Quanta Services Bundle

How Does Quanta Services Thrive in Today's Infrastructure Boom?

Quanta Services (NYSE: PWR) is a powerhouse, shaping the future of essential infrastructure across North America and beyond. With the rise of AI data centers and the push for electrification, Quanta Services is at the forefront, delivering critical solutions in electric power, renewable energy, and communications. The company's impressive financial performance, including a $23.67 billion revenue in 2024, highlights its significant impact and strategic positioning.

This deep dive into Quanta Services SWOT Analysis will explore its core operations, revealing how it capitalizes on the surge in demand for infrastructure services. We'll examine its business model, from engineering and procurement to construction and maintenance, and how it navigates the competitive landscape within the energy sector. Understanding Quanta Services' operations is key to grasping its role in modernizing the electric grid, supporting renewable energy projects, and building out crucial communications networks. Learn more about how Quanta Services manages large projects, its financial performance, and its recent acquisitions.

What Are the Key Operations Driving Quanta Services’s Success?

Quanta Services' business model centers on providing comprehensive infrastructure solutions. It primarily serves the electric power, pipeline, industrial, and communications industries. The company's core offerings include engineering, procurement, and construction (EPC) services, along with ongoing maintenance and repair services.

The company's value proposition is built on its ability to undertake large, multi-year capital investment programs with efficiency and schedule certainty. This is achieved through a focus on quality, productivity, and safety. Quanta Services' operational excellence and scale differentiate it within a highly fragmented market, making it a key player in the infrastructure services sector.

Quanta Services' operations are multifaceted, encompassing a wide range of services. For electric power, it involves designing, installing, upgrading, repairing, and maintaining electric power transmission and distribution networks, as well as substation facilities. In the renewable energy sector, Quanta provides EPC services for wind and solar projects. Its capabilities also extend to communications infrastructure, including fiber optic network buildouts, and pipeline and industrial services such as constructing and maintaining pipelines for natural gas and oil.

Quanta Services designs, installs, upgrades, repairs, and maintains electric power transmission and distribution networks. This includes substations, ensuring reliable power delivery. The company plays a crucial role in modernizing and strengthening the electric grid.

Quanta provides EPC services for wind and solar projects, supporting the growth of renewable energy. It integrates renewable generation with power infrastructure. This enhances control over project costs and schedules.

The company builds out fiber optic networks, supporting the expansion of high-speed internet and communication services. This includes constructing and maintaining critical communication infrastructure. This is vital for modern connectivity.

Quanta constructs and maintains pipelines for natural gas and oil, supporting energy transportation. It also supports energy transition projects. This includes alternative fuel facilities and carbon capture systems.

Quanta Services emphasizes self-performing approximately 85% of its work, providing insights into labor costs and project execution. Its broad geographic footprint is primarily in the U.S., generating approximately 85% of its revenue. The company has a large craft-skilled labor force of over 52,000 employees, which is a key differentiator in the market.

- Self-performance allows for better cost control and schedule management.

- Extensive geographic presence ensures broad market coverage.

- Large, skilled workforce supports complex projects.

- Focus on quality, productivity, and safety drives operational excellence.

Quanta Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Quanta Services Make Money?

The revenue streams and monetization strategies of Quanta Services are built on providing comprehensive infrastructure solutions, primarily in the electric power, renewable energy, and underground utility sectors. The company leverages a diversified approach to generate income and maintain a strong financial outlook. For the full year 2024, Quanta Services achieved consolidated revenues of $23.67 billion.

Quanta Services projects full-year 2025 revenues to range between $26.7 billion and $27.2 billion, indicating continued growth. This growth is supported by a robust backlog of projects and strategic focus on key sectors. The company's operations are structured to capitalize on expanding market demands for infrastructure development and maintenance.

The company's revenue streams are broadly categorized into two segments as of Q1 2025: Electric Infrastructure Solutions (EIS) and Underground Utility and Infrastructure Solutions (UUIS). The EIS segment, which now includes renewable energy, grid modernization, and communications infrastructure, is a significant growth driver. Renewable Energy revenues specifically increased 27.2% to $7.85 billion in 2024, while Electric Power revenues grew 15.2% to $11.17 billion. The UUIS segment, though smaller, also saw steady growth.

