O'Reilly Automotive Bundle

How Does O'Reilly Automotive Dominate the Auto Parts Market?

The automotive aftermarket is a dynamic sector, and O'Reilly Automotive has emerged as a key player. Founded in 1957, the company has grown from a single store to a vast network of over 6,100 locations across the United States. Understanding the O'Reilly Automotive SWOT Analysis is crucial to grasping its position.

This analysis delves into the O'Reilly Automotive competition, exploring its rivals and assessing its O'Reilly Automotive market share within the auto parts industry analysis. We'll examine the company's strategic moves and financial performance, providing insights into its ability to navigate the automotive aftermarket and maintain its competitive edge. Furthermore, we'll uncover the O'Reilly Automotive competitors and their impact.

Where Does O'Reilly Automotive’ Stand in the Current Market?

O'Reilly Automotive holds a significant market position in the automotive aftermarket sector. It stands as one of the largest retailers of automotive aftermarket parts, tools, supplies, equipment, and accessories across the United States. The company's robust presence is a key factor in its competitive standing within the auto parts industry analysis.

The company's primary focus is on two main customer segments: professional service providers and do-it-yourself (DIY) customers. This dual approach allows it to capture a broad market share. O'Reilly Automotive's strategy is to maintain a wide inventory and strong customer service, which has contributed to its sustained success.

The company's extensive geographic reach spans 48 U.S. states, demonstrating a broad reach across various regions. This wide network supports its ability to serve a large customer base efficiently. For insights into the strategies that drive its success, consider exploring the Marketing Strategy of O'Reilly Automotive.

O'Reilly Automotive consistently ranks among the top players in the automotive aftermarket. While specific market share figures for early 2025 are still emerging, the company maintains a strong position. Its key competitors include AutoZone and Advance Auto Parts.

O'Reilly caters to both professional service providers and DIY customers. Approximately 46% of its sales come from professional service providers, with the remaining 54% from DIY customers. This balanced approach helps in maintaining a stable revenue stream.

The company's extensive store network covers 48 U.S. states. This broad geographic footprint supports its ability to serve a wide range of customers. O'Reilly's strong presence in suburban and rural markets is a key competitive advantage.

In the first quarter of 2024, O'Reilly reported a 5.4% increase in net sales to $3.83 billion. Gross profit for the same period increased to $1.86 billion, representing 48.5% of net sales. Comparable store sales increased by 3.4% in Q1 2024, reflecting strong operational efficiency.

O'Reilly Automotive's competitive advantages include its extensive store network, comprehensive inventory, and strong customer service. The company's focus on both professional and DIY customers provides a diversified revenue stream. These factors contribute to its strong market position and growth potential.

- Extensive store network across 48 states.

- Balanced customer segmentation between professional and DIY customers.

- Strong financial performance with consistent sales growth.

- Focus on comprehensive inventory and customer service.

