Schrödinger Bundle

Who's Challenging Schrödinger in the Computational Chemistry Arena?

The pharmaceutical and biotechnology sectors are rapidly evolving, fueled by groundbreaking advancements in computational methods. Schrödinger is at the forefront of this transformation, revolutionizing how scientists approach molecular research. But in this dynamic landscape, understanding the Schrödinger SWOT Analysis and its competitive environment is crucial.

This exploration delves into the Schrödinger competitive landscape, providing a comprehensive Schrödinger market analysis. We'll dissect Schrödinger's company overview and its position within the computational chemistry market, identifying key Schrödinger competitors and their strategies. Understanding the competitive dynamics is essential for investors and industry professionals alike, as we examine Schrödinger's platform competitive advantages and its future outlook in this rapidly changing field.

Where Does Schrödinger’ Stand in the Current Market?

Schrödinger has established a strong market position in the drug discovery and materials science software industry. The company specializes in physics-based computational platforms, particularly its Schrödinger Suite. This suite offers tools for molecular modeling, simulation, and data analysis, which are essential in the drug discovery process, from identifying potential drug candidates to optimizing them.

The company's global presence includes a significant footprint in key pharmaceutical and biotechnology hubs across North America, Europe, and Asia. Schrödinger caters to a diverse clientele, including large pharmaceutical firms, small to mid-sized biotech companies, academic institutions, and government labs. This broad customer base highlights the versatility of its platform across various research and development settings.

Schrödinger has strategically evolved to become both a software vendor and a drug discovery company. This dual approach, which combines software licensing with drug discovery collaborations and partnerships, has significantly influenced its market approach. This strategic shift has allowed the company to leverage its computational platform to advance its own pipeline of therapeutic candidates, enhancing its competitive edge in the Schrödinger growth strategy.

Schrödinger is recognized as a leader in physics-based computational platforms. Its focus on highly accurate and predictive computational chemistry gives it a distinct advantage in a specialized niche. This leadership position is crucial in the Schrödinger competitive landscape.

For the full year 2023, Schrödinger reported total revenue of $174.5 million, with software revenue at $129.7 million and drug discovery revenue at $44.8 million. The company anticipates total revenue for 2024 to be between $200 million and $220 million, indicating continued growth. This financial health underscores its robust position in the Schrödinger industry analysis.

Schrödinger serves a diverse customer base, including large pharmaceutical companies, small to mid-sized biotechnology firms, academic research institutions, and government laboratories. This broad customer base reflects the versatility of its computational platform. Understanding the customer base is key to Schrödinger market analysis.

Schrödinger has a global presence with a strong foothold in major pharmaceutical and biotechnology hubs across North America, Europe, and Asia. This global reach supports its ability to serve a diverse customer base and compete effectively in the computational chemistry market.

Schrödinger's competitive advantages include its physics-based approach, which provides highly accurate and predictive computational chemistry. The company's dual business model, combining software licensing with drug discovery, is another key differentiator. This positions Schrödinger favorably in the Schrödinger competitive landscape.

- Strong leadership in physics-based computational platforms.

- Diverse customer base across various research and development settings.

- Dual business model: software licensing and drug discovery.

- Global presence in key pharmaceutical and biotechnology hubs.

Schrödinger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Schrödinger?

The Schrödinger competitive landscape is multifaceted, encompassing both direct and indirect rivals within the computational chemistry market and drug discovery sectors. Understanding these competitors is crucial for a comprehensive Schrödinger market analysis. The company faces challenges from established players and emerging technologies, requiring a strategic approach to maintain and expand its market position.

Schrödinger's company overview reveals a focus on physics-based software solutions. However, the Schrödinger industry analysis shows a dynamic environment, where innovation and strategic partnerships continually reshape the competitive dynamics. The company must continually demonstrate the value of its platform amidst these diverse and evolving competitive pressures.

The competitive environment for Schrödinger is shaped by various factors, including technological advancements, market consolidation, and the increasing adoption of artificial intelligence (AI) and machine learning (ML) in drug discovery. To gain a deeper understanding, consider reading a Brief History of Schrödinger.

Direct rivals offer similar computational chemistry and cheminformatics software. These companies often compete on features, performance, and customer service. The competition drives innovation and influences pricing strategies within the industry.

BIOVIA provides a broad suite of scientific software, including molecular modeling and simulation tools. It competes directly with Schrödinger in areas related to drug discovery and materials science. BIOVIA's extensive portfolio and market presence make it a significant competitor.

