Rapid7 Bundle

Can Rapid7 Maintain Its Edge in the Cybersecurity Arena?

In a world grappling with escalating cyber threats, understanding the players shaping the security landscape is paramount. Rapid7, a key provider since 2000, offers critical solutions in vulnerability management and threat detection. This analysis dives deep into the Rapid7 SWOT Analysis, providing a comprehensive overview of its competitive positioning.

This exploration of the Rapid7 competitive landscape will dissect the company's standing within the security industry analysis, identifying its key Rapid7 competitors and evaluating its strengths. We'll uncover how Rapid7 differentiates itself in the market, examining its strategies for navigating the complexities of vulnerability management vendors and the evolving challenges posed by cybersecurity threat intelligence providers. Ultimately, this Rapid7 market analysis aims to provide actionable insights for investors and businesses alike, offering a clear view of Rapid7's potential in the dynamic cybersecurity sector, including comparisons like Rapid7 vs. CrowdStrike and Rapid7 vs. Splunk.

Where Does Rapid7’ Stand in the Current Market?

Rapid7 maintains a strong market position within the cybersecurity sector, particularly in vulnerability management and security operations (SecOps). The company is consistently recognized as a top-tier provider in these areas. For example, in Gartner's 2024 Magic Quadrant for Application Security Testing, Rapid7 was acknowledged as a Challenger, highlighting its solid execution and growing market presence. This positioning is crucial for understanding the Rapid7 competitive landscape and its place in the security industry analysis.

The company's core offerings include InsightVM for vulnerability management, InsightIDR for extended detection and response (XDR), and DivvyCloud for cloud security posture management (CSPM). These products serve a broad range of customers, from mid-market businesses to large enterprises across various industries. Rapid7's ability to provide integrated solutions positions it well in the market, especially when considering the trends toward converged security platforms. Understanding the Rapid7 market analysis is key to appreciating its strategic moves and overall performance.

Rapid7's geographic presence is global, with a strong foothold in North America and expansion in EMEA and APAC. The company has strategically shifted towards a more integrated platform approach, consolidating its offerings to provide a holistic view of security operations. This digital transformation aligns with the industry trend towards converged security platforms, which is a critical factor in the Rapid7 competitive landscape.

Rapid7 reported total revenue of $798.8 million for the full year 2023, marking a 17% year-over-year increase. The company anticipated total revenue for the full year 2024 to be between $840.0 million and $850.0 million, demonstrating continued growth. However, Rapid7 also reported a net loss of $222.1 million for the full year 2023. This financial scale positions Rapid7 as a significant player, although profitability remains a focus.

Rapid7 holds a particularly strong position in sectors that require robust vulnerability management and incident response capabilities, such as financial services, healthcare, and technology. Its focus on these sectors allows it to tailor its offerings to meet specific industry needs, which is a key aspect of its market strategy. Customer satisfaction and retention are vital for long-term success.

Rapid7's product strategy focuses on providing integrated solutions that offer a holistic view of security operations. This approach helps customers consolidate their security tools and improve their overall security posture. By offering a comprehensive suite of products, Rapid7 can capture a larger share of the cybersecurity market. The company's commitment to innovation is evident in its product development and updates.

Rapid7's market positioning is centered on providing comprehensive security solutions that address the evolving needs of businesses. Its focus on vulnerability management and security operations allows it to compete effectively in the cybersecurity market. The company’s ability to adapt to market changes and customer demands is crucial for maintaining its competitive edge. Learn more about the Growth Strategy of Rapid7.

Rapid7's strengths include its strong product portfolio, integrated platform approach, and global presence. Its weaknesses may include its financial performance, particularly the net losses reported in 2023, which is a key factor in evaluating its overall market position. Understanding these strengths and weaknesses is essential when analyzing the Rapid7 competitors.

- Strong in vulnerability management and SecOps.

- Expanding globally, particularly in EMEA and APAC.

- Focus on integrated platform solutions.

- Financial performance, including net losses, needs improvement.