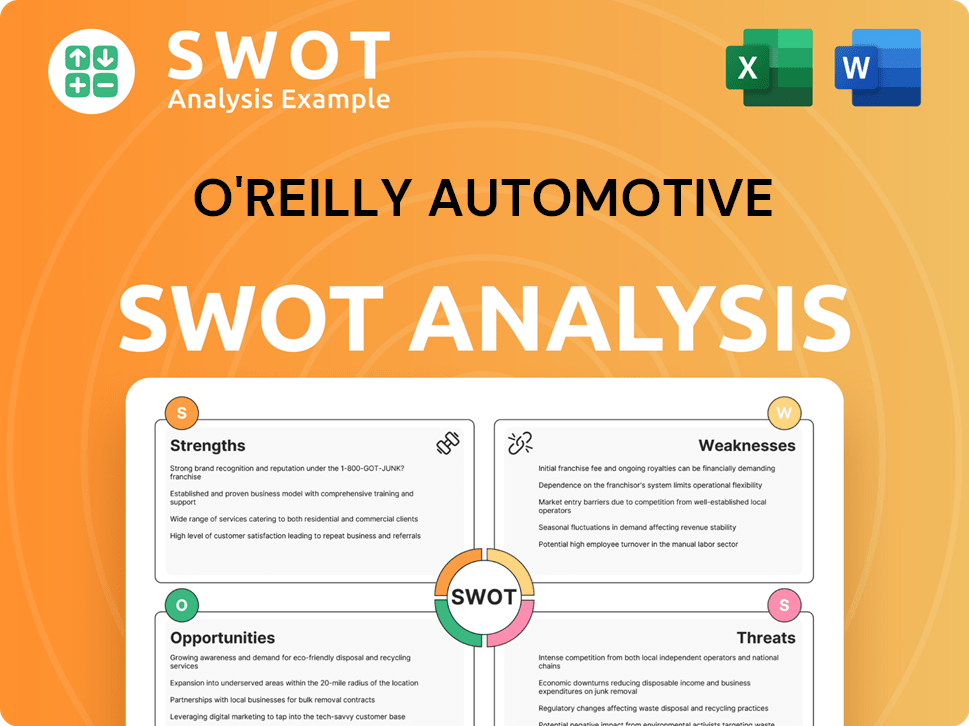

O'Reilly Automotive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging O'Reilly Automotive?

The competitive landscape for O'Reilly Automotive is intense, shaped by both direct and indirect rivals. Understanding the O'Reilly Automotive competition is crucial for assessing its market position and strategic direction. The auto parts industry analysis reveals a dynamic environment where companies constantly vie for market share.

O'Reilly Automotive competitors include a mix of large national chains, regional players, and online retailers. These competitors employ various strategies, such as aggressive pricing, extensive product offerings, and loyalty programs, to attract and retain customers. The automotive aftermarket is a significant sector, with companies continuously adapting to changing consumer demands and technological advancements.

The primary direct competitors of O'Reilly Automotive are AutoZone, Advance Auto Parts, and, to a lesser extent, Pep Boys. AutoZone is a major player, often competing on store density and brand recognition. Advance Auto Parts focuses on both DIY and professional customers. These companies challenge O'Reilly through pricing strategies and product offerings. High-profile 'battles' often involve market share shifts in specific regions or product categories.

AutoZone is a major direct competitor, known for its extensive store network and strong brand recognition. For its second quarter of fiscal 2024, AutoZone reported net sales of $4.2 billion, indicating its substantial presence in the market.

Advance Auto Parts competes directly with O'Reilly, targeting both DIY and professional customers. Advance Auto Parts reported net sales of $3.4 billion for its first quarter 2024, highlighting its significant market share.

Pep Boys, while a smaller player, also competes in the auto parts and service market. Its focus on both parts sales and service provides a different competitive angle.

Online retailers such as Amazon and eBay are increasingly significant competitors, offering wide selections and competitive pricing. These platforms disrupt traditional distribution channels.

Mass merchandisers like Walmart and Target offer a limited range of auto maintenance items, indirectly competing for the DIY customer segment.

Smaller regional chains and independent auto parts stores also contribute to the competitive landscape. These businesses often focus on localized customer service and specialized offerings.

The competitive landscape extends beyond these major players. Online retailers, such as Amazon and eBay, offer a wide array of parts and compete on price and convenience. Mass merchandisers like Walmart and Target also offer a limited selection of automotive maintenance items. The industry has seen consolidation through mergers and acquisitions, which can alter competitive dynamics. The evolution of vehicle technology, including the rise of electric vehicles, introduces new players and specialized parts suppliers. For more insights into the company's growth strategies, read about the Growth Strategy of O'Reilly Automotive.

Several factors shape the competitive dynamics within the auto parts industry.

- Pricing Strategies: Aggressive pricing and promotional activities are common to attract customers.

- Product Offerings: Extensive product catalogs and availability are critical.

- Store Network and Density: The number and location of stores impact market reach.

- Customer Service and Loyalty Programs: Providing excellent service and loyalty incentives are key to retaining customers.

- Online Presence and E-commerce: A strong online presence is essential for competing with online retailers.

