QuidelOrtho Bundle

How Does QuidelOrtho Navigate the Diagnostics Arena?

The in vitro diagnostics (IVD) industry is a complex ecosystem, constantly reshaped by innovation and evolving healthcare demands. The 2022 merger of Quidel Corporation and Ortho Clinical Diagnostics created QuidelOrtho, a major player in this dynamic market. This strategic alliance aimed to combine strengths in point-of-care and laboratory diagnostics, setting the stage for a deeper dive into its competitive positioning.

This exploration of the QuidelOrtho competitive landscape will identify its key rivals and analyze its market position. We'll examine the company's QuidelOrtho SWOT Analysis, dissecting its competitive advantages within the diagnostic testing companies sector. Understanding the IVD market share and QuidelOrtho's financial performance compared to competitors is crucial for investors and strategists alike.

Where Does QuidelOrtho’ Stand in the Current Market?

QuidelOrtho Corporation holds a significant market position within the In Vitro Diagnostics (IVD) industry. Formed through the merger of Quidel and Ortho Clinical Diagnostics, the company combines strengths in point-of-care (POC) and laboratory diagnostics. This strategic alignment allows QuidelOrtho to offer a broad range of diagnostic solutions, catering to diverse healthcare settings.

The company's core operations focus on developing, manufacturing, and marketing diagnostic testing solutions. These solutions span various disease areas, including infectious diseases, cardiometabolic health, and autoimmune diseases. QuidelOrtho's value proposition lies in its ability to provide comprehensive diagnostic offerings, from rapid tests used in urgent care settings to sophisticated laboratory instruments and assays.

QuidelOrtho's market position is strengthened by its global presence and diverse customer base. The company serves hospitals, reference laboratories, physician offices, and retail clinics. This wide reach enables QuidelOrtho to capture a significant portion of the IVD market. For a deeper dive, explore the Marketing Strategy of QuidelOrtho.

QuidelOrtho's product portfolio includes a wide array of diagnostic tests and instruments. Key areas include infectious disease diagnostics (like influenza and COVID-19), cardiometabolic health tests, and autoimmune disease diagnostics. The company's offerings cater to both POC and laboratory settings, providing a comprehensive suite of diagnostic solutions.

QuidelOrtho has a global presence, with operations and sales across multiple regions. The company's geographic reach allows it to serve a diverse customer base worldwide. This broad presence helps to mitigate risks and capitalize on market opportunities in different areas.

For the full year 2023, QuidelOrtho reported total revenues of $2.96 billion. This financial performance reflects the company's scale and market presence within the IVD industry. The company's financial results are a key indicator of its competitive standing and ability to invest in future growth.

QuidelOrtho serves a variety of customer segments, including hospitals, reference laboratories, physician offices, and retail clinics. This diverse customer base enables the company to capture a significant portion of the IVD market. The company's ability to meet the needs of various healthcare providers is a key factor in its success.

QuidelOrtho benefits from several key market trends, including the increasing demand for rapid diagnostic testing and the growing need for comprehensive diagnostic solutions. The company's competitive advantages include its broad product portfolio, global presence, and strong financial performance.

- Diversified Product Portfolio: Offers a wide range of diagnostic tests and instruments.

- Global Reach: Operates and sells products across multiple regions.

- Financial Strength: Demonstrated by $2.96 billion in revenue for 2023.

- Customer Base: Serves hospitals, labs, physician offices, and retail clinics.