OpenEye, now part of Cadence Design Systems, offers molecular modeling and cheminformatics solutions. They often emphasize speed and scalability. The acquisition by Cadence has expanded its resources and market reach.

Certara focuses on biosimulation and regulatory science, with some overlap in drug discovery support. It competes in areas of biosimulation and regulatory science. Certara's expertise in regulatory science provides a unique competitive advantage.

Indirect competition includes entities offering similar outcomes through different means. These competitors may provide services or leverage emerging technologies. The indirect competition landscape is constantly evolving.

CROs offer computational chemistry services, providing similar outcomes to Schrödinger's software. These organizations compete by offering specialized services. The growth of CROs impacts the demand for in-house software solutions.

Companies using AI and ML in drug discovery, such as Insilico Medicine and Recursion Pharmaceuticals, present indirect competition. They emphasize rapid hypothesis generation and lead identification. The rise of AI is transforming the drug discovery landscape.

Schrödinger's competitive strategy analysis involves assessing its strengths and weaknesses in relation to its competitors. The company must continuously demonstrate the unique value and predictive power of its physics-based platform. The competitive landscape is influenced by factors like the efficacy of computational predictions and the integration of various workflows.

- Schrödinger's market share in computational chemistry is influenced by its ability to innovate and adapt.

- Schrödinger's strengths and weaknesses vs. competitors include its physics-based approach.

- Schrödinger's pricing compared to competitors and customer base are critical for market positioning.

- Schrödinger's recent acquisitions and their impact on competition, as well as R&D spending, play a key role.

Schrödinger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Schrödinger a Competitive Edge Over Its Rivals?

The competitive landscape for Schrödinger is shaped by its proprietary, physics-based computational platform. This platform is a core competitive advantage, setting it apart from many rivals in the computational chemistry market. The company's focus on accurate and predictive modeling, derived from years of research, allows it to forecast molecular properties with high precision, which is a key differentiator.

Schrödinger leverages its deep scientific expertise and a talented workforce, including leading computational chemists and physicists. This specialized human capital is crucial for continuous innovation and providing high-level support to its sophisticated user base. The company's dual business model, combining software licensing with drug discovery collaborations, also acts as a competitive advantage. By actively engaging in drug discovery, Schrödinger validates and refines its platform in real-world scenarios, providing valuable feedback for software development.

Schrödinger's success is also evident in its financial performance. While specific market share data for 2024 is still emerging, the company's revenue has shown consistent growth, reflecting the increasing demand for its platform. For instance, in 2023, Schrödinger reported revenues of approximately $212.7 million, a significant increase from previous years. This growth underscores the company's strong position in the computational chemistry market and its ability to compete effectively. Furthermore, the company's strategic partnerships and collaborations have contributed to its revenue streams, as detailed in Revenue Streams & Business Model of Schrödinger.

Schrödinger's competitive edge stems from its proprietary technologies, including force fields, algorithms for molecular dynamics simulations, and advanced quantum mechanics methods. These technologies are protected by a robust portfolio of intellectual property, including numerous patents. This strong IP position creates a significant barrier to entry for competitors attempting to replicate its predictive power.

The dual business model, combining software licensing with drug discovery collaborations, is a strategic advantage. This model not only generates revenue from its own pipeline but also validates and refines its platform in real-world drug discovery scenarios. This provides invaluable feedback for software development, enhancing the company's competitive position.

Schrödinger continuously integrates advanced algorithms and machine learning techniques to enhance its physics-based models. This commitment to R&D is crucial for maintaining its competitive advantage. The company's ongoing investments in research and development, which amounted to approximately $77.4 million in 2023, are a testament to its dedication to innovation.

Schrödinger leverages its strengths in its marketing by showcasing successful drug discovery partnerships and the tangible impact of its platform on reducing development timelines and costs. These partnerships not only validate the platform's effectiveness but also provide valuable case studies that attract new customers and investors.

Schrödinger's competitive advantages are multifaceted, encompassing proprietary technology, a dual business model, and a strong focus on research and development. These factors enable Schrödinger to maintain a strong position in the computational chemistry market.

- Proprietary physics-based platform for accurate modeling.

- Dual business model combining software licensing and drug discovery.

- Strong intellectual property portfolio.

- Deep scientific expertise and a talented workforce.

Schrödinger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Schrödinger’s Competitive Landscape?

The competitive landscape for Schrödinger is shaped by evolving industry trends, presenting both challenges and opportunities. The company, a leader in computational chemistry, faces a dynamic market driven by increasing reliance on artificial intelligence (AI) and machine learning (ML) in drug discovery and materials science. Schrödinger's ability to integrate AI/ML with its physics-based approach positions it well, but it must navigate emerging threats and capitalize on growth prospects.

