O'Reilly Automotive Bundle

Who Really Owns O'Reilly Automotive?

Delving into the O'Reilly Automotive SWOT Analysis offers a glimpse into the company's strategic landscape, but understanding its ownership structure is equally vital. Knowing who controls O'Reilly Auto Parts provides critical insights into its future direction and financial health. From its humble beginnings to its current status as a leading auto parts retailer, the ownership story of O'Reilly is a compelling narrative.

This exploration into O'Reilly ownership will uncover the key players shaping the company's destiny. We'll examine the evolution of O'Reilly Automotive's ownership, from the founding family's initial vision to the influence of institutional investors and public shareholders. Understanding the O'Reilly company structure is key to grasping its market position and future potential, making it essential for anyone interested in the auto parts industry.

Who Founded O'Reilly Automotive?

The story of O'Reilly Automotive, now a leading auto parts retailer, began in 1957. The company was founded by Charles F. O'Reilly and his son, Chub O'Reilly. This marked the start of what would become a significant player in the auto parts industry.

Charles F. O'Reilly brought a wealth of experience to the table. He had been working in the automotive parts business since 1928, giving him deep industry knowledge. When the owner of Link Motor Supply decided to retire in 1957, Charles and Chub saw an opportunity to start their own venture.

The initial ownership of O'Reilly Automotive was primarily held within the O'Reilly family. While the exact equity split isn't publicly detailed, it's clear that Charles and Chub O'Reilly were the foundational owners. They used their industry experience and personal capital to launch the business. The early days were characterized by a strong family-oriented ownership structure.

Charles F. O'Reilly and his son, Chub O'Reilly, founded the company in 1957. Charles had extensive experience in the auto parts sector.

The initial ownership was largely concentrated within the O'Reilly family. No external investors are noted during the early stages.

The business was primarily self-funded, leveraging the founders' personal capital. This approach was typical for a startup at the time.

Details regarding early agreements on vesting schedules or founder exits are not widely available. The focus was on building the business.

The founding team's vision for a comprehensive auto parts supplier guided the company. They maintained direct control.

There were no reported ownership disputes or buyouts during the initial phase. This indicates a cohesive founding effort.

The early days of O'Reilly Auto Parts were marked by family ownership and a focus on building a strong foundation. The founders' experience and dedication were crucial to the company's initial success. For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of O'Reilly Automotive.

- Founded in 1957 by Charles F. O'Reilly and Chub O'Reilly.

- Initial ownership was primarily within the O'Reilly family.

- The founders' industry experience was a key asset.

- No public information on early external investors.

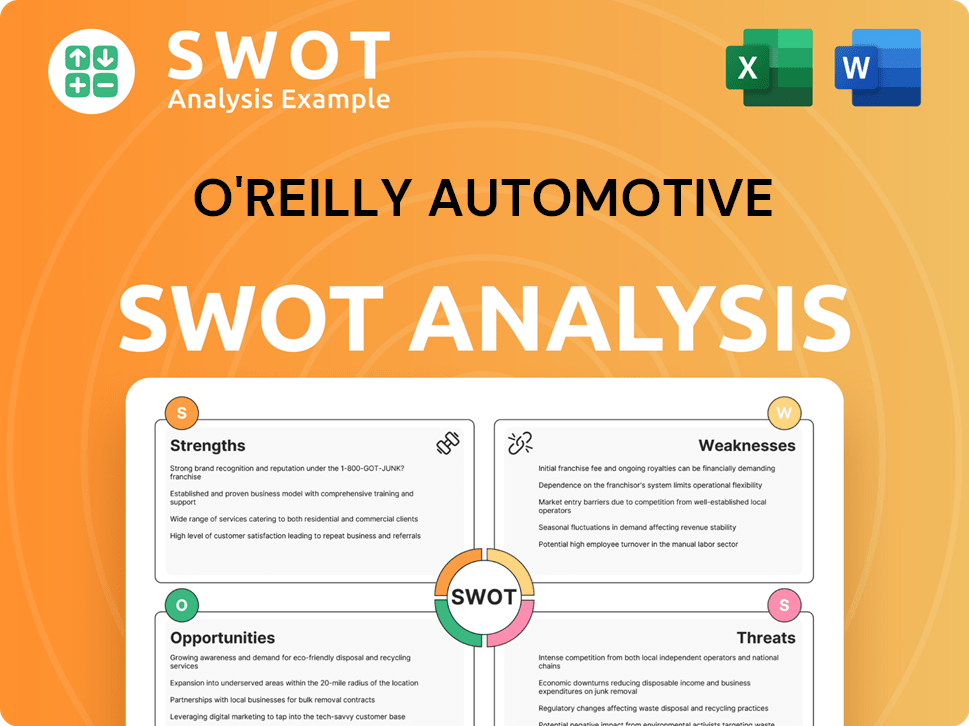

O'Reilly Automotive SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has O'Reilly Automotive’s Ownership Changed Over Time?