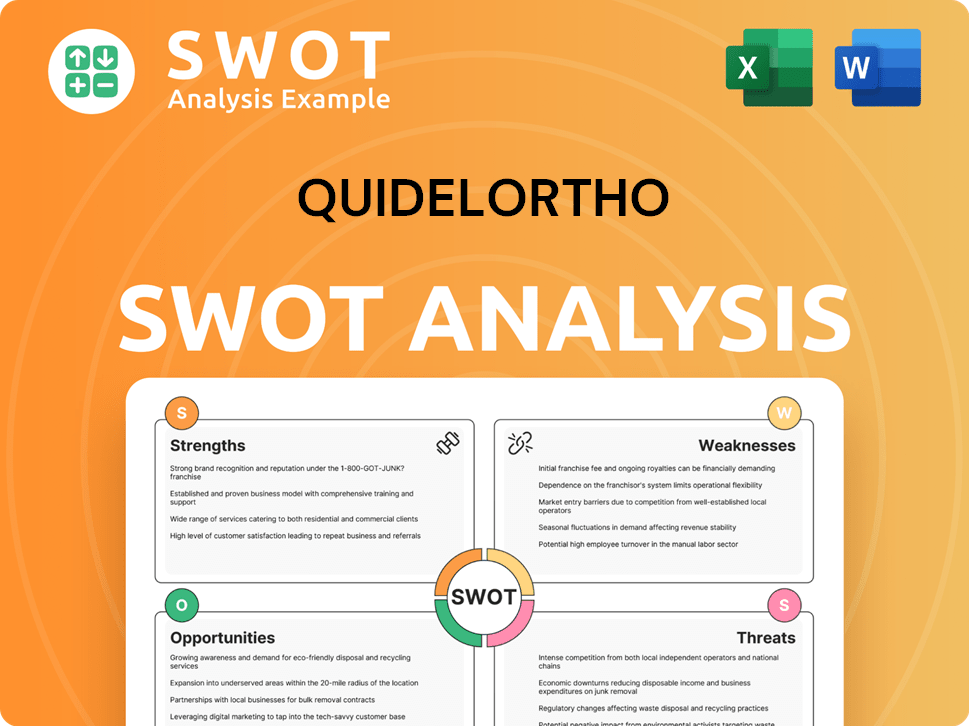

QuidelOrtho SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging QuidelOrtho?

The Growth Strategy of QuidelOrtho involves navigating a complex competitive landscape. The company faces both direct and indirect rivals in the In Vitro Diagnostics (IVD) industry, which impacts its market share and overall performance. Understanding the QuidelOrtho competitive landscape is crucial for assessing its position and potential.

QuidelOrtho's market analysis reveals a dynamic environment where innovation, pricing, and distribution are key competitive factors. The company's ability to differentiate its products and services against its competitors is vital for sustained success. The diagnostic testing companies in this sector are constantly evolving.

QuidelOrtho must contend with established players and emerging technologies. This includes assessing its competitive advantages and responding to market trends to maintain and grow its market position.

Direct competitors are those that offer similar products and services within the same diagnostic segments. These companies often compete head-to-head for market share.

Abbott is a major player, particularly in point-of-care diagnostics with its ID NOW platform and in laboratory diagnostics with a broad portfolio. Abbott's extensive resources and global reach make it a formidable competitor.

Roche is a global leader in clinical chemistry, immunodiagnostics, and molecular diagnostics, challenging QuidelOrtho in high-volume laboratory settings. Roche's strong brand and innovative products pose a significant competitive threat.

Danaher, through its subsidiaries Beckman Coulter and Cepheid, offers a wide range of clinical diagnostic instruments and molecular diagnostics solutions. Cepheid's expertise in molecular diagnostics is particularly noteworthy.

Siemens Healthineers competes across various segments, including immunoassay and clinical chemistry. Siemens' strong presence in the healthcare market makes it a key competitor.

Indirect competitors include companies focusing on niche areas or specific technologies. These companies may present challenges in specific market segments.

The competitive landscape is shaped by innovation, pricing, distribution, and brand recognition. Companies constantly strive to introduce faster, more accurate, and cost-effective tests. Mergers and acquisitions are strategic moves to gain market share.

- Innovation: Continuous development of new diagnostic tests and technologies.

- Pricing Strategies: Competitive pricing to attract customers and maintain market share.

- Distribution Networks: Efficient distribution to ensure product availability.

- Brand Recognition: Building a strong brand reputation to gain customer trust.

- Mergers and Alliances: Strategic moves to expand market presence and enhance competitiveness.

