O'Reilly Automotive Bundle

Can O'Reilly Automotive Maintain Its Dominance in the Auto Parts Market?

From a single store in 1957 to a sprawling network across North America, O'Reilly Automotive has become a powerhouse in the O'Reilly Automotive SWOT Analysis. But what's next for this auto parts retail giant? This analysis explores O'Reilly's strategic initiatives, expansion plans, and financial outlook to determine its future trajectory in the dynamic automotive industry.

As the automotive aftermarket evolves, understanding O'Reilly Automotive's growth strategy is critical for investors and industry watchers alike. We'll examine the company's approach to navigating automotive industry trends, including its focus on strategic acquisitions and its online sales strategy. This deep dive into O'Reilly Automotive's future outlook will provide insights into its competitive landscape and long-term investment potential.

How Is O'Reilly Automotive Expanding Its Reach?

The expansion strategy of O'Reilly Automotive is built on a foundation of new store openings, strategic acquisitions, and international market penetration. This multi-faceted approach aims to increase market share and capitalize on the growth opportunities within the auto parts retail sector. The company's commitment to growth is evident in its significant investments in infrastructure and its proactive pursuit of new markets.

In 2024, O'Reilly Automotive demonstrated its commitment to expansion by adding a substantial number of new stores. This growth is supported by considerable capital expenditures, which are crucial for sustaining the company's expansion plans. The company's strategic initiatives are designed to strengthen its position in the automotive industry and enhance its long-term value for Owners & Shareholders of O'Reilly Automotive.

O'Reilly Automotive's future outlook is promising, with continued investment in growth initiatives. The company's strategic acquisitions and international ventures are key components of its long-term expansion strategy. These efforts are supported by a robust distribution network, which is essential for efficiently serving its growing store network and meeting customer demands.

In 2024, O'Reilly Automotive added a net of 198 new stores, bringing the total to 6,378 locations. The company plans to open an additional 200-210 new stores in 2025, demonstrating its confidence in physical expansion. This expansion is a key part of O'Reilly Automotive's growth strategy, supported by significant capital investments.

O'Reilly has used acquisitions to expand its market presence. The acquisition of Groupe Del Vasto in December 2023 provided a foothold in the Canadian market. This acquisition added 23 company-owned stores under the Vast-Auto Distribution name. The company has also used acquisitions to grow its presence in Mexico.

O'Reilly Automotive is expanding its international footprint, particularly in Mexico and Canada. In 2024, the company opened 25 new stores in Mexico. As of March 31, 2025, O'Reilly operated 93 stores in Mexico and 25 stores in Canada. These international ventures aim to diversify revenue streams and access new customer bases.

O'Reilly Automotive is investing heavily in its infrastructure to support its expansion plans. Projected capital expenditures for 2025 are between $1.2 billion and $1.3 billion. The company's distribution network, including 30 regional distribution centers, is crucial for supporting its expansion, typically serving 250 stores with five-night-per-week deliveries.