The evolution of O'Reilly Automotive from a private entity to a publicly traded company marked a pivotal shift in its ownership structure. The Initial Public Offering (IPO) on April 22, 1993, was a key event, broadening its investor base. This transition was a significant step in the O'Reilly Auto Parts company's history, opening it up to a wider range of shareholders and altering its financial landscape.

Following the IPO, the ownership of O'Reilly Automotive has largely transitioned towards institutional investors. This shift has led to a greater emphasis on financial performance and shareholder returns. The influence of these large-scale investors has become increasingly important in shaping the company's strategy and governance.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | April 22, 1993 | Transitioned from private to public ownership, expanding the shareholder base. |

| Subsequent Stock Issuances | Ongoing | Diluted the ownership stake of the founding family and early investors. |

| Increased Institutional Investment | Ongoing | Shifted ownership towards institutional investors, influencing company strategy. |

As of early 2025, the major stakeholders in O'Reilly Automotive include a variety of institutional investors, such as large asset management firms and mutual fund complexes. While the O'Reilly family's direct ownership has decreased over time due to public offerings and stock issuances, family members have maintained involvement in the company's leadership. For instance, David O'Reilly, a grandson of co-founder Charles F. O'Reilly, served as Executive Chairman of the Board until February 2024. This ongoing presence ensures a degree of indirect influence. The increasing institutional ownership has influenced the company's strategy, focusing on consistent financial performance and shareholder returns. For more insights into the company's strategic direction, you can read about the Growth Strategy of O'Reilly Automotive.

The ownership of O'Reilly Automotive has evolved significantly since its IPO. Institutional investors now hold a substantial portion of the shares, impacting the company's strategic direction.

- The IPO in 1993 was a key moment, transforming the company's ownership structure.

- Institutional investors, including asset management firms and mutual funds, are major stakeholders.

- Family members continue to have an indirect influence through leadership roles.

- The focus is on consistent financial performance and shareholder value.

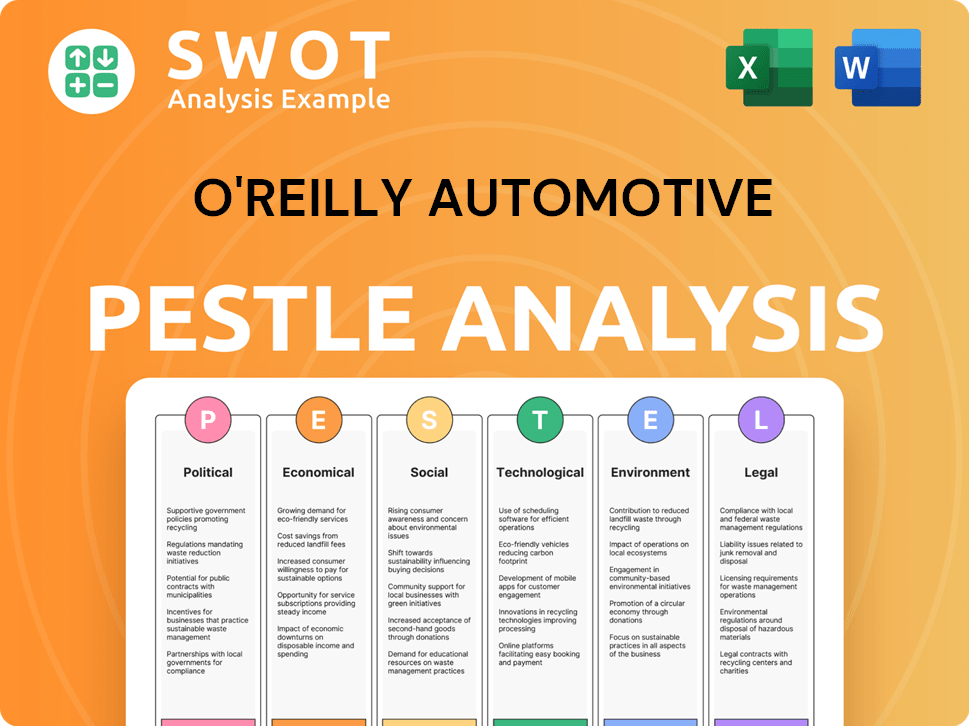

O'Reilly Automotive PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on O'Reilly Automotive’s Board?

