NFI Industries Bundle

Who Really Owns NFI Industries?

Ever wondered about the driving forces behind a logistics giant like NFI Industries? Understanding the NFI Industries SWOT Analysis starts with knowing its ownership. Unlike many of its competitors, NFI's story is rooted in family values and a long-term vision, making its ownership structure a key factor in its success. This unique aspect significantly shapes its strategic direction and operational approach.

Delving into the NFI ownership structure reveals a fascinating narrative of family legacy and business acumen. Since its inception in 1932, NFI Industries has remained a family-owned business, a characteristic that profoundly influences its commitment to innovation and its approach to the competitive landscape of NFI Logistics. This exploration will uncover the individuals behind the NFI leadership, the impact of this private ownership, and how these factors have shaped the NFI company profile and its impressive financial information, including its annual revenue and the scope of its services.

Who Founded NFI Industries?

The story of NFI Industries, a major player in the logistics sector, began in 1932 with Israel Brown. He launched National Hauling in Vineland, New Jersey, using a single truck to haul gravel. This marked the beginning of what would become a significant third-party logistics provider.

The company's roots are deeply embedded in the Brown family, with a history spanning four generations of family ownership and operation. Israel Brown's entrepreneurial spirit and hard work set the stage for the company's growth. This family-centric approach has been a cornerstone of the company's identity.

In the 1940s, Israel's son, Bernard 'Bernie' Brown, joined the business, playing a crucial role in its expansion. He was instrumental in transforming the small trucking firm into a national entity. Bernie secured contracts to supply the military during World War II. By the 1970s, National Freight had evolved from a New Jersey-based company into a regional force.

Israel Brown's vision was the foundation for NFI Industries. His initial focus on hauling gravel demonstrated a commitment to hard work and entrepreneurial spirit.

The Brown family's involvement has been central to NFI's history. Four generations of family ownership have shaped the company's culture and strategic direction.

Bernie Brown's contributions were pivotal in NFI's growth. Securing military contracts during WWII and expanding operations transformed the company.

The founders' commitment to expansion and diversification set an entrepreneurial tone. This has been a key factor in NFI's sustained success.

As a privately held company, NFI Industries' ownership details are not publicly available. The Brown family has maintained control throughout its history.

NFI's focus on continuous improvement and strategic partnerships has been a key driver of its success. This approach has helped the company adapt to changing market conditions.

Understanding the origins of NFI Industries provides insights into its culture and values. The company's history is marked by entrepreneurial spirit, family involvement, and strategic growth. For more on the company's strategies, see the Marketing Strategy of NFI Industries.

- NFI Industries was founded in 1932 by Israel Brown.

- NFI ownership has remained within the Brown family for four generations.

- Who owns NFI is the Brown family, as the company is privately held.

- The early expansion was led by Bernard 'Bernie' Brown in the 1940s.

