Quanta Services Bundle

How Does Quanta Services Stack Up in the Infrastructure Arena?

Quanta Services stands as a pivotal player in North American infrastructure, providing essential services across energy and utility sectors. Its comprehensive offerings, from engineering to maintenance, are vital for the nation's infrastructure. Understanding the Quanta Services SWOT Analysis is key to navigating its competitive environment.

This exploration of the Quanta Services competitive landscape will uncover its market position, identify Quanta Services competitors, and analyze its strengths. We'll examine Energy infrastructure trends, Utility services dynamics, and the role of Engineering and construction in shaping Quanta Services' future. This analysis provides crucial insights for investors, strategists, and researchers seeking a data-driven understanding of this key industry player and its rivals, including its market share analysis and financial performance compared to competitors.

Where Does Quanta Services’ Stand in the Current Market?

The company, a key player in specialized contracting, holds a leading position in the infrastructure solutions market, particularly in electric power and pipeline services. It consistently ranks among the top providers in North America for utility infrastructure. The company's primary focus is on providing engineering, procurement, and construction (EPC) services for electric power infrastructure, pipeline infrastructure, and, increasingly, communications infrastructure.

Its geographic presence is predominantly in North America, with operations across the United States and Canada, and some international ventures. The company serves a diverse customer base, including investor-owned utilities, independent power producers, governmental entities, and communication companies. The company's strategic shift emphasizes comprehensive EPC capabilities, moving beyond maintenance to become a full-service partner for major infrastructure projects.

The company's financial health, as evidenced by its robust revenue and backlog, positions it strongly against industry averages. For example, the company reported a record backlog of $30.4 billion as of December 31, 2023, with approximately 75% of this backlog associated with electric power infrastructure services. This strong backlog indicates sustained demand for its services and a solid financial outlook. The company holds a particularly strong position in regions with significant investments in grid modernization, renewable energy integration, and pipeline safety upgrades. To understand its growth strategy, you can read more about it in the Growth Strategy of Quanta Services.

While specific market share figures for 2024-2025 are proprietary, the company consistently ranks among the top providers in North America for utility infrastructure. The company's revenue for the full year 2023 was reported as $20.86 billion, reflecting significant growth and market presence.

The company offers a full spectrum of EPC services for electric power infrastructure (transmission, distribution, and substations), pipeline infrastructure (natural gas and liquids), and communications infrastructure (fiber optic and 5G deployment). This diversified service portfolio supports its strong market position.

The company's operations are predominantly in North America, specifically the United States and Canada, with select international ventures. This focus allows for efficient resource allocation and targeted market penetration within key regions.

The company serves a diverse customer base, including investor-owned utilities, independent power producers, governmental entities, and communication companies. This diverse customer base helps to mitigate risk and ensures a steady stream of projects.

The company's strong market position is supported by its comprehensive EPC capabilities and ability to handle large-scale, complex projects. The company's financial health, as evidenced by its robust revenue and backlog, positions it strongly against industry averages.

- Strong Backlog: A record backlog of $30.4 billion as of December 31, 2023, indicates sustained demand.

- EPC Expertise: Focus on comprehensive EPC services for electric power, pipeline, and communications infrastructure.

- Strategic Focus: Emphasis on grid modernization, renewable energy integration, and pipeline safety upgrades.

- Geographic Strength: Dominance in North America with strategic international ventures.

