Paycom Bundle

Can Paycom Maintain Its HCM Software Dominance?

The Human Capital Management (HCM) software industry is booming, fueled by cloud technology and AI, reshaping how businesses manage their workforce. Paycom, a leader in this space, offers an integrated suite of applications, simplifying HR and payroll processes. With impressive financial growth, including $1.88 billion in revenue in 2024, Paycom is a force to be reckoned with.

To understand Paycom's position, we must examine its Paycom SWOT Analysis and the competitive landscape. This analysis explores Paycom's market share, its main rivals, and the factors driving its success. This detailed

, offering a comprehensive

Where Does Paycom’ Stand in the Current Market?

Paycom operates within the human capital management (HCM) software industry, focusing primarily on small to mid-sized businesses in the United States. Its comprehensive cloud-based platform integrates payroll, talent management, and HR functions into a single system. This integrated approach aims to streamline workflows and reduce data fragmentation for clients.

The company's value proposition centers on providing a user-friendly, all-in-one HCM solution. Paycom emphasizes full-solution automation and an 'employee-first' approach, giving employees direct access to their HR data. This strategy is supported by tools like Beti, an automated payroll experience, and GONE, an AI-driven time-off management system.

Paycom's market share, according to Q1 2025 data, was at 0.54%, slightly down from 0.55% in Q4 2024, based on total revenue. While its market share may seem modest compared to industry giants, Paycom's strength lies in its specialized focus within the HCM sector, making a detailed Paycom competitive landscape analysis crucial for understanding its position. This focus allows the company to tailor its services to the specific needs of its target market, differentiating it from broader software providers.

Paycom offers a comprehensive suite of cloud-based HCM applications. These include payroll processing, talent management, time and attendance, benefits administration, talent acquisition, onboarding and offboarding, and HR management. All of these are integrated into a single, proprietary platform.

The single-database architecture is a key differentiator, designed to eliminate data fragmentation and streamline workflows for clients. Paycom's operations extend beyond the U.S. to include Canada, Mexico, the U.K., and Ireland, with new sales offices opening in 2025.

Paycom's value proposition emphasizes full-solution automation and an 'employee-first' approach. This empowers employees with direct access to their HR data, enhancing efficiency and satisfaction. Tools like Beti and GONE exemplify this digital transformation.

The company aims to provide a user-friendly, all-in-one HCM solution that simplifies HR processes. This integrated approach helps businesses manage their workforce effectively and efficiently, making it a strong contender in the Paycom industry.

Paycom primarily serves small to mid-sized businesses across the United States and is expanding internationally. Its market share in the HCM sector is notable, though it competes with larger players in the broader software market. The company's focus remains on specialized HCM solutions.

Paycom's geographical presence includes the U.S., Canada, Mexico, the U.K., and Ireland, with ongoing expansion. This strategic footprint supports its growth strategy and allows it to cater to a diverse client base. For more information about their strategy, see Growth Strategy of Paycom.

Paycom reported full-year revenues of $1.883 billion in 2024, an 11.2% increase from the previous year. Net income for 2024 reached $502 million, a 47.31% increase year-over-year. In Q1 2025, total revenue was $530.5 million, a 6.1% increase from Q1 2024.

The company maintains a strong financial position, remaining debt-free with $520.8 million in cash and cash equivalents as of March 31, 2025. Paycom's adjusted EBITDA margin hit 48% in Q1 2025, reflecting operational leverage. The annual revenue retention rate for 2024 was 90%, consistent with the prior year.

Paycom's key differentiators include its single-database architecture and its focus on an 'employee-first' approach. This allows for streamlined workflows and direct employee access to HR data. The company's financial health, with robust revenue growth and high retention rates, underscores its strong market position.

- The company's revenue for Q1 2025 was $530.5 million, a 6.1% increase year-over-year, showcasing its continuous growth.

- Paycom's adjusted EBITDA margin of 48% in Q1 2025 demonstrates effective operational leverage and profitability.

- The annual revenue retention rate of 90% in 2024 highlights strong customer satisfaction and loyalty.

- Paycom's debt-free status and significant cash reserves provide financial flexibility for future investments and growth.

