Renault Bundle

Who Buys Renault Cars?

In the ever-evolving automotive landscape, understanding customer demographics and target markets is crucial for sustained success. Renault, a historic name in the industry, has consistently adapted to meet the changing needs of its global customer base. This analysis dives into the heart of Renault's strategy, exploring who their customers are and how the company caters to their preferences.

From its inception, Renault has targeted a broad Renault SWOT Analysis customer base, ranging from families to young professionals, across diverse geographical locations. The company's ability to segment its market and tailor offerings, including electric vehicles, is key to its competitive advantage. This exploration will uncover the specifics of Renault's customer profile, including demographics, buying behaviors, and preferences, to understand how Renault captures its target audience. Understanding the Renault target market, including Renault car buyers, is essential for grasping the brand's future trajectory.

Who Are Renault’s Main Customers?

Understanding the customer demographics of the Renault Group is crucial for its market success. The company strategically targets diverse segments through its various brands, tailoring its offerings to meet specific consumer needs. This approach allows Renault to maintain a strong presence in both the consumer (B2C) and business (B2B) markets.

The Renault brand itself focuses significantly on retail customers, particularly in Europe. This emphasis is evident in the company's sales figures, which show a strong direct-to-consumer approach. The strategic focus extends to different vehicle segments, with a notable shift towards higher-value vehicles, reflecting evolving customer preferences and market trends.

The Renault Group's diverse portfolio, including brands like Dacia and Alpine, caters to a wide spectrum of customers. Dacia appeals to cost-conscious buyers, while Alpine targets performance enthusiasts. Renault Trucks serves the B2B market, particularly the heavy-duty vehicle sector, further diversifying the company's customer base.

In 2024, retail customers accounted for 63% of the Renault brand's sales in Europe, significantly above the market average. This highlights the brand's strong direct-to-consumer strategy. The focus on retail sales is a key element of Renault's customer strategy, driving a significant portion of its revenue.

Renault is strategically pursuing value, particularly by focusing on the C and above segments. Sales in the C-segment and above represented 41.3% for the Renault brand in Europe in 2024. This is a 15-point increase in four years, indicating a shift towards customers seeking larger, more feature-rich vehicles.

Dacia, a key brand under the Renault Group, recorded 676,340 sales worldwide in 2024, a 2.7% increase from 2023. Dacia's core customer base is retail buyers, and it consistently holds a strong position on the European PC retail sales podium. The Sandero was the best-selling car across all channels in Europe in 2024 with 271,000 units sold.

Alpine, a performance-oriented brand, saw a 5.9% increase in sales in 2024, with 4,585 vehicles sold. This brand appeals to enthusiasts and those seeking a premium, sporty driving experience. The growth reflects the brand's appeal within a niche market segment.

Renault's strategy includes a strong focus on electrified and technologically advanced vehicles, targeting a demographic interested in these features. Hybrid offerings constituted 40% of ICE sales in 2024, and EV models like the Scenic E-Tech electric and Renault 5 E-Tech electric are gaining traction.

- The Renault 5 E-Tech electric was the best-selling B-segment electric city car in France for November and December 2024.

- This indicates a shift towards customers interested in sustainable and technologically advanced vehicles.

- The success of these models highlights Renault's commitment to the EV market.

- This focus is also discussed in the Growth Strategy of Renault.

