Securitas Bundle

How Does Securitas Dominate the Security Services Market?

The security industry is undergoing a radical transformation, fueled by technological leaps and evolving client expectations. Securitas AB, a global leader, stands at the forefront of this change, consistently adapting its strategies to maintain its competitive edge. Uncover the dynamics of the Securitas SWOT Analysis and its impact on the company's market position.

This analysis delves into the Securitas competitive landscape, providing a detailed security industry analysis to understand the key players and their strategies. We'll explore Securitas competitors, examining their strengths, weaknesses, and how they stack up against Securitas in the security services market. Gain insights into Securitas market analysis and understand the factors driving its success, including its global presence and innovative solutions.

Where Does Securitas’ Stand in the Current Market?

Securitas holds a strong market position as a leading global security solutions partner. Operating in 44 markets worldwide, the company employs approximately 336,000 people as of 2024. The company's core operations revolve around providing comprehensive security services, including guarding, mobile patrol, monitoring, and technology-driven solutions.

The company's value proposition lies in its ability to offer integrated security solutions. These solutions encompass a wide range of services designed to meet diverse customer needs. Securitas aims to achieve an 8% operating margin by the end of 2025, with a long-term ambition exceeding 10%. This strategic focus supports its strong competitive position in the security services market.

In the first quarter of 2025, Securitas reported total sales of MSEK 39,606, achieving an operating margin of 6.4%. Technology and solutions sales represented 33% of total sales in Q1 2025, with a real sales growth of 5%. For the full year 2024, total sales reached MSEK 161,921, with an operating margin of 6.9%. This financial performance highlights Securitas's continued growth and profitability within the security industry.

Securitas has a significant global presence, operating in 44 markets worldwide. Its largest regions of operation are Europe and North America, with additional operations in Ibero-America and the AMEA region. This broad geographic footprint allows the company to serve a diverse customer base.

Securitas offers a comprehensive suite of security services. This includes guarding services, mobile patrol, monitoring, alarm systems, and electronic security. The company is also expanding its offerings in risk management and fire and safety solutions. This diversified portfolio supports its competitive advantages of Securitas.

Securitas maintains robust financial health, as demonstrated by its net debt/EBITDA ratio. As of Q1 2025, this ratio stood at 2.5, a decrease from 2.9 the previous year. This indicates improved financial stability and efficient management of its resources. This is a key factor for the Securitas market analysis.

The company is strategically shifting its focus towards higher-margin technology and solutions services. Securitas targets an 8–10% annual average real sales growth in this segment. This strategic shift is evident in the 6% real sales growth within technology and solutions for the full year 2024. This is a key element of the Securitas business strategy overview.

Securitas's financial performance is driven by several key performance indicators. These include total sales, operating margin, and sales growth in technology and solutions. The company's focus on technology and solutions is a significant factor in its competitive intelligence Securitas.

- Total Sales: MSEK 39,606 in Q1 2025, MSEK 161,921 in 2024.

- Operating Margin: 6.4% in Q1 2025, 6.9% in 2024.

- Technology & Solutions Sales Growth: 5% real growth in Q1 2025, 6% real growth in 2024.

- Net Debt/EBITDA Ratio: 2.5 in Q1 2025.

For a deeper understanding of Securitas's financial model and revenue streams, you can explore Revenue Streams & Business Model of Securitas.

Securitas SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Securitas?

The Securitas competitive landscape is characterized by intense rivalry within the global security market. Several key players compete with Securitas, influencing its market position and strategic decisions. Understanding these competitors is crucial for a comprehensive Securitas market analysis.

Securitas competitors employ various strategies to gain market share, including competitive pricing, technological innovation, and extensive distribution networks. The security industry is also affected by mergers, acquisitions, and technological advancements, creating a dynamic environment for all companies involved.

G4S, now part of Allied Universal since 2021, is a major integrated security company. Allied Universal is a leading provider of facility and security services, posing a significant challenge to Securitas.

Prosegur offers security and consulting services, similar to Securitas. It competes through a combination of service offerings and market reach.

Other competitors include SOC, Intelligent Monitoring Group, Tops Security, ADT, Security and Intelligence Services, and others. These companies contribute to the overall competitive pressure.

