Sembcorp Industries Bundle

Can Sembcorp Industries Power the Future?

Sembcorp Industries, a leader in energy and urban solutions, is making a bold move towards a sustainable future. This strategic shift is critical in an industry facing climate change and rising demand for clean energy. From its roots as a utilities provider, Sembcorp has transformed into a global player.

The company's evolution, from supporting Singapore's industrial development to its current global presence, exemplifies its dynamic business model. Sembcorp Industries SWOT Analysis provides insights into its strengths and weaknesses. This analysis will explore Sembcorp Industries' growth strategy and future prospects, focusing on its expansion in renewable energy and its role in the energy transition, alongside its financial performance and sustainability initiatives. We'll also delve into how Sembcorp plans to achieve sustainable growth, manage market challenges, and realize its long-term vision.

How Is Sembcorp Industries Expanding Its Reach?

The Sembcorp Industries Growth Strategy centers on significant expansion, particularly in renewable energy and integrated urban solutions. This strategic focus aims to capitalize on the global shift towards sustainable energy sources and urban development. The company's proactive approach positions it to meet evolving market demands and strengthen its financial performance.

This strategy is supported by strategic investments and partnerships across key geographical markets. By diversifying its portfolio and expanding its operational footprint, Sembcorp Industries aims to enhance its resilience and create long-term value. The company's commitment to sustainability and innovation is crucial for its future prospects.

Sembcorp Industries' expansion initiatives are designed to drive sustainable growth and create long-term value for stakeholders. The company's focus on renewable energy, combined with its integrated urban solutions, positions it well to meet the evolving needs of its customers and the broader market. For a deeper understanding of the company's origins, consider reading Brief History of Sembcorp Industries.

Sembcorp Industries plans to significantly increase its gross installed renewables capacity to 25GW by 2028. This is a substantial increase from its approximately 10GW capacity at the end of 2023. This expansion is a key part of the company's strategy to diversify revenue streams towards greener assets and capitalize on the global energy transition.

Key markets for expansion include China, India, and Southeast Asia. In October 2024, the company's gross renewables capacity, including acquisitions pending completion and projects under construction, stood at 17.7GW. This strategic focus allows Sembcorp Industries to tap into high-growth markets and contribute to sustainable development in these regions.

In December 2024, Sembcorp secured a contract with India's SECI for a 150 MW solar project and a 300 MWh energy storage system. This project marks its first integrated solar and storage project in India. Upon completion, Sembcorp's total renewable capacity in India will reach 6 GW.

Sembcorp entered the Philippine solar energy market in January 2025 by acquiring Puente Al Sol for SGD 105 million (approximately USD 77.6 million). A 96 MW solar installation is expected to commence commercial operations in 2025. In January 2025, the company also partnered with Indonesia's PLN to complete a 50 MW solar project with 14.2 MWh of storage capacity in Nusantara, Indonesia.

Sembcorp's Integrated Urban Solutions segment is also expanding, aiming to increase its land bank to 18,000 hectares and the gross floor area of its industrial properties to 1.5 million square meters by 2028. This segment delivered a 40% year-on-year net profit growth to S$169 million in FY2024.

- Secured new investment licenses in Vietnam, expanding its land bank.

- Expected to complete a hydroelectric acquisition in Vietnam in the first half of 2025, increasing total renewable energy capacity in Vietnam to 455 MW.

- These initiatives are designed to capitalize on new customer bases and diversify revenue streams.

- The company is strategically positioned to maintain a leading position in the evolving energy and urban development sectors.

