Netflix Bundle

Can Netflix Maintain Its Streaming Dominance?

The streaming wars are fierce, and Netflix stands at the center of the battle. With major studios pulling content to launch their own platforms, the pressure is on Netflix to innovate. Understanding the Netflix SWOT Analysis and the competitive landscape is crucial for anyone invested in the media industry.

Netflix's journey from DVD rentals to a global streaming giant is a masterclass in adaptation. This Netflix SWOT analysis dives deep into the Netflix competitive landscape, analyzing its Netflix competition and providing a comprehensive Netflix market analysis. We'll explore the video streaming industry, examining Netflix competitors 2024 and the impact of Netflix original programming impact on Netflix subscriber growth trends and the overall media industry.

Where Does Netflix’ Stand in the Current Market?

Netflix's core operation revolves around providing subscription-based video-on-demand services globally. It offers a vast library of content, including TV shows, movies, documentaries, and anime, accessible across various devices. The value proposition focuses on providing convenient, on-demand entertainment with a wide variety of choices, catering to diverse tastes and preferences.

The company's business model relies on recurring subscription fees, with different pricing tiers offering varying features, such as ad-supported options and different levels of streaming quality. This model has allowed Netflix to build a substantial subscriber base and generate significant revenue, which it reinvests in content creation and technology infrastructure.

As of Q1 2024, Netflix reported approximately 270 million global paid subscribers, showcasing its continued dominance in the video streaming industry. Revenue Streams & Business Model of Netflix are primarily driven by subscription fees, with the company generating $9.37 billion in revenue in Q1 2024.

Netflix holds a significant market share in the streaming services sector, although it faces increasing competition. Its subscriber base is a key indicator of its market position, with numbers fluctuating but remaining consistently high. Netflix's global presence and content offerings contribute to its substantial subscriber count.

Netflix operates in over 190 countries, making its geographic reach extensive. However, subscriber penetration varies across regions, influenced by factors like content availability, local market dynamics, and competition. The company's expansion strategy involves adapting to diverse markets.

Investment in original content is a cornerstone of Netflix's strategy, driving subscriber acquisition and retention. The company's content library includes a mix of original and licensed programming. This strategy helps differentiate Netflix from its competitors.

Netflix's financial performance is crucial to its market position, with revenue primarily generated from subscriptions. The introduction of ad-supported tiers has expanded revenue streams. The company's financial health supports its ability to invest in content and technology.

Netflix's market position is shaped by its large subscriber base, extensive geographic reach, and substantial investment in original content. The company's ability to adapt to market trends, such as the introduction of ad-supported tiers, is also significant. The Netflix competitive landscape is dynamic, with the company constantly evolving to maintain its position.

- Dominant player in the video streaming industry.

- Significant investment in original programming to attract and retain subscribers.

- Global presence with varying levels of market penetration across different regions.

- Strategic adaptation to market demands, including ad-supported subscription tiers.