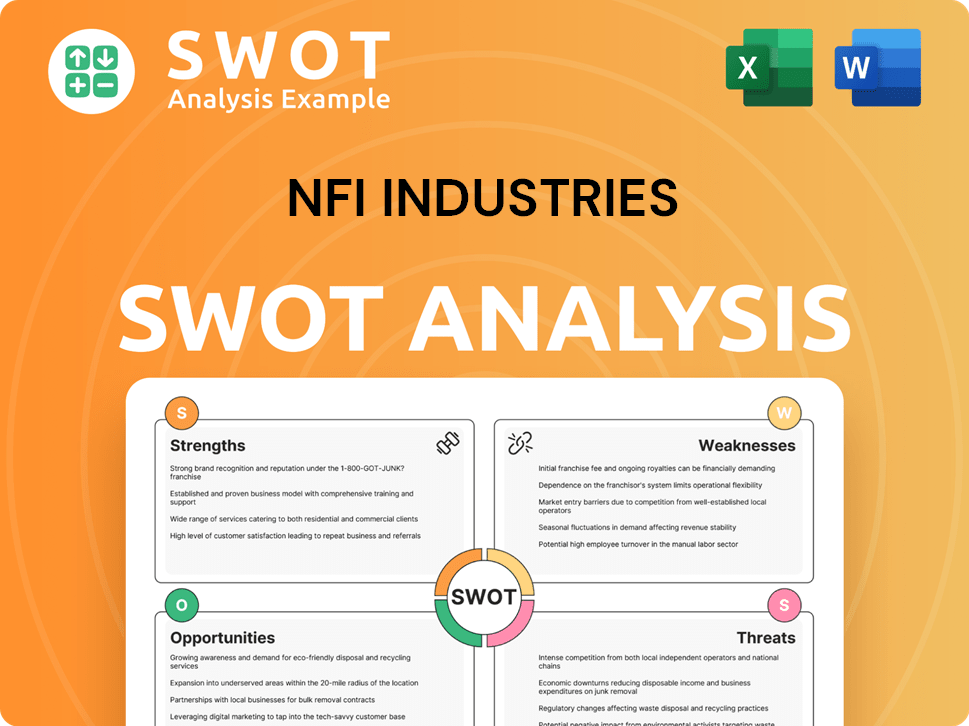

NFI Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has NFI Industries’s Ownership Changed Over Time?

Since its founding in 1932, NFI Industries has remained a privately held, family-owned entity. This structure has been a cornerstone of its operational strategy and governance. This contrasts sharply with publicly traded companies, which are subject to the dynamics of shareholder expectations and quarterly performance reports. The Brown family has consistently led the company through successive generations, maintaining a long-term perspective on growth and investment.

The current leadership comprises the third generation of the Brown family, including Sid Brown (CEO), Ike Brown (President – Vice Chairman), and Jeff Brown (President – Vice Chairman). The fourth generation is also actively involved, collectively bringing over 50 years of operational and leadership experience within logistics. This sustained family involvement underscores the company's commitment to a long-term vision, which has facilitated strategic acquisitions and organic expansion.

| Event | Date | Impact on NFI Ownership |

|---|---|---|

| Founding of NFI | 1932 | Establishment of family ownership. |

| Acquisition of California Cartage Company | 2017 | Expansion of NFI's North American presence. |

| Acquisition of G&P Trucking Company | 2019 | Strengthening of transportation presence in the Southeast. |

| Acquisition of SDR Distribution Services | April 2023 | Doubling of Canadian distribution footprint. |

| Acquisition of Transfix freight brokerage operation | June 2024 | Expansion of brokerage capabilities. |

NFI's strategic acquisitions, such as the 2017 purchase of California Cartage Company and the 2024 acquisition of the freight brokerage operation of Transfix, have broadened its service offerings and geographical footprint. These moves, along with the 2023 acquisition of SDR Distribution Services, reflect a focus on sustainable growth and diversification. This approach allows NFI to maintain a flexible capital structure and partner with other entities, including venture capitalists and family offices through NFI Ventures, solidifying its position within the logistics sector.

NFI Industries remains a privately held, family-owned business, ensuring long-term strategic focus. The Brown family's leadership spans multiple generations, driving consistent growth. Strategic acquisitions have broadened NFI's service offerings and geographical reach.

- Family ownership provides stability and a long-term vision.

- Strategic acquisitions enhance service capabilities and market presence.

- NFI Ventures facilitates partnerships and capital flexibility.

- The company's structure allows for adaptable financial strategies.

