Schrödinger Bundle

Can Schrödinger Revolutionize Drug Discovery and Materials Science?

Schrödinger, Inc. has fundamentally reshaped the landscape of drug discovery and materials science since its inception in 1990. By leveraging a physics-based computational platform, the company has moved the industry away from traditional methods. Today, Schrödinger stands at the forefront, serving a global clientele and driving innovation in scientific research.

This Schrödinger SWOT Analysis provides a comprehensive look into the company's ambitious plans. We'll explore Schrödinger's growth strategy, examining its expansion into new markets and commitment to technological innovation. This Schrödinger company analysis will also delve into its financial outlook and potential challenges, providing critical insights into its future prospects and long-term growth potential within the rapidly evolving field of drug discovery and beyond, including its impact of AI in drug discovery.

How Is Schrödinger Expanding Its Reach?

The growth strategy of the company centers on expanding into new markets and product categories. A key aspect of this strategy involves increasing its presence within the pharmaceutical sector, particularly in areas such as oncology and neuroscience. This is where computational drug discovery can significantly accelerate the identification of novel therapeutic candidates. The company is also exploring opportunities in adjacent industries, such as agricultural chemicals and advanced materials, utilizing its core computational platform to address challenges in these new domains.

Product pipeline expansion is another critical component of the company's growth. This includes developing new software modules and platforms to enhance the capabilities of its existing offerings. For example, the company continues to invest in its LiveDesign platform, aiming to provide a more collaborative and interactive environment for drug design teams. International expansion remains a priority, with efforts focused on strengthening its presence in key regions like Europe and Asia, where the demand for advanced computational tools in R&D is rapidly increasing.

The company also pursues strategic partnerships and collaborations with leading pharmaceutical companies and research institutions. These collaborations not only generate revenue but also validate its platform and expand its internal drug pipeline. These initiatives are designed to diversify revenue streams, access new customer bases, and maintain a competitive edge in a rapidly evolving scientific landscape. For a deeper understanding of the company's financial structure, consider exploring the Revenue Streams & Business Model of Schrödinger.

The company is actively expanding its reach within the pharmaceutical sector, especially in oncology and neuroscience. It is also exploring opportunities in adjacent industries like agricultural chemicals and advanced materials. This diversification strategy aims to leverage its core computational platform for broader applications and revenue streams.

The company is focused on developing new software modules and platforms to enhance its existing offerings. This includes improvements in simulation accuracy and the integration of AI-driven insights. The LiveDesign platform is a key area of investment, aiming to improve collaboration in drug design.

The company prioritizes strengthening its presence in key regions like Europe and Asia. These regions are experiencing rapid growth in demand for advanced computational tools in R&D. This international focus aims to capture a larger share of the global market.

The company is pursuing strategic partnerships with leading pharmaceutical companies and research institutions. These collaborations generate revenue and validate its platform. They also help to expand its internal drug pipeline and access new customer bases.

The company's expansion strategy includes several key initiatives designed to drive growth and maintain a competitive edge. These initiatives focus on market diversification, product innovation, and strategic partnerships. These efforts are crucial for the company's long-term growth potential.

- Expanding into new therapeutic areas like oncology and neuroscience.

- Developing new software modules and platforms.

- Strengthening its presence in key international markets.

- Forming strategic partnerships with leading pharmaceutical companies.

Schrödinger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Schrödinger Invest in Innovation?

The sustained growth of the company is driven by a robust innovation and technology strategy, centered on its physics-based computational platform. This approach is crucial for its long-term success, especially in the competitive landscape of the drug discovery industry. The company's commitment to research and development is a key factor in its ability to maintain a competitive edge.

The company's focus on digital transformation and the integration of cutting-edge technologies is another cornerstone of its strategy. Leveraging artificial intelligence (AI) and machine learning (ML) enhances its drug discovery process. These AI-driven capabilities accelerate the discovery cycle and improve the success rate of drug candidates.

The company's innovation and technology strategy is crucial for its future prospects. It directly impacts the company's ability to offer powerful and versatile tools to its clientele, contributing to its growth objectives. The company's consistent innovation in computational chemistry has historically positioned it as a leader in the field. For a deeper dive into the company's marketing approach, consider exploring the Marketing Strategy of Schrödinger.

The company maintains significant R&D investments, which are fundamental to its predictive capabilities. This commitment includes advancements in molecular dynamics simulations and quantum mechanics calculations. These investments are crucial for the company's long-term growth potential.