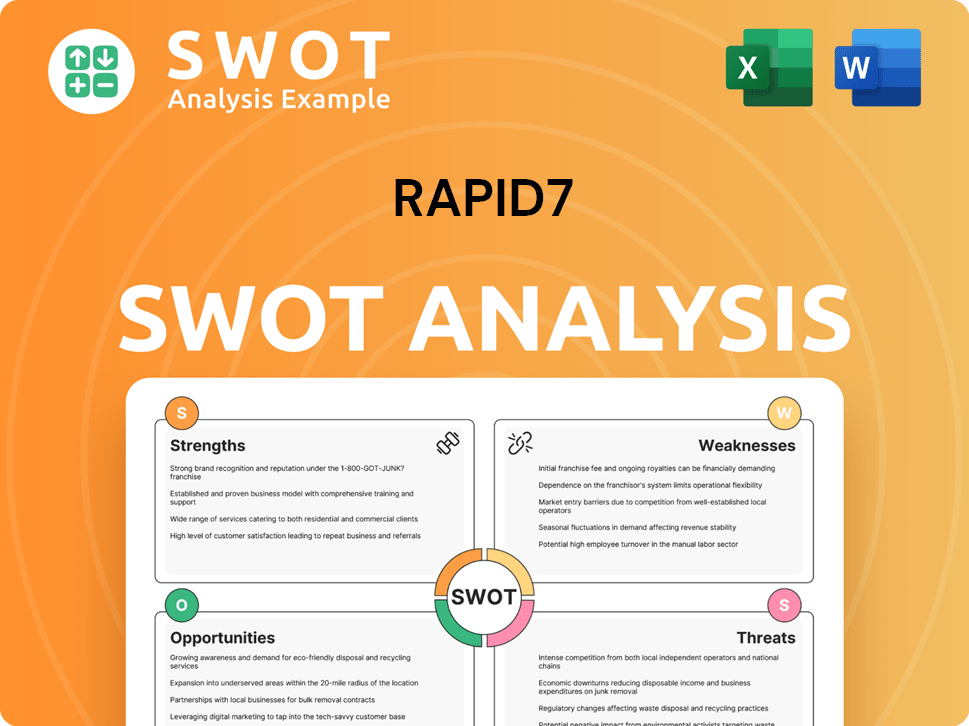

Rapid7 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Rapid7?

The cybersecurity market is fiercely competitive, and the Rapid7 competitive landscape is shaped by a variety of players. Rapid7 faces both direct and indirect competition, requiring it to continually innovate and differentiate its offerings. Understanding the key competitors is crucial for assessing Rapid7's market position and strategic direction.

This analysis delves into the major competitors in the vulnerability management, XDR, and SIEM segments. It also considers emerging players and the impact of industry consolidation. This overview provides a comprehensive security industry analysis, highlighting the challenges and opportunities for Rapid7.

Rapid7 operates in a dynamic cybersecurity market, facing competition from a diverse set of companies. Its main direct competitors in the vulnerability management space include Qualys and Tenable. These companies challenge Rapid7 through their established market presence, broad product portfolios, and strong brand recognition. For a deeper understanding of its customer base, you can explore the Target Market of Rapid7.

Rapid7 InsightVM competitors include Qualys and Tenable. These vendors offer comprehensive vulnerability management solutions. They compete on features, pricing, and market share.

Qualys is a cloud-based security and compliance solution provider. It offers a suite of tools for vulnerability management, web application security, and compliance. Qualys's strength lies in its integrated platform and broad compliance capabilities.

Tenable is known for its Nessus vulnerability scanner and provides extensive vulnerability management platforms. It caters to both IT and operational technology (OT) environments. Tenable's focus on OT security is a key differentiator.

In the XDR and SIEM segments, Rapid7 MDR competitors include Splunk, CrowdStrike, and Microsoft. These companies have significant market presence and offer comprehensive security solutions. They challenge Rapid7 on integration and scale.

Splunk is a dominant force in SIEM and security analytics. It offers powerful data collection and analysis capabilities. Splunk's strength is its ability to handle large datasets and provide advanced analytics.

CrowdStrike specializes in endpoint protection and cloud security. It leverages its Falcon platform for threat detection and response. CrowdStrike's focus on endpoint security is a key differentiator.