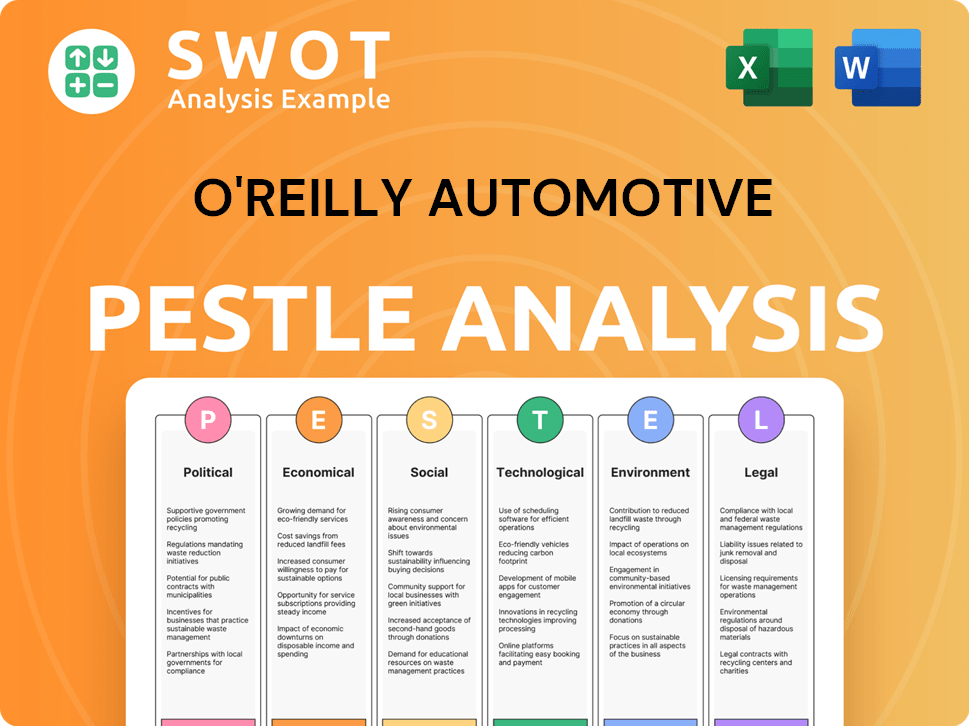

O'Reilly Automotive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives O'Reilly Automotive a Competitive Edge Over Its Rivals?

The competitive landscape for O'Reilly Automotive is shaped by its strategic focus on both professional service providers and do-it-yourself (DIY) customers. This dual-market approach, combined with a robust inventory management system, gives it a significant edge. Understanding the O'Reilly Automotive competition and the broader auto parts industry analysis is crucial for assessing its market position and growth potential. The company's ability to maintain high in-stock availability and an efficient distribution network further enhances its competitive advantages.

O'Reilly Automotive's success is also tied to its strong brand reputation and customer loyalty. The company has cultivated a reputation for knowledgeable staff and excellent customer service, which encourages repeat business. Its store format, often larger than some competitors, allows for a comprehensive product offering. Furthermore, economies of scale, derived from its extensive network of over 6,100 stores, enable it to negotiate favorable pricing with suppliers, leading to better margins and competitive pricing for customers. These advantages have evolved over time, with continuous investments in supply chain technology and employee training to maintain service levels.

The company's financial performance reflects its strong market position. In recent years, O'Reilly Automotive's revenue has consistently grown. For instance, in Q1 2024, the company reported a total revenue of approximately $4.1 billion, demonstrating its robust financial health and market strength. This financial success is further supported by its strategic focus on both professional and DIY customers, which allows it to capture a broader market segment and diversify its revenue streams.

O'Reilly Automotive serves both professional service providers and DIY customers. This strategy broadens its market reach and diversifies revenue streams. This approach allows the company to capture a broader market segment and diversify its revenue streams, contributing to its overall financial stability.

The company maintains high in-stock availability of a wide range of parts. This is crucial for both professional garages and DIY customers. Efficient inventory management ensures rapid replenishment of store inventory, supporting customer needs effectively.

O'Reilly has a strong reputation for knowledgeable staff and excellent customer service. This fosters repeat business and enhances customer loyalty. This aspect is a key differentiator in the competitive auto parts market.