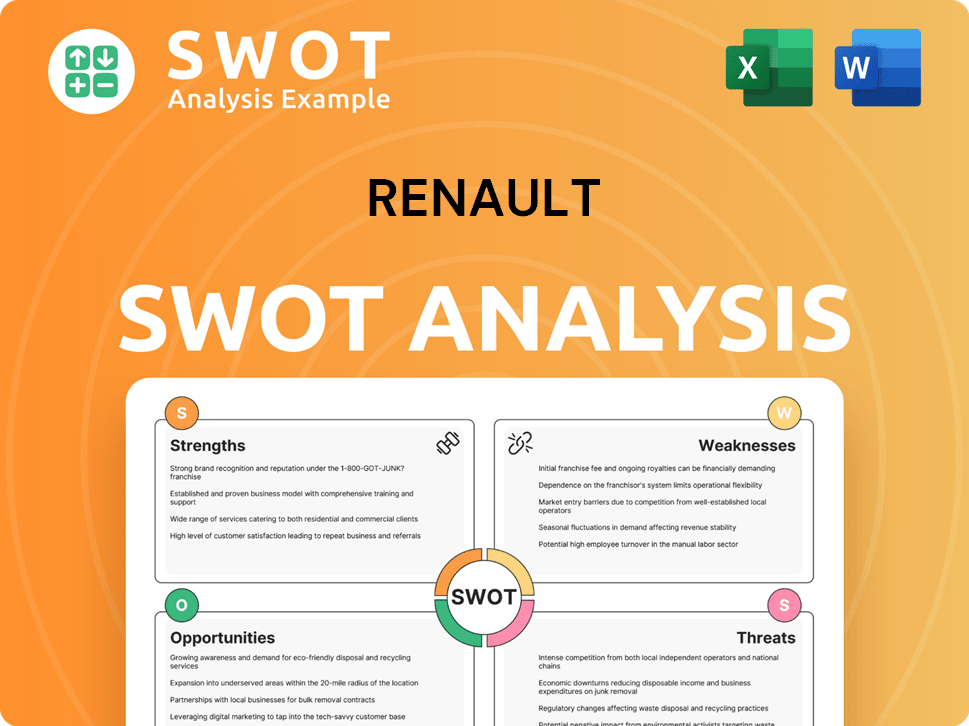

Renault SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Renault’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Renault Group. The company's approach is centered on delivering value, embracing electrification, and incorporating modern features to meet the evolving demands of its target market. This focus is evident in the strategic decisions and product offerings designed to resonate with its diverse customer base.

Renault's strategy emphasizes providing vehicles that offer a balance of quality, features, and affordability. This approach aims to boost competitiveness while protecting profit margins. The company's ability to adapt and respond to changing consumer needs, particularly in areas like electrification and vehicle features, is critical for maintaining its market position and appealing to its customer demographics.

The company's electrification strategy is a key driver, with a 33% electrified sales mix in Europe in 2024, marking a 4.1-point increase from 2023. For the Renault brand in Europe, nearly half of sales were electrified in 2024. This shift reflects the growing customer demand for electric and hybrid vehicles.

Renault's 'value over volume' strategy focuses on providing quality vehicles at competitive prices. This approach is designed to meet customer expectations while maintaining profitability. The company aims to pass on cost reductions to customers, enhancing competitiveness and protecting margins.

Electrification is a major focus, with a 33% electrified sales mix in Europe in 2024. The company's electrification offensive includes hybrid and fully electric models. The Renault brand in Europe saw 49% of sales electrified in 2024.

Hybrid vehicle sales increased by 30% in 2024, making Renault the second-largest player in the European full-hybrid market. This highlights a strong customer preference for hybrid options as a transition to full electric vehicles.

The Scenic E-Tech electric and Renault 5 E-Tech electric have received positive customer reception. These models have won awards and quickly become top sellers in their respective segments. The Renault 5 E-Tech electric, launched in October 2024, was the best-selling B-segment electric car in November and December.

Renault's strategic focus on the C and above segments, which represented 41.3% of the brand's sales in Europe in 2024, indicates a demand for more spacious, comfortable, and feature-rich cars. This shift aligns with changing customer preferences for enhanced vehicle experiences.

Renault launched 10 new models and two facelifts in 2024, with seven new models and two facelifts planned for 2025. This rapid product offensive aims to address evolving customer desires and maintain a fresh and competitive lineup.

The Renault Group's customer preferences are shaped by a desire for value, electrification, and modern features. The company's strategic focus on these areas drives its product development and market positioning. Understanding the Competitors Landscape of Renault is essential for adapting to market dynamics.

- Value: Customers seek vehicles that offer a balance of quality, features, and affordability.

- Electrification: Growing demand for electric and hybrid vehicles. In 2024, 49% of the Renault brand's sales in Europe were electrified.

- Modern Features: Preference for spacious, comfortable, and feature-rich cars, particularly in the C and above segments.

- Product Innovation: Rapid product updates and new model launches to meet evolving customer desires.