Emerging players and specialized vendors also contribute to the competitive landscape. Companies focusing on specific niches, such as cloud security posture management (CSPM) or attack surface management (ASM), can pose indirect threats. Mergers and acquisitions, like Broadcom's acquisition of VMware's security assets, reshape competitive dynamics, leading to consolidation and new integrated offerings. For example, in 2023, the global cybersecurity market was valued at approximately $200 billion, and is projected to reach $345 billion by 2028, indicating significant growth and competition. Rapid7 market share 2024 is influenced by these dynamics, as it continually navigates competitive pressures by focusing on innovation and differentiation in its platform. Understanding Rapid7 vs. CrowdStrike and Rapid7 vs. Splunk is crucial for evaluating Rapid7's position.

Several factors influence the Rapid7 market analysis and its ability to compete effectively.

- Product Features: The breadth and depth of features in vulnerability management and XDR solutions. Rapid7 vulnerability scanner features are compared against those of competitors.

- Pricing: Competitive Rapid7 pricing comparison is essential for attracting customers.

- Market Presence: Established brands and their existing customer bases.

- Innovation: The ability to develop new technologies and adapt to evolving threats.

- Customer Service: The quality of support and customer satisfaction. Rapid7 customer reviews provide insights into customer experiences.

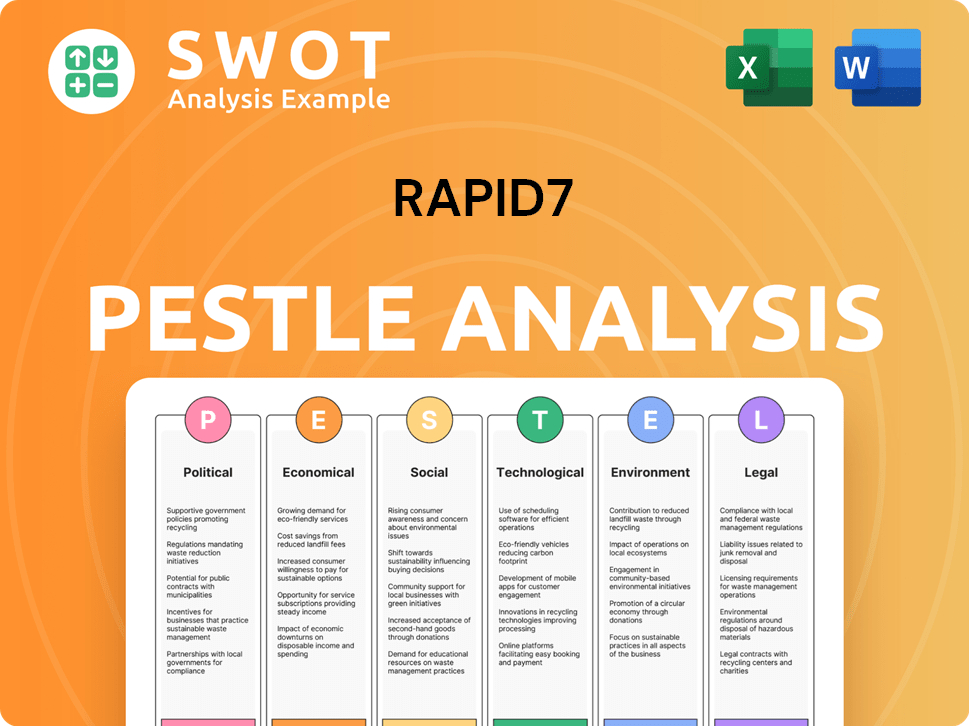

Rapid7 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Rapid7 a Competitive Edge Over Its Rivals?

Understanding the Rapid7 competitive landscape involves assessing its core strengths and how it differentiates itself in a crowded market. The company has carved a niche by providing an integrated security platform designed to simplify complex cybersecurity challenges. This approach allows for a more cohesive security posture compared to using disparate tools.

Key to Rapid7's success is its focus on user experience and automation, which are critical in addressing the cybersecurity skills gap. The company's strategy emphasizes providing actionable insights and streamlining security operations. This focus is reflected in its product offerings and is a key factor in customer loyalty.

The company's competitive advantages are continuously evolving, especially with the growing emphasis on cloud-native security and AI-driven analytics. However, the security industry analysis shows that Rapid7's ability to maintain its edge depends on its ongoing innovation and adaptation to the changing threat landscape.

