NFI Industries Bundle

How Does NFI Industries Stack Up in Today's Logistics Arena?

The global supply chain and logistics sector is a $12 trillion behemoth, constantly reshaped by innovation and fierce competition. NFI Industries, a long-standing player since 1932, has evolved from a regional transporter to a North American leader. This evolution demands a close look at its competitive positioning and strategic moves.

To truly understand NFI Industries' trajectory, we must dissect its NFI Industries SWOT Analysis and the broader market dynamics. This analysis will identify key NFI Industries competitors, assess NFI Industries' market share analysis, and illuminate the factors driving its financial performance. By examining NFI Industries' business overview and industry trends, we can forecast its future outlook and strategic direction within the NFI Industries competitive landscape.

Where Does NFI Industries’ Stand in the Current Market?

NFI Industries holds a significant market position within the North American supply chain and logistics sector. Although specific market share figures are not publicly disclosed due to its private status, the company consistently ranks among the top 3PL providers. This strong positioning is a key aspect of the NFI Industries competitive landscape.

The company's core operations encompass dedicated transportation, warehousing and distribution, port drayage, intermodal, brokerage, and global freight forwarding. This comprehensive suite of services allows NFI to serve a diverse customer base across various industries, including retail, food and beverage, and e-commerce. The integrated approach is a key element of NFI Industries' business overview.

NFI's value proposition centers on providing integrated logistics solutions, leveraging advanced technology, and promoting sustainability. This approach has strengthened its position in the evolving digital and environmentally conscious supply chain landscape. To understand how NFI Industries compares to its competitors, it's crucial to analyze its market position and service offerings.

NFI consistently ranks among the top 3PL providers in North America. For 2024, Transport Topics recognized NFI as a top 10 3PL provider. This ranking underscores its substantial presence and operational scale within the NFI Industries industry.

NFI's geographic presence is predominantly strong across North America. It has a vast network of distribution centers and transportation assets. This extensive network supports its ability to handle complex supply chains efficiently. This is a critical factor in the NFI Industries market analysis.

NFI serves a diverse range of customer segments, including retail, food and beverage, consumer packaged goods (CPG), manufacturing, and e-commerce. This diversification demonstrates its versatility and ability to manage complex supply chains across various industries. Understanding the customer base is key to analyzing NFI Industries' competitive advantages and disadvantages.

NFI's operational capacity is substantial, with an extensive asset base that includes over 15,000 tractors and trailers and more than 70 million square feet of warehousing space. This significant infrastructure supports its market penetration and allows it to handle large volumes. This capacity is a key indicator of NFI Industries' key performance indicators.

While specific financial data for 2024-2025 is not publicly available, NFI's consistent ranking among top logistics providers suggests robust financial health and scale compared to industry averages. Its extensive asset base and diversified service offerings contribute to its strong financial standing. For more insights, consider reading about the Growth Strategy of NFI Industries.

- NFI's focus on specialized transportation and warehousing, such as food-grade logistics and retail distribution, provides a competitive edge.

- The company's ability to integrate advanced technology and sustainability initiatives strengthens its position in the evolving supply chain landscape.

- The company's wide range of services and extensive network supports its ability to handle complex supply chains efficiently.

- NFI's strong presence in North America, with a vast distribution network, is a key factor in its market position.