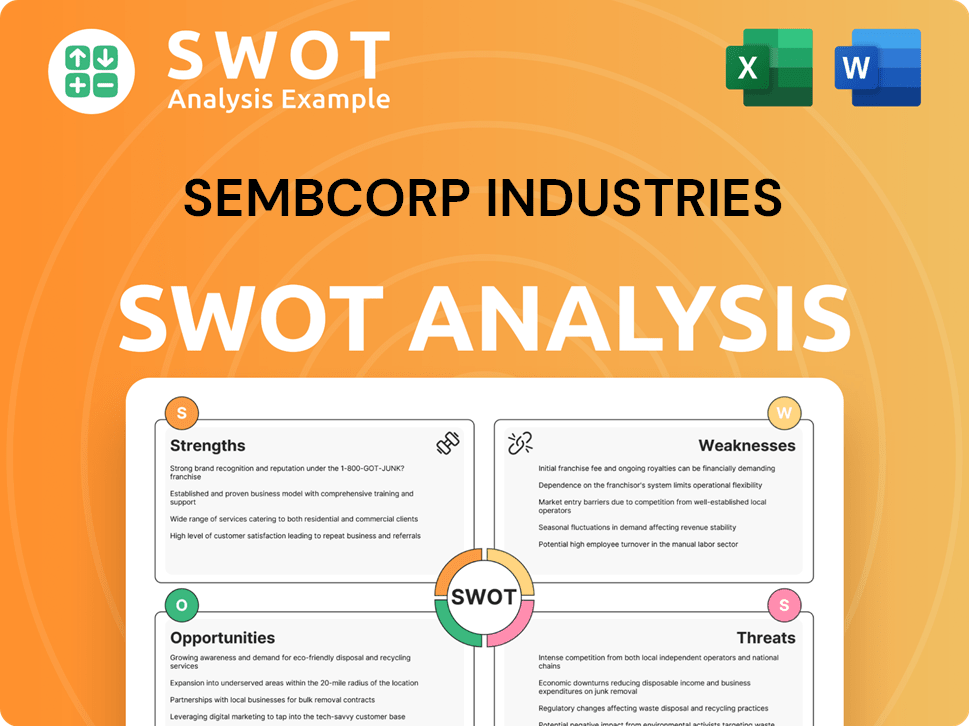

Sembcorp Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sembcorp Industries Invest in Innovation?

The innovation and technology strategy of Sembcorp Industries is central to its growth strategy and future prospects, particularly in the context of the global energy transition. The company is actively investing in technologies that support its shift from a 'brown to green' portfolio, aiming to increase its renewable energy capacity and reduce its carbon footprint. This strategic focus is designed to meet the growing demand for sustainable energy solutions and position the company as a leader in the evolving energy market.

Sembcorp Industries' commitment to digital transformation and cutting-edge technologies is evident in its initiatives, such as the GoNetZero™ platform and investments in energy storage systems. These efforts not only enhance operational efficiency but also enable the company to offer innovative solutions to its clients, further driving its growth. The company's partnerships and project developments, such as the joint venture with BPCL, also highlight its commitment to expanding its renewable energy portfolio and offering advanced sustainable solutions.

Sembcorp Industries' strategic plan to 2028 emphasizes a significant shift towards a 'brown to green' portfolio, with substantial capital deployment in renewables and decarbonization solutions. This includes investments in hydrogen-ready assets, which are critical for future low-carbon energy systems. For instance, Sembcorp plans to expand its 600MW hydrogen-ready power plant in Singapore by 2026, which is expected to boost future earnings. This expansion is a key component of Sembcorp Industries' growth strategy in renewable energy.

Sembcorp is investing in hydrogen-ready assets, which are crucial for future low-carbon energy systems. The expansion of its 600MW hydrogen-ready power plant in Singapore by 2026 is a key initiative. This investment is expected to significantly boost future earnings, demonstrating Sembcorp's commitment to sustainable energy solutions.

Launched in 2022, GoNetZero™ is a digital platform using blockchain technology. It provides one-stop access to renewable energy certificates, carbon credits, and environmental attribute portfolio management. This platform helps businesses manage their carbon footprint and transition to cleaner energy, showcasing Sembcorp's digital transformation efforts.

Sembcorp opened Southeast Asia's largest Energy Storage System (ESS) in 2023. This demonstrates its leadership in energy storage solutions, essential for grid stability with intermittent renewable energy sources. These systems are crucial for supporting the integration of renewable energy into the grid.

