Sembcorp Industries Bundle

How is Sembcorp Industries Navigating the Energy Transition?

The global energy sector is experiencing a monumental shift towards sustainability, and Sembcorp Industries is at the heart of this transformation. As a leading energy and urban solutions provider, Sembcorp is strategically positioned to capitalize on the growing demand for renewable energy and sustainable development. Understanding the Sembcorp Industries SWOT Analysis is crucial to grasping its position in this evolving landscape.

This exploration delves into the competitive landscape of Sembcorp Industries, providing an in-depth industry analysis. We'll examine Sembcorp's market position, key competitors, and how it differentiates itself in the energy sector. The analysis will also cover Sembcorp Industries' competitive advantages and market share, offering valuable insights for investors and strategists seeking to understand this dynamic market and its challenges.

Where Does Sembcorp Industries’ Stand in the Current Market?

Sembcorp Industries holds a strong market position as a leading provider of energy and urban solutions. The company has significantly expanded its presence in renewable energy, aiming to achieve 10 GW of gross installed renewable energy capacity by 2025. This strategic focus on renewables positions Sembcorp as a key player in the global energy transition, making it a notable entity in the competitive landscape.

The company's core operations revolve around renewable energy, gas and power, and integrated urban solutions. Sembcorp serves a diverse customer base, including industrial parks, utilities, and commercial and residential developments. Geographically, its footprint spans across Asia, with a strong presence in Singapore, India, and China, and is expanding into markets like Vietnam and the UK. This diversified approach supports its market position and growth potential.

Sembcorp Industries' value proposition lies in its ability to provide sustainable energy solutions and integrated urban development. By divesting from conventional energy assets and investing in renewables, the company aligns with global sustainability goals. This shift reflects a broader digital transformation and diversification of its offerings, enhancing its market competitiveness and appeal to environmentally conscious investors. For details on the company's ownership structure, you can read more at Owners & Shareholders of Sembcorp Industries.

As of the end of 2023, Sembcorp had 12.0 GW of gross installed renewable energy capacity, surpassing its 2025 target ahead of schedule. This growth demonstrates its strong market position and ability to execute its renewable energy strategy. Sembcorp's focus on sustainable solutions has driven significant expansion.

For the full year 2023, Sembcorp reported a net profit of S$798 million, a 10% increase from the previous year. This robust financial performance, combined with its aggressive renewable energy expansion, highlights its strong market standing. This financial health supports its competitive advantages.

Sembcorp has a strong presence in Asia, particularly in Singapore, India, and China. It is expanding its footprint in other markets, such as Vietnam and the UK. This strategic geographic diversification supports its market position and growth potential. This expansion strategy enhances the company's competitive landscape.

Sembcorp has strategically shifted its positioning towards sustainable solutions, divesting from conventional energy assets and investing heavily in renewables. This move aligns with global sustainability goals and enhances its market competitiveness. This focus is a key factor in its market position.

Sembcorp's market position is supported by several key strengths, including its strong renewable energy portfolio and robust financial performance. The company's strategic focus on sustainable solutions and geographic diversification further enhance its competitive advantages.

- Strong Renewable Energy Portfolio: 12.0 GW of gross installed renewable energy capacity.

- Robust Financial Performance: Net profit of S$798 million in 2023, a 10% increase.

- Strategic Focus on Sustainability: Divestment from conventional energy assets.

- Geographic Diversification: Strong presence in Asia and expansion into new markets.

