Netflix Bundle

How Does Netflix Stay on Top in the Streaming Wars?

Netflix has revolutionized how we consume entertainment, evolving from a DVD rental service to a global streaming behemoth. With over 269.6 million subscribers as of early 2024, its impact on the entertainment industry is undeniable. This exploration delves into the core mechanics of Netflix SWOT Analysis, its innovative strategies, and the forces that have propelled it to the forefront of the digital age.

This deep dive into the Netflix business model will unravel the complexities behind its success, from its vast content library to its sophisticated recommendation algorithms. Discover how this streaming service generates revenue, manages its global operations, and continues to adapt in a competitive video on demand (VOD) market. Understanding how Netflix works is crucial for anyone seeking to navigate the evolving landscape of entertainment and digital media, whether you're a subscriber, investor, or industry observer.

What Are the Key Operations Driving Netflix’s Success?

The core of the business revolves around providing on-demand video content, offering a wide variety of entertainment options, and personalizing the viewing experience. This service caters to a broad audience, from individual viewers to families, across almost every country. The primary offering is a subscription-based streaming service, accessible on various devices like smart TVs, smartphones, and web browsers.

The operational structure is multifaceted, starting with content acquisition and production. The company invests heavily in licensing existing content and, increasingly, in producing its own original content. In 2023, the company spent approximately $13 billion on content, and its projected content spend for 2024 is around $17 billion. Technology development is also a critical aspect, involving continuous innovation in its streaming infrastructure, recommendation algorithms, and user interface to ensure seamless delivery and a highly personalized viewing experience.

The company's supply chain is primarily digital, focusing on the efficient encoding, storage, and delivery of massive amounts of video data. Its partnerships extend to content creators, production studios, and internet service providers, crucial for both content acquisition and distribution. What makes the company's operations particularly unique and effective compared to competitors is its data-driven approach to content creation and personalization. Its sophisticated algorithms analyze vast amounts of user data to inform content acquisition decisions, guide original productions, and deliver highly relevant content recommendations.

The company invests significantly in licensing existing content and producing original content. This includes acquiring rights to movies and TV shows from various studios and creating its own original series and films. The company's content library is a key factor in attracting and retaining subscribers.

Continuous innovation in streaming infrastructure, recommendation algorithms, and user interface is crucial. This involves a global content delivery network (CDN) to efficiently distribute video streams. The company focuses on ensuring high-quality playback and minimizing buffering for a seamless viewing experience.

Sophisticated algorithms analyze user data, including viewing habits and ratings, to personalize content recommendations. This data-driven approach informs content acquisition decisions and guides original productions. This personalization enhances customer satisfaction and fosters deeper engagement with the platform.

The company operates on a subscription-based model, offering various plans with different features and pricing. Subscribers gain access to the company's extensive content library on multiple devices. This model provides a recurring revenue stream and allows for ongoing investment in content and technology.

The company's success is built on a combination of content, technology, and data analytics. This approach allows it to offer a superior and customized entertainment experience. This translates directly into customer benefits such as convenience, variety, and personalization, making it a leading player in the streaming market. For more detailed insights, explore the Marketing Strategy of Netflix.

- Content Acquisition: Licensing and producing a diverse range of movies and TV shows.

- Technology: Continuous innovation in streaming infrastructure and user experience.

- Data Analytics: Using user data to personalize recommendations and inform content decisions.

- Subscription Model: Offering various plans to provide access to its extensive content library.