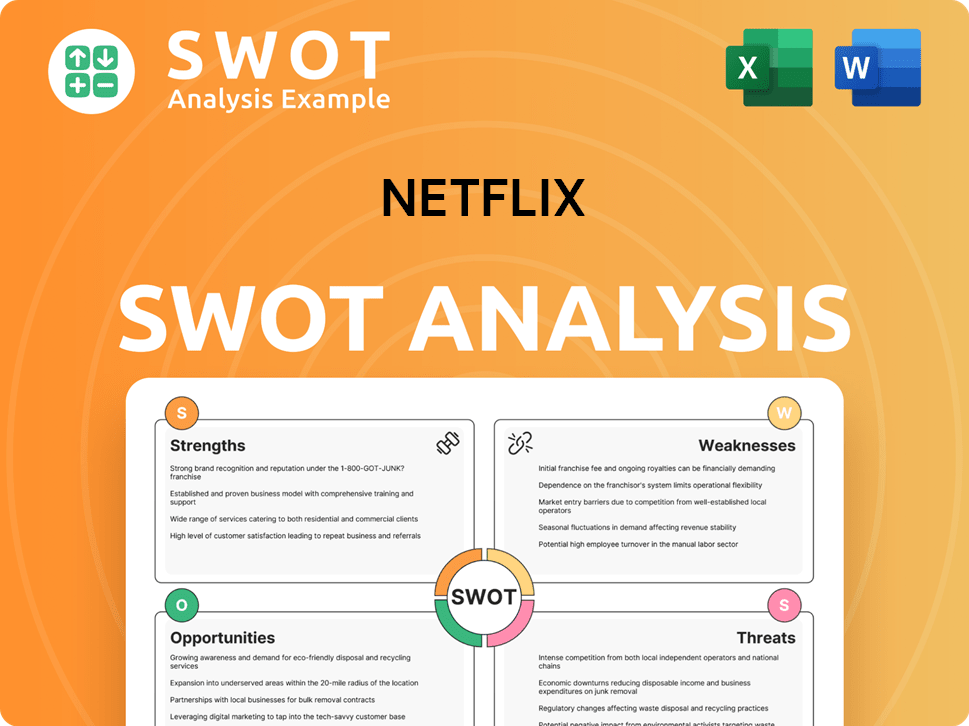

Netflix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Netflix?

The competitive landscape for the streaming service is incredibly dynamic, with numerous players vying for consumer attention and subscription dollars. This intense competition necessitates continuous adaptation and innovation in content creation, pricing strategies, and international expansion. Understanding the current and future competitive pressures is crucial for assessing the company's long-term prospects and strategic positioning within the video streaming industry.

The company faces a multi-faceted challenge from both direct and indirect competitors. Direct competitors offer similar streaming services, while indirect competitors compete for the same consumer time and entertainment budgets. The ongoing 'content arms race,' where platforms invest billions in original programming, further intensifies the competition. Analyzing the strategies and performance of key rivals provides critical insights into the overall market dynamics and the company's ability to maintain its leadership position.

The Target Market of Netflix is broad, but it is essential to understand how the company's competitors are targeting specific demographics and content preferences.

Direct competitors offer similar streaming services, competing for subscribers with original content, licensed programming, and user experience. These services directly challenge the company's market share and subscriber growth.

Indirect competitors include traditional television, social media platforms, and video game platforms. These entities compete for the same consumer time and entertainment budgets, affecting the overall demand for streaming services.

The massive investment in original content is a key battleground. The company spent approximately $17 billion on content in 2023. This investment is crucial for attracting and retaining subscribers.

Mergers and partnerships reshape the competitive landscape by consolidating content libraries and subscriber bases. The proposed joint venture between Disney and Warner Bros. Discovery for a new sports streaming service is a prime example.

Emerging players in niche content areas or regional markets disrupt the landscape. These companies target specific audiences or geographic regions, offering specialized content that appeals to a particular demographic.

Subscriber numbers are a key indicator of success. Disney+ had over 117 million subscribers as of early 2024, and Amazon Prime Video had an estimated 200 million global viewers as of early 2024, demonstrating the scale of competition.

The company's main competitors employ diverse strategies to attract and retain subscribers. These strategies include leveraging existing franchises, integrating with broader ecosystems, and focusing on premium content. Understanding these approaches is crucial for evaluating the competitive landscape.

- Disney+: Leverages its vast library of iconic franchises (Disney, Pixar, Marvel, Star Wars, National Geographic) and family-friendly content.

- Amazon Prime Video: Benefits from its integration with the Amazon Prime ecosystem, offering a wide range of content alongside e-commerce benefits.

- Max (formerly HBO Max): Targets a more adult-oriented audience with its premium HBO content and Warner Bros. Discovery library, competing on prestige and quality.

- Paramount+: Offers a mix of content from CBS, Paramount Pictures, and other sources, including live sports and news.

- Apple TV+: Focuses on original content and benefits from its integration with the Apple ecosystem.

- Peacock: Offers a mix of content from NBCUniversal, including live sports, news, and entertainment.