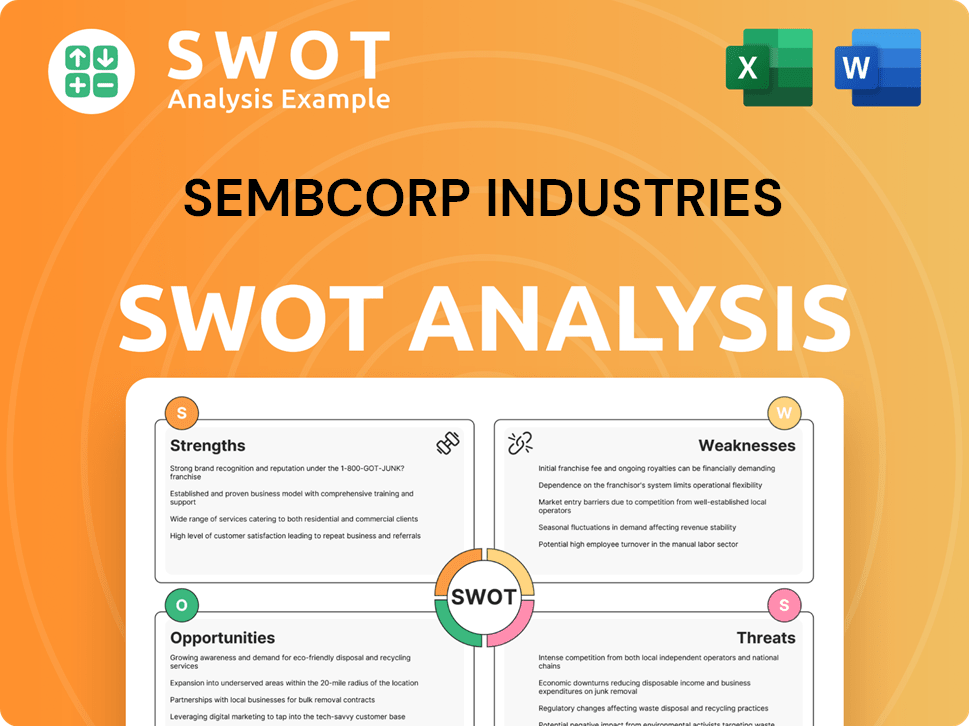

Sembcorp Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sembcorp Industries?

The competitive landscape for Sembcorp Industries is shaped by its operations in the energy and urban solutions sectors. The company faces a diverse range of competitors, from established global players to emerging regional entities. Understanding the competitive dynamics is crucial for assessing Sembcorp's market position and future prospects.

In the renewable energy segment, Sembcorp competes with firms that have significant project pipelines, technological expertise, and financial resources. In the gas and power sector, competition comes from traditional utilities and independent power producers. For integrated urban solutions, Sembcorp faces competition from developers and infrastructure groups. The market is also influenced by new entrants and technological advancements.

The competitive environment is constantly evolving due to mergers, acquisitions, and strategic partnerships. For a deeper understanding of Sembcorp's strategic positioning, consider exploring the Target Market of Sembcorp Industries.

Key competitors in renewable energy include Ørsted and Enel Green Power. These companies have substantial project portfolios and technological capabilities. Companies like China Three Gorges Corporation and Adani Green Energy also pose strong competition in their respective markets.

In the gas and power sector, Sembcorp competes with traditional utilities. These include Tenaga Nasional Berhad in Southeast Asia and various state-owned and private power companies in India and China. These competitors often have established infrastructure.

Sembcorp faces competition from industrial park developers and infrastructure groups. CapitaLand and Ascendas-Singbridge (now part of CapitaLand Investment) are notable competitors in this segment, particularly in Singapore and other Asian markets.

New entrants include technology-focused startups offering smart grid solutions and energy storage technologies. These companies could disrupt traditional business models. Mergers and alliances also reshape the competitive dynamics.

Competitive dynamics are driven by project development, pricing, and advancements in technology. Operational efficiency, fuel procurement, and grid reliability are crucial in the gas and power sector. Land acquisition and master planning are key in urban solutions.

Sembcorp's market position is influenced by its ability to compete effectively. Key factors include large-scale project development, competitive pricing, and technological innovation. Strategic partnerships and acquisitions also play a role in shaping the competitive landscape.

Sembcorp Industries' competitive advantages include its diverse portfolio and experience in both energy and urban solutions. However, the company faces challenges such as intense competition, fluctuating commodity prices, and the need to adapt to technological changes. For example, in 2024, the renewable energy sector saw significant growth, with companies like Ørsted and Enel Green Power expanding their capacities. Sembcorp's ability to secure long-term contracts and manage operational efficiency is crucial for maintaining its market position.

- Market Share Analysis: Sembcorp's market share in the energy sector is substantial, particularly in Southeast Asia.

- Financial Performance: The company's financial performance is closely watched, with analysts comparing its revenue growth and profitability against competitors.

- SWOT Analysis: Sembcorp's strengths include its diversified business model and strong presence in key markets.

- Strategic Partnerships: Collaborations with technology firms and infrastructure providers are essential for growth.