The current board of directors of O'Reilly Automotive plays a vital role in the company's governance. As of early 2025, the board includes a mix of independent directors and those with ties to the company's history or management. Greg Johnson serves as Chief Executive Officer and Co-President, and Brad Beckham serves as Co-President. David O'Reilly, transitioned to Chairman Emeritus in February 2024, maintaining a connection to the founding family's legacy. Other board members typically bring experience in retail, finance, or related industries, often serving as independent directors to ensure objective oversight.

The board's composition, focusing on independent oversight and experienced leadership, aims to ensure sound decision-making and accountability to the broad shareholder base. The Growth Strategy of O'Reilly Automotive is continuously scrutinized by institutional investors who, through their collective voting power, can significantly influence strategic direction and executive compensation. This structure generally promotes a more democratic governance model among shareholders.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Greg Johnson | Chief Executive Officer and Co-President | Extensive experience in automotive retail |

| Brad Beckham | Co-President | Experience in automotive retail |

| David O'Reilly | Chairman Emeritus | Founding family member, industry knowledge |

| Independent Directors | Various | Experience in finance, retail, and related fields |

O'Reilly Automotive operates under a one-share-one-vote structure, which is common for publicly traded companies. This structure ensures that each share of common stock carries equal voting rights. There are no publicly reported instances of dual-class shares or special voting rights. This promotes a democratic governance model among shareholders.

O'Reilly Automotive's board of directors oversees the company's strategic direction and ensures accountability to shareholders. The company operates under a one-share-one-vote structure, promoting fair governance.

- Board members include the CEO, Co-President, and independent directors.

- David O'Reilly, a founding family member, serves as Chairman Emeritus.

- Institutional investors have significant influence through their voting power.

- The board focuses on sound decision-making and accountability.

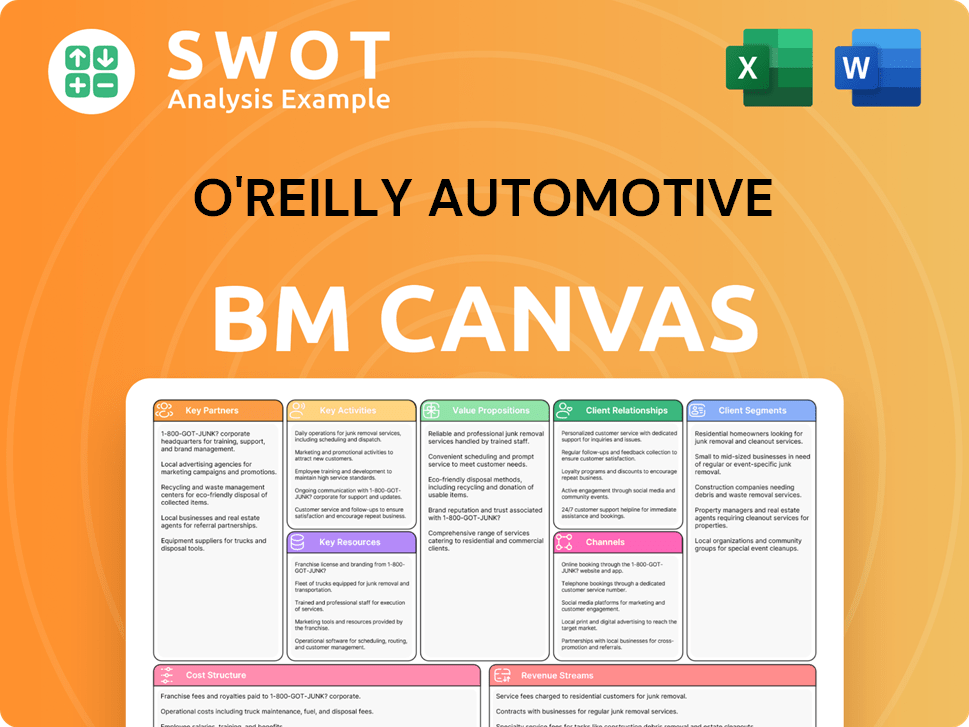

O'Reilly Automotive Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped O'Reilly Automotive’s Ownership Landscape?