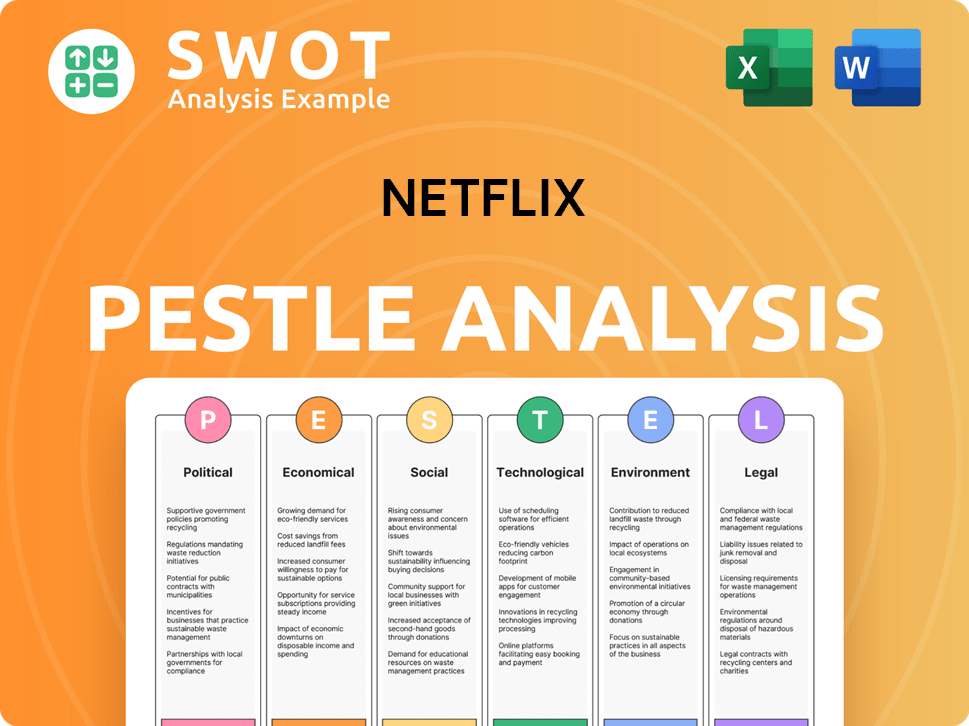

Netflix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Netflix a Competitive Edge Over Its Rivals?

Examining the competitive advantages of the company involves understanding its key milestones, strategic moves, and the elements that give it a competitive edge. This analysis is crucial for investors, analysts, and business strategists looking to understand the dynamics of the streaming market and the factors influencing the company's performance. A deep dive into these aspects provides a comprehensive view of its position within the video streaming industry.

The company has consistently adapted to market changes, from its DVD rental beginnings to its current dominance in streaming. Strategic investments in original content, international expansion, and technological advancements have been pivotal. Understanding these moves is essential for assessing the company's ability to sustain its competitive advantages in a rapidly evolving market. This is particularly important when considering the broader context of the media industry.

The company's competitive advantages are multifaceted and have evolved significantly over its history. A primary advantage lies in its vast and continually expanding library of original content. For example, the company's content spending reached $17 billion in 2023, reflecting its commitment to this strategy. This proprietary content fosters brand loyalty and provides exclusive viewing experiences not available elsewhere. This is crucial for any Owners & Shareholders of Netflix to understand.

The company's significant investment in original content production is a key differentiator. This strategy reduces reliance on licensed content and builds a unique offering. Award-winning TV shows, movies, and documentaries are central to its content strategy.

Operating in over 190 countries gives the company a significant advantage in global reach. This extensive distribution network allows for the amortization of content costs across a massive subscriber base. Few competitors can match this level of international penetration.

The company's sophisticated recommendation engine enhances user experience through personalized content discovery. Advanced algorithms and vast user data power this engine, leading to higher engagement and retention. This data-driven approach helps identify trends.

Years of pioneering streaming have built strong brand equity. The company is recognized as a leader in the streaming industry. This brand recognition is a significant competitive advantage.

The company's competitive advantages include its massive original content library, global reach, and sophisticated recommendation engine. These factors help it maintain a strong position in the video streaming industry. The company’s ability to adapt and innovate is also a key strength.