Competitors use pricing strategies, innovation in security technologies, brand recognition, extensive distribution networks, and advanced technological solutions to gain market share. These strategies directly impact Securitas's market position.

The integration of STANLEY Security into Securitas is a strategic move to enhance technology and solutions offerings. This highlights the importance of strategic acquisitions in the security industry analysis.

Emerging players and technological advancements in AI and remote monitoring continuously disrupt the competitive landscape. This pushes all major players to innovate and diversify their services.

Several factors influence the competitive dynamics within the security market. These include the ability to offer comprehensive security solutions, technological innovation, and global presence. For a deeper dive into the company's history, consider reading Brief History of Securitas.

- Pricing Strategies: Competitive pricing models are essential for attracting and retaining clients.

- Technological Innovation: Implementing advanced security technologies, such as AI and remote monitoring, is crucial.

- Brand Recognition: A strong brand reputation helps in gaining customer trust and market share.

- Distribution Networks: Extensive networks ensure broader market reach.

- Service Diversification: Offering a wide array of security services to meet diverse client needs.

Securitas PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Securitas a Competitive Edge Over Its Rivals?

Analyzing the Owners & Shareholders of Securitas reveals a company that has built a strong competitive position within the security industry. Several key factors distinguish it from its rivals, including its global presence, technological advancements, and specialized service offerings. These elements contribute to its ability to maintain a leading position in the Securitas competitive landscape.

The company's strategic moves have focused on expanding its global footprint and integrating advanced technologies. Securitas operates in 44 markets worldwide, with approximately 336,000 employees as of 2024. This extensive reach allows it to cater to diverse client needs across different regions, providing significant economies of scale. Its commitment to technology and digitalization is transforming it from a traditional guarding services provider to an intelligent protective solutions partner.

Securitas's competitive edge is further enhanced by its deep industry expertise, accumulated over nine decades. This allows it to understand evolving security challenges and offer innovative solutions. The company's resilient business model, which primarily delivers local security services, limits exposure to global trade shifts and macro volatility. These factors, combined with its core values, contribute to its unique company culture and strong brand equity, helping it to maintain a strong position in the security services market.

Securitas's global operations in 44 markets give it a significant advantage. This extensive reach allows the company to serve a diverse client base and benefit from economies of scale. Its ability to provide consistent, high-quality services across different regions strengthens its market position.

The company's focus on technology and digitalization is a key differentiator. Securitas is integrating AI, IoT, video analytics, and biometrics into its solutions. In the first quarter of 2025, technology and solutions sales accounted for 33% of total sales, with a 5% real sales growth.

Securitas leverages its nine decades of industry experience to understand and address evolving security challenges. The company's focus on innovation, as highlighted in its 2025 Global Technology Outlook Report, ensures it remains at the forefront of security technology. This helps them to maintain a strong Securitas market analysis.

Securitas's business model, focused on local security services, provides resilience against global economic fluctuations. This approach, combined with its core values, contributes to its strong brand equity and helps it to maintain a competitive edge in the security industry analysis.

Securitas's competitive advantages include its global presence, advanced technology integration, and specialized services. The company's focus on AI and digitalization aims to enhance operational efficiency and client engagement. These strengths help Securitas maintain its market leadership and differentiate itself from Securitas competitors.

- Global Reach: Operations in 44 markets worldwide.

- Technology Integration: Emphasis on AI, IoT, and video analytics.

- Industry Expertise: Over nine decades of experience.

- Resilient Business Model: Focus on local security services.

Securitas Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Securitas’s Competitive Landscape?

The security industry is experiencing significant shifts, which impacts the Securitas competitive landscape. These changes are driven by technological advancements, particularly in AI and data analytics, cloud technology, and integrated physical and cybersecurity solutions. The demand for technology-driven security solutions is rising, with a move towards remote monitoring and sustainability. Understanding the Securitas market analysis is crucial to navigate these evolving dynamics.

Key challenges for Securitas competitors include keeping pace with rapidly evolving threats, managing cybersecurity risks, and adapting to changing regulations. The global economic environment, marked by uncertainty and geopolitical risks, adds complexity for clients, requiring robust and adaptable security solutions. Furthermore, talent retention remains a persistent challenge within the industry. For a deeper dive into the company's strategic approach, consider exploring the Growth Strategy of Securitas.

