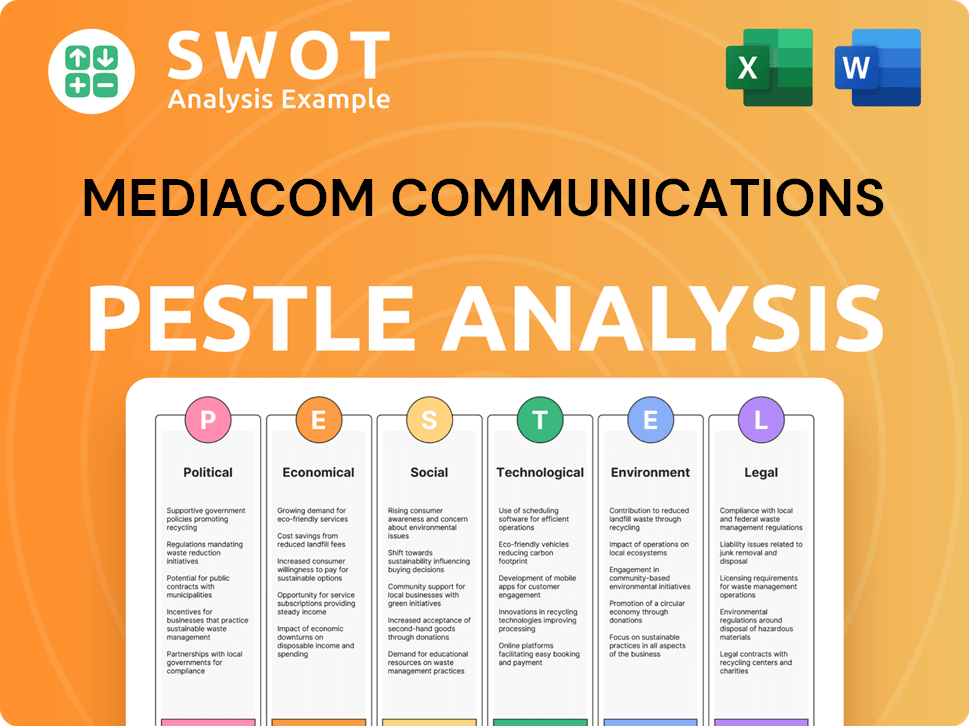

Mediacom Communications PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Mediacom Communications’s Growth Forecast?

The financial outlook for Mediacom Communications is robust, supported by strategic operations and consistent financial results. As of March 2024, S&P Global Ratings maintained a 'BBB+' issuer credit rating and a stable outlook for Mediacom, indicating a strong financial position. This positive assessment reflects the company's ability to generate substantial cash flow in the coming years.

Mediacom's financial strategy includes leveraging various funding sources to support its broadband expansion projects. This approach complements private investments and supports the company's growth strategy. The company's focus on financial stability and strategic investments positions it well for future growth in the telecommunications industry.

Mediacom's commitment to financial health is further demonstrated by its proactive debt management and strategic investments in infrastructure. These initiatives enhance its competitive position and support its long-term business model. The company's ability to secure funding and manage debt effectively showcases its financial acumen.

S&P Global Ratings maintained a 'BBB+' issuer credit rating with a stable outlook as of March 2024. This rating reflects Mediacom's strong financial standing and its ability to manage its debt effectively. The stable outlook suggests that the company's credit quality is expected to remain consistent in the near future.

In March 2024, Mediacom Holdings LLC proposed a senior unsecured term loan and an unsecured revolving credit facility. This strategic move, primarily aimed at refinancing existing debt, is expected to be leverage-neutral. This approach underscores the company's commitment to maintaining a healthy financial structure and supporting its future prospects.

Mediacom demonstrated remarkable financial consistency, achieving 100 consecutive quarters of year-over-year revenue growth as of Q4 2021. This sustained growth highlights the company's strong performance in the broadband market analysis and its ability to adapt to market dynamics.

While S&P Global Ratings projected a potential 7%-8% drop in Mediacom's EBITDA in 2025 due to intensifying competition, the company's overall credit quality is expected to remain stable. This indicates that, despite competitive pressures, Mediacom is well-positioned to maintain its financial stability.

Mediacom leverages grant dollars from federal, state, and local government partners to fund broadband expansion projects, complementing its private investments. This strategy supports Mediacom's expansion plans 2024 and its impact on rural communities.

