QuidelOrtho Bundle

How Does QuidelOrtho Thrive in the Diagnostics Industry?

QuidelOrtho Company, a major force in medical technology, offers crucial QuidelOrtho SWOT Analysis, empowering healthcare professionals with rapid and precise diagnostic tools. Born from a strategic merger in 2022, this company has quickly become a global leader in diagnostic solutions. With a diverse portfolio spanning point-of-care, laboratory, and transfusion medicine, QuidelOrtho addresses critical healthcare needs worldwide.

This comprehensive guide explores the inner workings of QuidelOrtho, examining its core operations and diverse revenue streams within the in vitro diagnostics sector. We'll dissect its market influence, driven by a reported $2.85 billion in revenue in 2023, and analyze the impact of its diagnostic tests. Whether you're an investor, a healthcare professional, or an industry observer, understanding How QuidelOrtho works is key to navigating the evolving diagnostics landscape and its role in patient care.

What Are the Key Operations Driving QuidelOrtho’s Success?

The QuidelOrtho Company, a key player in the medical technology sector, creates value through its comprehensive diagnostic solutions. These solutions serve a wide array of customers, including hospitals, laboratories, and clinics. The company's core business revolves around developing, manufacturing, and distributing in vitro diagnostics (IVD) products.

QuidelOrtho focuses on a broad spectrum of diagnostic platforms and assays. This includes point-of-care instruments for rapid testing and high-throughput laboratory systems. Their products are used for various purposes, such as disease screening and chronic disease management, impacting patient care significantly.

The operational processes of QuidelOrtho are meticulously managed, from research and development (R&D) to manufacturing and distribution. They invest heavily in R&D to innovate and improve their diagnostic technologies. Their manufacturing facilities adhere to strict quality standards, ensuring the production of reliable diagnostic instruments and reagents. The company's global presence is supported by efficient supply chains and distribution networks.

QuidelOrtho offers a wide range of diagnostic tests. These tests cover various medical conditions, including infectious diseases and chronic illnesses. Their product portfolio includes both point-of-care tests and laboratory-based assays, catering to diverse healthcare settings.

The company serves multiple customer segments. These include hospitals, reference laboratories, physician offices, and retail clinics. This broad reach allows QuidelOrtho to impact healthcare at various levels.

QuidelOrtho focuses on operational efficiency across its value chain. This includes R&D, manufacturing, and distribution. The company's commitment to quality and efficiency ensures reliable products and services.

QuidelOrtho provides value through its integrated diagnostic solutions. These solutions enable quicker diagnoses and improved patient outcomes. The company's focus on ease of use and rapid results streamlines laboratory workflows.

QuidelOrtho's operations are characterized by a commitment to innovation, quality, and customer service. The company's integrated approach to diagnostics, combining point-of-care and laboratory solutions, sets it apart in the medical technology field. This approach allows for comprehensive testing capabilities across various healthcare settings.

- Research and Development: Continuous investment in R&D to develop new diagnostic technologies.

- Manufacturing: Adherence to stringent quality standards in manufacturing processes.

- Distribution: Efficient supply chains and distribution networks to reach a global customer base.

- Customer Support: Focus on providing excellent customer service and support.

