Renault Bundle

How Does Renault Navigate the Cutthroat Automotive Industry?

In the ever-shifting world of automobiles, Renault carves its path as a major player, but who are its true rivals? Founded in 1898, this French car manufacturer has evolved from early motorized vehicles to a global force. This analysis dives deep into the Renault SWOT Analysis, exploring the company's competitive landscape and strategic positioning in the global car market.

Understanding the Renault competitive landscape is crucial for investors and industry watchers alike. This exploration will identify Renault's main rivals, from established giants to emerging challengers, and provide a detailed Renault market analysis. We'll examine Renault's competitive advantages, its performance in the SUV market, and its strategic partnerships, comparing it against competitors like Peugeot and Volkswagen to understand its impact on the European car market and its global sales figures.

Where Does Renault’ Stand in the Current Market?

The Renault Group holds a significant position in the global automotive industry, particularly in Europe. Its market strategy focuses on enhancing profitability and market share through electrification and a shift towards higher-value segments. The company demonstrated strong performance in 2023, with increased sales and a strengthened financial position.

In 2023, the Renault Group's worldwide sales reached 2,235,345 units, marking a 9% increase compared to 2022. The Renault brand itself saw a 9.4% increase in worldwide sales, with 1,548,748 units sold. This solidifies its position as the best-selling French brand globally. The company's focus on the European market and its expansion in the electrified vehicle segment are key components of its competitive strategy.

Renault's core operations center on designing, manufacturing, and selling a wide range of vehicles. The value proposition lies in providing innovative, reliable, and affordable vehicles, with a growing emphasis on electric and hybrid models. This approach aims to meet evolving consumer demands and maintain a competitive edge in the Growth Strategy of Renault.

Europe remains Renault's core market. The brand is a leader in the electrified vehicle segment. In 2023, the Renault brand's electrified passenger car sales in Europe increased by 19.7% year-on-year, demonstrating a strong position in the electric vehicle market.

Renault is strategically focusing on higher-value segments. C-segment vehicles represented 39% of the Renault brand's sales in Europe in 2023, an increase of 6 points compared to 2022. This shift aims to improve profitability and market share in key segments.

The Dacia brand, part of the Renault Group, also demonstrated strong performance. Dacia sold 658,321 units worldwide in 2023, up 14.7% from 2022. This growth contributes significantly to the Renault Group's overall market position.

Early 2024 financial indicators show an improving financial performance for the Renault Group. The company is experiencing significant deleveraging and a strengthened balance sheet. These improvements support its strategic initiatives and enhance its competitive position.

Renault's Renault competitive landscape is characterized by its strong presence in Europe and a growing focus on electric vehicles. The company's Renault competitors include major global automotive manufacturers. A comprehensive Renault market analysis reveals a strategic shift towards higher-value segments and electrification.

- Strong sales growth in 2023, with a 9% increase in worldwide sales.

- Significant increase in electrified vehicle sales in Europe.

- Successful performance of the Dacia brand, contributing to overall growth.

- Improved financial health with deleveraging and a strengthened balance sheet.