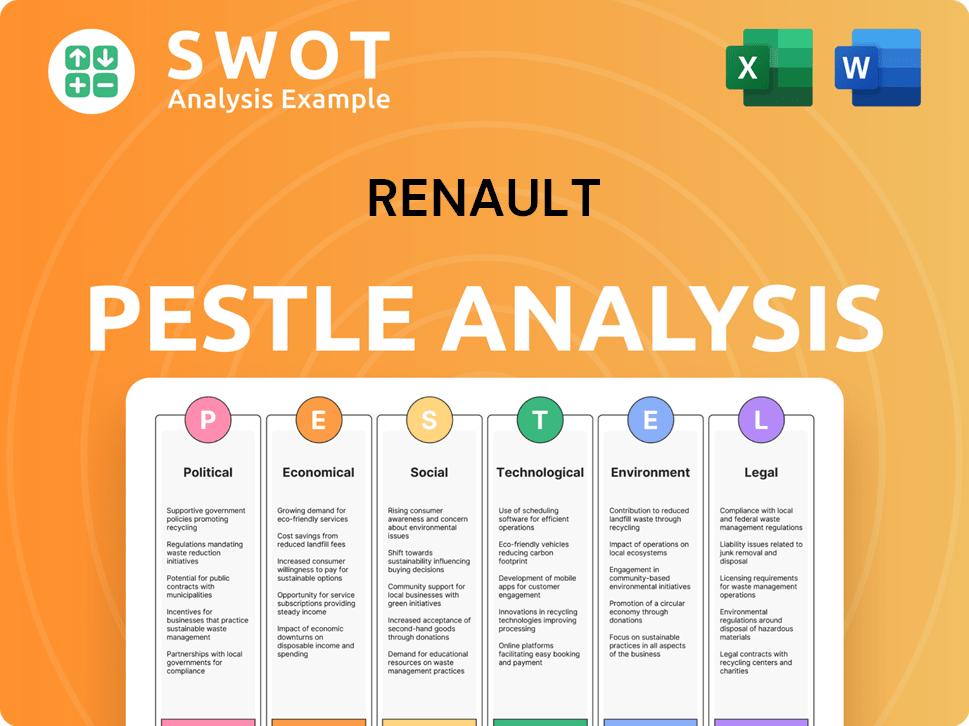

Renault PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Renault operate?

The geographical market presence of the company is extensive, spanning across 114 countries. In 2024, the company sold a total of 2.265 million vehicles globally, demonstrating its widespread reach. Europe remains a key stronghold for the company, with significant market share and sales figures.

In 2024, the company's sales in Europe reached 1.6 million cars, securing its third position in the PC+LCV (Passenger Car + Light Commercial Vehicle) segment. The company brand itself experienced a growth of 3.3% in Europe, outpacing the market's 1.7% growth rate. The company holds a 6.7% market share in Europe.

The company's strategic approach includes targeted expansion outside of Europe, particularly in regions outlined in its 'International Game Plan'. This strategy involves focusing on specific markets and adapting products to meet local demands. This approach is crucial for maintaining competitiveness and driving growth across diverse geographical locations.

The company holds a strong position in Europe, with sales figures reaching 1.6 million cars in 2024. The company brand's growth in Europe outpaced the market, demonstrating its strength. The company's market share in Europe is currently at 6.7%, highlighting its competitive presence.

The company is actively expanding in key international markets. Growth in South Korea reached 80.6% in 2024, driven by the Grand Koleos SUV. Brazil saw a 10.3% increase, fueled by the Kardian model. Morocco also experienced growth of 7.2% in 2024.

The company employs localized strategies to address regional differences in customer demographics and preferences. This includes adapting pricing and product offerings to meet specific market needs. The launch of the CMF-B platform in India, with four new models in 2025, is a key example of this approach.

The company is committed to achieving carbon neutrality in Europe by 2040 and worldwide by 2050. This commitment reflects a global approach to environmental challenges. This also aligns with evolving regulatory landscapes and consumer preferences.

The company's focus on specific regions has led to significant growth. The company's strategy includes targeting specific customer segments and adapting its offerings to local preferences. Understanding the Marketing Strategy of Renault is key to grasping their geographical market approach.

- South Korea: 80.6% growth in 2024, driven by the Grand Koleos SUV.

- Brazil: 10.3% growth in 2024, with the Kardian model leading the way.

- Morocco: 7.2% growth in 2024, demonstrating strong regional performance.

