Securitas Bundle

How Does Securitas Secure Your World?

Securitas, a global powerhouse in the security sector, consistently demonstrates its strength through impressive financial results and strategic initiatives. In 2024 alone, the Securitas SWOT Analysis reveals a company navigating a dynamic market. Understanding the inner workings of Securitas is key to grasping its impact on the security landscape.

With a diverse range of Securitas services, from security guard presence to advanced electronic systems, the company caters to a broad clientele. The company's focus on innovation, integrating technology with traditional security guard roles, is a key factor in its continued success. This exploration will uncover how Securitas operates, its revenue streams, and its strategies for maintaining a competitive edge in the private security industry.

What Are the Key Operations Driving Securitas’s Success?

The Securitas company creates and delivers value by providing tailored security solutions that protect client assets, people, and information. Its core offerings include on-site guarding, mobile security services, electronic security solutions, and specialized security services. Securitas services a broad spectrum of customer segments, from small businesses to large multinational corporations, across various industries.

The operational processes enabling these offerings are multifaceted, involving extensive recruitment and training of security guard personnel, deployment of advanced security technologies, and a robust logistical framework for mobile patrols and rapid response. The company's supply chain primarily revolves around sourcing and deploying security technology, maintaining a vast fleet of vehicles for mobile services, and ensuring the continuous training and equipping of its security officers.

What makes Securitas's operations unique is its blend of human intelligence and technology, providing what it terms 'intelligent security.' This approach integrates on-site guarding with advanced electronic security systems and data analytics, enabling proactive threat detection and more efficient incident response. This integrated approach translates into significant customer benefits, offering a more comprehensive and adaptive security posture compared to competitors.

Securitas offers a wide range of security services. These include on-site guarding, mobile patrols, and electronic security systems. Specialized services like corporate risk management and security consulting are also part of their portfolio.

Securitas serves a diverse customer base. This includes small businesses, large corporations, and various industries. Key sectors include retail, manufacturing, healthcare, and critical infrastructure.

The company's operations involve several key processes. These include recruiting and training security personnel, deploying advanced technologies, and managing logistics. They also focus on maintaining a supply chain for technology and vehicles.

Securitas uses an 'intelligent security' approach. This combines human intelligence with technology. It integrates on-site guarding with electronic systems and data analytics.

Securitas's approach to security is comprehensive, integrating various elements to provide effective protection. Their operations are supported by extensive training programs and strategic partnerships. The company's financial performance reflects its strong market position.

- Extensive training programs for security personnel.

- Strategic partnerships with technology providers.

- Focus on integrating human intelligence with technology.

- Comprehensive security solutions for diverse clients.

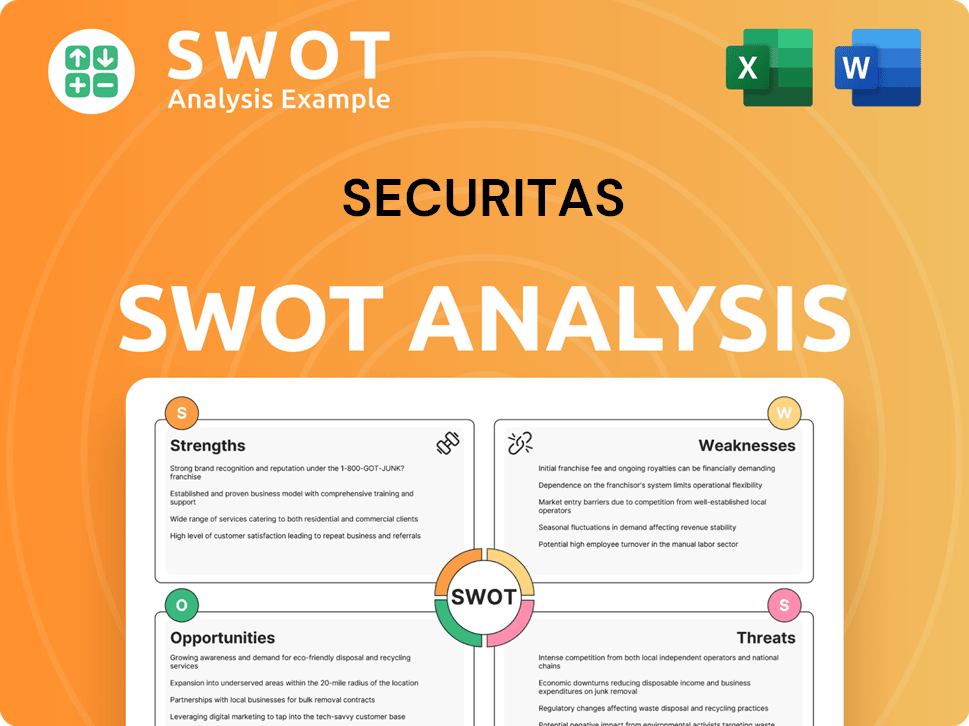

Securitas SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Securitas Make Money?