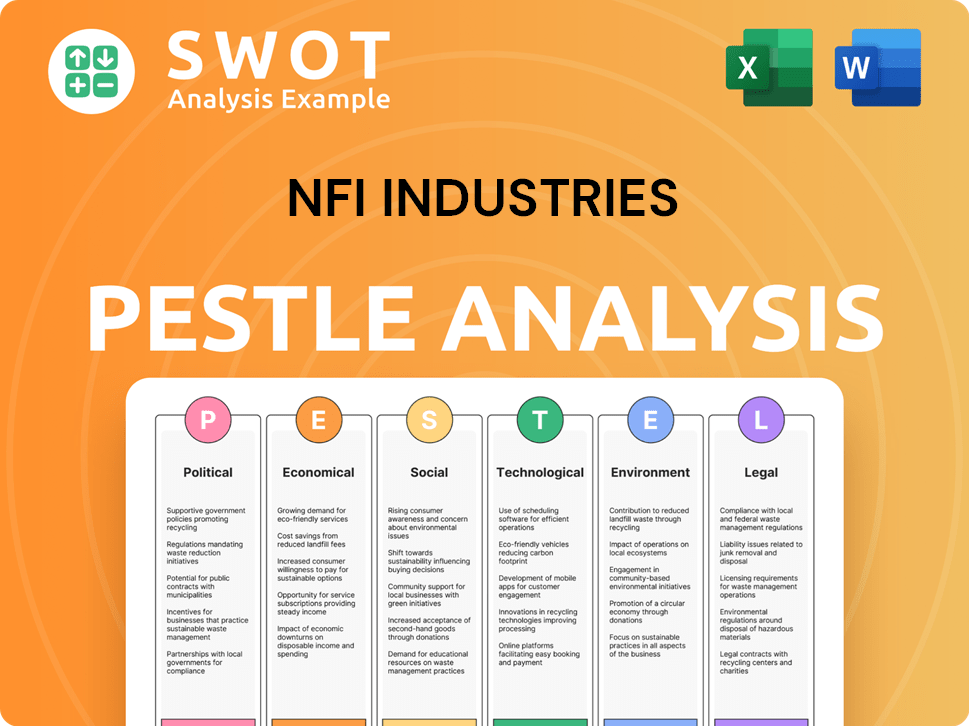

NFI Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on NFI Industries’s Board?

The leadership and governance structure of NFI Industries, a privately held company, are centered around the Brown family. Sid Brown serves as CEO, while Ike Brown and Jeff Brown hold positions as President – Vice Chairman. This family-centric approach means that the board of directors is not structured in the same way as a publicly traded company, where independent board members and shareholder representatives are common. The family's direct involvement ensures a long-term perspective focused on the company's sustainable growth and the interests of its employees. Understanding the Growth Strategy of NFI Industries is crucial to understanding its leadership's vision.

Due to its private status, specific details about the board's composition and voting structure are not publicly available. However, it is understood that the Brown family maintains ultimate control and voting power. This structure typically involves a 'one-share-one-vote' system or similar arrangements that consolidate control within the family. This contrasts sharply with publicly traded companies, where shareholder votes and proxy battles can significantly influence board decisions. This centralized control allows the family to directly shape the company's strategic direction and governance.

| Leadership Role | Name | Family Affiliation |

|---|---|---|

| CEO | Sid Brown | Brown Family |

| President – Vice Chairman | Ike Brown | Brown Family |

| President – Vice Chairman | Jeff Brown | Brown Family |

It is important to note that NFI Industries' structure differs significantly from NFI Group Inc. (TSX: NFI), a publicly traded company. NFI Group Inc. has a board of directors elected by shareholders, with a majority voting policy. For example, in May 2024, NFI Group Inc. re-elected its ten board nominees with strong shareholder support. This public company governance model does not apply to the privately held NFI Industries.

NFI Industries is a family-owned business, with the Brown family holding significant ownership and control. This structure influences the company's strategic decisions and long-term goals.

- Family ownership ensures a long-term focus.

- Decisions are made with the company's sustainable growth in mind.

- The Brown family directly shapes the company's strategic direction.

- No public shareholder influence or proxy battles.