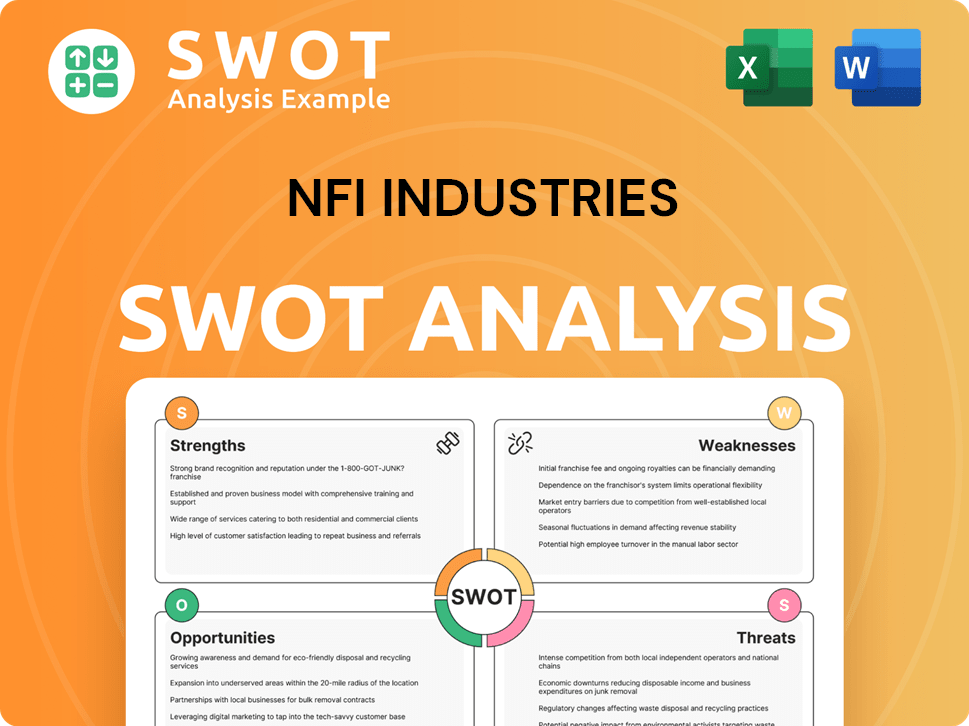

NFI Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NFI Industries?

The competitive landscape for NFI Industries is intense, shaped by a mix of large, established players and agile, specialized firms. Understanding the NFI Industries competitive landscape is crucial for assessing its market position and strategic options. This analysis considers both direct and indirect competitors, highlighting the key challenges and opportunities within the NFI Industries industry.

The market is dynamic, influenced by technological advancements, mergers and acquisitions, and evolving customer demands. A thorough NFI Industries market analysis reveals the complex interplay of factors affecting its performance. This overview provides insights into the competitive forces shaping the company's trajectory.

Direct competitors offer similar services across transportation, warehousing, and logistics. These companies compete directly with NFI Industries for market share. Key players include established logistics giants and specialized providers.

C.H. Robinson is a major player, competing with NFI Industries in freight brokerage and global forwarding. They leverage a vast network and advanced technology platforms. In 2024, C.H. Robinson reported revenues of approximately $20.7 billion, highlighting its significant scale and market presence.

XPO Logistics competes in less-than-truckload (LTL) and truck brokerage, directly challenging NFI's transportation services. XPO Logistics generated approximately $7.9 billion in revenue in 2024, demonstrating its strong position in the market.

Ryder System focuses on fleet management and dedicated contract carriage, competing with NFI in dedicated transportation and warehousing. Ryder's revenue for 2024 was around $11.9 billion, showcasing its strong presence in fleet solutions.

J.B. Hunt is a leader in intermodal and dedicated services, posing significant competition in the North American transportation market. J.B. Hunt's revenue in 2024 was roughly $14.9 billion, reflecting its substantial market share.

Indirect competitors include a variety of regional trucking companies, specialized warehousing providers, and tech-driven logistics startups. These players often focus on specific niches, such as last-mile delivery or cold chain logistics. The competitive landscape is also shaped by mergers and acquisitions.

The NFI Industries competitive landscape is influenced by several key trends, including the adoption of advanced analytics, AI, and automation. These technologies are changing traditional competitive dynamics. For more details on the company's business model, see Revenue Streams & Business Model of NFI Industries.

- Mergers and Acquisitions: Consolidation in freight brokerage and warehousing impacts the market.

- Technological Advancements: AI and automation are offering optimized routing and predictive analytics.

- Specialized Services: Niche players focusing on last-mile delivery and cold chain logistics.