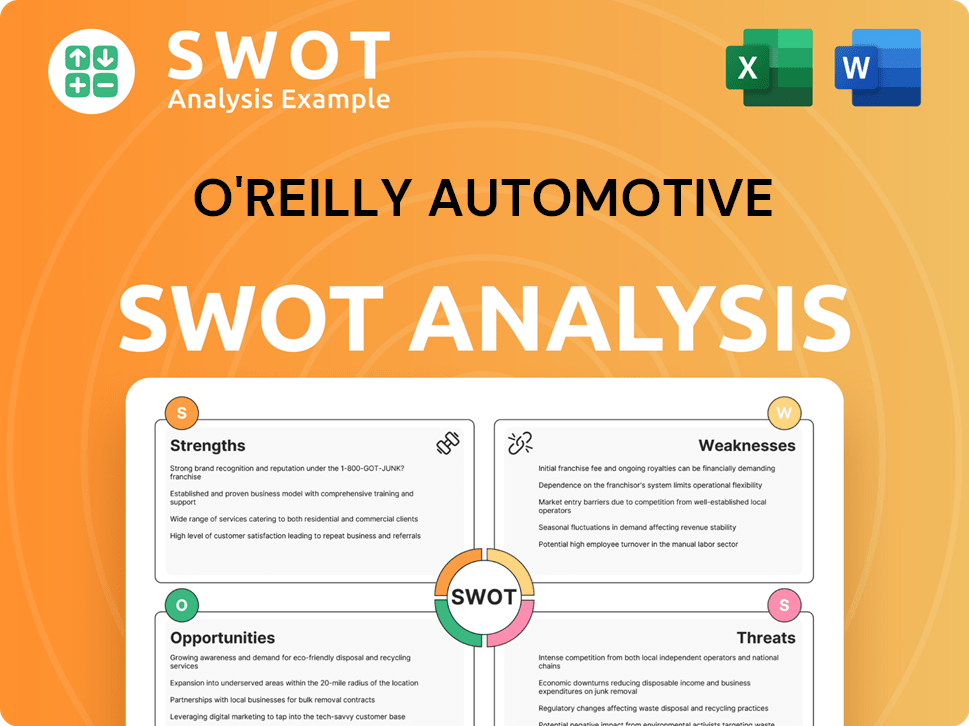

O'Reilly Automotive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does O'Reilly Automotive Invest in Innovation?

O'Reilly Automotive's innovation and technology strategy is pivotal for its sustained growth and competitive advantage in the auto parts retail sector. The company continually invests in technology to improve operational efficiency, enhance customer experience, and adapt to evolving automotive industry trends. This commitment to technological advancement is a key component of its strategy for the future.

A central element of O'Reilly's strategy involves continuous investment in its supply chain and distribution network. This is crucial for maintaining superior product availability and supporting its expansion plans. The company's focus on operational excellence through advanced logistics and inventory management is a cornerstone of its growth objectives and overall financial performance.

In 2024, O'Reilly completed the relocation and modernization of its Atlanta distribution center, which is now its largest and most automated facility. This strategic move highlights the company's dedication to efficiency and its proactive approach to meeting the demands of a growing market. This is part of their broader Brief History of O'Reilly Automotive, which has always been about adapting and growing.

O'Reilly is exploring the use of artificial intelligence (AI) to enhance customer service and develop predictive maintenance solutions. This includes the integration of Internet of Things (IoT) devices to provide real-time vehicle performance data. These initiatives aim to optimize platforms for voice interactions and improve overall customer engagement.

The company is committed to sustainability, integrating it into daily operations. O'Reilly aims to achieve net-zero greenhouse gas emissions by 2050. This includes efforts to improve energy efficiency in stores and distribution centers.

O'Reilly has focused on improving energy efficiency. By the end of 2023, LED lighting installations were completed in all stores. These measures demonstrate a commitment to reducing environmental impact and lowering operational costs.

O'Reilly champions product circularity through remanufacturing and offers extensive recycling options for batteries and fluids. This approach aligns environmental responsibility with business practices, supporting sustainable growth and customer satisfaction.

The company is continuously optimizing its supply chain. This includes investments in distribution centers and logistics technology to ensure timely delivery and product availability. These efforts are critical for maintaining a competitive edge in the auto parts retail market.

O'Reilly is focused on enhancing customer experience through technology. This involves digital initiatives, such as online sales strategy improvements and the use of AI-powered customer service tools. The goal is to provide seamless and efficient service across all touchpoints.

O'Reilly's strategy incorporates several key elements to drive growth and maintain its competitive position. These initiatives are designed to improve operational efficiency, enhance customer experience, and support sustainable practices.

- Supply Chain Optimization: Investments in distribution centers and logistics technology to ensure efficient product delivery and availability.

- AI and Machine Learning: Exploring AI for customer service and predictive maintenance, enhancing customer engagement.

- Sustainability Initiatives: Aiming for net-zero emissions by 2050, improving energy efficiency, and promoting product circularity.

- Digital Transformation: Enhancing online sales strategy and leveraging digital tools to improve customer service and overall experience.

- Data Analytics: Using data to understand market trends, customer preferences, and optimize inventory management.

