Qualcomm Bundle

How Does Qualcomm Dominate the Wireless Tech World?

Qualcomm, a titan in wireless technology, is at the heart of the mobile revolution, powering countless devices and driving the global 5G rollout. Its strategic moves, like expanding its automotive design win pipeline, show a clear ambition to diversify and capture growth in emerging sectors. With the tech landscape constantly shifting, understanding Qualcomm's competitive standing is more critical than ever.

This analysis dives deep into the Qualcomm SWOT Analysis to dissect Qualcomm's competitive landscape, examining its key rivals and market share in detail. We'll explore Qualcomm's strategies for maintaining its lead, assessing its strengths and weaknesses within the dynamic semiconductor market. Furthermore, we'll investigate Qualcomm's competitive advantages, its influence on the 5G market, and its response to competitor threats, providing a comprehensive Qualcomm industry analysis.

Where Does Qualcomm’ Stand in the Current Market?

Qualcomm holds a significant market position within the wireless technology and semiconductor sectors. The company is particularly strong in mobile processors and modems, with its Snapdragon platforms being widely adopted in premium Android smartphones. This widespread adoption gives Qualcomm a substantial share in the high-value smartphone market, making it a key player in the industry.

In the first quarter of fiscal year 2024, Qualcomm reported revenues of $9.9 billion. The QCT (Qualcomm CDMA Technologies) segment, which includes mobile, automotive, and IoT, generated $8.4 billion. This financial performance highlights Qualcomm's considerable scale and influence in the market. This solid financial foundation allows the company to invest heavily in research and development, ensuring it remains at the forefront of technological advancements.

Qualcomm's primary product lines include Snapdragon mobile platforms, RF front-end solutions, automotive platforms, and IoT chipsets. Geographically, Qualcomm has a strong global presence, with significant revenue streams from Asia, particularly China, where many of its smartphone manufacturing partners are located. The company also serves diverse customer segments, ranging from smartphone manufacturers like Samsung and Xiaomi to automotive giants and IoT device makers. Over time, Qualcomm has strategically diversified its offerings beyond just mobile, recognizing the saturation in the smartphone market. This shift is evident in its automotive segment, where its design win pipeline has reached $15 billion, indicating a strong move into connected vehicles and advanced driver-assistance systems (ADAS). Similarly, its expansion into IoT is addressing the growing demand for intelligent edge devices across various industries. While Qualcomm maintains a robust financial position compared to industry averages, its licensing business (QTL) continues to be a significant revenue driver, albeit one that has faced regulatory scrutiny and legal challenges in the past.

Qualcomm's strategies for staying competitive involve continuous innovation in wireless technology and diversification into new markets. The company focuses on maintaining its leadership in 5G technology and expanding its presence in the automotive and IoT sectors. This approach helps Qualcomm address the challenges in the semiconductor market while capitalizing on new growth opportunities. For a deeper understanding of Qualcomm's strategic direction, you can explore the Target Market of Qualcomm.

- Market Share: Qualcomm maintains a leading position in the mobile processor market, particularly in the premium segment.

- Competitive Advantages: Qualcomm's competitive advantages include its strong intellectual property portfolio, advanced technology, and established relationships with key industry players.

- Revenue Streams: Qualcomm's revenue is derived from its QCT segment (mobile, automotive, IoT) and its QTL segment (licensing).

- Future Outlook: Qualcomm's future outlook is positive, driven by growth in 5G, automotive, and IoT markets, although it faces ongoing competition and regulatory challenges.