Rapid7 unifies vulnerability management (InsightVM), extended detection and response (InsightIDR), and cloud security (DivvyCloud) into a single platform. This integration enhances data correlation, threat detection, and incident response. This approach simplifies security management and reduces the complexity often associated with multiple security tools.

Rapid7 invests heavily in proprietary technologies, including vulnerability research and threat intelligence. The company's research team constantly identifies new vulnerabilities and develops signatures. This intellectual property provides up-to-date protection and a competitive advantage in the rapidly evolving threat landscape.

Rapid7 emphasizes automation within its platform to streamline routine tasks, prioritize vulnerabilities, and automate responses. The company's focus on user-friendly interfaces and actionable insights fosters strong customer loyalty. Automation improves operational efficiency for security teams.

Rapid7 has built a strong brand reputation for innovation and customer support. Its commitment to delivering actionable insights and a user-friendly interface has fostered strong customer loyalty. This reputation helps the company maintain its competitive position.

Rapid7 distinguishes itself through its integrated platform, proprietary technologies, and a strong focus on user experience and automation. The company's ability to provide comprehensive visibility and rapid response is a key differentiator. This approach is highlighted in the article Revenue Streams & Business Model of Rapid7.

- Integrated Security Platform: Unifies various security functions for better data correlation and threat detection.

- Proprietary Technologies: Extensive vulnerability research and threat intelligence capabilities provide up-to-date protection.

- Automation: Streamlines routine tasks and automates responses to improve operational efficiency.

- User-Friendly Interface: Actionable insights and a user-friendly interface foster strong customer loyalty.

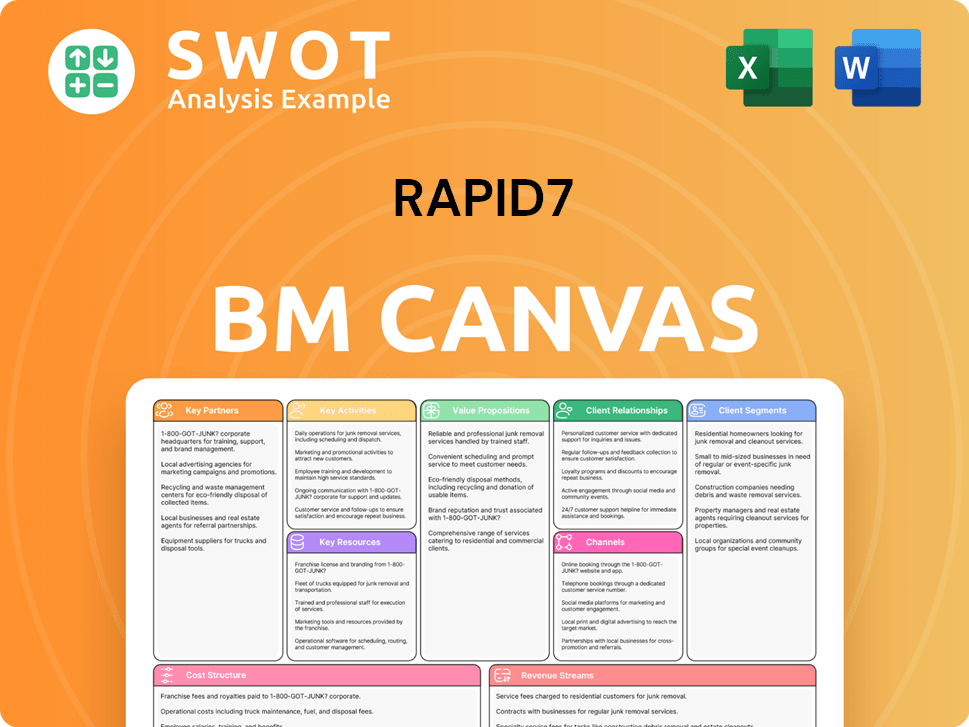

Rapid7 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Rapid7’s Competitive Landscape?

Understanding the Rapid7 competitive landscape involves analyzing its position within the dynamic cybersecurity industry. The company faces both opportunities and challenges shaped by evolving industry trends, including the increasing sophistication of cyber threats and the growing adoption of cloud technologies. A comprehensive Rapid7 market analysis reveals the need to navigate these complexities to maintain a competitive edge.