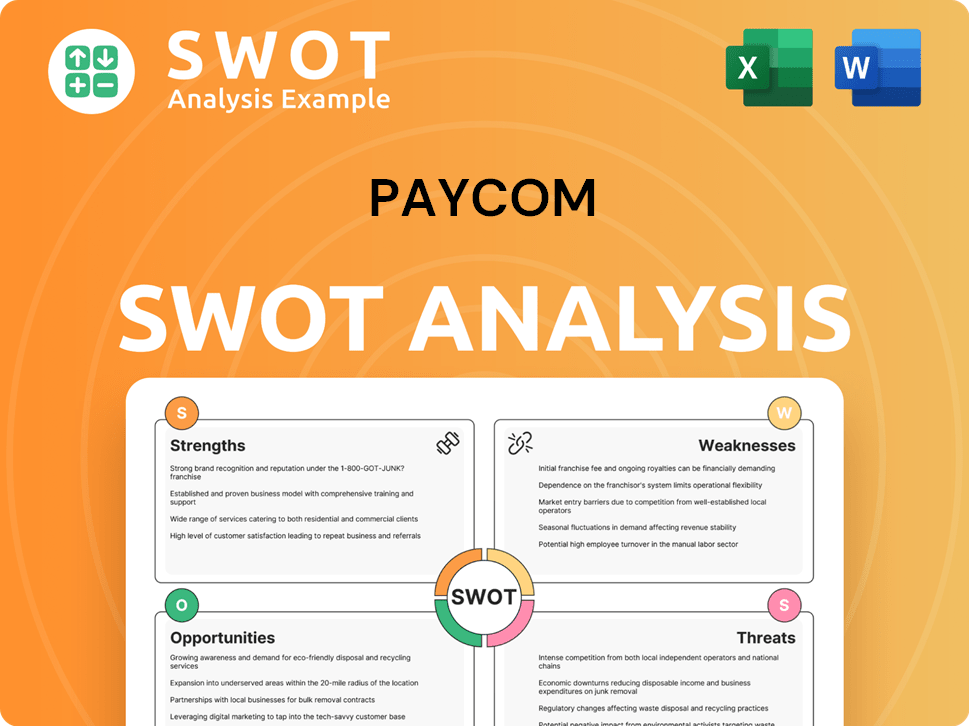

Paycom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Paycom?

The Revenue Streams & Business Model of Paycom operates within a dynamic and highly competitive Human Capital Management (HCM) software market. Understanding the Paycom competitive landscape is crucial for assessing its market position and growth potential. This analysis examines key competitors and the strategic dynamics shaping the industry.

The Paycom industry is characterized by continuous innovation and a wide range of offerings, from comprehensive HCM suites to specialized payroll solutions. This competitive environment requires constant adaptation and strategic focus to maintain a competitive edge. The following sections detail the key players and their strategies.

Paycom competitors include a mix of direct and indirect rivals, each vying for market share by offering diverse HR and payroll solutions. Analyzing these competitors provides insights into the competitive pressures and strategic moves within the HCM market.

Direct competitors offer similar payroll and HR services, often targeting the same client segments. These companies compete head-on with Paycom, focusing on features, pricing, and customer service.

Paylocity is a cloud-based platform that offers a comprehensive suite of HR and payroll management tools. It directly competes with Paycom, providing payroll processing, benefits administration, and employee self-service features.

Paycor focuses on larger enterprises with a manager-centric approach. It offers integrated HR solutions, robust analytics, and compliance tools, positioning itself as a strong competitor.

Workday HCM is a cloud-based software that provides HR management, financial management, planning, and analytics. Known for its customizability and integration capabilities, it competes in the broader HR tech market.

Paychex is a leading payroll software provider that caters to businesses of all sizes. It offers scalable plans and a wide range of HR resources, making it a significant competitor.

Other companies also compete in the HR tech space, each with unique strengths and target markets. These companies offer various HR solutions, contributing to the competitive landscape.

Gusto offers an all-in-one HR platform, focusing on payroll, benefits, and HR support for small businesses. It competes by providing user-friendly solutions.

Rippling focuses on workforce management, offering a platform that integrates HR, IT, and finance. It aims to simplify HR processes for businesses.

UKG Pro provides comprehensive HCM solutions, including HR, payroll, talent management, and workforce management. It targets larger enterprises with its extensive feature set.

BambooHR focuses on providing HR software for small and medium-sized businesses (SMBs). It offers user-friendly tools for managing HR tasks.

ADP Workforce Now offers a comprehensive suite of HR and payroll solutions, serving businesses of various sizes. It is a well-established player in the market.

Sloneek is an innovative HR solution powered by advanced AI technology. It provides streamlined payroll management and a cost-effective pricing model, emerging as a new competitor.