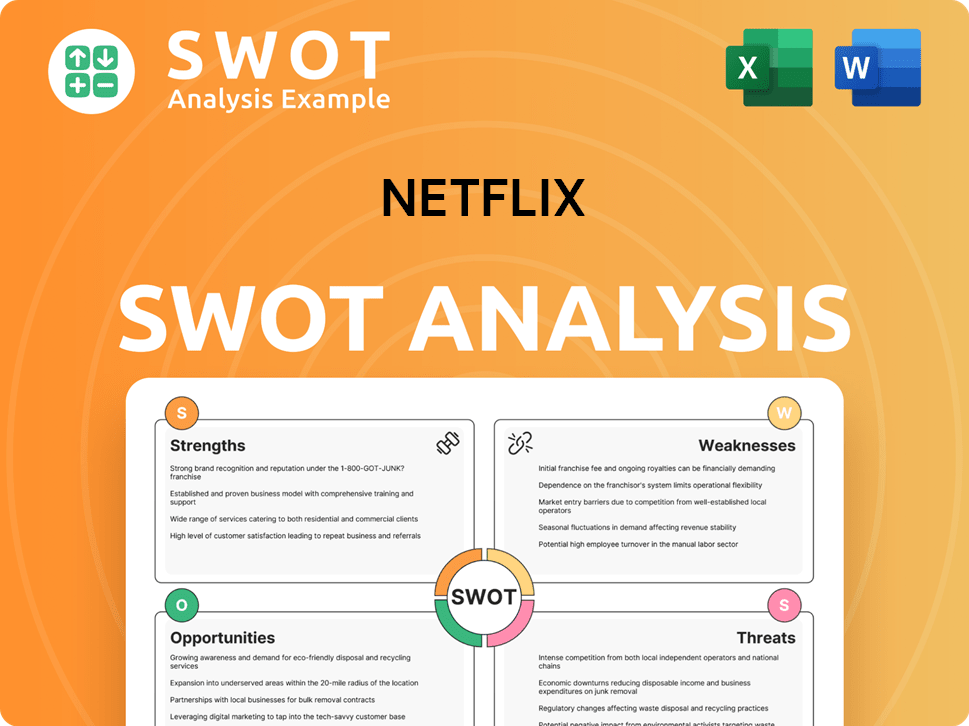

Netflix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Netflix Make Money?

The primary revenue stream for Netflix is its subscription-based streaming service. This model allows users to access a vast library of movies and TV shows for a monthly fee. In the first quarter of 2024, Netflix reported revenues of $9.37 billion, with subscription fees being the main contributor.

Netflix offers different subscription plans to cater to various customer preferences and budgets. These typically include standard, premium, and ad-supported options. The introduction of the ad-supported plan in late 2022 was a strategic move to attract more price-sensitive subscribers and diversify revenue streams.

By May 2024, the ad-supported plan had over 40 million global subscribers, showing its growing importance. This tiered pricing strategy allows Netflix to capture a broader audience while maintaining premium options for those seeking an ad-free experience and higher quality viewing.

Netflix employs several strategies to generate revenue and maximize profitability. These include tiered subscription plans, geographic pricing adjustments, and content investments. The company continually evolves its approach, as seen in its move from a DVD-by-mail service to a streaming platform and the integration of advertising.

- Subscription Tiers: Netflix offers various plans, including standard, premium, and ad-supported tiers, to cater to different customer needs and price points.

- Geographic Pricing: Prices are adjusted based on regional market conditions and content costs. This ensures competitiveness and profitability in different territories.

- Ad-Supported Plan: Launched in late 2022, the ad-supported plan attracts price-sensitive subscribers and diversifies revenue streams.

- Content Investments: Significant investments in original content and licensed programming drive subscriber growth and engagement.

- Continuous Innovation: Netflix continuously adapts its business model, as highlighted in Brief History of Netflix, to stay ahead in the competitive streaming market.

