Sembcorp Industries Bundle

How Does Sembcorp Industries Thrive in the Energy Transition?

Sembcorp Industries, a leader in Asia's sustainable development, is transforming the energy landscape. Achieving over S$1 billion in net profit for the second year running in FY2024, Sembcorp's resilience is undeniable. This success showcases its robust Sembcorp Industries SWOT Analysis and strategic adaptability in a dynamic market.

The core of

What Are the Key Operations Driving Sembcorp Industries’s Success?

Sembcorp Industries operates across three core segments, delivering value through its expertise in energy and urban solutions. The company's business model focuses on providing essential services and sustainable infrastructure. This approach allows Sembcorp to contribute to both energy transition and urban development, creating a diversified portfolio.

The company's operations are designed to generate stable cash flows, particularly from its availability-based power and water purchase agreements. Sembcorp's commitment to sustainability is evident in its investments in renewable energy and its efforts to transform raw land into sustainable urban developments. The company's strategy is built on long-term contracts and partnerships, ensuring financial stability and operational effectiveness.

As of end-2024, Sembcorp's gas-fired portfolio had a strong contracting strategy, with 98% of its portfolio underpinned by offtake contracts. This provides a solid foundation for its operations. The company's focus on renewable energy and sustainable urban solutions positions it well for future growth and contributions to a low-carbon economy.

Sembcorp provides essential energy solutions, including power generation and process steam production. Its facilities have a gross power capacity of over 16GW. The company ensures operational stability through a proactive contracting strategy, with a significant portion of its portfolio secured by long-term offtake contracts.

The Renewables segment focuses on solar, wind, and energy storage solutions. As of October 2024, Sembcorp's gross renewables capacity was 17.7GW, including projects secured and under construction. This segment is a significant growth engine, contributing to global decarbonization efforts.

This segment transforms raw land into sustainable urban developments, including industrial parks and commercial spaces. With over 30 years of experience, Sembcorp has developed 24 industrial parks across key markets. It offers integrated solutions for water and waste management, and green infrastructure.

Sembcorp's value proposition lies in its ability to combine extensive experience in renewable energy and urban solutions. This allows it to address multiple aspects of sustainability and energy transition. The company's strong predictability of stable cash flows further enhances its operational effectiveness.

Sembcorp's operations are characterized by a strategic focus on long-term contracts and sustainable solutions. The company's approach to Sembcorp operations ensures a balance between financial stability and environmental responsibility. Its business strategy is centered on growth in renewables and integrated urban solutions.

- 16GW+ gross power capacity from gas and related services.

- 17.7GW gross renewables capacity as of October 2024.

- Over 30 years of experience in developing industrial parks.

- A significant portion of the gas-fired portfolio is secured by long-term offtake contracts, ensuring stable revenue streams.

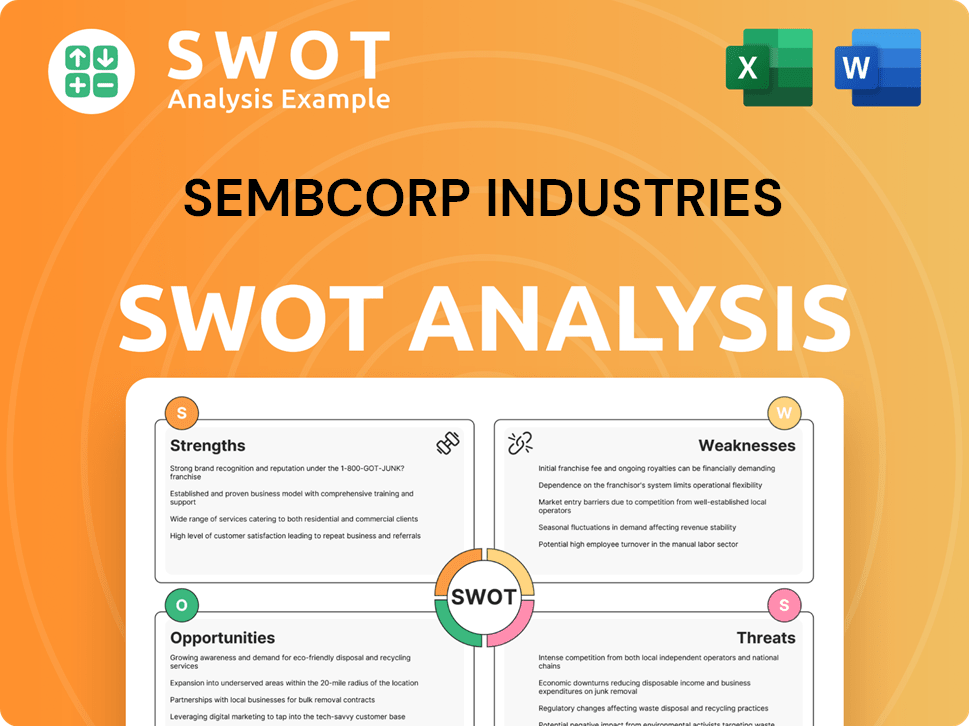

Sembcorp Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sembcorp Industries Make Money?