In April 2025, Sembcorp signed a Joint Venture Agreement with BPCL to boost green hydrogen transition and renewable energy in India. This partnership is a strategic move to expand its presence in the renewable energy market and contribute to the energy transition in India. This collaboration is a key aspect of Sembcorp's expansion plans in Asia.

Sembcorp secured a contract in December 2024 for a 150 MW solar project coupled with a 300 MWh energy storage system in India. This represents its first integrated solar and storage project in the country. These projects directly contribute to Sembcorp's growth objectives by expanding its renewable energy portfolio and offering advanced sustainable solutions to its clients.

Sembcorp's digital transformation initiatives, such as GoNetZero™, enhance operational efficiency and enable innovative solutions. These efforts support the company's commitment to environmental sustainability and provide a competitive edge. The company's focus on digital solutions is a key driver of its future success.

Sembcorp's focus on innovation extends to its partnerships and project developments, such as the joint venture with BPCL and the integrated solar and storage project in India. These initiatives are designed to expand its renewable energy portfolio and provide advanced sustainable solutions to its clients. The company's investments in technology and strategic partnerships position it well for future growth.

- Energy Storage Solutions: Sembcorp's investment in Southeast Asia's largest ESS highlights its commitment to grid stability and the integration of renewable energy.

- Strategic Partnerships: The joint venture with BPCL in India supports the green hydrogen transition and renewable energy initiatives.

- Digital Platforms: GoNetZero™ enables businesses to manage their carbon footprint and transition to cleaner energy.

- Project Developments: The integrated solar and storage projects in India expand the renewable energy portfolio.

- Financial Performance: Sembcorp's investments in technology and strategic partnerships are expected to drive financial performance and contribute to its sustainable growth. For detailed insights, you can explore the Competitors Landscape of Sembcorp Industries.

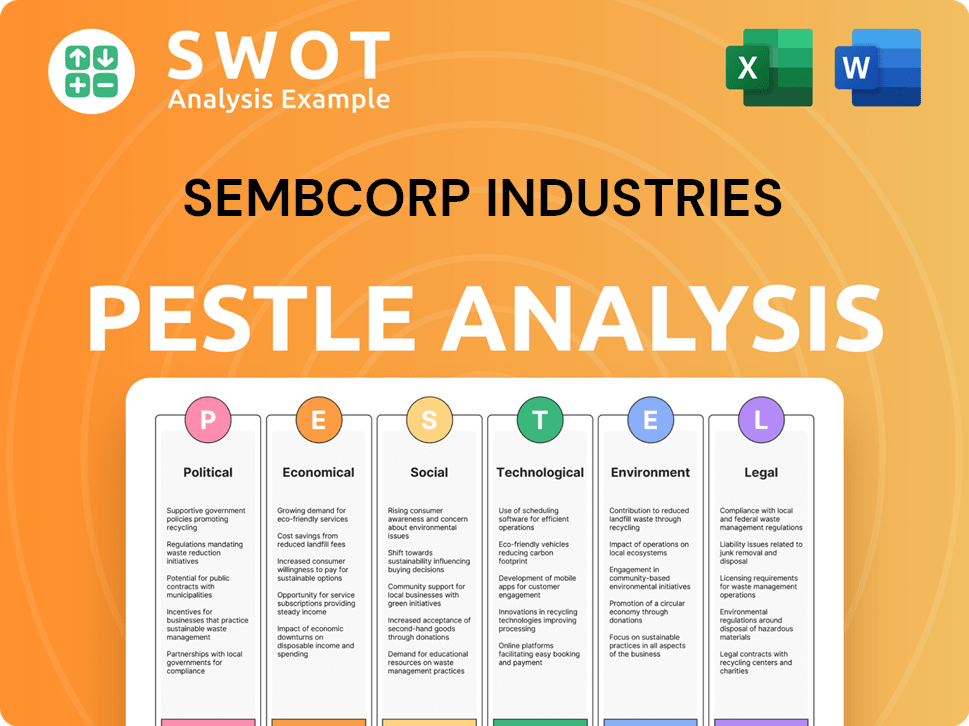

Sembcorp Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sembcorp Industries’s Growth Forecast?