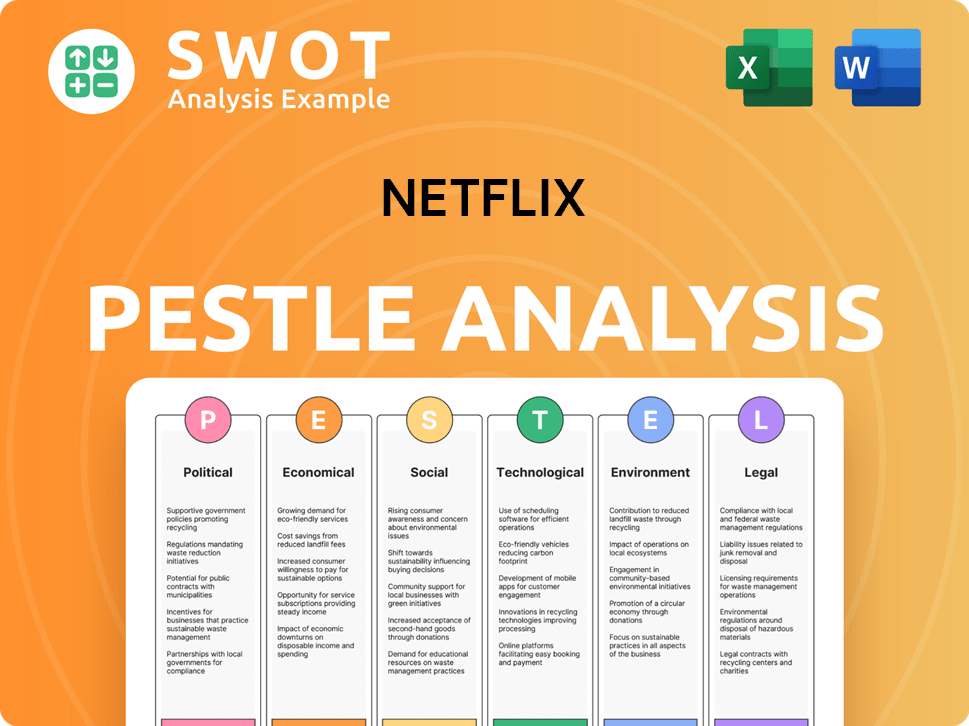

Netflix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Netflix’s Business Model?

The journey of the entertainment giant has been marked by significant milestones that have reshaped its operations and financial landscape. A pivotal moment was the transition from a DVD-by-mail service to online streaming in 2007, a strategic move that placed it at the forefront of the digital entertainment revolution. This shift, though initially challenging, proved visionary, capitalizing on the increasing adoption of broadband internet. Another crucial milestone was the aggressive investment in original content production, starting in 2013 with 'House of Cards,' transforming the company from a content distributor into a major content creator.

The company has navigated various operational and market challenges, including intense competition from new streaming entrants like Disney+, Max, and Amazon Prime Video, as well as rising content costs and password sharing. In response, strategic moves were implemented, such as introducing an ad-supported tier in 2022 to attract price-sensitive customers and combat subscriber churn. Further, to address password sharing, the company began rolling out paid sharing options in 2023, which initially led to some subscriber losses but ultimately contributed to subscriber growth.

The company's competitive advantages are multifaceted, including strong brand recognition built over decades, synonymous with quality streaming entertainment. Technology leadership, particularly in recommendation algorithms and global streaming infrastructure, provides a superior user experience. Economies of scale, derived from its massive global subscriber base, allow significant investment in content and technology, creating a virtuous cycle. The vast content library, especially its acclaimed original programming, creates a powerful ecosystem effect, making it a compelling value proposition for consumers. To remain competitive, the company continues to adapt to new trends by exploring interactive content, live streaming of certain events, and expanding its gaming offerings, demonstrating its commitment to evolving its business model.

The shift to streaming in 2007 was a critical decision, allowing the company to capitalize on the growing internet penetration. The investment in original content, starting with 'House of Cards' in 2013, transformed it into a content creator. By 2023, the company had released over 1,700 original titles, showcasing its commitment to this strategy.

The introduction of an ad-supported tier in 2022 aimed to attract cost-conscious customers. Addressing password sharing through paid sharing options in 2023 helped to mitigate subscriber losses and drive growth. These moves reflect the company's adaptability in a competitive market.