- Europe: The company brand grew by 3.3% in Europe in 2024, outpacing the market's 1.7% growth.

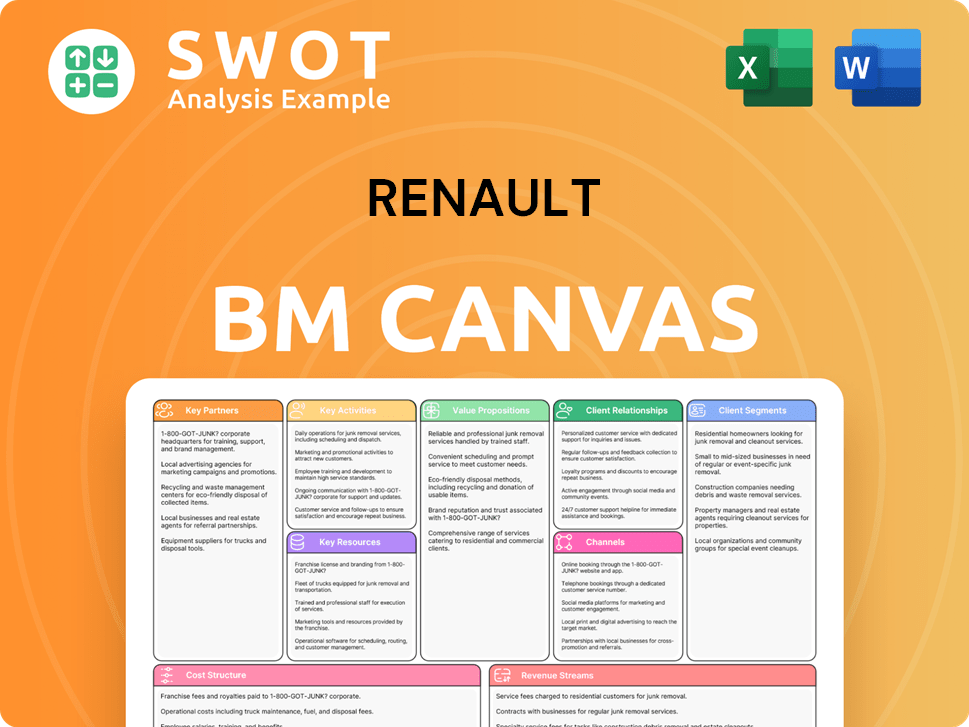

Renault Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Renault Win & Keep Customers?

The Renault Group's approach to attracting and keeping customers is multifaceted, focusing on product innovation, electric vehicle (EV) adoption, and delivering value. The company's 'Renaulution' strategy, initiated in 2021, prioritizes profitability and a strong product lineup. This involves launching new models and facelifts to maintain a fresh and appealing range, aimed at both acquiring new customers and encouraging existing ones to upgrade.

A key element of Renault's customer acquisition strategy is its emphasis on electric vehicles. The brand's success with models like the Renault 5 E-Tech electric, which won the Car of the Year 2025 award, is a strong draw for customers seeking electric mobility. Renault's strategy includes offering both electric and ICE & hybrid vehicles, providing flexibility to adapt to the pace of EV transition and catering to a wider customer base. This dual approach allows the company to capture a broader market share.

For customer retention, Renault emphasizes sales quality and personalized experiences, aiming to build strong relationships with its end-users. The focus on maintaining high residual values for its vehicles supports customer loyalty and repeat purchases. Renault also aims to reduce costs and pass those gains to customers through improved vehicle content, making their offerings more competitive.

Renault launched 10 new models and two facelifts in 2024. An additional seven models are planned for 2025. This continuous product refresh attracts new buyers and encourages existing customers to upgrade, increasing brand appeal.

Renault’s electrified sales mix in Europe reached 33% in 2024, a 4.1-point increase from 2023. The Renault brand's electrified sales mix in Europe was 49% in 2024, with hybrid sales up 30%. The Renault 5 E-Tech electric is a key model driving EV adoption.

Sales to retail customers in Europe represented 63% of the Group's sales in 2024. This is a 21-point increase over the market average, showing a strong direct relationship with end-users. This focus improves customer satisfaction and retention.

Renault aims to incorporate 33% of materials from the circular economy into new vehicles by 2030. The company targets a net-zero carbon footprint in Europe by 2040. These efforts appeal to environmentally conscious customers.