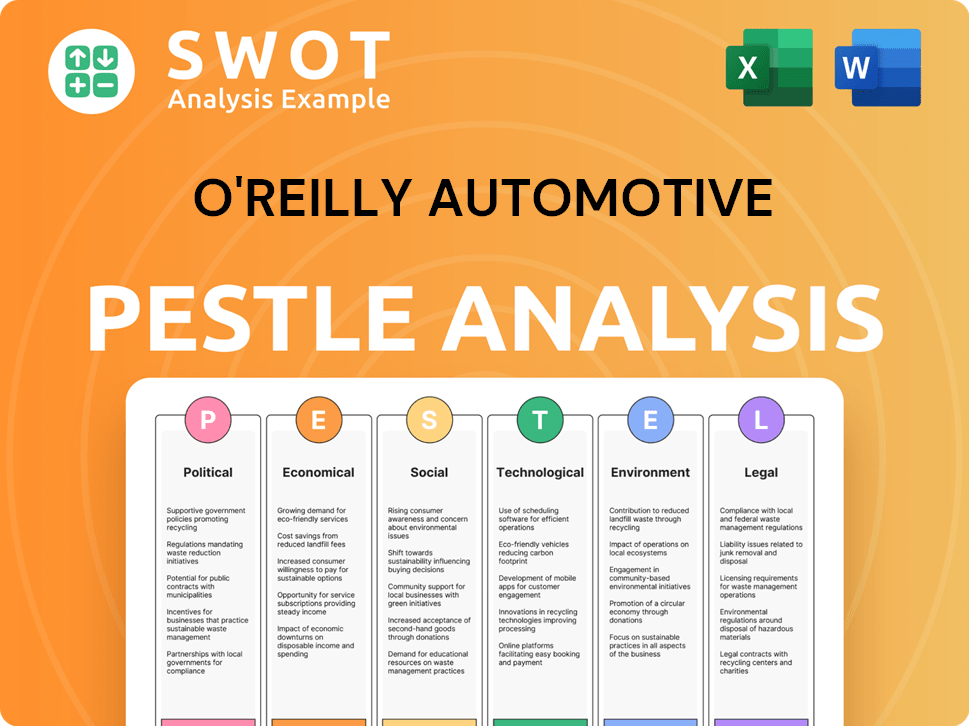

O'Reilly Automotive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is O'Reilly Automotive’s Growth Forecast?

The financial outlook for O'Reilly Automotive in 2025 showcases a continued growth trajectory, reflecting its strategic focus on expansion and market penetration. The company's performance in 2024, with a 6% increase in sales to $16.71 billion and a 2% rise in net income to $2.39 billion, sets a solid foundation for future growth. This performance is further underscored by a 6% increase in diluted earnings per share to $40.66 in 2024, demonstrating the company's ability to generate value for its shareholders. The company's commitment to returning value to shareholders is evident through its stock repurchase program, with $2.08 billion of common stock repurchased in 2024.

O'Reilly Automotive's strategic approach includes a focus on enhancing its market presence and operational efficiency. The projected revenue for 2025, estimated between $17.4 billion and $17.7 billion, indicates a positive outlook for the company's growth. The anticipated comparable store sales growth, ranging from 2.0% to 4.0%, highlights the company's ability to drive sales within its existing store network. The company's strategic decisions are aimed at capitalizing on the evolving dynamics of the auto parts retail industry, including leveraging automotive industry trends to meet customer demands.

The company's financial guidance for 2025 anticipates continued profitability and operational excellence. Diluted earnings per share are forecasted to be between $42.60 and $43.10, with a raised guidance range of $42.90 to $43.40 as of April 2025, reflecting the company's confidence in its earnings potential. The stable gross margin, expected to range from 51.2% to 51.7%, and the operating profit guidance set at 19.2% to 19.7% for 2025, demonstrate the company's focus on maintaining profitability. The expected free cash flow for 2025, ranging from $1.6 billion to $1.9 billion, will support strategic initiatives, including O'Reilly Automotive expansion and investment in its supply chain.

O'Reilly Automotive's financial outlook for 2025 is promising, with several key projections indicating continued growth and profitability. The company's strategic initiatives and market position are expected to drive these positive outcomes, reflecting its strong performance in the auto parts retail sector.

- Total Revenue: Projected between $17.4 billion and $17.7 billion.

- Comparable Store Sales Growth: Anticipated to be in the range of 2.0% to 4.0%.

- Diluted Earnings Per Share: Forecasted to be between $42.60 and $43.10, with a raised guidance range of $42.90 to $43.40 as of April 2025.

- Gross Margin: Expected to be stable, ranging from 51.2% to 51.7%.