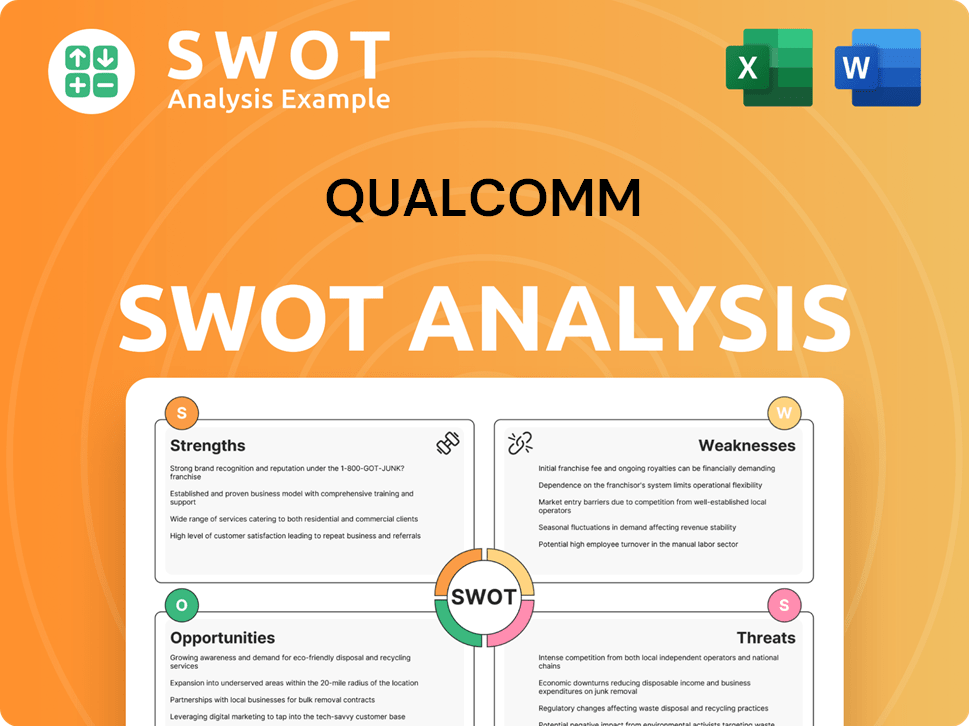

Qualcomm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Qualcomm?

The Qualcomm competitive landscape is complex, with rivals across its various business segments. The company faces challenges and opportunities in a rapidly evolving tech market. Understanding Qualcomm's competitors is crucial for assessing its market position and future prospects.

Qualcomm's market share and overall success depend on its ability to innovate, form strategic partnerships, and effectively navigate the competitive environment. The company's strategies must adapt to the dynamic shifts in the semiconductor and wireless technology industries. For more insights, you can read a Brief History of Qualcomm.

Qualcomm's challenges in the semiconductor market include intense competition and the need to continually invest in research and development to stay ahead. The company's financial performance is closely watched, as it reflects its ability to compete and maintain its position. As of 2024, Qualcomm's revenue streams and strategies are under constant scrutiny.

Qualcomm's main rivals in 2024 in this segment include MediaTek and Apple. MediaTek offers competitive chipsets, particularly in the Android market. Apple designs its own processors, impacting Qualcomm's market share in premium devices.

Intel and AMD are significant competitors in this area. Intel's dominance in the PC market presents a challenge. Qualcomm is expanding its presence with Snapdragon X Elite processors.

NVIDIA and Mobileye are key competitors. NVIDIA offers SoCs for autonomous driving and infotainment. Mobileye is a leader in ADAS, creating competition for Qualcomm's automotive solutions.

Broadcom and Qorvo compete with Qualcomm's integrated solutions. These companies offer their own RF front-end components, challenging Qualcomm's market share in this segment.

Smaller specialized firms and emerging players also contribute to competitive pressure. These companies often focus on niche IoT applications or specific wireless technologies, adding to the competitive landscape.

Past disputes over intellectual property and licensing fees highlight the intense competition. These battles underscore the strategic importance of patent portfolios in the sector, influencing Qualcomm's competitive position.

The competitive landscape is shaped by various factors, including technological advancements, market trends, and strategic moves by competitors. Qualcomm's competitive advantages include its strong patent portfolio and integrated solutions. However, the company also faces challenges from competitors with specialized expertise.

- Qualcomm's market position in mobile processors is strong, but MediaTek's growth poses a threat.

- Qualcomm's strategies for staying competitive involve innovation, partnerships, and expansion into new markets.

- The company's response to competitor threats includes aggressive R&D spending and strategic acquisitions.

- Qualcomm's strengths and weaknesses analysis reveals its reliance on the smartphone market and the need to diversify.

- Qualcomm's financial performance compared to competitors shows its ability to generate revenue and maintain profitability. In fiscal year 2024, Qualcomm's revenue was approximately $44.2 billion.