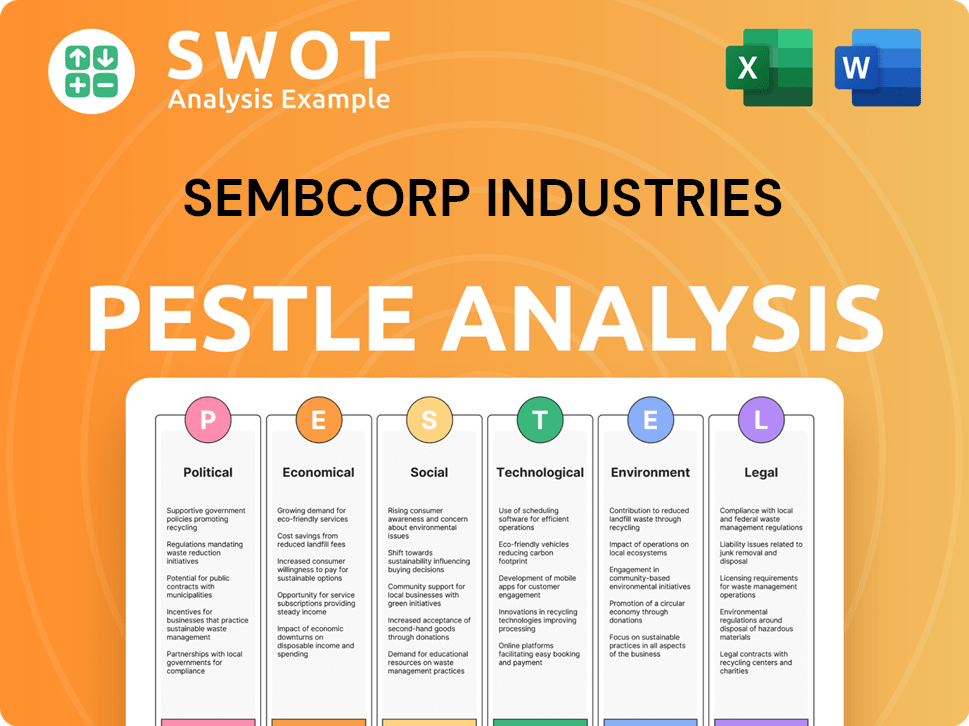

Sembcorp Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sembcorp Industries a Competitive Edge Over Its Rivals?

The competitive landscape of Sembcorp Industries is shaped by its integrated business model and strategic focus on sustainability. The company's ability to offer comprehensive energy and urban solutions, along with its aggressive pivot towards renewable energy, sets it apart from competitors. This approach allows Sembcorp to create a strong market position and capitalize on the growing demand for clean energy solutions.

Sembcorp Industries distinguishes itself through several core competitive advantages, primarily rooted in its integrated business model, strong focus on sustainability, and strategic geographic presence. The company’s commitment to renewable energy and its operational excellence in managing large-scale infrastructure projects contribute to its strong reputation and ability to secure new projects. These advantages are crucial in a market where sustainability and efficiency are increasingly important.

As of the end of 2023, Sembcorp had 12.0 GW of gross installed renewable energy capacity, exceeding its 2025 target. This positions the company as a leader in the green energy transition. Its strong relationships with governments and regulatory bodies in key markets also facilitate project development and expansion, further strengthening its competitive edge. These factors collectively contribute to Sembcorp Industries' ability to maintain and enhance its market position within the competitive landscape.

Sembcorp Industries offers a comprehensive suite of services encompassing power generation, utilities, and urban development. This holistic offering, particularly for industrial parks, creates a sticky customer base. This integrated approach allows for cross-selling opportunities, differentiating it from competitors that may specialize in only one segment.

Sembcorp's strong focus on renewable energy provides a substantial competitive edge. The company has established itself as a leader in the green energy transition, with 12.0 GW of gross installed renewable energy capacity as of the end of 2023. This commitment provides access to green financing and a growing market for clean energy.

Sembcorp has a proven track record in developing and managing large-scale infrastructure projects, both in conventional and renewable energy. The company's operational excellence and project management capabilities contribute to its strong reputation and ability to secure new projects. This includes strong relationships with governments and regulatory bodies.

Sembcorp leverages its strong relationships with governments and regulatory bodies in its key markets, facilitating project development and expansion. Its talent pool, particularly in engineering and project management, further strengthens its ability to execute complex projects efficiently. This strategic approach supports its growth strategy.

Sembcorp's competitive advantages are sustainable as long as the company continues to innovate in renewable technologies and maintain strong client relationships. However, these advantages face potential threats from rapid technological advancements by competitors and shifts in government policies. The company must adapt to evolving regulatory landscapes to maintain its market position.

- Innovation in renewable technologies.

- Strong client relationships.

- Adaptation to evolving regulatory landscapes.

- Efficient project management.

Sembcorp Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sembcorp Industries’s Competitive Landscape?

The energy and urban solutions sectors are experiencing a major transformation, largely driven by the global emphasis on decarbonization and sustainability. This shift is accelerating the adoption of renewable energy sources like solar and wind, supported by government policies and increasing investor interest in environmentally responsible assets. Digitalization and smart technologies are also playing a key role, improving energy efficiency and urban planning. These trends shape the Sembcorp Industries' competitive landscape, presenting both challenges and opportunities.