- Customer Demands: Increasing demand for transparency, real-time tracking, and sustainable solutions.

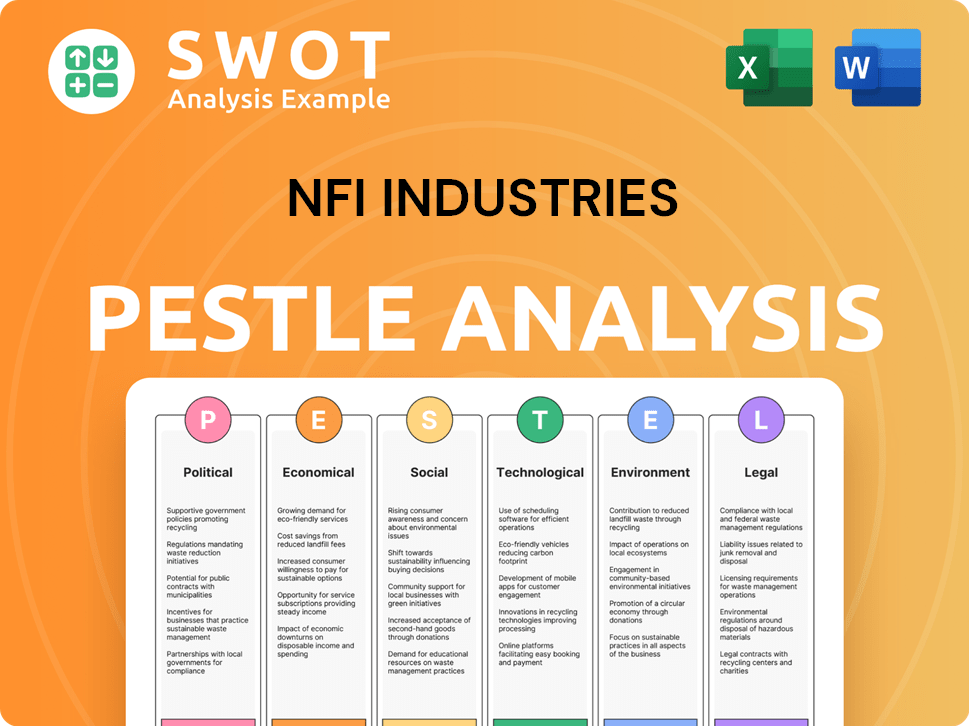

NFI Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NFI Industries a Competitive Edge Over Its Rivals?

Understanding the NFI Industries competitive landscape requires a deep dive into its strategic advantages. The company has carved a significant niche in the NFI Industries industry through its integrated service model and extensive asset base. This approach allows for a streamlined supply chain, providing a competitive edge in a market characterized by complex logistics challenges.

NFI Industries' business overview highlights its commitment to technological innovation and long-standing customer relationships. These factors contribute to its strong market position. The company's ability to adapt to changing market demands and maintain operational excellence solidifies its standing among NFI Industries competitors.

The privately-held nature of the company also contributes to its strategic flexibility, allowing it to make long-term investments without the pressures of short-term public market expectations. This structure supports sustained growth and innovation, which is crucial for maintaining a competitive edge in the logistics sector. For more information about the company, you can read more about the Owners & Shareholders of NFI Industries.

NFI Industries offers a comprehensive suite of supply chain solutions, including transportation, warehousing, and global logistics. This integrated model provides clients with a single point of contact and seamless coordination. This approach contrasts with competitors that offer more siloed services, enhancing efficiency and customer satisfaction.

The company boasts a significant asset base, including a large fleet of dedicated trucks and a vast network of distribution centers. This extensive infrastructure provides economies of scale and operational flexibility. This asset-heavy model ensures greater control over service quality and capacity, especially during market volatility.

NFI Industries invests heavily in technology, utilizing advanced warehouse management systems (WMS) and transportation management systems (TMS). This technological edge optimizes supply chain efficiency and enhances visibility. The adoption of data analytics provides actionable insights for clients, strengthening customer loyalty.