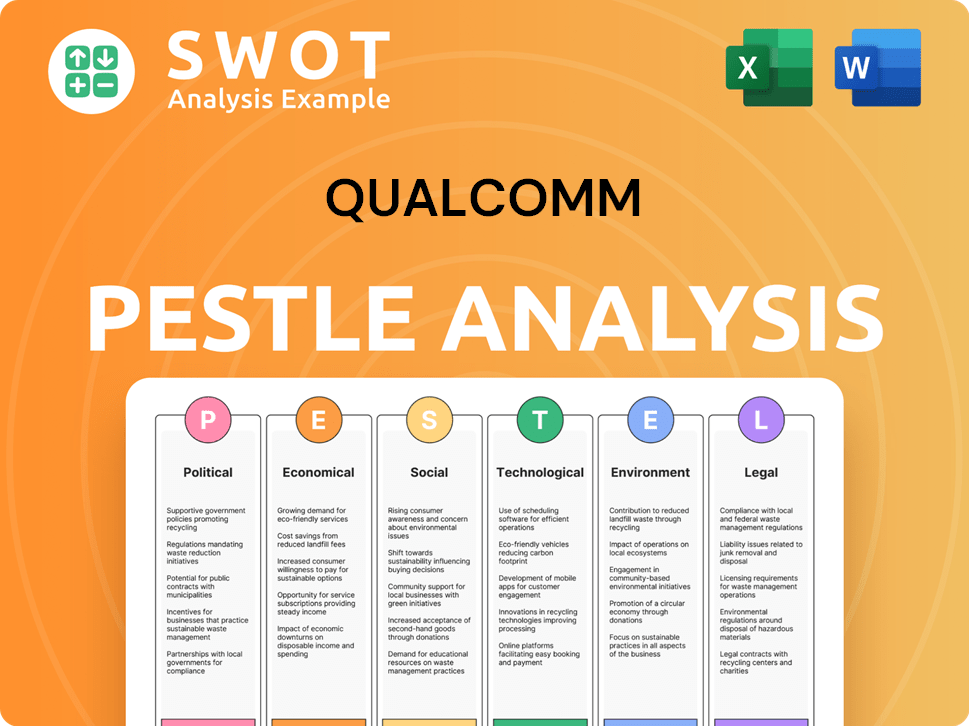

Qualcomm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Qualcomm a Competitive Edge Over Its Rivals?

The competitive landscape for Qualcomm is shaped by its robust intellectual property portfolio and its pioneering role in wireless communication technologies. This has allowed the company to establish a strong position in the semiconductor market. Qualcomm's strategies focus on innovation and strategic partnerships to maintain its competitive edge. Understanding the company's strengths and weaknesses is crucial for assessing its market position.

Qualcomm's competitive advantages stem from its vast patent portfolio and continuous investment in research and development. This has enabled it to license its technologies to major mobile phone manufacturers, creating a broad ecosystem around its innovations. The company's ability to integrate advanced technologies into its Snapdragon mobile platforms further solidifies its position. Analyzing Qualcomm's growth strategy provides further insights into its market approach.

Qualcomm's influence extends to the 5G market and beyond, as it aims to disrupt the traditional computing market with its Snapdragon X Elite processors. The company's financial performance, compared to its competitors, reflects its strong market position. Its ability to adapt to evolving industry dynamics and maintain strong customer relationships is key to its sustained success.

Qualcomm's extensive patent portfolio is a core competitive advantage. The company generates significant revenue through its QTL segment by licensing its technologies. This intellectual property provides a substantial barrier to entry for competitors in the Qualcomm competitive landscape.

The company's continuous investment in research and development, especially in 5G and 5G Advanced, keeps it at the forefront of technology. Qualcomm's Snapdragon mobile platforms integrate advanced processing and AI capabilities. This commitment to innovation is key to its sustained success.

Qualcomm benefits from strong customer loyalty and deep relationships with leading smartphone manufacturers. The company's strategic partnerships with leading foundries are also crucial. These relationships help maintain its market position.

Qualcomm's economies of scale in semiconductor manufacturing enable it to produce chips efficiently. The company's expertise in chip design and strategic relationships with manufacturers are vital. This efficiency helps in maintaining competitive costs.

Qualcomm's competitive advantages are multifaceted, including its extensive patent portfolio, continuous innovation, and strong customer relationships. These strengths allow the company to maintain its leadership despite intense competition and evolving industry dynamics. The company's focus on end-to-end solutions helps it stay ahead in the Qualcomm industry analysis.

- Intellectual Property: Qualcomm holds a vast number of patents globally, generating significant licensing revenue.

- Technological Leadership: Continuous investment in R&D, especially in 5G and 5G Advanced, ensures Qualcomm remains at the forefront.

- Strategic Partnerships: Relationships with leading smartphone manufacturers and foundries are crucial for market position.

- Economies of Scale: Efficient chip production and competitive costs help maintain its market share.