The primary challenge for Sembcorp is the intensified competition in the renewable energy sector. New and established players are expanding their capacities, which could lead to price pressures and tighter margins. Regulatory uncertainties and the need for significant investment in energy storage and grid modernization also pose risks. However, the growing global demand for clean energy and sustainable urban infrastructure offers substantial opportunities for growth.

Key trends include the move towards decarbonization and sustainable development, driving renewable energy adoption. Digitalization and smart technologies are reshaping energy management and urban planning. Changing consumer preferences are increasing the demand for cleaner energy and sustainable living environments. These trends directly impact Sembcorp Industries' strategic direction.

Intensifying competition in the renewable energy sector poses a significant challenge, potentially leading to price pressures and margin compression. Regulatory uncertainties in various markets, especially regarding renewable energy incentives, also present risks. The need for investment in energy storage and grid modernization is capital-intensive. Geopolitical tensions and supply chain disruptions could impact project development and operational costs.

The growing global demand for clean energy and sustainable urban infrastructure provides a large addressable market. Expansion into emerging markets with high energy demand and nascent renewable energy sectors offers significant growth potential. Innovation in areas like green hydrogen and advanced energy storage could open new revenue streams. Strategic partnerships and collaborations can accelerate growth and mitigate risks.

Sembcorp Industries is transforming its portfolio, aiming for 10 GW of gross installed renewable energy capacity by 2025. The company's competitive position is evolving towards a greater emphasis on renewable energy and digital solutions. Continued focus on integrated urban development will help maintain resilience and achieve long-term growth. This strategy is detailed in the Revenue Streams & Business Model of Sembcorp Industries article.

Sembcorp Industries' market position is strengthened by its strong renewable energy portfolio and expertise in integrated urban solutions. The company's strategic focus on renewable energy and digital solutions, combined with its commitment to sustainable urban development, positions it well for long-term growth. This strategic direction is supported by a clear vision for the future.

- Expansion into emerging markets with high growth potential.

- Innovation in green technologies and advanced energy storage.

- Strategic partnerships to accelerate growth and manage risks.

- Continued focus on integrated urban development for resilience.

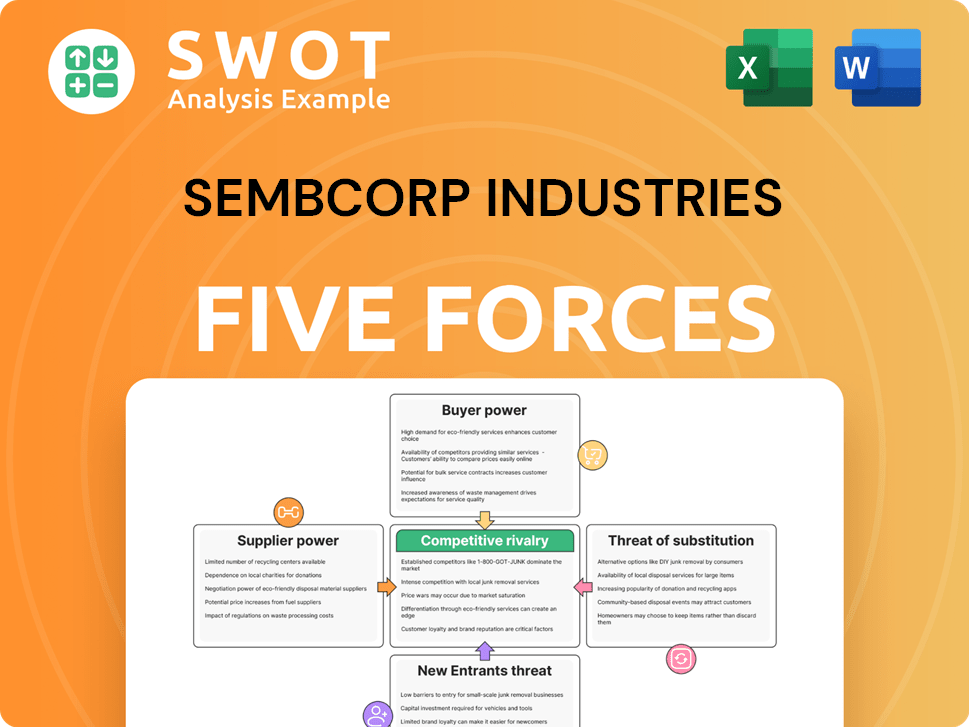

Sembcorp Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sembcorp Industries Company?

- What is Growth Strategy and Future Prospects of Sembcorp Industries Company?

- How Does Sembcorp Industries Company Work?

- What is Sales and Marketing Strategy of Sembcorp Industries Company?

- What is Brief History of Sembcorp Industries Company?

- Who Owns Sembcorp Industries Company?

- What is Customer Demographics and Target Market of Sembcorp Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.