Renault Bundle

Can Renault Revitalize Its Automotive Empire?

Renault, a titan of the automotive industry since 1898, is navigating a rapidly evolving landscape. The company's 'Renaulution' plan marks a pivotal shift, prioritizing value over volume in a bid to redefine its future. This analysis explores Renault's ambitious growth strategy, examining its expansion plans, innovations, and strategic foresight in the face of intense competition.

This deep dive into Renault SWOT Analysis will uncover the core elements of Renault's strategy, providing insights into its market positioning and how it plans to capitalize on automotive industry trends. We'll assess Renault's future prospects, considering its electric vehicle market initiatives, strategic partnerships, and expansion plans in emerging markets. Understanding Renault's competitive advantages, financial performance, and adaptation to changing consumer preferences is crucial for evaluating its long-term vision and goals in the global automotive market.

How Is Renault Expanding Its Reach?

The Brief History of Renault reveals the company's ongoing commitment to expansion, a key component of its Renault growth strategy. This strategy focuses on broadening its global footprint, diversifying its product offerings, and forming strategic alliances to solidify its position in the automotive industry. These initiatives are designed to capitalize on emerging market opportunities and adapt to the evolving landscape of the automotive sector, including the growing demand for electric vehicles.

Renault's expansion initiatives are multifaceted, encompassing market penetration, product diversification, and strategic partnerships. The company's plans to acquire 100% of Renault Nissan Automotive India Private Ltd (RNAIPL) from Nissan are a prime example of its dedication to expanding its international business, particularly in the Indian market. This move is a strategic step towards strengthening its presence in key automotive markets outside of Europe. Renault is also focused on introducing new models and technologies to meet the changing needs of consumers and maintain its competitive edge.

Product diversification is a core element of Renault's strategy. The company has launched a significant number of new vehicles and facelifts. This includes the commercial launch of Renault 4 E-Tech electric and the extension of Renault 5 E-Tech electric with a new 40 KWh battery version in 2025. The Dacia brand, part of the Renault Group, achieved 676,340 sales worldwide in 2024, a 2.7% increase compared to 2023, and recorded record market shares in several countries. This demonstrates the company's ability to adapt to changing consumer preferences and maintain a strong market position.

Renault is actively expanding its global presence, focusing on emerging markets. The acquisition of RNAIPL in India is a key move to strengthen its position in the region. Introducing models like Grand Koleos and Kardian in new geographies also supports this expansion.

Renault is launching a range of new models and facelifts to cater to different market segments. This includes electric vehicles like the Renault 4 and 5 E-Tech, as well as models under the Dacia brand. The company aims to offer a mix of electric, ICE, and hybrid vehicles.

Renault is forming strategic alliances to enhance its capabilities and market reach. These partnerships are crucial for adapting to changing consumer preferences and staying competitive. The company is also focusing on the refurbishment of automotive parts.

Renault is committed to sustainability, as seen in its investment in 'The Remakers'. This initiative, launched in May 2024, focuses on the refurbishment of automotive parts. The company targets 50% growth in this business by 2030.

Renault's expansion strategy involves a multi-pronged approach to ensure sustainable growth and adapt to the changing automotive industry trends. The company is focused on market penetration, product diversification, and strategic partnerships to achieve its goals. This includes a 'derisked approach' to offer a variety of vehicle types.

- Expanding into new markets, particularly India.

- Launching new models, including electric vehicles.

- Focusing on strategic partnerships to enhance capabilities.

- Investing in sustainability through initiatives like 'The Remakers'.