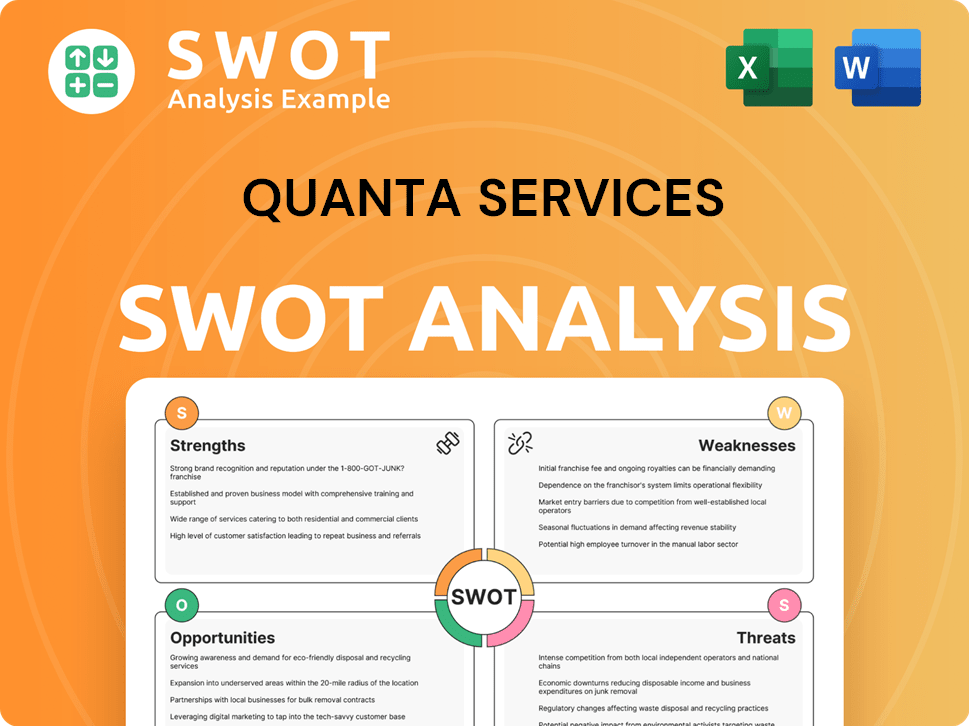

Quanta Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Quanta Services?

The competitive landscape for Quanta Services is multifaceted, encompassing a range of direct and indirect rivals. The company faces competition across its diverse segments, including electric power infrastructure, pipeline, and industrial sectors. Understanding the key players and their strategies is crucial for assessing Quanta Services' position in the market.

The industry is also influenced by mergers and acquisitions, which have led to the consolidation of competitors. This dynamic environment requires a continuous evaluation of competitive forces and market trends. For example, the acquisition of Henkels & McCoy by MasTec has reshaped the competitive landscape.

Quanta Services' competitive strategy is also impacted by emerging players, particularly in renewable energy infrastructure. The Marketing Strategy of Quanta Services highlights the importance of adapting to these changes.

In the electric power infrastructure sector, Quanta Services faces competition from companies like MYR Group Inc. and Pike Corporation. These competitors often bid on regional projects and specialized services.

In the pipeline and industrial sectors, key competitors include MasTec, Inc. and Primoris Services Corporation. These companies offer a broad range of infrastructure services.

Indirect competition comes from smaller, regional contractors specializing in niche services. These firms often compete on price, particularly for smaller projects.

New entrants focusing on renewable energy infrastructure and advanced communications networks also pose competition. These players may operate on a smaller scale initially.

Mergers and acquisitions, such as MasTec's acquisition of Henkels & McCoy, have consolidated the industry. This has led to fewer but larger and more diversified competitors.

The competitive dynamics are also influenced by new and emerging players focusing on renewable energy infrastructure and advanced communications networks, though these often operate on a smaller scale than Quanta.

The key competitors of Quanta Services vary depending on the segment. Understanding their strengths and weaknesses is essential for strategic planning. Here's a breakdown:

- MYR Group Inc.: Focuses on transmission and distribution lines, competing on regional projects. In 2024, MYR Group reported revenues of approximately $3.2 billion.

- Pike Corporation: Provides similar services, often competing for maintenance and smaller construction projects. Pike's revenue in 2024 was around $2.8 billion.

- MasTec, Inc.: Offers a broad range of infrastructure services, including oil and gas pipelines. MasTec's revenue in 2024 was approximately $11.5 billion.

- Primoris Services Corporation: Competes in heavy civil, pipeline, and utility construction projects. Primoris reported revenues of about $3.6 billion in 2024.