- Received an $821,758 Border-to-Border Broadband Development Grant for a fiber build in St. Louis County, Minnesota.

- Investing over $1.2 million of private capital in the same area.

- This approach enables Mediacom to extend its services and increase its market share analysis.

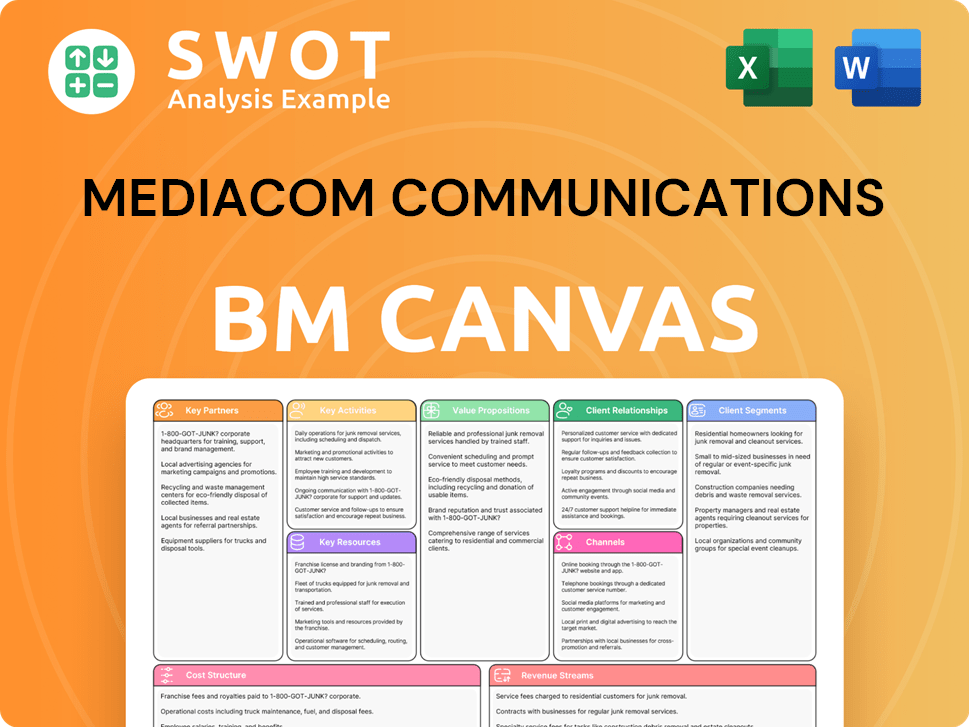

Mediacom Communications Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Mediacom Communications’s Growth?

Understanding the potential risks and obstacles is crucial for assessing the Mediacom Communications growth strategy and future prospects. The telecommunications industry faces rapid changes, and several factors could hinder Mediacom's expansion. These challenges range from increased competition to regulatory hurdles and financial constraints.

Intense competition, particularly from Fiber-to-the-Home (FTTH) and Fixed Wireless Access (FWA) providers, is a significant concern. Regulatory adjustments and financial factors also play a role in shaping Mediacom's operational landscape. Addressing these risks is essential for Mediacom to achieve its strategic objectives and maintain a competitive position in the broadband market.

The competitive environment is expected to contribute to an estimated 7%-8% drop in Mediacom's EBITDA in 2025. While Mediacom operates mainly in smaller cities and towns, the growing deployment of FTTH by other telcos, with an estimated 9 million new fiber passings in 2025, poses a threat. This competitive pressure requires Mediacom to innovate and adapt to maintain its market share and drive subscriber growth trends.

Mediacom faces increasing competition from FTTH and FWA providers. This shift in the competitive landscape is a primary challenge. Mediacom's future prospects depend on its ability to differentiate itself in this evolving market.

Regulatory changes pose potential obstacles for Mediacom. The 'Rip and Replace' program, due to the Secure and Trusted Communications Networks Act, has impacted the company. Delays and funding shortfalls can hinder network upgrades and expansion timelines, affecting Mediacom's expansion plans 2024.

Financial risks also present challenges. The company's ownership structure and potential for acquisitions or dividends could lead to increased leverage. Although Mediacom aims to reduce net leverage, these factors introduce financial uncertainties that could impact its financial performance review.