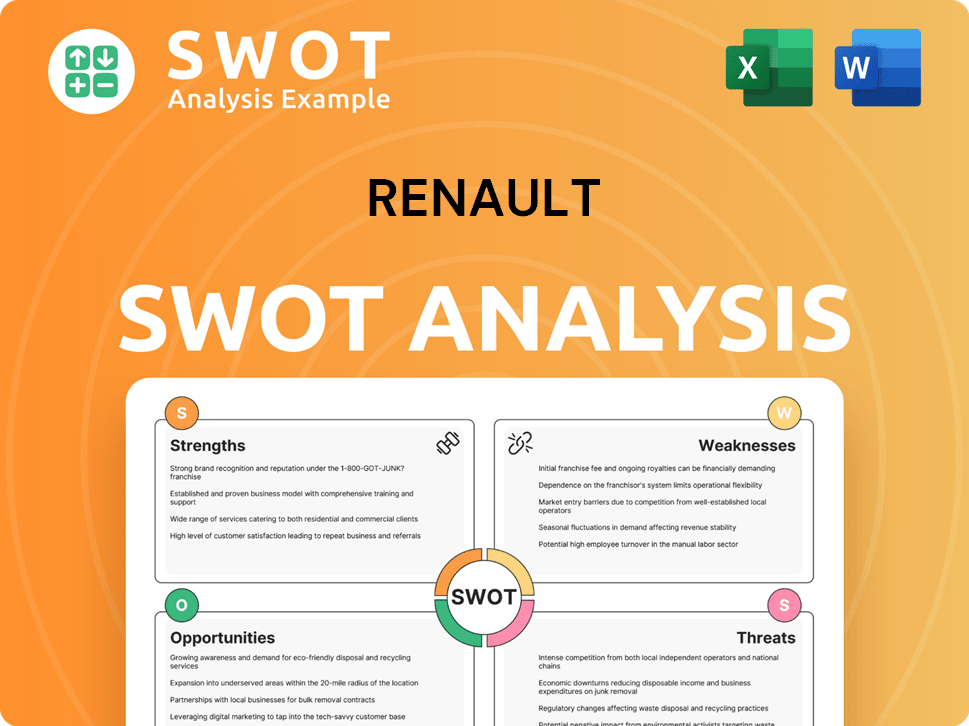

Renault SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Renault Invest in Innovation?

The innovation and technology strategy is a cornerstone of Renault's growth strategy, driving its future prospects in the rapidly evolving automotive industry. This strategy involves substantial investments in research and development, focusing on cutting-edge technologies to meet changing consumer preferences and navigate automotive industry trends. The company's commitment to innovation is evident in its strategic initiatives aimed at enhancing its market share and competitive advantages.

Renault's approach encompasses a two-pronged electrification strategy, highlighting its dedication to both hybrid and electric vehicles. This dual strategy allows the company to cater to diverse customer needs while contributing to the growth of the electric vehicle market. The company's focus on advanced technologies, including AI and IoT, further strengthens its position in the global automotive market.

By integrating sustainable initiatives and focusing on autonomous driving technology, Renault is positioning itself for long-term success. The company's plans for new car models and technologies, coupled with its expansion plans in emerging markets, reflect its commitment to adapting to the challenges and opportunities in the global market. This comprehensive approach is designed to boost Renault's financial performance and outlook.

In 2024, sales of electrified vehicles (electric + hybrid) in Europe increased by 20%. Full-hybrid vehicle sales saw a 30% rise, accounting for 40% of ICE vehicle sales. Renault holds the number two position in the European full-hybrid market.

Renault is implementing dedicated electric platforms, AmpR Small (B segment) and AmpR Medium (C segment), to enhance customer value. These platforms aim to deliver lighter, more efficient, and modern vehicles.

The Renault 5 E-Tech electric was voted Car of the Year 2025, and the Scenic E-Tech electric won Car of the Year 2024. These accolades highlight the success of the electric vehicle strategy.

Renault plans to implement 3,000 AI applications by 2025 to support software-defined vehicles and advanced assembly processes. This initiative is a key part of Renault's investment in autonomous driving technology.

The company showcased its first autonomous electric minibus at the Roland-Garros 2024 tennis tournament, pursuing L4 autonomy for public transportation.

Renault aims for carbon neutrality in its Electro-North pole facilities by 2025 and all European facilities by 2030. The company plans to reduce worldwide emissions by 50% compared to 2019 levels.

Renault is integrating LFP (Lithium Iron Phosphate) battery technology alongside NCM batteries. The first models with LFP technology are expected from early 2026. This strategic move is part of Renault's long-term vision and goals.

- The company's focus on sustainable initiatives reflects its commitment to adapting to changing consumer preferences.

- Renault's investment in AI and IoT technologies is a key part of its strategy for entering the North American market.

- The integration of LFP battery technology is a significant step in Renault's plans for new car models and technologies.