Quanta Services' monetization strategies focus on securing large-scale, long-term contracts and maintaining a substantial backlog. The company's financial performance is enhanced by its strategic approach to project management and market positioning. To learn more about their strategic vision, consider reading about the Growth Strategy of Quanta Services.

- At the end of 2024, the total backlog stood at $34.54 billion, increasing to a record $35.3 billion by Q1 2025, with $17.6 billion in remaining performance obligations (RPO) expected to be completed in the coming years.

- The 'base business' activities, which involve contracts less than $100 million and primarily consist of electric and gas utility spend and recurring renewable projects, represent approximately 87% of its 2025 revenues, contributing to stable and predictable earnings.

- Quanta also benefits from emergency restoration services and large-scale transmission and pipeline projects.

- The company's disciplined capital allocation strategy, including strategic acquisitions, further enhances its revenue-generating capabilities and market presence.

Quanta Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Quanta Services’s Business Model?

Quanta Services has a history marked by significant milestones and strategic decisions that have shaped its trajectory in the infrastructure services sector. The company's approach has been characterized by a focus on expanding its service offerings and geographic reach, primarily through strategic acquisitions. These moves have been instrumental in positioning the company to capitalize on emerging opportunities within the utility services and energy sector.

A key component of Quanta Services' growth strategy involves strategic acquisitions. This approach has allowed the company to broaden its capabilities and market presence. For instance, the 2024 acquisition of Cupertino Electric, a leading electrical contractor specializing in data center construction, has significantly bolstered Quanta's ability to meet the surging demand for AI-driven infrastructure. Another notable acquisition in 2023 was Pennsylvania Transformer Technology, valued at $300 million, which further expanded its portfolio.

Quanta Services has demonstrated its ability to adapt to operational and market challenges. The company has effectively responded to supply chain disruptions and regulatory hurdles, leveraging its large backlog and diversified service offerings to mitigate near-term volatility. Management emphasizes leveraging its scale and supplier relationships to navigate these issues, ensuring continued operational efficiency and project success.

Strategic acquisitions have been a cornerstone of Quanta Services' growth, expanding its service offerings and geographic reach. The acquisition of Cupertino Electric in 2024 is a prime example, bolstering its capabilities in data center construction. These moves align with Quanta's strategy to expand its capabilities and market presence.

Quanta Services has strategically navigated operational and market challenges, including supply chain disruptions and regulatory hurdles. The company's large backlog and diversified service offerings help mitigate near-term volatility. Management focuses on leveraging scale and supplier relationships to navigate these issues.

Quanta Services benefits from a strong backlog, diversified business model, and expertise in large-scale project management. A significant portion of its work is self-performed, offering greater control over project costs and schedules. The company continues to adapt to new trends, such as the increasing demand for power driven by data centers and AI.

Quanta Services reported a record backlog of $35.3 billion in Q1 2025, providing a solid foundation for future revenue. The company's diversified business model across electric power, renewable energy, and communications infrastructure contributes to its financial resilience. The company's focus on self-performing a significant portion of its work (around 85%) offers greater control over project costs and schedules.

Quanta Services maintains a strong competitive edge through its robust backlog, diversified business model, and expertise in managing large-scale projects. The company's ability to self-perform a significant portion of its work provides greater control over project costs and schedules, contributing to higher margins compared to peers. Moreover, Quanta's position as the largest provider of electric power and infrastructure solutions, coupled with a substantial craft-skilled labor force, further solidifies its market leadership.

- Strong Backlog: Reached a record $35.3 billion in Q1 2025, ensuring future revenue streams.

- Diversified Business Model: Spans electric power, renewable energy, and communications infrastructure, providing resilience.

- Self-Performance: Approximately 85% of work is self-performed, enhancing control over project costs and schedules.

- Market Leadership: Largest provider of electric power and infrastructure solutions.

For a deeper dive into the strategies, consider exploring the Marketing Strategy of Quanta Services. The company's ability to adapt to new trends, such as the increasing demand for power driven by data centers and AI, by enhancing its capabilities in these areas through strategic investments and acquisitions, is a key factor in its sustained success.

Quanta Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Quanta Services Positioning Itself for Continued Success?

This chapter examines the industry position, risks, and future outlook for Quanta Services. The company holds a leading market position within the infrastructure services sector, particularly in electric power and renewable energy infrastructure. Its strong relationships with key clients and a substantial backlog support its revenue and growth prospects. However, Quanta Services faces various challenges, including economic conditions, supply chain issues, and regulatory uncertainties.