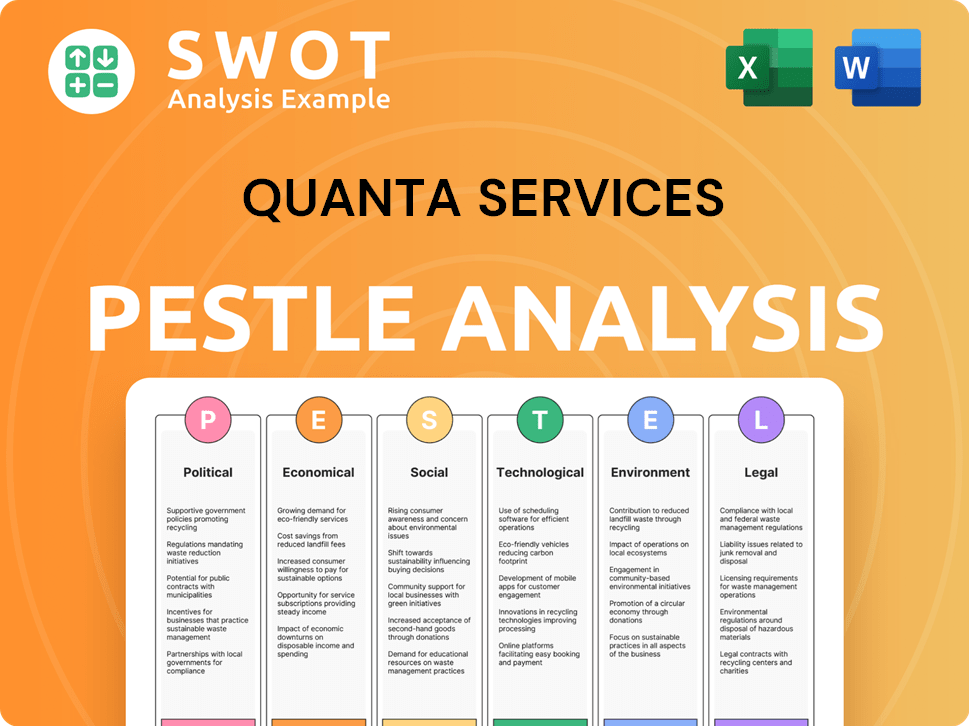

Quanta Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Quanta Services a Competitive Edge Over Its Rivals?

The competitive landscape for Quanta Services is shaped by its significant scale, comprehensive service offerings, and established customer relationships. The company has built a strong position in the energy infrastructure and utility services sectors. Its ability to undertake large, complex projects and its integrated engineering, procurement, and construction (EPC) capabilities set it apart. Understanding the Owners & Shareholders of Quanta Services is crucial for grasping the company's strategic direction and competitive positioning.

Quanta Services' success is rooted in its extensive geographic reach, allowing it to serve a broad customer base across North America. This wide reach, combined with a skilled workforce and a focus on safety, has enabled the company to secure and execute major projects. The company's competitive advantages have evolved from a strategy of consolidating regional players. This has allowed Quanta to leverage collective expertise and resources, creating a significant barrier to entry for new competitors.

The company's competitive advantages are substantial, but they face threats from imitation by larger diversified competitors and the ongoing need to attract and retain skilled labor. The company's focus on renewable energy projects and its ability to adapt to evolving industry demands are critical for maintaining its competitive edge. The company's ability to adapt to evolving industry demands is critical for maintaining its competitive edge.

Quanta Services has a broad geographic presence across North America, allowing it to undertake large-scale projects. This extensive reach provides economies of scale and operational efficiencies. The company's ability to self-perform a vast majority of its services is a key advantage.

Quanta Services offers integrated EPC capabilities, streamlining project execution and reducing complexities. This single-source solution enhances project delivery and client satisfaction. This integrated approach is a significant differentiator in the market.

The company's highly skilled and safety-conscious workforce, including specialized linemen and engineers, is a critical asset. Quanta invests heavily in training and safety programs, fostering a culture of expertise and reliability. This focus on safety and expertise is crucial.