- Renault's growth strategy in the European market is heavily influenced by its electrification efforts.

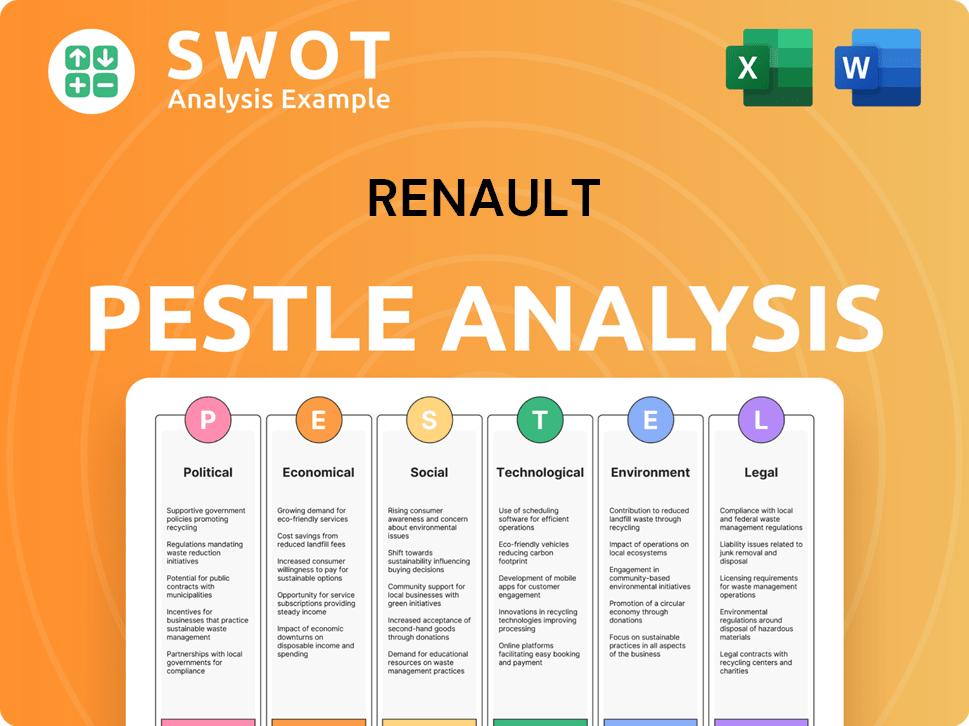

Renault PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Renault’s Growth Forecast?

The financial performance of the Renault Group in 2024 demonstrated significant strength, exceeding the initial guidance for the year. The company achieved record operating profit and robust cash generation, reflecting the effectiveness of its strategic initiatives. This performance underscores the company's resilience and its ability to navigate the complexities of the automotive industry.

In 2024, Renault Group's revenue reached €56.2 billion, marking a 7.4% increase compared to the previous year. The operating profit reached a historic high of €4.3 billion, representing 7.6% of revenue. Net income, Group share, also saw a substantial increase, reaching €2.8 billion, a 21% rise compared to 2023, excluding the impacts related to Nissan. The company's financial health is further highlighted by a solid free cash flow of €2.9 billion, surpassing the guidance of at least €2.5 billion.

The Automotive net cash financial position nearly doubled, reaching €7.1 billion as of December 31, 2024. This strong financial position provides a solid foundation for future investments and strategic growth initiatives. The Group's commitment to financial discipline and operational efficiency has clearly paid off, positioning it well for continued success in the competitive automotive market. For a deeper understanding of the company's strategic marketing approach, you can explore the Marketing Strategy of Renault.

For 2025, Renault Group maintains a positive financial outlook, targeting a Group operating margin of at least 7%. This target includes an estimated negative impact of approximately one point from CO2 emissions regulations in Europe (CAFE). The company's focus remains on sustainable growth and adapting to regulatory changes.

Renault Group aims for a free cash flow of at least €2 billion in 2025. This includes €150 million from the Mobilize Financial Services (MFS) dividend. This demonstrates the company's confidence in its ability to generate strong cash flow and manage its financial resources effectively.