The Paycom market analysis reveals a dynamic landscape where competitors use various strategies to gain market share. HR technology companies are constantly innovating, and the Paycom competitive landscape is shaped by these strategic moves.

Competitors employ various strategies to challenge Paycom, including focusing on specific market segments and expanding their offerings. The market dynamics are influenced by technological advancements and the evolving needs of businesses.

- Market Segment Focus: Paylocity and Paycor directly compete in the mid-market and enterprise client segments, which are central to Paycom's business.

- Innovation and Technology: ADP and Workday have expanded their AI-driven payroll capabilities, competing for innovation leadership.

- Integrated Solutions: The fragmented nature of the HR tech market presents an opportunity for integrated solution providers like Paycom.

- Emerging Players: New players, particularly those leveraging AI, are disrupting the traditional competitive landscape, requiring continuous innovation.

- Market Share Battles: Intense competition for market share is a constant in the Paycom industry, with companies vying for new customers and expanding their service offerings.

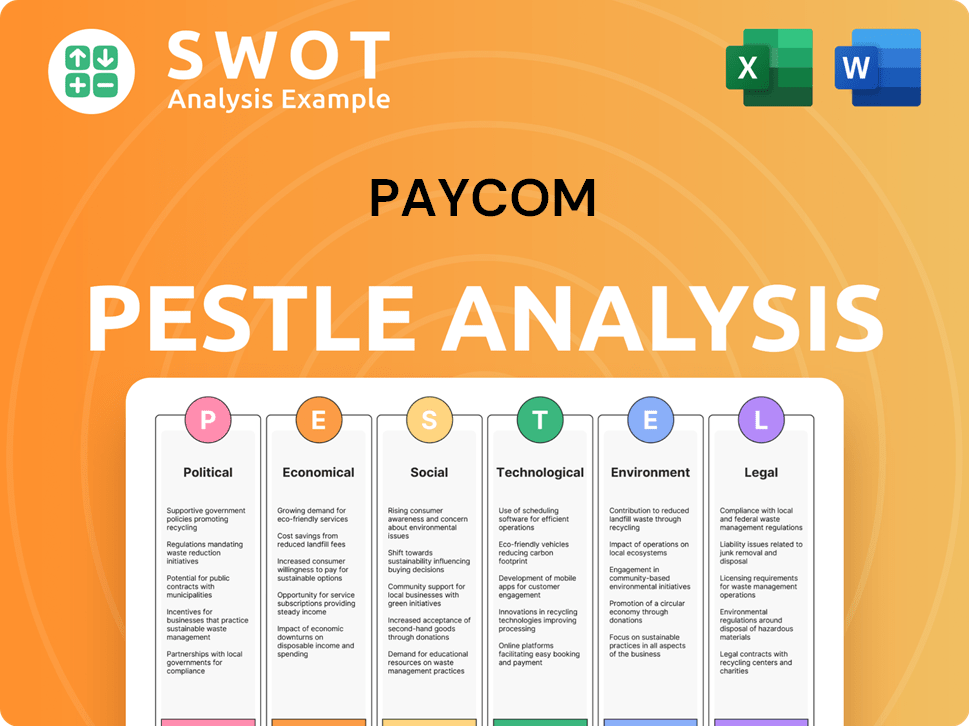

Paycom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Paycom a Competitive Edge Over Its Rivals?

Understanding the Paycom competitive landscape involves recognizing its key strengths and how it differentiates itself within the Paycom industry. The company's success stems from its proprietary technology and focus on providing a full-solution automation approach. This strategy has allowed it to carve out a significant market position among HR technology companies and payroll software providers.

Paycom's key differentiators include its single-database platform, which integrates all HR and payroll data. This unified approach streamlines processes and reduces errors, setting it apart from competitors. Furthermore, the company's commitment to innovation, as demonstrated by its investment in research and development, ensures it remains at the forefront of HCM solutions. To understand more about the company, you can read a Brief History of Paycom.

The company's focus on customer satisfaction and retention, along with its robust financial health, further strengthens its competitive position. These factors are crucial in assessing Paycom market analysis and its ability to sustain growth in a competitive environment. The company’s strategic moves and innovations have positioned it well within the Paycom competitive landscape.

Paycom’s core advantage lies in its proprietary technology, particularly its single-database platform. This architecture combines all HR and payroll data, reducing inefficiencies. The company's automation strategy, including tools like Beti® and GONE®, enhances accuracy and efficiency, offering a seamless experience for clients.