Quanta Services has long-standing relationships with major utility companies and energy providers. These relationships build a strong reputation and recurring revenue streams. This creates a significant barrier to entry for new competitors.

Quanta Services' competitive edge stems from its scale, integrated services, and skilled workforce. The company's ability to self-perform a vast majority of its services provides significant operational efficiencies. These advantages allow Quanta to undertake large, complex projects.

- Extensive geographic reach across North America.

- Integrated EPC capabilities for streamlined project execution.

- A highly skilled and safety-conscious workforce.

- Strong, long-standing relationships with major clients.

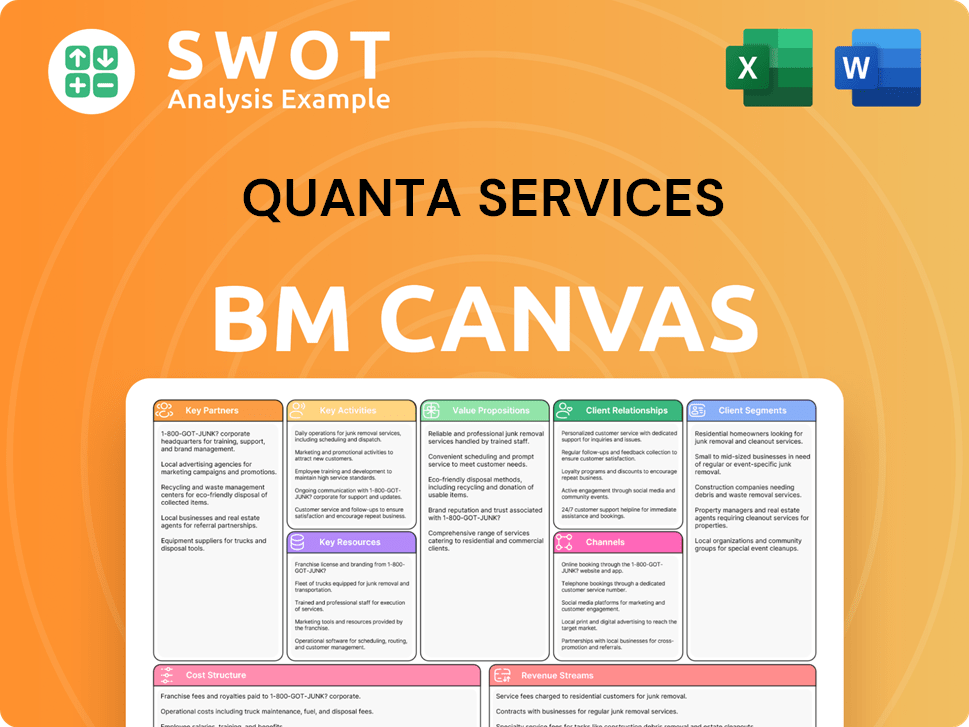

Quanta Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Quanta Services’s Competitive Landscape?

The infrastructure industry is currently undergoing significant shifts, creating both challenges and opportunities for companies like Quanta Services. These changes are driven by factors such as the need for grid modernization, the expansion of renewable energy, and the growth of communication networks. Understanding these trends is crucial for assessing the competitive landscape and future prospects of Quanta Services.

Several risks and challenges could impact Quanta Services. These include supply chain disruptions, labor shortages, and increased competition. However, the company also has significant opportunities, particularly in the growing markets for renewable energy and energy transition projects. A strategic approach to these trends will be vital for Quanta Services' continued success.

The infrastructure sector is experiencing a surge in demand for grid modernization and renewable energy projects. The expansion of communication infrastructure, particularly fiber optic networks and 5G technology, is another significant trend. Regulatory changes and government initiatives are also shaping the industry landscape, creating new project opportunities.

Managing supply chain disruptions and controlling inflationary pressures on materials and labor are key challenges. Addressing the shortage of skilled labor is also crucial. Increased competition from diversified engineering and construction firms and technological disruptions pose additional hurdles.