The security industry is increasingly shaped by technology, with a focus on AI, data analytics, and cloud solutions. There is a rising demand for integrated physical and cybersecurity solutions. Sustainability is also becoming a key factor, influencing the development and deployment of security services.

Challenges include continuous investment in electronic security systems to counter evolving threats and managing cybersecurity risks. Adapting to changing regulations and the global economic climate are also significant hurdles. Talent retention remains a persistent issue within the security sector.

Opportunities lie in the increased demand for technology-driven security solutions and expansion into emerging markets. Strategic acquisitions and diversification of service offerings, particularly in integrated physical and cybersecurity, are also key. There is a focus on delivering technology-driven solutions and enhancing operational efficiency.

The company aims for an 8% operating margin by the end of 2025, leveraging technology, optimizing its service portfolio, and focusing on cost efficiency. Continued investment in AI and digitalization is a core part of the strategy to deliver more technology-driven solutions and improve operational efficiency.

The security services market is projected to grow significantly. The demand for data centers is expected to rise, presenting new security challenges. The company is focusing on profitable growth and divesting certain business units to sharpen its long-term performance.

- The company aims for an 8% operating margin by the end of 2025.

- Strategic focus on technology-driven solutions and operational efficiency.

- Emphasis on integrated physical and cybersecurity solutions.

- Continued investment in AI and digitalization.

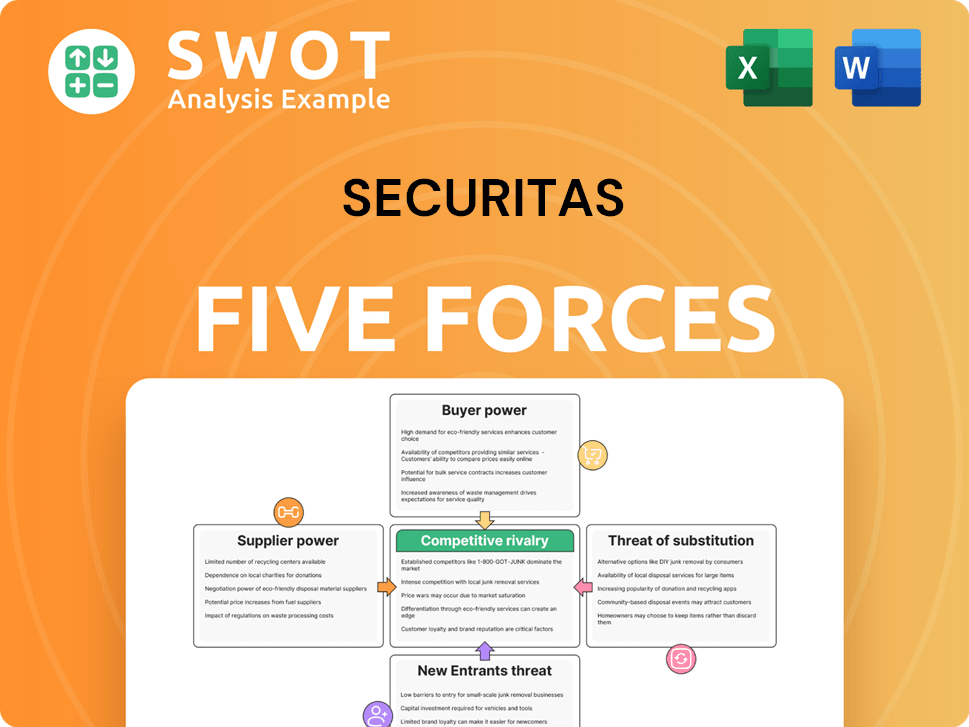

Securitas Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Securitas Company?

- What is Growth Strategy and Future Prospects of Securitas Company?

- How Does Securitas Company Work?

- What is Sales and Marketing Strategy of Securitas Company?

- What is Brief History of Securitas Company?

- Who Owns Securitas Company?

- What is Customer Demographics and Target Market of Securitas Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.