Qualcomm Bundle

How Does Qualcomm Power Your Digital World?

Qualcomm, a titan in wireless technology, is the unseen force driving the mobile revolution. From the smartphones in our pockets to the burgeoning Internet of Things, Qualcomm's innovations are everywhere. With billions in revenue and a pivotal role in 5G, this Qualcomm SWOT Analysis will help you understand the company's strengths, weaknesses, opportunities, and threats.

Delving deeper into Qualcomm reveals a semiconductor company with a complex business model. Understanding Qualcomm's Qualcomm technology, including its Qualcomm Snapdragon processors and its role in wireless communication, is key to grasping the future of tech. This exploration will illuminate how Qualcomm designs chips, its impact on the smartphone industry, and its competitive landscape.

What Are the Key Operations Driving Qualcomm’s Success?

Qualcomm operates through two main segments, delivering value via its technologies and licensing agreements. The company focuses on developing and supplying integrated circuits (ICs) and system software. This includes its widely recognized Qualcomm Snapdragon processors and automotive platforms, which are key in various industries.

The semiconductor company also licenses its extensive intellectual property portfolio, particularly its foundational technologies in wireless communication. This dual approach allows Qualcomm to generate revenue through both product sales and patent licensing, establishing a strong market position.

Qualcomm's value proposition centers on continuous innovation, providing high-performance solutions that enable advanced connectivity. Its operational effectiveness stems from its deep expertise in wireless R&D, integration of complex technologies, and strategic partnerships. This results in faster connectivity, improved user experiences, and quicker time-to-market for new products.

The QCT segment develops and supplies ICs and system software. It includes Qualcomm Snapdragon processors, essential for smartphones and other connected devices. Extensive R&D in wireless communication, chip design, and manufacturing oversight are key processes.

The QTL segment focuses on licensing Qualcomm's intellectual property. This includes patents for 3G, 4G, and 5G wireless communication technologies. Revenue is generated by licensing patents to wireless product manufacturers.

Qualcomm offers high-performance and energy-efficient solutions. It enables advanced connectivity and computing capabilities. Strategic partnerships across the mobile ecosystem are crucial for success.

Deep expertise in wireless R&D is a core strength. Qualcomm integrates complex technologies into system-on-chips (SoCs). This leads to faster connectivity and enhanced user experiences.

Qualcomm's technologies drive faster connectivity and improved user experiences. They also accelerate time-to-market for new products, benefiting both manufacturers and consumers. The company's influence extends throughout the smartphone industry and beyond.

- The Qualcomm Snapdragon processor features are key in many leading smartphones.

- Qualcomm's role in 5G technology is significant, driving the evolution of wireless communication.

- Qualcomm's partnerships with mobile phone manufacturers ensure its technology is widely adopted.

- To learn more about the company's growth strategy, read Growth Strategy of Qualcomm.

Qualcomm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Qualcomm Make Money?

The financial success of the semiconductor company, Qualcomm, hinges on its diverse revenue streams and strategic monetization approaches. These strategies are primarily centered around two key segments: Qualcomm CDMA Technologies (QCT) and Qualcomm Technology Licensing (QTL). Understanding these segments is crucial for grasping how Qualcomm generates and sustains its financial performance.

Qualcomm's business model is designed to leverage its technological innovations in wireless communication and mobile processors. The company's approach combines the sale of hardware and software with the licensing of its intellectual property. This dual strategy enables Qualcomm to capture value from both the creation and the utilization of its technologies, contributing significantly to its financial results.

In fiscal year 2023, Qualcomm's QCT segment, which focuses on the sale of integrated circuits and software, generated a substantial $29.0 billion in revenue. This segment provides essential components for a wide range of devices, including mobile phones, automotive platforms, and IoT solutions. The company's monetization strategy involves selling these components to original equipment manufacturers (OEMs).

The QCT segment is a cornerstone of Qualcomm's revenue generation, focusing on the sale of hardware and software solutions. This includes the sale of essential components like Snapdragon processors, modems, and RF front-end solutions. The company's monetization strategy involves selling these hardware and software components to original equipment manufacturers (OEMs).

- Snapdragon Processors: These are the central processing units (CPUs) that power many smartphones and other devices.

- Modems: Qualcomm modems enable wireless communication, supporting technologies like 5G.

- RF Front-End Solutions: These components manage the radio frequency signals, crucial for wireless connectivity.

- Software: Qualcomm also provides software that enhances the functionality and performance of its hardware.