The Securitas company generates revenue primarily through recurring service contracts, offering a range of security solutions. These solutions include on-site guarding, mobile security, electronic security, and specialized services. This approach allows for a steady and predictable income stream, crucial for long-term financial stability.

The company's focus is on expanding its higher-margin, technology-driven offerings, indicating a strategic shift towards more advanced security solutions. This move aims to increase profitability and meet the evolving needs of the security market. The company's revenue model is designed to provide comprehensive security coverage, ensuring clients receive tailored solutions.

Understanding the revenue streams and monetization strategies of Securitas is essential for investors and stakeholders. The company's financial performance is closely tied to its ability to secure and retain long-term contracts, along with its success in integrating new technologies and expanding its service portfolio. To learn more about the company's past, read the Brief History of Securitas.

The company's revenue model is built on recurring service contracts, ensuring a stable income stream. This includes on-site guarding services, mobile security services, and electronic security solutions. The company also employs cross-selling strategies to offer comprehensive packages.

- On-site Guarding Services: Historically a significant revenue source, providing physical security personnel.

- Mobile Security Services: Includes patrol and response services, offering a flexible security solution.

- Electronic Security Solutions: Involves the installation and maintenance of security systems, such as alarms and surveillance.

- Specialized Security Services: Tailored solutions for specific client needs, enhancing the service portfolio.

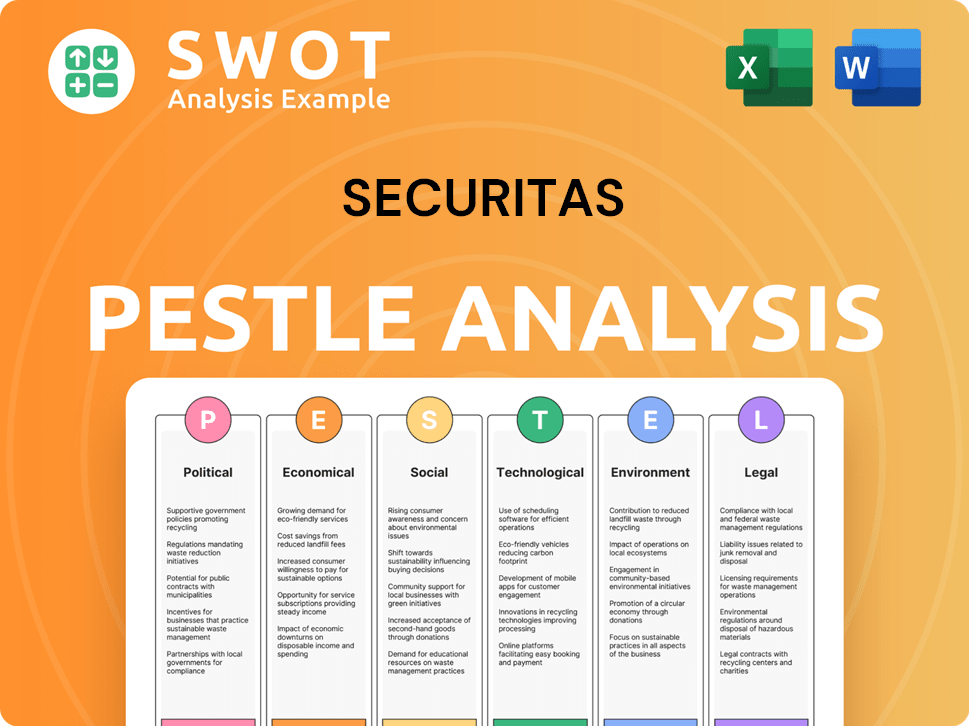

Securitas PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Securitas’s Business Model?