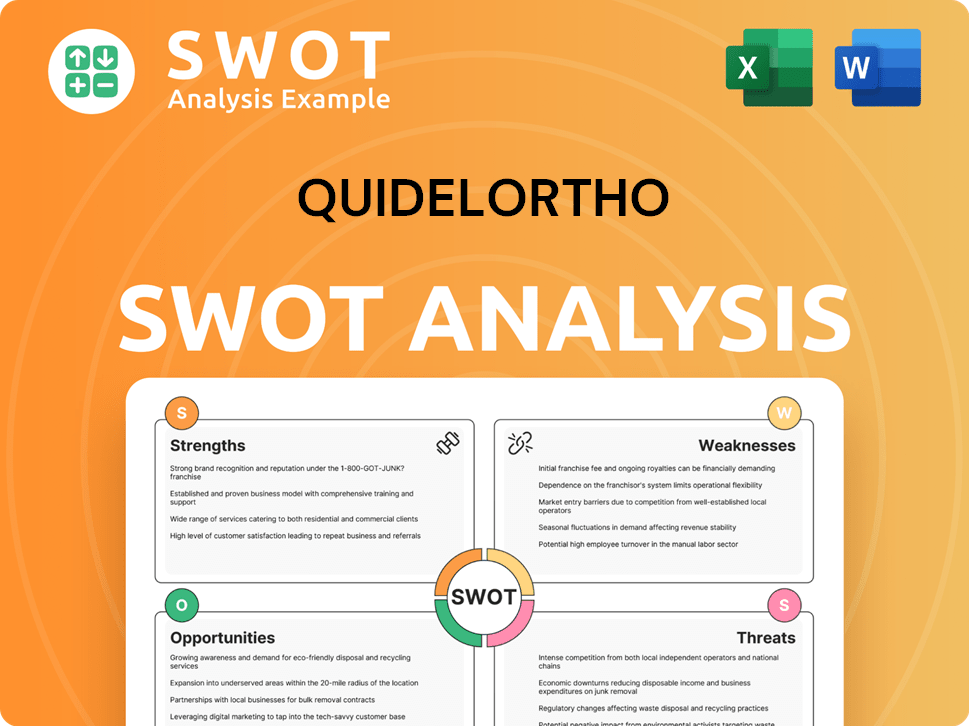

QuidelOrtho SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does QuidelOrtho Make Money?

The QuidelOrtho Company generates revenue through a multifaceted approach centered on diagnostic solutions. This includes the sale of instruments, reagents, and related services, creating diverse revenue streams. The company's business model relies on both initial instrument sales and the recurring revenue from consumables, ensuring a stable financial base.

A significant portion of QuidelOrtho's revenue comes from the continuous sales of reagents, which are essential for use with their diagnostic instruments. Instrument sales serve as the initial point of entry for many customers into the QuidelOrtho ecosystem. This approach allows for a comprehensive offering that supports long-term customer relationships.

In fiscal year 2023, QuidelOrtho reported total revenues of approximately $2.85 billion. The company employs several monetization strategies, such as offering bundled solutions that combine instruments and reagents, as well as providing service contracts for instrument maintenance and support. This strategy allows for a robust and diversified revenue model.

The company's revenue model is built on a combination of product sales and recurring revenue streams. QuidelOrtho focuses on both point-of-care and laboratory diagnostics, creating opportunities for cross-selling and expanding its market presence. The company is continually exploring new avenues for revenue growth, including expansion into new diagnostic areas and geographic markets.

- Sales of diagnostic instruments form a key revenue stream.

- Recurring revenue from reagents, essential for instrument operation, provides a stable income source.

- Service contracts for instrument maintenance and support contribute to revenue.

- Bundled solutions, combining instruments and reagents, enhance customer value.

- Strategic focus on both point-of-care and laboratory diagnostics supports cross-selling opportunities.

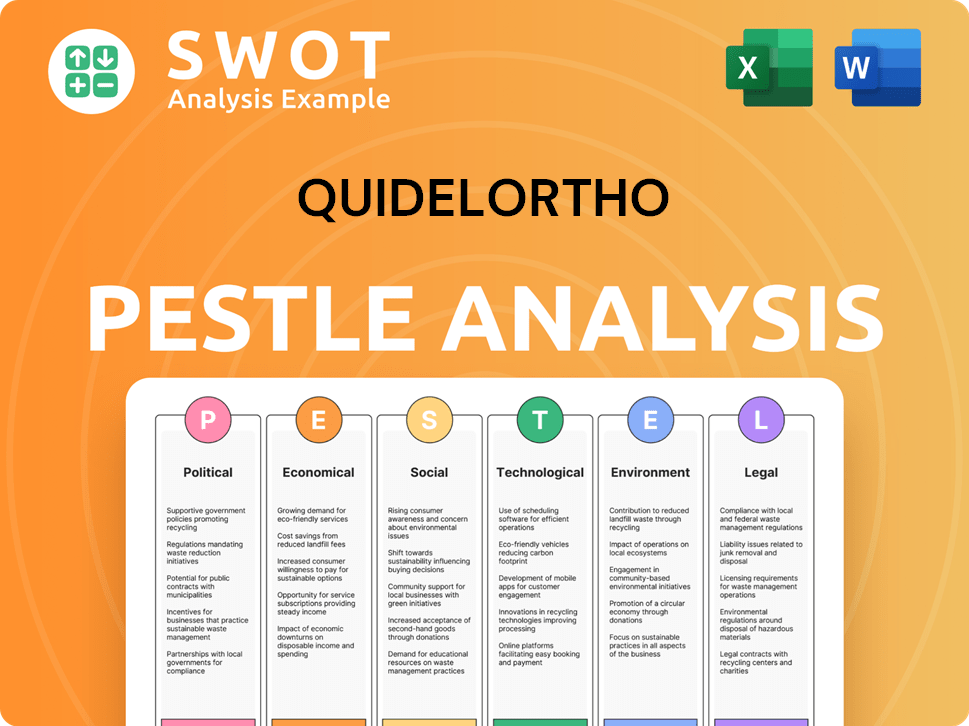

QuidelOrtho PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped QuidelOrtho’s Business Model?