The future outlook for Quanta Services is positive, driven by strong infrastructure demand and strategic initiatives. The company anticipates continued revenue growth and expansion through acquisitions and increased capacity. Strategic investments and capitalizing on the global shift towards renewable energy are key components of its long-term strategy, positioning it well for future success. For further insights, consider reading the Owners & Shareholders of Quanta Services article.

Quanta Services is a leading player in the utility services and infrastructure services market. In 2023, it held a 0.78% share of the total market. The company is recognized as a top provider of electric power and infrastructure solutions. Its strong customer relationships contribute to stable revenues.

Quanta Services faces several risks, including economic downturns and project delays. Supply chain disruptions and rising material costs can impact margins. Regulatory uncertainties and labor constraints also pose challenges. Geopolitical factors and changes in tax bills are additional risks.

The future outlook for Quanta Services is positive, driven by strong infrastructure demand. The company expects continued growth in 2025, with revenues projected between $26.7 billion and $27.2 billion. Strategic acquisitions and geographic expansion are key initiatives.

Quanta Services is focused on increasing capacity and building more infrastructure. Strategic investments, operational efficiency, and capitalizing on renewable energy are key. The company's substantial backlog provides a strong foundation for future revenue.

Quanta Services projects continued growth in 2025. Revenues are expected to be between $26.7 billion and $27.2 billion. Adjusted EPS is projected to be between $10.05 and $10.65.

- The company's backlog reached $35.3 billion in Q1 2025.

- Strategic acquisitions are part of the company's growth strategy.

- Focus on data centers, onshoring, and economic expansion.

- Committed to strategic investments and operational efficiency.

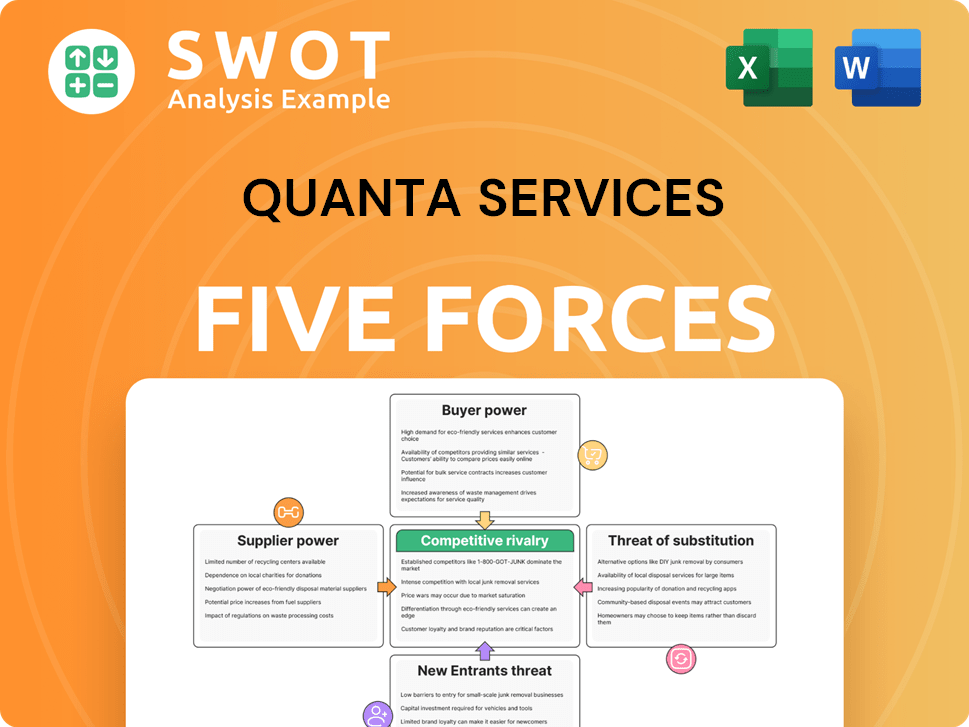

Quanta Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Quanta Services Company?

- What is Competitive Landscape of Quanta Services Company?

- What is Growth Strategy and Future Prospects of Quanta Services Company?

- What is Sales and Marketing Strategy of Quanta Services Company?

- What is Brief History of Quanta Services Company?

- Who Owns Quanta Services Company?

- What is Customer Demographics and Target Market of Quanta Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.