Sembcorp Industries' Sembcorp operations are structured around three main business segments, each contributing to its overall revenue and profitability. The company's Sembcorp business model focuses on providing essential services and sustainable solutions across various sectors. This approach allows Sembcorp to diversify its revenue streams and mitigate risks.

The company's revenue streams are diverse, with a focus on long-term contracts and strategic investments to ensure financial stability and growth. Sembcorp Industries leverages its expertise in energy, infrastructure, and urban solutions to create value for its stakeholders. This strategy is supported by a commitment to Sembcorp sustainability and innovation.

In FY2024, Sembcorp Industries generated a total revenue of S$6.417 billion. The company's financial performance reflects its strategic focus on sustainable growth and operational efficiency. The following details the revenue streams and monetization strategies of each segment.

The Gas and Related Services segment is a significant contributor to Sembcorp energy revenues. This segment's revenue primarily comes from the sale of power and gas, with a substantial portion secured through long-term offtake contracts. The acquisition of a 30% stake in Senoko Energy in November 2024 is expected to further boost earnings.

- Net profit before exceptional items in FY2024: S$727 million.

- Revenue sources: Sale of power and gas.

- Monetization strategy: Long-term offtake contracts for stable cash flows.

- Strategic move: Acquisition of a stake in Senoko Energy.

The Renewables segment focuses on generating revenue from renewable energy sources. This segment includes solar, wind, and energy storage assets. While performance in FY2024 was impacted by curtailment in China and lower wind speeds in India, Sembcorp's role in urban development is growing.

- Net profit before exceptional items in FY2024: S$183 million.

- Revenue source: Sale of electricity from solar, wind, and energy storage assets.

- Challenges: Curtailment in China and lower wind speeds in India.

- Future growth: Expansion of renewables capacity.

The Integrated Urban Solutions segment focuses on urban development and infrastructure. This segment's revenue streams include land sales, leasing of industrial properties, and providing integrated water and wastewater treatment services. Sembcorp infrastructure is a key component of its business model.

- Net profit before exceptional items in FY2024: S$169 million, a 40% increase from the previous year.

- Revenue streams: Land sales, leasing of industrial properties, and water and wastewater treatment.

- Growth drivers: Higher land sales in Vietnam and Indonesia.

- Strategic goal: Increase industrial property portfolio to 1.5 million square meters by 2028.

Sembcorp's investments in sustainable infrastructure are supported by strategic capital allocation. Approximately S$10.5 billion (75% of its 2024-2028 total investments) is earmarked for renewables, 10% for hydrogen-ready assets and decarbonization solutions, and 5% for Integrated Urban Solutions. For further insights, explore the Marketing Strategy of Sembcorp Industries.