Renault's strategy reflects a deep understanding of its Brief History of Renault and the evolving needs of the market. The company's customer acquisition and retention strategies are designed to adapt to changing consumer preferences and technological advancements. The emphasis on value, electrification, and sustainability is likely to attract a broad range of customers, from those seeking economical options to those prioritizing environmental responsibility. Renault's ability to balance these factors will be critical to its long-term success in a competitive automotive market. Understanding the

Renault's customer base includes a mix of demographics, with a growing focus on environmentally conscious buyers. The company's product range caters to various needs, from compact city cars to larger SUVs. The target audience includes both individual consumers and fleet customers.

Renault segments its market based on vehicle type, price point, and customer needs. The company targets specific segments with tailored marketing campaigns and product offerings. This targeted approach helps maximize market penetration and customer satisfaction.

Renault's customer buying behavior is influenced by factors such as price, fuel efficiency, and brand reputation. The company uses data analytics to understand these behaviors and personalize its marketing efforts. Online configurators and test drives play a crucial role.

Renault is actively targeting customers interested in electric vehicles (EVs). The Renault 5 E-Tech electric and other EV models are designed to attract buyers seeking sustainable mobility solutions. Government incentives and charging infrastructure also influence EV adoption.

Renault appeals to customers who value innovation, sustainability, and affordability. The brand's focus on value and advanced features resonates with a broad audience. Customer feedback is crucial to understand and adapt to changing values.

Renault targets emerging markets with vehicles designed to meet local needs and preferences. The company tailors its product offerings and marketing strategies to each region. This approach helps Renault expand its global footprint.

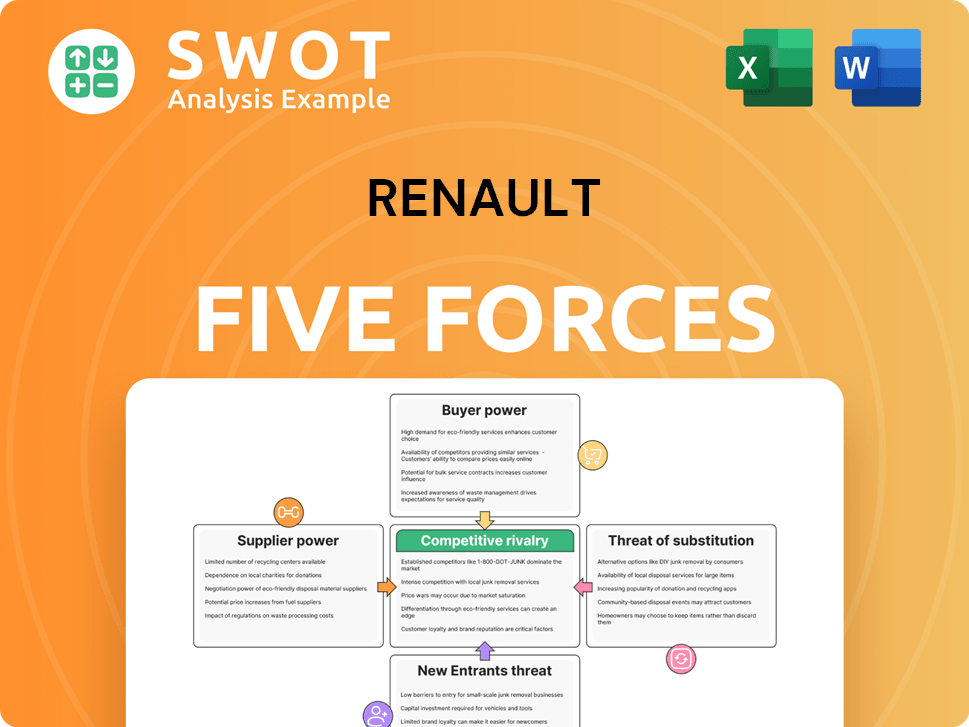

Renault Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renault Company?

- What is Competitive Landscape of Renault Company?

- What is Growth Strategy and Future Prospects of Renault Company?

- How Does Renault Company Work?

- What is Sales and Marketing Strategy of Renault Company?

- What is Brief History of Renault Company?

- Who Owns Renault Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.