The company fosters a dynamic ecosystem of scientific advancement through strategic collaborations. These partnerships with external innovators and academic institutions complement in-house development efforts. These collaborations are key to its competitive advantages.

The company is a pioneer in leveraging AI and ML to enhance its drug discovery process. This includes hit identification, lead optimization, and ADMET prediction. This integration significantly impacts the company's role in precision medicine.

The company's platforms contribute to sustainability initiatives by reducing the need for extensive physical experimentation. This minimizes waste and resource consumption. This focus aligns with broader environmental goals.

The company continuously develops new software products and platforms. Recent advancements in force fields and enhanced sampling methods directly contribute to its growth objectives. This continuous development is essential for Schrödinger's business model.

While specific recent patents or awards from 2024-2025 are not readily available in general public information, the company's consistent innovation in computational chemistry has historically positioned it as a leader in the field. This innovation is key to the company's market share analysis.

The company's innovation strategy is centered around its physics-based computational platform, which is crucial for drug discovery. The company focuses on several key areas to drive its growth and maintain a competitive edge.

- Molecular Dynamics and Quantum Mechanics: Continuous advancements in these areas are fundamental to the company's predictive capabilities.

- AI and Machine Learning: Integration of AI and ML to enhance drug discovery, including hit identification and lead optimization.

- Software Development: Continuous development of new software products and platforms, such as advancements in force fields and enhanced sampling methods.

- Strategic Partnerships: Collaborations with external innovators and academic institutions to foster scientific advancement.

Schrödinger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Schrödinger’s Growth Forecast?

The financial outlook for the company is centered on sustained growth, driven by its software business and drug discovery collaborations. The company's Schrödinger growth strategy focuses on expanding its software offerings and increasing its drug discovery partnerships, which are key drivers of its revenue. This strategy is supported by significant investments in research and development (R&D) and sales and marketing, aimed at strengthening its market position and expanding its reach within the pharmaceutical and biotechnology sectors.

For the first quarter of 2025, the company demonstrated robust revenue growth, with total revenue reaching $56.9 million, a 28% increase compared to the same period in 2024. Software revenue increased by 19% to $42.2 million, and drug discovery revenue saw a significant 65% increase to $14.7 million. This strong performance highlights the effectiveness of the company's strategic initiatives and the growing demand for its computational platform. The company's Schrödinger company analysis reveals a commitment to long-term value creation through strategic investments and expansion.

The company's full-year 2025 guidance projects total revenue to be in the range of $235 million to $255 million. This represents a substantial increase from previous years, reflecting the company's confidence in its growth trajectory and its ability to capitalize on market opportunities. The company is actively pursuing strategic funding rounds to support its ambitious growth plans, including expanding its scientific teams and enhancing its technological infrastructure, which are crucial for achieving its Schrödinger future prospects.

The primary revenue drivers for the company include software sales and drug discovery collaborations. Software revenue growth is fueled by the increasing adoption of its computational platform. Drug discovery revenue is boosted by successful partnerships and the advancement of drug candidates through the development pipeline.

The company is heavily investing in R&D to enhance its platform and expand its capabilities. These investments are crucial for maintaining a competitive edge and driving innovation in the drug discovery and materials science industries. This commitment to innovation is a key aspect of its Schrödinger's competitive advantages.

Strategic partnerships play a vital role in the company's growth strategy. Collaborations with pharmaceutical and biotechnology companies provide access to new markets and opportunities for revenue generation. These partnerships also help in accelerating the development of drug candidates, contributing to the company's long-term success.

While the company has historically operated at a net loss due to investments, it is focused on achieving profitability as revenues scale. Analysts generally align with the company's positive outlook, highlighting the increasing demand for its computational platform. For a detailed Schrödinger's financial performance review, see the latest financial reports.

The company is focused on expanding its presence in the drug discovery and materials science industries. This involves targeting new markets and increasing its customer base. The expansion strategy includes both organic growth and potential strategic acquisitions to broaden its capabilities and market reach. The company's Schrödinger's market share analysis indicates significant growth potential.

The company has significant long-term growth potential, driven by its innovative platform and strategic partnerships. The increasing adoption of AI in drug discovery and the growing demand for precision medicine solutions are expected to boost its growth. The company's continued investment in R&D and its ability to secure strategic funding rounds support its long-term growth objectives. For more, read about the Schrödinger's long-term growth potential.