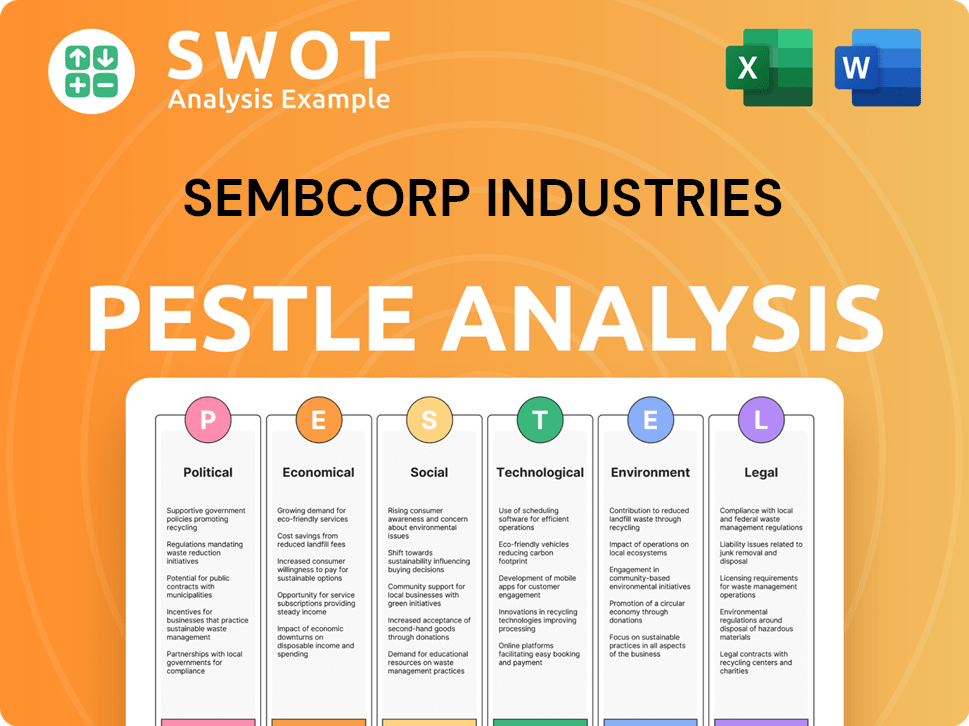

Sembcorp Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sembcorp Industries’s Business Model?

Sembcorp Industries has undergone significant transformations, marked by strategic shifts and ambitious targets. Its journey includes a strong focus on sustainability, aiming to transition its portfolio towards greener energy sources. This strategic direction has been pivotal in shaping its operational and financial trajectory.

The company's commitment to renewable energy is evident in its accelerated growth and substantial investments in sustainable infrastructure. Sembcorp's strategic moves, including acquisitions and developments in the energy sector, have strengthened its market position. These actions reflect its adaptability and commitment to long-term value creation.

Sembcorp's competitive edge is rooted in its financial strength, diversified portfolio, and focus on low-carbon solutions. Its ability to secure long-term contracts and its strategic focus on low-carbon solutions and green infrastructure differentiate it in the market. Through these initiatives, Sembcorp Industries is positioning itself as a key player in the energy and urban development sectors.

In 2021, Sembcorp unveiled its strategic plan to shift from 'brown to green,' significantly increasing renewables capacity. The company achieved its initial 10GW renewables capacity target ahead of schedule. By October 2024, Sembcorp's gross renewables capacity reached 17.7GW, with a further aim to reach 25GW by 2028.

A notable strategic move in November 2024 was the acquisition of a 30% stake in Senoko Energy. This strengthened Sembcorp's position in Singapore's power sector. The company is also developing a 600MW hydrogen-ready power plant, expected to contribute to earnings upon completion in 2026. In August 2024, Sembcorp refreshed its strategy for Integrated Urban Solutions.

Sembcorp's competitive advantages include a strong financial position, supported by Temasek Holdings, and a diversified portfolio. The company's established brand value and proven track record in large-scale projects provide a significant edge. Sembcorp's focus on low-carbon solutions and green infrastructure sets it apart.

Despite operational challenges, including maintenance and curtailment issues in FY2024, Sembcorp delivered resilient earnings. Sembcorp has allocated S$10.5 billion (75% of its 2024-2028 total investments) to renewables, demonstrating its commitment to sustainable growth. The company's strategic focus on low-carbon solutions and green infrastructure differentiates it in the market.

Sembcorp's business strategy revolves around a 'brown to green' transformation, with a strong emphasis on renewable energy and sustainable infrastructure. This includes significant investments in solar, wind, and energy storage projects. The company aims to expand its land bank and industrial properties, focusing on low-carbon industrial park development in Asia.

- Renewable Energy Focus: Sembcorp is significantly increasing its renewable energy capacity, targeting 25GW by 2028. This is a key aspect of its sustainability strategy.

- Strategic Investments: Acquisitions like the stake in Senoko Energy and development of new power plants are part of Sembcorp's strategic moves to strengthen its market position.

- Integrated Urban Solutions: The company is focusing on becoming a leading low-carbon industrial park developer, expanding its land bank and industrial properties.

- Financial Performance: Despite operational challenges, Sembcorp has shown resilient earnings, demonstrating its adaptability and strong financial position. For more information about the company, you can read about Owners & Shareholders of Sembcorp Industries.

Sembcorp Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sembcorp Industries Positioning Itself for Continued Success?

Sembcorp Industries holds a strong industry position, particularly in Asia's energy and urban solutions sectors. The company is a key player in the energy transition, offering a full suite of green energy solutions. As of the end of 2024, Sembcorp's total clean power capacity was at 17.0 GW, including 13.1 GW of installed capacity, demonstrating its significant market share in renewables. Its integrated urban solutions business has attracted over 1,000 customers and secured more than US$50 billion in investments since 1994.