- Operating Profit: Guidance set at 19.2% to 19.7%.

- Free Cash Flow: Expected to be in the range of $1.6 billion to $1.9 billion.

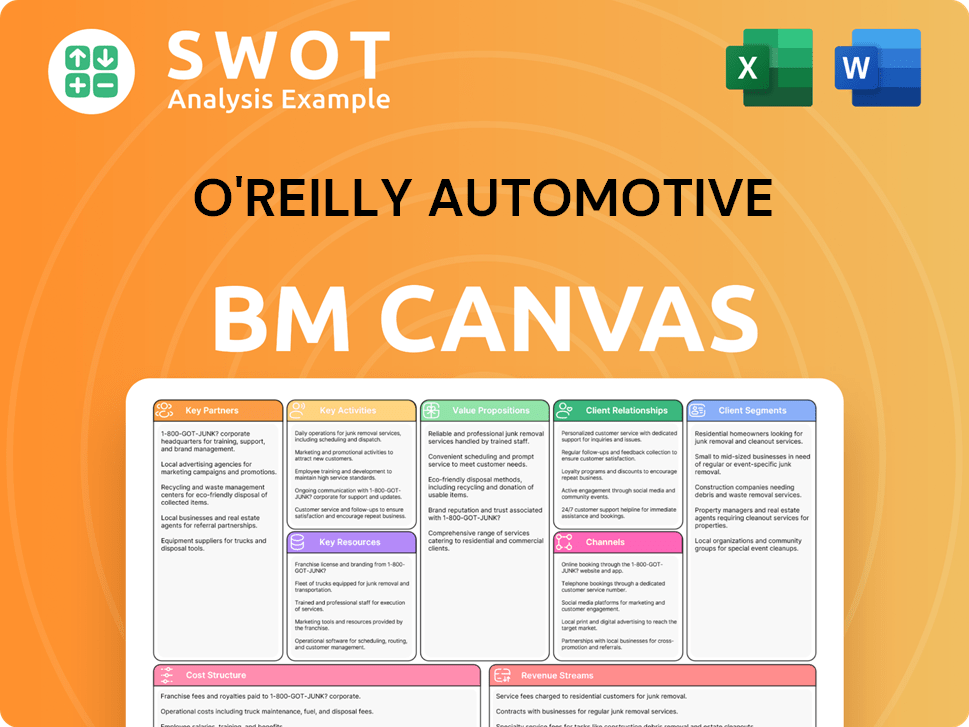

O'Reilly Automotive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow O'Reilly Automotive’s Growth?

The growth strategy of O'Reilly Automotive faces several potential risks and obstacles that could influence its future. The company operates within a fiercely competitive auto parts retail market, requiring continuous innovation and strategic investment to maintain market share. Increased selling, general, and administrative (SG&A) expenses also pose a challenge, impacting cost management and profitability.

Regulatory changes and global trade disputes, such as tariffs, present additional risks. These factors can affect sourcing, pricing, and overall cost structures, potentially squeezing profit margins. Supply chain vulnerabilities and economic headwinds, including inflation and consumer debt, further complicate O'Reilly's outlook.

The company must navigate these challenges to sustain its growth trajectory. Effective inventory management, strategic supply chain investments, and a focus on both DIY and professional customer segments are vital for mitigating risks. The Target Market of O'Reilly Automotive is crucial in understanding the company's customer base and adapting to changing market dynamics.

O'Reilly Automotive operates in a highly competitive auto parts retail environment. This necessitates constant innovation and strategic investment to maintain and grow its market share. The company faces competition from national chains, independent stores, and online retailers, requiring a robust competitive strategy.

Increased selling, general, and administrative (SG&A) expenses are a significant concern. In Q3 2024, SG&A expenses rose by 7% to $1.35 billion, representing 31.0% of sales. Managing these costs is crucial for maintaining profitability and supporting O'Reilly's expansion plans.

Regulatory changes and trade disputes, particularly tariffs, pose a risk to O'Reilly's operations. Tariffs on imported parts can affect sourcing and pricing strategies, impacting cost structures and profit margins. While the gross margin was stable at 51.3% in Q1 2025, the future impact remains uncertain.

O'Reilly's supply chain is critical to its operations, but it is also a source of vulnerability. Potential disruptions can affect product availability and pricing. Effective inventory management and procurement strategies are essential to mitigate these risks and maintain a steady supply of auto parts.