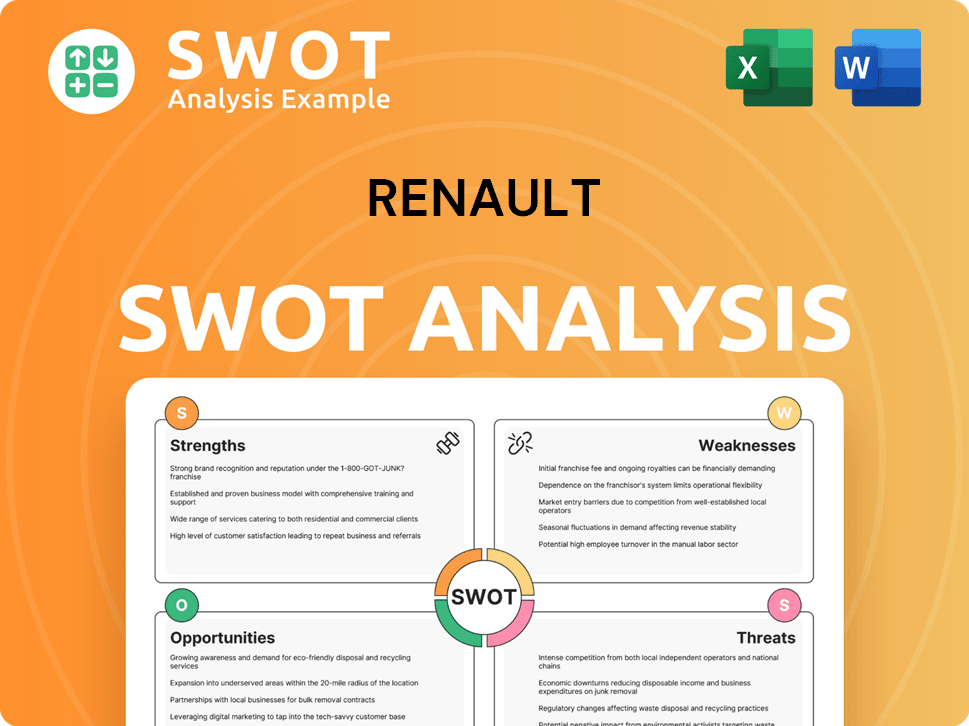

Renault SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Renault?

The Brief History of Renault reveals that the company operates within a dynamic and fiercely competitive global automotive market. Understanding the Renault competitive landscape is crucial for assessing its market position and future prospects. This involves a detailed analysis of its rivals across various segments and geographies.

Renault faces a complex web of competitors, ranging from established European giants to emerging electric vehicle (EV) manufacturers and local players in key markets. The automotive industry is characterized by high capital investments, rapid technological advancements, and shifting consumer preferences, intensifying the competitive pressure.

The company's market share and financial performance are directly impacted by its ability to compete effectively against these rivals. This analysis considers various factors, including product offerings, technological innovation, pricing strategies, and global market presence.

In Europe, Renault's primary direct competitors include the Volkswagen Group, Stellantis, and BMW Group. These companies compete head-on in the passenger car and light commercial vehicle segments. For example, in 2024, Volkswagen's market share in Europe was approximately 12%, posing a significant challenge to Renault.

The EV market presents a new battleground, with Tesla as a key competitor in the premium segment. Chinese EV manufacturers like BYD are rapidly expanding globally. BYD's global sales in 2024 are projected to be over 3 million vehicles, challenging Renault's EV ambitions.

In markets like India, local manufacturers such as Maruti Suzuki and Tata Motors are significant competitors. These companies often have a strong presence due to competitive pricing and local market understanding. Maruti Suzuki's market share in India is consistently above 40%.

The LCV segment sees competition from Ford, Stellantis, and Volkswagen. These competitors offer robust product lines and strong distribution networks. Ford's LCV sales in Europe remain strong, with a market share consistently above 10%.

Strategic alliances and mergers, like the Stellantis merger, reshape the competitive landscape. Stellantis, with its diverse brand portfolio, presents a formidable challenge. Stellantis's global sales in 2024 are projected to be around 6 million vehicles.

Technological advancements, particularly in electric vehicles and autonomous driving, are crucial. Renault's ability to innovate and compete in these areas will determine its future success. Investment in R&D is critical to stay competitive.

Renault's market analysis must consider several factors to understand its competitive position. These factors include product range, pricing strategies, brand image, and technological innovation. Renault's global sales figures in 2024 are expected to be around 1.5 million vehicles.

- Product Range: The breadth and appeal of Renault's model lineup compared to competitors.

- Pricing Strategies: Competitive pricing to attract customers in various segments.

- Brand Image: The perception of the brand in different markets.

- Technological Innovation: Investments in EVs, autonomous driving, and connectivity.