The company's vast network of over 6,100 stores enables favorable pricing with suppliers. This leads to better margins and competitive pricing for customers. This advantage supports its ability to maintain profitability and market share.

O'Reilly Automotive's competitive advantages include a dual-market strategy, efficient inventory management, brand equity, and economies of scale. These factors contribute to its strong market position and financial performance. Continuous investment in supply chain technology and employee training is crucial to maintain these advantages.

- Dual-market approach targeting both professional and DIY customers.

- Efficient inventory management and distribution network.

- Strong brand reputation and customer loyalty.

- Economies of scale from a vast store network.

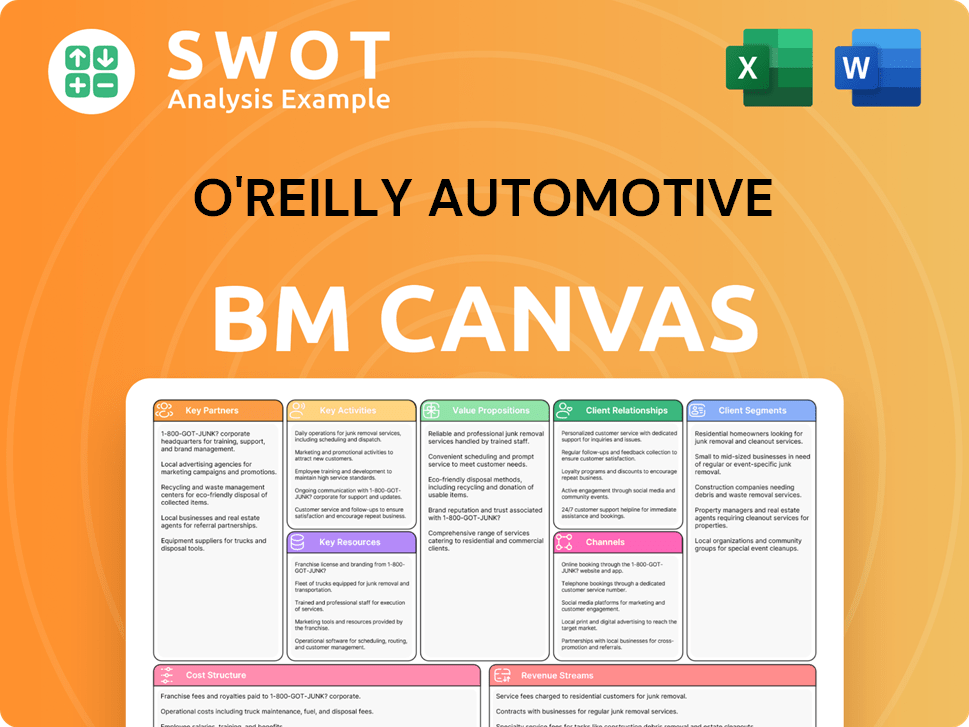

O'Reilly Automotive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping O'Reilly Automotive’s Competitive Landscape?

The automotive aftermarket industry is currently undergoing significant shifts, influencing the competitive landscape for companies like O'Reilly Automotive. These changes, driven by technological advancements, evolving consumer preferences, and regulatory pressures, present both challenges and opportunities. Understanding these dynamics is crucial for assessing O'Reilly's strategic positioning and future prospects.

The company faces potential risks from a changing market, including the rise of electric vehicles (EVs) and increased competition. However, it also benefits from the enduring demand for auto parts and services, the complexity of modern vehicles, and its established presence. The ability to adapt to emerging trends and capitalize on new opportunities will be key to O'Reilly's sustained success within the auto parts industry.

Technological advancements, especially in vehicle complexity and EV adoption, are reshaping the automotive aftermarket. Consumer preferences are evolving towards convenience and digital shopping experiences. Stricter emissions standards and regulatory changes also impact the types of parts and services required. The automotive aftermarket is expected to reach $475.8 billion by 2028, according to a report by Global Market Insights.

A slowdown in vehicle miles traveled could decrease demand for parts and services. Rapid EV adoption might reduce the need for traditional ICE parts, requiring inventory adjustments. Intense competition from online retailers and direct-to-consumer models could erode market share. Competitors like AutoZone and Advance Auto Parts are also expanding their market presence.