The journey of the Securitas company has been marked by strategic adaptations and key milestones. Their continuous global expansion, achieved through organic growth and strategic acquisitions, has been a cornerstone of their strategy. This expansion has allowed them to establish a presence in over 45 countries, solidifying their position in the private security market.

A notable recent strategic move is the acceleration of its transformation journey, focusing on higher-margin security solutions and digital transformation. The acquisition of Stanley Security in 2022 significantly strengthened their electronic security capabilities and market position, particularly in North America. This move reflects a proactive approach to adapting to evolving market demands and technological advancements in the security sector.

Operational challenges have included navigating diverse regulatory environments and managing a large global workforce. Responding to these challenges, Securitas has invested heavily in training and technology, standardizing best practices, and fostering a culture of innovation. This commitment to operational excellence is crucial for maintaining their competitive edge in the security solutions industry.

Securitas's history includes continuous global expansion through organic growth and acquisitions. They have established a presence in over 45 countries. This expansion has been a key factor in their success.

A recent strategic move is the acceleration of its transformation journey, focusing on higher-margin security solutions and digital transformation. The acquisition of Stanley Security in 2022 was a pivotal move. This strengthened their electronic security capabilities.

Securitas's competitive advantages stem from their strong global brand recognition and extensive operational footprint. They offer competitive pricing and comprehensive service packages. Their commitment to 'intelligent security' provides significant differentiation.

Operational challenges include navigating diverse regulatory environments and managing a large global workforce. Securitas has responded by investing in training and technology. They are also standardizing best practices and fostering innovation.

The company's competitive advantages stem from strong global brand recognition, extensive operational footprint, and economies of scale. They offer competitive pricing and comprehensive service packages. Their commitment to 'intelligent security,' integrating human expertise with technology, provides a significant differentiation.

- Securitas continues to adapt to new trends such as the increasing demand for integrated security solutions.

- They are also addressing cybersecurity threats and the adoption of AI and automation in security operations.

- They constantly refine their offerings to maintain their competitive edge.

- In 2024, Securitas's focus on higher-margin security solutions and digital transformation is expected to drive further growth.

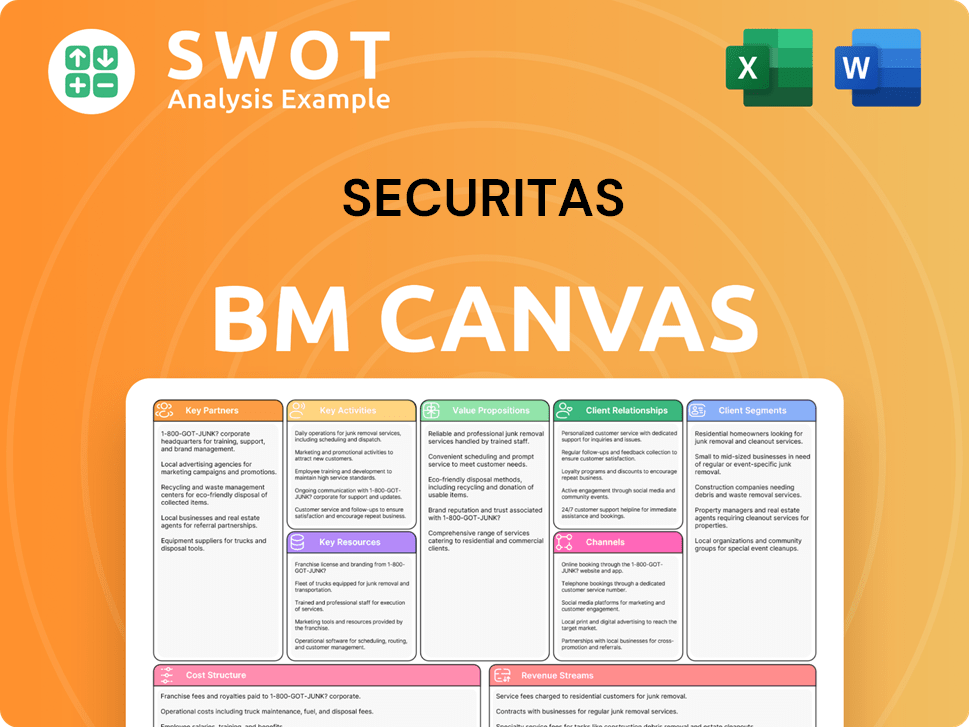

Securitas Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Securitas Positioning Itself for Continued Success?