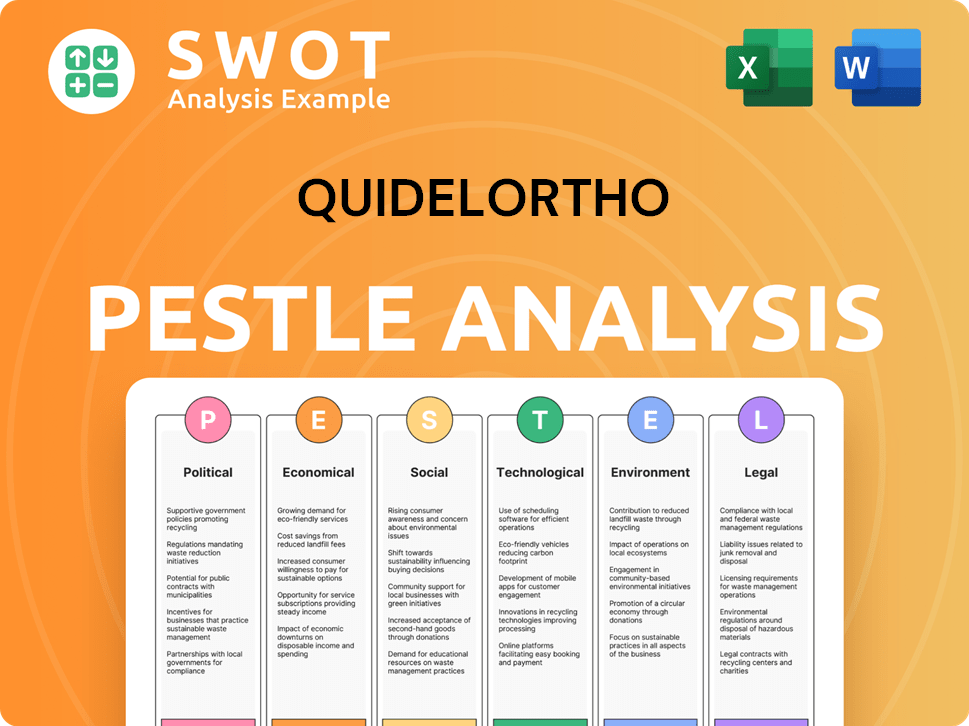

QuidelOrtho PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives QuidelOrtho a Competitive Edge Over Its Rivals?

Understanding the QuidelOrtho competitive landscape involves assessing its key strengths and how they position the company within the In Vitro Diagnostics industry. QuidelOrtho's competitive advantages are multifaceted, stemming from its extensive product offerings, technological prowess, and established market presence. These factors contribute to its ability to compete effectively in the rapidly evolving IVD market.

The company's strategic moves, including the merger of Quidel and Ortho Clinical Diagnostics, have reshaped its market position. This consolidation has allowed for a broader portfolio and enhanced operational efficiencies. Analyzing QuidelOrtho's market analysis reveals a focus on both point-of-care (POC) and laboratory settings, catering to a wide range of customer needs. This dual approach is a key element of its competitive strategy.

QuidelOrtho's ability to compete in the diagnostic testing market is influenced by its product portfolio, technological innovations, and global reach. The company's financial performance, when compared to competitors, highlights its ability to leverage these advantages. Continuous innovation and adaptation are essential for sustaining its competitive edge.

QuidelOrtho boasts a comprehensive product portfolio covering various diagnostic areas. Its expertise in rapid diagnostics, particularly for infectious diseases, provides a strong competitive edge. Proprietary technologies and intellectual property, including patents, protect its innovations.

The company benefits from a well-established global distribution network. This extensive network allows for broad market access and strong customer relationships. QuidelOrtho's brand equity, built over decades, instills trust among healthcare professionals.

Economies of scale in manufacturing and distribution contribute to cost efficiencies. This allows for a stronger competitive pricing position in the market. QuidelOrtho's ability to manage costs effectively is a key competitive advantage.

The combined R&D capabilities of Quidel and Ortho Clinical Diagnostics foster a continuous pipeline of new products. Investments in R&D support the development of innovative diagnostic solutions. This continuous innovation is crucial for maintaining a competitive edge.