- Original Content: The company's investment in original content is a significant differentiator.

- Global Reach: Operating in over 190 countries gives the company a broad distribution network.

- Recommendation Engine: Advanced algorithms enhance user experience through personalized content discovery.

- Brand Equity: Years of pioneering streaming have built strong brand recognition.

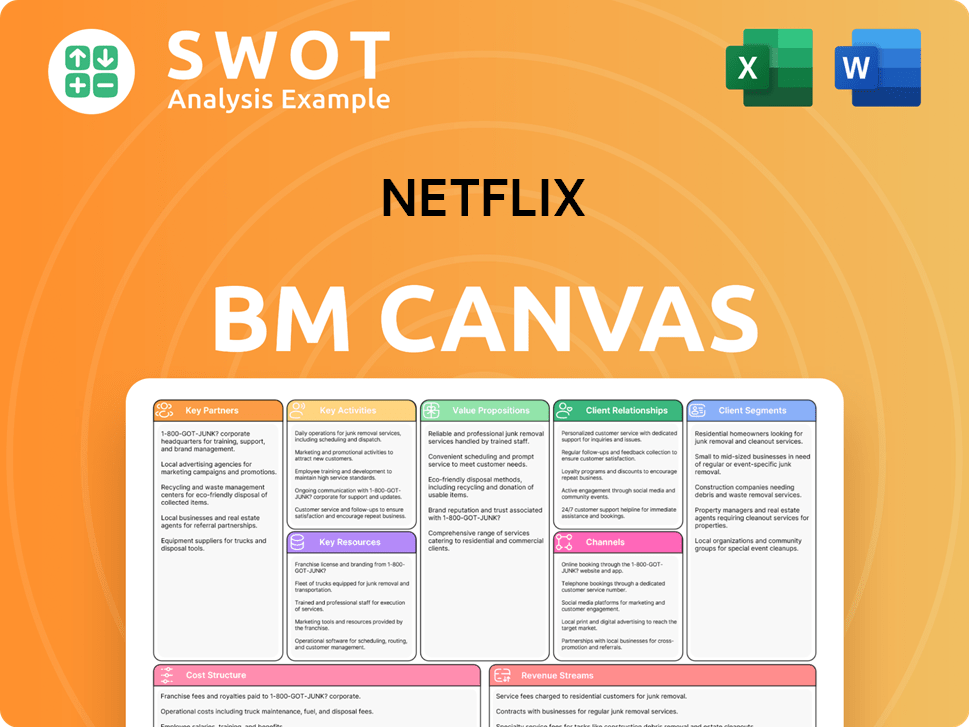

Netflix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Netflix’s Competitive Landscape?

The streaming industry is currently experiencing significant shifts, driven by technological advancements, evolving consumer behaviors, and increased regulatory oversight. The market is becoming more fragmented, with new entrants and consolidation among existing players. This dynamic environment presents both challenges and opportunities for companies like Netflix, influencing its competitive landscape and future prospects. Understanding these trends is crucial for a comprehensive Netflix market analysis.

Consumers are increasingly facing 'subscription fatigue,' leading to higher churn rates and a demand for greater value. The rise of ad-supported tiers is also becoming standard, impacting subscriber growth and retention. For Netflix, this means navigating a complex environment to maintain its position as a leading streaming service. The company's ability to adapt to these trends will be critical for its long-term success. The competitive dynamics within the video streaming industry are constantly evolving.

Technological advancements, such as AI-driven content recommendations and immersive experiences (VR/AR), are shaping the industry. The increasing adoption of ad-supported tiers and the rise of bundled offerings are also significant trends. Furthermore, the global economic landscape and varied regulatory environments impact operational strategies and profitability. This is reshaping the Netflix competitive landscape.

Rising content costs and the increasing bargaining power of content creators pose significant challenges. Intensified competition from bundled offerings, declining demand in mature markets, and stricter content regulations are potential threats. Managing subscriber churn and maintaining growth in a saturated market are also key challenges. These factors influence the Netflix future outlook.