The decision to cancel the Ampere IPO process in January 2024 was driven by current equity market conditions. Renault Group is committed to funding Ampere's development until it reaches breakeven in 2025. This strategic move ensures the continued advancement of its electric vehicle initiatives.

The cancellation of the Ampere IPO does not impact Renault Group's financial guidance for 2025. This highlights the company's ability to adapt to changing market conditions while maintaining its strategic objectives and financial targets. Renault's strategic focus on the electric vehicle market is a key part of its future prospects.

Renault's financial performance in 2024 and its outlook for 2025 demonstrate a commitment to sustainable growth and financial stability. The company's strategic decisions and operational efficiencies are crucial for navigating the automotive industry trends.

- €56.2 billion: Group revenue in 2024.

- 7.6%: Operating margin in 2024.

- €2.8 billion: Net income, Group share, in 2024.

- €2.9 billion: Free cash flow in 2024.

- At least 7%: Group operating margin target for 2025.

- At least €2 billion: Free cash flow target for 2025.

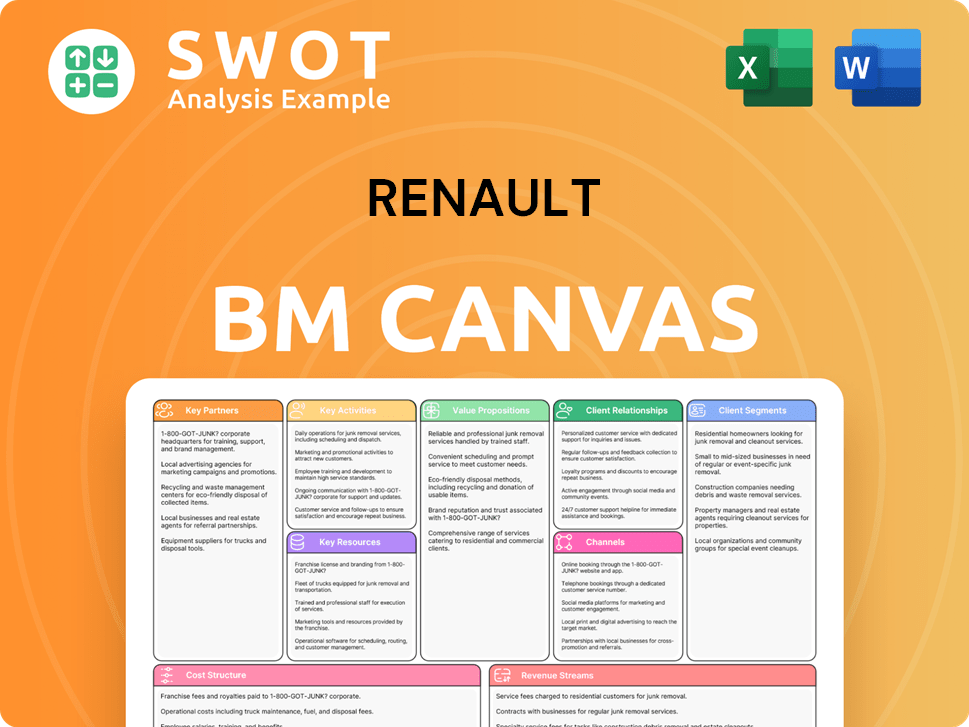

Renault Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Renault’s Growth?

The Renault growth strategy faces several potential risks and obstacles. These challenges span market competition, regulatory pressures, supply chain vulnerabilities, technological disruptions, and internal resource constraints. Navigating these hurdles is crucial for Renault's future prospects and achieving its strategic goals.

Intense competition from both established automakers and new electric vehicle (EV) manufacturers, including the growing presence of Chinese EVs in Europe, presents a significant market challenge. Furthermore, the automotive industry is undergoing rapid technological changes, particularly in areas like AI, autonomous driving, and battery technology, requiring substantial investment and adaptation.

Renault company analysis reveals that stricter CO2 emissions regulations in Europe are expected to reduce the company's operating margin. The company is also working on cost reduction and pricing actions to boost competitiveness and protect margins.

The automotive industry is highly competitive, with established players and new entrants, especially in the electric vehicle market. Chinese EV manufacturers are increasing their presence in Europe, intensifying the competition. This competition impacts Renault market share and profitability.