QuidelOrtho's competitive advantages are multi-faceted, encompassing a broad product portfolio, technological expertise, and a strong global presence. The company's focus on rapid diagnostics, particularly for infectious diseases, gives it a significant edge. The company's ability to leverage its scale and distribution network further enhances its competitive position.

- Extensive product range covering POC and laboratory settings.

- Strong presence in rapid diagnostics, such as QuickVue and Sofia platforms.

- Proprietary technologies and intellectual property protecting innovations.

- Global distribution network and established customer relationships.

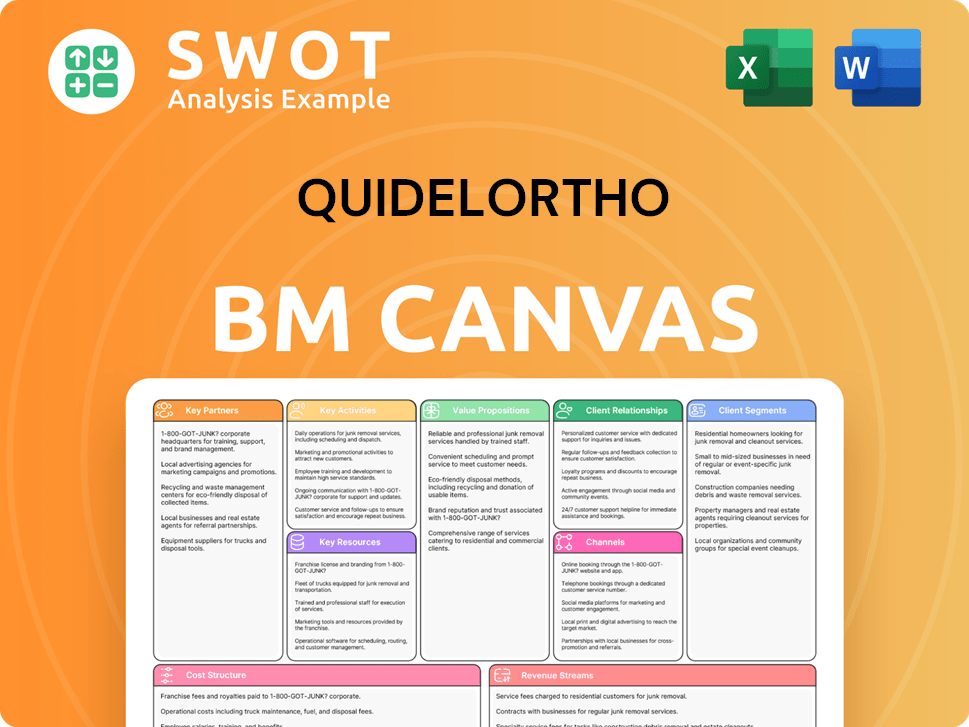

QuidelOrtho Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping QuidelOrtho’s Competitive Landscape?

The diagnostic industry is currently experiencing significant shifts that impact the QuidelOrtho competitive landscape. Technological advancements, regulatory changes, and evolving consumer preferences are reshaping the market. Understanding these trends is crucial for assessing the company's position and future outlook.

Key risks include the pace of innovation, the need for continuous R&D investment, and supply chain vulnerabilities. However, opportunities abound, particularly in expanding markets and through strategic partnerships. The ability to adapt and leverage its combined expertise will be vital for QuidelOrtho to remain competitive.

The In Vitro Diagnostics industry is seeing increased adoption of molecular diagnostics, automation, and digital health solutions. There's a growing focus on personalized medicine, demanding more sophisticated tests. Regulatory changes, especially in data privacy and test approvals, are also influencing market dynamics. Consumer demand for at-home testing and accessible solutions is rising, impacting market strategies.

Maintaining a competitive edge amid rapid technological advancements and aggressive R&D by larger rivals is a key challenge. QuidelOrtho must continually invest in R&D to bring new solutions to market. Supply chain resilience remains critical, particularly after global disruptions. Regulatory scrutiny and reimbursement pressures can also impact profitability. The QuidelOrtho competitive landscape is intense.