Growth opportunities exist in emerging markets with lower streaming penetration. Further diversification of content libraries, including live sports and gaming, presents another avenue for expansion. Strategic partnerships can also help expand its ecosystem and reach new audiences. These opportunities are essential for a successful Netflix market analysis.

Continued investment in original content, the expansion of the ad-supported tier, and exploring new revenue streams are key strategies. Adapting to the evolving competitive landscape involves focusing on subscriber retention and acquisition. The company aims to leverage data and analytics to optimize content offerings and user experiences. For more insights into the company’s strategy, you can explore the Growth Strategy of Netflix.

In Q1 2024, Netflix reported over 269 million paid memberships globally, demonstrating continued growth. The company's revenue for the same quarter reached $9.37 billion, reflecting strong financial performance. Netflix's ad-supported plan has attracted over 23 million active users, indicating the success of its diversification strategy. Despite fierce competition, Netflix maintains its position as a leading streaming service. These figures highlight the importance of understanding Netflix competitors 2024.

- Investment in original content continues to be a priority, with significant budgets allocated to high-quality programming.

- Expansion into gaming and other interactive content formats is ongoing, aiming to enhance user engagement and diversify revenue streams.

- Strategic partnerships and collaborations are being pursued to expand global reach and offer bundled services.

- The company is actively working to optimize its pricing strategies and subscription tiers to cater to diverse consumer preferences.

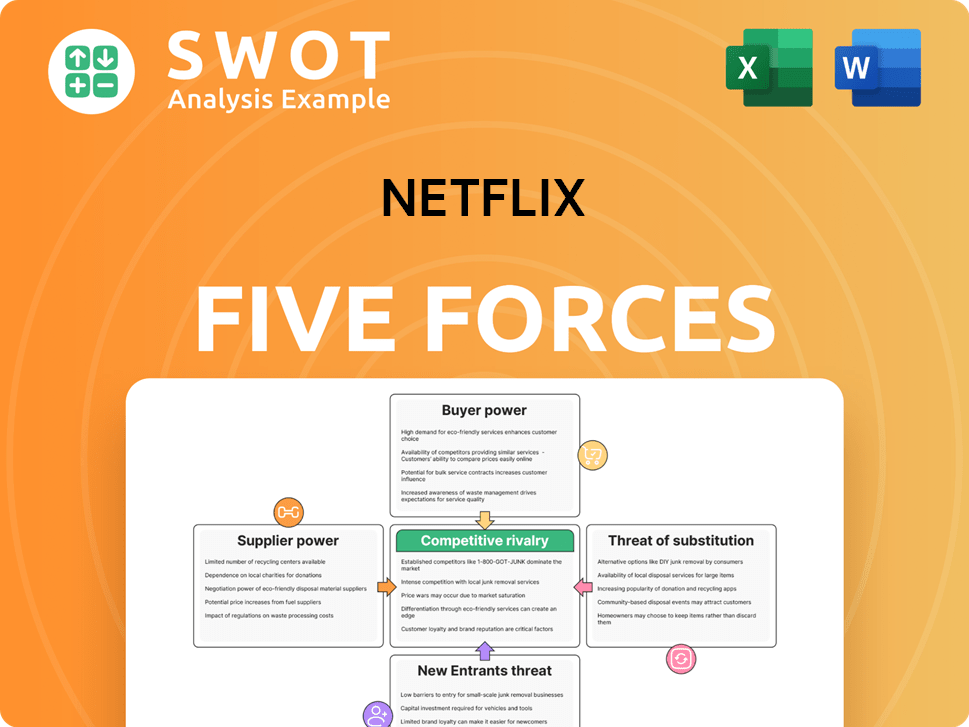

Netflix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Netflix Company?

- What is Growth Strategy and Future Prospects of Netflix Company?

- How Does Netflix Company Work?

- What is Sales and Marketing Strategy of Netflix Company?

- What is Brief History of Netflix Company?

- Who Owns Netflix Company?

- What is Customer Demographics and Target Market of Netflix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.