Strong brand recognition, technology leadership in recommendation algorithms, and economies of scale are key advantages. The vast content library, particularly original programming, provides a compelling value proposition. The company's ongoing exploration of interactive content and live streaming demonstrates its commitment to evolving its business model.

In Q4 2023, the company reported 260.8 million global paid memberships. Revenue for 2023 reached $33.7 billion. The company's operating margin for 2023 was 21%, up from 18% in 2022, indicating improved profitability. The company's ability to maintain and grow its subscriber base, despite increased competition, is a testament to its successful strategies.

The company has consistently adapted to market changes, such as the rise of competitors and evolving consumer preferences. The introduction of the ad-supported tier and the crackdown on password sharing are examples of its proactive approach. These moves are aimed at maintaining a competitive edge in the Growth Strategy of Netflix.

- The ad-supported tier has broadened its appeal to a wider audience.

- Paid sharing options aim to capture revenue from shared accounts.

- Investment in interactive content and gaming expands its entertainment offerings.

- Ongoing innovation ensures its continued relevance in the streaming market.

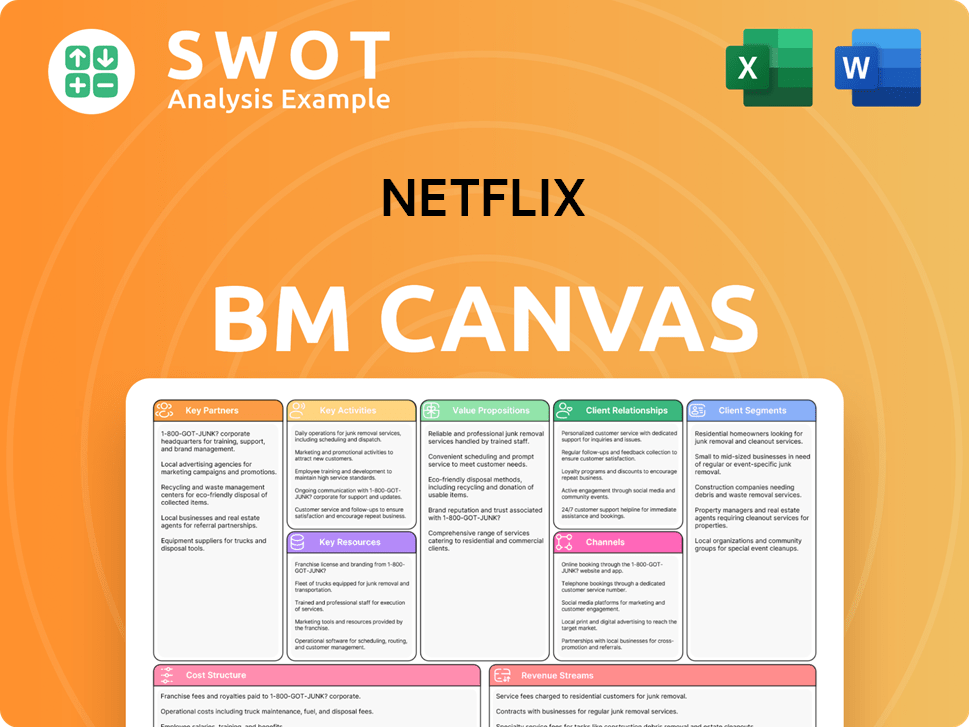

Netflix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Netflix Positioning Itself for Continued Success?

The company holds a strong position in the global streaming market, despite facing significant competition. As of Q1 2024, it remained the largest streaming service by subscribers, boasting 269.6 million paid memberships worldwide. Its market share, though challenged by competitors such as Disney+ and Amazon Prime Video, remains substantial, especially in established markets.

However, the company faces several risks that could impact its operations and revenue. These include regulatory changes, competition, technological disruptions, and evolving consumer preferences. The company is actively pursuing strategic initiatives like expanding its ad-supported tier and investing in original content to maintain its market position.