A key aspect is its employee-driven model, with tools like Beti® allowing employees to manage their own payroll. GONE®, an AI-driven time-off management system, automates decisions. These innovations contribute to significant ROI for clients, with GONE® potentially saving up to 821% over three years by reducing administrative hours.

Paycom consistently invests in research and development, spending $242.6 million in 2024, a 22% increase from 2023. This investment fuels the development of cutting-edge HCM solutions. The company's debt-free and highly liquid balance sheet, with $520.8 million in cash as of March 31, 2025, supports future initiatives.

Paycom benefits from strong customer loyalty, reflected in a 90% client retention rate since its 2014 IPO. The company's net promoter score has improved, indicating enhanced customer satisfaction. Its high-touch service model and AI-driven automation have improved client satisfaction and service-related margins.

Paycom's competitive advantages are multifaceted, primarily centered around its proprietary technology and integrated platform. The company's focus on automation, especially through employee-driven tools, significantly streamlines HR and payroll processes. This approach enhances accuracy and efficiency, leading to higher customer satisfaction and retention.

- Single-Database Platform: Integrates all HR and payroll data, minimizing errors and inefficiencies.

- Automation Tools: Beti® and GONE® automate tasks, reducing manual work and improving accuracy.

- High R&D Investment: $242.6 million in 2024, driving innovation in HCM solutions.

- Strong Financial Health: Debt-free and highly liquid, supporting strategic initiatives.

- High Customer Retention: 90% client retention rate since the IPO.

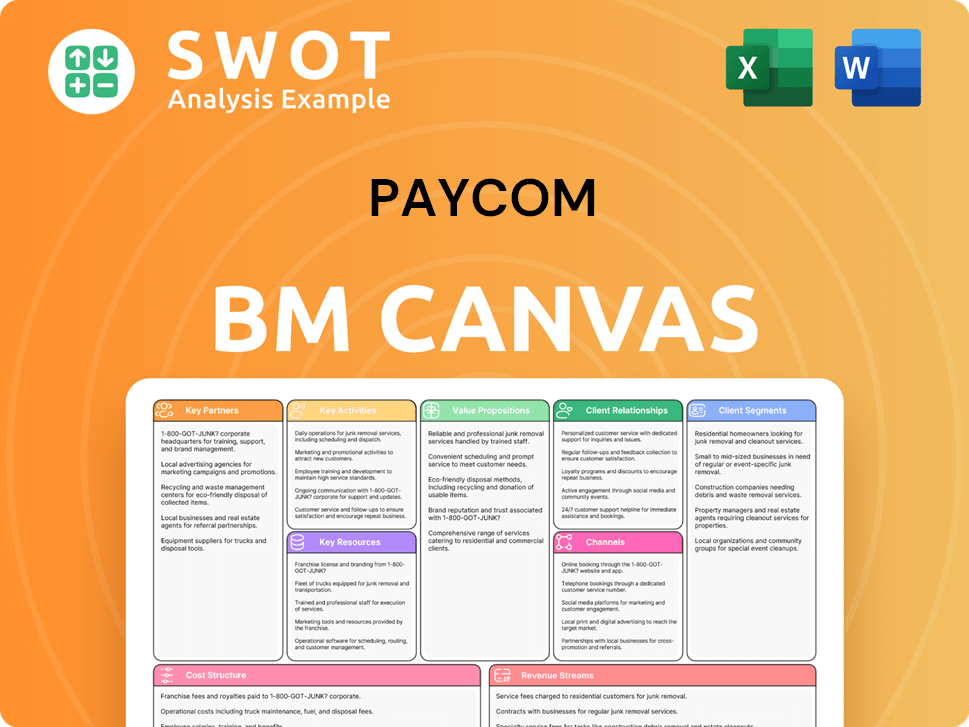

Paycom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Paycom’s Competitive Landscape?

The Human Capital Management (HCM) industry is dynamic, with trends like AI integration and data-driven HR practices shaping the competitive landscape of companies like Paycom. This analysis examines industry trends, future challenges, and opportunities, providing insights into Paycom's position and prospects. Understanding the current market dynamics is crucial for investors and stakeholders looking at the Paycom competitive landscape.