The Securitas company holds a leading position in the global security services industry. It's recognized as a major player, competing with other large firms. With operations spanning over 45 markets across the globe, the company has a strong presence and a broad customer base. This widespread reach and established brand support strong customer loyalty, contributing to its market position.

However, the Securitas company faces various challenges. These include intense competition from both international and local companies, potential regulatory changes affecting operations, and technological disruptions from new security solutions. Economic downturns could also decrease demand for security services, impacting the company's performance. Understanding these risks is crucial for evaluating its long-term prospects.

The Securitas company is a prominent player in the global security services market. It competes with other large international firms. The company's global reach and brand recognition contribute to its strong market position.

The company faces intense competition and potential regulatory changes. Technological advancements and economic downturns pose additional challenges. These factors can affect the demand for Securitas services.

Securitas focuses on intelligent security solutions, integrating technology and enhancing digital capabilities. Investment in innovation, talent, and sustainable practices are key. These initiatives aim to adapt to evolving market demands.

The future involves leveraging its global scale to capitalize on the growing demand for integrated security solutions. Adapting service offerings and operational models is crucial. The goal is to sustain revenue growth and market leadership.

To maintain its position, Securitas is investing in technology and innovation, focusing on higher-margin services, and expanding its digital capabilities. This includes offering advanced security solutions to meet changing client needs. The company's success depends on its ability to adapt and offer comprehensive security services.

- Focus on integrated security solutions.

- Enhance digital capabilities and technology integration.

- Invest in innovation and talent development.

- Adapt service offerings to meet market demands.

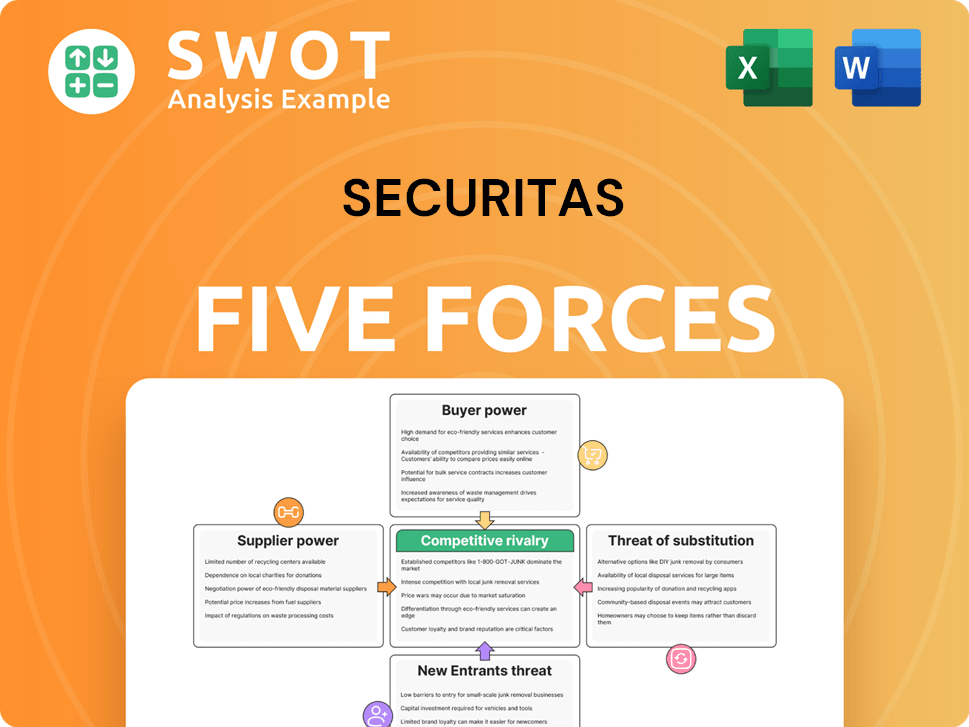

Securitas Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Securitas Company?

- What is Competitive Landscape of Securitas Company?

- What is Growth Strategy and Future Prospects of Securitas Company?

- What is Sales and Marketing Strategy of Securitas Company?

- What is Brief History of Securitas Company?

- Who Owns Securitas Company?

- What is Customer Demographics and Target Market of Securitas Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.