NFI Industries maintains long-standing relationships with a diverse portfolio of clients, many spanning decades. This is built on a reputation for reliability and a deep understanding of industry-specific logistics challenges. These enduring partnerships underscore the company's strong brand equity and customer loyalty.

NFI Industries distinguishes itself in the NFI Industries competitive landscape through its integrated service model, substantial asset base, technological investments, and enduring customer relationships. These advantages contribute to its sustained success and ability to navigate market challenges. The company's focus on innovation and customer satisfaction further solidifies its position.

- Integrated Solutions: Offering end-to-end supply chain services.

- Extensive Infrastructure: Large fleet and distribution network.

- Technological Integration: Utilizing advanced WMS and TMS.

- Customer Loyalty: Long-term relationships with key clients.

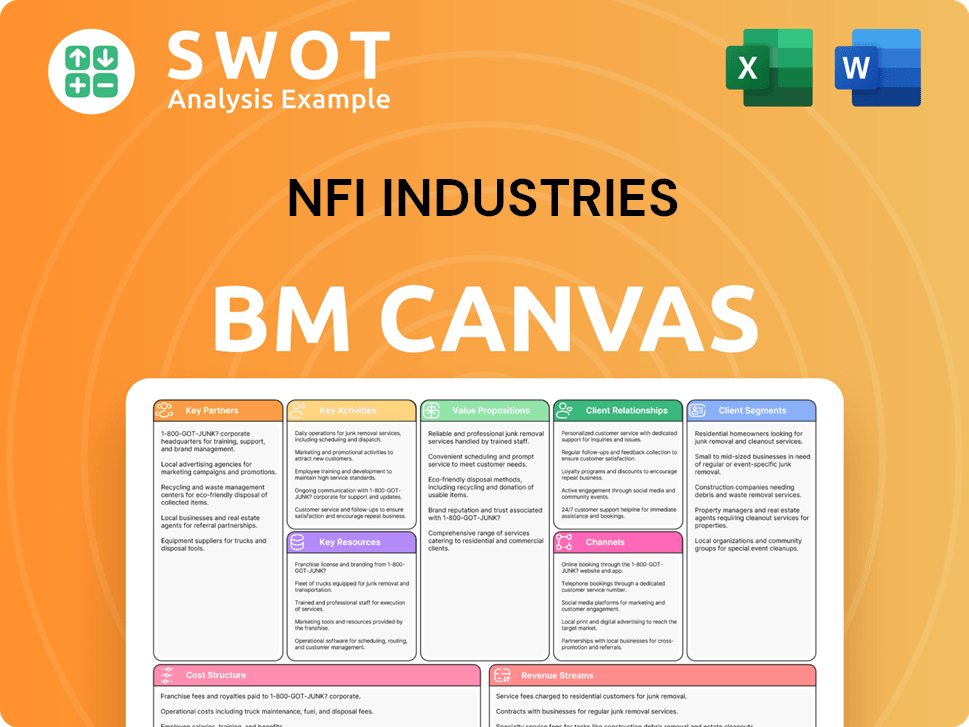

NFI Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NFI Industries’s Competitive Landscape?

The industry is experiencing significant shifts, creating both challenges and opportunities for companies like NFI Industries. The competitive landscape for NFI Industries is dynamic, influenced by technological advancements, regulatory changes, and evolving consumer demands. Understanding these factors is crucial for assessing NFI Industries' future outlook and strategic positioning within the NFI Industries industry.

NFI Industries' business overview reveals a focus on adapting to these trends through strategic investments and partnerships. The company faces risks from intensified competition and economic fluctuations, yet it can capitalize on growth opportunities in e-commerce and emerging markets. A thorough NFI Industries market analysis provides insights into the company's competitive advantages and disadvantages, which are key to its long-term success.

Technological advancements, including automation and AI, are transforming supply chain operations. E-commerce continues to drive demand for faster and more transparent delivery solutions. Regulatory changes, such as stricter emissions standards, are influencing operational practices.