The financial outlook for Sembcorp Industries is robust, underpinned by a strong FY2024 performance. The company's strategic focus on energy transition, AI-driven advancements, and industrial realignment positions it well for future growth. This strategic direction is primarily driven by its core growth engines: Gas and Related Services, Renewables, and Integrated Urban Solutions.

In FY2024, Sembcorp Industries demonstrated solid financial results, with a net profit before exceptional items and discontinued operations of S$1.02 billion, closely matching FY2023. After accounting for exceptional items and discontinued operations, net profit increased by 7% to S$1.01 billion, up from S$942 million in FY2023. This performance reflects resilience, despite significant planned maintenance in the first half of 2024. For a deeper dive into the company's structure, consider exploring the Revenue Streams & Business Model of Sembcorp Industries.

Sembcorp's commitment to shareholder returns is evident through its proposed final dividend of 17.0 cents per share for FY2024, bringing the total dividend to 23.0 cents per share, a 77% increase from the previous year. This represents a 40% payout ratio, up from 23% in FY2023, indicating strong cash flow and management's confidence in sustainable returns. This financial strategy supports the company's long-term vision and goals.

The Gas and Related Services segment maintained a stable net profit before exceptional items of S$727 million in FY2024. This segment is expected to see over 5% earnings growth, boosted by the November 2024 acquisition of a 30% stake in Senoko Energy.

Despite some headwinds in FY2024, the Renewables segment is projected to achieve a profit CAGR of over 20%, supported by its project pipeline. This growth is a key part of Sembcorp Industries' growth strategy in renewable energy.

The Integrated Urban Solutions segment delivered a strong net profit before exceptional items of S$169 million, driven by higher land sales. The segment aims to maintain a profit CAGR of approximately 15% and a 10% ROE.

Sembcorp plans to invest approximately USD 10.5 billion (equivalent to 75% of its 2024-2028 total investments) in renewables, with 10% allocated to hydrogen-ready assets and decarbonization solutions, and the remaining 5% to the Integrated Urban Solutions segment.

Sembcorp Industries aims for its Return on Equity (ROE) to be at least 13.0% by 2028. Analyst consensus as of May 2025 indicates a target price of S$7.447 for Sembcorp Industries, representing an upside potential of 13.3% from its current share price of S$6.57. This financial performance analysis provides insights into the company's strategies for navigating market challenges.

- The company's strong dividend policy reflects confidence in its cash flow.

- Investments in renewables and urban solutions are key drivers for future success.

- The company is well-positioned to capitalize on the energy transition and smart urban solutions.

- Sembcorp Industries' competitive advantages in the market include a strategic focus on sustainable growth.

Sembcorp Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sembcorp Industries’s Growth?

Sembcorp Industries Company Analysis reveals several potential risks and obstacles that could influence its Sembcorp Industries Future Prospects. These challenges span market competition, regulatory changes, supply chain vulnerabilities, and internal resource constraints. Understanding these risks is critical for assessing the long-term sustainability and growth potential of the company.

The company's strategic and operational environment is dynamic, particularly within the energy sector. Sembcorp Industries Growth Strategy faces competition from established players and new entrants. The evolving regulatory landscape, especially concerning cross-border energy agreements, poses a significant risk to its operations and expansion plans.

Moreover, external factors such as supply chain disruptions and technological advancements could affect Sembcorp Industries Business Model. Internal factors, like the availability of skilled labor and capital for large projects, also present challenges. The company must proactively manage these risks to maintain its competitive edge and achieve its strategic goals.

Intensified competition in the renewable energy sector, especially as the company expands into new markets like the Philippines solar energy market, poses a challenge. New entrants and established players increase the competitive pressure.

Regulatory changes, such as the termination of a gas sales agreement in March 2025 due to Indonesian regulatory issues, highlight the risks associated with cross-border energy projects. These changes can delay or halt projects.