The QTL segment, which focuses on patent licensing, generated $6.8 billion in revenue in fiscal year 2023. This segment licenses Qualcomm technology to manufacturers of wireless devices. This licensing model allows Qualcomm to generate revenue from its extensive portfolio of patents, which are fundamental to wireless communication technologies. The company employs a tiered pricing model, often based on the selling price of the end device.

The QTL segment is a significant revenue source for Qualcomm, primarily through patent licensing. This involves licensing Qualcomm's extensive portfolio of patents to manufacturers of wireless devices. This segment is highly profitable due to the high margins associated with intellectual property licensing.

- Licensing Agreements: Qualcomm licenses its patents to manufacturers, allowing them to use Qualcomm's technologies in their products.

- Tiered Pricing: The licensing fees are often based on the selling price of the end device.

- High Margins: This business model is highly profitable due to the high margins associated with intellectual property.

Qualcomm's revenue streams are influenced by market dynamics and technological advancements. While QCT revenue saw a decline of 19% in fiscal year 2023, primarily due to a downturn in the handset market, QTL revenue remained relatively stable. This highlights the resilience of the licensing business model. Qualcomm is actively expanding its revenue sources beyond mobile, with strong growth in its automotive and IoT segments, which are expected to contribute significantly to future revenue diversification. To understand more about the company's strategic growth, you can read about the Growth Strategy of Qualcomm.

Qualcomm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Qualcomm’s Business Model?

Qualcomm's journey is marked by significant milestones, establishing it as a leader in wireless technology. A key moment was its pioneering work in Code Division Multiple Access (CDMA) technology in the 1990s, which became a foundational standard for 2G and 3G wireless networks. More recently, Qualcomm's leadership in 5G technology development and commercialization has been a crucial strategic move, positioning it at the heart of the next generation of wireless connectivity.

The launch of its Snapdragon 8 Gen 3 Mobile Platform in late 2023 further showcased its continued innovation in mobile processing and AI capabilities. Qualcomm has also navigated various operational and market challenges, including intense patent disputes and regulatory scrutiny regarding its licensing practices. The company has strategically diversified its portfolio, emphasizing growth in automotive and IoT, which collectively saw revenues of $5.7 billion in fiscal year 2023.

Qualcomm's competitive advantages include its unparalleled technology leadership in wireless communication, its vast and essential patent portfolio, strong brand recognition (especially with Snapdragon), and an extensive ecosystem of partnerships across the mobile and automotive industries. The company continues to adapt to new trends by investing heavily in AI, edge computing, and new vertical markets to sustain its business model and maintain its competitive edge. For a deeper dive into the company's origins, consider reading a brief history of Qualcomm.

Qualcomm's early work in CDMA technology was crucial for 2G and 3G wireless networks. Its advancements in 5G technology have positioned it at the forefront of the next generation of wireless connectivity. The Snapdragon 8 Gen 3 Mobile Platform launch demonstrated its continued innovation in mobile processing and AI.

Qualcomm has diversified its portfolio to include automotive and IoT, which saw revenues of $5.7 billion in fiscal year 2023. The company has responded to market challenges by engaging in legal battles, reaching settlements, and adapting its business practices to comply with evolving regulations. Strategic investments in AI and edge computing are ongoing.

Qualcomm's technology leadership in wireless communication is a significant advantage. Its vast patent portfolio and strong brand recognition, especially with Snapdragon, are also key. An extensive ecosystem of partnerships across the mobile and automotive industries further strengthens its position.

Qualcomm faced challenges such as patent disputes and regulatory scrutiny. The company responded by engaging in legal battles and adapting its business practices. The decline in the handset market in 2023 prompted strategic diversification into automotive and IoT.

Qualcomm's success is built on several key strengths that have allowed it to maintain a competitive edge in the fast-paced technology market. These include technological innovation, a strong patent portfolio, and strategic partnerships.

- Technological Leadership: Qualcomm is a leader in wireless communication and mobile processors, continually innovating to stay ahead of the curve.

- Patent Portfolio: A vast and essential patent portfolio protects its intellectual property and provides a significant barrier to entry for competitors.

- Brand Recognition: The Snapdragon brand is widely recognized and trusted by consumers and manufacturers alike.

- Strategic Partnerships: Partnerships across the mobile and automotive industries help Qualcomm integrate its technology into various products.

Qualcomm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Qualcomm Positioning Itself for Continued Success?

Qualcomm holds a dominant position in the mobile chipset market, particularly for premium and high-tier smartphones. The semiconductor company is also rapidly expanding into the automotive and IoT sectors. While facing competition, Qualcomm's technology leadership and comprehensive solutions provide a strong competitive advantage. Its market share reflects its influence in the wireless ecosystem.