The cybersecurity market is experiencing significant growth, with projections estimating the global cybersecurity market to reach approximately $345.7 billion in 2024. This expansion provides a favorable backdrop for companies like Rapid7. However, this growth also attracts intense competition, necessitating continuous innovation and strategic adaptation to maintain and grow market share. The ability to effectively manage risks and capitalize on emerging trends will be crucial for success.

The cybersecurity industry is driven by cloud adoption, hybrid work models, and increased cyber threats. These trends are pushing demand for advanced security solutions. Regulatory changes like stricter data privacy laws also influence the market.

Intense competition and the talent shortage in cybersecurity are key challenges. A slowdown in enterprise IT spending could also impact Rapid7. Staying ahead requires continuous innovation in AI and automation.

The demand for integrated security platforms and proactive security solutions is increasing. Expansion into new markets and strategic partnerships can unlock growth. AI-driven innovations present significant opportunities for enhancing offerings.

Rapid7 must invest in R&D for AI and automation, and expand cloud security offerings. Strategic acquisitions can broaden the portfolio and market reach. Adapting to evolving trends will define its competitive position.

To maintain a competitive edge, Rapid7 needs to focus on several key areas. These include enhancing AI-driven threat intelligence, expanding cloud security offerings, and potentially pursuing strategic acquisitions. The company should also consider its pricing strategies and customer service to stay competitive in the market.

- Prioritize investments in research and development, particularly in AI and automation.

- Expand cloud security offerings to meet the growing demand for cloud-based solutions.

- Explore strategic partnerships and acquisitions to broaden the product portfolio and market reach.

- Focus on customer satisfaction and retention to build a loyal customer base.

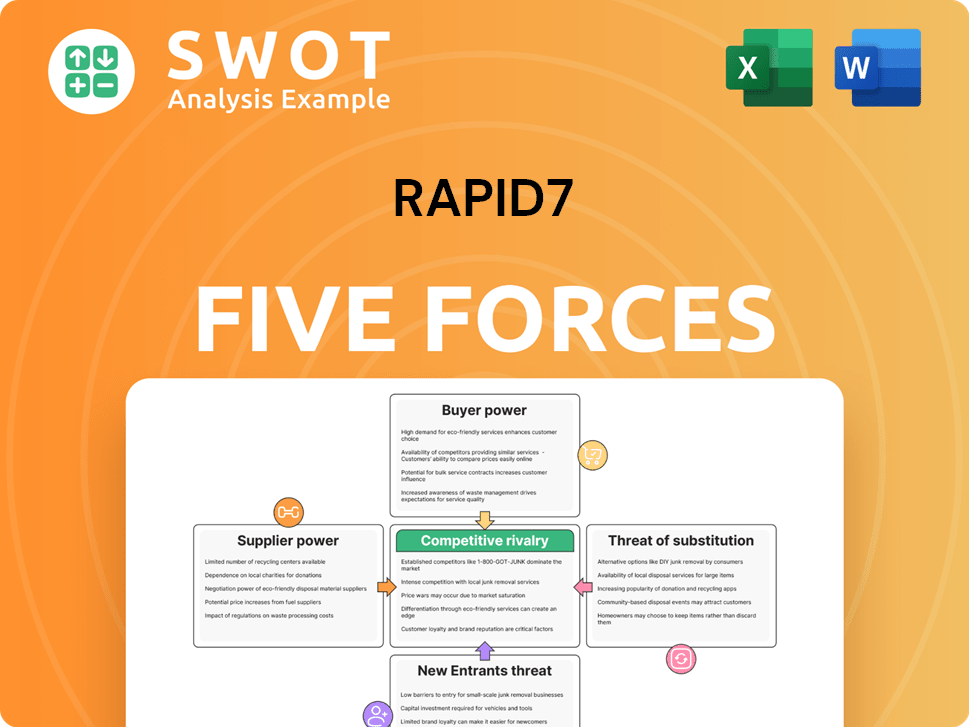

Rapid7 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rapid7 Company?

- What is Growth Strategy and Future Prospects of Rapid7 Company?

- How Does Rapid7 Company Work?

- What is Sales and Marketing Strategy of Rapid7 Company?

- What is Brief History of Rapid7 Company?

- Who Owns Rapid7 Company?

- What is Customer Demographics and Target Market of Rapid7 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.