In the past few years, the ownership structure of O'Reilly Automotive has largely reflected broader market trends, with a continued emphasis on institutional ownership and share buyback programs. The company regularly repurchases its shares, decreasing the total number of outstanding shares. For instance, in the first quarter of 2024, O'Reilly Automotive repurchased approximately 0.6 million shares of its common stock, spending around $600 million on these buybacks. This strategy is designed to return value to shareholders and can lead to a subtle consolidation of ownership among long-term investors.

There have been no significant mergers, acquisitions, or major leadership changes that have substantially altered the overall ownership of O'Reilly Automotive in recent years. The company's ownership has remained relatively stable, with a strong institutional presence. Market trends, such as the increasing influence of passive investment vehicles like index funds, have also influenced O'Reilly's ownership, as these funds hold shares proportionate to market capitalization. The company's consistent financial performance and strategic market position continue to attract and retain significant institutional investment. There have been no public statements about potential privatization or major shifts in public listing status.

Institutional ownership remains a dominant force in O'Reilly Automotive's ownership structure. Share buyback programs are a consistent strategy, reducing outstanding shares. No significant changes in ownership have occurred due to mergers, acquisitions, or leadership departures.

Share repurchases in Q1 2024 totaled 0.6 million shares. The company spent approximately $600 million on these repurchases. This strategy increases the ownership stake of existing shareholders.

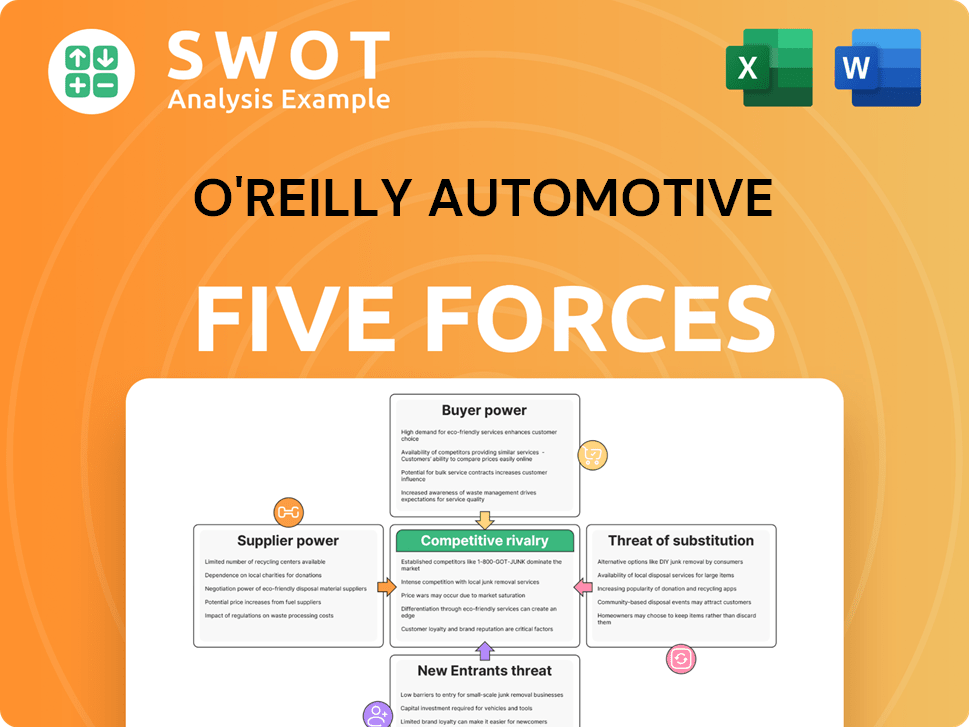

O'Reilly Automotive Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of O'Reilly Automotive Company?

- What is Competitive Landscape of O'Reilly Automotive Company?

- What is Growth Strategy and Future Prospects of O'Reilly Automotive Company?

- How Does O'Reilly Automotive Company Work?

- What is Sales and Marketing Strategy of O'Reilly Automotive Company?

- What is Brief History of O'Reilly Automotive Company?

- What is Customer Demographics and Target Market of O'Reilly Automotive Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.