However, Qualcomm faces risks, including regulatory scrutiny over its licensing practices and the cyclical nature of the semiconductor industry. Geopolitical tensions and supply chain disruptions can also impact operations. Looking ahead, Qualcomm is focused on diversifying revenue streams, with a strong emphasis on automotive, IoT, and computing. The company's innovation roadmap includes advancements in 5G, 6G, AI, and the metaverse, aiming to maintain and expand profitability.

Qualcomm is a leading semiconductor company, especially in the mobile processor market. Its Qualcomm Snapdragon processors are widely used in high-end smartphones. The company is expanding into automotive and IoT, diversifying its revenue streams.

Regulatory scrutiny of licensing practices is a key risk for Qualcomm. The company is also vulnerable to the cyclical nature of the semiconductor industry. Geopolitical tensions and supply chain disruptions can impact operations.

Qualcomm is strategically diversifying beyond smartphones, focusing on automotive, IoT, and computing. Innovation in 5G, 6G, and AI are central to its future. The company aims to develop foundational technologies for the connected intelligent edge.

In fiscal year 2024, Qualcomm generated approximately $36.4 billion in revenue. The company holds a significant market share in the mobile processor market, with Qualcomm Snapdragon processors being a key component in many smartphones. For more information, check out the Marketing Strategy of Qualcomm.

Qualcomm's strategy focuses on innovation in 5G, 6G, and AI, aiming to expand its market presence. The company is investing heavily in research and development to maintain its technological edge. This includes advancements in Qualcomm technology such as the Adreno GPU and Qualcomm Snapdragon processor features.

- Continued investment in 5G and 6G technologies to improve wireless communication.

- Expansion into automotive and IoT sectors.

- Focus on AI at the edge for improved performance and efficiency.

- Strategic partnerships with mobile phone manufacturers and other tech companies.

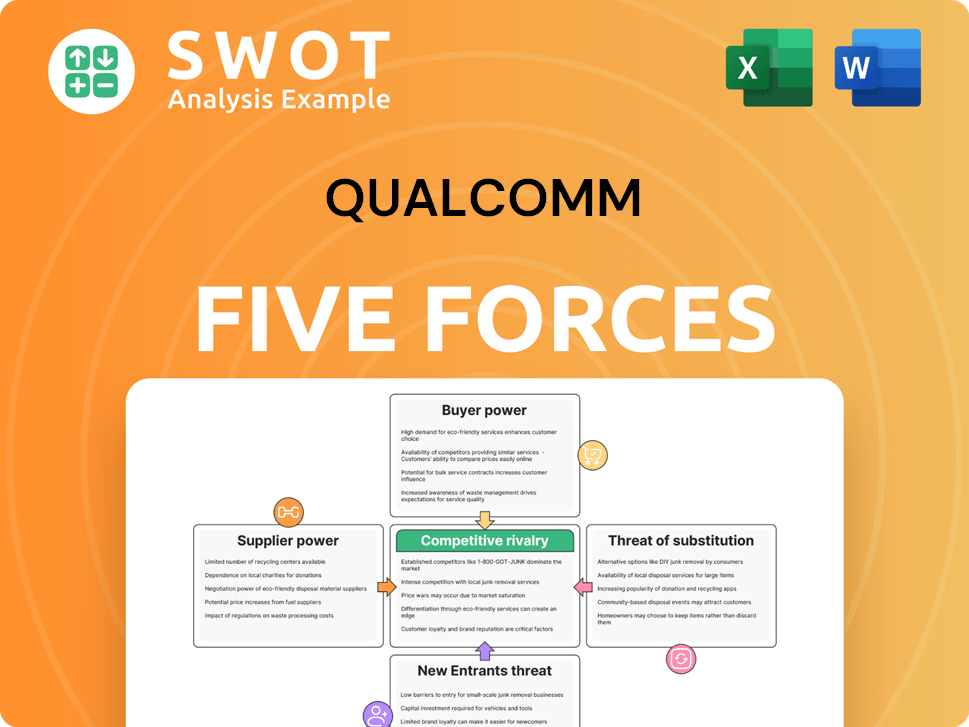

Qualcomm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Qualcomm Company?

- What is Competitive Landscape of Qualcomm Company?

- What is Growth Strategy and Future Prospects of Qualcomm Company?

- What is Sales and Marketing Strategy of Qualcomm Company?

- What is Brief History of Qualcomm Company?

- Who Owns Qualcomm Company?

- What is Customer Demographics and Target Market of Qualcomm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.