Supply chain vulnerabilities can affect network upgrades. Delays in equipment delivery and funding shortfalls can hinder expansion. Addressing these vulnerabilities is crucial for maintaining competitiveness in the broadband market, as detailed in the Owners & Shareholders of Mediacom Communications article.

Operational challenges include the need for timely network upgrades. The company must adapt to changing market demands. These challenges can impact Mediacom's customer satisfaction ratings and overall market share analysis.

Mediacom is actively working with government partners to expand broadband access. The company offers low-cost plans like Xtream Connect to address affordability. These strategies can mitigate some competitive and market-related risks, supporting Mediacom's long-term business model.

The increasing deployment of FTTH by competitors, with approximately 9 million new fiber passings expected in 2025, intensifies market competition. This requires Mediacom to continuously evaluate and adjust its cable company strategy. The company must focus on innovative services to maintain its competitive advantage.

The Secure and Trusted Communications Networks Act and related programs, such as 'Rip and Replace,' have impacted Mediacom. Funding shortfalls and supply chain issues can affect network upgrades. These factors can influence Mediacom's financial performance review and its ability to invest in fiber optic infrastructure.

To address these challenges, Mediacom is actively working with government partners to expand broadband access. Offering low-cost plans is a key strategy. These initiatives support Mediacom's impact on rural communities and help it navigate the telecommunications industry landscape.

Mediacom's future in the internet service provider market depends on its ability to overcome these obstacles. Adapting to the broadband market analysis and focusing on innovation in entertainment services are essential. These efforts are crucial for achieving sustained subscriber growth trends.

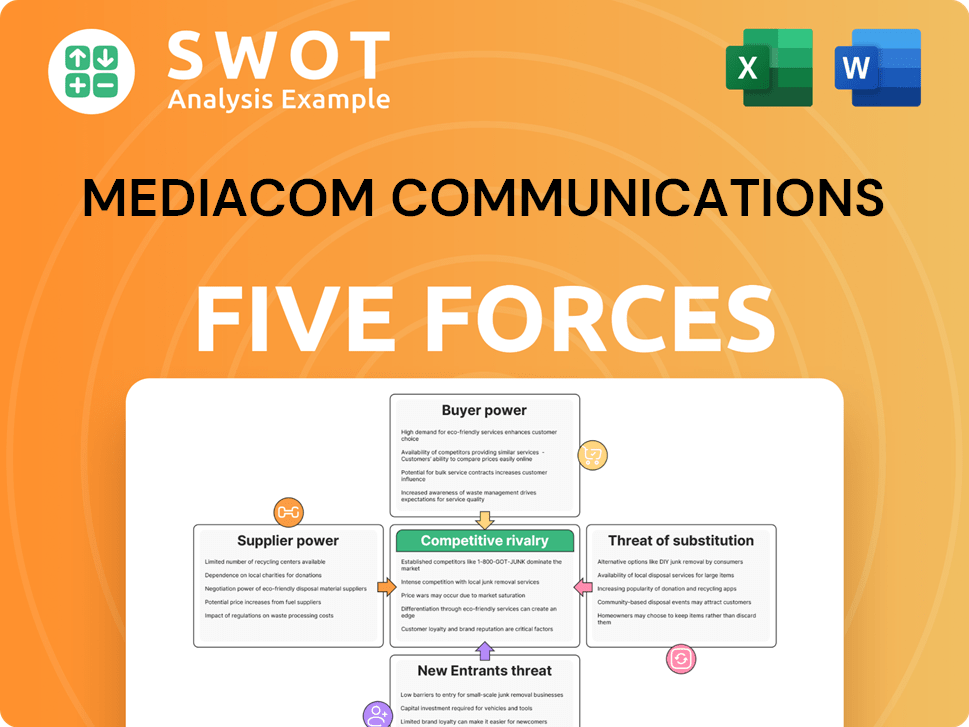

Mediacom Communications Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mediacom Communications Company?

- What is Competitive Landscape of Mediacom Communications Company?

- How Does Mediacom Communications Company Work?

- What is Sales and Marketing Strategy of Mediacom Communications Company?

- What is Brief History of Mediacom Communications Company?

- Who Owns Mediacom Communications Company?

- What is Customer Demographics and Target Market of Mediacom Communications Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.