The company maintains a leading position in the streaming industry. It benefits from a vast and regularly updated content library. Its global reach, operating in over 190 countries, provides a strong advantage in content localization and international market penetration.

Regulatory changes, content licensing issues, and data privacy concerns pose risks. Intensified competition within the media industry and technological advancements could shift consumer preferences. Changes in consumer behavior, such as subscription fatigue, also present challenges.

The company is expanding its ad-supported tier to diversify revenue streams. It is exploring live sports streaming, as evidenced by its partnership to air NFL games. The company plans to continue innovating its content offerings and optimizing its pricing strategies.

The company focuses on profitability, sustainable growth, and delivering value to subscribers. It is investing heavily in original content to attract and retain subscribers. The company is exploring new monetization avenues, such as advertising and gaming.

The company is focused on several key strategies to ensure its continued success in the streaming market. These strategies include expanding its ad-supported tier and investing in original content to drive subscriber growth and retention.

- Continued investment in original content to attract and retain subscribers.

- Expansion of the ad-supported tier to diversify revenue streams.

- Exploration of new content formats, such as live sports streaming.

- Optimization of pricing strategies to maximize revenue.

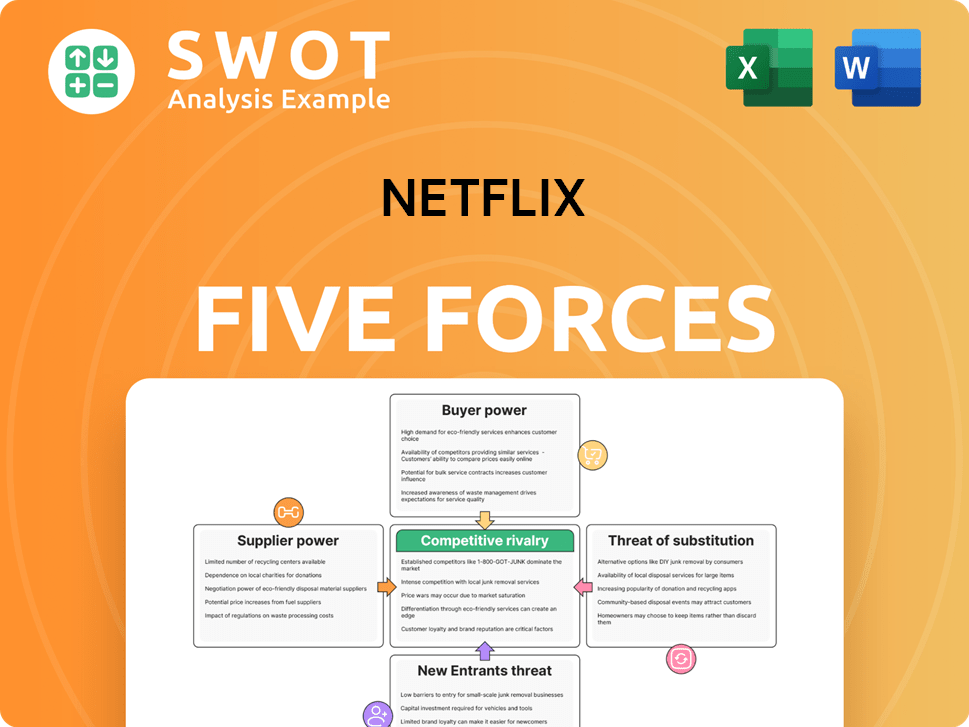

Netflix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Netflix Company?

- What is Competitive Landscape of Netflix Company?

- What is Growth Strategy and Future Prospects of Netflix Company?

- What is Sales and Marketing Strategy of Netflix Company?

- What is Brief History of Netflix Company?

- Who Owns Netflix Company?

- What is Customer Demographics and Target Market of Netflix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.