Broader economic factors, such as inflation and consumer debt, can impact consumer spending on vehicle maintenance. This can affect sales in discretionary categories like tools and accessories. O'Reilly anticipates economic weakness to persist in 2025, potentially affecting comparable sales growth.

O'Reilly Automotive employs several strategies to mitigate these risks. These include strategic investments in its supply chain, improving operational efficiencies, and maintaining a diversified customer base. These measures aim to provide some hedging against market cycles and economic fluctuations.

The auto parts retail market is highly fragmented, with national chains, independent stores, and online retailers vying for market share. O'Reilly Automotive must continuously adapt its strategies to stay competitive. This includes offering competitive pricing, expanding its product range, and providing excellent customer service.

Rising SG&A expenses and potential margin pressures from tariffs and supply chain disruptions pose financial challenges. Managing costs effectively and maintaining a strong gross margin are crucial for O'Reilly's financial health. The company needs to carefully monitor its financial performance and adjust its strategies as needed.

Effective supply chain management is critical for O'Reilly to ensure product availability and manage costs. This involves maintaining strong relationships with suppliers and implementing efficient inventory management systems. Disruptions in the supply chain can lead to lost sales and higher costs.

The economic outlook for 2025 includes potential headwinds from inflation and consumer debt. These factors can affect consumer spending on vehicle maintenance and repairs. O'Reilly Automotive must adapt its strategies to navigate these economic uncertainties and maintain its growth trajectory.

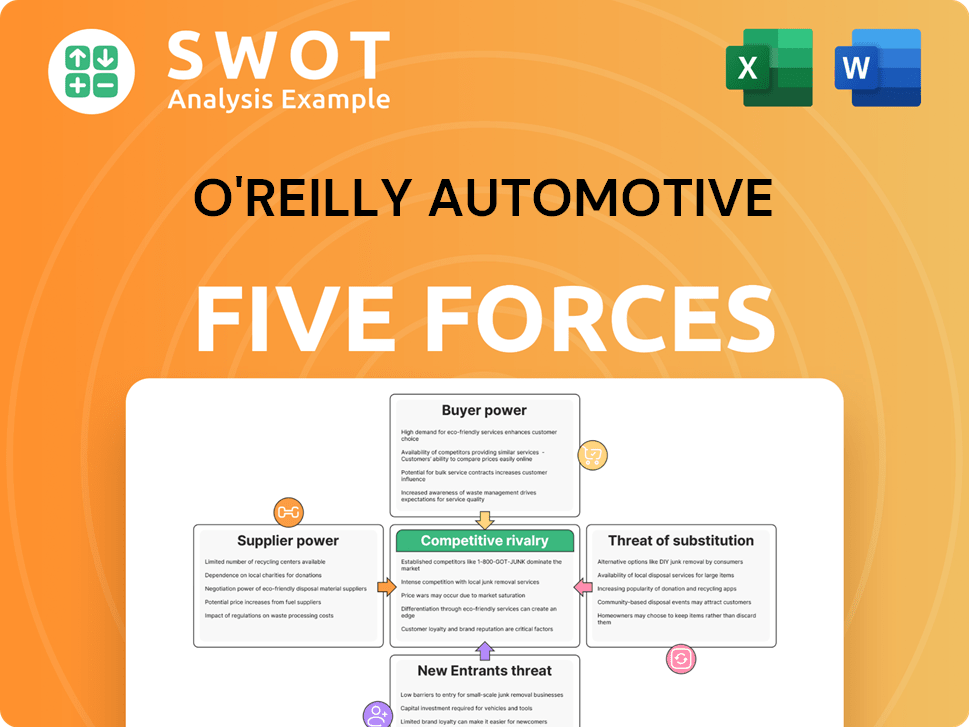

O'Reilly Automotive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of O'Reilly Automotive Company?

- What is Competitive Landscape of O'Reilly Automotive Company?

- How Does O'Reilly Automotive Company Work?

- What is Sales and Marketing Strategy of O'Reilly Automotive Company?

- What is Brief History of O'Reilly Automotive Company?

- Who Owns O'Reilly Automotive Company?

- What is Customer Demographics and Target Market of O'Reilly Automotive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.