The most significant event shaping how the Quidel Ortho Company operates and its financial performance was the merger of Quidel Corporation and Ortho Clinical Diagnostics in 2022. This strategic move created a global leader in in vitro diagnostics, significantly altering its competitive standing. The merger enhanced scale, broadened the product portfolio, and expanded geographic reach.

The company has navigated operational challenges, including supply chain disruptions that impacted the broader diagnostics industry. QuidelOrtho responded by optimizing its manufacturing processes and diversifying its supplier base to ensure product availability. This proactive approach has been crucial for maintaining its market position and serving its customers effectively.

QuidelOrtho's competitive advantages are numerous. Its extensive portfolio of diagnostic solutions, spanning both point-of-care and centralized lab testing, provides a distinct market differentiation. The company benefits from strong brand recognition and a reputation for reliable, high-quality diagnostic products. Technological leadership, particularly in rapid diagnostic testing and advanced immunoassay technologies, sustains its business model by offering innovative solutions that meet evolving healthcare needs.

The merger of Quidel Corporation and Ortho Clinical Diagnostics in 2022 was a pivotal moment. This created a major player in the in vitro diagnostics market. The integration expanded the company's reach and capabilities.

QuidelOrtho has focused on optimizing manufacturing and diversifying its supply chain. These moves have helped the company manage disruptions. The company continues to invest in research and development to stay competitive.

The company's broad diagnostic solutions portfolio and strong brand recognition are key advantages. Technological innovation, especially in rapid testing, sets it apart. Economies of scale from the merger support efficient operations.

In 2023, the company reported revenues that reflected the impact of the merger and market dynamics. Specific financial details can be found in the company's SEC filings, reflecting the ongoing evolution of the business. The company's financial health is crucial for its continued success.

QuidelOrtho is adapting to the increasing demand for decentralized testing and personalized medicine. The company invests in research and development and strategic partnerships to bring new solutions to market. This focus helps the company stay relevant in a changing healthcare landscape.

- Investment in R&D to develop new diagnostic tests.

- Strategic partnerships to expand its product offerings.

- Focus on point-of-care testing to meet evolving healthcare needs.

- Continuous adaptation to changing market dynamics.

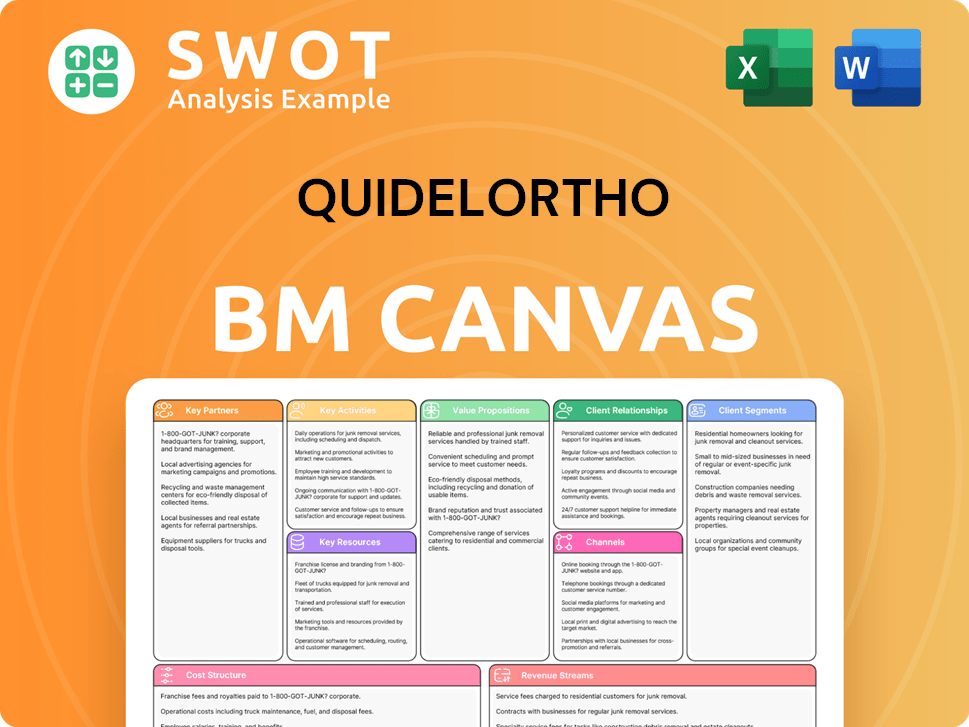

QuidelOrtho Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is QuidelOrtho Positioning Itself for Continued Success?