Intensified competition from tech-driven logistics startups poses a threat. Economic downturns could reduce freight volumes. Geopolitical instability and trade policy shifts introduce uncertainty.

Growth opportunities exist in emerging markets with increasing logistics needs. Specialized logistics services, such as cold chain for pharmaceuticals, offer expansion avenues. Product innovation and strategic acquisitions can expand service portfolios and geographic reach.

NFI Industries is deploying strategies that focus on technology investments and strategic acquisitions. The company is fostering strong customer partnerships and expanding its service offerings. These actions are designed to navigate challenges and capitalize on emerging opportunities in the market.

NFI Industries' competitive landscape is evolving towards integrated, technology-driven, and sustainable supply chain solutions. The company's growth strategy includes continued technological investment and strategic acquisitions. These moves are aimed at expanding its service portfolio and geographic reach, as highlighted in the Growth Strategy of NFI Industries article.

- Technological Investment: Investing in automation, AI, and predictive analytics to enhance operational efficiency.

- Strategic Acquisitions: Expanding service offerings and geographic presence through acquisitions and mergers.

- Customer Partnerships: Strengthening relationships to ensure customer satisfaction and retention.

- Market Expansion: Targeting emerging markets and specialized logistics services for growth.

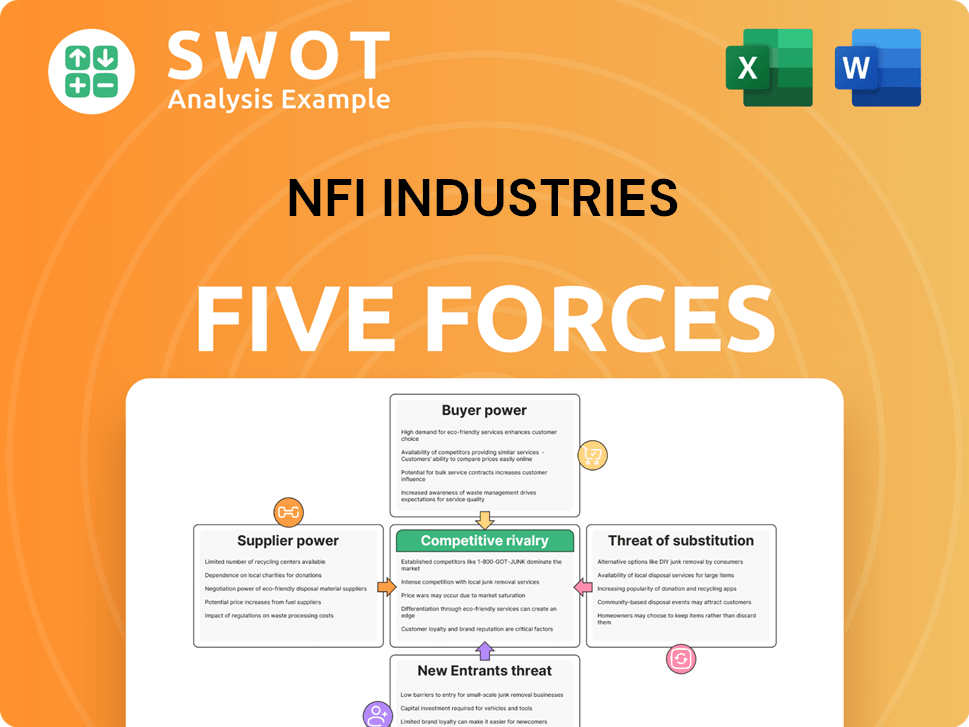

NFI Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NFI Industries Company?

- What is Growth Strategy and Future Prospects of NFI Industries Company?

- How Does NFI Industries Company Work?

- What is Sales and Marketing Strategy of NFI Industries Company?

- What is Brief History of NFI Industries Company?

- Who Owns NFI Industries Company?

- What is Customer Demographics and Target Market of NFI Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.