Growing global demand for diagnostic testing, driven by an aging population and increasing chronic diseases, offers a substantial market. Emerging markets with developing healthcare infrastructures present expansion opportunities. Strategic partnerships, acquisitions, and diversification into new areas like companion diagnostics could drive growth. The company can leverage its expertise in both point-of-care and laboratory diagnostics.

QuidelOrtho's ability to adapt to technological changes and market demands will determine its success. Focusing on innovation, supply chain resilience, and strategic partnerships is crucial. The company's ability to leverage its combined expertise in both point-of-care and laboratory diagnostics positions it well to capitalize on the increasing demand for integrated diagnostic solutions. For further insights, explore the Revenue Streams & Business Model of QuidelOrtho.

The IVD market share is influenced by several key trends. These include the rise of molecular diagnostics, the demand for point-of-care testing, and the increasing adoption of digital health solutions. Companies are focusing on personalized medicine and expanding into emerging markets.

- Technological Advancements: Focus on molecular diagnostics and automation.

- Market Expansion: Growth in emerging markets.

- Strategic Partnerships: Collaborations to enhance product offerings.

- Product Diversification: Expansion into new diagnostic areas.

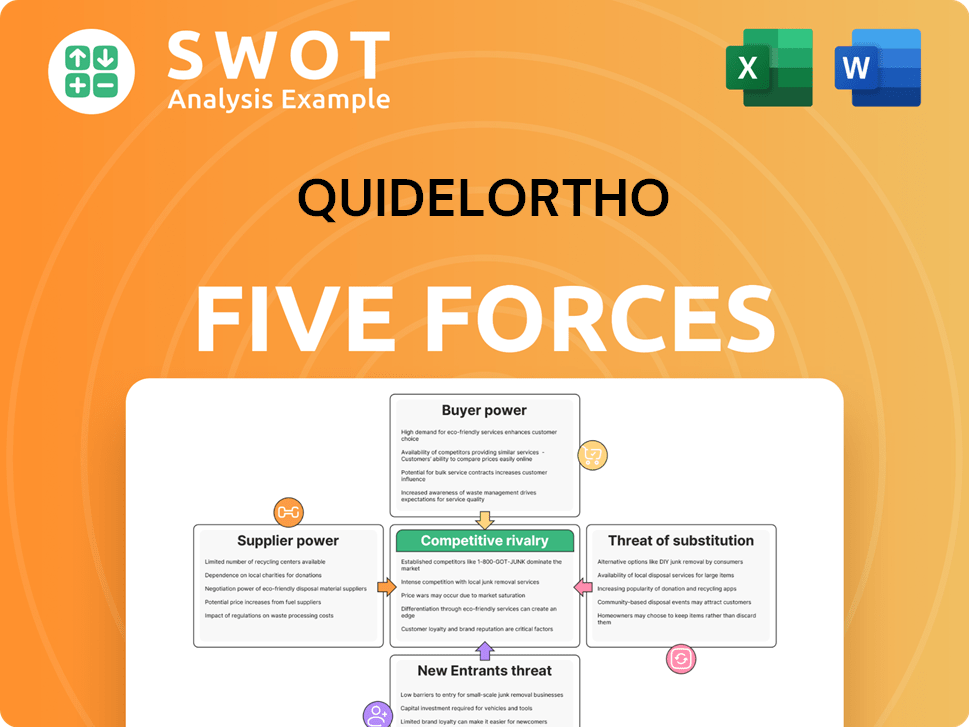

QuidelOrtho Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuidelOrtho Company?

- What is Growth Strategy and Future Prospects of QuidelOrtho Company?

- How Does QuidelOrtho Company Work?

- What is Sales and Marketing Strategy of QuidelOrtho Company?

- What is Brief History of QuidelOrtho Company?

- Who Owns QuidelOrtho Company?

- What is Customer Demographics and Target Market of QuidelOrtho Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.