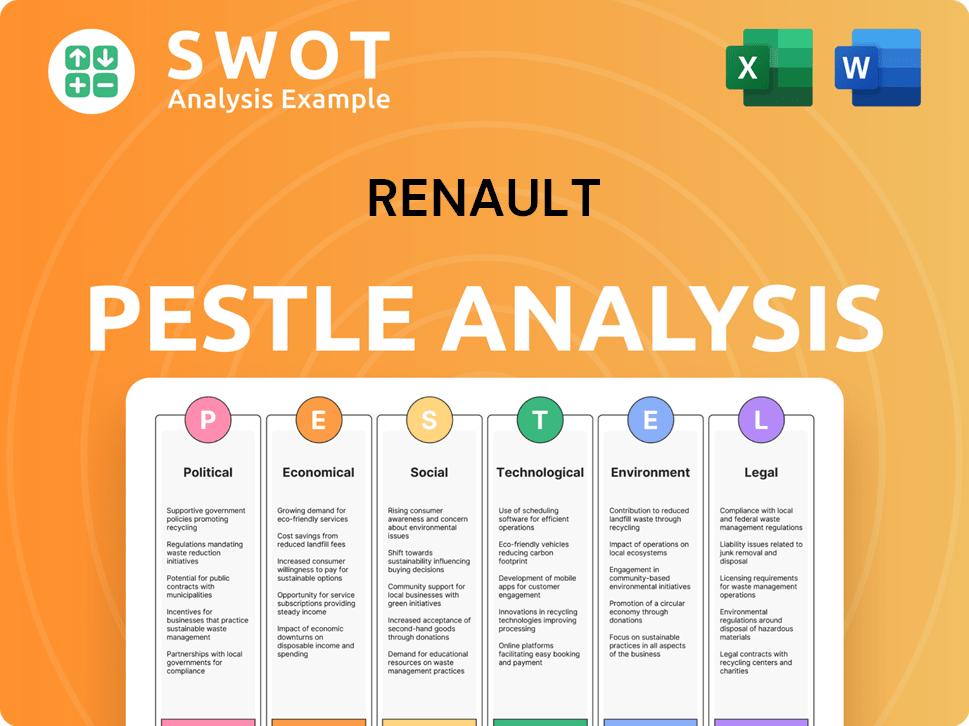

Renault PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Renault a Competitive Edge Over Its Rivals?

Understanding the Revenue Streams & Business Model of Renault is essential to grasping its competitive advantages within the automotive industry. Key milestones for the French car manufacturer include its early adoption of electric vehicle (EV) technology and strategic partnerships, particularly through the Alliance with Nissan and Mitsubishi. These moves have significantly shaped its position in the global car market.

Renault's competitive edge is defined by its strong brand recognition, especially in Europe, and its strategic diversification with the Dacia brand, offering value-focused vehicles. This dual-brand strategy allows the company to cater to a broader customer base and address diverse market segments. Renault's focus on innovation, particularly in EV technology, and its strategic alliances provide a solid foundation for sustained growth.

The company's ability to adapt to market changes and leverage its strengths in design, technology, and strategic partnerships is crucial. Renault's competitive landscape is constantly evolving, requiring it to navigate challenges and capitalize on opportunities in the global automotive industry.

Renault benefits from strong brand recognition, especially in Europe, where it has a long-standing presence. This helps maintain a solid market share. In 2023, the company's global sales reached approximately 1.54 million vehicles.

The Dacia brand provides a competitive advantage by offering affordable vehicles. This strategy allows Renault to target different customer segments and price points effectively. Dacia's sales contributed significantly to the group's overall performance, with over 658,000 vehicles sold in 2023.

Renault is a pioneer in the EV market, particularly in Europe. Its early investments have given it a head start in EV technology and infrastructure. The company's EV sales continue to grow, driven by models like the Megane E-Tech Electric. Renault aims to increase its EV sales to over 30% of its total sales by 2025.