The QuidelOrtho company holds a strong position in the in vitro diagnostics (IVD) sector. It competes with major players in the industry, and its diverse product range and global infrastructure help it maintain a competitive edge. The merger of the two companies has created a significant contender across various diagnostic areas. The performance of its instruments and assays, as well as its strong customer support, fosters customer loyalty.

Several factors could affect QuidelOrtho's operations and revenue. These include intense competition, the need for continuous innovation due to rapid technological advancements, and evolving regulations in different countries. Supply chain issues and changes in healthcare spending or reimbursement models also pose risks. However, the company is actively pursuing strategic initiatives to mitigate these risks and drive future growth. This includes investment in R&D and expansion into emerging markets.

QuidelOrtho is a significant player in the IVD market, competing with global leaders. Its broad product portfolio and global reach contribute to its strong market position. Customer loyalty is supported by reliable products and customer service. For more insights, consider looking at the Competitors Landscape of QuidelOrtho.

Key risks include intense competition and rapid technological changes. Supply chain disruptions and changes in healthcare policies also pose challenges. The company must continually innovate to stay competitive and adapt to regulatory changes.

The company is focused on strategic initiatives for growth, including R&D and expansion. It aims to broaden its technological capabilities and market reach. Leadership emphasizes innovation and operational excellence to sustain revenue growth in the changing healthcare landscape.

Financial results for 2024 and early 2025 will provide the most current data. Investors should watch for reports on revenue, profitability, and R&D spending. These figures will help assess the company's ability to execute its growth strategies.

QuidelOrtho is focusing on several key areas to drive future success and mitigate risks. These include continued investment in research and development to develop next-generation diagnostic platforms. Expansion into emerging markets is also a priority, as is potential strategic acquisitions or partnerships.

- Investment in R&D for new diagnostic platforms.

- Expansion into emerging markets to increase global presence.

- Strategic acquisitions or partnerships to broaden technology.

- Focus on innovation and operational excellence.

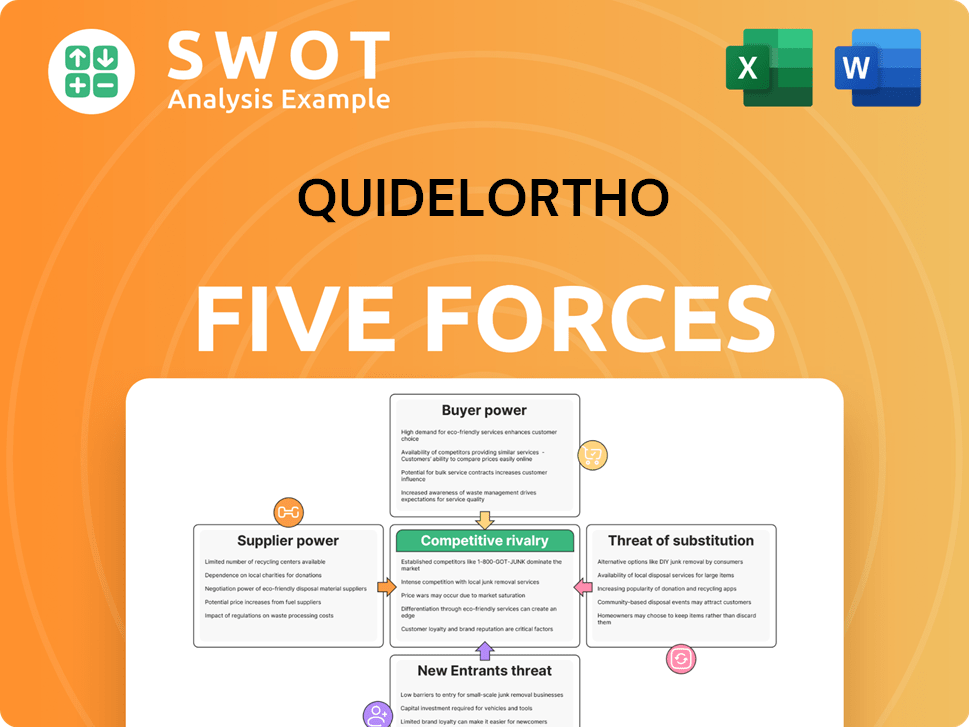

QuidelOrtho Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuidelOrtho Company?

- What is Competitive Landscape of QuidelOrtho Company?

- What is Growth Strategy and Future Prospects of QuidelOrtho Company?

- What is Sales and Marketing Strategy of QuidelOrtho Company?

- What is Brief History of QuidelOrtho Company?

- Who Owns QuidelOrtho Company?

- What is Customer Demographics and Target Market of QuidelOrtho Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.