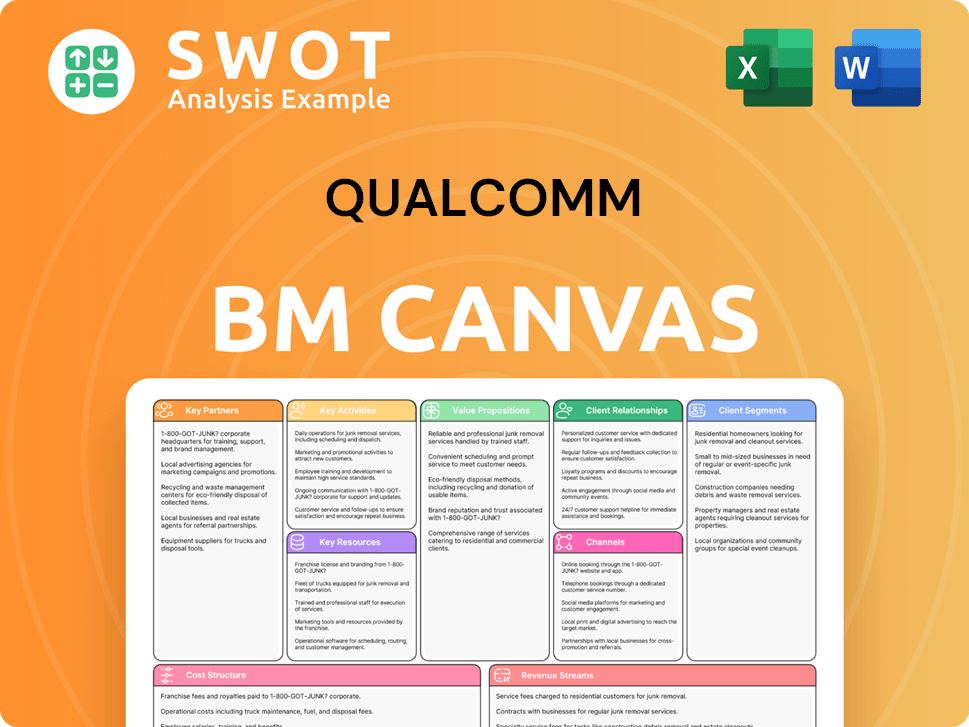

Qualcomm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Qualcomm’s Competitive Landscape?

The competitive landscape for Qualcomm is significantly shaped by industry trends, including the expansion of 5G, the growth of on-device AI, and the rise of IoT. These factors present both challenges and opportunities, influencing Qualcomm's market position. Understanding these dynamics is crucial for assessing the company's future outlook and its ability to maintain its competitive edge.

Risks include the maturity of the smartphone market, the potential for key customers to design their own silicon, geopolitical tensions affecting supply chains, and regulatory scrutiny. However, Qualcomm also benefits from the continued rollout of 5G, the demand for on-device AI, and the growth in the automotive and IoT sectors. For a deeper dive into the company's ownership and stakeholder structure, consider reading Owners & Shareholders of Qualcomm.

The primary trends affecting Qualcomm are the global expansion of 5G, the increasing demand for on-device AI, the proliferation of IoT devices, and the digitalization of the automotive industry. These trends drive the need for advanced modems, AI processing capabilities, and specialized chipsets. The company is well-positioned to capitalize on these trends, particularly in the 5G and automotive sectors.

Key challenges for Qualcomm include the maturation of the smartphone market, the risk of major customers designing their own silicon, geopolitical and supply chain vulnerabilities, and regulatory scrutiny of its licensing practices. These challenges could impact Qualcomm's market share and financial performance. The company must adapt to these challenges through diversification and innovation.

The continued rollout of 5G, the growth of on-device AI, the automotive sector, and the expansion of IoT provide significant opportunities for Qualcomm. The automotive sector, in particular, is a major growth engine, with Qualcomm's design win pipeline reaching $15 billion. These opportunities require continuous innovation, strategic partnerships, and expansion into new verticals.

Qualcomm's strategies include continuous innovation in core technologies, aggressive expansion into new verticals like automotive and computing, and strategic partnerships to build comprehensive ecosystems. These strategies are vital for maintaining a competitive position. The company's ability to adapt and capitalize on emerging technologies will determine its long-term success.

Qualcomm's competitive advantages include its strong intellectual property portfolio, its Snapdragon platforms, and its strategic partnerships. The company's focus on 5G technology and on-device AI processing gives it a significant edge in the market. Qualcomm's market position in mobile processors is strong, but it faces increasing competition from other players.

- Strong IP portfolio, including patents for 5G and wireless technologies.

- Leading position in the mobile processor market with its Snapdragon platforms.

- Strategic partnerships with major players in the tech and automotive industries.

- Diversification into the automotive and IoT sectors to reduce reliance on smartphones.

Qualcomm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Qualcomm Company?

- What is Growth Strategy and Future Prospects of Qualcomm Company?

- How Does Qualcomm Company Work?

- What is Sales and Marketing Strategy of Qualcomm Company?

- What is Brief History of Qualcomm Company?

- Who Owns Qualcomm Company?

- What is Customer Demographics and Target Market of Qualcomm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.