The Alliance with Nissan and Mitsubishi provides shared platforms, technology, and economies of scale. This enhances Renault's competitive position in purchasing and R&D. The Alliance has helped reduce costs and improve efficiency in vehicle production. The Alliance partners are working together to launch over 35 new models by 2030.

Renault's competitive advantages are enhanced by its technological advancements and strategic partnerships. The company's focus on design and innovation, as seen in models like the Scenic E-Tech Electric, strengthens product appeal and market position. Renault's involvement in motorsports, particularly through the Alpine F1 team, contributes to brand visibility and technological development.

- Early mover advantage in the EV market.

- Strong brand recognition and customer loyalty.

- Strategic partnerships for shared resources and cost reduction.

- Focus on innovation and design to meet market demands.

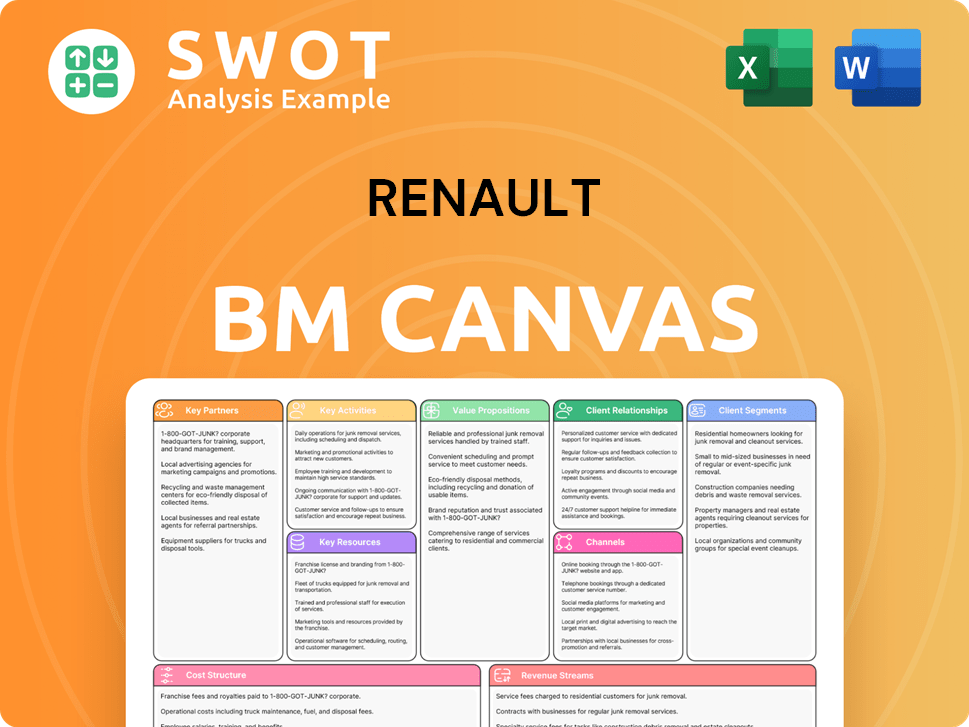

Renault Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Renault’s Competitive Landscape?

The Owners & Shareholders of Renault are navigating a dynamic automotive industry, marked by rapid technological advancements and shifting consumer preferences. The Renault competitive landscape is influenced by the global transition to electric vehicles (EVs), the rise of autonomous driving, and the need for sustainable mobility solutions. This environment presents both challenges and opportunities, requiring strategic adaptation and innovation to maintain and enhance market position.

The Renault market analysis reveals a complex interplay of factors. Stringent emission regulations, particularly in Europe, necessitate significant investments in EV technology. Simultaneously, economic uncertainties, supply chain disruptions, and geopolitical tensions impact production and market demand. The French car manufacturer must also contend with intense competition from established automakers and emerging players, especially in the rapidly growing EV market.

The automotive industry is experiencing a profound transformation driven by electrification, autonomous driving, and connected car services. Consumer preferences are shifting towards sustainable and digitally integrated mobility solutions. Global economic shifts and geopolitical tensions also play a significant role.