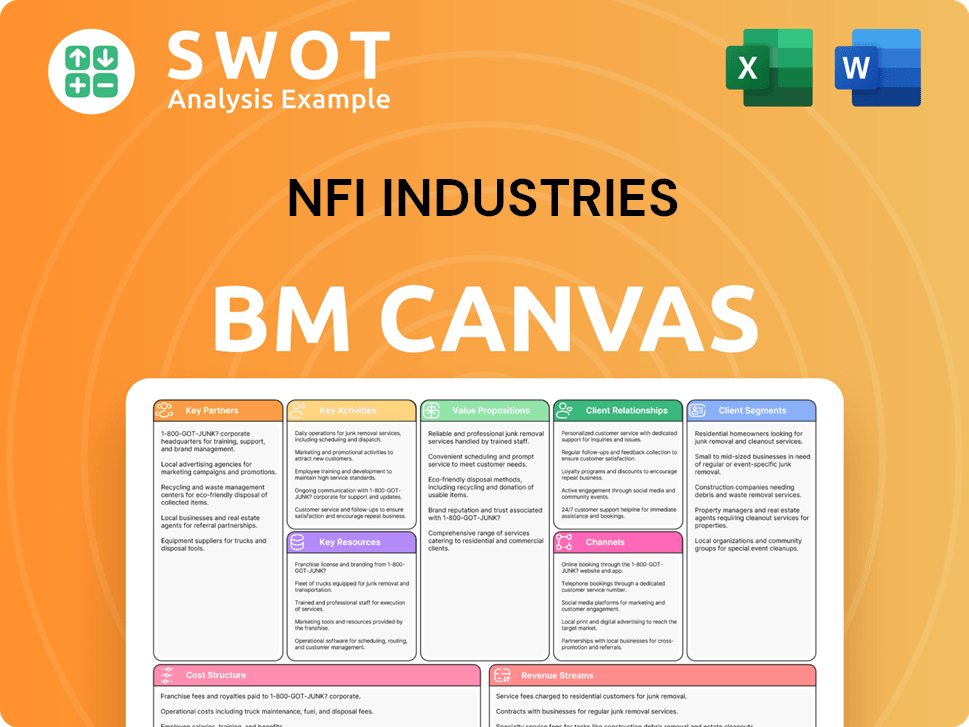

NFI Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped NFI Industries’s Ownership Landscape?

Over the past few years, the ownership of NFI Industries has remained consistent, with the Brown family retaining firm control. This private ownership structure allows for long-term strategic planning and investment, such as the acquisitions of SDR Distribution Services in April 2023 and Transfix's freight brokerage operation in June 2024. These moves have expanded NFI's warehousing and digital freight capabilities, reflecting a commitment to growth and diversification within the supply chain solutions sector.

NFI Industries reported strong financial results for 2024, with annual revenue exceeding $3.9 billion. The company continues to invest in sustainable transportation solutions, aiming for a 100% zero-emission drayage fleet. Additionally, NFI Ventures, the venture arm created by the Brown family, actively invests in early-stage companies within the supply chain industry, demonstrating a commitment to innovation and industry advancement. There are no current plans for an initial public offering or privatization, reinforcing the family-owned business model.

| Key Development | Date | Impact |

|---|---|---|

| Acquisition of SDR Distribution Services | April 2023 | Expanded Canadian warehousing and distribution footprint to over 5 million square feet. |

| Acquisition of Transfix's freight brokerage operation | June 2024 | Enhanced digital freight capabilities. |

| Annual Revenue | 2024 | Reached over $3.9 billion. |

The Competitors Landscape of NFI Industries reveals that the company's focus on sustainable practices and strategic acquisitions positions it as a key player in the logistics sector. The consistent ownership by the Brown family allows NFI to make decisions that support long-term growth and innovation within the industry.

NFI Industries is a privately held, family-owned company. The Brown family maintains control, enabling long-term strategic decisions. This structure allows for investments in sustainable practices and acquisitions.

Key acquisitions include SDR Distribution Services in 2023 and Transfix's freight brokerage in 2024. These moves expand NFI's warehousing and digital freight capabilities. The acquisitions support the company's growth strategy.

NFI Industries reported over $3.9 billion in annual revenue for 2024. The company continues to invest in sustainable transportation solutions. Financial performance reflects strategic growth and market positioning.

NFI Ventures supports innovation in the supply chain industry. There are no plans for privatization or public listing. The focus remains on family ownership and long-term strategic growth.

NFI Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NFI Industries Company?

- What is Competitive Landscape of NFI Industries Company?

- What is Growth Strategy and Future Prospects of NFI Industries Company?

- How Does NFI Industries Company Work?

- What is Sales and Marketing Strategy of NFI Industries Company?

- What is Brief History of NFI Industries Company?

- What is Customer Demographics and Target Market of NFI Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.