The company's future hinges on its capacity to innovate, adapt to regulatory changes, and forge strategic partnerships. The Marketing Strategy of Schrödinger will be critical in navigating these dynamics and maintaining a competitive edge. Schrödinger needs to stay ahead in a market that is increasingly competitive.

The computational chemistry market is experiencing rapid growth, driven by the increasing need for faster and more cost-effective drug discovery and materials design processes. AI and ML are becoming crucial for accelerating R&D. Regulatory changes that support in silico methods could further benefit Schrödinger.

The rise of AI-focused startups poses a significant challenge, as these companies aggressively pursue novel approaches. Potential threats include declining demand for traditional software licenses and increased regulatory scrutiny. Aggressive new competitors could disrupt the market with innovative technologies.

Emerging markets, particularly in Asia, offer substantial growth potential due to the expansion of pharmaceutical and biotechnology sectors. Product innovations, such as expanding the platform to new therapeutic areas or materials science applications, are crucial. Strategic partnerships are vital for expanding reach and integrating the platform into broader research ecosystems.

Schrödinger's competitive position is evolving towards a more integrated solutions provider. The company is leveraging its platform to not only enable drug discovery but also to actively participate in developing novel therapeutics. This approach ensures resilience in a rapidly changing industry. The company’s future outlook is promising.

Schrödinger's success will depend on several factors, including its ability to innovate, adapt to market changes, and form strategic alliances. The company’s ability to differentiate itself from competitors will be crucial for long-term success. Schrödinger's market analysis shows that it must continuously enhance its platform.

- Innovation: Continuously integrating AI/ML and expanding platform capabilities.

- Strategic Partnerships: Collaborating with pharmaceutical companies and research institutions.

- Market Expansion: Targeting emerging markets and new therapeutic areas.

- Regulatory Compliance: Adapting to evolving regulatory requirements.

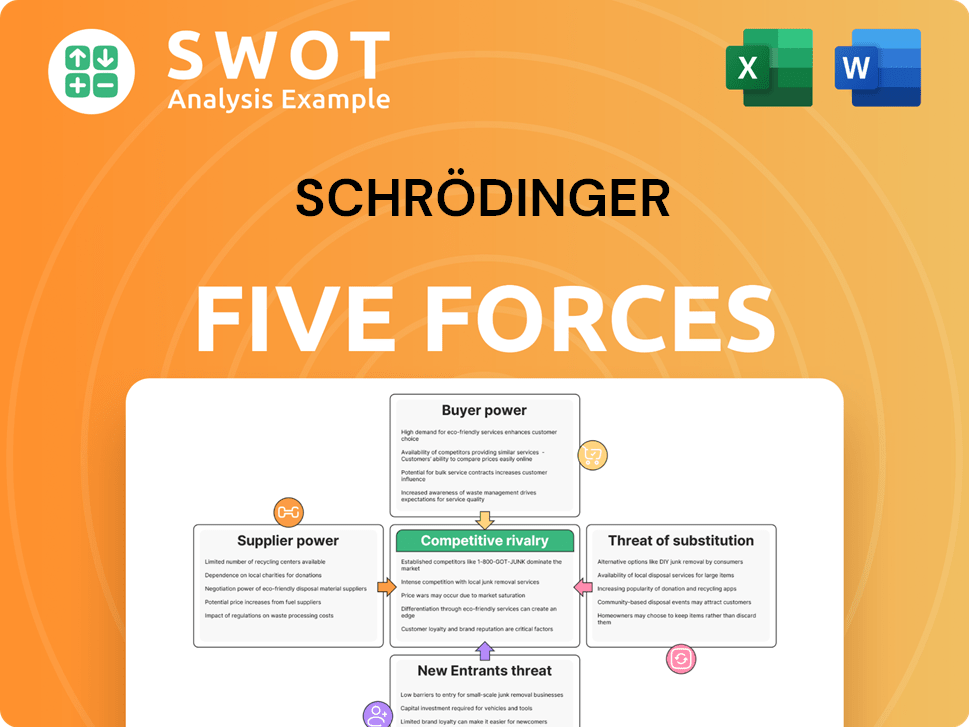

Schrödinger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Schrödinger Company?

- What is Growth Strategy and Future Prospects of Schrödinger Company?

- How Does Schrödinger Company Work?

- What is Sales and Marketing Strategy of Schrödinger Company?

- What is Brief History of Schrödinger Company?

- Who Owns Schrödinger Company?

- What is Customer Demographics and Target Market of Schrödinger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.