Maintaining a leadership position in the EV market amid increasing competition is a key challenge. Adapting to stricter emission standards and integrating advanced technologies like autonomous driving requires substantial investment. Supply chain disruptions, raw material costs, and fluctuating market demand pose additional hurdles.

The growing demand for EVs globally, particularly in emerging markets, offers substantial growth potential. Expanding its charging infrastructure and focusing on affordable mobility solutions through brands like Dacia can capture market share. Strategic partnerships and the 'Renaulution' plan support long-term success.

Renault is investing in EV models and expanding charging infrastructure to capitalize on the growing EV market. The 'Renaulution' plan focuses on value over volume and profitability. Strategic partnerships and collaborations are being utilized to share R&D costs and accelerate technological development.

The Renault competitive landscape is shaped by its ability to adapt to evolving industry trends and consumer demands within the global car market. Renault competitors include major players like Volkswagen and Peugeot, with strategic moves impacting the company's future. Successful navigation requires a focus on innovation, strategic partnerships, and financial resilience.

- Investment in Electric Vehicles: Continuing to develop and launch new EV models to meet growing demand and regulatory requirements.

- Technological Advancements: Investing in autonomous driving and connected car technologies to remain competitive.

- Strategic Partnerships: Forming alliances to share R&D costs and accelerate technological development.

- Market Expansion: Targeting growth in emerging markets, particularly with EV offerings.

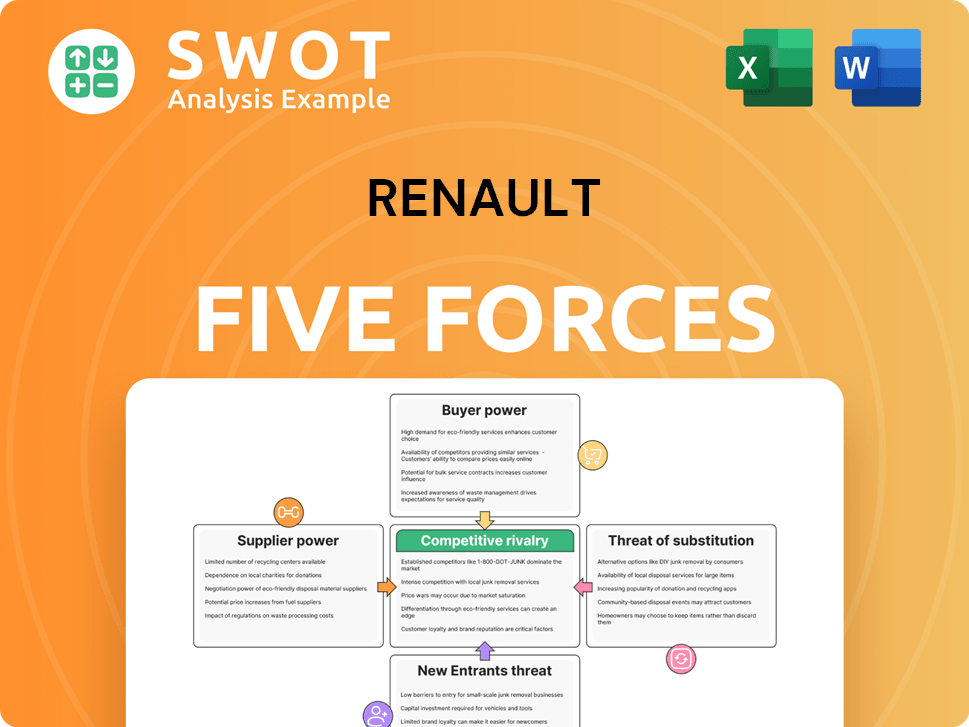

Renault Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renault Company?

- What is Growth Strategy and Future Prospects of Renault Company?

- How Does Renault Company Work?

- What is Sales and Marketing Strategy of Renault Company?

- What is Brief History of Renault Company?

- Who Owns Renault Company?

- What is Customer Demographics and Target Market of Renault Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.