Economic uncertainties, competitive pressures, and evolving regulations present challenges, while international expansion, product innovation, and market growth offer significant opportunities. Paycom's ability to adapt to these changes and capitalize on its strengths will determine its long-term success. A closer look at the Paycom market analysis reveals key areas for growth and potential risks.

The HCM industry is experiencing a surge in AI integration, revolutionizing HR operations from automation to data analysis. People analytics and data-driven practices are becoming increasingly important for understanding employee well-being and engagement. Remote and hybrid work models continue to evolve, requiring new approaches to community building and resource access.

Economic uncertainties and increased competition pose significant challenges to Paycom. Slower revenue growth may weaken its competitive position and impact investor confidence. Rising operational and customer acquisition costs could also pressure profitability. Regulatory changes and compliance requirements are continuous challenges for HR technology companies.

International expansion presents a key growth area, with substantial potential to penetrate global markets. Continued product innovation, particularly in AI and automation, is crucial for accelerating top-line growth. The HCM market is projected to reach $18 billion by 2027, offering a substantial addressable market for payroll software providers.

Paycom is focusing on continued investment in innovation and automation, expanding its global footprint, and reinforcing customer loyalty. The company's strong financial health, including its debt-free status and substantial cash reserves, provides flexibility for investment. Paycom's single-database architecture and end-to-end automation are key differentiators.

Paycom faces both headwinds and tailwinds in the HCM market. Slower revenue growth, potentially below market estimates, could impact its competitive position. However, international expansion and product innovation offer significant growth potential. For a deeper dive into Paycom's market approach, consider reading about the Marketing Strategy of Paycom.

- Paycom anticipates full-year 2025 revenue between $2.023 billion and $2.038 billion, representing roughly 8% growth at the midpoint.

- Recurring revenue growth is projected at over 9% for 2025.

- Adjusted EBITDA is forecast to be between $843 million and $858 million for 2025.

- Client retention consistently remains at 90%.

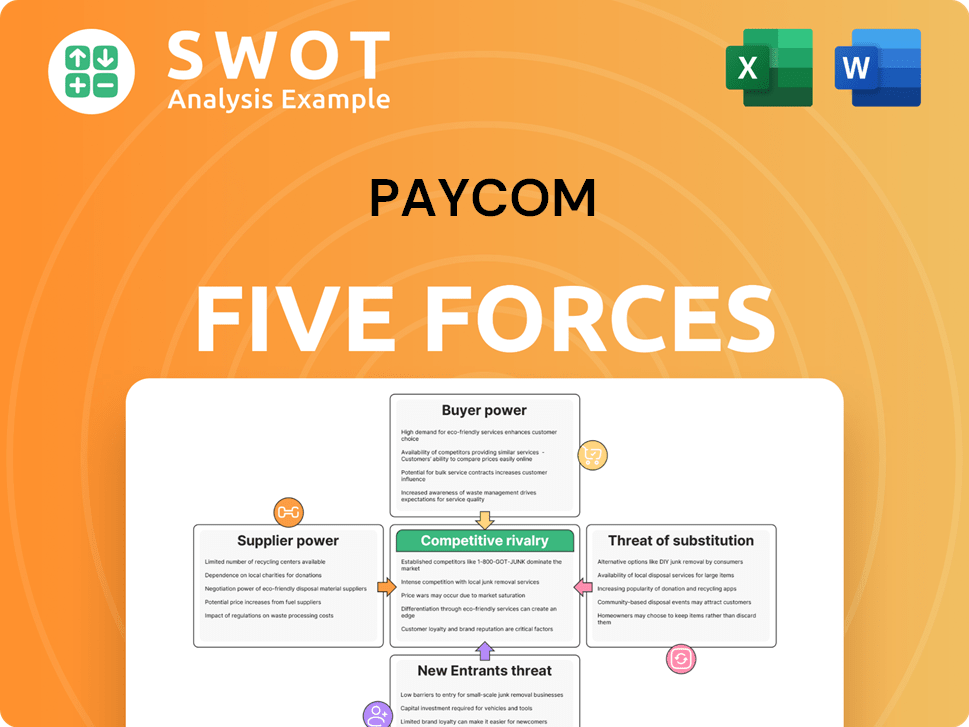

Paycom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Paycom Company?

- What is Growth Strategy and Future Prospects of Paycom Company?

- How Does Paycom Company Work?

- What is Sales and Marketing Strategy of Paycom Company?

- What is Brief History of Paycom Company?

- Who Owns Paycom Company?

- What is Customer Demographics and Target Market of Paycom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.