Stricter CO2 emissions regulations in Europe (CAFE) pose a significant challenge. These regulations are expected to reduce Renault's operating margin by one percentage point, which is equivalent to approximately €500 million in operating profit for 2025. The automotive industry trends are significantly impacted by these regulations.

Supply chain disruptions remain a general industry risk, potentially affecting production and costs. Although not explicitly detailed in recent reports, it's a factor that could impact Renault's operations. These vulnerabilities can lead to production delays and increased expenses.

The automotive industry is rapidly evolving with advancements in AI, autonomous driving, and battery technology. This presents a constant challenge as Renault needs to invest in research and development to stay competitive. These advancements require significant investment and adaptation.

Internal resource constraints, like managing R&D spending and maintaining a healthy capitalization rate, are also factors. Efficient allocation of resources is critical for Renault's success. Managing these constraints is essential for sustainable growth.

The pace of the energy transition is uncertain, requiring Renault to adopt a 'derisked strategy'. This strategy includes offering a mix of electric and ICE/hybrid vehicles. This allows the company to navigate the transition while mitigating risks.

Renault is focusing on cost reduction and pricing actions to protect its margins. The company is also implementing a 'derisked strategy' by offering a mix of electric and ICE/hybrid vehicles. These actions are designed to boost competitiveness and protect profitability in a challenging market.

Stricter CO2 emissions regulations are expected to reduce Renault's operating margin by one percentage point, approximately €500 million in operating profit, for 2025. While the European Commission proposed a strategic plan on March 5, 2025, to support the automotive industry, Renault is not factoring in potential relaxations in its forecasts.

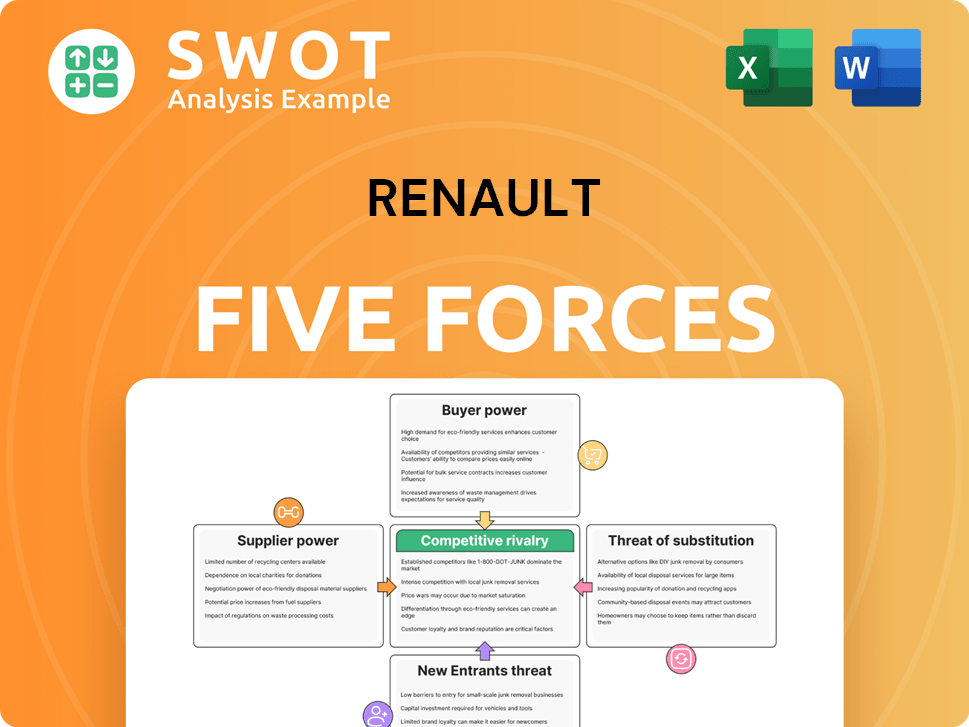

Renault Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renault Company?

- What is Competitive Landscape of Renault Company?

- How Does Renault Company Work?

- What is Sales and Marketing Strategy of Renault Company?

- What is Brief History of Renault Company?

- Who Owns Renault Company?

- What is Customer Demographics and Target Market of Renault Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.