The aging U.S. vehicle fleet continues to fuel demand for maintenance and repair parts. The increasing complexity of vehicles makes DIY repairs more challenging, benefiting professional service providers. Expanding into emerging markets and offering EV-specific parts and accessories are potential growth areas. Strategic partnerships and leveraging its store network for last-mile delivery offer competitive advantages. O'Reilly Automotive's revenue in 2024 was approximately $16.2 billion.

O'Reilly is likely to focus on technological adaptation, including e-commerce integration and workforce training. Maintaining a robust supply chain and enhancing its digital presence are critical. The company may explore diversification into new service offerings related to future vehicle technologies. The company's focus on digital transformation and supply chain efficiency is crucial for maintaining its competitive edge.

The O'Reilly Automotive competition includes major players like AutoZone, Advance Auto Parts, and numerous smaller regional and online retailers. To maintain its position, O'Reilly must emphasize technological adaptation, e-commerce integration, and workforce training.

- Enhance e-commerce capabilities and omnichannel strategies to meet evolving consumer expectations.

- Invest in workforce training to handle the increasing complexity of vehicles and the rise of EVs.

- Explore strategic partnerships to expand into new markets and service offerings.

- Strengthen supply chain management to ensure efficient inventory and distribution.

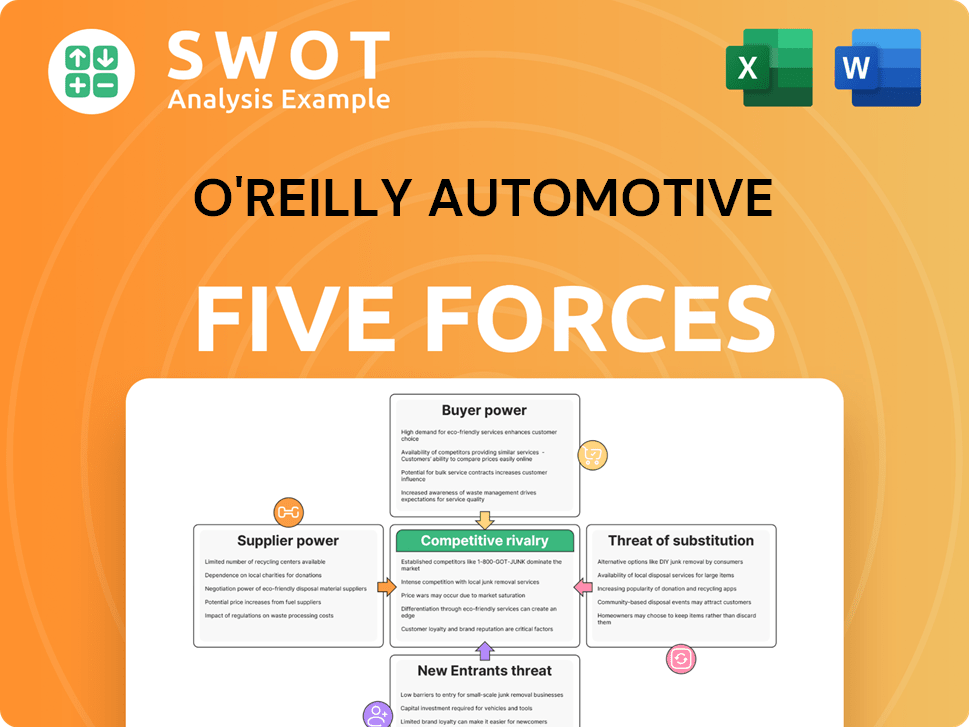

O'Reilly Automotive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of O'Reilly Automotive Company?

- What is Growth Strategy and Future Prospects of O'Reilly Automotive Company?

- How Does O'Reilly Automotive Company Work?

- What is Sales and Marketing Strategy of O'Reilly Automotive Company?

- What is Brief History of O'Reilly Automotive Company?

- Who Owns O'Reilly Automotive Company?

- What is Customer Demographics and Target Market of O'Reilly Automotive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.