Schrödinger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Schrödinger’s Growth?

The ambitious Schrödinger growth strategy faces several risks and obstacles. Competition within the computational chemistry software market and the rise of AI-driven drug discovery platforms pose significant challenges. Regulatory changes, particularly in data privacy and intellectual property, could also affect the adoption of Schrödinger's technologies.

Technological disruption is a constant, requiring continuous innovation and adaptation. The need for ongoing R&D investment, especially in AI and quantum computing, is crucial. Internal resource constraints, such as attracting and retaining top talent, could also hinder growth. These factors influence the Schrödinger company analysis and its ability to achieve its Schrödinger future prospects.

Schrödinger addresses these challenges through a multi-pronged approach. Diversifying its client base across various sectors helps mitigate risks. The company utilizes robust risk management frameworks, including scenario planning, to prepare for market shifts. While specific recent examples of overcoming obstacles in 2024-2025 are not widely publicized, Schrödinger's history demonstrates resilience in navigating complex scientific and industry changes. Understanding the Mission, Vision & Core Values of Schrödinger provides additional context for its strategic direction.

Competition from other computational chemistry software providers and emerging AI-driven platforms remains a key challenge. Rapid advancements in AI and quantum computing necessitate continuous R&D investment. Staying ahead requires ongoing innovation and adaptation of its platform to remain at the forefront of scientific advancements. These factors directly impact Schrödinger's market share analysis.

Changes in regulations within the pharmaceutical and biotechnology industries, particularly concerning data privacy and intellectual property, could affect Schrödinger's operations. Supply chain vulnerabilities, although less direct, could indirectly impact research conducted by Schrödinger's partners. These risks can influence Schrödinger's long-term growth potential.

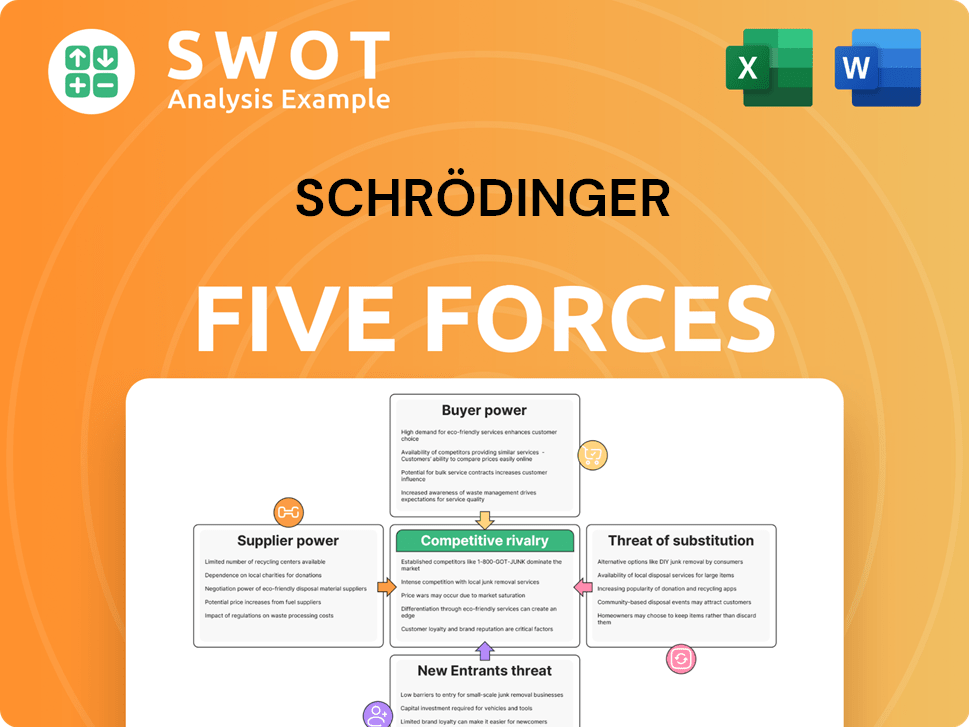

Schrödinger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Schrödinger Company?

- What is Competitive Landscape of Schrödinger Company?

- How Does Schrödinger Company Work?

- What is Sales and Marketing Strategy of Schrödinger Company?

- What is Brief History of Schrödinger Company?

- Who Owns Schrödinger Company?

- What is Customer Demographics and Target Market of Schrödinger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.