Despite its strong market position, Sembcorp faces several risks. These include potential execution challenges in its renewable energy plans, increased competition in China's renewables market, regulatory changes, and the emergence of new competitors. The weak macroeconomic environment in China could also negatively impact renewable energy demand. Understanding these factors is crucial for assessing Sembcorp's Growth Strategy of Sembcorp Industries.

Sembcorp Industries is a leading provider of energy and urban solutions in Asia. The company is well-established in urban development across Vietnam, China, and Indonesia. Sembcorp's focus on sustainable infrastructure positions it well for future growth.

Sembcorp faces risks such as execution challenges in renewable energy projects and increased competition. Regulatory changes and economic conditions in China could also affect the company. The company's ability to navigate these risks will be crucial.

Sembcorp is positioned to capitalize on growth opportunities in energy transition and AI advancements. The company aims to grow its gross installed renewables capacity to 25 GW by 2028. Sembcorp is focused on expanding its land bank and industrial properties in Vietnam and Indonesia.

The Sembcorp business model is driven by three growth engines: Gas and Related Services, Renewables, and Integrated Urban Solutions. The company is investing heavily in renewables and decarbonization solutions. This strategic approach supports its long-term profitability and shareholder value.

Sembcorp's strategic plan through 2028 is driven by its three growth engines: Gas and Related Services, Renewables, and Integrated Urban Solutions. The company aims to grow its gross installed renewables capacity to 25GW by 2028, representing over 80% of its total power portfolio. Sembcorp's urban business aims for a net profit compound annual growth rate of over 15% from 2022 to 2028.

- Investment in renewables accounts for approximately 75% of total investments from 2024-2028.

- Target to halve its emissions intensity to 0.15 tCO2e/MWh from 2023 levels by 2028.

- Focus on expanding land bank and industrial properties in Vietnam and Indonesia.

- Expected return on equity (ROE) of 10% by 2028.

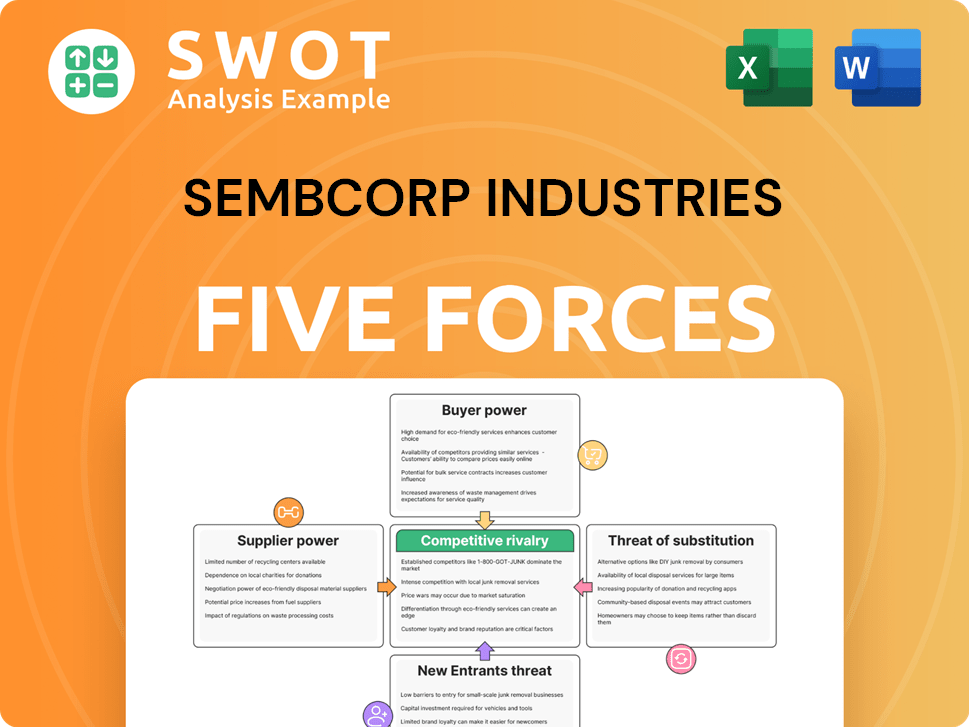

Sembcorp Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sembcorp Industries Company?

- What is Competitive Landscape of Sembcorp Industries Company?

- What is Growth Strategy and Future Prospects of Sembcorp Industries Company?

- What is Sales and Marketing Strategy of Sembcorp Industries Company?

- What is Brief History of Sembcorp Industries Company?

- Who Owns Sembcorp Industries Company?

- What is Customer Demographics and Target Market of Sembcorp Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.