Volatility in global energy markets and commodity prices can expose the company to supply chain disruptions. Diversification of energy sources, including increased LNG imports, is crucial to mitigate these risks.

The company must adapt quickly to emerging technologies to avoid being disrupted by competitors. Failure to do so could impact its market position.

Internal resource constraints, such as the availability of skilled personnel and capital for large projects, could hinder expansion plans. However, the company's strong operating cash flow helps mitigate these issues.

Diversification across business segments and geographical markets helps to reduce risk. Long-term contracts for gas-fired portfolios, with 98% backed by offtake agreements, provide earnings stability. The 'brown to green' transformation strategy is also a proactive measure.

Sembcorp Industries Financial Performance benefits from its diversified business segments and geographical markets. Long-term contracts for its gas-fired portfolio, with over 60% locked in for more than five years, ensure earnings stability. These strategies are vital for navigating market challenges.

The company's commitment to its 'brown to green' transformation strategy, with significant investments in renewables and decarbonization solutions, reflects its focus on Sembcorp Industries Sustainability Initiatives. This approach addresses sustainability concerns and regulatory shifts towards cleaner energy sources. For more insights into their core values, consider reading the article about Mission, Vision & Core Values of Sembcorp Industries.

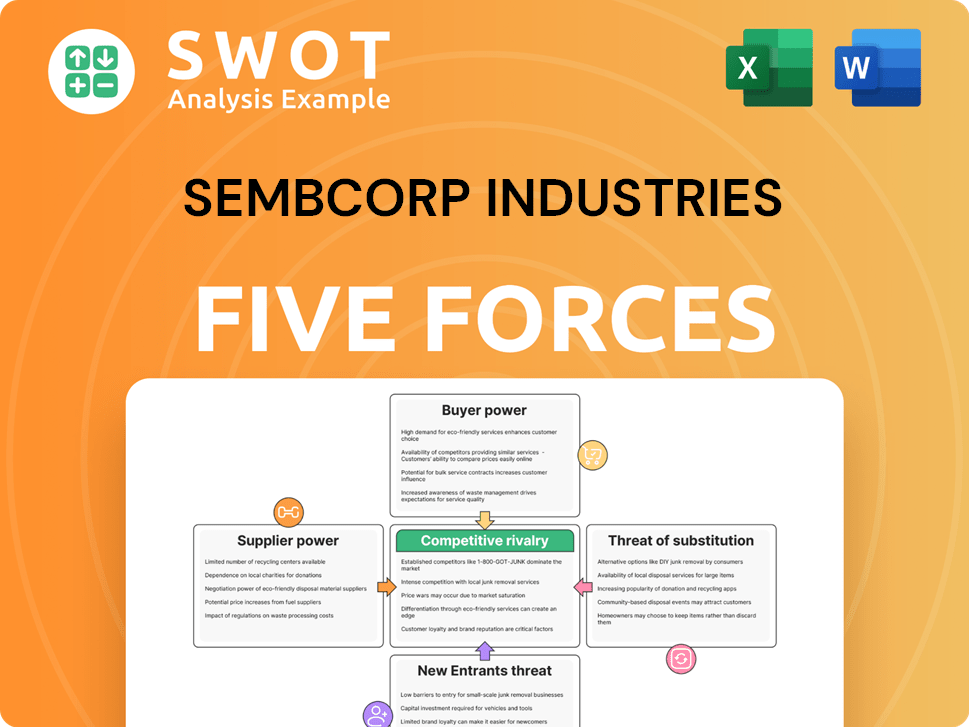

Sembcorp Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sembcorp Industries Company?

- What is Competitive Landscape of Sembcorp Industries Company?

- How Does Sembcorp Industries Company Work?

- What is Sales and Marketing Strategy of Sembcorp Industries Company?

- What is Brief History of Sembcorp Industries Company?

- Who Owns Sembcorp Industries Company?

- What is Customer Demographics and Target Market of Sembcorp Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.