Expanding into new energy transition markets, such as hydrogen infrastructure and carbon capture projects, presents significant opportunities. Strategic partnerships and acquisitions can strengthen market position. Focusing on large-scale, complex projects in critical infrastructure sectors is also advantageous.

Leveraging an integrated service model and investing in technology and workforce development are crucial. Pursuing strategic acquisitions can expand service offerings and market reach. Adaptability and innovation are essential for navigating the evolving industry landscape.

To maintain a strong competitive position, Quanta Services should focus on several key strategies. These include expanding into new energy markets and leveraging its integrated service model. Investing in workforce development and pursuing strategic acquisitions are also critical for future growth.

- Energy Transition: Capitalize on the growth of renewable energy and emerging technologies like hydrogen and carbon capture.

- Integrated Services: Leverage its comprehensive service offerings to provide end-to-end solutions to clients.

- Technology and Innovation: Invest in technology and workforce training to improve efficiency and project execution.

- Strategic Acquisitions: Pursue acquisitions to expand service offerings and market presence.

The competitive landscape for Quanta Services involves several key players in the energy infrastructure, utility services, and engineering and construction sectors. Understanding the strengths and weaknesses of competitors is crucial for strategic planning. For more detailed insights into the company's growth strategy, consider reading about the Growth Strategy of Quanta Services.

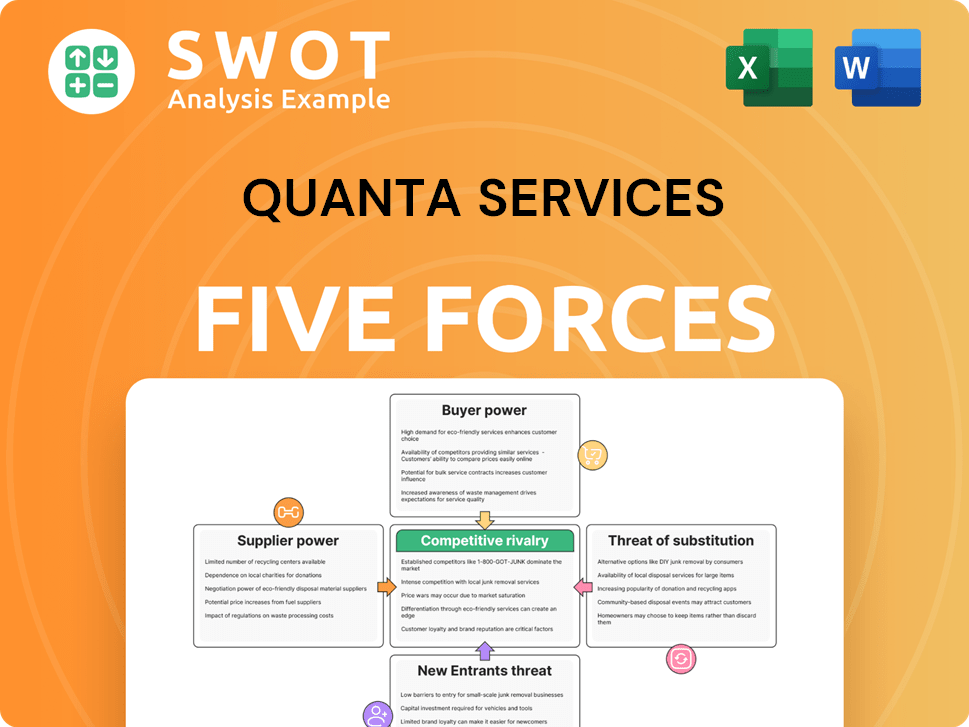

Quanta Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Quanta Services Company?

- What is Growth Strategy and Future Prospects of Quanta Services Company?

- How Does Quanta Services Company Work?

- What is Sales and Marketing Strategy of Quanta Services Company?

- What is Brief History of Quanta Services Company?

- Who Owns Quanta Services Company?

- What is Customer Demographics and Target Market of Quanta Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.